444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa low calorie sweeteners market represents a rapidly expanding segment within the global food and beverage industry, driven by increasing health consciousness and rising diabetes prevalence across the region. Low calorie sweeteners have gained significant traction as consumers seek healthier alternatives to traditional sugar, with the market experiencing robust growth of approximately 8.2% CAGR over recent years. The region’s diverse demographic landscape, encompassing both developed economies like the UAE and Saudi Arabia alongside emerging markets across Africa, creates unique opportunities for sweetener manufacturers and distributors.

Market dynamics in the Middle East & Africa are influenced by several key factors, including government initiatives to combat obesity, increasing urbanization, and growing awareness of lifestyle-related diseases. The food and beverage industry’s transformation toward healthier product formulations has positioned low calorie sweeteners as essential ingredients across multiple applications, from carbonated drinks to baked goods and dairy products.

Regional consumption patterns vary significantly, with Gulf Cooperation Council (GCC) countries leading adoption rates due to higher disposable incomes and greater health awareness, while African markets show promising growth potential driven by expanding middle-class populations and increasing access to processed foods. The market encompasses various sweetener types, including artificial sweeteners like aspartame and sucralose, as well as natural alternatives such as stevia and monk fruit extracts.

The Middle East & Africa low calorie sweeteners market refers to the commercial ecosystem encompassing the production, distribution, and consumption of sugar alternatives that provide sweetness with significantly reduced caloric content across the Middle Eastern and African regions. These sweetening agents are designed to deliver the taste satisfaction of traditional sugar while containing minimal or zero calories, making them attractive to health-conscious consumers and individuals managing diabetes or weight concerns.

Low calorie sweeteners include both artificial compounds synthesized through chemical processes and natural extracts derived from plants, offering food and beverage manufacturers versatile ingredients for product reformulation. The market encompasses various product categories, from high-intensity sweeteners requiring minimal quantities to bulk sweeteners that can replace sugar’s functional properties in baking and food processing applications.

Market participants include multinational ingredient suppliers, regional distributors, food and beverage manufacturers, and retail channels serving both institutional and consumer segments. The definition extends beyond simple ingredient supply to encompass technical support, regulatory compliance, and innovation in sweetener technology tailored to regional taste preferences and cultural dietary requirements.

Strategic market positioning reveals the Middle East & Africa low calorie sweeteners market as a high-growth opportunity driven by demographic shifts, health awareness campaigns, and regulatory support for sugar reduction initiatives. The market demonstrates strong fundamentals with increasing penetration rates across key application segments, particularly in beverages where sugar reduction has become a primary focus for manufacturers responding to consumer demand and government regulations.

Key growth drivers include rising diabetes prevalence, which affects approximately 12.8% of adults in the Middle East region, creating substantial demand for sugar alternatives. The African continent’s expanding urban population and growing middle class contribute to increased consumption of processed foods and beverages, driving demand for low calorie sweetening solutions. Government initiatives across multiple countries have introduced sugar taxes and health labeling requirements, accelerating manufacturer adoption of alternative sweeteners.

Market segmentation reveals diverse opportunities across artificial sweeteners, natural sweeteners, and sugar alcohols, with each category serving specific consumer preferences and application requirements. The competitive landscape features both global ingredient giants and regional specialists, creating a dynamic environment for innovation and market expansion.

Future prospects indicate continued robust growth supported by expanding health consciousness, increasing disposable incomes in key markets, and ongoing product innovation in natural sweetener alternatives. MarkWide Research analysis suggests the market will benefit from continued urbanization trends and growing awareness of the health implications associated with excessive sugar consumption.

Consumer behavior analysis reveals significant shifts in purchasing patterns, with health-conscious consumers increasingly scrutinizing product labels and actively seeking low calorie alternatives. The following key insights shape market development:

Health consciousness surge represents the primary driver propelling market growth, as consumers increasingly recognize the connection between excessive sugar consumption and lifestyle-related diseases. The prevalence of diabetes in the Middle East, affecting over 10% of the adult population in several countries, has created urgent demand for sugar reduction solutions. This health awareness extends beyond diabetic consumers to include weight management and general wellness considerations.

Government regulatory initiatives have emerged as powerful market catalysts, with multiple countries implementing sugar taxes, mandatory nutrition labeling, and public health campaigns targeting sugar reduction. These policies create both consumer awareness and manufacturer incentives to reformulate products using low calorie sweeteners. The regulatory environment continues evolving toward stricter sugar content guidelines across food and beverage categories.

Urbanization and lifestyle changes contribute significantly to market expansion, as urban populations typically consume more processed foods and beverages where sweeteners find primary application. Rising disposable incomes in key markets enable consumers to prioritize health considerations in purchasing decisions, supporting premium pricing for healthier product alternatives.

Food industry transformation drives demand as manufacturers respond to consumer preferences and regulatory requirements by reformulating existing products and developing new offerings featuring reduced calorie content. The beverage industry leads this transformation, with major brands introducing zero-calorie variants and reducing sugar content across product portfolios.

Technological advancement in sweetener production and application has improved taste profiles and functionality, addressing historical consumer concerns about artificial flavors and aftertastes. These improvements expand market acceptance and enable broader application across food categories previously limited by technical constraints.

Consumer perception challenges continue to limit market penetration, particularly regarding artificial sweeteners where health concerns and taste preferences create resistance among certain consumer segments. Despite scientific evidence supporting safety, negative perceptions persist in some markets, limiting adoption rates and requiring ongoing education and marketing investment from manufacturers.

Regulatory complexity across the diverse Middle East & Africa region creates challenges for manufacturers seeking to market products across multiple countries. Varying approval processes, labeling requirements, and permitted sweetener types necessitate significant regulatory expertise and compliance costs, particularly affecting smaller companies and new market entrants.

Price sensitivity in many African markets limits adoption of premium low calorie sweeteners, as cost-conscious consumers prioritize affordability over health benefits. This economic constraint particularly affects natural sweeteners, which typically command higher prices than artificial alternatives, limiting market penetration in price-sensitive segments.

Technical application limitations restrict sweetener use in certain food processing applications where sugar provides functional benefits beyond sweetness, such as texture, preservation, and browning properties. These technical constraints require specialized formulation expertise and may increase production costs for manufacturers.

Cultural and traditional preferences in some regional markets favor natural sugar and traditional sweetening methods, creating resistance to artificial or processed alternatives. These cultural factors require targeted marketing approaches and gradual consumer education to overcome established preferences and consumption patterns.

Natural sweetener expansion presents significant growth opportunities as consumer preference shifts toward plant-based and naturally derived ingredients. The growing acceptance of stevia, monk fruit, and other natural alternatives creates opportunities for companies investing in natural sweetener production and application technology. This trend aligns with broader clean label movements and organic food preferences.

Emerging market penetration across sub-Saharan Africa offers substantial growth potential as urbanization accelerates and middle-class populations expand. These markets present opportunities for companies developing cost-effective sweetener solutions tailored to local taste preferences and economic conditions. Strategic partnerships with local distributors and food manufacturers can facilitate market entry and expansion.

Product innovation opportunities exist in developing sweetener blends that optimize taste profiles while maintaining cost-effectiveness. Combination products utilizing multiple sweetener types can address specific application requirements and consumer preferences, creating differentiated offerings in competitive markets.

Application diversification beyond traditional beverage and confectionery uses presents growth opportunities in bakery, dairy, and processed food categories. The development of functional sweeteners offering additional health benefits, such as prebiotic properties or vitamin fortification, creates premium market segments with higher value propositions.

E-commerce and direct-to-consumer channels provide opportunities to reach health-conscious consumers directly, bypassing traditional retail limitations and enabling targeted marketing of specialized low calorie sweetener products. Digital platforms facilitate consumer education and brand building in markets where traditional retail presence may be limited.

Supply chain evolution reflects the market’s maturation, with manufacturers investing in regional production facilities and distribution networks to serve growing demand more effectively. The establishment of local production capabilities reduces costs and improves supply security, particularly important given the region’s diverse geographic and economic landscape. Vertical integration strategies among key players aim to control quality and costs while ensuring consistent supply to major food and beverage customers.

Competitive intensity has increased as both global ingredient companies and regional specialists recognize market opportunities. This competition drives innovation in product development, application support, and pricing strategies, ultimately benefiting consumers through improved products and competitive pricing. Market consolidation trends may emerge as companies seek scale advantages and broader product portfolios.

Technology advancement continues reshaping market dynamics through improved production processes, enhanced taste profiles, and new sweetener compounds. Research investments focus on addressing consumer concerns about artificial ingredients while maintaining cost-effectiveness and functionality. Biotechnology applications in natural sweetener production offer potential for significant cost reductions and improved sustainability.

Regulatory harmonization efforts across regional markets may simplify market access and reduce compliance costs, potentially accelerating market growth. However, the diverse regulatory landscape continues requiring specialized expertise and strategic planning for companies operating across multiple countries.

Consumer education initiatives by industry associations and companies aim to address misconceptions about sweetener safety and benefits, potentially expanding market acceptance. These efforts complement government health campaigns and contribute to overall market development by building consumer confidence in low calorie sweetener products.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and actionable insights into the Middle East & Africa low calorie sweeteners market. The research approach combines quantitative data collection with qualitative analysis to provide a complete market perspective covering all key segments and regional variations.

Primary research activities include structured interviews with industry executives, food and beverage manufacturers, distributors, and regulatory officials across key markets. These interviews provide insights into market trends, competitive dynamics, and future growth prospects from industry participants with direct market experience. Consumer surveys conducted across major urban centers capture purchasing behavior, brand preferences, and health consciousness trends driving market demand.

Secondary research methodology encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary research findings. Regulatory database analysis ensures comprehensive understanding of approval processes and compliance requirements across different countries within the region.

Market modeling techniques utilize statistical analysis and forecasting models to project market growth trends and segment performance. These models incorporate economic indicators, demographic trends, and industry-specific factors to provide reliable market projections. Scenario analysis considers various economic and regulatory conditions to assess potential market outcomes under different circumstances.

Data validation processes ensure research accuracy through triangulation of multiple data sources and expert review of findings. Quality control measures include peer review of analysis and validation of key statistics through independent sources to maintain research integrity and reliability.

Gulf Cooperation Council markets lead regional adoption with the UAE, Saudi Arabia, and Qatar demonstrating the highest penetration rates for low calorie sweeteners. These markets benefit from high disposable incomes, strong health awareness, and supportive regulatory environments. The UAE market shows particular strength in natural sweetener adoption, with approximately 35% market share for stevia-based products reflecting consumer preference for clean label ingredients.

Saudi Arabia’s market dynamics are influenced by government health initiatives and Vision 2030 objectives promoting healthier lifestyles. The kingdom’s large beverage industry and growing food processing sector create substantial demand for sweetening solutions. Recent sugar tax implementation has accelerated manufacturer adoption of alternative sweeteners across multiple product categories.

North African markets, particularly Egypt and Morocco, demonstrate growing potential driven by urbanization and increasing health consciousness. Egypt’s large population and expanding food industry create significant opportunities, though price sensitivity remains a key consideration for market penetration. Local production initiatives in these markets aim to reduce costs and improve accessibility.

Sub-Saharan African markets present the highest growth potential despite current low penetration rates. South Africa leads regional adoption with established food and beverage industries increasingly incorporating low calorie alternatives. Nigeria and Kenya show promising growth trends supported by expanding urban populations and rising middle-class incomes.

Market share distribution reveals significant variation across countries, with GCC markets accounting for approximately 45% of regional consumption despite representing a smaller population base. This concentration reflects economic development levels and consumer purchasing power differences across the region.

Market leadership is distributed among several global ingredient companies and regional specialists, creating a competitive environment that drives innovation and market development. The competitive landscape reflects both scale advantages of multinational corporations and specialized expertise of focused sweetener companies.

Competitive strategies focus on product innovation, technical support, and strategic partnerships with food and beverage manufacturers. Companies invest heavily in research and development to improve taste profiles and develop application-specific solutions. Market positioning varies from cost leadership in commodity sweeteners to premium positioning for natural and specialty products.

Product type segmentation reveals distinct market dynamics across different sweetener categories, each serving specific consumer preferences and application requirements. The segmentation analysis provides insights into growth opportunities and competitive positioning across various product categories.

By Sweetener Type:

By Application:

By End User:

Artificial sweeteners category maintains market leadership through established supply chains, proven safety profiles, and cost advantages. Aspartame continues dominating beverage applications despite growing competition from newer alternatives, while sucralose gains market share in baking applications due to heat stability properties. The category benefits from extensive regulatory approval and manufacturer familiarity, though faces challenges from consumer preference shifts toward natural alternatives.

Natural sweeteners segment demonstrates the highest growth potential, with stevia leading adoption rates across multiple applications. Consumer willingness to pay premium prices for natural alternatives supports market expansion, though taste optimization remains crucial for broader acceptance. Monk fruit extracts emerge as promising alternatives with superior taste profiles but face supply chain and cost challenges limiting mass market adoption.

Sugar alcohols category serves specialized applications requiring functional properties beyond sweetness, particularly in sugar-free confectionery and pharmaceutical applications. Erythritol gains popularity due to digestive tolerance advantages, while xylitol maintains strong positions in oral care applications. The category faces competition from high-intensity sweeteners in cost-sensitive applications.

Beverage applications drive market growth with carbonated soft drinks leading adoption of low calorie formulations. Energy drinks and sports beverages increasingly utilize sweetener blends to optimize taste and functionality. Juice and dairy beverages present growing opportunities as manufacturers respond to sugar reduction demands while maintaining taste expectations.

Food applications expand beyond traditional confectionery uses into bakery, dairy, and processed foods. Baking applications require specialized sweetener solutions addressing functional properties like browning and texture, creating opportunities for technical innovation and premium pricing.

Manufacturers gain competitive advantages through product differentiation and market positioning opportunities created by incorporating low calorie sweeteners into product formulations. These ingredients enable companies to address health-conscious consumer segments while complying with regulatory requirements for sugar reduction. Cost optimization becomes possible through high-intensity sweeteners requiring minimal quantities compared to sugar, potentially reducing raw material costs and transportation expenses.

Retailers benefit from expanding product assortments that cater to health-conscious consumers willing to pay premium prices for healthier alternatives. Category management opportunities arise from growing consumer interest in sugar-free and reduced-calorie products across multiple categories. Private label development using low calorie sweeteners enables retailers to capture higher margins while meeting consumer demand for healthier options.

Consumers receive health benefits through reduced caloric intake and better blood sugar management while maintaining taste satisfaction. Dietary flexibility increases for individuals managing diabetes, weight concerns, or following specific nutritional programs. Product variety expansion provides consumers with more choices to align purchasing decisions with health objectives and taste preferences.

Healthcare systems potentially benefit from reduced healthcare costs associated with diabetes, obesity, and related lifestyle diseases as low calorie sweetener adoption contributes to improved population health outcomes. Preventive health measures supported by accessible sugar alternatives may reduce long-term healthcare burdens and improve quality of life indicators.

Investors find opportunities in companies positioned to capitalize on health and wellness trends driving market growth. Portfolio diversification becomes possible through investments in sweetener technology, natural ingredient development, and health-focused food and beverage companies benefiting from market trends.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement drives significant market transformation as consumers increasingly scrutinize ingredient lists and prefer recognizable, natural components. This trend particularly benefits stevia and monk fruit sweeteners while challenging artificial alternatives to improve consumer perception through education and product innovation. Manufacturers respond by reformulating products to feature natural sweeteners despite higher costs and technical challenges.

Personalized nutrition trends create opportunities for specialized sweetener products targeting specific health conditions or dietary preferences. Diabetic-friendly formulations and keto-compatible sweeteners address growing consumer segments following specialized diets. This trend supports premium pricing and brand differentiation through targeted marketing and product positioning.

Sustainability focus influences sourcing and production decisions as consumers and manufacturers prioritize environmental responsibility. Sustainable stevia farming and eco-friendly production processes become competitive advantages, particularly in markets with strong environmental consciousness. Companies invest in supply chain transparency and sustainability certifications to meet evolving consumer expectations.

Functional ingredient integration combines sweetening properties with additional health benefits such as prebiotic effects, vitamin fortification, or antioxidant properties. These value-added sweeteners command premium pricing while addressing multiple consumer health objectives simultaneously. The trend supports product differentiation and brand positioning in competitive markets.

Digital health integration connects sweetener consumption with health monitoring applications and personalized dietary recommendations. Smart packaging and connected products provide consumers with usage tracking and health impact information, supporting informed consumption decisions and brand engagement.

Flavor enhancement technology addresses taste concerns through improved sweetener blends and masking agents that eliminate aftertastes and improve overall flavor profiles. These technological advances expand market acceptance and enable broader application across food categories previously limited by taste constraints.

Regulatory approvals for new sweetener compounds expand market opportunities, with recent approvals for allulose and advantame in several regional markets providing manufacturers with additional formulation options. These approvals reflect ongoing scientific research and regulatory evolution supporting market growth and innovation.

Production capacity expansion by major manufacturers indicates confidence in market growth prospects, with new facilities planned across the Middle East and Africa to serve growing regional demand. Local production initiatives aim to reduce costs and improve supply chain reliability while creating employment opportunities in key markets.

Strategic partnerships between sweetener suppliers and food manufacturers create integrated supply chains and collaborative product development programs. These partnerships accelerate market adoption through technical support and customized solutions addressing specific application requirements and consumer preferences.

Investment in research and development focuses on taste improvement, cost reduction, and new application development. Biotechnology applications in natural sweetener production promise significant cost reductions and improved sustainability, potentially transforming market dynamics and accessibility.

Acquisition activity consolidates market participants as companies seek scale advantages and broader product portfolios. Recent acquisitions focus on natural sweetener capabilities and regional market access, reflecting strategic priorities for market expansion and technological advancement.

Sustainability initiatives include carbon-neutral production commitments and sustainable sourcing programs addressing environmental concerns and consumer expectations. These initiatives support brand differentiation and may become competitive requirements as environmental consciousness increases.

Market entry strategies should prioritize natural sweetener portfolios given consumer preference trends and premium pricing opportunities. Companies entering the market should focus on stevia and monk fruit applications while building technical capabilities for taste optimization and application support. Strategic partnerships with local distributors and food manufacturers can accelerate market penetration and reduce entry barriers.

Investment priorities should emphasize research and development in taste improvement and cost reduction technologies. MWR analysis suggests companies investing in biotechnology applications for natural sweetener production will gain competitive advantages through improved cost structures and sustainability profiles. Production localization in key markets offers opportunities for cost reduction and supply chain optimization.

Product development focus should address specific regional taste preferences and application requirements. Customized sweetener blends optimized for local food and beverage categories can create competitive differentiation and customer loyalty. Functional ingredient integration offers opportunities for premium positioning and expanded market applications.

Marketing strategies must address consumer education needs regarding sweetener safety and benefits. Transparent communication about production processes, sourcing, and health impacts can build consumer confidence and market acceptance. Digital marketing channels enable targeted messaging to health-conscious consumer segments most likely to adopt low calorie alternatives.

Regulatory compliance requires specialized expertise and ongoing monitoring of evolving requirements across multiple markets. Companies should invest in regulatory affairs capabilities and maintain relationships with local authorities to ensure compliance and facilitate new product approvals. Proactive regulatory engagement can influence policy development and create competitive advantages.

Supply chain optimization should focus on reliability and cost-effectiveness while maintaining quality standards. Diversified sourcing strategies reduce supply risks, while local production capabilities improve cost competitiveness and market responsiveness. Sustainability initiatives in supply chain management address consumer expectations and regulatory requirements.

Market growth trajectory indicates continued expansion driven by health consciousness, regulatory support, and technological advancement. The market is projected to maintain robust growth rates of approximately 7.5% CAGR over the next five years, with natural sweeteners leading growth at significantly higher rates. Demographic trends including urbanization and rising incomes across African markets will create substantial new demand opportunities.

Technology evolution will address current market limitations through improved taste profiles, reduced costs, and enhanced functionality. Biotechnology applications in natural sweetener production promise to reduce cost differentials with artificial alternatives while maintaining clean label benefits. Advanced sweetener blends will optimize taste and functionality across diverse applications.

Regulatory environment development will likely support market growth through continued sugar reduction initiatives and streamlined approval processes for new sweetener compounds. Harmonization efforts across regional markets may reduce compliance complexity and accelerate market access for innovative products. Health claim regulations may evolve to support marketing of functional sweetener benefits.

Consumer acceptance will continue improving through education, product innovation, and generational changes in health consciousness. Natural sweetener adoption will accelerate as production scales increase and costs decline, making these products accessible to broader market segments. Younger consumers show higher acceptance rates for alternative sweetening solutions.

Market consolidation may occur as companies seek scale advantages and broader product portfolios to serve diverse customer requirements. Vertical integration strategies will aim to control costs and quality while ensuring supply security. Strategic partnerships between ingredient suppliers and food manufacturers will create integrated value chains.

Application expansion will drive market growth beyond traditional food and beverage uses into pharmaceuticals, personal care, and emerging categories. Functional food applications combining sweetening with health benefits will create premium market segments with higher value propositions and profit margins.

The Middle East & Africa low calorie sweeteners market represents a dynamic and rapidly expanding opportunity driven by compelling health trends, supportive regulatory environments, and evolving consumer preferences. Market fundamentals remain strong with rising diabetes prevalence, increasing health consciousness, and government initiatives creating sustained demand for sugar alternatives across the region.

Growth prospects are particularly promising for natural sweetener categories, where consumer preference trends and premium pricing opportunities align with technological advancement and production scale improvements. The market’s diversity across developed GCC economies and emerging African markets provides multiple growth vectors and risk diversification for industry participants.

Strategic success factors include investment in natural sweetener capabilities, local market partnerships, and consumer education initiatives addressing perception challenges. Companies that combine technological innovation with market-specific strategies will capture the greatest opportunities in this evolving landscape. MarkWide Research projects continued robust growth supported by demographic trends, regulatory support, and ongoing product innovation addressing taste and functionality requirements.

The market’s future trajectory indicates transformation from a niche health product category to mainstream ingredient adoption across food and beverage applications. Sustainable competitive advantages will emerge from technological leadership, regulatory expertise, and deep understanding of regional consumer preferences and market dynamics driving this significant growth opportunity.

What is Low Calorie Sweeteners?

Low calorie sweeteners are sugar substitutes that provide a sweet taste with fewer calories than traditional sugar. They are commonly used in food and beverage products to help reduce overall caloric intake while maintaining sweetness.

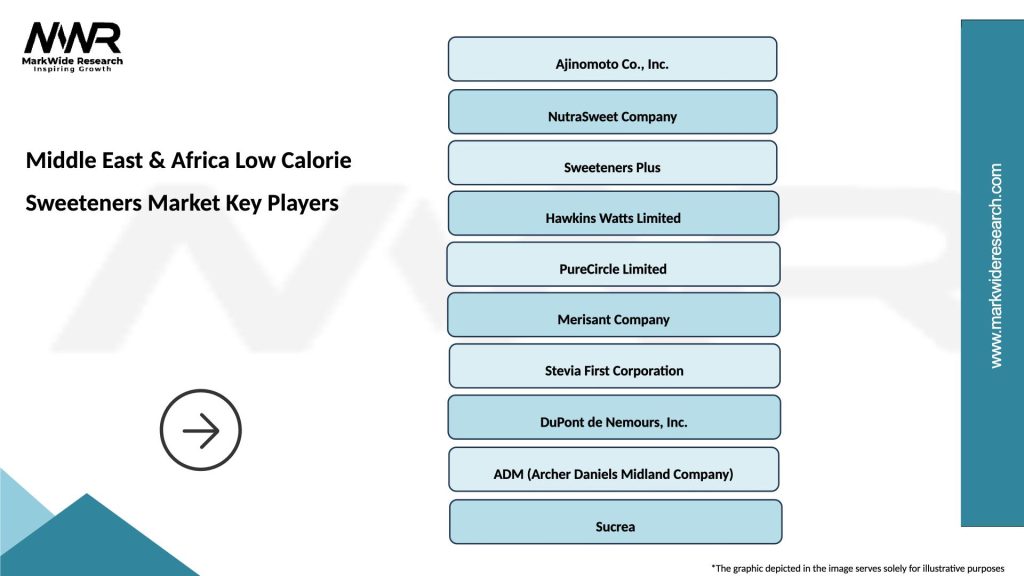

What are the key players in the Middle East & Africa Low Calorie Sweeteners Market?

Key players in the Middle East & Africa Low Calorie Sweeteners Market include companies like Cargill, Tate & Lyle, and DuPont, which are known for their innovative sweetening solutions and extensive product portfolios, among others.

What are the growth factors driving the Middle East & Africa Low Calorie Sweeteners Market?

The growth of the Middle East & Africa Low Calorie Sweeteners Market is driven by increasing health consciousness among consumers, rising demand for low-calorie food and beverages, and the growing prevalence of obesity and diabetes in the region.

What challenges does the Middle East & Africa Low Calorie Sweeteners Market face?

Challenges in the Middle East & Africa Low Calorie Sweeteners Market include regulatory hurdles regarding the safety of sweeteners, consumer skepticism about artificial ingredients, and competition from natural sweeteners.

What opportunities exist in the Middle East & Africa Low Calorie Sweeteners Market?

Opportunities in the Middle East & Africa Low Calorie Sweeteners Market include the rising trend of clean label products, increasing demand for plant-based sweeteners, and the expansion of the food and beverage industry in emerging markets.

What trends are shaping the Middle East & Africa Low Calorie Sweeteners Market?

Trends shaping the Middle East & Africa Low Calorie Sweeteners Market include the growing popularity of natural sweeteners like stevia, innovations in sweetener formulations, and the increasing use of low calorie sweeteners in functional foods and beverages.

Middle East & Africa Low Calorie Sweeteners Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stevia, Sucralose, Aspartame, Acesulfame K |

| End User | Food Manufacturers, Beverage Producers, Confectionery, Bakery |

| Application | Dietary Supplements, Snacks, Sauces, Dairy Products |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Low Calorie Sweeteners Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at