444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa hair conditioner market represents a dynamic and rapidly evolving segment within the broader personal care industry. This region has witnessed substantial growth in hair care product consumption, driven by increasing consumer awareness about hair health, rising disposable incomes, and evolving beauty standards. The market encompasses a diverse range of conditioning products, from traditional rinse-out conditioners to innovative leave-in treatments and deep conditioning masks.

Market dynamics in the Middle East & Africa are characterized by unique climatic conditions that create specific hair care needs. The region’s predominantly arid climate, combined with high temperatures and humidity variations, necessitates specialized conditioning formulations that address moisture retention, heat protection, and environmental damage repair. Consumer preferences have shifted toward premium and natural conditioning products, with organic and sulfate-free formulations gaining significant traction at a growth rate of 12.5% annually.

Regional diversity plays a crucial role in market segmentation, with the Gulf Cooperation Council (GCC) countries leading in premium product adoption, while North African markets show strong demand for value-oriented conditioning solutions. The market demonstrates robust expansion potential, with hair conditioner penetration rates reaching 68% in urban areas and 34% in rural regions, indicating substantial room for growth across different demographic segments.

The Middle East & Africa hair conditioner market refers to the comprehensive ecosystem of conditioning products, distribution channels, and consumer segments operating within the MEA region’s personal care landscape. This market encompasses all forms of hair conditioning treatments designed to improve hair texture, manageability, and overall health while addressing region-specific environmental challenges and cultural preferences.

Product categories within this market include rinse-out conditioners, leave-in treatments, deep conditioning masks, co-washing products, and specialized treatments for chemically processed or heat-damaged hair. The market also includes both mass-market and premium segments, catering to diverse economic demographics and varying quality expectations across different countries within the region.

Geographic scope covers major markets including Saudi Arabia, United Arab Emirates, Egypt, South Africa, Nigeria, Morocco, and other emerging economies throughout the Middle East and Africa. Each sub-region presents unique opportunities and challenges based on local climate conditions, cultural practices, economic development levels, and regulatory environments affecting product formulation and marketing strategies.

Strategic market positioning reveals the Middle East & Africa hair conditioner market as a high-growth segment with exceptional potential for both established international brands and emerging local players. The market benefits from favorable demographic trends, including a young population base with increasing beauty consciousness and growing female workforce participation driving personal care spending.

Key growth drivers include urbanization trends affecting 78% of the target demographic, rising awareness of hair care routines, and increasing availability of international beauty brands through expanding retail networks. E-commerce penetration has accelerated market access, particularly in Gulf countries where online beauty sales represent 23% of total conditioner purchases.

Competitive landscape features a mix of global multinational corporations, regional players, and emerging local brands competing across different price points and product categories. Innovation focus centers on natural ingredients, sustainable packaging, and formulations specifically designed for the region’s climate challenges and diverse hair types prevalent among MEA consumers.

Market challenges include economic volatility in certain regions, regulatory complexities across different countries, and the need for culturally sensitive marketing approaches. However, these challenges are offset by strong underlying demand fundamentals and increasing consumer sophistication in hair care product selection and usage.

Consumer behavior analysis reveals distinct purchasing patterns across the Middle East & Africa hair conditioner market, with several critical insights shaping industry strategies:

Economic prosperity across key Middle Eastern markets has significantly enhanced consumer purchasing power, enabling greater investment in premium personal care products. Rising disposable incomes, particularly in Gulf countries, have created a substantial consumer base willing to invest in high-quality conditioning treatments that deliver superior results and align with luxury lifestyle aspirations.

Demographic advantages provide strong market fundamentals, with a predominantly young population that demonstrates high engagement with beauty trends and willingness to experiment with new conditioning products. The region’s growing female workforce participation has increased demand for professional-grade hair care solutions that maintain hair health despite busy lifestyles and challenging environmental conditions.

Climate-driven demand creates unique market opportunities, as the region’s harsh environmental conditions necessitate specialized conditioning formulations. Extreme temperatures, UV exposure, and varying humidity levels require products that provide intensive moisture, heat protection, and environmental damage repair, driving consistent demand for advanced conditioning technologies.

Cultural evolution toward Western beauty standards and increased exposure to international hair care practices through social media and travel has expanded consumer awareness of conditioning benefits. This cultural shift has transformed hair conditioning from an occasional treatment to an essential daily routine for many consumers across the region.

Retail infrastructure development has improved product accessibility through expanding modern trade channels, including hypermarkets, specialty beauty stores, and e-commerce platforms. Enhanced distribution networks have made premium conditioning products available to broader consumer segments while supporting brand awareness and education initiatives.

Economic volatility in certain regional markets creates challenges for sustained growth, as fluctuating oil prices and currency instabilities affect consumer spending patterns on non-essential personal care items. Economic uncertainties can lead to downtrading behavior, where consumers shift from premium to value-oriented conditioning products during challenging periods.

Regulatory complexities across different countries within the MEA region create barriers for product standardization and market entry. Varying cosmetic regulations, ingredient restrictions, and labeling requirements increase compliance costs and complicate regional expansion strategies for both international and local brands.

Cultural sensitivities require careful navigation of marketing messages and product positioning, as traditional values and religious considerations influence beauty product acceptance in certain markets. Brands must balance modern hair care benefits with cultural appropriateness, which can limit marketing creativity and product innovation approaches.

Infrastructure limitations in some African markets affect distribution efficiency and product availability, particularly in rural areas where cold chain requirements for certain conditioning formulations may be challenging to maintain. Limited retail infrastructure can restrict market penetration and increase distribution costs.

Price sensitivity among significant consumer segments limits premium product adoption, as many consumers prioritize value over advanced conditioning benefits. This price consciousness requires brands to develop tiered product portfolios that address different economic segments while maintaining profitability.

Untapped rural markets present substantial expansion opportunities, as increasing urbanization and rising rural incomes create new consumer segments for conditioning products. Rural market penetration strategies focusing on affordable, effective formulations could unlock significant growth potential while building long-term brand loyalty among emerging consumers.

E-commerce expansion offers accelerated market access, particularly in regions where traditional retail infrastructure remains limited. Digital platforms enable direct consumer engagement, personalized product recommendations, and subscription-based conditioning regimens that enhance customer lifetime value while reducing distribution costs.

Natural and organic positioning aligns with growing consumer preferences for clean beauty products, creating opportunities for brands that can effectively communicate ingredient transparency and environmental sustainability. This trend particularly resonates with educated urban consumers willing to pay premium prices for perceived health and environmental benefits.

Professional channel development through salon partnerships and beauty professional education programs can drive premium product adoption while building credibility through expert endorsements. Professional channels also provide opportunities for introducing advanced conditioning treatments and building consumer awareness of proper hair care routines.

Innovation in formulation addressing specific regional needs, such as extreme heat protection, humidity control, and pollution defense, can create differentiated product propositions that command premium pricing while solving real consumer problems unique to the MEA climate and environmental conditions.

Supply chain evolution within the Middle East & Africa hair conditioner market reflects increasing sophistication in distribution networks and inventory management systems. Local manufacturing capabilities have expanded significantly, with several international brands establishing regional production facilities to reduce costs and improve supply chain responsiveness while meeting growing demand more efficiently.

Competitive intensity has escalated as both global and regional players recognize the market’s growth potential, leading to increased marketing investments, product innovation cycles, and promotional activities. This competition benefits consumers through improved product quality, competitive pricing, and enhanced availability across different retail channels.

Technology integration is transforming how conditioning products are formulated, marketed, and distributed throughout the region. Advanced ingredient technologies, personalized product recommendations through AI-driven platforms, and digital marketing strategies are reshaping consumer engagement and purchase behavior patterns.

Regulatory harmonization efforts across certain regional blocs are gradually reducing compliance complexities, enabling more efficient market entry strategies and standardized product formulations. These regulatory improvements support market consolidation and encourage investment in regional manufacturing and distribution capabilities.

Consumer education initiatives by brands and industry associations are elevating awareness of proper conditioning techniques and product benefits, driving category growth while establishing brand differentiation through educational content and professional partnerships that build consumer trust and loyalty.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Middle East & Africa hair conditioner market. Primary research included extensive consumer surveys across major urban centers, in-depth interviews with industry stakeholders, and focus group discussions with target demographic segments to understand purchasing behavior and product preferences.

Secondary research integration incorporated analysis of industry reports, trade publications, regulatory filings, and company financial statements to validate primary findings and establish market sizing parameters. Cross-referencing multiple data sources ensured consistency and reliability in market trend identification and competitive landscape assessment.

Regional segmentation analysis involved detailed examination of country-specific market conditions, regulatory environments, and consumer behavior patterns across different MEA sub-regions. This approach enabled identification of regional variations in product preferences, pricing strategies, and distribution channel effectiveness.

Industry expert consultations with beauty industry professionals, retail executives, and marketing specialists provided qualitative insights into market dynamics, competitive strategies, and future growth opportunities. These expert perspectives enhanced understanding of market nuances and strategic implications for different stakeholder groups.

Data validation processes included triangulation of findings across multiple sources, statistical analysis of survey responses, and peer review of research conclusions to ensure accuracy and reliability of market insights and projections presented throughout this comprehensive analysis.

Gulf Cooperation Council markets lead the Middle East & Africa hair conditioner market in terms of premium product adoption and per-capita consumption. Saudi Arabia and the United Arab Emirates represent the largest markets within this sub-region, with consumers demonstrating strong preference for international brands and willingness to invest in high-quality conditioning treatments. The GCC markets account for approximately 42% of regional premium conditioner sales.

North African markets show distinct characteristics, with Egypt and Morocco leading in volume consumption while maintaining price-sensitive purchasing behavior. These markets favor value-oriented products that deliver effective conditioning benefits at accessible price points. Local and regional brands have gained significant market share by offering culturally relevant formulations at competitive prices.

Sub-Saharan Africa presents emerging opportunities, with South Africa and Nigeria representing the most developed markets in terms of modern retail infrastructure and consumer sophistication. These markets demonstrate growing interest in natural and organic conditioning products, with local ingredient preferences driving product innovation and brand differentiation strategies.

Levant region markets including Jordan, Lebanon, and other countries show resilience despite economic challenges, with consumers maintaining hair care routines and seeking value-oriented conditioning solutions. These markets benefit from cultural emphasis on personal grooming and appearance, supporting consistent demand for conditioning products across different economic segments.

Market penetration rates vary significantly across regions, with urban areas in Gulf countries achieving 85% conditioner usage rates compared to 45% in rural African markets, indicating substantial growth potential through targeted market development and education initiatives.

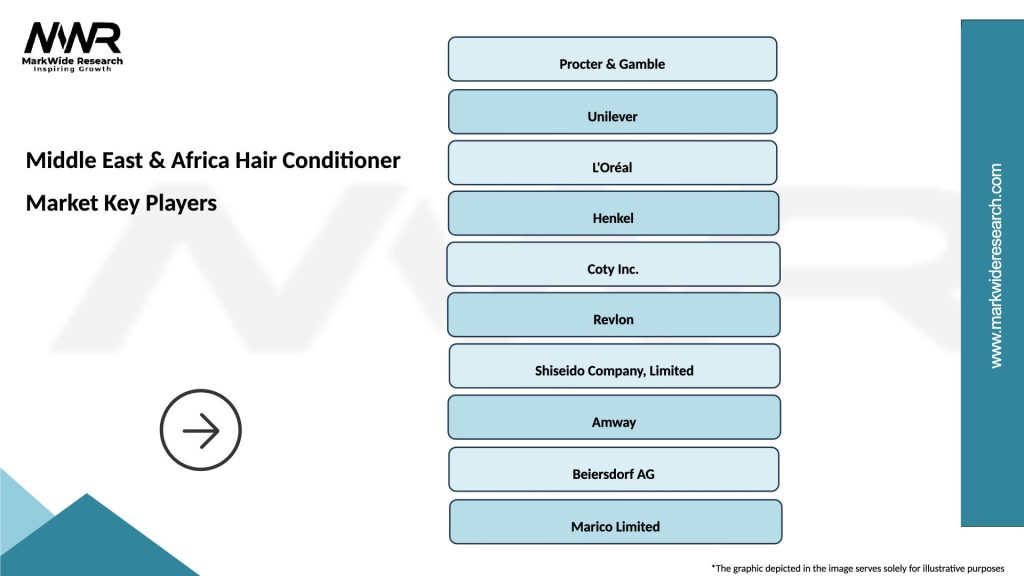

Market leadership in the Middle East & Africa hair conditioner market is characterized by intense competition among established international brands and emerging regional players. The competitive environment reflects diverse strategies ranging from premium positioning to value-oriented approaches, with companies adapting their offerings to meet specific regional preferences and economic conditions.

Leading market participants include:

Competitive strategies focus on product innovation, localized marketing approaches, and distribution network expansion. Companies invest heavily in understanding regional consumer preferences and developing formulations that address specific climate challenges while maintaining cost competitiveness across different market segments.

Strategic partnerships with local distributors, salon chains, and retail networks enable international brands to enhance market penetration while regional players leverage these relationships to compete effectively against global competitors through superior local market knowledge and customer relationships.

Product type segmentation reveals diverse conditioning categories serving different consumer needs and preferences across the Middle East & Africa market:

By Product Type:

By Hair Type:

By Distribution Channel:

Premium conditioning segment demonstrates exceptional growth potential, driven by increasing consumer sophistication and willingness to invest in high-quality hair care solutions. This category benefits from superior formulations, innovative packaging, and strong brand positioning that justifies premium pricing while delivering superior conditioning results.

Natural and organic categories show accelerating adoption rates as consumers become more ingredient-conscious and environmentally aware. Products featuring botanical extracts, essential oils, and sulfate-free formulations appeal to health-conscious consumers willing to pay premium prices for perceived safety and environmental benefits.

Professional-grade products available through salon channels command higher margins while building consumer loyalty through expert endorsements and superior performance. This category benefits from professional education programs and stylist recommendations that drive consumer trial and repeat purchases.

Value-oriented segments remain crucial for market penetration in price-sensitive regions, requiring efficient formulations that deliver essential conditioning benefits at accessible price points. Success in this category depends on optimizing cost structures while maintaining product efficacy and consumer satisfaction.

Specialized treatment categories addressing specific hair concerns like heat damage, chemical processing effects, and environmental protection create opportunities for premium positioning and brand differentiation through targeted marketing and specialized retail placement strategies.

Manufacturers benefit from expanding market opportunities across diverse consumer segments and geographic regions within the MEA market. The growing demand for conditioning products enables production scale economies while innovation opportunities in natural ingredients and specialized formulations support premium positioning and margin enhancement strategies.

Retailers gain from the hair conditioner category’s ability to drive traffic and basket size increases, as conditioning products often accompany shampoo purchases and other beauty items. The category’s consistent demand patterns and diverse price points enable retailers to serve different customer segments while maintaining healthy profit margins.

Distributors enjoy stable demand fundamentals and opportunities for geographic expansion as market penetration increases across the region. The category’s essential nature ensures consistent sales volumes while premium product growth provides margin enhancement opportunities through value-added distribution services.

Consumers receive access to increasingly sophisticated conditioning formulations that address specific hair care needs while offering improved convenience and performance. Market competition drives innovation and competitive pricing, ensuring consumers benefit from better products at accessible price points across different quality tiers.

Professional stylists benefit from access to advanced conditioning treatments that enhance service offerings and client satisfaction. Professional product lines provide additional revenue streams while positioning salons as hair care experts capable of addressing complex conditioning needs and recommending appropriate home care regimens.

Investors find attractive opportunities in a growing market with strong demographic fundamentals and increasing consumer sophistication. The market’s resilience and essential product nature provide defensive characteristics while innovation opportunities and premium segment growth offer attractive return potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus has emerged as a dominant trend, with consumers increasingly seeking conditioning products featuring eco-friendly packaging, biodegradable formulations, and ethically sourced ingredients. Brands responding to this trend through comprehensive sustainability initiatives are gaining competitive advantages and building stronger consumer loyalty among environmentally conscious segments.

Personalization revolution is transforming how conditioning products are formulated and marketed, with brands leveraging technology to offer customized solutions based on individual hair types, environmental conditions, and specific conditioning needs. This trend enables premium positioning while enhancing consumer satisfaction through targeted product benefits.

Multi-functional formulations combining conditioning benefits with additional features like UV protection, heat styling protection, and color preservation are gaining popularity among time-conscious consumers seeking comprehensive hair care solutions. These products command premium pricing while simplifying consumer routines and reducing product proliferation.

Clean beauty movement continues gaining momentum, with consumers demanding transparency in ingredient lists and avoiding products containing sulfates, parabens, and synthetic fragrances. Brands successfully navigating this trend through reformulation and clear communication are capturing growing market segments willing to pay premiums for perceived safety benefits.

Digital engagement strategies utilizing social media influencers, virtual try-on technologies, and personalized content are reshaping how brands connect with consumers and drive product discovery. According to MarkWide Research analysis, digital marketing initiatives influence 64% of conditioning product purchases among younger consumers in urban markets.

Professional-grade accessibility through retail channels is democratizing access to salon-quality conditioning treatments, enabling consumers to achieve professional results at home while building brand loyalty through superior performance and expert endorsements.

Manufacturing localization has accelerated across the region, with several international brands establishing production facilities in key markets to reduce costs, improve supply chain efficiency, and better serve local consumer preferences. These investments demonstrate long-term commitment to regional growth while creating employment opportunities and supporting economic development.

Strategic partnerships between global brands and local distributors have expanded market reach while enabling cultural adaptation of marketing messages and product positioning. These collaborations leverage local market knowledge and established distribution networks to accelerate market penetration and brand awareness building.

Innovation investments in research and development have intensified, with companies developing specialized formulations addressing regional climate challenges, local hair types, and cultural preferences. These innovations create differentiated product propositions that justify premium positioning while solving specific consumer problems.

Retail channel diversification has expanded beyond traditional outlets to include specialty beauty stores, professional salons, and e-commerce platforms. This multi-channel approach improves product accessibility while enabling targeted marketing strategies for different consumer segments and purchase occasions.

Regulatory compliance initiatives have streamlined product registration processes in several markets, reducing barriers to entry and enabling faster product launches. These regulatory improvements support market development while ensuring consumer safety and product quality standards.

Sustainability commitments by major brands include packaging reduction initiatives, renewable energy adoption in manufacturing, and sustainable ingredient sourcing programs. These commitments respond to growing consumer environmental consciousness while supporting long-term brand reputation and market positioning.

Market entry strategies should prioritize understanding local consumer preferences and cultural sensitivities while adapting global product formulations to address regional climate challenges and hair care needs. Successful market entry requires comprehensive consumer research and localized marketing approaches that resonate with target demographic segments.

Investment priorities should focus on distribution network expansion, particularly in underserved rural markets where infrastructure development can unlock significant growth potential. Companies should also invest in e-commerce capabilities and digital marketing expertise to capture growing online consumer segments and enhance customer engagement.

Product development focus should emphasize natural ingredients, sustainable packaging, and multi-functional formulations that address specific regional needs while appealing to environmentally conscious consumers. Innovation should balance performance benefits with cost considerations to serve diverse economic segments effectively.

Partnership opportunities with local distributors, salon chains, and beauty influencers can accelerate market penetration while building credibility through trusted local relationships. Strategic alliances should leverage complementary strengths and shared market development objectives to maximize mutual benefits.

Brand positioning strategies should differentiate products through clear value propositions that address specific consumer pain points while building emotional connections through culturally relevant messaging. Premium brands should emphasize superior performance and ingredient quality, while value brands should focus on accessibility and essential benefits.

Regulatory compliance requires proactive engagement with local authorities and industry associations to stay informed about changing requirements and ensure smooth product registration processes. Companies should invest in regulatory expertise and compliance systems to avoid delays and market access issues.

Growth trajectory for the Middle East & Africa hair conditioner market remains highly positive, supported by favorable demographic trends, increasing urbanization, and rising consumer sophistication in hair care routines. MWR projects sustained market expansion driven by both volume growth in emerging segments and value growth in premium categories.

Innovation acceleration will continue reshaping the market landscape, with brands investing in advanced formulation technologies, personalized product offerings, and sustainable packaging solutions. These innovations will create new market segments while enhancing competitive differentiation and consumer loyalty among quality-conscious segments.

Digital transformation will fundamentally change how conditioning products are marketed, sold, and consumed throughout the region. E-commerce growth, social media marketing, and personalized customer experiences will become increasingly important for market success, particularly among younger consumer demographics.

Market consolidation may occur as successful brands expand their market presence while smaller players struggle to compete with established distribution networks and marketing resources. This consolidation could create opportunities for strategic acquisitions and partnerships that enhance market coverage and operational efficiency.

Sustainability integration will become a competitive necessity rather than a differentiation opportunity, as consumers increasingly expect environmental responsibility from beauty brands. Companies failing to address sustainability concerns may face market share losses to more environmentally conscious competitors.

Regional market maturation will create opportunities for premium product expansion while maintaining strong demand for value-oriented offerings in price-sensitive segments. This market evolution will require sophisticated portfolio management and targeted marketing strategies to serve diverse consumer needs effectively.

The Middle East & Africa hair conditioner market represents a compelling growth opportunity characterized by strong demographic fundamentals, increasing consumer sophistication, and expanding distribution infrastructure. The market’s unique combination of climate-driven demand, cultural diversity, and economic development creates multiple pathways for sustainable growth across different product categories and consumer segments.

Strategic success factors include deep understanding of local consumer preferences, investment in appropriate distribution channels, and development of formulations that address specific regional needs while maintaining competitive pricing. Companies that effectively balance global expertise with local market adaptation will be best positioned to capture the market’s substantial growth potential.

Future market evolution will be shaped by continued urbanization, digital transformation, and increasing environmental consciousness among consumers. Brands that anticipate these trends and invest in appropriate capabilities will build sustainable competitive advantages while contributing to the market’s overall development and consumer satisfaction enhancement throughout the Middle East & Africa region.

What is Hair Conditioner?

Hair conditioner is a hair care product designed to improve the texture and appearance of hair. It works by moisturizing and detangling hair, making it smoother and easier to manage.

What are the key players in the Middle East & Africa Hair Conditioner Market?

Key players in the Middle East & Africa Hair Conditioner Market include L’Oréal, Unilever, Procter & Gamble, and Henkel, among others.

What are the main drivers of growth in the Middle East & Africa Hair Conditioner Market?

The growth of the Middle East & Africa Hair Conditioner Market is driven by increasing consumer awareness of hair care, rising disposable incomes, and the growing demand for premium hair care products.

What challenges does the Middle East & Africa Hair Conditioner Market face?

Challenges in the Middle East & Africa Hair Conditioner Market include intense competition among brands, fluctuating raw material prices, and varying consumer preferences across different regions.

What opportunities exist in the Middle East & Africa Hair Conditioner Market?

Opportunities in the Middle East & Africa Hair Conditioner Market include the expansion of e-commerce platforms, the introduction of organic and natural products, and the increasing trend of personalized hair care solutions.

What trends are shaping the Middle East & Africa Hair Conditioner Market?

Trends in the Middle East & Africa Hair Conditioner Market include the rise of sustainable and eco-friendly products, the incorporation of advanced technologies in formulations, and the growing popularity of multi-functional hair care products.

Middle East & Africa Hair Conditioner Market

| Segmentation Details | Description |

|---|---|

| Product Type | Leave-In, Rinse-Out, Deep Conditioning, Treatment |

| End User | Women, Men, Children, Salons |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Pharmacies |

| Formulation | Cream, Gel, Spray, Oil |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Hair Conditioner Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at