444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa frozen food market represents one of the fastest-growing segments within the global food industry, driven by rapid urbanization, changing consumer lifestyles, and increasing disposable income across the region. This dynamic market encompasses a diverse range of frozen products including ready-to-eat meals, frozen vegetables, meat and poultry, seafood, bakery items, and dairy products. The region’s strategic geographic position as a trade hub between Asia, Europe, and Africa has significantly contributed to the expansion of frozen food distribution networks and supply chain infrastructure.

Market dynamics in the Middle East & Africa are characterized by a growing young population, increasing female workforce participation, and rapid retail modernization. Countries such as the UAE, Saudi Arabia, South Africa, and Egypt are leading the adoption of frozen food products, with urban penetration rates reaching approximately 68% in major metropolitan areas. The market is experiencing robust growth driven by convenience-seeking consumers, busy lifestyles, and the expansion of modern retail formats including hypermarkets, supermarkets, and online grocery platforms.

Regional variations play a crucial role in market development, with the Gulf Cooperation Council (GCC) countries showing higher adoption rates due to elevated purchasing power and established cold chain infrastructure. Meanwhile, African markets are witnessing accelerated growth as infrastructure development and retail modernization create new opportunities for frozen food penetration. The market is projected to grow at a compound annual growth rate of 8.2% over the forecast period, reflecting strong consumer demand and expanding distribution capabilities.

The Middle East & Africa frozen food market refers to the comprehensive ecosystem of frozen food products, distribution networks, retail channels, and consumer segments operating across the Middle Eastern and African regions. This market encompasses all food products that have been preserved through freezing processes, maintaining nutritional value and extending shelf life while providing convenience to consumers seeking quick meal solutions.

Frozen food products in this market include ready-to-cook meals, frozen fruits and vegetables, processed meat products, seafood, bakery items, ice cream, and specialty ethnic foods tailored to local tastes and preferences. The market definition extends beyond product categories to include the entire value chain from manufacturing and processing facilities to cold storage infrastructure, transportation networks, and retail distribution points.

Geographic scope covers major economies including Saudi Arabia, UAE, Qatar, Kuwait, Egypt, South Africa, Nigeria, Kenya, and Morocco, each presenting unique market characteristics, consumer preferences, and regulatory environments. The market operates within diverse cultural contexts, requiring adaptation of product offerings to meet halal requirements, local taste preferences, and traditional dietary patterns while introducing international cuisine options.

Strategic market positioning reveals the Middle East & Africa frozen food market as a high-growth opportunity driven by demographic shifts, lifestyle changes, and infrastructure development. The market benefits from a young, increasingly urbanized population with growing disposable income and changing food consumption patterns favoring convenience and variety.

Key growth drivers include rapid urbanization with urban population growth rates of 3.1% annually, expanding retail infrastructure, increasing female workforce participation, and rising awareness of food safety and hygiene standards. The market is supported by significant investments in cold chain infrastructure, with major retailers and food service operators expanding their frozen food offerings to meet growing consumer demand.

Competitive landscape features a mix of international food giants, regional players, and local manufacturers competing across various product categories and price segments. Market leaders are focusing on product innovation, local flavor adaptation, and distribution network expansion to capture market share in this rapidly evolving landscape.

Future prospects indicate sustained growth momentum supported by continued urbanization, retail modernization, and changing consumer preferences. The market is expected to benefit from technological advancements in freezing and packaging technologies, expansion of e-commerce platforms, and increasing penetration of modern retail formats across both urban and semi-urban areas.

Consumer behavior analysis reveals significant shifts in food consumption patterns across the Middle East & Africa region, with increasing preference for convenient, time-saving meal solutions. The following key insights shape market development:

Demographic transformation serves as the primary catalyst for frozen food market expansion across the Middle East & Africa region. The growing young population, with median ages below 30 years in most countries, demonstrates higher acceptance of convenience foods and international cuisine options. This demographic shift, combined with increasing urbanization rates, creates a substantial consumer base seeking quick, convenient meal solutions that fit modern lifestyles.

Economic development and rising disposable income levels enable consumers to spend more on convenience foods and premium frozen products. Countries experiencing economic diversification, particularly in the Gulf region, show increased consumer spending on food and beverages, with frozen foods capturing a growing share of household food budgets. The expansion of the middle class across various African markets further amplifies demand for quality frozen food products.

Lifestyle changes driven by urbanization, increased female workforce participation, and longer working hours create strong demand for time-saving food solutions. Modern consumers increasingly value convenience, leading to higher adoption rates of frozen ready meals, pre-prepared ingredients, and quick-cooking frozen products that align with busy schedules and changing family structures.

Infrastructure development in cold chain logistics, retail modernization, and transportation networks enables better distribution and availability of frozen food products. Significant investments in cold storage facilities, refrigerated transportation, and modern retail formats create the foundation for market expansion and improved product quality maintenance throughout the supply chain.

Infrastructure limitations in certain regions pose significant challenges to frozen food market development, particularly in less developed areas where cold chain infrastructure remains inadequate. Limited availability of reliable electricity supply, insufficient cold storage facilities, and inadequate refrigerated transportation networks restrict market penetration and product quality maintenance in rural and semi-urban areas.

Cultural and traditional preferences for fresh, locally-sourced foods create resistance to frozen food adoption among certain consumer segments. Traditional cooking practices, preference for daily fresh food shopping, and skepticism about processed foods limit market expansion in communities with strong culinary traditions and established food preparation habits.

Economic constraints affect purchasing power in lower-income segments, where frozen foods are often perceived as premium products compared to fresh alternatives. Price sensitivity, particularly during economic downturns or periods of currency devaluation, can impact demand for frozen food products and limit market growth in price-conscious consumer segments.

Regulatory challenges including complex import procedures, varying food safety standards across countries, and halal certification requirements create barriers for market entry and expansion. Compliance with diverse regulatory frameworks, labeling requirements, and quality standards increases operational complexity and costs for frozen food manufacturers and distributors.

E-commerce expansion presents tremendous opportunities for frozen food market growth, with online grocery platforms experiencing rapid adoption across the region. The development of sophisticated last-mile delivery solutions, including temperature-controlled delivery systems, enables frozen food companies to reach new customer segments and expand market coverage beyond traditional retail locations.

Product innovation opportunities exist in developing culturally-adapted frozen food products that combine international convenience with local flavors and preferences. Companies can capitalize on growing demand for ethnic frozen foods, healthy options, and premium product segments by creating innovative offerings that meet specific regional tastes and dietary requirements.

Market penetration in underserved regions offers significant growth potential as infrastructure development and retail modernization expand across Africa and secondary cities in the Middle East. Early market entry in emerging markets provides competitive advantages and opportunities to establish strong brand presence before market saturation occurs.

Strategic partnerships with local retailers, food service operators, and distribution companies create opportunities for market expansion and improved supply chain efficiency. Collaborative approaches enable frozen food companies to leverage local market knowledge, distribution networks, and consumer insights while sharing infrastructure investments and market development costs.

Supply chain evolution drives significant changes in market dynamics, with companies investing heavily in cold chain infrastructure and logistics capabilities. The development of regional distribution hubs, advanced cold storage facilities, and temperature-controlled transportation networks improves product quality, reduces waste, and enables market expansion into previously inaccessible areas.

Competitive intensity increases as international brands compete with regional players and local manufacturers for market share across different product categories and price segments. This competition drives innovation, improves product quality, and leads to more competitive pricing, ultimately benefiting consumers while challenging companies to differentiate their offerings and optimize operational efficiency.

Consumer education plays a crucial role in market development, with companies investing in awareness campaigns to communicate the benefits of frozen foods, including convenience, nutritional value, and food safety. Educational initiatives help overcome traditional preferences and misconceptions about frozen foods while building consumer confidence in product quality and safety standards.

Technology integration transforms market operations through advanced freezing technologies, smart packaging solutions, and digital supply chain management systems. These technological advancements improve product quality, extend shelf life, enhance traceability, and optimize inventory management while reducing operational costs and environmental impact.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary research methodologies to provide accurate, reliable insights into the Middle East & Africa frozen food market. The research framework incorporates quantitative and qualitative analysis techniques to capture market trends, consumer behavior patterns, and competitive dynamics across diverse regional markets.

Primary research activities include extensive surveys with consumers, retailers, distributors, and industry stakeholders across key markets in the region. In-depth interviews with industry executives, market experts, and regulatory officials provide valuable insights into market challenges, opportunities, and future trends. Focus group discussions with target consumer segments reveal preferences, purchasing behaviors, and attitudes toward frozen food products.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, company annual reports, and regulatory documents. Market data validation involves cross-referencing multiple sources to ensure accuracy and reliability of market estimates, growth projections, and trend analysis. MarkWide Research employs rigorous data verification processes to maintain research quality and credibility.

Data analysis techniques include statistical modeling, trend analysis, market segmentation, and competitive benchmarking to provide comprehensive market insights. Advanced analytical tools and methodologies enable accurate market sizing, growth forecasting, and identification of key success factors for market participants.

Gulf Cooperation Council (GCC) countries represent the most mature and developed segment of the Middle East & Africa frozen food market, with the UAE and Saudi Arabia leading in terms of market penetration and consumer adoption. These markets benefit from high disposable income, established retail infrastructure, and strong cold chain capabilities. The GCC region accounts for approximately 42% of regional frozen food consumption, driven by expatriate populations, busy lifestyles, and well-developed modern retail formats.

North African markets, including Egypt, Morocco, and Tunisia, show strong growth potential driven by large populations, increasing urbanization, and expanding retail modernization. Egypt represents the largest market by volume in North Africa, with growing middle-class consumers and improving cold chain infrastructure supporting market expansion. These markets demonstrate annual growth rates exceeding 9.5% as consumer preferences shift toward convenience foods.

Sub-Saharan Africa presents emerging opportunities with South Africa leading market development, followed by Nigeria, Kenya, and Ghana. These markets are characterized by rapid urbanization, growing middle-class populations, and increasing retail modernization. Infrastructure development and improving economic conditions create favorable conditions for frozen food market expansion, with urban market penetration rates reaching 35% in major cities.

Levant region markets, including Jordan, Lebanon, and Iraq, show varied development levels with Lebanon demonstrating higher market maturity due to established retail infrastructure and consumer sophistication. Political stability and economic conditions significantly influence market development in these regions, with recovery and stabilization creating new growth opportunities for frozen food companies.

Market leadership is distributed among international food giants, regional players, and specialized frozen food manufacturers, each competing across different product categories and market segments. The competitive environment is characterized by ongoing consolidation, strategic partnerships, and continuous product innovation to meet evolving consumer preferences.

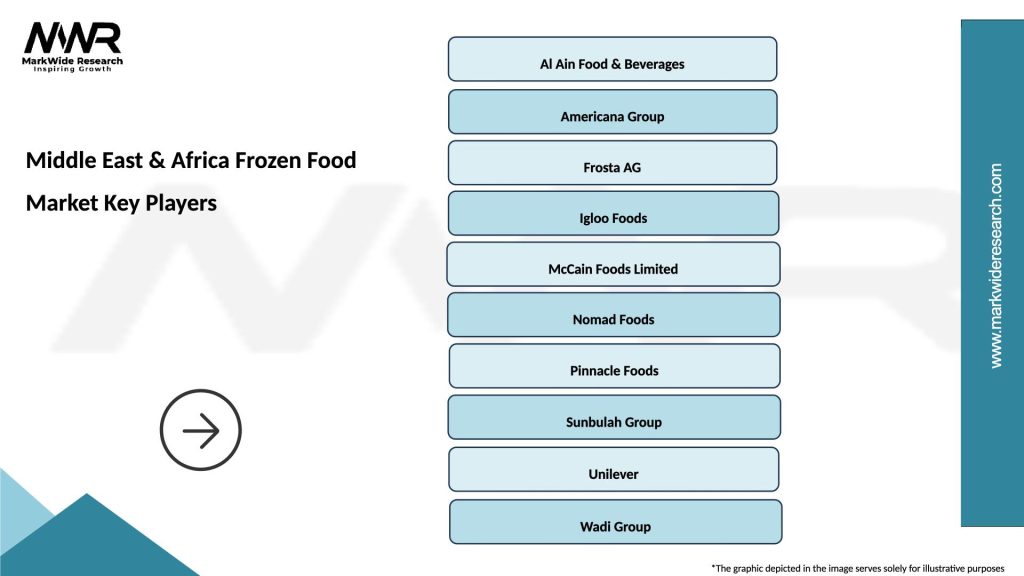

Key market participants include:

Competitive strategies focus on product localization, distribution network expansion, strategic acquisitions, and investment in cold chain infrastructure. Companies are increasingly emphasizing halal certification, local flavor adaptation, and premium product development to differentiate their offerings and capture market share in this competitive landscape.

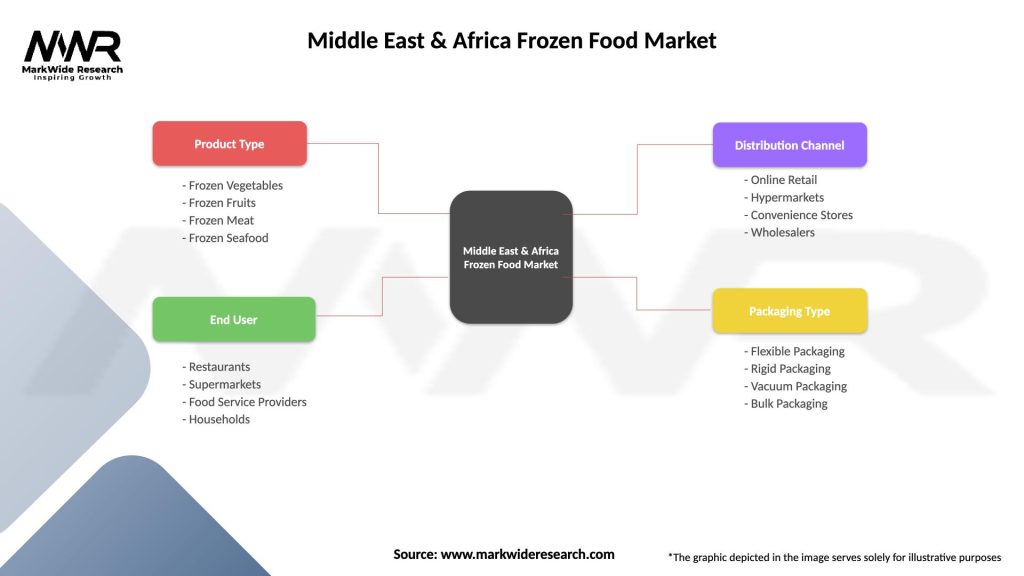

Product category segmentation reveals diverse market opportunities across multiple frozen food segments, each with distinct growth patterns, consumer preferences, and competitive dynamics. The market segmentation provides insights into category-specific trends and opportunities for targeted market development strategies.

By Product Type:

By Distribution Channel:

Frozen ready meals dominate market revenues, driven by busy lifestyles and increasing demand for convenient meal solutions. This category shows strong innovation with companies developing culturally-adapted products that combine international convenience with local flavors. Premium and organic options within this segment are experiencing growth rates of 12.3% annually, reflecting consumer willingness to pay for quality and health-conscious options.

Frozen vegetables represent a rapidly growing category as health-conscious consumers seek convenient ways to incorporate vegetables into their diets. This segment benefits from year-round availability, extended shelf life, and retention of nutritional value. Organic and specialty vegetable products are gaining traction, particularly in affluent markets where consumers prioritize health and quality.

Frozen meat and poultry products require strict halal certification and quality standards to succeed in regional markets. This category is characterized by strong demand for premium cuts, marinated products, and ready-to-cook options. Local and regional suppliers often have advantages due to cultural understanding and established halal supply chains.

Ice cream and frozen desserts maintain strong market presence with established consumer loyalty and seasonal demand patterns. Innovation in this category focuses on premium ingredients, unique flavors, and health-conscious options including sugar-free and low-fat alternatives. Regional flavor preferences drive product development and market success.

Manufacturers benefit from expanding market opportunities, economies of scale in production, and diversification of revenue streams across multiple product categories and geographic markets. The growing market enables companies to invest in advanced production technologies, improve operational efficiency, and develop innovative products that meet evolving consumer preferences.

Retailers gain from higher margin opportunities, increased customer traffic, and enhanced store differentiation through comprehensive frozen food offerings. Modern retail formats can leverage frozen foods to improve inventory turnover, reduce waste, and provide convenient shopping solutions that meet contemporary consumer needs.

Distributors capitalize on growing demand for specialized cold chain logistics services, creating opportunities for service expansion and operational optimization. Investment in temperature-controlled distribution networks enables companies to serve broader geographic areas while maintaining product quality and safety standards.

Consumers enjoy increased convenience, product variety, extended shelf life, and consistent quality from frozen food products. The expanding market provides access to international cuisines, healthy options, and time-saving meal solutions that align with modern lifestyle requirements and dietary preferences.

Economic stakeholders benefit from job creation in manufacturing, logistics, and retail sectors, while infrastructure development supports broader economic growth and modernization initiatives across the region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness focus drives significant market transformation as consumers increasingly seek frozen food options that align with healthy lifestyle choices. This trend manifests in growing demand for organic frozen vegetables, low-sodium ready meals, protein-rich options, and products with clean label ingredients. Manufacturers are responding by reformulating existing products and developing new offerings that meet health-conscious consumer preferences.

Premium product development reflects growing consumer sophistication and willingness to pay for quality, convenience, and unique experiences. Premium frozen food segments, including gourmet ready meals, artisanal ice creams, and specialty ethnic foods, are experiencing robust growth as affluent consumers seek restaurant-quality experiences at home.

Sustainability initiatives gain importance as environmental consciousness increases among consumers and regulatory bodies. Companies are investing in sustainable packaging solutions, reducing food waste through improved supply chain management, and implementing environmentally-friendly production processes to meet growing sustainability expectations.

Digital transformation revolutionizes market operations through e-commerce platforms, digital marketing strategies, and smart supply chain technologies. Online grocery shopping adoption accelerates, particularly following global events that emphasized convenience and safety, creating new opportunities for frozen food market expansion.

Local flavor adaptation becomes increasingly important as companies recognize the need to cater to regional taste preferences while maintaining international quality standards. Successful products combine global convenience with local culinary traditions, creating unique value propositions that resonate with regional consumers.

Infrastructure expansion initiatives across the region include major investments in cold storage facilities, refrigerated transportation networks, and modern retail formats. These developments create the foundation for sustained market growth and improved product availability across diverse geographic areas.

Strategic acquisitions and partnerships reshape the competitive landscape as companies seek to expand market presence, access local expertise, and leverage established distribution networks. Recent consolidation activities demonstrate the industry’s focus on achieving economies of scale and operational efficiency.

Technology adoption accelerates across the value chain, with companies implementing advanced freezing technologies, smart packaging solutions, and digital supply chain management systems. These technological advancements improve product quality, reduce operational costs, and enhance customer experience.

Regulatory harmonization efforts in certain regional blocs aim to streamline food safety standards, import procedures, and quality requirements. These initiatives facilitate trade, reduce compliance costs, and enable more efficient market access for frozen food companies.

Sustainability programs gain momentum as companies implement comprehensive environmental initiatives including sustainable sourcing, packaging innovation, and waste reduction programs. These efforts respond to growing consumer and regulatory expectations for environmental responsibility.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and cultural sensitivities. MarkWide Research analysis indicates that successful market entry requires comprehensive market research, strategic partnerships with local distributors, and adaptation of product offerings to meet regional tastes and dietary requirements.

Investment priorities should focus on cold chain infrastructure development, distribution network expansion, and product innovation capabilities. Companies should allocate resources to building temperature-controlled supply chains, establishing regional distribution hubs, and developing products that combine international quality with local flavor preferences.

Competitive positioning requires differentiation through quality, innovation, and customer service excellence. Companies should focus on building strong brand recognition, developing unique product offerings, and creating superior customer experiences that drive loyalty and market share growth.

Risk management strategies should address supply chain vulnerabilities, regulatory compliance requirements, and economic volatility impacts. Diversification across multiple markets, products, and distribution channels can help mitigate risks and ensure sustainable business growth.

Growth acceleration opportunities exist in e-commerce channel development, premium product segments, and underserved geographic markets. Companies should invest in digital capabilities, develop premium product lines, and explore expansion into emerging markets with growing middle-class populations.

Long-term growth prospects remain highly positive for the Middle East & Africa frozen food market, supported by favorable demographic trends, continued urbanization, and ongoing infrastructure development. The market is expected to maintain robust growth momentum with projected annual growth rates of 8.5% over the next five years, driven by expanding consumer base and improving market accessibility.

Technology integration will continue transforming market operations through advanced freezing technologies, smart packaging solutions, and digital supply chain management systems. These innovations will improve product quality, reduce costs, and enhance customer experiences while enabling more efficient market operations and expansion into new geographic areas.

Market maturation in developed regions will drive focus toward premium products, health-conscious options, and specialized offerings that meet sophisticated consumer preferences. Meanwhile, emerging markets will continue experiencing rapid growth as infrastructure development and retail modernization create new opportunities for market penetration.

Sustainability focus will become increasingly important as environmental consciousness grows among consumers and regulatory bodies. Companies that successfully implement comprehensive sustainability programs, including sustainable sourcing, eco-friendly packaging, and waste reduction initiatives, will gain competitive advantages in the evolving market landscape.

Regional integration efforts may facilitate trade harmonization, reduce regulatory barriers, and enable more efficient supply chain operations across country borders. These developments could accelerate market growth and create opportunities for regional expansion and operational optimization.

The Middle East & Africa frozen food market represents a dynamic and rapidly evolving opportunity characterized by strong growth fundamentals, diverse consumer preferences, and expanding infrastructure capabilities. The market benefits from favorable demographic trends, increasing urbanization, and changing lifestyle patterns that drive demand for convenient, quality food solutions.

Strategic success factors include understanding local market dynamics, investing in appropriate infrastructure, developing culturally-adapted products, and building strong distribution networks. Companies that effectively combine international expertise with local market knowledge are best positioned to capture growth opportunities and build sustainable competitive advantages.

Future market development will be shaped by continued infrastructure investment, technology adoption, sustainability initiatives, and evolving consumer preferences toward health, convenience, and quality. The market’s growth trajectory remains positive, supported by strong fundamentals and expanding opportunities across diverse product categories and geographic regions.

Investment opportunities abound for companies willing to commit resources to market development, infrastructure building, and product innovation. The Middle East & Africa frozen food market offers substantial potential for growth, profitability, and long-term success for organizations that approach it with appropriate strategies, local partnerships, and commitment to meeting evolving consumer needs in this dynamic and promising market environment.

What is Frozen Food?

Frozen food refers to food products that have been preserved by freezing, which helps to maintain their freshness and nutritional value. This category includes a wide range of items such as vegetables, fruits, meats, and ready-to-eat meals.

What are the key players in the Middle East & Africa Frozen Food Market?

Key players in the Middle East & Africa Frozen Food Market include companies like Al Ain Farms, Americana Group, and Nestlé, which offer a variety of frozen products ranging from vegetables to ready meals, among others.

What are the growth factors driving the Middle East & Africa Frozen Food Market?

The growth of the Middle East & Africa Frozen Food Market is driven by factors such as increasing urbanization, changing consumer lifestyles, and a rising demand for convenient meal options. Additionally, the expansion of retail channels is facilitating greater access to frozen food products.

What challenges does the Middle East & Africa Frozen Food Market face?

Challenges in the Middle East & Africa Frozen Food Market include supply chain issues, fluctuating raw material prices, and the need for proper cold storage facilities. These factors can impact the availability and pricing of frozen food products.

What opportunities exist in the Middle East & Africa Frozen Food Market?

Opportunities in the Middle East & Africa Frozen Food Market include the growing trend of online grocery shopping and the increasing demand for organic and health-focused frozen food options. These trends present avenues for innovation and expansion in product offerings.

What trends are shaping the Middle East & Africa Frozen Food Market?

Trends shaping the Middle East & Africa Frozen Food Market include the rise of plant-based frozen products, advancements in freezing technology, and a focus on sustainability in packaging. These trends reflect changing consumer preferences and environmental considerations.

Middle East & Africa Frozen Food Market

| Segmentation Details | Description |

|---|---|

| Product Type | Frozen Vegetables, Frozen Fruits, Frozen Meat, Frozen Seafood |

| End User | Restaurants, Supermarkets, Food Service Providers, Households |

| Distribution Channel | Online Retail, Hypermarkets, Convenience Stores, Wholesalers |

| Packaging Type | Flexible Packaging, Rigid Packaging, Vacuum Packaging, Bulk Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Frozen Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at