444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa frozen bread market represents a rapidly evolving segment within the region’s food processing industry, characterized by increasing urbanization, changing consumer lifestyles, and growing demand for convenient food solutions. This market encompasses a diverse range of frozen bread products including traditional flatbreads, artisanal loaves, specialty breads, and innovative fusion varieties that cater to the region’s multicultural population.

Market dynamics in the Middle East & Africa region are particularly influenced by the growing expatriate population, rising disposable incomes, and the expansion of modern retail infrastructure. The frozen bread sector has experienced substantial growth driven by busy urban lifestyles, increasing working women population, and the need for extended shelf life in challenging climatic conditions. Regional preferences vary significantly, with traditional Arabic breads dominating in Gulf countries while international varieties gain traction in cosmopolitan areas.

Consumer adoption has accelerated at approximately 8.5% annually, reflecting the market’s strong growth trajectory. The region’s unique demographic composition, featuring a significant proportion of young consumers and expatriate communities, has created diverse demand patterns for both traditional and international frozen bread varieties. Retail expansion through hypermarkets, supermarkets, and convenience stores has facilitated market penetration, while foodservice establishments increasingly rely on frozen bread solutions for operational efficiency.

Climate considerations play a crucial role in market development, as the region’s hot and humid conditions make frozen storage an attractive option for maintaining bread quality and extending product life. This environmental factor, combined with growing awareness of food waste reduction, has positioned frozen bread as a practical solution for both consumers and commercial establishments across the Middle East & Africa region.

The Middle East & Africa frozen bread market refers to the commercial ecosystem encompassing the production, distribution, and retail of frozen bread products across countries in the Middle East and African continent. This market includes various bread types that have been baked and then rapidly frozen to preserve freshness, texture, and nutritional value while extending shelf life significantly beyond traditional fresh bread products.

Frozen bread products in this regional context span from traditional Middle Eastern varieties such as pita bread, naan, and khubz to international options including baguettes, croissants, and specialty artisanal breads. The market encompasses both fully baked frozen products that require simple reheating and par-baked items that complete the baking process after thawing, providing flexibility for both retail consumers and foodservice operators.

Market participants include large-scale commercial bakeries, specialized frozen food manufacturers, international food companies with regional operations, and local producers catering to specific cultural preferences. The distribution network involves cold chain logistics, frozen food distributors, retail chains, and foodservice suppliers who ensure product integrity from production facilities to end consumers.

Regional significance extends beyond mere convenience, as frozen bread solutions address specific challenges including extreme weather conditions, supply chain complexities, and the need for consistent quality across diverse geographic markets. This market represents a convergence of traditional baking heritage with modern food preservation technology, creating opportunities for both preserving cultural food traditions and introducing international culinary experiences to regional consumers.

Strategic market positioning of frozen bread in the Middle East & Africa region reflects a dynamic intersection of traditional food culture and modern convenience demands. The market has demonstrated resilience and adaptability, particularly during periods of supply chain disruption, establishing frozen bread as an essential component of the region’s food security infrastructure.

Growth drivers include rapid urbanization rates exceeding 3.2% annually in key markets, increasing participation of women in the workforce, and expanding tourism sectors that demand consistent food quality. The market benefits from favorable demographic trends, with approximately 60% of the population under 30 years of age, representing consumers more open to convenient food solutions and international culinary experiences.

Market segmentation reveals distinct patterns across product categories, with traditional Middle Eastern breads maintaining strong market share while international varieties experience faster growth rates. The foodservice segment has emerged as a significant growth driver, accounting for substantial market demand as restaurants, hotels, and catering services seek operational efficiency and consistent product quality.

Regional variations are pronounced, with Gulf Cooperation Council countries showing higher adoption rates of premium frozen bread products, while North African markets demonstrate strong preference for traditional varieties. Sub-Saharan African markets present emerging opportunities, particularly in urban centers where modern retail infrastructure is expanding rapidly.

Investment trends indicate increasing interest from both regional and international players, with capacity expansion projects and technology upgrades driving market development. The integration of advanced freezing technologies, improved packaging solutions, and enhanced distribution networks positions the market for sustained growth across diverse regional markets.

Consumer behavior analysis reveals several critical insights shaping the Middle East & Africa frozen bread market landscape:

Market intelligence indicates that successful brands focus on authenticity, convenience, and quality consistency while adapting to regional preferences and dietary requirements. The integration of traditional recipes with modern freezing technology has proven particularly effective in building consumer trust and market acceptance across diverse cultural contexts.

Urbanization acceleration stands as the primary driver transforming the Middle East & Africa frozen bread market, with major cities experiencing unprecedented population growth and lifestyle changes. Urban consumers increasingly seek convenient food solutions that align with busy schedules while maintaining quality expectations, creating substantial demand for frozen bread products that can be quickly prepared at home or in commercial settings.

Demographic transformation significantly influences market dynamics, particularly the growing number of working women and dual-income households. This demographic shift has reduced time available for traditional bread preparation, driving adoption of frozen alternatives that provide authentic taste and texture without extensive preparation time. Expatriate communities across the region also drive demand for international bread varieties, creating market opportunities for diverse product portfolios.

Retail infrastructure development has expanded dramatically, with modern hypermarkets and supermarkets investing heavily in frozen food sections and cold chain capabilities. This infrastructure improvement has made frozen bread products more accessible to consumers while ensuring product quality maintenance throughout the distribution process. E-commerce growth further enhances accessibility, particularly in markets where traditional retail penetration remains limited.

Foodservice sector expansion creates substantial demand for frozen bread solutions, as restaurants, hotels, cafes, and catering services seek operational efficiency and consistent quality. The tourism industry’s growth across the region drives demand for international bread varieties, while the expanding quick-service restaurant sector relies heavily on frozen bread products for menu standardization and cost management.

Climate considerations make frozen storage particularly attractive in the region’s challenging environmental conditions. High temperatures and humidity levels can compromise fresh bread quality rapidly, making frozen alternatives more practical for both storage and distribution. This environmental factor creates a natural competitive advantage for frozen bread products over traditional fresh alternatives in many regional markets.

Cultural resistance represents a significant challenge in certain market segments where traditional bread preparation holds deep cultural significance. Many consumers, particularly in rural areas and among older demographics, maintain strong preferences for freshly baked bread from local bakeries, viewing frozen alternatives as inferior substitutes that compromise authenticity and cultural traditions.

Infrastructure limitations constrain market development in several regions, particularly in sub-Saharan Africa where reliable electricity supply and cold chain logistics remain challenging. Inconsistent power supply can compromise frozen product integrity, while limited cold storage facilities restrict distribution reach and increase operational costs for market participants.

Price sensitivity affects market penetration, especially in price-conscious consumer segments where frozen bread products command premium pricing compared to local fresh alternatives. Economic volatility and currency fluctuations in several regional markets create additional pricing pressures, making frozen bread less accessible to lower-income consumer segments.

Quality perceptions continue to challenge market acceptance, as some consumers associate frozen products with inferior taste, texture, or nutritional value compared to fresh alternatives. Overcoming these perceptions requires significant investment in consumer education and product quality improvements, particularly in markets where frozen food adoption remains relatively low.

Regulatory complexities across different countries create compliance challenges for manufacturers and distributors operating in multiple markets. Varying food safety standards, labeling requirements, and import regulations increase operational complexity and costs, particularly for international companies seeking regional market expansion.

Competition from alternatives includes not only fresh bread from local bakeries but also other convenient carbohydrate options such as rice, pasta, and traditional flatbreads that can be prepared quickly at home. This competitive landscape requires frozen bread manufacturers to clearly differentiate their value propositions and demonstrate superior convenience or quality benefits.

Product innovation presents substantial opportunities for market expansion, particularly through development of region-specific frozen bread varieties that combine traditional recipes with modern convenience. Artisanal frozen breads targeting premium market segments show significant potential, as consumers increasingly seek authentic, high-quality products that rival fresh bakery offerings.

Health and wellness trends create opportunities for specialized frozen bread products including gluten-free, low-carb, high-protein, and organic varieties. The growing awareness of dietary requirements and health-conscious consumption patterns opens new market segments, particularly among urban, educated consumers willing to pay premium prices for healthier alternatives.

Foodservice sector expansion offers substantial growth potential as the hospitality industry continues developing across the region. Hotels, restaurants, catering services, and institutional foodservice operations represent high-volume customers seeking consistent quality and operational efficiency. Quick-service restaurant growth particularly drives demand for standardized frozen bread products that ensure menu consistency across multiple locations.

E-commerce development creates new distribution channels and market reach opportunities, particularly in markets where traditional retail infrastructure remains limited. Online grocery platforms and direct-to-consumer delivery services can expand market access while providing detailed product information and customer education opportunities.

Export opportunities exist for regional manufacturers to serve neighboring markets, leveraging cultural similarities and established trade relationships. Cross-border trade within regional economic communities can facilitate market expansion while reducing dependence on single-country operations.

Technology integration opportunities include smart packaging solutions, improved freezing technologies, and enhanced distribution systems that can differentiate products and improve market competitiveness. Investment in research and development can create proprietary advantages and support premium positioning strategies.

Supply chain evolution continues reshaping the Middle East & Africa frozen bread market, with manufacturers investing heavily in cold chain infrastructure and distribution networks. The integration of advanced logistics technologies and temperature-controlled transportation systems has improved product quality consistency while expanding market reach to previously underserved areas.

Competitive intensity has increased significantly as both regional and international players recognize market potential and invest in capacity expansion. This competition drives innovation in product development, packaging solutions, and marketing strategies while generally benefiting consumers through improved quality and competitive pricing. Market consolidation trends indicate larger players acquiring smaller regional manufacturers to expand geographic coverage and product portfolios.

Consumer education initiatives by industry participants have gradually improved market acceptance and understanding of frozen bread benefits. Demonstration programs, sampling campaigns, and partnership with retail chains have helped overcome initial resistance and quality perceptions, contributing to market growth rates of approximately 7.2% annually in key segments.

Regulatory environment evolution has generally supported market development through improved food safety standards and clearer labeling requirements. However, varying regulations across different countries continue to create compliance complexities for manufacturers operating in multiple markets, requiring ongoing investment in regulatory expertise and quality assurance systems.

Technology advancement in freezing processes, packaging materials, and distribution systems continues improving product quality while reducing costs. Innovation cycles have accelerated, with manufacturers introducing new products and varieties more frequently to capture evolving consumer preferences and market opportunities.

Economic factors including currency fluctuations, commodity price volatility, and changing consumer spending patterns create ongoing market dynamics that require adaptive strategies from market participants. The resilience demonstrated during recent economic challenges has strengthened confidence in the market’s long-term growth potential.

Primary research for the Middle East & Africa frozen bread market analysis involved comprehensive data collection through structured interviews with industry stakeholders, including manufacturers, distributors, retailers, and foodservice operators across key regional markets. Survey methodologies encompassed both quantitative questionnaires and qualitative in-depth interviews to capture market dynamics, consumer preferences, and industry trends.

Secondary research utilized extensive analysis of industry reports, trade publications, government statistics, and company financial statements to establish market baselines and validate primary research findings. Data triangulation methods ensured accuracy and reliability by cross-referencing multiple information sources and identifying consistent patterns across different data sets.

Market segmentation analysis employed statistical modeling techniques to identify distinct consumer groups, product categories, and geographic markets with unique characteristics and growth patterns. Demographic analysis incorporated population data, economic indicators, and lifestyle factors to understand market drivers and consumer behavior patterns across different regional markets.

Competitive landscape assessment involved detailed analysis of major market participants, including market share estimation, product portfolio analysis, and strategic positioning evaluation. Supply chain mapping traced product flows from manufacturers through distribution channels to end consumers, identifying key bottlenecks and opportunities for market development.

Trend analysis utilized both historical data and forward-looking indicators to identify emerging market opportunities and potential challenges. Scenario modeling explored different growth trajectories under various economic and market conditions to provide robust market projections and strategic recommendations.

Quality assurance protocols ensured data accuracy through multiple validation steps, expert review processes, and consistency checks across all research components. The methodology incorporated feedback from industry experts and market participants to refine analysis and ensure practical relevance of findings and recommendations.

Gulf Cooperation Council countries represent the most mature and developed segment of the Middle East & Africa frozen bread market, with the United Arab Emirates and Saudi Arabia leading adoption rates. These markets benefit from high disposable incomes, diverse expatriate populations, and well-developed retail infrastructure. Market penetration in GCC countries reaches approximately 45% of urban households, significantly higher than other regional markets.

North African markets including Egypt, Morocco, and Tunisia demonstrate strong potential for traditional frozen bread varieties, particularly those aligned with local culinary preferences. These markets show growing acceptance of frozen alternatives while maintaining strong cultural connections to traditional bread preparation methods. Urban centers in North Africa experience faster adoption rates, with Cairo and Casablanca leading market development.

Levantine region countries including Jordan, Lebanon, and Syria present unique opportunities for authentic Middle Eastern frozen bread products. Despite economic challenges in some areas, these markets maintain strong food culture traditions that create demand for high-quality frozen alternatives to traditional breads. Refugee populations and humanitarian aid programs have also created specific market segments for affordable, nutritious frozen bread products.

Sub-Saharan Africa represents the largest growth opportunity, with countries like Nigeria, Kenya, and South Africa showing increasing urbanization and retail modernization. These markets currently have low frozen bread penetration but demonstrate rapid growth potential as infrastructure develops and consumer awareness increases. Urban growth rates exceeding 4% annually in major cities create expanding target markets for frozen bread products.

East African markets including Ethiopia and Tanzania show emerging potential, particularly in urban areas where modern retail formats are expanding. These markets present opportunities for both international brands and regional manufacturers to establish market presence before competition intensifies.

Regional trade dynamics facilitate market expansion, with established trade relationships and economic cooperation agreements supporting cross-border product distribution. Free trade zones and economic partnerships create opportunities for manufacturers to serve multiple markets from strategic production locations.

Market leadership in the Middle East & Africa frozen bread sector is characterized by a mix of international food companies, regional manufacturers, and specialized frozen food producers. The competitive environment continues evolving as market growth attracts new entrants while established players expand their regional presence and product portfolios.

Competitive strategies focus on product differentiation, regional adaptation, and distribution network expansion. Successful companies demonstrate ability to balance international expertise with local market knowledge, creating products that meet authentic taste expectations while providing modern convenience benefits.

Market positioning varies significantly, with some companies targeting premium segments through artisanal products while others focus on volume markets with affordable, everyday bread varieties. Innovation cycles have accelerated as companies introduce new flavors, formats, and packaging solutions to differentiate their offerings and capture market share.

Strategic partnerships between international companies and regional distributors or manufacturers have become increasingly common, allowing rapid market entry while leveraging local expertise and established distribution networks. These collaborations often result in improved product adaptation and market acceptance rates.

Product type segmentation reveals distinct market categories with varying growth patterns and consumer preferences across the Middle East & Africa frozen bread market:

By Product Type:

By Distribution Channel:

By End-User:

Geographic segmentation shows distinct patterns with Gulf countries leading in premium product adoption, North African markets preferring traditional varieties, and Sub-Saharan Africa representing emerging growth opportunities with basic product categories.

Traditional Middle Eastern breads dominate market volume across most regional markets, with pita bread and various flatbread varieties maintaining strong consumer loyalty and cultural relevance. These products benefit from authentic recipe adaptation and familiar taste profiles that resonate with local consumer preferences. Growth rates in this category remain steady at approximately 6.5% annually, driven by increasing convenience adoption rather than market expansion.

International bread varieties demonstrate the fastest growth rates, particularly in cosmopolitan urban centers and areas with significant expatriate populations. Croissants, baguettes, and European-style breads appeal to consumers seeking diverse culinary experiences and premium quality products. This category benefits from growing food culture sophistication and increasing exposure to international cuisine through travel and media.

Specialty and artisanal breads represent the highest value segment, targeting affluent consumers willing to pay premium prices for superior quality and unique characteristics. These products often feature organic ingredients, traditional baking methods, and distinctive flavor profiles that differentiate them from mass-market alternatives. Premium positioning allows for higher profit margins while serving niche market segments.

Health-focused categories including gluten-free, low-carb, and high-protein options show strong growth potential as health consciousness increases among urban consumers. These products address specific dietary needs while maintaining taste and texture expectations, creating opportunities for specialized manufacturers and premium pricing strategies.

Foodservice-specific products designed for commercial kitchen efficiency and consistency represent a growing category with unique requirements including portion control, preparation simplicity, and cost-effectiveness. These products often feature different packaging formats and preparation instructions optimized for commercial operations rather than household use.

Private label development by major retailers has created additional category dynamics, with store brands offering competitive alternatives to manufacturer brands while providing retailers with higher profit margins and customer loyalty benefits.

Manufacturers benefit from expanding market opportunities driven by urbanization, changing lifestyles, and growing acceptance of frozen food solutions. The market provides opportunities for both large-scale production efficiency and specialized niche products, allowing companies to optimize their strategies based on capabilities and market positioning. Export potential enables regional manufacturers to serve multiple markets from centralized production facilities.

Retailers gain from frozen bread products’ attractive profit margins, extended shelf life, and reduced waste compared to fresh alternatives. These products require less frequent restocking, reduce inventory management complexity, and provide consistent availability for consumers. Category expansion allows retailers to offer diverse product portfolios that meet varying consumer preferences and price points.

Foodservice operators achieve significant operational benefits including consistent quality, reduced preparation time, lower labor costs, and improved inventory management. Frozen bread products enable menu standardization across multiple locations while reducing dependency on local bakery suppliers. Cost predictability helps with budgeting and pricing strategies in competitive foodservice markets.

Consumers benefit from convenient access to diverse bread varieties, extended storage life, and consistent quality regardless of location or time of purchase. Frozen bread products provide flexibility in meal planning, reduce food waste, and offer authentic taste experiences for traditional and international varieties. Time savings appeal particularly to busy urban consumers and working families.

Distributors and logistics providers benefit from growing cold chain requirements and expanding distribution networks needed to serve the frozen bread market. These companies can leverage existing frozen food infrastructure while expanding service offerings to new customer segments and geographic markets.

Technology providers find opportunities in supplying freezing equipment, packaging solutions, cold storage systems, and distribution technologies that support market growth and quality improvement initiatives across the value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness integration has emerged as a dominant trend, with manufacturers increasingly focusing on nutritious ingredients, reduced additives, and functional benefits. Whole grain varieties, protein-enriched options, and products featuring ancient grains or superfoods appeal to health-conscious consumers willing to pay premium prices for perceived nutritional benefits.

Authenticity emphasis drives product development toward traditional recipes and artisanal production methods that maintain cultural relevance while providing modern convenience. Manufacturers invest in recipe research and traditional baking technique adaptation to create frozen products that closely replicate fresh, locally-made alternatives.

Packaging innovation focuses on sustainability, convenience, and product protection through advanced materials and design solutions. Eco-friendly packaging addresses environmental concerns while resealable formats and portion control options enhance consumer convenience and reduce waste.

Digital marketing expansion leverages social media, influencer partnerships, and online content to educate consumers about product benefits and preparation methods. Recipe sharing and cooking demonstrations help overcome quality perceptions while building brand engagement and consumer loyalty.

Foodservice customization trends include development of products specifically designed for commercial kitchen requirements, featuring optimized sizes, preparation methods, and cost structures that address operational efficiency needs in restaurants and catering operations.

Regional flavor fusion creates innovative products that combine traditional Middle Eastern or African flavors with international bread styles, appealing to adventurous consumers and multicultural market segments seeking unique culinary experiences.

Supply chain transparency becomes increasingly important as consumers seek information about ingredient sourcing, production methods, and quality assurance processes, driving manufacturers to provide detailed product information and traceability systems.

Capacity expansion projects across the region indicate strong industry confidence in market growth potential, with several major manufacturers announcing significant investments in production facilities and cold storage infrastructure. These developments aim to serve growing demand while improving operational efficiency and market coverage.

Technology adoption has accelerated, with companies implementing advanced freezing technologies, automated production systems, and improved packaging solutions that enhance product quality while reducing costs. MarkWide Research analysis indicates that technology investments have contributed to quality improvements that address traditional consumer concerns about frozen bread products.

Strategic partnerships between international companies and regional players have increased, facilitating market entry, local expertise access, and distribution network expansion. These collaborations often result in product adaptation and improved market acceptance rates through combination of global expertise with local market knowledge.

Regulatory harmonization efforts across regional economic communities aim to simplify cross-border trade and reduce compliance complexity for manufacturers operating in multiple markets. These developments support market expansion and operational efficiency improvements for industry participants.

Sustainability initiatives have gained prominence, with companies investing in energy-efficient production processes, sustainable packaging materials, and waste reduction programs that address environmental concerns while potentially reducing operational costs.

Product certification programs including halal, organic, and quality assurance certifications have expanded to meet diverse consumer requirements and facilitate market access across different regional markets with varying regulatory and cultural requirements.

Cold chain infrastructure development by logistics providers and retailers has improved product quality maintenance and market reach, enabling frozen bread manufacturers to serve previously inaccessible markets while maintaining product integrity throughout the distribution process.

Market entry strategies should prioritize understanding local consumer preferences and cultural sensitivities, particularly regarding traditional bread varieties and preparation methods. Successful market penetration requires authentic product adaptation rather than simple international product transplantation, with emphasis on maintaining familiar taste profiles while providing convenience benefits.

Investment priorities should focus on cold chain infrastructure development, quality assurance systems, and consumer education programs that address perception barriers and demonstrate product benefits. Technology investments in advanced freezing and packaging solutions can provide competitive advantages while improving product quality and shelf life.

Distribution strategy optimization should emphasize partnerships with established retail chains and foodservice distributors who possess market knowledge and customer relationships. Multi-channel approaches combining traditional retail, modern trade, and emerging e-commerce channels can maximize market coverage and consumer accessibility.

Product portfolio development should balance traditional varieties that serve core market demand with innovative products that capture emerging trends and premium segments. Segmentation strategies should address different consumer groups including price-sensitive segments, health-conscious consumers, and premium quality seekers.

Marketing communication should emphasize quality, authenticity, and convenience benefits while addressing common misconceptions about frozen products. Educational campaigns demonstrating proper preparation methods and highlighting quality maintenance can improve consumer acceptance and usage rates.

Regulatory compliance preparation should anticipate evolving food safety standards and labeling requirements across different regional markets. Certification strategies should include relevant quality, religious, and organic certifications that facilitate market access and consumer acceptance.

Sustainability integration should address packaging, production efficiency, and waste reduction concerns that increasingly influence consumer purchasing decisions and regulatory requirements across regional markets.

Market expansion is projected to continue at robust rates, driven by ongoing urbanization, infrastructure development, and changing consumer lifestyles across the Middle East & Africa region. Growth acceleration is expected in currently underserved markets, particularly in Sub-Saharan Africa where retail modernization and urban development create expanding opportunities for frozen bread products.

Product innovation will likely focus on health and wellness trends, with increased development of functional breads featuring added nutrients, reduced sodium, and specialized dietary formulations. Premium segment growth is anticipated as consumer sophistication increases and disposable incomes rise in key urban markets.

Technology integration will continue advancing, with smart packaging, improved freezing processes, and enhanced distribution systems supporting quality improvements and operational efficiency gains. Automation adoption in production and distribution processes will likely reduce costs while improving consistency and scalability.

Market consolidation trends may accelerate as successful companies expand through acquisitions and partnerships, creating larger regional players with enhanced distribution capabilities and product portfolios. International expansion by regional manufacturers into neighboring markets is expected to increase as companies leverage established expertise and cultural understanding.

Sustainability focus will intensify, with companies investing in environmentally friendly packaging, energy-efficient production processes, and waste reduction initiatives that address consumer concerns and regulatory requirements. Circular economy principles may influence packaging design and production processes.

E-commerce integration will expand significantly, particularly in urban markets where delivery infrastructure supports frozen food distribution. MWR projections indicate that online channels could account for approximately 15% of retail sales within the next five years in major urban markets.

Regulatory evolution will likely continue toward harmonization and standardization across regional markets, potentially simplifying compliance requirements and facilitating cross-border trade for industry participants.

The Middle East & Africa frozen bread market represents a rapidly expanding food sector driven by urbanization, changing lifestyle patterns, and increasing demand for convenient food solutions across diverse regional markets. Market dynamics across key countries including Saudi Arabia, UAE, Egypt, South Africa, Nigeria, and emerging African economies demonstrate substantial growth potential supported by retail modernization, cold-chain infrastructure development, and rising consumer acceptance of frozen bakery products. Food safety standards and quality assurance improvements continue enhancing market credibility and consumer confidence throughout the MEA region.

Strategic success in this diverse market requires understanding cultural food preferences, economic conditions, and distribution challenges that vary significantly across Middle Eastern and African countries. Companies that prioritize halal certification, local flavor adaptations, and robust cold-chain logistics will be best positioned to capture opportunities in this growing sector. Retail partnerships with modern grocery chains and foodservice establishments have become essential for maintaining market presence and reaching diverse consumer segments across urban and emerging markets.

Innovation excellence in product formulation, shelf-life extension, and packaging solutions positions the region for continued market expansion and export potential. Manufacturing capabilities and local production facilities leverage regional wheat supplies while reducing import dependency and transportation costs. Consumer trend integration including healthy options, premium varieties, and portion-controlled packaging aligns with evolving dietary preferences and lifestyle changes across MEA markets.

The competitive environment will continue intensifying as both established international brands and regional manufacturers compete for market share in this high-growth food category. Sustained growth will require ongoing investment in cold-chain infrastructure, product innovation, and market-specific strategies to meet diverse consumer needs and regulatory requirements across MEA countries. Market-focused approaches emphasizing affordability, convenience, and cultural relevance will become increasingly important differentiators in this dynamic and rapidly expanding Middle East & Africa frozen bread market.

What is Frozen Bread?

Frozen bread refers to bread products that are prepared and then frozen to preserve freshness and extend shelf life. This category includes various types of bread such as loaves, rolls, and specialty breads that can be easily thawed and baked for consumption.

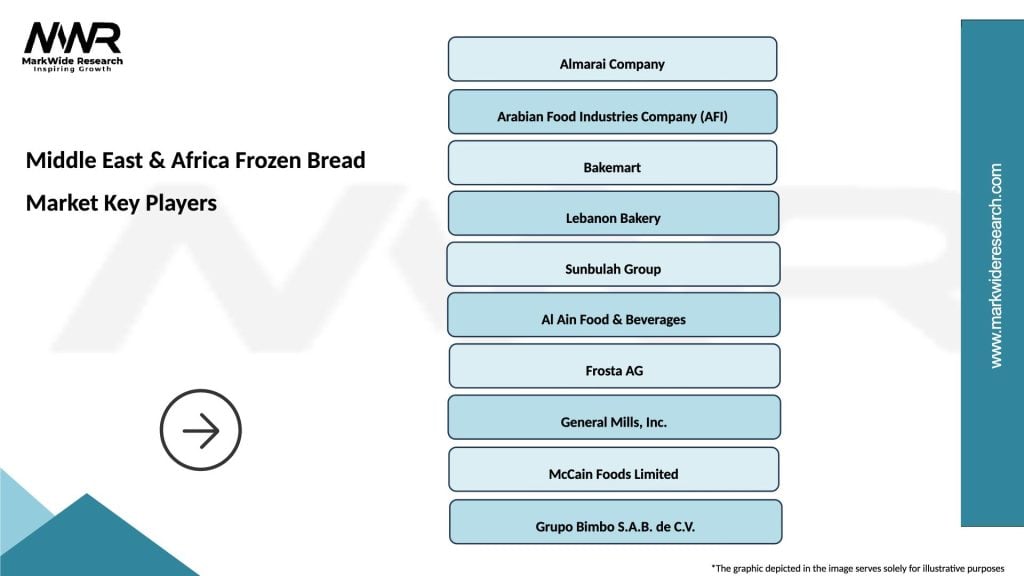

What are the key players in the Middle East & Africa Frozen Bread Market?

Key players in the Middle East & Africa Frozen Bread Market include companies like Aryzta AG, Grupo Bimbo, and Almarai, which are known for their extensive product ranges and distribution networks in the frozen food sector, among others.

What are the growth factors driving the Middle East & Africa Frozen Bread Market?

The growth of the Middle East & Africa Frozen Bread Market is driven by increasing consumer demand for convenience foods, the rise in the number of quick-service restaurants, and the growing trend of on-the-go eating among busy lifestyles.

What challenges does the Middle East & Africa Frozen Bread Market face?

Challenges in the Middle East & Africa Frozen Bread Market include fluctuating raw material prices, competition from fresh bread products, and logistical issues related to distribution and storage of frozen goods.

What opportunities exist in the Middle East & Africa Frozen Bread Market?

Opportunities in the Middle East & Africa Frozen Bread Market include the potential for product innovation, such as gluten-free and organic options, and the expansion of e-commerce platforms for frozen food distribution.

What trends are shaping the Middle East & Africa Frozen Bread Market?

Trends shaping the Middle East & Africa Frozen Bread Market include the increasing popularity of artisanal and specialty breads, the rise of health-conscious consumer choices, and advancements in freezing technology that enhance product quality.

Middle East & Africa Frozen Bread Market

| Segmentation Details | Description |

|---|---|

| Product Type | White Bread, Whole Wheat Bread, Multigrain Bread, Gluten-Free Bread |

| End User | Retail Chains, Food Service, Bakeries, Households |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Wholesalers |

| Packaging Type | Plastic Bags, Vacuum Packs, Cardboard Boxes, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Frozen Bread Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at