444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa food fortifying agents market represents a rapidly expanding sector driven by increasing awareness of nutritional deficiencies and government initiatives to combat malnutrition. This dynamic market encompasses a comprehensive range of vitamins, minerals, amino acids, and other essential nutrients that are systematically added to food products to enhance their nutritional value. The region’s diverse population, varying dietary patterns, and significant prevalence of micronutrient deficiencies create substantial opportunities for food fortification programs.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.8% driven by mandatory fortification regulations and rising consumer health consciousness. The market spans across various food categories including cereals, dairy products, beverages, and processed foods, with each segment demonstrating unique growth trajectories and consumer preferences.

Regional variations play a crucial role in market development, as different countries within the Middle East and Africa implement distinct fortification policies and face varying nutritional challenges. The market’s expansion is further supported by increasing urbanization, changing lifestyle patterns, and growing awareness of the link between nutrition and health outcomes.

The Middle East & Africa food fortifying agents market refers to the comprehensive ecosystem of nutritional additives, supplements, and enhancement compounds specifically designed to improve the nutritional profile of food products across the Middle Eastern and African regions. This market encompasses the production, distribution, and application of essential vitamins, minerals, amino acids, fatty acids, and other bioactive compounds that are systematically incorporated into various food matrices to address nutritional deficiencies and enhance public health outcomes.

Food fortification in this context represents a strategic public health intervention that involves the deliberate addition of micronutrients to commonly consumed foods to prevent or correct demonstrated deficiencies in populations. The market includes both mandatory fortification programs mandated by government regulations and voluntary fortification initiatives undertaken by food manufacturers to meet consumer demand for nutritionally enhanced products.

Strategic market positioning reveals the Middle East & Africa food fortifying agents market as a critical component of the region’s public health infrastructure, addressing widespread nutritional deficiencies while creating significant commercial opportunities. The market demonstrates strong growth momentum, supported by increasing government investments in nutrition programs and rising consumer awareness of health and wellness benefits.

Key market drivers include mandatory fortification regulations covering 85% of wheat flour in major regional markets, growing prevalence of lifestyle-related diseases, and expanding middle-class population with increased purchasing power. The market benefits from technological advancements in fortification techniques, improved bioavailability of nutrients, and development of cost-effective delivery systems suitable for diverse food applications.

Market segmentation reveals vitamins as the dominant category, accounting for significant market share, followed by minerals and amino acids. The cereals and grains segment represents the largest application area, driven by staple food fortification programs, while the beverages segment shows the highest growth potential due to increasing consumer preference for functional drinks.

Comprehensive market analysis reveals several critical insights that shape the Middle East & Africa food fortifying agents landscape:

Government initiatives serve as the primary catalyst for market expansion, with comprehensive national nutrition strategies implemented across multiple countries in the region. These initiatives include mandatory fortification programs for staple foods, public awareness campaigns, and substantial budget allocations for nutrition improvement projects. The regulatory environment creates stable, long-term demand for fortifying agents while establishing quality standards and monitoring frameworks.

Rising health consciousness among consumers drives voluntary fortification demand, particularly in urban areas where disposable income levels support premium nutritional products. This trend is amplified by increasing prevalence of lifestyle-related diseases, growing awareness of preventive healthcare, and expanding access to health information through digital platforms and social media channels.

Demographic factors contribute significantly to market growth, including rapid population growth, increasing urbanization rates, and expanding middle-class segments with enhanced purchasing power. The region’s young demographic profile creates substantial demand for child nutrition products, while aging populations in certain areas drive demand for age-specific nutritional solutions.

Economic development across the region supports market expansion through improved food processing infrastructure, enhanced supply chain capabilities, and increased investment in food technology. Growing food processing industries create demand for fortifying agents, while improving economic conditions enable broader population access to fortified products.

Cost considerations represent a significant challenge, particularly in price-sensitive markets where fortification can increase product costs by 15-25% compared to non-fortified alternatives. This cost burden affects both manufacturers and consumers, potentially limiting market penetration in lower-income segments and rural areas where purchasing power remains constrained.

Technical challenges include maintaining nutrient stability in harsh climatic conditions, ensuring uniform distribution in food matrices, and preventing adverse effects on taste, color, or texture. These technical complexities require sophisticated manufacturing processes and quality control systems, increasing operational costs and complexity for food manufacturers.

Regulatory inconsistencies across different countries create market fragmentation and compliance challenges for manufacturers operating in multiple markets. Varying fortification standards, approval processes, and monitoring requirements increase operational complexity and limit economies of scale in production and distribution.

Consumer acceptance barriers persist in certain market segments, including concerns about artificial additives, cultural preferences for traditional foods, and limited awareness of fortification benefits. These factors particularly affect rural markets and traditional consumer segments, limiting market penetration and growth potential.

Emerging market segments present substantial growth opportunities, particularly in functional beverages, sports nutrition, and specialized dietary products. The growing popularity of health and wellness trends creates demand for innovative fortified products that combine traditional foods with modern nutritional science, appealing to health-conscious consumers across various demographic segments.

Technology advancement opportunities include development of novel delivery systems, improved bioavailability formulations, and cost-effective production methods. Innovations in microencapsulation, nanotechnology, and precision nutrition create possibilities for more effective and affordable fortification solutions tailored to specific regional needs and preferences.

Public-private partnerships offer significant expansion potential through collaborative programs that combine government policy support with private sector innovation and efficiency. These partnerships can accelerate market development, improve product accessibility, and create sustainable business models that serve both commercial and public health objectives.

Export opportunities emerge as regional manufacturers develop expertise and capacity in food fortification, creating potential for technology transfer and product export to other developing markets. This expansion can drive economies of scale and support continued innovation in fortification technologies and applications.

Supply chain evolution demonstrates increasing sophistication as market participants invest in cold chain infrastructure, quality management systems, and traceability technologies. These improvements enhance product quality, reduce waste, and enable more effective distribution to remote markets, supporting overall market growth and accessibility.

Competitive dynamics show intensifying competition among international and regional suppliers, driving innovation in product formulations, cost optimization, and customer service. This competition benefits end users through improved product quality, competitive pricing, and expanded product options tailored to specific market needs and applications.

Technology integration accelerates across the value chain, with digital solutions improving supply chain visibility, quality monitoring, and consumer engagement. Advanced analytics and IoT technologies enable more precise fortification processes, better inventory management, and enhanced product traceability throughout the distribution network.

Market consolidation trends emerge as larger players acquire specialized companies and regional distributors to expand market reach and technical capabilities. This consolidation creates more integrated supply chains while maintaining innovation through specialized subsidiaries and partnership arrangements.

Comprehensive research approach employed multiple data collection methods to ensure accurate and reliable market analysis. Primary research included structured interviews with key industry stakeholders, including fortifying agent manufacturers, food processors, regulatory officials, and nutrition experts across major markets in the Middle East and Africa regions.

Secondary research encompassed extensive analysis of government publications, industry reports, academic studies, and regulatory documents from relevant authorities in target markets. This research provided historical market data, regulatory frameworks, and policy developments that influence market dynamics and growth trajectories.

Data validation processes included cross-referencing multiple sources, expert consultations, and statistical analysis to ensure data accuracy and reliability. Market sizing and forecasting employed established econometric models adjusted for regional market characteristics and growth patterns specific to the Middle East and Africa food fortification sector.

Regional coverage included detailed analysis of major markets including Saudi Arabia, UAE, Egypt, South Africa, Nigeria, and Kenya, with additional insights from emerging markets across the broader Middle East and Africa regions. This comprehensive geographic coverage ensures representative market analysis and accurate trend identification.

Middle East markets demonstrate strong growth driven by government initiatives and increasing health awareness, with the Gulf Cooperation Council countries leading in premium fortified product adoption. Saudi Arabia and UAE represent the largest markets, accounting for 45% of regional demand, supported by mandatory fortification programs and high consumer purchasing power.

North African markets show significant potential driven by large population bases and active government nutrition programs. Egypt leads the region with comprehensive flour fortification initiatives, while Morocco and Algeria demonstrate growing market development through expanding food processing sectors and increasing consumer awareness of nutritional benefits.

Sub-Saharan Africa presents the highest growth potential due to widespread nutritional deficiencies and increasing government focus on public health improvement. South Africa maintains market leadership with 35% market share in the sub-region, followed by Nigeria and Kenya, which show rapid growth in both mandatory and voluntary fortification programs.

East African markets demonstrate emerging opportunities through regional integration initiatives and harmonized fortification standards. Countries including Ethiopia, Tanzania, and Uganda show increasing adoption of fortification programs, supported by international development partnerships and growing food processing industries.

Market leadership is distributed among several key players who have established strong regional presence through strategic partnerships and local manufacturing capabilities:

Regional players maintain significant market positions through local expertise, cost advantages, and established customer relationships. These companies often focus on specific product categories or geographic markets, creating competitive dynamics that drive innovation and market development.

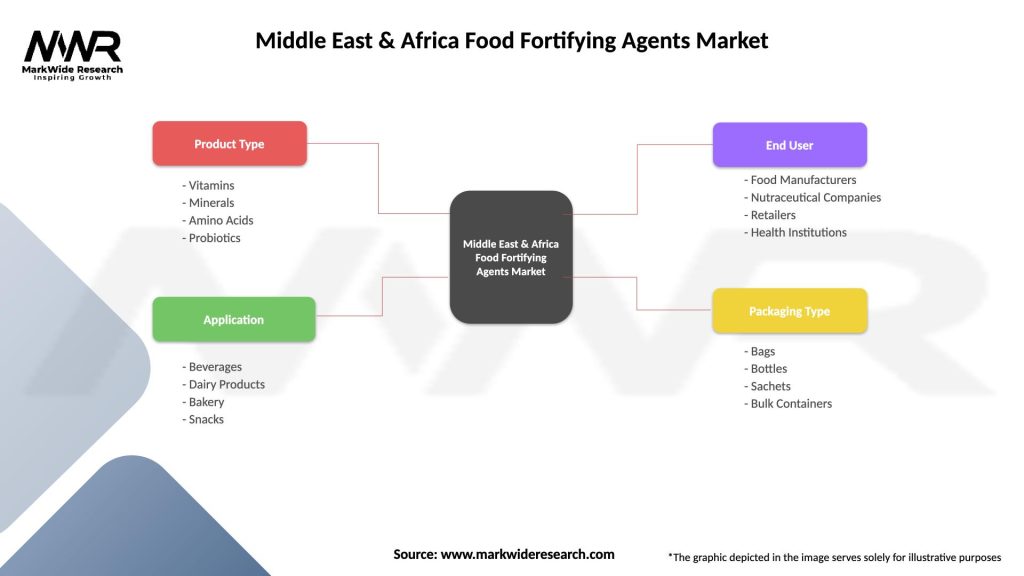

By Product Type:

By Application:

By End User:

Vitamin fortification represents the most established category, with vitamin A fortification programs achieving 78% coverage in major regional markets. This category benefits from well-established regulatory frameworks, proven health benefits, and cost-effective implementation across various food matrices. Growth drivers include expanding fortification mandates and increasing consumer awareness of vitamin deficiency health impacts.

Mineral fortification shows strong growth potential, particularly iron fortification programs addressing widespread anemia prevalence across the region. Calcium fortification gains momentum through dairy product applications, while zinc fortification emerges as a priority for child nutrition programs. Technical challenges include maintaining mineral bioavailability and preventing adverse sensory effects.

Amino acid fortification represents an emerging category with significant growth potential, driven by increasing focus on protein quality and essential amino acid profiles. This category particularly benefits from growing sports nutrition markets and increasing awareness of protein malnutrition in certain population segments.

Specialty ingredients including probiotics, prebiotics, and functional compounds show rapid growth in premium market segments. These ingredients appeal to health-conscious consumers and support development of differentiated products with specific health claims and benefits.

Manufacturers benefit from stable demand created by mandatory fortification programs, opportunities for product differentiation, and access to growing health-conscious consumer segments. The market provides platforms for innovation in delivery systems, formulation optimization, and development of region-specific solutions that address unique nutritional challenges and cultural preferences.

Food processors gain competitive advantages through fortified product offerings, compliance with regulatory requirements, and ability to command premium pricing for nutritionally enhanced products. Fortification enables market expansion into health-focused segments and supports brand positioning as socially responsible companies contributing to public health improvement.

Consumers receive significant health benefits through improved nutritional status, reduced risk of deficiency-related diseases, and access to convenient nutrition enhancement through everyday foods. Fortification provides cost-effective nutrition improvement compared to separate supplement purchases, particularly benefiting lower-income populations.

Governments achieve public health objectives through cost-effective population-wide nutrition interventions, reduced healthcare costs associated with deficiency diseases, and improved economic productivity through better population health outcomes. Fortification programs support national development goals and international nutrition commitments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized nutrition emerges as a significant trend, with increasing focus on population-specific and demographic-targeted fortification solutions. This trend drives development of specialized products for children, pregnant women, elderly populations, and specific health conditions, creating new market segments and growth opportunities.

Clean label movement influences product development, with consumers increasingly demanding natural and organic fortifying agents over synthetic alternatives. This trend drives innovation in natural vitamin sources, plant-based minerals, and organic certification processes, creating premium market segments with higher value propositions.

Sustainability focus gains prominence as environmental consciousness grows among consumers and manufacturers. This trend promotes development of sustainable sourcing practices, eco-friendly packaging solutions, and environmentally responsible production methods that appeal to environmentally conscious market segments.

Digital integration transforms market dynamics through e-commerce platforms, digital marketing strategies, and consumer education programs. According to MarkWide Research analysis, digital channels show rapid growth of 22% annually in reaching consumers with fortified product information and purchasing options.

Functional convergence creates opportunities for multi-benefit products that combine fortification with other functional ingredients such as probiotics, antioxidants, and bioactive compounds. This trend supports premium positioning and differentiated product offerings in competitive markets.

Regulatory harmonization initiatives across regional economic communities create opportunities for standardized fortification approaches and reduced compliance complexity. Recent developments include African Union nutrition guidelines and Gulf Cooperation Council food safety standards that support market integration and expansion.

Technology partnerships between international suppliers and local manufacturers accelerate knowledge transfer and capacity building. These collaborations enhance local production capabilities, reduce costs, and improve product quality while supporting sustainable market development and technology localization.

Investment expansion by major international companies demonstrates confidence in regional market potential. Recent facility expansions, local manufacturing investments, and distribution network developments indicate strong commitment to long-term market participation and growth.

Innovation accelerators including research partnerships with regional universities and government research institutions drive development of locally relevant solutions. These initiatives focus on addressing specific regional nutritional challenges and developing cost-effective fortification technologies suitable for local conditions.

Quality assurance improvements through international certification programs and quality management system implementations enhance product reliability and consumer confidence. These developments support market credibility and enable access to international markets and premium customer segments.

Strategic recommendations for market participants include focusing on cost-effective solutions that balance nutritional benefits with affordability constraints in price-sensitive markets. Companies should prioritize development of region-specific formulations that address local nutritional deficiencies while considering cultural dietary preferences and consumption patterns.

Investment priorities should emphasize local manufacturing capabilities, supply chain optimization, and quality assurance systems that ensure product reliability and regulatory compliance. Building strong relationships with government agencies and participating in public-private partnerships can create sustainable competitive advantages and market access opportunities.

Innovation focus should target advanced delivery systems that improve nutrient stability and bioavailability in challenging environmental conditions. Development of natural and organic fortifying agents can capture growing clean label demand while premium positioning supports improved profit margins.

Market expansion strategies should prioritize underserved rural markets through appropriate distribution channels and affordable product formulations. Digital marketing and consumer education programs can accelerate awareness building and market penetration in emerging segments.

Partnership development with international development organizations, government agencies, and local food processors can create scalable business models that serve both commercial objectives and public health goals. These collaborations can provide access to funding, technical expertise, and market credibility.

Long-term growth prospects remain highly positive, supported by expanding government nutrition programs, increasing health awareness, and growing economic development across the region. MWR projections indicate sustained growth momentum with compound annual growth rates exceeding 7% over the next five years, driven by both mandatory and voluntary fortification expansion.

Technology evolution will continue driving market development through improved delivery systems, enhanced bioavailability, and cost-effective production methods. Advances in nanotechnology, microencapsulation, and precision nutrition will create new opportunities for product differentiation and market expansion.

Market maturation in developed regional markets will drive focus toward premium segments and specialized applications, while emerging markets will continue experiencing rapid growth in basic fortification programs. This dual dynamic creates opportunities for companies with diverse product portfolios and market positioning strategies.

Regulatory evolution toward harmonized standards and expanded fortification mandates will support market growth while creating opportunities for companies with strong compliance capabilities and quality management systems. International trade agreements and regional integration initiatives will facilitate market access and expansion opportunities.

Consumer behavior shifts toward health-conscious purchasing decisions and premium product preferences will support market value growth and innovation investment. Increasing disposable income and urbanization will expand accessible market segments and support sustainable business model development.

The Middle East & Africa food fortifying agents market represents a dynamic and rapidly expanding sector with substantial growth potential driven by compelling public health needs, supportive regulatory frameworks, and increasing consumer health consciousness. The market’s evolution from basic mandatory fortification programs toward sophisticated, consumer-driven nutrition enhancement solutions creates diverse opportunities for industry participants across the value chain.

Strategic market positioning requires understanding of regional diversity, regulatory complexity, and varying consumer preferences while maintaining focus on cost-effectiveness and nutritional efficacy. Companies that successfully balance innovation with affordability, quality with accessibility, and global expertise with local relevance will capture the most significant growth opportunities in this expanding market.

Future success factors include continued investment in technology development, strategic partnerships with government and development organizations, and commitment to sustainable business practices that serve both commercial objectives and public health goals. The market’s positive trajectory, supported by demographic trends, economic development, and increasing health awareness, positions food fortifying agents as essential components of the region’s nutrition and health infrastructure development.

What is Food Fortifying Agents?

Food fortifying agents are substances added to food products to enhance their nutritional value. They are commonly used to combat deficiencies in essential vitamins and minerals, improving public health outcomes.

What are the key players in the Middle East & Africa Food Fortifying Agents Market?

Key players in the Middle East & Africa Food Fortifying Agents Market include DSM Nutritional Products, BASF SE, and Archer Daniels Midland Company, among others.

What are the main drivers of the Middle East & Africa Food Fortifying Agents Market?

The main drivers of the Middle East & Africa Food Fortifying Agents Market include the rising prevalence of malnutrition, increasing health awareness among consumers, and government initiatives promoting fortified foods.

What challenges does the Middle East & Africa Food Fortifying Agents Market face?

Challenges in the Middle East & Africa Food Fortifying Agents Market include regulatory hurdles, varying consumer acceptance of fortified products, and the need for education on the benefits of food fortification.

What opportunities exist in the Middle East & Africa Food Fortifying Agents Market?

Opportunities in the Middle East & Africa Food Fortifying Agents Market include the growing demand for functional foods, advancements in fortification technologies, and increasing investments in food safety and quality.

What trends are shaping the Middle East & Africa Food Fortifying Agents Market?

Trends shaping the Middle East & Africa Food Fortifying Agents Market include the rise of plant-based fortifying agents, increased focus on clean label products, and the integration of fortification in everyday food items.

Middle East & Africa Food Fortifying Agents Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Amino Acids, Probiotics |

| Application | Beverages, Dairy Products, Bakery, Snacks |

| End User | Food Manufacturers, Nutraceutical Companies, Retailers, Health Institutions |

| Packaging Type | Bags, Bottles, Sachets, Bulk Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Food Fortifying Agents Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at