444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa construction adhesives & sealants market represents a dynamic and rapidly evolving sector within the broader construction materials industry. This market encompasses a comprehensive range of bonding and sealing solutions specifically designed for construction applications across residential, commercial, and infrastructure projects. The region’s unique climatic conditions, including extreme temperatures and humidity variations, create specific demands for high-performance adhesive and sealant products that can withstand harsh environmental conditions.

Market dynamics in the Middle East & Africa are primarily driven by substantial infrastructure development initiatives, urbanization trends, and increasing construction activities across key economies. The market demonstrates robust growth potential, with construction adhesives and sealants experiencing growing adoption rates of approximately 8.5% annually across major regional markets. Countries such as the United Arab Emirates, Saudi Arabia, South Africa, and Nigeria are leading this expansion through ambitious construction projects and modernization efforts.

Regional characteristics significantly influence product development and market strategies. The Middle East’s focus on mega-projects, including smart cities and luxury developments, drives demand for premium adhesive solutions, while Africa’s emphasis on affordable housing and basic infrastructure creates opportunities for cost-effective sealant products. This dual market approach enables manufacturers to address diverse customer needs while capitalizing on the region’s overall construction boom.

The Middle East & Africa construction adhesives & sealants market refers to the comprehensive ecosystem of bonding and sealing products specifically formulated for construction applications within these geographic regions. This market encompasses various product categories including structural adhesives, weatherproofing sealants, insulation materials, and specialty bonding solutions designed to meet the unique environmental and performance requirements of Middle Eastern and African construction projects.

Construction adhesives in this context include epoxy-based systems, polyurethane formulations, silicone-modified polymers, and hybrid technologies that provide structural bonding capabilities for building materials. These products serve critical functions in modern construction, enabling architects and engineers to create innovative designs while ensuring long-term durability and performance. The adhesives category covers applications ranging from tile installation and flooring systems to curtain wall assembly and structural glazing.

Sealants represent the protective component of this market, focusing on weatherproofing, air sealing, and moisture management solutions. These products include silicone sealants, polyurethane sealants, acrylic formulations, and specialized compounds designed to prevent water infiltration, air leakage, and thermal bridging in building envelopes. The sealants segment addresses critical performance requirements for energy efficiency, comfort, and building longevity in challenging regional climates.

Strategic market positioning within the Middle East & Africa construction adhesives & sealants sector reveals significant growth opportunities driven by infrastructure development, urbanization trends, and evolving construction methodologies. The market benefits from increasing adoption of modern building techniques, growing awareness of energy efficiency requirements, and rising quality standards across residential and commercial construction projects.

Key growth drivers include government infrastructure investments, private sector construction activities, and the region’s transition toward sustainable building practices. The market experiences particularly strong demand in the Gulf Cooperation Council countries, where construction spending continues to increase, and in major African economies where urbanization drives housing and commercial development. Technology adoption rates show approximately 12% annual growth in advanced adhesive applications.

Market segmentation reveals diverse opportunities across product types, applications, and end-user categories. Structural adhesives demonstrate the highest growth potential, particularly in high-rise construction and industrial applications, while weatherproofing sealants maintain steady demand across all construction segments. The market’s evolution toward high-performance, environmentally friendly formulations creates additional opportunities for innovation and differentiation.

Competitive dynamics feature a mix of international manufacturers and regional suppliers, with market leadership determined by product quality, technical support capabilities, and distribution network strength. The market’s fragmented nature provides opportunities for both established players and emerging companies to capture market share through specialized product offerings and targeted customer service strategies.

Market intelligence reveals several critical insights that shape the Middle East & Africa construction adhesives & sealants landscape. Understanding these insights enables stakeholders to make informed decisions and capitalize on emerging opportunities within this dynamic market environment.

Infrastructure development initiatives serve as the primary catalyst for market growth across the Middle East & Africa region. Government investments in transportation networks, utilities, healthcare facilities, and educational institutions create substantial demand for construction adhesives and sealants. These projects often require specialized products capable of meeting stringent performance specifications and environmental requirements.

Urbanization trends significantly impact market dynamics, particularly in rapidly growing cities across both regions. The migration of populations from rural to urban areas drives residential construction demand, while the development of commercial and retail facilities supports the need for advanced bonding and sealing solutions. Urban development projects increasingly emphasize quality and durability, favoring premium adhesive products.

Economic diversification efforts in oil-dependent economies create new construction opportunities as governments invest in non-petroleum sectors. These initiatives include the development of manufacturing facilities, tourism infrastructure, and technology centers, all requiring specialized adhesive and sealant applications. The diversification trend supports sustained market growth beyond traditional construction segments.

Climate adaptation requirements drive demand for high-performance products capable of withstanding extreme environmental conditions. The region’s challenging climate necessitates adhesives and sealants with superior temperature resistance, UV stability, and moisture management capabilities. This requirement creates opportunities for premium product categories and innovative formulations designed specifically for regional conditions.

Economic volatility presents significant challenges for the construction adhesives & sealants market, particularly in oil-dependent economies where commodity price fluctuations impact construction spending. Economic uncertainties can delay or cancel construction projects, directly affecting demand for adhesive and sealant products. Market participants must navigate these cyclical challenges while maintaining operational efficiency.

Technical skill limitations in certain markets restrict the adoption of advanced adhesive technologies. The proper application of high-performance adhesives and sealants requires specialized knowledge and training, which may not be readily available in all regional markets. This constraint limits market penetration for sophisticated product categories and creates barriers to technology adoption.

Import dependency challenges affect market accessibility and pricing stability. Many regional markets rely heavily on imported adhesive and sealant products, making them vulnerable to currency fluctuations, trade restrictions, and supply chain disruptions. These dependencies can create cost pressures and availability issues that impact market growth.

Regulatory complexity varies significantly across different countries within the region, creating challenges for manufacturers seeking to serve multiple markets. Compliance with diverse building codes, environmental regulations, and product certification requirements increases operational complexity and market entry costs. Regulatory harmonization efforts remain limited, maintaining these barriers to market expansion.

Sustainable construction trends create substantial opportunities for environmentally friendly adhesive and sealant products. The growing emphasis on green building certifications, energy efficiency, and reduced environmental impact drives demand for low-VOC formulations, bio-based materials, and recyclable products. Manufacturers can capitalize on this trend by developing innovative sustainable solutions tailored to regional requirements.

Smart city initiatives across the Middle East present opportunities for advanced adhesive technologies in intelligent building systems. These projects require specialized bonding solutions for sensor installations, communication systems, and automated building components. The integration of technology into construction creates new application areas and premium product opportunities.

Affordable housing programs in African markets offer significant volume opportunities for cost-effective adhesive and sealant solutions. Government and private sector initiatives to address housing shortages create demand for products that balance performance with affordability. This market segment requires innovative approaches to product development and distribution.

Industrial facility development across both regions creates demand for specialized adhesive applications in manufacturing, logistics, and processing facilities. The growth of industrial sectors beyond oil and gas requires high-performance bonding solutions for equipment installation, facility construction, and maintenance applications. This trend supports market diversification and growth.

Supply chain evolution significantly impacts market dynamics as manufacturers establish regional production capabilities and distribution networks. The development of local manufacturing facilities reduces import dependencies while improving product availability and customer service. This trend creates competitive advantages for companies investing in regional infrastructure and supports market growth through improved accessibility.

Technology advancement drives market evolution through the introduction of innovative adhesive and sealant formulations. Advanced polymer technologies, hybrid systems, and specialized additives enable products to meet increasingly demanding performance requirements. The rate of technology adoption shows approximately 15% annual growth in premium product categories, reflecting market sophistication.

Customer education initiatives play a crucial role in market development by improving awareness of proper product selection and application techniques. Training programs, technical support services, and educational resources help contractors and specifiers maximize product performance while reducing application errors. These initiatives support market expansion and customer satisfaction.

Competitive intensity increases as more manufacturers enter the market and existing players expand their regional presence. Competition drives innovation, improves product quality, and enhances customer service while potentially pressuring profit margins. Market participants must differentiate through technology, service, or cost advantages to maintain competitive positions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Middle East & Africa construction adhesives & sealants market. The research approach combines quantitative data collection with qualitative analysis to provide a complete understanding of market dynamics, trends, and opportunities.

Primary research activities include extensive interviews with industry stakeholders, including manufacturers, distributors, contractors, and end-users across key regional markets. These interviews provide firsthand insights into market challenges, opportunities, and emerging trends. Survey methodologies capture quantitative data on market preferences, purchasing behaviors, and performance requirements.

Secondary research sources encompass industry publications, government statistics, trade association reports, and company financial statements. This information provides historical context, market sizing data, and competitive intelligence. The integration of multiple secondary sources ensures comprehensive coverage of market factors and validation of primary research findings.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert review of findings. Quality assurance measures ensure the accuracy and reliability of market insights while identifying potential data limitations or biases. The validation process supports confident decision-making based on research findings.

Gulf Cooperation Council markets demonstrate the highest growth potential within the Middle East & Africa region, driven by substantial infrastructure investments and construction activities. The UAE and Saudi Arabia lead regional demand, with construction adhesive adoption rates reaching approximately 18% annually. These markets favor premium products and advanced technologies, creating opportunities for high-performance adhesive and sealant solutions.

North African markets show steady growth supported by infrastructure development and urbanization trends. Egypt, Morocco, and Algeria represent key opportunities, with government investments in transportation, housing, and industrial facilities driving demand. The market share distribution shows approximately 35% concentration in residential applications and 40% in commercial projects.

Sub-Saharan African markets present significant long-term opportunities despite current infrastructure limitations. South Africa leads regional development, while Nigeria, Kenya, and Ghana show emerging potential. The focus on affordable housing and basic infrastructure creates demand for cost-effective adhesive solutions with reliable performance characteristics.

Levant region markets demonstrate resilience and recovery potential as political stability improves. Jordan and Lebanon maintain active construction sectors, while reconstruction efforts in other areas create future opportunities. The market requires products capable of meeting both immediate needs and long-term performance requirements in challenging environments.

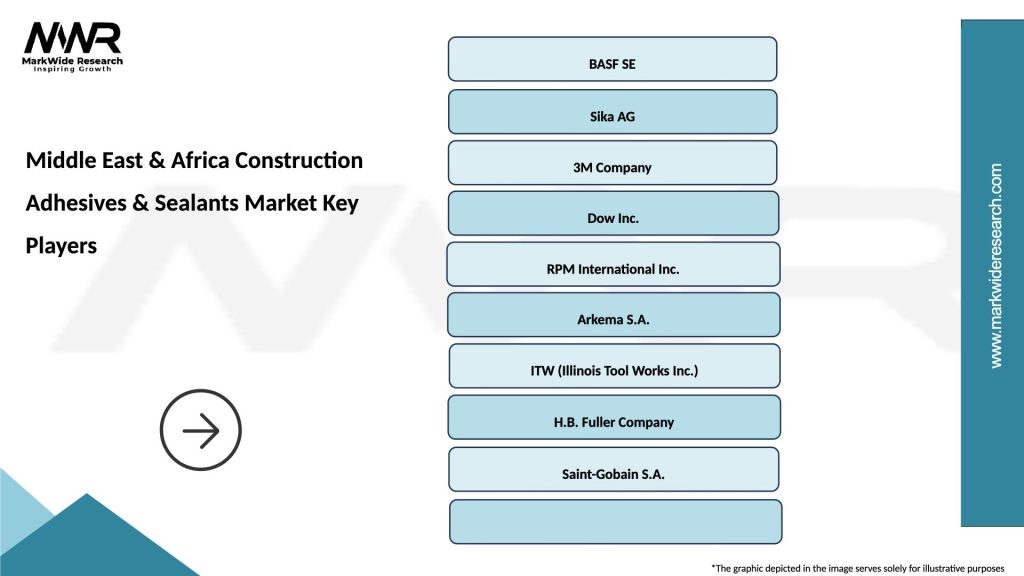

Market leadership in the Middle East & Africa construction adhesives & sealants sector is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment features both international manufacturers with global expertise and regional companies with local market knowledge.

Competitive strategies focus on product innovation, technical support capabilities, and distribution network development. Leading companies invest in regional manufacturing facilities, local partnerships, and customer education programs to strengthen market positions. The emphasis on sustainability and environmental compliance creates additional competitive dimensions.

Product type segmentation reveals distinct market dynamics across different adhesive and sealant categories. Each segment addresses specific application requirements and performance criteria, creating targeted opportunities for manufacturers and suppliers.

By Technology:

By Application:

By End-User:

Structural adhesives represent the fastest-growing category within the Middle East & Africa market, driven by increasing adoption of modern construction techniques and architectural innovations. These products enable new design possibilities while providing superior performance compared to traditional mechanical fastening methods. The structural adhesive segment shows growth rates of approximately 14% annually in premium applications.

Weatherproofing sealants maintain steady demand across all construction segments, with particular strength in building envelope applications. The harsh regional climate creates specific requirements for UV resistance, temperature cycling performance, and moisture management capabilities. Silicone-based sealants dominate this category, representing approximately 60% market share in weatherproofing applications.

Flooring adhesives benefit from growing demand for ceramic tiles, natural stone, and engineered flooring systems. The category serves both residential and commercial applications, with increasing emphasis on rapid-setting formulations and low-emission products. Market penetration rates show approximately 25% adoption of premium flooring adhesive systems in high-end projects.

Insulation adhesives gain importance as energy efficiency requirements drive demand for continuous insulation systems. These products support thermal performance goals while addressing fire safety and durability requirements. The insulation adhesive category demonstrates strong growth potential as building codes evolve to emphasize energy performance.

Manufacturers benefit from the Middle East & Africa construction adhesives & sealants market through access to growing construction sectors and opportunities for product innovation. The market’s diversity enables companies to develop specialized solutions for regional requirements while leveraging global expertise and technology platforms. Regional manufacturing capabilities provide cost advantages and improved customer service.

Distributors and suppliers gain from expanding market opportunities and increasing product sophistication. The growing construction sector creates demand for comprehensive product portfolios and technical support services. Distribution partnerships with leading manufacturers provide access to innovative products and marketing support while enabling local market expertise to drive sales growth.

Contractors and applicators benefit from improved product performance, application efficiency, and technical support resources. Advanced adhesive and sealant technologies enable faster installation, reduced labor costs, and enhanced project quality. Training programs and technical assistance help contractors maximize product benefits while reducing application risks.

Building owners and developers realize advantages through improved building performance, reduced maintenance requirements, and enhanced durability. High-quality adhesive and sealant systems contribute to energy efficiency, comfort, and long-term value. The availability of warranty programs and performance guarantees provides additional confidence in product selection decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend shaping product development and market positioning strategies. Manufacturers increasingly focus on low-VOC formulations, bio-based materials, and recyclable packaging to meet environmental requirements and customer preferences. This trend creates opportunities for premium positioning while addressing regulatory compliance needs.

Digital transformation impacts market dynamics through improved customer engagement, technical support delivery, and supply chain management. Digital platforms enable better product selection tools, application guidance, and performance monitoring capabilities. The integration of digital technologies enhances customer experience while improving operational efficiency.

Performance enhancement continues as a key trend, with manufacturers developing products offering superior durability, faster curing times, and enhanced application properties. Advanced polymer technologies enable products to meet increasingly demanding performance specifications while maintaining cost competitiveness. Performance improvements support market premiumization and customer satisfaction.

Application diversification expands market opportunities beyond traditional construction uses into specialized segments such as renewable energy installations, telecommunications infrastructure, and transportation systems. This diversification reduces market concentration risks while creating new growth avenues for innovative products and applications.

Manufacturing expansion initiatives by leading companies demonstrate confidence in regional market potential. Several manufacturers have announced or completed new production facilities across the Middle East & Africa region, improving product availability while reducing costs. These investments support market growth and competitive positioning.

Technology partnerships between international manufacturers and regional companies accelerate market development and knowledge transfer. These collaborations combine global expertise with local market understanding, creating synergies that benefit all stakeholders. Partnership strategies enable faster market penetration and improved customer service.

Product innovation continues at an accelerated pace, with new formulations addressing specific regional requirements and emerging applications. Recent developments include climate-resistant formulations, rapid-cure systems, and sustainable alternatives to traditional products. Innovation drives market differentiation and supports premium positioning strategies.

Regulatory developments across the region increasingly emphasize environmental performance and building safety requirements. New standards and certification programs create opportunities for compliant products while potentially restricting non-conforming alternatives. Regulatory evolution supports market quality improvement and professional development.

Market entry strategies should prioritize understanding local requirements, building distribution partnerships, and investing in technical support capabilities. MarkWide Research analysis indicates that successful market participants combine global expertise with regional adaptation to meet diverse customer needs effectively. Entry strategies must address both immediate opportunities and long-term market development goals.

Product development focus should emphasize climate-resistant formulations, sustainable alternatives, and application-specific solutions. The region’s unique environmental conditions create opportunities for specialized products that command premium pricing while delivering superior performance. Innovation should address both current needs and emerging market trends.

Distribution network development requires comprehensive coverage of diverse geographic markets with varying infrastructure capabilities. Successful distribution strategies combine direct sales for large projects with dealer networks for smaller applications. Technical support and training programs enhance distribution effectiveness and customer satisfaction.

Competitive positioning should leverage unique strengths while addressing market-specific requirements. Companies can differentiate through technology leadership, service excellence, or cost competitiveness depending on target market segments. Positioning strategies must consider both current competitive dynamics and future market evolution.

Long-term growth prospects for the Middle East & Africa construction adhesives & sealants market remain positive, supported by continued infrastructure development, urbanization trends, and economic diversification efforts. The market is projected to maintain robust growth rates, with premium product segments showing particularly strong potential as quality standards continue to evolve.

Technology evolution will continue driving market advancement through innovative formulations, improved application methods, and enhanced performance characteristics. The integration of smart technologies, sustainable materials, and specialized additives will create new product categories and application opportunities. Technology adoption rates are expected to accelerate as market sophistication increases.

Market consolidation may occur as larger manufacturers acquire regional players or establish stronger local presence through partnerships and investments. This consolidation could improve market efficiency while maintaining competitive dynamics. The balance between global expertise and local market knowledge will remain crucial for success.

Regulatory harmonization efforts across the region may simplify market access while raising quality standards. Improved regulatory frameworks could facilitate trade and investment while ensuring product safety and environmental compliance. MWR projections suggest that regulatory evolution will support market professionalization and growth sustainability, with compliance-focused companies gaining competitive advantages.

The Middle East & Africa construction adhesives & sealants market presents compelling opportunities for growth and development across diverse geographic and application segments. The market’s evolution reflects broader regional trends toward infrastructure modernization, quality improvement, and sustainable construction practices. Success in this dynamic market requires understanding of local requirements, investment in appropriate technologies, and commitment to customer service excellence.

Strategic positioning within this market demands careful consideration of regional variations, competitive dynamics, and emerging trends. Companies that combine global expertise with local market adaptation while maintaining focus on innovation and quality are best positioned to capitalize on growth opportunities. The market’s complexity creates both challenges and opportunities for differentiation and value creation.

Future success will depend on continued investment in product development, market education, and distribution capabilities. The region’s long-term growth potential, supported by demographic trends and economic development initiatives, provides a solid foundation for sustained market expansion. Companies that establish strong regional presence and customer relationships today will benefit from the market’s continued evolution and growth in the years ahead.

What is Construction Adhesives & Sealants?

Construction adhesives and sealants are materials used to bond or seal various construction elements, including wood, metal, glass, and concrete. They play a crucial role in ensuring structural integrity and durability in construction projects.

What are the key players in the Middle East & Africa Construction Adhesives & Sealants Market?

Key players in the Middle East & Africa Construction Adhesives & Sealants Market include Henkel AG, Sika AG, Bostik, and Mapei. These companies are known for their innovative products and strong market presence, among others.

What are the growth factors driving the Middle East & Africa Construction Adhesives & Sealants Market?

The growth of the Middle East & Africa Construction Adhesives & Sealants Market is driven by increasing construction activities, urbanization, and the demand for sustainable building materials. Additionally, advancements in adhesive technologies are enhancing product performance.

What challenges does the Middle East & Africa Construction Adhesives & Sealants Market face?

Challenges in the Middle East & Africa Construction Adhesives & Sealants Market include fluctuating raw material prices and stringent regulations regarding environmental impact. These factors can affect production costs and market stability.

What opportunities exist in the Middle East & Africa Construction Adhesives & Sealants Market?

Opportunities in the Middle East & Africa Construction Adhesives & Sealants Market include the growing demand for eco-friendly products and the expansion of infrastructure projects. The rise in renovation activities also presents significant growth potential.

What trends are shaping the Middle East & Africa Construction Adhesives & Sealants Market?

Trends in the Middle East & Africa Construction Adhesives & Sealants Market include the increasing use of smart adhesives and sealants that offer enhanced performance and durability. Additionally, there is a growing focus on sustainable and low-VOC products.

Middle East & Africa Construction Adhesives & Sealants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyurethane, Silicone, Acrylic, Epoxy |

| Application | Construction, Automotive, Aerospace, Marine |

| End User | Contractors, Manufacturers, Distributors, Retailers |

| Packaging Type | Tubes, Cans, Pails, Drums |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Construction Adhesives & Sealants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at