444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa clean label ingredients market represents a rapidly evolving sector driven by increasing consumer awareness and demand for transparent food labeling. This dynamic market encompasses natural preservatives, organic flavors, plant-based proteins, and minimally processed additives that align with consumer preferences for healthier, more recognizable ingredients. The region’s diverse food culture, combined with growing health consciousness, has created substantial opportunities for clean label ingredient manufacturers and suppliers.

Market dynamics in the Middle East & Africa are characterized by significant growth potential, with the sector experiencing robust expansion at a CAGR of 8.2% over the forecast period. The increasing penetration of international food brands, coupled with rising disposable incomes and urbanization trends, has accelerated the adoption of clean label formulations across various food and beverage categories. Consumer preferences are shifting toward products with shorter ingredient lists, natural origins, and transparent manufacturing processes.

Regional variations play a crucial role in market development, with the Gulf Cooperation Council (GCC) countries leading adoption rates due to higher purchasing power and greater exposure to global food trends. Meanwhile, African markets are experiencing gradual but steady growth, particularly in urban centers where health awareness is increasing among middle-class consumers. The market’s expansion is further supported by regulatory initiatives promoting food safety and transparency across the region.

The Middle East & Africa clean label ingredients market refers to the commercial ecosystem encompassing the production, distribution, and consumption of food additives, preservatives, flavors, and functional ingredients that meet clean label criteria within the MEA region. These ingredients are characterized by their natural origin, minimal processing, and easily recognizable names that consumers can understand and trust.

Clean label ingredients represent a paradigm shift from traditional food additives toward more transparent and consumer-friendly alternatives. This includes natural antioxidants derived from plant sources, organic acids for preservation, plant-based proteins for nutritional enhancement, and natural flavoring compounds that replace synthetic alternatives. The market encompasses both direct-to-manufacturer sales and retail distribution channels serving food processors, beverage companies, and specialty food producers throughout the region.

Market scope extends beyond simple ingredient substitution to include comprehensive formulation solutions that maintain product quality, shelf life, and sensory attributes while meeting clean label standards. This involves collaboration between ingredient suppliers, food technologists, and manufacturers to develop innovative solutions that satisfy both regulatory requirements and consumer expectations across diverse cultural and dietary preferences in the Middle East and Africa.

Strategic market positioning reveals the Middle East & Africa clean label ingredients market as a high-growth sector with substantial expansion opportunities driven by evolving consumer preferences and regulatory support. The market demonstrates strong momentum across multiple application segments, with bakery and confectionery leading adoption rates at 32% market share, followed by dairy and beverages sectors showing significant growth potential.

Key growth drivers include increasing health consciousness, rising prevalence of lifestyle-related diseases, and growing awareness of food ingredient transparency. The market benefits from supportive government initiatives promoting food safety and quality standards, particularly in GCC countries where regulatory frameworks are becoming more aligned with international best practices. Consumer education campaigns and social media influence have accelerated the demand for clean label products across urban populations.

Competitive landscape features a mix of international ingredient suppliers and regional players, with market consolidation occurring through strategic partnerships and acquisitions. Innovation focus centers on developing culturally appropriate clean label solutions that respect traditional flavors while meeting modern health standards. The market’s future trajectory indicates continued expansion, supported by infrastructure development and increasing retail modernization across the region.

Consumer behavior analysis reveals several critical insights shaping the Middle East & Africa clean label ingredients market:

Market penetration varies significantly across the region, with GCC countries showing higher adoption rates compared to other African markets, creating opportunities for targeted market development strategies and localized product offerings.

Health consciousness surge represents the primary driver propelling the Middle East & Africa clean label ingredients market forward. Increasing awareness of the relationship between diet and health outcomes has prompted consumers to scrutinize ingredient lists more carefully, seeking products with recognizable, natural components. This trend is particularly pronounced among younger demographics and urban populations who have greater access to health information and international food trends.

Regulatory support across the region has strengthened significantly, with governments implementing stricter food safety standards and labeling requirements that favor clean label formulations. The UAE, Saudi Arabia, and South Africa have introduced comprehensive food safety frameworks that encourage transparency and natural ingredient usage. These regulatory developments create a favorable environment for clean label ingredient adoption while establishing barriers for synthetic alternatives.

Lifestyle disease prevalence continues to rise across the region, with diabetes, obesity, and cardiovascular conditions reaching concerning levels. This health crisis has prompted both consumers and healthcare professionals to advocate for cleaner, more natural food options. The growing medical community support for preventive nutrition has legitimized clean label ingredients as part of a healthier lifestyle approach.

Urbanization and modernization trends have exposed Middle Eastern and African consumers to global food trends and international brands that emphasize clean label positioning. The expansion of modern retail formats, including hypermarkets and specialty health food stores, has improved access to clean label products and ingredients, facilitating market growth and consumer education.

Cost considerations present significant challenges for clean label ingredient adoption across the Middle East & Africa market. Natural and organic ingredients typically command premium pricing compared to synthetic alternatives, creating affordability barriers for price-sensitive consumer segments. This cost differential is particularly pronounced in developing African markets where purchasing power remains limited, restricting market penetration to higher-income demographics.

Technical limitations of certain clean label ingredients pose formulation challenges for food manufacturers. Natural preservatives may offer shorter shelf life compared to synthetic alternatives, while plant-based proteins might present texture or flavor challenges in traditional applications. These technical constraints require significant research and development investment to overcome, potentially slowing market adoption rates.

Supply chain complexities in the region create obstacles for consistent clean label ingredient availability and quality. Limited local production capabilities for specialized natural ingredients necessitate imports, introducing currency fluctuation risks and supply disruption possibilities. The lack of established cold chain infrastructure in some markets further complicates the distribution of sensitive natural ingredients.

Consumer education gaps persist across various market segments, particularly in rural areas where traditional food practices dominate. Limited awareness of clean label benefits and skepticism toward new ingredient technologies can slow adoption rates. Additionally, cultural preferences for familiar flavors and textures may resist reformulation efforts using clean label alternatives.

Halal certification integration presents substantial opportunities for clean label ingredient suppliers in the Middle East & Africa market. The alignment between clean label principles and halal requirements creates synergistic benefits, as both emphasize natural origins, ethical sourcing, and transparent processing methods. This convergence enables suppliers to address both health-conscious and religiously observant consumer segments simultaneously, expanding market reach significantly.

Local sourcing initiatives offer opportunities for developing indigenous clean label ingredient supply chains. The region’s rich biodiversity, including unique spices, herbs, and plant proteins, can be leveraged to create distinctive clean label solutions that celebrate local food heritage while meeting modern health standards. This approach reduces import dependency while supporting local agricultural communities and creating authentic regional product differentiation.

E-commerce expansion across the region creates new distribution channels for clean label ingredients and finished products. The growing digital marketplace penetration, accelerated by recent global events, enables specialized suppliers to reach consumers directly while providing educational content about clean label benefits. This digital transformation particularly benefits niche and premium clean label products that require consumer education.

Food service sector growth presents significant opportunities as restaurants, hotels, and catering companies increasingly adopt clean label ingredients to meet customer demands for healthier options. The expanding tourism industry in GCC countries and major African destinations creates demand for internationally acceptable clean label formulations that maintain local flavor profiles while meeting diverse dietary requirements.

Demand-supply equilibrium in the Middle East & Africa clean label ingredients market reflects a rapidly evolving landscape where consumer demand consistently outpaces supply capabilities. This dynamic creates opportunities for new market entrants while challenging existing suppliers to scale production and improve distribution networks. The market experiences seasonal fluctuations tied to religious observances and cultural celebrations that influence food consumption patterns.

Price volatility affects market dynamics significantly, particularly for imported natural ingredients subject to currency fluctuations and global commodity price movements. Local suppliers benefit from price stability advantages, while international suppliers must develop hedging strategies to maintain competitive positioning. The market shows increasing price sensitivity as clean label products expand beyond premium segments into mainstream categories.

Innovation cycles drive continuous market evolution, with new clean label ingredient technologies emerging regularly to address specific formulation challenges. The pace of innovation has accelerated as suppliers invest in research and development to create more effective natural alternatives to synthetic ingredients. This innovation focus particularly emphasizes improving functionality while maintaining clean label compliance.

Regulatory evolution continues to shape market dynamics as governments refine food safety standards and labeling requirements. The harmonization of standards across regional trade blocs creates opportunities for suppliers to achieve economies of scale while simplifying compliance requirements. According to MarkWide Research analysis, regulatory support has contributed to improved market confidence and accelerated adoption rates across multiple application segments.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Middle East & Africa clean label ingredients market. Primary research included extensive interviews with industry stakeholders, including ingredient suppliers, food manufacturers, regulatory officials, and consumer focus groups across key markets in the region. This qualitative research provided deep insights into market dynamics, consumer preferences, and industry challenges.

Secondary research encompassed analysis of industry reports, government publications, trade association data, and academic studies related to clean label trends and ingredient markets. Statistical databases from national statistical offices and international organizations provided quantitative foundations for market sizing and growth projections. Patent analysis revealed innovation trends and technological developments shaping the market’s future direction.

Market validation processes included cross-referencing data sources, conducting expert interviews for verification, and employing triangulation methods to ensure data accuracy. Regional market variations were analyzed through country-specific research approaches that accounted for cultural, economic, and regulatory differences across the Middle East and Africa. Consumer surveys conducted in major urban centers provided insights into purchasing behavior and brand preferences.

Analytical frameworks incorporated both quantitative and qualitative assessment tools, including SWOT analysis, Porter’s Five Forces evaluation, and market segmentation studies. Time-series analysis of historical data enabled identification of growth patterns and market trends, while scenario modeling projected future market developments under various economic and regulatory conditions.

Gulf Cooperation Council countries lead the Middle East & Africa clean label ingredients market, accounting for approximately 45% of regional demand. The UAE and Saudi Arabia demonstrate the highest adoption rates, driven by affluent consumer bases, advanced retail infrastructure, and strong regulatory frameworks supporting food safety and quality. These markets benefit from high import capabilities and exposure to international food trends through tourism and expatriate populations.

North African markets, particularly Egypt, Morocco, and Tunisia, show growing interest in clean label ingredients, with adoption rates increasing at 12% annually. These markets balance traditional food practices with modern health consciousness, creating opportunities for culturally adapted clean label solutions. The region’s agricultural capabilities provide potential for local ingredient sourcing and processing development.

Sub-Saharan Africa presents emerging opportunities with South Africa leading regional adoption due to its developed food processing industry and health-conscious urban population. Nigeria and Kenya show promising growth potential as middle-class populations expand and modern retail formats proliferate. However, market development faces challenges from limited infrastructure and price sensitivity among consumer segments.

Market maturity levels vary significantly across the region, with GCC countries approaching mature market characteristics while many African markets remain in early development stages. This variation creates opportunities for staged market entry strategies and localized product development approaches that respect regional preferences and economic conditions.

Market leadership in the Middle East & Africa clean label ingredients sector features a diverse competitive landscape combining international ingredient giants with specialized regional players. The competitive environment emphasizes innovation, quality assurance, and cultural adaptation capabilities as key differentiating factors.

Competitive strategies emphasize local partnerships, cultural adaptation, and supply chain optimization to address regional market requirements effectively. Companies invest significantly in research and development to create region-specific solutions that balance international quality standards with local taste preferences and regulatory requirements.

By Ingredient Type:

By Application:

By Source:

Natural Preservatives represent the fastest-growing category within the Middle East & Africa clean label ingredients market, driven by consumer concerns about synthetic preservatives and their potential health impacts. Plant-based antioxidants such as rosemary extract, green tea extract, and tocopherols show strong adoption rates across multiple food categories. The segment benefits from increasing regulatory scrutiny of synthetic preservatives and growing consumer awareness of natural alternatives.

Plant-based Proteins demonstrate exceptional growth potential, particularly in markets with growing vegetarian and flexitarian populations. Chickpea, lentil, and quinoa proteins resonate well with regional dietary traditions while meeting modern nutritional requirements. The category shows 18% annual growth as manufacturers seek to enhance protein content while maintaining clean label compliance.

Natural Flavors face unique challenges in the region due to diverse cultural preferences and traditional flavor profiles. Success requires deep understanding of local taste preferences and ability to recreate authentic flavors using natural ingredients. Middle Eastern spice-based flavors and African fruit flavors present significant opportunities for specialized suppliers with regional expertise.

Functional Ingredients gain traction as health consciousness increases across the region. Probiotics and prebiotics show particular promise in dairy applications, while omega-3 fatty acids and plant sterols attract interest in functional food development. The category benefits from growing medical community support for preventive nutrition approaches.

Manufacturers benefit from clean label ingredient adoption through enhanced brand positioning, premium pricing opportunities, and improved consumer loyalty. Clean label formulations enable differentiation in competitive markets while addressing growing health consciousness among target demographics. The transition to natural ingredients often results in simplified supply chains and reduced regulatory compliance complexity.

Suppliers gain access to high-growth market segments with favorable pricing dynamics and long-term partnership opportunities. The clean label trend creates demand for specialized expertise and technical support services, enabling value-added relationships with food manufacturers. Innovation investments in clean label technologies provide competitive advantages and market leadership positions.

Retailers benefit from increased consumer traffic and higher basket values associated with clean label products. These products often command premium shelf space and pricing, improving overall category profitability. Clean label positioning supports retailer sustainability and health initiatives, enhancing corporate social responsibility profiles.

Consumers gain access to healthier food options with transparent ingredient lists and improved nutritional profiles. Clean label products often provide better taste experiences through high-quality natural ingredients while supporting personal health goals. The trend enables informed purchasing decisions based on ingredient transparency and quality assurance.

Regulatory Bodies benefit from improved food safety profiles and reduced need for synthetic additive monitoring. Clean label ingredients often align with public health objectives and support national nutrition improvement initiatives. The trend facilitates international trade through harmonized natural ingredient standards and simplified approval processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend shaping the Middle East & Africa clean label ingredients market. Consumers increasingly demand ingredients sourced through environmentally responsible practices, creating opportunities for suppliers emphasizing sustainable agriculture and ethical sourcing. This trend particularly resonates in markets where environmental consciousness intersects with health awareness, driving premium positioning for sustainably sourced clean label ingredients.

Functional food convergence represents another significant trend, where clean label ingredients serve dual purposes of maintaining natural profiles while delivering specific health benefits. Probiotics, adaptogens, and bioactive compounds gain popularity as consumers seek foods that support wellness goals beyond basic nutrition. This trend creates opportunities for ingredient suppliers to develop multifunctional solutions that address both clean label and health enhancement requirements.

Localization strategies gain momentum as suppliers recognize the importance of cultural adaptation in ingredient selection and application. Traditional Middle Eastern and African ingredients receive renewed attention as clean label alternatives to imported solutions. Date-based sweeteners, indigenous spices, and traditional fermentation techniques provide authentic clean label options that resonate with local consumers while meeting international quality standards.

Technology-enabled transparency transforms how clean label ingredients are marketed and verified. Blockchain technology, QR code traceability, and digital certification systems enable consumers to verify ingredient origins and processing methods. According to MWR research, transparency technologies contribute to increased consumer confidence and willingness to pay premium prices for verified clean label products.

Strategic partnerships between international ingredient suppliers and regional food manufacturers have accelerated market development across the Middle East & Africa. These collaborations focus on developing culturally appropriate clean label solutions while leveraging global expertise and local market knowledge. Recent partnerships emphasize joint research and development initiatives targeting specific regional applications and consumer preferences.

Manufacturing capacity expansion represents a significant industry development as suppliers invest in regional production facilities to reduce costs and improve supply chain reliability. New manufacturing plants in the UAE, Saudi Arabia, and South Africa focus on clean label ingredient processing and formulation capabilities. These investments demonstrate long-term commitment to regional market development and local value creation.

Regulatory harmonization efforts across regional trade blocs create opportunities for standardized clean label ingredient approval processes. The African Continental Free Trade Area (AfCFTA) and GCC standardization initiatives facilitate cross-border trade in clean label ingredients while reducing compliance complexity for suppliers. These developments support market integration and economies of scale achievement.

Innovation breakthroughs in natural ingredient processing technologies enable improved functionality and cost-effectiveness for clean label applications. Advanced extraction techniques, fermentation optimization, and encapsulation technologies enhance natural ingredient performance while maintaining clean label compliance. These technological advances address traditional limitations of natural ingredients and expand application possibilities.

Market entry strategies should prioritize cultural adaptation and local partnership development to succeed in the diverse Middle East & Africa clean label ingredients market. Companies entering the market should invest in understanding regional taste preferences, dietary restrictions, and traditional food practices. Successful market entry requires balancing international quality standards with local relevance and affordability considerations.

Investment priorities should focus on supply chain localization and technology integration to achieve sustainable competitive advantages. Developing regional sourcing capabilities reduces cost pressures while improving supply chain reliability. Technology investments in processing capabilities and quality assurance systems enable premium positioning and regulatory compliance across diverse market requirements.

Product development initiatives should emphasize multifunctional ingredients that address both clean label requirements and specific health benefits. Innovation focus should target ingredients that solve multiple formulation challenges while maintaining natural profiles. Collaborative research and development with regional food manufacturers ensures practical applicability and market relevance of new ingredient solutions.

Distribution strategy optimization should leverage both traditional trade channels and emerging e-commerce platforms to maximize market reach. Digital marketing and education initiatives prove essential for consumer awareness building and preference development. Strategic partnerships with modern retail formats and food service operators accelerate market penetration and brand building efforts.

Growth trajectory for the Middle East & Africa clean label ingredients market remains strongly positive, with sustained expansion expected across all major segments and geographic regions. The market’s evolution toward mainstream adoption creates opportunities for suppliers to achieve economies of scale while maintaining premium positioning for specialized applications. MarkWide Research projects continued robust growth driven by demographic trends, regulatory support, and increasing health consciousness across the region.

Technology integration will play an increasingly important role in market development, with advances in natural ingredient processing, preservation, and functionality enhancement. Artificial intelligence and machine learning applications in ingredient development and quality assurance will accelerate innovation cycles while reducing development costs. Digital platforms will transform ingredient sourcing, quality verification, and consumer education processes.

Market consolidation trends indicate potential for strategic mergers and acquisitions as companies seek to achieve scale advantages and expand regional capabilities. Vertical integration opportunities may emerge as suppliers seek greater control over raw material sourcing and quality assurance. However, the market’s diversity and cultural complexity will continue to support specialized regional players alongside global ingredient giants.

Sustainability imperatives will increasingly influence ingredient selection and sourcing decisions, creating opportunities for suppliers emphasizing environmental responsibility and social impact. Climate change adaptation strategies will become essential for agricultural ingredient sourcing, while circular economy principles will drive innovation in ingredient processing and waste reduction. The market’s future success will depend on balancing growth objectives with sustainability commitments and social responsibility requirements.

The Middle East & Africa clean label ingredients market represents a dynamic and rapidly expanding sector with substantial growth potential driven by evolving consumer preferences, regulatory support, and increasing health consciousness across the region. The market’s diverse cultural landscape creates both opportunities and challenges for ingredient suppliers seeking to balance international quality standards with local relevance and affordability requirements.

Strategic success in this market requires deep understanding of regional variations, cultural preferences, and economic conditions that influence ingredient selection and application. Companies that invest in local partnerships, cultural adaptation, and supply chain localization will be best positioned to capitalize on the market’s growth potential while building sustainable competitive advantages.

The convergence of clean label principles with traditional food practices, halal requirements, and sustainability imperatives creates unique opportunities for innovation and differentiation. As the market matures, successful participants will be those who can effectively combine global expertise with local knowledge to deliver ingredient solutions that meet both functional requirements and cultural expectations while supporting the region’s broader health and wellness objectives.

What is Clean Label Ingredients?

Clean label ingredients refer to food components that are perceived as natural, simple, and free from artificial additives. These ingredients are often sourced from whole foods and are transparent in their labeling, appealing to health-conscious consumers.

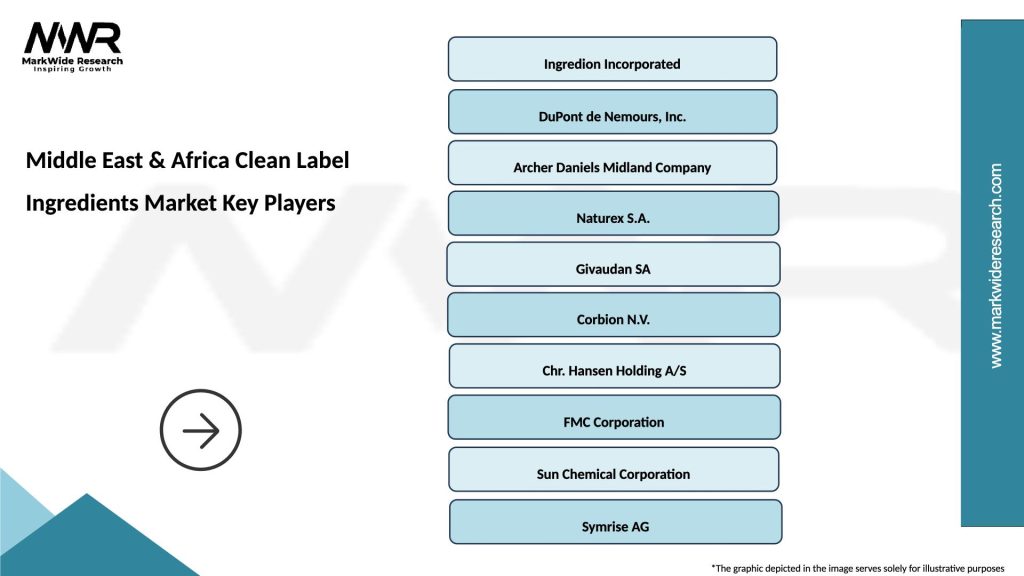

What are the key players in the Middle East & Africa Clean Label Ingredients Market?

Key players in the Middle East & Africa Clean Label Ingredients Market include companies like Ingredion, DuPont, and Kerry Group, which provide a range of clean label solutions for food and beverage applications, among others.

What are the growth factors driving the Middle East & Africa Clean Label Ingredients Market?

The growth of the Middle East & Africa Clean Label Ingredients Market is driven by increasing consumer demand for transparency in food labeling, rising health awareness, and a shift towards natural and organic products in the food industry.

What challenges does the Middle East & Africa Clean Label Ingredients Market face?

Challenges in the Middle East & Africa Clean Label Ingredients Market include the higher cost of clean label ingredients compared to conventional options and the need for regulatory compliance in food labeling, which can complicate product development.

What opportunities exist in the Middle East & Africa Clean Label Ingredients Market?

Opportunities in the Middle East & Africa Clean Label Ingredients Market include the potential for innovation in product formulations and the growing trend of plant-based diets, which can lead to new product lines and market segments.

What trends are shaping the Middle East & Africa Clean Label Ingredients Market?

Trends in the Middle East & Africa Clean Label Ingredients Market include the increasing popularity of functional ingredients, the rise of clean label snacks, and a focus on sustainability in sourcing and production practices.

Middle East & Africa Clean Label Ingredients Market

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Preservatives, Organic Sweeteners, Clean Label Colors, Emulsifiers |

| End User | Food Manufacturers, Beverage Producers, Nutraceutical Companies, Personal Care Brands |

| Application | Dairy Products, Bakery Items, Snacks, Sauces |

| Packaging Type | Flexible Packaging, Rigid Containers, Glass Bottles, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Clean Label Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at