444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa biofertilizers market represents a rapidly evolving agricultural sector that is transforming traditional farming practices across the region. This dynamic market encompasses the production, distribution, and application of biological fertilizers derived from living microorganisms that enhance soil fertility and plant nutrition. The region’s unique agricultural challenges, including arid climates, water scarcity, and soil degradation, have created substantial demand for sustainable fertilization solutions.

Market growth in the Middle East & Africa has been particularly robust, with the biofertilizers sector experiencing a compound annual growth rate (CAGR) of 12.3% over recent years. This expansion is driven by increasing awareness of environmental sustainability, government initiatives promoting organic farming, and the growing need for food security in densely populated urban areas. Countries such as South Africa, Egypt, Morocco, and the United Arab Emirates are leading adoption efforts, implementing comprehensive agricultural modernization programs.

Regional dynamics vary significantly across the Middle East & Africa, with North African countries focusing on cereal crop enhancement while Gulf states emphasize greenhouse agriculture and hydroponic systems. Sub-Saharan Africa demonstrates strong potential for smallholder farmer adoption, particularly in countries with established agricultural extension services. The market’s evolution reflects broader trends toward precision agriculture, climate-smart farming practices, and reduced dependency on synthetic chemical inputs.

The Middle East & Africa biofertilizers market refers to the comprehensive ecosystem of biological fertilizer products, technologies, and services designed to enhance agricultural productivity through natural microbial processes. These products contain living microorganisms that establish beneficial relationships with plant roots, improving nutrient uptake, soil health, and crop yields while reducing environmental impact compared to conventional chemical fertilizers.

Biofertilizers in this regional context encompass various categories including nitrogen-fixing bacteria, phosphate-solubilizing microorganisms, potassium-mobilizing bacteria, and mycorrhizal fungi. These biological agents work by converting atmospheric nitrogen into plant-available forms, solubilizing bound phosphorus in soil, and enhancing root surface area for improved nutrient absorption. The market includes both single-strain and multi-strain formulations tailored to specific crops and soil conditions prevalent in Middle Eastern and African agricultural systems.

Market participants range from multinational agricultural companies to local biotechnology firms, research institutions, and agricultural cooperatives. The sector encompasses product development, manufacturing, quality control, distribution networks, and farmer education programs. This integrated approach ensures effective technology transfer and adoption across diverse agricultural landscapes, from large-scale commercial farms to smallholder operations.

Strategic positioning of the Middle East & Africa biofertilizers market reflects the region’s commitment to sustainable agricultural transformation and food security enhancement. The market has demonstrated exceptional resilience and growth potential, driven by favorable government policies, increasing environmental awareness, and the urgent need to improve agricultural productivity in water-stressed environments.

Key market drivers include rising organic food demand, which has increased by 18.7% annually in urban centers, government subsidies for sustainable farming practices, and growing recognition of soil health importance. The region’s agricultural sector faces mounting pressure to increase yields while conserving water resources and maintaining soil fertility, creating ideal conditions for biofertilizer adoption.

Technological advancement has been instrumental in market development, with innovations in microbial formulation, shelf-life extension, and application methods specifically adapted to regional climate conditions. Local manufacturing capabilities have expanded significantly, reducing import dependency and improving product accessibility for farmers across different economic segments.

Market segmentation reveals strong growth across multiple categories, with nitrogen-fixing biofertilizers commanding the largest share, followed by phosphate-solubilizing and multi-nutrient formulations. Application areas span field crops, horticulture, and greenhouse production, with each segment demonstrating distinct growth patterns and adoption rates.

Market penetration analysis reveals significant opportunities for expansion across the Middle East & Africa region, with current adoption rates varying considerably between countries and agricultural sectors. The following insights highlight critical market dynamics:

Environmental sustainability concerns represent the primary driver for biofertilizer adoption across the Middle East & Africa region. Growing awareness of soil degradation, water pollution from chemical runoff, and long-term agricultural sustainability has prompted farmers, governments, and agricultural organizations to seek environmentally friendly alternatives to synthetic fertilizers.

Government initiatives and policy support have created favorable conditions for market growth. Many countries have implemented subsidy programs, tax incentives, and regulatory frameworks that encourage organic farming practices and biofertilizer use. These policies often include farmer training programs, research funding, and infrastructure development to support sustainable agriculture transitions.

Water scarcity challenges throughout the region have intensified focus on efficient resource utilization. Biofertilizers enhance plant water-use efficiency and improve soil water retention capacity, making them particularly valuable in arid and semi-arid agricultural systems. This benefit resonates strongly with farmers facing increasing water costs and availability constraints.

Food security imperatives drive demand for technologies that can increase agricultural productivity without compromising long-term soil health. Population growth, urbanization, and changing dietary preferences create pressure for enhanced crop yields, while climate change adds urgency to developing resilient farming systems.

Economic considerations increasingly favor biofertilizers as input costs for synthetic fertilizers continue rising. Farmers recognize the long-term economic benefits of improved soil health, reduced input dependency, and premium prices for organically produced crops in both domestic and export markets.

Limited awareness and technical knowledge among farmers represent significant barriers to biofertilizer adoption. Many agricultural communities lack understanding of microbial processes, application methods, and expected outcomes, leading to hesitation in transitioning from familiar synthetic fertilizer practices.

Infrastructure challenges affect product distribution and storage across the region’s diverse geographical landscape. Biofertilizers require specific storage conditions to maintain microbial viability, and inadequate cold chain facilities in rural areas can compromise product effectiveness and farmer confidence.

Quality control concerns arise from inconsistent product standards and limited regulatory oversight in some markets. Farmers may experience variable results due to poor-quality products, leading to skepticism about biofertilizer effectiveness and reluctance to adopt these technologies.

Initial investment requirements for transitioning to biofertilizer-based systems can be substantial, particularly for smallholder farmers with limited financial resources. While long-term benefits are significant, the upfront costs and learning curve associated with new farming practices create adoption barriers.

Climate sensitivity of microbial products poses challenges in extreme weather conditions common throughout the region. High temperatures, low humidity, and intense solar radiation can affect product stability and application timing, requiring specialized formulations and handling procedures.

Organic certification programs present substantial opportunities for market expansion as consumer demand for certified organic products grows across urban centers in the Middle East & Africa. Farmers adopting biofertilizers can access premium markets and export opportunities, creating strong economic incentives for technology adoption.

Technology integration with precision agriculture systems offers significant potential for enhanced biofertilizer effectiveness. Smart application systems, soil monitoring technologies, and data-driven farming practices can optimize microbial product performance and demonstrate clear return on investment to farmers.

Regional manufacturing expansion opportunities exist as demand grows and import costs increase. Local production facilities can reduce transportation costs, improve product freshness, and create employment opportunities while serving growing regional demand more effectively.

Smallholder farmer programs represent untapped market potential, particularly in Sub-Saharan Africa where millions of small-scale farmers could benefit from affordable biofertilizer solutions. Microfinance partnerships and cooperative purchasing programs can facilitate access to these technologies.

Research and development initiatives focusing on region-specific microbial strains and formulations can create competitive advantages and improved product performance. Collaboration between international companies and local research institutions can accelerate innovation and market development.

Supply chain evolution in the Middle East & Africa biofertilizers market reflects increasing sophistication and regional integration. Manufacturers are establishing local production facilities and distribution networks to serve growing demand while maintaining product quality and reducing costs. This localization trend has resulted in 23% reduction in average product costs over the past three years.

Competitive dynamics show intensifying rivalry between international corporations and emerging local players. Global companies leverage advanced research capabilities and established distribution networks, while local firms offer specialized knowledge of regional conditions and closer farmer relationships. This competition drives innovation and improves product accessibility across different market segments.

Regulatory landscape continues evolving as governments develop comprehensive frameworks for biofertilizer registration, quality standards, and market oversight. Harmonization efforts across regional trade blocs facilitate cross-border commerce and technology transfer, while maintaining safety and efficacy standards.

Technology adoption patterns vary significantly across the region, with commercial farms typically leading adoption followed by progressive smallholder farmers. Extension services and demonstration programs play crucial roles in technology transfer, with successful projects showing adoption rates increasing by 35% in areas with active support programs.

Market integration with broader agricultural value chains creates synergies and efficiency improvements. Biofertilizer adoption often accompanies other sustainable farming practices, creating comprehensive agricultural transformation programs that deliver enhanced environmental and economic outcomes.

Comprehensive market analysis for the Middle East & Africa biofertilizers market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive surveys of farmers, distributors, manufacturers, and agricultural extension services across key countries in the region.

Data collection methods encompass structured interviews with industry stakeholders, focus group discussions with farmer communities, and detailed questionnaires administered to market participants. Secondary research involves analysis of government agricultural statistics, trade data, regulatory documents, and academic publications related to biofertilizer technology and adoption.

Market sizing and segmentation analysis utilizes bottom-up and top-down approaches, incorporating production data, import/export statistics, and consumption patterns across different agricultural sectors. Regional variations are carefully analyzed to account for diverse agricultural systems, economic conditions, and policy environments.

Trend analysis incorporates historical data spanning multiple years to identify growth patterns, seasonal variations, and emerging market dynamics. Forward-looking projections consider demographic trends, policy developments, and technological advancement trajectories to provide realistic market forecasts.

Quality assurance measures include data triangulation from multiple sources, expert validation of findings, and peer review of analytical methodologies. This rigorous approach ensures research conclusions accurately reflect market realities and provide reliable guidance for stakeholder decision-making.

North Africa leads regional biofertilizer adoption, with Egypt and Morocco demonstrating particularly strong market development. These countries benefit from established agricultural research institutions, government support programs, and progressive farming communities. Egypt’s focus on cereal crop enhancement has driven significant biofertilizer demand, while Morocco’s export-oriented agriculture emphasizes quality and sustainability.

Gulf Cooperation Council countries show growing interest in biofertilizers for greenhouse and hydroponic applications. The United Arab Emirates and Saudi Arabia are investing heavily in controlled-environment agriculture, creating demand for specialized microbial products. These markets emphasize high-quality formulations and technical support services.

Sub-Saharan Africa represents the largest potential market, with countries like South Africa, Kenya, and Nigeria showing increasing adoption rates. South Africa leads with 38% of regional biofertilizer consumption, driven by commercial farming operations and supportive regulatory frameworks. Smallholder farmer programs in Kenya and Nigeria demonstrate significant growth potential.

East Africa shows promising development with Ethiopia, Tanzania, and Uganda implementing agricultural modernization programs that include biofertilizer promotion. Coffee and tea production systems are particularly receptive to biological fertilization approaches, driven by export market quality requirements.

West Africa markets are emerging as cocoa, cotton, and food crop producers recognize biofertilizer benefits. Ghana and Côte d’Ivoire are developing programs to enhance cocoa sustainability, while Nigeria’s large agricultural sector presents substantial opportunities for market expansion.

Market leadership in the Middle East & Africa biofertilizers sector is distributed among several key players, each bringing distinct strengths and market approaches. The competitive environment reflects a mix of multinational corporations, regional specialists, and emerging local companies.

Strategic positioning varies among competitors, with some focusing on premium products for commercial agriculture while others target smallholder farmer segments. Research and development capabilities, distribution networks, and local partnerships significantly influence competitive success in this diverse regional market.

Product type segmentation reveals distinct market preferences and growth patterns across the Middle East & Africa biofertilizers market. Each category serves specific agricultural needs and demonstrates unique adoption characteristics.

By Microorganism Type:

By Formulation:

By Application Method:

Cereal crops represent the largest application category for biofertilizers in the Middle East & Africa, driven by food security priorities and government support programs. Wheat, maize, and rice production systems show strong adoption rates, with farmers reporting improved yields and reduced fertilizer costs. Nitrogen-fixing bacteria are particularly popular for cereal applications.

Horticultural crops demonstrate the highest growth rates in biofertilizer adoption, driven by export market requirements and premium pricing for sustainably produced fruits and vegetables. Greenhouse operations in Gulf countries and commercial fruit production in North and South Africa lead this segment’s expansion.

Legume crops naturally align with biofertilizer technology, particularly nitrogen-fixing bacteria that enhance nodulation and biological nitrogen fixation. This category shows consistent growth across the region, with smallholder farmers increasingly recognizing economic benefits.

Cash crops including cotton, cocoa, and coffee show growing biofertilizer adoption driven by sustainability certification requirements and quality premiums. Export-oriented producers particularly value biofertilizers for meeting international environmental standards.

Specialty crops such as herbs, spices, and medicinal plants represent emerging opportunities for biofertilizer application. These high-value crops justify premium biological inputs and often require organic certification, creating strong demand for effective microbial solutions.

Farmers benefit from biofertilizer adoption through multiple pathways that enhance both economic and environmental outcomes. Improved soil health leads to sustained productivity increases, while reduced dependency on synthetic fertilizers lowers input costs over time. Enhanced crop quality often commands premium prices in organic and export markets.

Manufacturers gain from growing market demand and opportunities for product differentiation through specialized formulations. Local production capabilities reduce transportation costs and improve product freshness, while research partnerships with agricultural institutions drive innovation and competitive advantage.

Distributors and retailers benefit from expanding product portfolios and higher margin opportunities compared to commodity fertilizers. Technical support services and farmer education programs create additional revenue streams while building customer loyalty and market share.

Government stakeholders achieve multiple policy objectives through biofertilizer promotion, including environmental protection, agricultural sustainability, food security enhancement, and rural economic development. Reduced fertilizer subsidies and improved agricultural productivity contribute to fiscal sustainability.

Environmental benefits extend to broader society through reduced chemical pollution, improved soil health, enhanced biodiversity, and climate change mitigation. These positive externalities support sustainable development goals and long-term agricultural viability.

Research institutions find expanding opportunities for collaboration, funding, and technology commercialization. Academic-industry partnerships accelerate innovation while providing practical applications for scientific research and student training programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture integration represents a transformative trend in the Middle East & Africa biofertilizers market. Smart farming technologies, including soil sensors, GPS-guided application systems, and data analytics platforms, are being combined with biofertilizer programs to optimize application timing, dosage, and placement. This integration has shown yield improvements of up to 28% compared to conventional application methods.

Customized formulations are gaining popularity as manufacturers develop region-specific and crop-specific microbial blends. These tailored products address local soil conditions, climate challenges, and crop requirements more effectively than generic formulations. Research partnerships between international companies and local institutions drive this customization trend.

Organic certification programs are expanding rapidly across the region, creating structured demand for biofertilizer products. Farmers increasingly seek certified organic inputs to access premium markets and export opportunities, driving quality standards and traceability requirements throughout the supply chain.

Digital platforms for farmer education and support are emerging as key market development tools. Mobile applications, online training programs, and digital advisory services help overcome knowledge barriers and provide ongoing technical support for biofertilizer adoption.

Sustainable packaging initiatives reflect growing environmental consciousness among manufacturers and consumers. Biodegradable containers, reduced packaging materials, and recycling programs align with broader sustainability objectives and enhance brand positioning.

Public-private partnerships are becoming more common as governments collaborate with private sector entities to accelerate biofertilizer adoption. These partnerships combine public policy support with private sector innovation and distribution capabilities.

Manufacturing expansion across the Middle East & Africa has accelerated significantly, with several major companies establishing local production facilities. These investments reduce import dependency, improve product freshness, and create employment opportunities while serving growing regional demand more effectively.

Research collaborations between international corporations and regional universities have intensified, focusing on developing climate-adapted microbial strains and application technologies. MarkWide Research indicates that research and development investments have increased by 34% annually over the past three years.

Regulatory harmonization efforts across regional trade blocs are facilitating cross-border commerce and technology transfer. Standardized registration procedures and mutual recognition agreements reduce barriers to market entry and product distribution.

Extension service programs have expanded significantly, with governments and NGOs implementing comprehensive farmer training initiatives. These programs combine technical education with demonstration plots and peer-to-peer learning networks to accelerate technology adoption.

Quality certification systems are being implemented to address product variability concerns and build farmer confidence. Third-party testing, standardized labeling, and quality assurance programs enhance market transparency and product reliability.

Digital transformation initiatives are revolutionizing market access and customer service. E-commerce platforms, mobile payment systems, and digital advisory services improve product accessibility, particularly for smallholder farmers in remote areas.

Market entry strategies should prioritize local partnerships and gradual market development rather than aggressive expansion approaches. Understanding regional agricultural practices, building farmer trust, and providing comprehensive technical support are essential for sustainable market penetration.

Product development focus should emphasize climate-adapted formulations and application methods suited to regional conditions. Heat-stable formulations, extended shelf-life products, and simplified application procedures will enhance adoption rates and farmer satisfaction.

Distribution network development requires careful attention to cold chain requirements and rural accessibility. Partnerships with agricultural cooperatives, extension services, and established input suppliers can accelerate market reach while maintaining product quality.

Farmer education programs should combine technical training with economic demonstrations to build confidence and adoption. Successful programs typically include demonstration plots, peer farmer testimonials, and ongoing technical support services.

Regulatory compliance strategies should anticipate evolving standards and maintain proactive engagement with regulatory authorities. Early compliance with emerging requirements and participation in standard-setting processes can provide competitive advantages.

Investment priorities should balance immediate market opportunities with long-term capacity building. Local manufacturing capabilities, research partnerships, and human resource development create sustainable competitive advantages in this growing market.

Market expansion prospects for the Middle East & Africa biofertilizers sector remain exceptionally positive, driven by converging trends in environmental sustainability, food security, and agricultural modernization. MarkWide Research projections indicate continued robust growth with expanding adoption across all major agricultural segments and geographic regions.

Technology advancement will continue driving market evolution, with innovations in microbial formulation, application methods, and integration with precision agriculture systems. Next-generation products will offer enhanced stability, broader spectrum activity, and improved cost-effectiveness for farmers across diverse agricultural systems.

Regional integration trends will facilitate technology transfer, trade expansion, and knowledge sharing across borders. Harmonized standards, mutual recognition agreements, and regional research collaborations will accelerate market development and innovation diffusion.

Sustainability imperatives will intensify as climate change impacts become more pronounced and environmental regulations strengthen. Biofertilizers will play increasingly important roles in climate-smart agriculture strategies and sustainable intensification programs.

Market maturation will bring improved quality standards, enhanced farmer education, and more sophisticated distribution networks. Professional service providers, specialized retailers, and technical support systems will emerge to serve growing market demand.

Growth projections suggest the market will maintain strong momentum with projected annual growth rates of 11-14% over the next five years. Smallholder farmer adoption, organic market expansion, and government policy support will drive continued market development across the region.

The Middle East & Africa biofertilizers market represents a dynamic and rapidly expanding sector that is fundamentally transforming agricultural practices across the region. Strong growth drivers including environmental sustainability concerns, government policy support, and economic incentives create favorable conditions for continued market expansion and technology adoption.

Regional diversity in agricultural systems, economic conditions, and development stages creates both opportunities and challenges for market participants. Successful strategies require nuanced understanding of local conditions, farmer needs, and regulatory environments while maintaining focus on product quality and technical support services.

Future prospects remain exceptionally positive as converging trends in sustainable agriculture, food security, and climate adaptation drive continued demand for biological fertilizer solutions. The market’s evolution toward greater sophistication, improved quality standards, and enhanced farmer education will support sustained growth and broader adoption across diverse agricultural segments throughout the Middle East & Africa region.

What is Biofertilizers?

Biofertilizers are natural fertilizers that enhance soil fertility and plant growth by using living microorganisms. They are used in various agricultural practices to improve crop yield and sustainability.

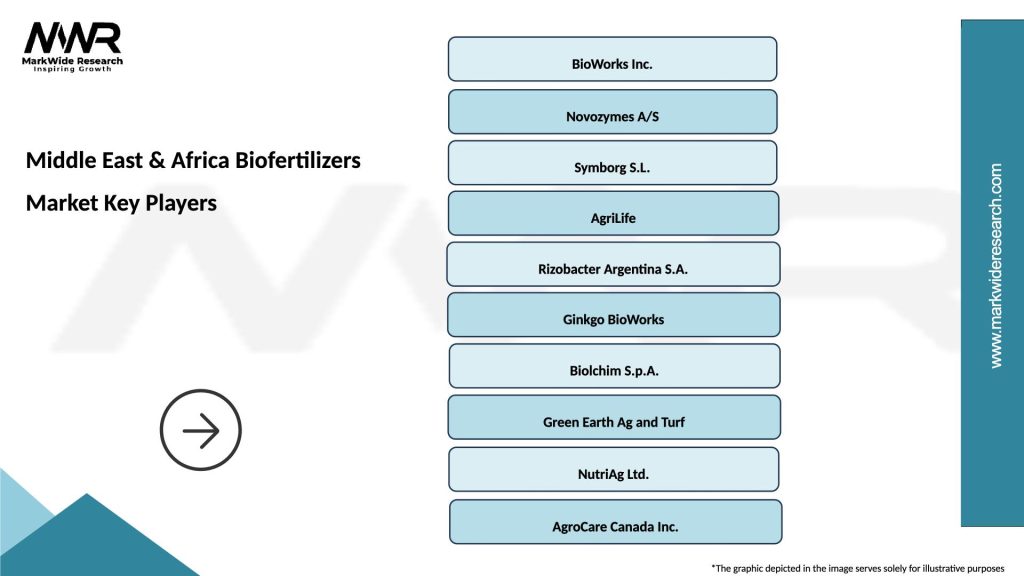

What are the key players in the Middle East & Africa Biofertilizers Market?

Key players in the Middle East & Africa Biofertilizers Market include Novozymes, BioWorks, and Rizobacter, among others. These companies are involved in the development and distribution of biofertilizer products tailored for regional agricultural needs.

What are the growth factors driving the Middle East & Africa Biofertilizers Market?

The growth of the Middle East & Africa Biofertilizers Market is driven by increasing awareness of sustainable agriculture, rising demand for organic food, and government initiatives promoting eco-friendly farming practices.

What challenges does the Middle East & Africa Biofertilizers Market face?

Challenges in the Middle East & Africa Biofertilizers Market include limited awareness among farmers, regulatory hurdles, and competition from synthetic fertilizers, which may hinder market growth.

What opportunities exist in the Middle East & Africa Biofertilizers Market?

Opportunities in the Middle East & Africa Biofertilizers Market include the potential for innovation in product development, increasing investment in agricultural technology, and expanding markets for organic produce.

What trends are shaping the Middle East & Africa Biofertilizers Market?

Trends in the Middle East & Africa Biofertilizers Market include the growing adoption of precision agriculture, advancements in microbial technology, and an increasing focus on sustainable farming practices.

Middle East & Africa Biofertilizers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Biofertilizers, Granular Biofertilizers, Powder Biofertilizers, Bioinoculants |

| Application | Agriculture, Horticulture, Forestry, Landscaping |

| End User | Farmers, Agricultural Cooperatives, Research Institutions, Commercial Growers |

| Distribution Channel | Online Retail, Direct Sales, Distributors, Agricultural Supply Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Biofertilizers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at