444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa AI cybersecurity market represents one of the most rapidly evolving technology sectors in the region, driven by increasing digital transformation initiatives and escalating cyber threats. This dynamic market encompasses artificial intelligence-powered security solutions designed to protect organizations from sophisticated cyberattacks, data breaches, and emerging digital vulnerabilities. The region’s unique geopolitical landscape, combined with substantial investments in smart city projects and digital infrastructure, has created a compelling environment for AI-driven cybersecurity adoption.

Regional governments across the Middle East and Africa are prioritizing cybersecurity as a national security imperative, with countries like the UAE, Saudi Arabia, and South Africa leading significant initiatives to strengthen their digital defense capabilities. The market is experiencing robust growth at a CAGR of 18.5%, reflecting the urgent need for advanced threat detection and response mechanisms. This growth trajectory is supported by increasing awareness of AI’s potential to enhance traditional security measures and provide proactive threat intelligence.

Enterprise adoption of AI cybersecurity solutions has accelerated dramatically, with organizations recognizing the limitations of conventional security approaches in addressing modern cyber threats. The integration of machine learning algorithms, behavioral analytics, and automated response systems has become essential for maintaining robust security postures. Financial services, government agencies, and critical infrastructure operators are driving significant demand for these advanced solutions.

The Middle East & Africa AI cybersecurity market refers to the comprehensive ecosystem of artificial intelligence-powered security technologies, services, and solutions deployed across organizations in the MEA region to protect against cyber threats, detect anomalies, and automate security responses through advanced machine learning and data analytics capabilities.

AI cybersecurity solutions leverage sophisticated algorithms to analyze vast amounts of security data, identify patterns indicative of malicious activities, and respond to threats in real-time without human intervention. These systems continuously learn from new threat vectors, adapt to evolving attack methodologies, and provide predictive insights that enable proactive security measures. The technology encompasses various components including threat intelligence platforms, behavioral analytics engines, automated incident response systems, and predictive risk assessment tools.

Key characteristics of this market include the integration of natural language processing for threat analysis, computer vision for identifying suspicious activities, and deep learning models for advanced persistent threat detection. The solutions are designed to complement existing security infrastructure while providing enhanced capabilities for threat hunting, vulnerability assessment, and compliance management across diverse industry verticals.

Market dynamics in the Middle East & Africa AI cybersecurity sector are characterized by unprecedented growth driven by digital transformation acceleration and increasing sophistication of cyber threats. The region’s strategic focus on becoming a global technology hub has intensified investments in advanced cybersecurity infrastructure, creating substantial opportunities for AI-powered security solution providers.

Government initiatives across key markets are establishing regulatory frameworks that mandate enhanced cybersecurity measures, particularly for critical infrastructure and financial institutions. The UAE’s National Cybersecurity Strategy and Saudi Arabia’s Vision 2030 program are driving significant public and private sector investments in AI cybersecurity capabilities. These initiatives have resulted in 65% of large enterprises in the region actively evaluating or implementing AI-driven security solutions.

Technology adoption patterns reveal strong preference for cloud-based AI cybersecurity platforms that offer scalability and cost-effectiveness. Organizations are increasingly seeking integrated solutions that combine threat detection, incident response, and compliance management within unified platforms. The market is witnessing growing demand for solutions that can address region-specific challenges including multilingual threat analysis and compliance with local data protection regulations.

Competitive landscape features both international technology giants and emerging regional players, creating a diverse ecosystem of solution providers. Strategic partnerships between global AI cybersecurity vendors and local system integrators are becoming increasingly common, facilitating market penetration and localized service delivery.

Critical market insights reveal several transformative trends shaping the Middle East & Africa AI cybersecurity landscape:

Digital transformation acceleration across the Middle East and Africa is fundamentally reshaping cybersecurity requirements, creating unprecedented demand for AI-powered security solutions. Organizations are rapidly digitizing operations, expanding cloud infrastructure, and implementing IoT technologies, significantly expanding their attack surfaces and requiring more sophisticated defense mechanisms.

Escalating cyber threats represent a primary driver for AI cybersecurity adoption, with the region experiencing increasing frequency and sophistication of cyberattacks. Nation-state actors, cybercriminal organizations, and hacktivists are targeting critical infrastructure, financial institutions, and government agencies with advanced techniques that traditional security measures cannot effectively counter. The need for proactive threat hunting and predictive analytics has become critical for maintaining organizational security.

Regulatory compliance requirements are driving significant investments in AI cybersecurity solutions as governments implement stricter data protection and cybersecurity regulations. The UAE’s Data Protection Law, Saudi Arabia’s Personal Data Protection Law, and similar regulations across the region mandate enhanced security measures that often require AI-powered capabilities for effective implementation and ongoing compliance monitoring.

Skills shortage challenges in cybersecurity are compelling organizations to adopt AI-powered automation to augment limited human resources. The region faces a significant gap between cybersecurity talent demand and supply, making intelligent automation essential for maintaining effective security operations. AI solutions enable organizations to scale their security capabilities without proportional increases in specialized personnel.

Government cybersecurity initiatives are providing substantial momentum for market growth, with national cybersecurity strategies emphasizing the importance of advanced threat detection and response capabilities. Public sector investments in AI cybersecurity are creating demonstration effects that encourage private sector adoption and establish market credibility for these solutions.

High implementation costs present significant barriers to AI cybersecurity adoption, particularly for small and medium-sized enterprises across the region. The substantial capital investments required for comprehensive AI cybersecurity platforms, including infrastructure upgrades, software licensing, and professional services, can be prohibitive for organizations with limited technology budgets.

Technical complexity challenges associated with AI cybersecurity implementation create adoption barriers for organizations lacking advanced technical expertise. The complexity of integrating AI-powered solutions with existing security infrastructure, configuring machine learning models, and maintaining optimal system performance requires specialized knowledge that may not be readily available in all markets.

Data privacy concerns and regulatory uncertainties surrounding AI technology usage in cybersecurity applications create hesitation among potential adopters. Organizations are concerned about the implications of AI systems processing sensitive security data and the potential for algorithmic bias or false positives that could impact business operations.

Limited local expertise in AI cybersecurity technologies constrains market growth, as organizations struggle to find qualified professionals capable of implementing, managing, and optimizing these advanced solutions. The shortage of AI specialists with cybersecurity domain knowledge creates dependencies on external consultants and vendors, increasing implementation costs and complexity.

Infrastructure limitations in certain markets within the region may constrain the deployment of sophisticated AI cybersecurity solutions that require high-performance computing resources and reliable network connectivity. Organizations in markets with limited digital infrastructure may face challenges in fully leveraging AI cybersecurity capabilities.

Smart city initiatives across the Middle East and Africa present substantial opportunities for AI cybersecurity solution providers, as governments invest heavily in connected infrastructure that requires comprehensive security protection. Projects like NEOM in Saudi Arabia, Dubai Smart City, and various African smart city developments create demand for integrated AI cybersecurity platforms capable of protecting complex IoT ecosystems.

Financial services digitization is creating significant opportunities for specialized AI cybersecurity solutions designed to address the unique requirements of banking, insurance, and fintech organizations. The rapid growth of digital banking, mobile payments, and cryptocurrency adoption in the region requires advanced fraud detection, transaction monitoring, and customer authentication capabilities powered by AI technologies.

Critical infrastructure protection represents a high-value opportunity segment, with energy, telecommunications, and transportation sectors requiring specialized AI cybersecurity solutions. The region’s strategic importance in global energy markets and ongoing infrastructure development projects create demand for solutions capable of protecting operational technology environments and ensuring business continuity.

Cloud security services present growing opportunities as organizations accelerate cloud migration and require AI-powered solutions for multi-cloud security management. The shift toward hybrid and multi-cloud architectures creates demand for unified security platforms that can provide consistent protection across diverse cloud environments.

Managed security services powered by AI technologies offer significant opportunities for service providers to address the skills shortage challenge while providing cost-effective cybersecurity solutions. Organizations increasingly prefer outsourced security operations that leverage AI for 24/7 threat monitoring and response capabilities.

Technological evolution is fundamentally reshaping the Middle East & Africa AI cybersecurity market, with continuous advances in machine learning algorithms, natural language processing, and behavioral analytics driving solution sophistication. The integration of emerging technologies like quantum computing and edge AI is creating new possibilities for threat detection and response while also introducing novel security challenges that require innovative solutions.

Competitive dynamics are intensifying as both global technology leaders and regional specialists compete for market share through innovation, strategic partnerships, and localized service delivery. The market is witnessing increased collaboration between international AI cybersecurity vendors and local system integrators to provide culturally appropriate and regulatory-compliant solutions.

Customer expectations are evolving rapidly, with organizations demanding AI cybersecurity solutions that provide immediate value, seamless integration, and measurable security improvements. The emphasis on return on investment and demonstrable threat reduction is driving vendors to develop more user-friendly platforms with clear performance metrics and reporting capabilities.

Regulatory evolution continues to influence market dynamics as governments refine cybersecurity requirements and establish clearer guidelines for AI technology usage in security applications. The development of regional cybersecurity frameworks and international cooperation initiatives is creating more predictable regulatory environments that facilitate long-term planning and investment.

Economic factors including oil price fluctuations, currency volatility, and economic diversification efforts impact cybersecurity investment priorities across different markets in the region. Organizations are increasingly seeking cost-effective AI cybersecurity solutions that provide maximum protection while optimizing operational expenses.

Comprehensive research approach employed for analyzing the Middle East & Africa AI cybersecurity market combines multiple data collection and analysis methodologies to ensure accuracy and reliability of findings. The research framework incorporates both quantitative and qualitative research techniques, providing a holistic view of market dynamics, trends, and opportunities.

Primary research activities include extensive interviews with key stakeholders across the AI cybersecurity ecosystem, including technology vendors, system integrators, end-user organizations, government officials, and industry experts. These interviews provide valuable insights into market challenges, adoption patterns, and future requirements that may not be captured through secondary research alone.

Secondary research methodology involves comprehensive analysis of industry reports, government publications, regulatory documents, company financial statements, and technology research papers. This approach ensures that market analysis is grounded in verified data sources and incorporates diverse perspectives on market development and trends.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews to verify key findings, and applying statistical analysis techniques to ensure data consistency and reliability. The research methodology emphasizes accuracy and objectivity in presenting market insights and projections.

Market modeling techniques utilize advanced analytical frameworks to project market growth, segment performance, and competitive dynamics. These models incorporate various economic, technological, and regulatory factors that influence market development, providing robust foundations for strategic decision-making.

United Arab Emirates leads the regional AI cybersecurity market with the most advanced digital infrastructure and progressive cybersecurity policies. The country’s strategic focus on becoming a global technology hub has resulted in substantial investments in AI cybersecurity capabilities, with 78% of large enterprises having implemented or planning to implement AI-powered security solutions. Dubai and Abu Dhabi serve as regional headquarters for major international cybersecurity vendors, creating a vibrant ecosystem of solution providers and service partners.

Saudi Arabia represents the largest market opportunity in the region, driven by Vision 2030 initiatives and massive digital transformation projects. The Kingdom’s focus on developing domestic technology capabilities and reducing dependence on foreign expertise is creating opportunities for local AI cybersecurity solution development. Government mandates for enhanced cybersecurity in critical sectors are driving rapid adoption across energy, finance, and telecommunications industries.

South Africa dominates the African portion of the market, with the most mature cybersecurity industry and established regulatory frameworks. The country’s well-developed financial services sector and growing technology industry create substantial demand for AI cybersecurity solutions. However, economic challenges and infrastructure limitations in certain areas constrain market growth potential compared to Middle Eastern markets.

Qatar and Kuwait are emerging as significant markets driven by government digitization initiatives and substantial technology investments. These markets show strong preference for comprehensive AI cybersecurity platforms that can address both current threats and future security challenges associated with ongoing digital transformation projects.

Other regional markets including Egypt, Nigeria, Kenya, and Morocco are showing increasing interest in AI cybersecurity solutions, though adoption rates remain lower due to economic constraints and limited technical infrastructure. These markets present long-term growth opportunities as digital transformation accelerates and cybersecurity awareness increases.

Market leadership in the Middle East & Africa AI cybersecurity sector is characterized by a mix of global technology giants and specialized regional players, each bringing unique strengths and capabilities to address diverse customer requirements across different market segments.

Strategic partnerships between international vendors and regional system integrators are becoming increasingly important for market success, enabling global technology leaders to provide localized services and support while helping regional partners access advanced AI cybersecurity technologies.

Emerging competitors include regional technology companies and startups developing specialized AI cybersecurity solutions tailored to local market requirements and regulatory compliance needs. These companies often focus on specific industry verticals or unique regional challenges that may not be adequately addressed by global solution providers.

By Technology:

By Application:

By Deployment:

By Organization Size:

Financial Services represents the most mature and sophisticated segment of the AI cybersecurity market, with banks, insurance companies, and fintech organizations leading adoption of advanced threat detection and fraud prevention solutions. This sector demonstrates 85% adoption rate of AI-powered security technologies among major institutions, driven by regulatory requirements and the high value of financial data.

Government and Defense sectors are experiencing rapid growth in AI cybersecurity adoption, with national security agencies and defense organizations investing heavily in advanced threat intelligence and automated response capabilities. These organizations require specialized solutions capable of addressing nation-state threats and protecting classified information systems.

Energy and Utilities companies are increasingly adopting AI cybersecurity solutions to protect critical infrastructure from sophisticated cyberattacks. The sector’s unique requirements for operational technology security and business continuity are driving demand for specialized industrial cybersecurity platforms with AI capabilities.

Healthcare organizations are emerging as significant adopters of AI cybersecurity solutions, driven by increasing digitization of medical records and growing threats to patient data privacy. The sector requires solutions that balance security requirements with operational efficiency and regulatory compliance needs.

Telecommunications providers are implementing AI cybersecurity solutions to protect network infrastructure and customer data while enabling secure delivery of digital services. The sector’s role as critical infrastructure makes cybersecurity a strategic priority requiring advanced threat detection capabilities.

Enhanced Threat Detection: AI cybersecurity solutions provide unprecedented capabilities for identifying sophisticated threats that traditional security measures might miss, enabling organizations to detect and respond to attacks in their early stages before significant damage occurs.

Operational Efficiency: Automation of routine security tasks and intelligent prioritization of security alerts enable cybersecurity teams to focus on high-value activities while reducing the time required for threat investigation and incident response.

Cost Optimization: AI-powered security platforms help organizations optimize cybersecurity spending by reducing false positives, automating manual processes, and enabling more efficient resource allocation across security operations.

Compliance Assurance: Automated compliance monitoring and reporting capabilities help organizations maintain adherence to regulatory requirements while reducing the administrative burden associated with compliance management.

Scalability: AI cybersecurity solutions provide the ability to scale security operations without proportional increases in human resources, enabling organizations to maintain effective security as they grow and expand their digital footprint.

Predictive Capabilities: Advanced analytics and machine learning enable organizations to anticipate potential security threats and vulnerabilities, allowing for proactive security measures rather than reactive responses to incidents.

Competitive Advantage: Organizations with advanced AI cybersecurity capabilities can operate with greater confidence in digital environments, enabling them to pursue digital transformation initiatives and competitive strategies with reduced security risks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Autonomous Security Operations are becoming increasingly prevalent as organizations seek to reduce dependence on human intervention for routine security tasks. AI-powered security orchestration platforms are enabling fully automated threat detection, analysis, and response workflows that can operate continuously without human oversight.

Zero Trust Architecture Integration represents a significant trend where AI cybersecurity solutions are being designed to support zero trust security models that assume no implicit trust and continuously verify every transaction and access request. This approach requires sophisticated AI capabilities for continuous risk assessment and adaptive access controls.

Cloud-Native Security solutions are gaining prominence as organizations migrate to cloud infrastructure and require security platforms that are designed specifically for cloud environments. These solutions leverage cloud-native AI services and provide seamless integration with major cloud platforms.

Behavioral Analytics Enhancement is driving development of more sophisticated user and entity behavior analytics (UEBA) capabilities that can detect subtle indicators of compromise and insider threats through advanced pattern recognition and anomaly detection algorithms.

Threat Intelligence Automation is evolving to provide real-time threat intelligence gathering, analysis, and dissemination capabilities that enable organizations to stay ahead of emerging threats and adapt their security postures accordingly.

Industry-Specific Solutions are becoming more common as vendors develop specialized AI cybersecurity platforms tailored to specific industry requirements, regulatory compliance needs, and operational characteristics of different vertical markets.

Strategic Acquisitions are reshaping the competitive landscape as major cybersecurity vendors acquire AI technology companies and startups to enhance their artificial intelligence capabilities and expand their solution portfolios. These acquisitions are enabling rapid integration of advanced AI technologies into established cybersecurity platforms.

Government Partnerships between AI cybersecurity vendors and regional governments are creating opportunities for large-scale deployments and establishing reference implementations that demonstrate the effectiveness of AI-powered security solutions in protecting critical infrastructure and government systems.

Technology Integration initiatives are producing more comprehensive platforms that combine AI cybersecurity capabilities with other security technologies such as identity management, network security, and compliance management to provide unified security management experiences.

Research and Development investments are accelerating as companies recognize the importance of continuous innovation in maintaining competitive advantages in the rapidly evolving AI cybersecurity market. MarkWide Research analysis indicates that leading vendors are investing 15-20% of revenue in R&D activities focused on AI technology advancement.

Regulatory Compliance solutions are being developed to address evolving data protection and cybersecurity regulations across the region, with vendors creating specialized modules and features designed to support compliance with local and international regulatory requirements.

Skills Development programs are being launched by vendors and industry associations to address the cybersecurity skills shortage through training and certification programs focused on AI cybersecurity technologies and best practices.

Investment Prioritization should focus on AI cybersecurity solutions that provide immediate value while building foundations for long-term security enhancement. Organizations should prioritize platforms that offer strong integration capabilities, proven threat detection effectiveness, and clear return on investment metrics.

Vendor Selection criteria should emphasize solution providers with strong regional presence, local support capabilities, and demonstrated experience in addressing region-specific cybersecurity challenges. Organizations should also consider vendors’ roadmaps for AI technology advancement and their ability to adapt to evolving threat landscapes.

Implementation Strategy should adopt phased approaches that begin with high-impact use cases and gradually expand AI cybersecurity capabilities across the organization. This approach enables organizations to build expertise and demonstrate value while minimizing implementation risks and costs.

Skills Development initiatives should be prioritized to ensure organizations can effectively implement, manage, and optimize AI cybersecurity solutions. Investment in training and certification programs for existing cybersecurity staff is essential for maximizing the value of AI technology investments.

Regulatory Preparation should include proactive assessment of current and anticipated cybersecurity regulations to ensure AI cybersecurity solutions can support compliance requirements. Organizations should engage with legal and compliance teams early in the selection and implementation process.

Performance Measurement frameworks should be established to track the effectiveness of AI cybersecurity investments and demonstrate value to stakeholders. Key performance indicators should include threat detection rates, false positive reduction, incident response times, and compliance metrics.

Market evolution in the Middle East & Africa AI cybersecurity sector is expected to accelerate significantly over the next five years, driven by continued digital transformation, increasing cyber threat sophistication, and growing government support for advanced cybersecurity capabilities. MarkWide Research projects that the market will experience sustained growth with expanding adoption across all industry verticals and organization sizes.

Technology advancement will continue to drive market development, with emerging capabilities in quantum-resistant encryption, edge AI processing, and autonomous security operations creating new opportunities for enhanced threat protection. The integration of AI cybersecurity with other emerging technologies such as 5G networks, IoT platforms, and blockchain systems will create additional market segments and use cases.

Regional leadership is expected to shift as different countries advance their digital transformation and cybersecurity initiatives at varying paces. The UAE and Saudi Arabia are likely to maintain their positions as regional leaders, while other markets including Egypt, Nigeria, and Kenya may emerge as significant growth markets as their digital infrastructure and cybersecurity awareness mature.

Industry consolidation may occur as the market matures, with larger vendors acquiring specialized AI cybersecurity companies to enhance their capabilities and market reach. This consolidation could lead to more comprehensive platforms but may also create opportunities for new entrants with innovative approaches to AI cybersecurity challenges.

Regulatory development will continue to influence market dynamics as governments refine cybersecurity requirements and establish clearer guidelines for AI technology usage in security applications. These regulatory developments are expected to create more predictable market conditions while potentially mandating adoption of advanced cybersecurity capabilities in certain sectors.

The Middle East & Africa AI cybersecurity market represents a dynamic and rapidly expanding sector with substantial growth potential driven by digital transformation acceleration, escalating cyber threats, and strong government support for advanced cybersecurity capabilities. The market’s evolution reflects the region’s strategic focus on becoming a global technology hub while addressing critical security challenges associated with increasing digital connectivity and data proliferation.

Key success factors for market participants include the ability to provide comprehensive AI-powered solutions that address region-specific challenges, establish strong local partnerships for service delivery and support, and demonstrate clear value propositions that justify investment in advanced cybersecurity technologies. The market rewards vendors who can combine global technology leadership with local market understanding and regulatory compliance expertise.

Future growth prospects remain highly favorable, with continued expansion expected across all market segments and geographic regions. The increasing sophistication of cyber threats, combined with growing digital transformation initiatives and supportive government policies, creates a compelling environment for sustained market development. Organizations that invest strategically in AI cybersecurity capabilities today will be well-positioned to capitalize on emerging opportunities and maintain competitive advantages in an increasingly digital business environment.

What is AI cybersecurity?

AI cybersecurity refers to the use of artificial intelligence technologies to enhance the security of computer systems and networks. It involves the application of machine learning, data analytics, and automation to detect and respond to cyber threats more effectively.

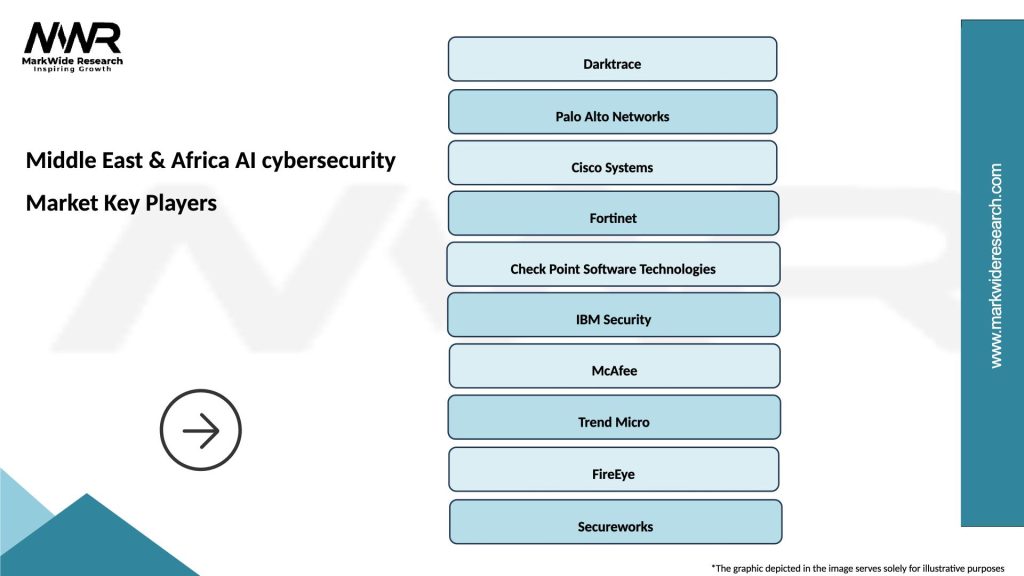

What are the key players in the Middle East & Africa AI cybersecurity Market?

Key players in the Middle East & Africa AI cybersecurity Market include companies like Darktrace, Check Point Software Technologies, and Palo Alto Networks, among others. These companies are known for their innovative solutions in threat detection and response.

What are the main drivers of growth in the Middle East & Africa AI cybersecurity Market?

The growth of the Middle East & Africa AI cybersecurity Market is driven by increasing cyber threats, the rising adoption of cloud services, and the need for regulatory compliance in various industries. Organizations are investing in AI-driven solutions to enhance their security posture.

What challenges does the Middle East & Africa AI cybersecurity Market face?

Challenges in the Middle East & Africa AI cybersecurity Market include a shortage of skilled cybersecurity professionals, the complexity of integrating AI technologies, and the evolving nature of cyber threats. These factors can hinder the effective implementation of AI solutions.

What opportunities exist in the Middle East & Africa AI cybersecurity Market?

Opportunities in the Middle East & Africa AI cybersecurity Market include the growing demand for advanced threat detection systems, the expansion of IoT devices, and increased investment in cybersecurity infrastructure. These factors present avenues for innovation and growth.

What trends are shaping the Middle East & Africa AI cybersecurity Market?

Trends in the Middle East & Africa AI cybersecurity Market include the increasing use of machine learning for threat intelligence, the rise of automated security solutions, and a focus on proactive cybersecurity measures. Organizations are prioritizing AI to stay ahead of emerging threats.

Middle East & Africa AI cybersecurity Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Government, BFSI, Healthcare, Telecommunications |

| Solution | Threat Intelligence, Identity Management, Data Loss Prevention, Incident Response |

| Technology | Machine Learning, Blockchain, Encryption, Behavioral Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa AI cybersecurity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at