444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa adhesives and sealants market represents a dynamic and rapidly evolving sector driven by substantial infrastructure development, expanding manufacturing capabilities, and increasing industrial diversification across the region. This market encompasses a comprehensive range of bonding and sealing solutions that serve critical functions in construction, automotive, packaging, electronics, and aerospace applications throughout the MEA region.

Market dynamics indicate robust growth potential, with the region experiencing a 6.8% CAGR driven by mega infrastructure projects, urbanization initiatives, and industrial expansion programs. The market demonstrates strong performance across multiple segments, with construction applications commanding approximately 45% market share due to extensive building and infrastructure development activities.

Regional characteristics show significant variation in market maturity and growth patterns. The Gulf Cooperation Council (GCC) countries lead in terms of advanced applications and premium product adoption, while African markets present substantial opportunities for volume growth and market penetration. Technology adoption rates vary considerably, with structural adhesives and high-performance sealants gaining 35% faster adoption in developed MEA markets compared to traditional bonding solutions.

Industrial diversification across the region continues to drive demand for specialized adhesive and sealant formulations. Manufacturing sectors, particularly automotive assembly, electronics production, and renewable energy installations, contribute significantly to market expansion. The region’s strategic position as a global logistics hub further enhances demand for packaging adhesives and industrial sealants.

The Middle East & Africa adhesives and sealants market refers to the comprehensive ecosystem of bonding and sealing solutions designed to join materials, provide weatherproofing, and ensure structural integrity across diverse industrial and commercial applications throughout the MEA region. This market encompasses synthetic and natural formulations that create permanent or semi-permanent bonds between substrates while offering protection against environmental factors.

Adhesives in this context include structural bonding agents, pressure-sensitive adhesives, hot-melt formulations, and specialty bonding solutions that provide mechanical strength and durability. These products serve critical functions in manufacturing processes, construction applications, and end-use products across multiple industries.

Sealants represent specialized formulations designed to prevent the passage of fluids, gases, dust, and other environmental contaminants through joints, gaps, and interfaces. These products provide weatherproofing, insulation, and protective barriers essential for building envelope integrity and industrial equipment performance.

Market scope includes both commodity and specialty formulations, ranging from basic construction adhesives to advanced aerospace-grade bonding systems. The definition encompasses water-based, solvent-based, and reactive formulations tailored to specific performance requirements and environmental conditions prevalent in the MEA region.

Strategic market positioning reveals the Middle East & Africa adhesives and sealants market as a high-growth region characterized by substantial infrastructure investment, industrial expansion, and increasing adoption of advanced bonding technologies. The market benefits from favorable economic conditions, government-led development initiatives, and growing manufacturing capabilities across key countries.

Growth drivers include massive construction projects, automotive industry development, packaging sector expansion, and increasing focus on renewable energy installations. Construction applications continue to dominate market demand, representing nearly half of total consumption, while automotive and industrial segments show accelerating growth rates.

Technology trends indicate strong movement toward high-performance formulations, environmentally sustainable products, and application-specific solutions. Structural adhesives experience 40% higher growth rates compared to traditional mechanical fastening alternatives, driven by weight reduction requirements and improved performance characteristics.

Regional dynamics show the GCC countries leading in market value and advanced product adoption, while African markets present significant volume opportunities. Nigeria, South Africa, and Kenya emerge as key growth markets, with infrastructure development driving 25% annual increases in adhesive consumption.

Competitive landscape features a mix of global multinational corporations and regional specialists, with increasing focus on local manufacturing capabilities and supply chain optimization. Market consolidation continues as companies seek to expand geographic coverage and enhance product portfolios.

Infrastructure development serves as the primary market catalyst, with government-led initiatives across the region driving unprecedented demand for construction adhesives and sealants. Major projects including smart cities, transportation networks, and industrial zones require advanced bonding solutions that meet stringent performance and durability requirements.

Market maturity levels vary significantly across the region, with GCC countries demonstrating advanced application techniques and premium product adoption, while emerging African markets focus on volume growth and basic formulation requirements. This diversity creates opportunities for both commodity and specialty product segments.

Infrastructure investment represents the most significant market driver, with governments across the MEA region allocating substantial resources to construction and development projects. These initiatives include transportation networks, urban development, industrial zones, and renewable energy installations that require extensive use of adhesives and sealants.

Economic diversification efforts drive industrial development beyond traditional oil and gas sectors, creating demand for manufacturing-grade bonding solutions. Countries throughout the region actively promote manufacturing capabilities, automotive assembly, electronics production, and value-added processing industries that rely heavily on advanced adhesive technologies.

Urbanization trends accelerate construction activity as growing populations require residential, commercial, and infrastructure development. This demographic shift creates sustained demand for building adhesives, sealants, and weatherproofing solutions essential for modern construction techniques and energy-efficient building designs.

Automotive sector expansion contributes significantly to market growth as several MEA countries develop vehicle manufacturing and assembly capabilities. These operations require structural adhesives, interior bonding solutions, and sealing compounds that meet automotive industry standards for performance, durability, and safety.

Packaging industry growth driven by consumer goods expansion, e-commerce development, and food processing activities increases demand for packaging adhesives. The region’s position as a global logistics hub further enhances requirements for reliable packaging solutions that maintain product integrity during transportation and storage.

Technology adoption accelerates as industries recognize the performance advantages of modern adhesive and sealant formulations over traditional mechanical fastening methods. These benefits include weight reduction, improved aesthetics, enhanced durability, and simplified manufacturing processes.

Raw material volatility presents ongoing challenges as adhesive and sealant formulations depend on petrochemical derivatives and specialty chemicals subject to price fluctuations and supply disruptions. These cost pressures particularly affect commodity-grade products and can impact market growth in price-sensitive applications.

Technical expertise limitations constrain market development in certain regions where proper application techniques, surface preparation methods, and quality control procedures require specialized knowledge and training. This skills gap can lead to performance issues and reduced confidence in adhesive solutions.

Regulatory complexity increases as environmental and safety standards become more stringent across the region. Compliance with volatile organic compound regulations, workplace safety requirements, and environmental protection standards adds complexity and cost to product development and manufacturing operations.

Import dependence creates supply chain vulnerabilities for specialized formulations and raw materials not available locally. Currency fluctuations, trade restrictions, and logistics challenges can impact product availability and pricing stability in certain markets.

Competition from alternatives includes traditional mechanical fastening methods, welding techniques, and other joining technologies that may offer lower initial costs or familiar application procedures. Overcoming established practices requires demonstration of clear performance and economic benefits.

Economic uncertainties in certain regions can impact construction activity, industrial investment, and consumer spending that drive adhesive and sealant demand. Political instability, commodity price volatility, and global economic conditions affect market growth prospects.

Renewable energy expansion creates substantial opportunities as solar, wind, and other clean energy projects require specialized bonding and sealing solutions. These applications demand high-performance formulations capable of withstanding extreme environmental conditions while maintaining long-term reliability and performance.

Smart construction technologies drive demand for advanced adhesive systems that support modern building techniques, prefabricated components, and energy-efficient designs. Green building initiatives and sustainable construction practices create opportunities for eco-friendly formulations and high-performance solutions.

Manufacturing localization presents opportunities for establishing regional production capabilities that reduce import dependence, improve supply chain reliability, and better serve local market requirements. This trend supports both multinational expansion and local company development.

Automotive industry development offers significant growth potential as vehicle manufacturing expands across the region. Electric vehicle production, in particular, requires specialized adhesives for battery systems, lightweight components, and advanced materials integration.

Packaging innovation driven by e-commerce growth, food safety requirements, and consumer convenience creates demand for advanced packaging adhesives. Sustainable packaging initiatives also drive development of bio-based and recyclable adhesive formulations.

Infrastructure modernization in established markets creates opportunities for retrofit applications, maintenance solutions, and upgrade projects that require high-performance bonding and sealing products. These applications often command premium pricing and require specialized technical support.

Technology transfer opportunities exist for introducing advanced formulations and application techniques developed in mature markets to emerging MEA regions. This includes training programs, technical support services, and customized product development initiatives.

Supply chain evolution reflects the region’s transition from import-dependent markets to increasingly localized production and distribution networks. This transformation improves product availability, reduces costs, and enhances customer service capabilities while creating opportunities for regional suppliers and manufacturers.

Technology integration accelerates as industries adopt digital manufacturing processes, automation systems, and quality control technologies that require compatible adhesive and sealant solutions. These developments drive demand for formulations that support advanced manufacturing techniques and precision applications.

Customer sophistication increases as end-users develop greater understanding of adhesive and sealant capabilities, leading to more demanding performance requirements and application-specific solutions. This trend supports market premiumization and drives innovation in product development.

Competitive intensity grows as both global and regional players expand their presence in attractive MEA markets. This competition drives innovation, improves service levels, and can lead to pricing pressures in commodity segments while supporting value creation in specialty applications.

Regulatory harmonization efforts across the region create opportunities for standardized products and streamlined market entry procedures. However, varying implementation timelines and local requirements continue to create complexity for market participants.

Investment patterns show increasing focus on high-growth segments including automotive, renewable energy, and advanced manufacturing applications. These sectors offer attractive returns and support long-term market development strategies.

Primary research encompasses comprehensive interviews with industry stakeholders including manufacturers, distributors, end-users, and technical experts across key MEA markets. This approach provides direct insights into market conditions, competitive dynamics, and emerging trends that shape industry development.

Secondary research involves analysis of industry publications, government statistics, trade association reports, and company financial statements to establish market baselines and validate primary research findings. This methodology ensures comprehensive coverage of market segments and geographic regions.

Market sizing utilizes multiple approaches including top-down analysis based on construction activity, manufacturing output, and economic indicators, combined with bottom-up assessment of application-specific demand patterns and consumption rates across different market segments.

Competitive analysis examines company strategies, product portfolios, geographic presence, and market positioning to understand competitive dynamics and identify key success factors. This includes assessment of both multinational corporations and regional specialists operating in MEA markets.

Trend analysis incorporates evaluation of technological developments, regulatory changes, economic conditions, and demographic shifts that influence market growth and evolution. This forward-looking approach supports strategic planning and investment decision-making.

Data validation procedures include cross-referencing multiple sources, expert review processes, and statistical analysis to ensure accuracy and reliability of market assessments and projections.

Gulf Cooperation Council countries lead the MEA adhesives and sealants market in terms of value and advanced product adoption, representing approximately 55% of regional market share. The UAE, Saudi Arabia, and Qatar drive demand through massive infrastructure projects, industrial diversification, and high-quality construction standards that require premium bonding solutions.

Saudi Arabia emerges as the largest single market within the GCC, supported by Vision 2030 initiatives that promote construction, manufacturing, and renewable energy development. The kingdom’s focus on industrial cities, smart urban development, and automotive manufacturing creates substantial demand for both commodity and specialty adhesive products.

United Arab Emirates demonstrates strong market sophistication with emphasis on high-performance applications, sustainable construction practices, and advanced manufacturing capabilities. Dubai and Abu Dhabi serve as regional hubs for adhesive distribution and technical support services.

South Africa represents the largest African market, accounting for approximately 30% of continental demand, driven by established manufacturing sectors, construction activity, and automotive assembly operations. The country serves as a gateway for market entry into broader African markets.

Nigeria shows rapid growth potential with expanding construction sector, growing manufacturing capabilities, and increasing consumer goods production. Infrastructure development and urbanization drive strong demand growth for construction adhesives and sealants.

Kenya and other East African markets demonstrate emerging opportunities supported by infrastructure investment, manufacturing development, and regional trade integration. These markets focus primarily on commodity-grade products with growing interest in performance solutions.

North African markets including Egypt, Morocco, and Algeria show mixed performance based on economic conditions and political stability. Construction and manufacturing activities drive demand, while import restrictions and currency challenges create market complexities.

Market leadership reflects a combination of global multinational corporations and regional specialists, each serving different market segments and geographic areas. The competitive environment emphasizes product quality, technical support, and supply chain reliability as key differentiating factors.

Competitive strategies focus on local manufacturing development, technical service enhancement, and product portfolio expansion to meet diverse regional requirements. Companies increasingly invest in application-specific solutions and customer support capabilities.

Market consolidation continues as larger players acquire regional specialists and niche manufacturers to expand geographic coverage and enhance product offerings. This trend supports market development while creating challenges for smaller independent suppliers.

By Technology: The market segments into distinct technology categories, each serving specific performance requirements and application needs across the MEA region.

By Application: Market segmentation reflects diverse end-use requirements across multiple industries and applications.

By End-User: Market classification based on customer types and purchasing patterns across the region.

Structural Adhesives demonstrate the strongest growth trajectory within the MEA market, driven by construction industry adoption and automotive manufacturing expansion. These high-performance formulations offer superior strength and durability compared to traditional mechanical fastening methods, supporting their increasing adoption in critical applications.

Construction Sealants maintain dominant market position due to extensive building and infrastructure development across the region. Weatherproofing requirements, energy efficiency standards, and building code compliance drive consistent demand for both commodity and premium sealing solutions.

Packaging Adhesives show accelerating growth supported by consumer goods expansion, e-commerce development, and food processing industry growth. Hot-melt and water-based formulations gain preference due to processing efficiency and environmental considerations.

Industrial Assembly adhesives benefit from manufacturing sector diversification and automation adoption across the region. These applications require reliable bonding solutions that support efficient production processes and quality requirements.

Automotive Adhesives represent a high-growth category as vehicle manufacturing expands throughout the MEA region. Structural bonding, interior assembly, and aftermarket applications drive demand for specialized formulations that meet automotive industry standards.

Specialty Applications including electronics, aerospace, and renewable energy create opportunities for premium-priced formulations with advanced performance characteristics. These segments require technical expertise and certification compliance but offer attractive margins and growth potential.

Manufacturers benefit from expanding market opportunities, diversified application segments, and growing demand for high-performance solutions. The region’s economic development and industrial expansion create sustainable growth prospects for both commodity and specialty product categories.

Distributors gain from increasing market sophistication, expanding customer base, and opportunities for value-added services including technical support and application assistance. Regional distribution networks become increasingly valuable as markets mature and customer requirements become more complex.

End-users benefit from improved product availability, enhanced technical support, and access to advanced formulations that improve operational efficiency and product performance. Local manufacturing development also provides supply chain reliability and cost advantages.

Technology providers find opportunities for innovation transfer, application development, and technical service expansion. The region’s growing industrial sophistication creates demand for advanced solutions and specialized expertise.

Investors benefit from attractive growth prospects, market expansion opportunities, and potential for value creation through strategic positioning in high-growth segments and geographic markets.

Government stakeholders gain from industrial development, technology transfer, and economic diversification supported by adhesive and sealant industry expansion. Local manufacturing development contributes to employment creation and reduced import dependence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with increasing focus on eco-friendly formulations, reduced volatile organic compound emissions, and recyclable packaging solutions. MarkWide Research indicates that sustainable adhesive formulations experience 30% faster adoption rates in environmentally conscious applications.

Smart Manufacturing adoption drives demand for adhesives compatible with automated application systems, precision dispensing equipment, and quality control technologies. These developments support efficiency improvements and consistent application results across manufacturing operations.

Performance Enhancement continues as a key trend with development of formulations offering superior strength, durability, and environmental resistance. High-performance solutions gain preference in critical applications where failure consequences are significant.

Application Specialization increases as industries require customized solutions for specific performance requirements, environmental conditions, and regulatory compliance needs. This trend supports market premiumization and technical service development.

Supply Chain Localization accelerates as companies establish regional manufacturing and distribution capabilities to improve service levels, reduce costs, and enhance supply chain reliability. This trend supports both multinational expansion and local company development.

Digital Integration includes online ordering systems, technical support platforms, and application guidance tools that enhance customer experience and support market development in emerging regions.

Manufacturing Investments across the region include new production facilities, capacity expansions, and technology upgrades that support local market development and reduce import dependence. Major players continue investing in regional manufacturing capabilities to better serve growing demand.

Product Innovations focus on high-performance formulations, sustainable solutions, and application-specific products that meet evolving market requirements. Research and development efforts emphasize environmental compliance, performance enhancement, and cost optimization.

Strategic Partnerships between global manufacturers and regional distributors enhance market coverage, technical support capabilities, and customer service levels. These collaborations support market development and competitive positioning.

Regulatory Developments include updated environmental standards, safety requirements, and quality specifications that influence product development and market strategies. Companies invest in compliance capabilities and product reformulations to meet evolving requirements.

Technology Transfer initiatives bring advanced formulations and application techniques from mature markets to emerging MEA regions. These programs include training, technical support, and customized product development activities.

Market Consolidation continues through acquisitions, joint ventures, and strategic alliances that enhance geographic coverage, product portfolios, and competitive capabilities. This trend shapes competitive dynamics and market structure.

Market Entry Strategy should emphasize local partnerships, technical support capabilities, and gradual market development rather than aggressive expansion approaches. Understanding regional requirements, regulatory compliance, and customer preferences proves essential for successful market penetration.

Product Portfolio Development requires balancing commodity and specialty formulations to serve diverse market segments effectively. Companies should focus on applications with clear performance advantages and growth potential while maintaining competitive positions in volume segments.

Investment Priorities should emphasize supply chain development, technical service capabilities, and customer relationship building over pure capacity expansion. Market success depends on service quality and reliability rather than just product availability.

Technology Focus should prioritize sustainable formulations, high-performance solutions, and application-specific products that address evolving market requirements. Innovation efforts should consider local environmental conditions and regulatory requirements.

Partnership Strategy becomes crucial for market development, with emphasis on distributor relationships, technical service providers, and end-user engagement. Collaborative approaches often prove more effective than independent market development efforts.

Risk Management should address supply chain vulnerabilities, regulatory changes, and economic volatility through diversified sourcing, flexible manufacturing, and conservative expansion strategies. Market participants should maintain financial flexibility for uncertain conditions.

Growth Trajectory indicates sustained market expansion driven by infrastructure development, industrial diversification, and increasing adoption of advanced bonding technologies. MWR analysis projects continued strong performance across multiple application segments with particular strength in construction and automotive applications.

Technology Evolution will emphasize sustainable formulations, smart manufacturing compatibility, and enhanced performance characteristics. Bio-based adhesives and recyclable formulations gain importance as environmental regulations become more stringent and sustainability awareness increases.

Market Maturation varies significantly across the region, with GCC countries advancing toward premium product adoption while African markets focus on volume growth and basic formulation requirements. This diversity creates opportunities for both commodity and specialty product strategies.

Competitive Dynamics will intensify as both global and regional players expand their presence in attractive MEA markets. Success factors include technical expertise, supply chain reliability, and customer service capabilities rather than just product availability and pricing.

Regulatory Environment continues evolving toward stricter environmental and safety standards, requiring ongoing investment in product development and compliance capabilities. Companies must balance performance requirements with regulatory compliance and cost considerations.

Investment Opportunities remain attractive across multiple segments and geographic markets, with particular potential in renewable energy applications, automotive manufacturing, and advanced construction techniques. Strategic positioning in high-growth segments offers significant value creation potential.

The Middle East & Africa adhesives and sealants market presents compelling growth opportunities driven by substantial infrastructure investment, industrial diversification, and increasing adoption of advanced bonding technologies across the region. Market dynamics reflect strong fundamentals with construction applications maintaining dominance while automotive, packaging, and specialty segments show accelerating growth potential.

Regional characteristics create diverse opportunities for both commodity and premium product strategies, with GCC countries leading in value and sophistication while African markets offer substantial volume growth potential. This market diversity requires tailored approaches that consider local requirements, regulatory environments, and competitive conditions.

Success factors emphasize technical expertise, supply chain reliability, and customer service capabilities over traditional competitive advantages. Companies that invest in local manufacturing, technical support, and market development capabilities position themselves for sustained growth and competitive advantage in this dynamic market environment.

Future prospects remain positive with continued infrastructure development, manufacturing expansion, and technology adoption supporting long-term market growth. The region’s strategic importance, economic development trajectory, and industrial diversification efforts create sustainable demand for adhesive and sealant solutions across multiple application segments and geographic markets.

What is Adhesives and Sealants?

Adhesives and sealants are substances used to bond materials together or to seal joints and surfaces. They are widely used in construction, automotive, and consumer goods applications.

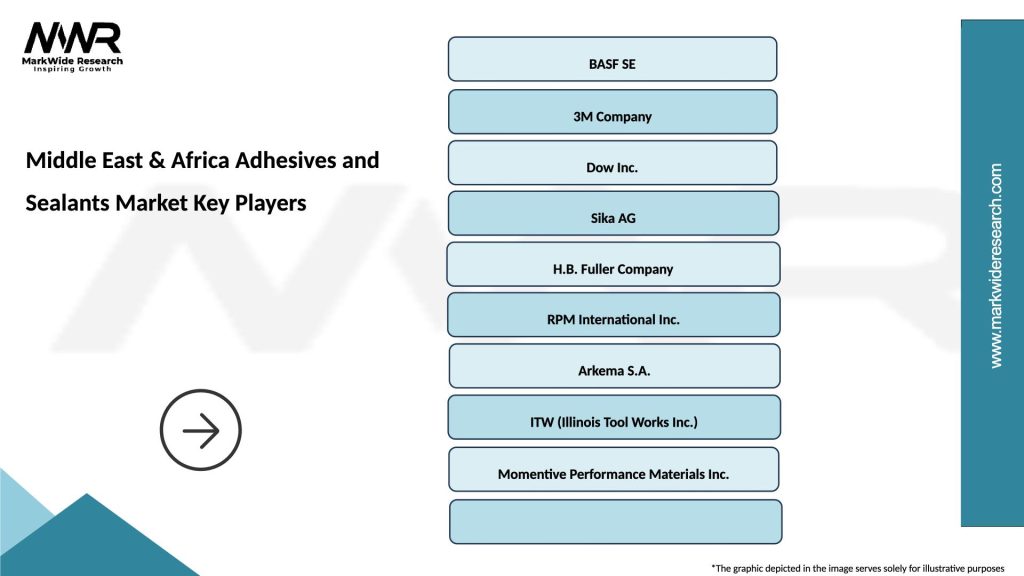

What are the key players in the Middle East & Africa Adhesives and Sealants Market?

Key players in the Middle East & Africa Adhesives and Sealants Market include Henkel AG, Sika AG, Bostik, and H.B. Fuller, among others.

What are the growth factors driving the Middle East & Africa Adhesives and Sealants Market?

The growth of the Middle East & Africa Adhesives and Sealants Market is driven by increasing construction activities, rising demand from the automotive sector, and the expansion of the packaging industry.

What challenges does the Middle East & Africa Adhesives and Sealants Market face?

Challenges in the Middle East & Africa Adhesives and Sealants Market include fluctuating raw material prices, stringent regulations regarding chemical safety, and competition from alternative bonding technologies.

What opportunities exist in the Middle East & Africa Adhesives and Sealants Market?

Opportunities in the Middle East & Africa Adhesives and Sealants Market include the growing demand for eco-friendly adhesives, advancements in technology, and the increasing use of adhesives in the electronics industry.

What trends are shaping the Middle East & Africa Adhesives and Sealants Market?

Trends in the Middle East & Africa Adhesives and Sealants Market include the rise of sustainable products, innovations in adhesive formulations, and the increasing adoption of automation in manufacturing processes.

Middle East & Africa Adhesives and Sealants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyurethane, Silicone, Acrylic, Epoxy |

| Application | Construction, Automotive, Electronics, Packaging |

| End User | Manufacturing, Construction, Aerospace, Marine |

| Form | Liquid, Paste, Film, Granules |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Adhesives and Sealants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at