444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The microfinance market is a dynamic sector that plays a crucial role in promoting financial inclusion and empowering underserved communities worldwide. This market overview provides valuable insights into the microfinance industry, its growth potential, key players, and the factors driving its expansion.

Meaning

Microfinance refers to the provision of financial services, including loans, savings, insurance, and remittances, to low-income individuals and underserved communities who have limited access to traditional banking systems. It plays a vital role in promoting financial inclusion, reducing poverty, and fostering economic development.

Executive Summary

The microfinance market has witnessed significant growth in recent years, driven by the increasing recognition of its impact on poverty reduction and inclusive economic growth. This market overview delves into the key insights, drivers, restraints, opportunities, dynamics, and regional analysis of the microfinance market, providing industry participants and stakeholders with valuable information to navigate this evolving landscape.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

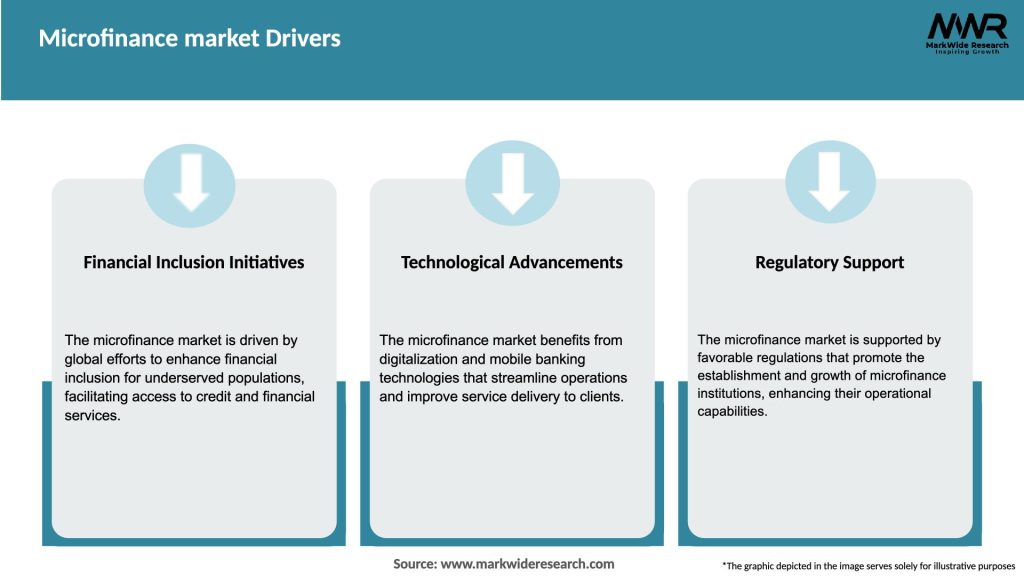

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The microfinance market operates within a dynamic environment shaped by socioeconomic factors, technological advancements, regulatory frameworks, and shifting consumer behaviors. Understanding these dynamics is crucial for stakeholders to adapt and thrive in this ever-evolving landscape.

Regional Analysis

The microfinance market exhibits regional variations, influenced by cultural, economic, and regulatory factors. The following regions showcase distinct characteristics and opportunities in the microfinance sector:

Competitive Landscape

Leading Companies in the Microfinance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

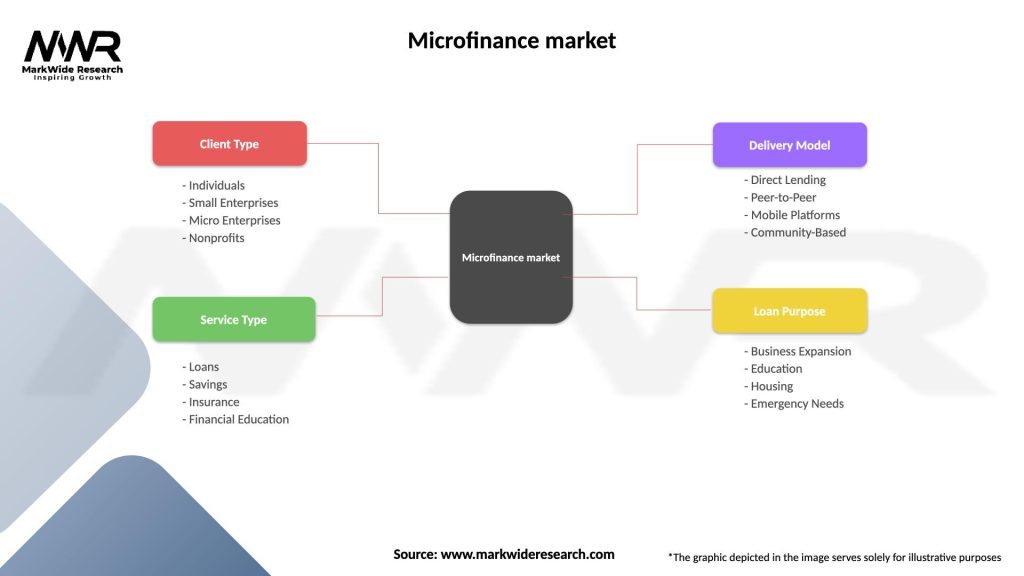

Segmentation

The microfinance market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has posed significant challenges to the microfinance sector, including increased default rates, liquidity concerns, and disruptions to field operations. However, it has also underscored the resilience and adaptability of microfinance institutions in supporting vulnerable communities during times of crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The microfinance market is poised for continued growth, driven by the increasing recognition of its potential to alleviate poverty, promote financial inclusion, and stimulate economic development. Technological advancements, supportive regulations, and collaborative efforts are expected to reshape the industry, unlocking new opportunities and delivering sustainable social impact.

Conclusion

The microfinance market holds immense promise in empowering individuals, businesses, and communities by providing them with access to financial services. Through a combination of technology, collaboration, and innovative product offerings, microfinance institutions can contribute to poverty reduction, financial inclusion, and sustainable economic growth. As the market continues to evolve, embracing opportunities, managing risks, and prioritizing the needs of the underserved will be critical for the success of industry participants and stakeholders.

What is Microfinance?

Microfinance refers to financial services that provide small loans, savings, and other financial products to individuals or small businesses that lack access to traditional banking services. It aims to empower low-income populations and promote entrepreneurship.

What are the key players in the Microfinance market?

Key players in the Microfinance market include organizations like Grameen Bank, BRAC, and Accion, which focus on providing financial services to underserved communities. These companies often operate in developing regions and aim to foster economic development among others.

What are the main drivers of growth in the Microfinance market?

The main drivers of growth in the Microfinance market include the increasing demand for financial inclusion, the rise of entrepreneurship in developing countries, and the support from governments and NGOs for microfinance initiatives. These factors contribute to expanding access to capital for small businesses.

What challenges does the Microfinance market face?

The Microfinance market faces challenges such as high default rates, regulatory hurdles, and the risk of over-indebtedness among borrowers. These issues can hinder the sustainability and effectiveness of microfinance institutions.

What opportunities exist in the Microfinance market?

Opportunities in the Microfinance market include the potential for digital financial services, partnerships with fintech companies, and the expansion into new geographic regions. These developments can enhance service delivery and reach more clients.

What trends are shaping the Microfinance market?

Trends shaping the Microfinance market include the integration of technology in service delivery, a focus on social impact measurement, and the growing interest in sustainable finance. These trends are influencing how microfinance institutions operate and engage with clients.

Microfinance market

| Segmentation Details | Description |

|---|---|

| Client Type | Individuals, Small Enterprises, Micro Enterprises, Nonprofits |

| Service Type | Loans, Savings, Insurance, Financial Education |

| Delivery Model | Direct Lending, Peer-to-Peer, Mobile Platforms, Community-Based |

| Loan Purpose | Business Expansion, Education, Housing, Emergency Needs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Microfinance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at