444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Microencapsulation is a technique that involves the encapsulation of tiny particles or droplets within a protective coating. It finds applications in various industries such as pharmaceuticals, food and beverages, personal care, agriculture, and textiles. The microencapsulation market has witnessed significant growth in recent years due to the increasing demand for controlled release systems, improved product stability, and enhanced functionality. This article provides an in-depth analysis of the microencapsulation market, including key market insights, drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, and future outlook.

Meaning

Microencapsulation refers to the process of enclosing small particles, such as solids, liquids, or gases, within a protective shell or coating. The encapsulation material acts as a barrier, shielding the core material from external factors such as light, moisture, temperature, and chemical reactions. This technology offers numerous advantages, including controlled release properties, improved stability, reduced volatility, enhanced bioavailability, and targeted delivery. Microencapsulation finds applications across various industries, offering innovative solutions and improving product performance.

Executive Summary

The microencapsulation market has experienced substantial growth in recent years, driven by the increasing demand for functional and sustainable products across multiple industries. The market is characterized by advancements in encapsulation techniques, growing R&D activities, and the development of novel applications. Key players in the market are focusing on expanding their product portfolios, strategic collaborations, and mergers and acquisitions to gain a competitive edge. The market is projected to witness significant growth in the coming years, driven by the rising demand for extended-release formulations, personalized medicine, and eco-friendly encapsulation materials.

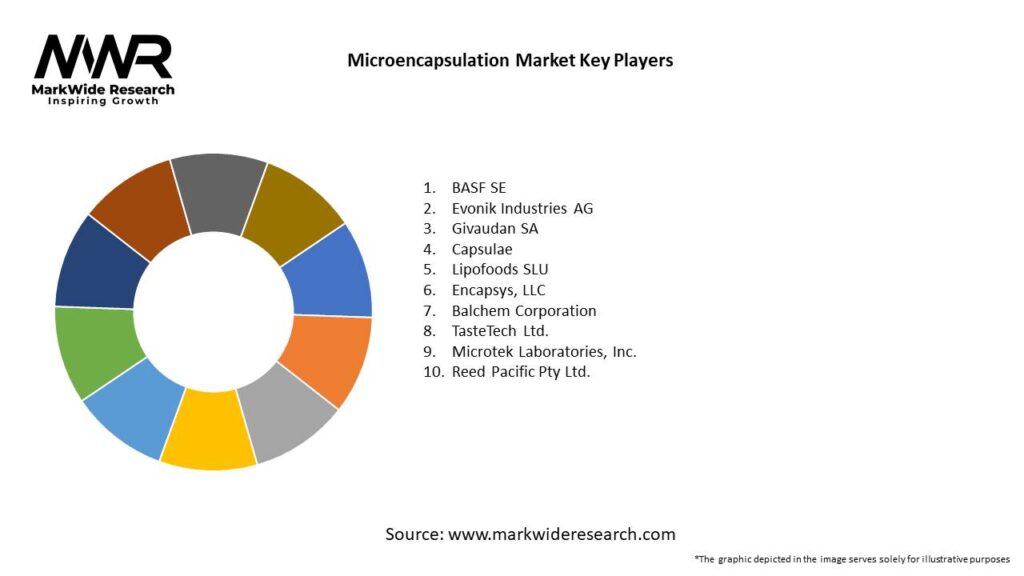

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The microencapsulation market is driven by dynamic factors such as technological advancements, changing consumer preferences, and industry collaborations. Advancements in encapsulation techniques, including spray drying, fluid bed coating, and coacervation, have led to improved efficiency and scalability. Consumer demand for functional and sustainable products is shaping the market landscape, prompting manufacturers to invest in research and development. Additionally, strategic collaborations between industry players, academia, and research institutes are fostering innovation and driving market growth.

Regional Analysis

The microencapsulation market exhibits regional variations, influenced by factors such as economic growth, industrial development, and consumer preferences. The Asia Pacific region is expected to dominate the market due to the presence of key pharmaceutical and food industries in countries like China and India. North America and Europe are significant markets for microencapsulation, driven by advanced healthcare systems, technological advancements, and high consumer awareness. Latin America, the Middle East, and Africa are witnessing increasing adoption of microencapsulation technologies, primarily driven by the food and agriculture sectors.

Competitive Landscape

Leading Companies in the Microencapsulation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

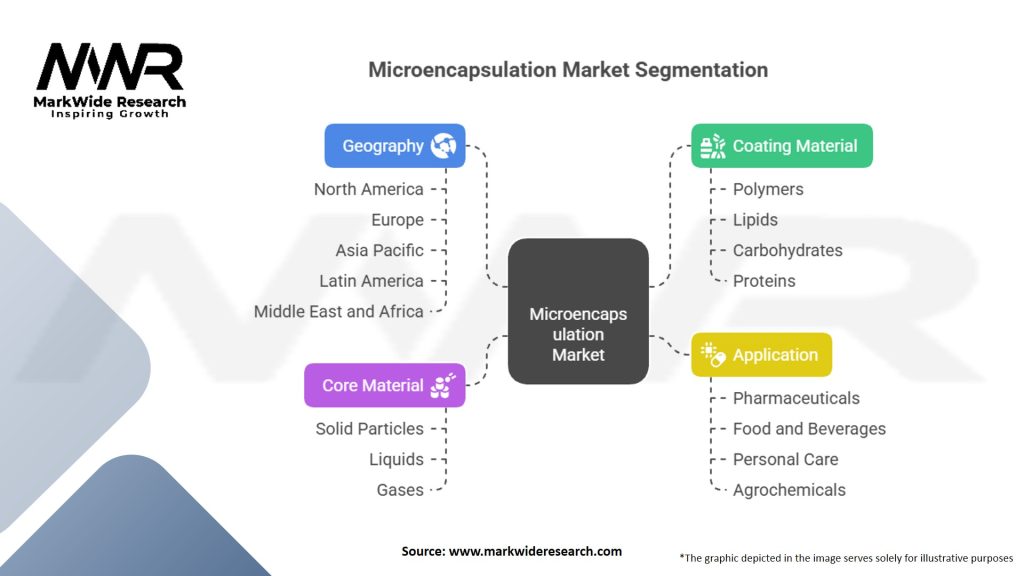

Segmentation

The microencapsulation market is highly versatile, and its applications span numerous industries. It can be segmented based on technology, type of core material, application, and region.

By Technology:

By Core Material:

By Application:

By Region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the microencapsulation market. On one hand, the demand for certain pharmaceutical products, such as vaccines and antiviral drugs, has surged, driving the need for advanced encapsulation techniques. On the other hand, disruptions in supply chains, manufacturing activities, and reduced consumer spending have affected the market. However, the market is expected to recover and grow in the post-pandemic period, driven by the need for controlled release systems, personalized medicine, and functional products.

Key Industry Developments

The microencapsulation market is highly competitive, with several global and regional players offering a wide range of microencapsulation solutions. Key players include:

Analyst Suggestions

Future Outlook

The microencapsulation market is poised for significant growth in the coming years, driven by technological advancements, increasing consumer demand for functional products, and the expansion of end-use industries. The development of sustainable encapsulation materials and the integration of microencapsulation with nanotechnology are expected to open up new avenues for market growth. The market players who adapt to changing trends, invest in R&D, and forge strategic collaborations are likely to thrive in the highly competitive microencapsulation market.

Conclusion

The microencapsulation market is witnessing steady growth, driven by the demand for controlled release systems, improved product stability, and enhanced functionality across various industries. Advancements in encapsulation techniques, increasing consumer preferences for functional products, and expanding end-use applications are shaping the market landscape. Despite challenges such as high production costs and regulatory complexities, the market presents numerous opportunities for industry participants and stakeholders. The future outlook for the microencapsulation market is promising, with sustained growth expected in the coming years, driven by technological innovations, strategic collaborations, and evolving consumer needs.

What is Microencapsulation?

Microencapsulation is a process that involves enclosing active substances within a coating to create small capsules. This technique is widely used in pharmaceuticals, food technology, and cosmetics to enhance the stability and controlled release of ingredients.

What are the key players in the Microencapsulation Market?

Key players in the Microencapsulation Market include BASF SE, Evonik Industries AG, and Givaudan SA, among others. These companies are known for their innovative solutions and extensive product portfolios in various applications such as food, pharmaceuticals, and personal care.

What are the growth factors driving the Microencapsulation Market?

The Microencapsulation Market is driven by the increasing demand for controlled release formulations in pharmaceuticals and the growing need for enhanced flavor and aroma retention in the food industry. Additionally, advancements in technology are enabling more efficient microencapsulation processes.

What challenges does the Microencapsulation Market face?

Challenges in the Microencapsulation Market include the high cost of production and the complexity of the encapsulation process. Furthermore, ensuring the stability and effectiveness of the encapsulated materials can be difficult, particularly in varying environmental conditions.

What opportunities exist in the Microencapsulation Market?

The Microencapsulation Market presents opportunities in the development of new applications, particularly in the nutraceutical and agricultural sectors. Innovations in biodegradable materials for encapsulation are also paving the way for sustainable solutions.

What trends are shaping the Microencapsulation Market?

Current trends in the Microencapsulation Market include the increasing use of nanotechnology to enhance encapsulation efficiency and the rise of personalized medicine. Additionally, there is a growing focus on sustainable practices and the use of natural materials in microencapsulation.

Microencapsulation Market

| Segmentation Details | Description |

|---|---|

| Coating Material | Polymers, lipids, carbohydrates, proteins, others |

| Core Material | Solid particles, liquids, gases, others |

| Application | Pharmaceuticals, food and beverages, personal care, agrochemicals, others |

| Geography | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Microencapsulation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at