444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Microelectronics packaging refers to the process of enclosing microelectronic components such as integrated circuits (ICs) and semiconductors in protective casings. This packaging is essential for safeguarding delicate electronic components from external factors like moisture, heat, and physical damage. The microelectronics packaging market plays a critical role in the overall electronics industry, as it ensures the reliability and longevity of electronic devices.

Meaning

Microelectronics packaging involves the assembly and encapsulation of microelectronic components into protective casings. These casings provide electrical connections, thermal management, and protection from environmental factors. The packaging process involves various techniques such as wire bonding, flip-chip, through-silicon vias (TSVs), and wafer-level packaging. It ensures the performance, reliability, and miniaturization of electronic devices.

Executive Summary

The microelectronics packaging market has witnessed significant growth in recent years due to the rising demand for compact and high-performance electronic devices. The increasing complexity and integration of microelectronics components have driven the need for advanced packaging technologies. With the proliferation of smartphones, tablets, wearables, and IoT devices, the market for microelectronics packaging is expected to expand further.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

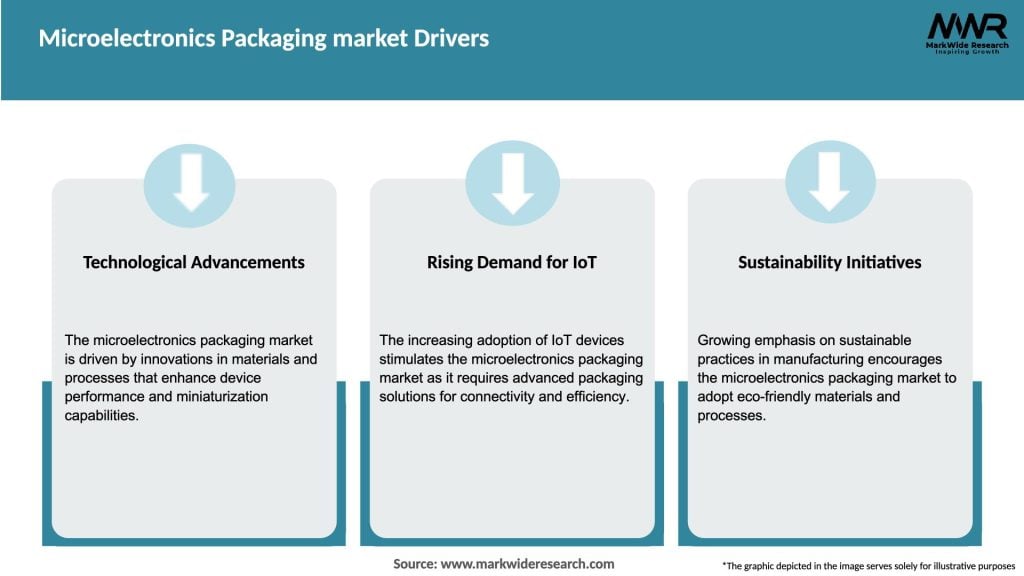

The microelectronics packaging market is driven by a combination of technological advancements, changing consumer preferences, and industry trends. The demand for smaller, faster, and more efficient electronic devices has propelled the market growth. Additionally, the emergence of new applications such as 5G networks, electric vehicles, and wearable devices has created opportunities for innovative packaging solutions. However, challenges related to cost, miniaturization, and environmental concerns need to be addressed to ensure sustainable growth in the market.

Regional Analysis

The microelectronics packaging market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these regions, Asia Pacific dominates the market, driven by the presence of major semiconductor manufacturing countries like China, South Korea, and Taiwan. North America and Europe also hold significant market shares due to the presence of leading technology companies and a strong consumer electronics market. Latin America and the Middle East and Africa are expected to witness substantial growth due to increasing investments in the electronics industry.

Competitive Landscape

leading companies in the Microelectronics Packaging Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

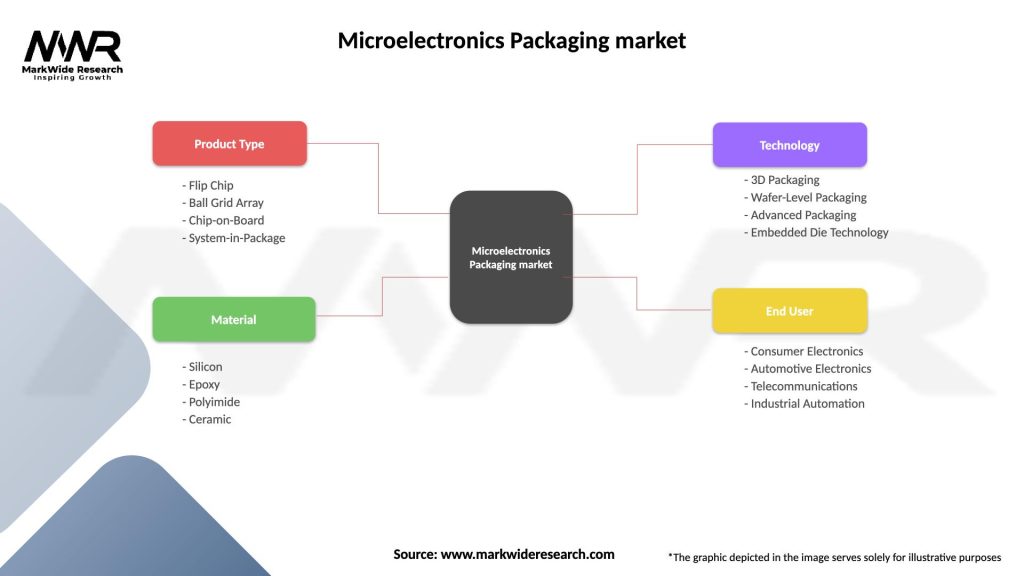

Segmentation

The microelectronics packaging market can be segmented based on packaging technology, material, end-use industry, and region. By packaging technology, the market can be divided into wire bonding, flip-chip, 3D packaging, wafer-level packaging, and others. Material-wise segmentation includes organic substrates, ceramics, metals, and others. Based on end-use industry, the market can be categorized into consumer electronics, automotive, healthcare, aerospace and defense, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the microelectronics packaging market. While the initial phase of the pandemic resulted in disruptions in the global supply chain and manufacturing operations, the demand for electronic devices increased as people shifted to remote work and online activities. The market witnessed a surge in demand for laptops, tablets, and communication devices during the lockdown period. However, the pandemic also highlighted vulnerabilities in the global supply chain, leading to increased focus on localization and supply chain resilience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The microelectronics packaging market is expected to witness significant growth in the coming years. The increasing demand for compact and high-performance electronic devices, coupled with technological advancements, will drive market expansion. Advanced packaging technologies such as 3D packaging and SiP will gain prominence, enabling higher integration and miniaturization. The automotive sector, 5G networks, and the healthcare industry will provide lucrative opportunities for microelectronics packaging. However, challenges related to cost, miniaturization, and environmental sustainability need to be addressed for sustainable growth in the market.

Conclusion

The microelectronics packaging market plays a crucial role in ensuring the reliability and longevity of electronic devices. It involves the assembly and encapsulation of microelectronic components in protective casings, providing electrical connections, thermal management, and environmental protection. The market is driven by the increasing demand for compact and high-performance electronic devices, rapid technological advancements, and the emergence of new applications. While the market offers significant opportunities, challenges related to cost, miniaturization, and environmental sustainability need to be addressed. Continuous innovation, collaboration, and sustainable practices will be key to success in the microelectronics packaging market.

What is Microelectronics Packaging?

Microelectronics Packaging refers to the technology and processes used to enclose and protect microelectronic devices, ensuring their functionality and reliability. This includes various methods such as chip-on-board, flip chip, and system-in-package, which are essential for applications in consumer electronics, automotive, and telecommunications.

What are the key players in the Microelectronics Packaging market?

Key players in the Microelectronics Packaging market include Amkor Technology, ASE Group, and STMicroelectronics, among others. These companies are known for their innovative packaging solutions and significant contributions to the advancement of microelectronics technology.

What are the growth factors driving the Microelectronics Packaging market?

The Microelectronics Packaging market is driven by the increasing demand for compact and efficient electronic devices, advancements in packaging technologies, and the growth of the Internet of Things (IoT). Additionally, the rise in electric vehicles and wearable technology is further propelling market growth.

What challenges does the Microelectronics Packaging market face?

The Microelectronics Packaging market faces challenges such as the rising complexity of packaging designs and the need for cost-effective solutions. Additionally, environmental regulations and the demand for sustainable materials pose significant hurdles for manufacturers.

What opportunities exist in the Microelectronics Packaging market?

Opportunities in the Microelectronics Packaging market include the development of advanced packaging techniques like three-dimensional (3D) packaging and the integration of artificial intelligence in manufacturing processes. Furthermore, the growing demand for high-performance computing and mobile devices presents significant growth potential.

What trends are shaping the Microelectronics Packaging market?

Trends in the Microelectronics Packaging market include the shift towards miniaturization and increased functionality of electronic components. Additionally, the adoption of flexible packaging solutions and the integration of smart technologies are becoming more prevalent, driving innovation in the industry.

Microelectronics Packaging market

| Segmentation Details | Description |

|---|---|

| Product Type | Flip Chip, Ball Grid Array, Chip-on-Board, System-in-Package |

| Material | Silicon, Epoxy, Polyimide, Ceramic |

| Technology | 3D Packaging, Wafer-Level Packaging, Advanced Packaging, Embedded Die Technology |

| End User | Consumer Electronics, Automotive Electronics, Telecommunications, Industrial Automation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

leading companies in the Microelectronics Packaging Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at