444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico wound care management devices market represents a rapidly evolving healthcare sector driven by increasing prevalence of chronic wounds, aging population demographics, and advancing medical technologies. Healthcare providers across Mexico are increasingly adopting sophisticated wound care solutions to address the growing burden of diabetic ulcers, pressure sores, and surgical wounds. The market encompasses a comprehensive range of products including advanced wound dressings, negative pressure wound therapy systems, wound closure devices, and active wound care products.

Market dynamics indicate significant growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% driven by rising diabetes prevalence and improved healthcare infrastructure. Public and private healthcare institutions are investing heavily in modern wound care technologies, creating substantial opportunities for medical device manufacturers and healthcare technology providers.

Regional healthcare initiatives and government programs focused on chronic disease management are accelerating market expansion. The integration of telemedicine and digital health solutions into wound care protocols is transforming traditional treatment approaches, enabling more efficient patient monitoring and improved clinical outcomes across Mexico’s diverse healthcare landscape.

The Mexico wound care management devices market refers to the comprehensive ecosystem of medical devices, technologies, and solutions designed to facilitate the healing process of acute and chronic wounds within Mexico’s healthcare system. This market encompasses traditional wound dressings, advanced therapeutic devices, diagnostic tools, and innovative treatment modalities that healthcare professionals utilize to manage various types of wounds effectively.

Wound care management involves the systematic approach to treating wounds through appropriate device selection, monitoring healing progress, and preventing complications such as infections or delayed healing. The market includes products ranging from basic gauze and bandages to sophisticated negative pressure wound therapy systems and bioengineered tissue products that promote cellular regeneration and wound closure.

Healthcare stakeholders including hospitals, clinics, long-term care facilities, and home healthcare providers rely on these devices to deliver optimal patient care while managing treatment costs and improving quality of life for patients with various wound types including diabetic foot ulcers, venous leg ulcers, pressure injuries, and post-surgical wounds.

Mexico’s wound care management devices market is experiencing robust expansion driven by demographic shifts, increasing chronic disease prevalence, and healthcare infrastructure modernization. The market demonstrates strong growth momentum with diabetic wound care representing 42% of total demand, reflecting the country’s significant diabetes burden and associated complications.

Advanced wound dressings dominate market share, accounting for the largest revenue segment, while negative pressure wound therapy systems show the highest growth rates among technology categories. Healthcare digitization initiatives are creating new opportunities for smart wound monitoring devices and connected healthcare solutions that enable remote patient management and data-driven treatment decisions.

Market consolidation trends indicate increasing collaboration between international medical device manufacturers and local healthcare providers to expand market reach and improve product accessibility. The integration of artificial intelligence and machine learning technologies into wound assessment and treatment protocols represents a significant innovation driver, with AI-powered diagnostic tools showing 35% adoption growth among leading healthcare institutions.

Regulatory harmonization with international standards is facilitating market entry for innovative wound care technologies while ensuring patient safety and treatment efficacy. The market outlook remains positive with sustained investment in healthcare infrastructure and growing awareness of advanced wound care benefits among healthcare professionals and patients.

Strategic market analysis reveals several critical insights shaping Mexico’s wound care management devices landscape:

Primary market drivers propelling growth in Mexico’s wound care management devices sector include the escalating prevalence of diabetes and associated complications. Diabetic foot ulcers represent a significant clinical challenge, with healthcare systems investing in specialized wound care technologies to prevent amputations and improve patient outcomes. The aging population demographic creates sustained demand for chronic wound care solutions as elderly patients experience higher rates of pressure ulcers and delayed wound healing.

Healthcare infrastructure modernization initiatives across Mexico are facilitating adoption of advanced wound care technologies. Government investments in hospital equipment upgrades and medical technology procurement are creating opportunities for innovative wound care device manufacturers. Medical tourism growth is driving quality improvements in healthcare facilities, leading to increased adoption of premium wound care management systems.

Clinical evidence supporting advanced wound care interventions is encouraging healthcare providers to transition from traditional wound care approaches to evidence-based treatment protocols. The demonstrated cost-effectiveness of modern wound care devices in reducing healing times and preventing complications is driving institutional adoption. Insurance coverage expansion for wound care treatments is improving patient access to advanced therapeutic options, stimulating market demand across diverse patient populations.

Cost considerations represent the primary market restraint, as advanced wound care devices often require significant upfront investments that may challenge healthcare budgets, particularly in resource-constrained settings. Limited reimbursement coverage for certain advanced wound care technologies creates barriers to adoption, especially for innovative products without established clinical protocols or cost-effectiveness data.

Healthcare professional training requirements present implementation challenges, as effective utilization of sophisticated wound care devices demands specialized knowledge and ongoing education. The shortage of trained wound care specialists in certain regions limits market penetration for advanced technologies that require expert clinical oversight and management.

Regulatory complexity and lengthy approval processes for new wound care technologies can delay market entry and increase development costs for manufacturers. Infrastructure limitations in rural healthcare facilities may restrict adoption of advanced wound care systems that require reliable power supply, maintenance support, and technical expertise for optimal operation.

Cultural factors and traditional healing practices in some communities may create resistance to modern wound care approaches, requiring targeted education and awareness programs to demonstrate the benefits of evidence-based wound management protocols.

Digital health integration presents substantial opportunities for wound care device manufacturers to develop connected solutions that enable remote monitoring, data analytics, and personalized treatment protocols. Telemedicine expansion creates demand for portable wound assessment devices and mobile health applications that facilitate virtual consultations and treatment guidance.

Home healthcare growth represents a significant market opportunity as patients increasingly prefer receiving wound care in comfortable home environments. The development of user-friendly, patient-operated wound care devices and monitoring systems addresses this growing demand while reducing healthcare system burden and costs.

Artificial intelligence applications in wound assessment and treatment planning offer innovative opportunities for device manufacturers to differentiate their products through intelligent diagnostic capabilities and predictive analytics. Biotechnology integration enables development of advanced wound care products incorporating growth factors, stem cells, and bioengineered materials that accelerate healing processes.

Public-private partnerships create opportunities for collaborative initiatives that expand access to advanced wound care technologies while sharing development costs and risks. Medical device manufacturing localization initiatives supported by government policies present opportunities for international companies to establish Mexican operations and serve regional markets more effectively.

Competitive dynamics in Mexico’s wound care management devices market reflect a complex interplay between international medical device manufacturers, local distributors, and healthcare providers seeking optimal patient outcomes at sustainable costs. Innovation cycles are accelerating as companies invest in research and development to create next-generation wound care solutions that address specific clinical needs and market requirements.

Supply chain considerations have become increasingly important, with healthcare providers prioritizing reliable product availability and consistent quality standards. The COVID-19 pandemic highlighted the importance of supply chain resilience, leading to increased focus on local sourcing and inventory management strategies that ensure continuous access to essential wound care products.

Technology convergence is creating new market dynamics as wound care devices integrate with broader healthcare information systems, enabling data sharing and coordinated care approaches. Value-based healthcare models are influencing purchasing decisions, with healthcare providers increasingly evaluating wound care devices based on clinical outcomes, cost-effectiveness, and patient satisfaction metrics rather than solely on acquisition costs.

Regulatory evolution continues to shape market dynamics as authorities adapt approval processes to accommodate innovative technologies while maintaining safety standards. The harmonization of regulatory requirements with international standards facilitates market entry for global manufacturers while ensuring product quality and efficacy for Mexican healthcare providers and patients.

Comprehensive market research methodology employed for analyzing Mexico’s wound care management devices market incorporates multiple data collection approaches to ensure accuracy and reliability of findings. Primary research activities include structured interviews with healthcare professionals, hospital administrators, medical device distributors, and key opinion leaders across Mexico’s healthcare ecosystem to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research components encompass analysis of government healthcare statistics, medical device registration data, clinical literature reviews, and industry reports to establish market baseline information and validate primary research findings. Quantitative analysis utilizes statistical modeling techniques to project market growth trends and segment performance based on historical data and identified market drivers.

Qualitative assessment methods include focus group discussions with healthcare providers and patient advocacy groups to understand user preferences, treatment protocols, and adoption barriers for various wound care technologies. Market validation processes involve cross-referencing multiple data sources and expert opinions to ensure research conclusions accurately reflect market realities and future projections.

Data triangulation techniques combine information from diverse sources to minimize bias and enhance research credibility, while ongoing market monitoring ensures findings remain current and relevant to stakeholder decision-making processes.

Mexico City metropolitan area dominates the wound care management devices market, accounting for 38% of national demand due to concentrated healthcare infrastructure, leading medical institutions, and higher patient volumes. The region demonstrates strong adoption rates for advanced wound care technologies and serves as a testing ground for innovative products before broader national rollout.

Northern border states including Nuevo León, Chihuahua, and Baja California show robust market growth driven by proximity to United States healthcare markets, cross-border medical collaboration, and established medical device distribution networks. These regions benefit from technology transfer initiatives and joint healthcare programs that facilitate access to cutting-edge wound care solutions.

Central Mexico regions encompassing Jalisco, Puebla, and Estado de México represent significant growth opportunities with expanding healthcare infrastructure and increasing investment in medical technology upgrades. Regional healthcare networks are driving standardization of wound care protocols and bulk procurement initiatives that create economies of scale for device manufacturers.

Southern and southeastern states present emerging market opportunities despite infrastructure challenges, with government healthcare expansion programs and international development initiatives supporting improved access to modern wound care technologies. Rural healthcare programs are gradually increasing penetration of basic wound care devices while creating foundation for future advanced technology adoption.

Market leadership in Mexico’s wound care management devices sector is characterized by a mix of international medical device manufacturers and specialized wound care companies competing across multiple product categories and customer segments.

Competitive strategies include product innovation, clinical evidence development, healthcare provider education programs, and strategic partnerships with local distributors to expand market reach and improve customer service capabilities.

Product-based segmentation reveals distinct market categories with varying growth trajectories and competitive dynamics:

By Product Type:

By Technology:

By End User:

Advanced wound dressings demonstrate the strongest market performance with consistent growth driven by clinical evidence supporting improved healing outcomes and reduced infection rates. Hydrocolloid dressings maintain market leadership due to versatility and cost-effectiveness, while foam dressings show rapid adoption for exuding wounds and pressure ulcer management.

Negative pressure wound therapy represents the fastest-growing technology category with 12.5% annual growth rate as healthcare providers recognize benefits for complex wound management and reduced healing times. Portable NPWT systems are gaining traction in home healthcare settings, expanding market reach beyond traditional hospital applications.

Bioactive wound care products including growth factors and tissue-engineered solutions show promising growth potential despite higher costs, as clinical evidence demonstrates superior outcomes for challenging wounds. Antimicrobial dressings experience increased demand due to growing awareness of infection prevention and antibiotic resistance concerns.

Digital wound assessment tools represent an emerging category with significant growth potential as healthcare providers seek objective measurement capabilities and documentation solutions. Smart bandages incorporating sensors and monitoring capabilities are attracting investment and development interest from technology companies and medical device manufacturers.

Healthcare providers benefit from improved patient outcomes through access to advanced wound care technologies that accelerate healing, reduce complications, and minimize treatment costs. Clinical efficiency gains result from standardized wound care protocols and evidence-based treatment approaches that optimize resource utilization and staff productivity.

Patients experience enhanced quality of life through reduced pain, faster healing times, and improved functional outcomes with modern wound care management approaches. Home-based care options provide convenience and comfort while maintaining clinical effectiveness and safety standards.

Medical device manufacturers gain access to expanding market opportunities driven by demographic trends, healthcare infrastructure development, and increasing awareness of advanced wound care benefits. Innovation partnerships with healthcare providers enable product development aligned with clinical needs and market requirements.

Healthcare systems achieve cost savings through reduced hospital readmissions, shorter length of stay, and prevention of wound-related complications that require expensive interventions. Value-based care models reward effective wound management approaches that demonstrate measurable clinical and economic benefits.

Government healthcare programs benefit from improved population health outcomes and reduced healthcare expenditures associated with chronic wound complications and preventable amputations, particularly in diabetes management initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization of wound care represents a transformative trend with healthcare providers increasingly adopting digital photography, measurement tools, and electronic documentation systems for wound assessment and monitoring. Artificial intelligence integration enables automated wound analysis, healing prediction models, and personalized treatment recommendations that improve clinical decision-making.

Personalized medicine approaches are gaining momentum in wound care with genetic testing, biomarker analysis, and patient-specific treatment protocols becoming more prevalent. Precision wound care utilizes individual patient characteristics to optimize device selection and treatment strategies for improved outcomes.

Sustainability initiatives are influencing product development with manufacturers focusing on environmentally friendly materials, recyclable packaging, and reduced waste generation throughout the product lifecycle. Circular economy principles are being applied to wound care device design and manufacturing processes.

Value-based healthcare adoption is driving focus on clinical outcomes, cost-effectiveness, and patient satisfaction metrics rather than traditional volume-based purchasing decisions. Outcome measurement tools and quality indicators are becoming standard requirements for wound care device procurement and utilization.

Collaborative care models emphasizing multidisciplinary teams and coordinated treatment approaches are creating demand for integrated wound care solutions that support communication and data sharing among healthcare providers.

Regulatory harmonization initiatives are streamlining medical device approval processes and aligning Mexican standards with international best practices, facilitating faster market entry for innovative wound care technologies. MarkWide Research analysis indicates that regulatory improvements have reduced average approval times by 25% over the past two years.

Technology partnerships between medical device manufacturers and healthcare technology companies are accelerating development of smart wound care solutions incorporating sensors, connectivity, and data analytics capabilities. Innovation hubs and research collaborations are fostering development of next-generation wound care products tailored to Mexican market needs.

Healthcare infrastructure investments including new hospital construction, equipment modernization programs, and telemedicine network expansion are creating substantial opportunities for wound care device manufacturers. Public-private partnerships are facilitating large-scale procurement initiatives and technology implementation programs.

Clinical evidence development through local research studies and real-world evidence collection is supporting adoption of advanced wound care technologies and reimbursement coverage expansion. Medical education programs and professional certification initiatives are building clinical expertise and driving evidence-based wound care practices.

Supply chain localization efforts by international manufacturers are establishing Mexican production facilities and distribution networks to improve product availability and reduce costs for healthcare providers.

Market entry strategies should prioritize partnerships with established local distributors and healthcare networks to leverage existing relationships and market knowledge. Product localization efforts should consider specific clinical needs, cost constraints, and regulatory requirements unique to the Mexican healthcare environment.

Investment priorities should focus on digital health integration capabilities, home healthcare solutions, and cost-effective products that demonstrate clear clinical and economic benefits. Training and education programs represent essential investments for successful technology adoption and market penetration.

Regulatory compliance strategies should emphasize early engagement with Mexican health authorities and alignment with international quality standards to facilitate smooth approval processes. Clinical evidence development through local studies and partnerships with Mexican healthcare institutions will support market acceptance and reimbursement coverage.

Competitive differentiation should emphasize unique value propositions such as superior clinical outcomes, cost-effectiveness, ease of use, or innovative technology features that address specific market needs. Customer service excellence and technical support capabilities are critical success factors in the Mexican healthcare market.

Long-term sustainability requires continuous innovation, adaptation to evolving healthcare needs, and commitment to building lasting relationships with healthcare providers and patients throughout Mexico’s diverse healthcare landscape.

Market projections indicate sustained growth momentum for Mexico’s wound care management devices sector, driven by demographic trends, healthcare infrastructure development, and increasing adoption of advanced wound care technologies. MWR forecasts suggest the market will maintain robust expansion with compound annual growth rates exceeding 8% through the next five-year period.

Technology evolution will continue transforming wound care delivery with artificial intelligence, robotics, and biotechnology creating new treatment possibilities and improving patient outcomes. Smart wound care ecosystems integrating devices, software, and services will become standard practice in leading healthcare institutions.

Healthcare accessibility improvements through telemedicine expansion and home healthcare growth will democratize access to advanced wound care technologies across Mexico’s diverse geographic and socioeconomic landscape. Mobile health applications and portable devices will enable wound care delivery in previously underserved communities.

Regulatory environment evolution will continue supporting innovation while maintaining safety standards, with streamlined approval processes and international harmonization facilitating faster market entry for breakthrough technologies. Reimbursement coverage expansion will improve patient access to advanced wound care treatments and drive market growth.

Industry consolidation trends may reshape competitive dynamics through mergers, acquisitions, and strategic partnerships that create larger, more comprehensive wound care solution providers capable of serving diverse market needs effectively.

Mexico’s wound care management devices market presents compelling opportunities for healthcare stakeholders, medical device manufacturers, and investors seeking exposure to a rapidly growing healthcare sector. The convergence of demographic trends, technological innovation, and healthcare infrastructure development creates a favorable environment for sustained market expansion and clinical advancement.

Strategic success in this market requires understanding of local healthcare dynamics, commitment to clinical evidence development, and investment in education and training programs that support effective technology adoption. Collaboration between international manufacturers, local partners, and healthcare providers will be essential for maximizing market potential and improving patient outcomes.

Future market leaders will be those organizations that successfully combine innovative technology solutions with practical implementation strategies, cost-effective pricing models, and comprehensive support services tailored to Mexican healthcare needs. The Mexico wound care management devices market represents not only a significant commercial opportunity but also a chance to meaningfully improve healthcare outcomes for millions of patients across the country’s diverse healthcare landscape.

What is Wound Care Management Devices?

Wound Care Management Devices refer to a range of products designed to assist in the treatment and management of wounds. These devices include dressings, bandages, and advanced therapies that promote healing and prevent infection.

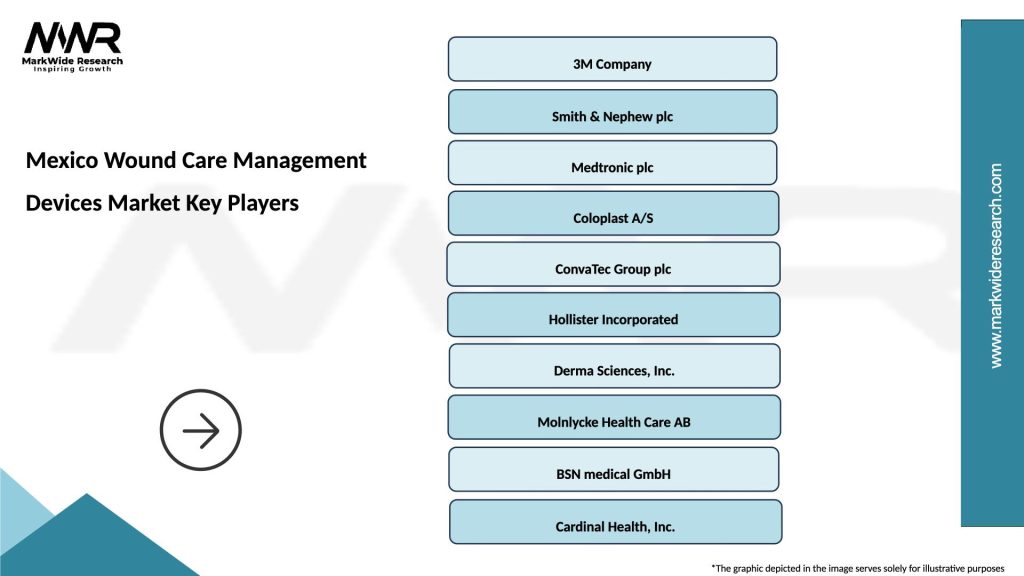

What are the key players in the Mexico Wound Care Management Devices Market?

Key players in the Mexico Wound Care Management Devices Market include companies like Smith & Nephew, Medtronic, and Mölnlycke Health Care, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the Mexico Wound Care Management Devices Market?

The Mexico Wound Care Management Devices Market is driven by factors such as the increasing prevalence of chronic wounds, a growing aging population, and advancements in wound care technologies. Additionally, rising healthcare expenditures contribute to market growth.

What challenges does the Mexico Wound Care Management Devices Market face?

Challenges in the Mexico Wound Care Management Devices Market include high costs associated with advanced wound care products and a lack of awareness among healthcare professionals. Regulatory hurdles can also impede market entry for new products.

What opportunities exist in the Mexico Wound Care Management Devices Market?

Opportunities in the Mexico Wound Care Management Devices Market include the development of innovative wound care solutions and the expansion of telemedicine services for wound management. There is also potential for growth in home healthcare settings.

What trends are shaping the Mexico Wound Care Management Devices Market?

Trends in the Mexico Wound Care Management Devices Market include the increasing adoption of advanced wound dressings and the integration of smart technologies in wound care. Additionally, there is a growing focus on personalized medicine and patient-centered care.

Mexico Wound Care Management Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dressings, Bandages, Sutures, Grafts |

| Technology | Hydrocolloid, Foam, Alginate, Antimicrobial |

| End User | Hospitals, Clinics, Home Care, Long-term Care |

| Application | Chronic Wounds, Surgical Wounds, Burns, Traumatic Injuries |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Wound Care Management Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at