444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico wires and cables market represents a dynamic and rapidly expanding sector within the country’s industrial infrastructure landscape. Market dynamics indicate robust growth driven by increasing urbanization, infrastructure development, and the expansion of renewable energy projects across the nation. The market encompasses a comprehensive range of products including power cables, control cables, communication cables, and specialty wires designed for various industrial applications.

Infrastructure modernization initiatives have positioned Mexico as a key player in the North American wires and cables industry. The market benefits from strategic geographic location, favorable trade agreements, and growing manufacturing capabilities. Industrial expansion across automotive, telecommunications, and energy sectors continues to drive substantial demand for high-quality cable solutions.

Technological advancement in cable manufacturing has enabled Mexican producers to compete effectively in both domestic and international markets. The sector demonstrates strong growth potential with projected expansion at a CAGR of 6.8% over the forecast period, supported by increasing investments in smart grid infrastructure and renewable energy installations.

The Mexico wires and cables market refers to the comprehensive ecosystem of manufacturers, distributors, and end-users involved in the production, distribution, and application of electrical conductors and cable systems within Mexican territory. This market encompasses various product categories including power transmission cables, building wires, automotive cables, and specialized industrial conductors.

Market scope includes both copper and aluminum-based conductors, fiber optic cables, and hybrid cable solutions designed for diverse applications ranging from residential construction to industrial automation. The market serves multiple end-use industries including construction, automotive manufacturing, telecommunications, oil and gas, and renewable energy sectors.

Geographic coverage spans across Mexico’s major industrial regions, with significant concentrations in manufacturing hubs such as Monterrey, Guadalajara, and Mexico City. The market structure includes both domestic manufacturers and international companies establishing production facilities to serve the growing demand for cable solutions in Mexico and broader Latin American markets.

Market performance in Mexico’s wires and cables sector demonstrates exceptional resilience and growth potential, driven by sustained infrastructure investment and industrial expansion. The market has established itself as a critical component of Mexico’s manufacturing ecosystem, supporting diverse industries from automotive production to renewable energy development.

Key growth drivers include government infrastructure initiatives, increasing foreign direct investment, and the ongoing transition toward renewable energy sources. The automotive sector represents approximately 28% of total cable demand, reflecting Mexico’s position as a major automotive manufacturing hub in North America.

Competitive landscape features a mix of established international players and emerging domestic manufacturers, creating a dynamic market environment that fosters innovation and competitive pricing. The market benefits from Mexico’s strategic trade relationships, particularly the USMCA agreement, which facilitates cross-border trade and investment in cable manufacturing capabilities.

Future prospects remain highly favorable, with anticipated growth in smart grid infrastructure, electric vehicle manufacturing, and telecommunications network expansion. The market is positioned to capitalize on Mexico’s role as a manufacturing gateway between North and South American markets.

Market segmentation reveals distinct growth patterns across various product categories and end-use applications. The following insights highlight critical market dynamics:

Market maturity varies significantly across different segments, with traditional power cables representing a mature market while specialty and smart cables offer substantial growth opportunities. The integration of digital technologies in cable manufacturing and monitoring systems presents new avenues for market expansion.

Infrastructure development serves as the primary catalyst for Mexico’s wires and cables market expansion. Government initiatives focused on modernizing electrical grid infrastructure, expanding transportation networks, and developing smart city projects create substantial demand for various cable solutions.

Manufacturing sector growth significantly impacts cable demand, particularly in automotive, electronics, and appliance manufacturing. Mexico’s position as a preferred manufacturing destination for North American companies drives consistent demand for industrial cables and specialized conductors. The automotive sector alone contributes to 35% of industrial cable consumption.

Renewable energy expansion represents a major growth driver, with solar and wind power projects requiring extensive cable infrastructure for power transmission and grid connection. Government renewable energy targets and international climate commitments support continued investment in clean energy infrastructure.

Telecommunications infrastructure modernization, including 5G network deployment and fiber optic expansion, creates growing demand for communication cables and related infrastructure components. Digital transformation initiatives across industries further amplify this demand.

Urbanization trends drive residential and commercial construction activity, resulting in increased demand for building wires and electrical installation cables. Mexico’s growing urban population requires expanded electrical infrastructure to support modern living standards.

Raw material price volatility poses significant challenges for cable manufacturers, particularly fluctuations in copper and aluminum prices that directly impact production costs and profit margins. These price variations can affect market competitiveness and investment decisions.

Regulatory compliance requirements create barriers for market entry and increase operational costs for manufacturers. Stringent safety standards, environmental regulations, and quality certifications require substantial investments in testing and compliance infrastructure.

Competition from imports presents ongoing challenges for domestic manufacturers, particularly from low-cost producers in Asia. Import competition can pressure pricing and market share for local cable manufacturers, affecting industry profitability.

Economic uncertainty and currency fluctuations impact investment decisions and project timelines, potentially delaying infrastructure projects that drive cable demand. Economic volatility can affect both domestic demand and export opportunities.

Technical skill shortages in specialized cable manufacturing and installation limit industry growth potential. The sector requires skilled technicians and engineers familiar with advanced cable technologies and installation techniques.

Electric vehicle infrastructure development presents substantial opportunities for cable manufacturers, as EV charging networks require specialized high-voltage cables and charging infrastructure components. Mexico’s growing automotive manufacturing sector positions the country well to capitalize on EV-related cable demand.

Smart grid implementation offers significant growth potential for advanced cable solutions incorporating monitoring and communication capabilities. Government initiatives to modernize electrical infrastructure create opportunities for technology-enhanced cable products.

Export market expansion leverages Mexico’s strategic location and trade agreements to serve broader Latin American markets. Mexican cable manufacturers can capitalize on regional infrastructure development and industrial growth opportunities.

Renewable energy projects continue to offer substantial opportunities, particularly in solar and wind power installations requiring specialized cables for harsh environmental conditions. Government renewable energy targets support sustained demand growth.

Industrial automation trends create demand for specialized cables supporting Industry 4.0 implementations, including data cables, sensor cables, and flexible automation cables for robotic applications.

Supply chain integration plays a crucial role in market dynamics, with successful companies developing vertically integrated operations from raw material processing to finished cable production. This integration helps manage cost pressures and ensure quality control throughout the manufacturing process.

Technology evolution drives continuous product development, with manufacturers investing in advanced materials, improved insulation systems, and smart cable technologies. Innovation in cable design and manufacturing processes creates competitive advantages and opens new market segments.

Customer relationships significantly influence market dynamics, as cable suppliers develop long-term partnerships with major industrial customers, construction companies, and infrastructure developers. These relationships provide market stability and growth opportunities.

Regulatory environment shapes market development through safety standards, environmental requirements, and trade policies. Compliance with international standards enables Mexican manufacturers to compete in global markets while meeting domestic quality expectations.

Market consolidation trends affect competitive dynamics, with larger companies acquiring smaller manufacturers to expand capabilities and market reach. This consolidation can improve efficiency but may reduce competition in certain market segments.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including cable manufacturers, distributors, end-users, and industry associations. Direct engagement with market participants provides insights into current trends, challenges, and growth opportunities across different market segments.

Secondary research involves extensive analysis of industry reports, government publications, trade statistics, and company financial statements. This approach ensures comprehensive market coverage and validates primary research findings through multiple data sources.

Data collection processes include structured surveys, expert interviews, and market observation studies conducted across Mexico’s major industrial regions. The methodology ensures representative sampling across different market segments and geographic areas.

Market sizing techniques employ bottom-up and top-down approaches, analyzing production capacity, consumption patterns, and trade flows to develop accurate market assessments. Cross-validation through multiple methodologies ensures data reliability and accuracy.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified growth drivers and market dynamics. This comprehensive approach provides reliable market forecasts and strategic insights.

Northern Mexico dominates the wires and cables market, accounting for approximately 42% of national consumption. This region benefits from high manufacturing density, particularly in automotive and electronics industries, creating substantial demand for industrial cables and specialized conductors.

Central Mexico represents the second-largest market region, driven by Mexico City’s urban infrastructure needs and surrounding industrial activities. The region shows strong demand for building wires, power cables, and telecommunications infrastructure, supported by ongoing urbanization and commercial development.

Western Mexico demonstrates growing market importance, particularly in Guadalajara’s technology corridor and surrounding manufacturing areas. The region shows increasing demand for communication cables and industrial automation solutions, reflecting its role as a technology and manufacturing hub.

Gulf Coast region presents significant opportunities in oil and gas infrastructure, petrochemical facilities, and port operations. Specialized cables for harsh environments and marine applications drive demand in this region, supported by ongoing energy sector investments.

Southern Mexico shows emerging market potential, particularly in renewable energy projects and infrastructure development. Government initiatives to develop southern regions create opportunities for power transmission cables and rural electrification projects.

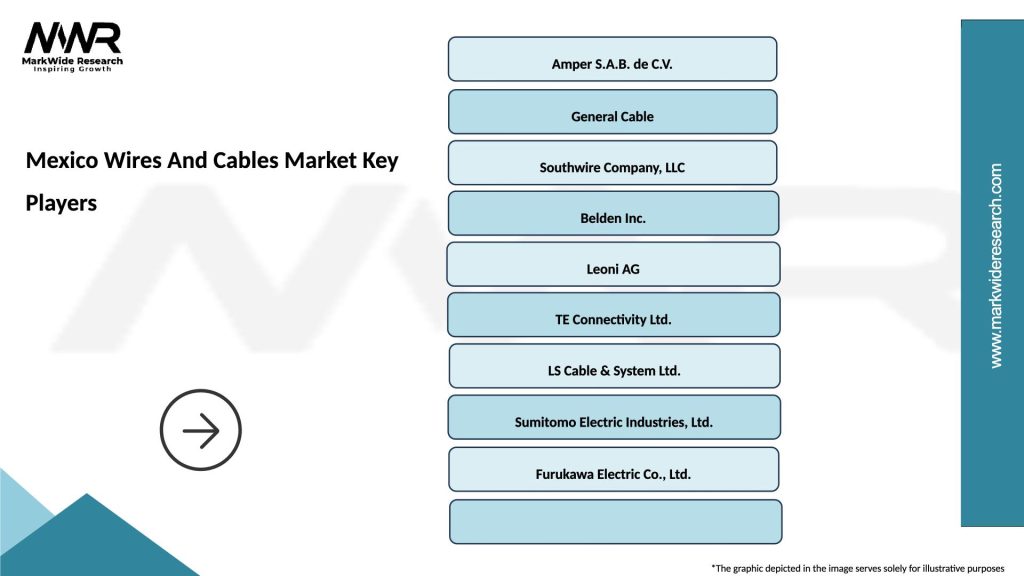

Market leadership is distributed among several key players, each with distinct strengths and market positions. The competitive environment fosters innovation and customer service excellence:

Competitive strategies focus on product innovation, manufacturing efficiency, and customer service excellence. Companies invest in research and development to create advanced cable solutions while maintaining competitive pricing through operational optimization.

Market positioning varies among competitors, with some focusing on premium technology solutions while others compete on cost-effectiveness and broad product availability. This diversity creates a dynamic competitive environment serving various customer segments.

By Product Type:

By Application:

By Voltage Level:

Power cables represent the largest market category, driven by ongoing grid modernization and infrastructure development projects. This segment shows steady growth with increasing demand for higher voltage applications and improved cable technologies. Smart grid initiatives create opportunities for cables with integrated monitoring capabilities.

Automotive cables demonstrate the highest growth rate, reflecting Mexico’s position as a major automotive manufacturing hub. Electric vehicle production drives demand for high-voltage cables and specialized charging infrastructure components. The segment benefits from automotive sector growth of 8.2% annually.

Communication cables show strong growth potential with 5G network deployment and fiber optic infrastructure expansion. Data center development and telecommunications modernization create sustained demand for high-performance communication cables and related infrastructure components.

Building wires maintain steady demand correlation with construction activity, showing resilience during economic fluctuations. Green building initiatives and smart home technologies create opportunities for advanced building wire solutions with improved energy efficiency and monitoring capabilities.

Specialty cables serve niche applications with higher margins and technical requirements. Mining, marine, and harsh environment applications drive demand for specialized cable solutions designed for extreme conditions and demanding performance requirements.

Manufacturers benefit from Mexico’s strategic location providing access to both North and South American markets through favorable trade agreements. The country offers competitive manufacturing costs, skilled workforce availability, and established supply chain infrastructure supporting efficient cable production operations.

End-users gain access to diverse cable solutions from both domestic and international suppliers, ensuring competitive pricing and product availability. Local manufacturing presence provides responsive customer service, technical support, and reduced delivery times for critical applications.

Investors find attractive opportunities in Mexico’s growing cable market, supported by infrastructure development, industrial expansion, and favorable economic conditions. The market offers potential for both greenfield investments and acquisition opportunities in a growing industry sector.

Government stakeholders benefit from increased industrial capacity, job creation, and technology transfer associated with cable manufacturing investments. The sector contributes to economic development goals while supporting critical infrastructure modernization initiatives.

Distributors capitalize on growing market demand and expanding product portfolios, developing specialized expertise in different cable categories and applications. Strong manufacturer relationships and technical capabilities create competitive advantages in serving diverse customer segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization integration transforms cable manufacturing and monitoring, with smart cables incorporating sensors and communication capabilities for real-time performance monitoring. This trend enables predictive maintenance and improved system reliability across various applications.

Sustainability focus drives development of eco-friendly cable materials, recycling programs, and energy-efficient manufacturing processes. Companies invest in sustainable practices to meet environmental regulations and customer sustainability requirements.

Automation advancement in manufacturing improves production efficiency, quality control, and cost competitiveness. Advanced manufacturing technologies enable Mexican producers to compete effectively with international suppliers while maintaining quality standards.

Customization demand increases as customers seek specialized cable solutions for specific applications and operating conditions. Manufacturers develop flexible production capabilities to serve niche markets and specialized requirements.

Supply chain localization trends encourage development of domestic supply chains to reduce dependence on imports and improve supply security. This creates opportunities for local suppliers and component manufacturers.

Technology convergence combines power and communication capabilities in hybrid cable solutions, supporting smart infrastructure and industrial automation applications. According to MarkWide Research analysis, hybrid cable demand shows growth potential of 12.5% annually.

Manufacturing expansion projects by major cable companies demonstrate confidence in Mexico’s market potential. Recent investments in production capacity and technology upgrades position the country as a regional manufacturing hub for cable solutions.

Technology partnerships between Mexican manufacturers and international technology providers accelerate innovation and capability development. These collaborations bring advanced cable technologies and manufacturing processes to the Mexican market.

Infrastructure investments by government and private sector create substantial cable demand across power transmission, telecommunications, and transportation sectors. Major projects include grid modernization, highway development, and urban infrastructure expansion.

Regulatory updates establish new safety standards and quality requirements for cable products, driving industry modernization and technology adoption. These changes create opportunities for companies with advanced capabilities while challenging traditional suppliers.

Sustainability initiatives by major manufacturers include development of recyclable cable materials, energy-efficient production processes, and circular economy programs. These efforts address environmental concerns while creating competitive advantages.

Market consolidation activities include acquisitions and strategic partnerships that reshape competitive dynamics and create larger, more capable industry players. This consolidation can improve efficiency and innovation capabilities across the sector.

Investment focus should prioritize advanced manufacturing technologies and automation capabilities to maintain competitiveness with international suppliers. Companies should invest in flexible production systems capable of serving diverse market segments and specialized applications.

Market positioning strategies should emphasize technical expertise, customer service excellence, and rapid response capabilities that leverage Mexico’s geographic advantages. Local presence and understanding of customer requirements create competitive advantages over distant suppliers.

Product development efforts should focus on high-growth segments including automotive cables, renewable energy applications, and smart infrastructure solutions. Innovation in these areas can command premium pricing and establish market leadership positions.

Partnership development with international technology providers can accelerate capability building and market access. Strategic alliances enable Mexican companies to access advanced technologies while providing international partners with local market expertise.

Supply chain optimization should balance cost efficiency with supply security, developing both local and international supplier relationships. Diversified supply chains reduce risk while maintaining competitive cost structures.

Sustainability integration becomes increasingly important for market competitiveness and regulatory compliance. Companies should develop comprehensive sustainability strategies covering materials, manufacturing processes, and product lifecycle management.

Market growth prospects remain highly favorable, supported by continued infrastructure investment, industrial expansion, and technology advancement. MWR projects sustained growth across most market segments, with particular strength in automotive and renewable energy applications.

Technology evolution will continue driving product innovation and manufacturing advancement, creating opportunities for companies that invest in research and development capabilities. Smart cable technologies and advanced materials represent key growth areas for future market development.

Regional expansion opportunities exist as Mexican manufacturers develop capabilities to serve broader Latin American markets. Trade relationships and geographic proximity provide advantages for expanding beyond domestic market boundaries.

Industry consolidation trends are expected to continue, creating larger, more capable companies with enhanced technology and market reach. This consolidation can improve industry efficiency while maintaining competitive dynamics across different market segments.

Sustainability requirements will increasingly influence market development, driving innovation in eco-friendly materials and manufacturing processes. Companies that proactively address sustainability challenges will gain competitive advantages in future market conditions.

Digital transformation will reshape both products and business models, with smart cables and digital services creating new revenue opportunities. The integration of IoT technologies and data analytics will enhance cable performance monitoring and maintenance capabilities, with market penetration expected to reach 25% by 2030.

Mexico’s wires and cables market presents exceptional opportunities for growth and development, supported by robust infrastructure investment, industrial expansion, and favorable economic conditions. The market demonstrates strong fundamentals with diverse end-use applications and growing demand across multiple sectors.

Strategic advantages including geographic location, trade relationships, and manufacturing capabilities position Mexico as a key player in the North American cable industry. The combination of domestic market growth and export opportunities creates attractive prospects for both existing players and new market entrants.

Future success in this market will depend on companies’ ability to adapt to changing technology requirements, maintain competitive cost structures, and develop specialized capabilities for high-growth segments. Investment in innovation, sustainability, and customer service excellence will differentiate successful market participants.

Market evolution toward smart technologies, sustainable practices, and specialized applications creates opportunities for companies that proactively address these trends. The Mexico wires and cables market is well-positioned to capitalize on regional growth opportunities while serving as a manufacturing hub for broader international markets.

What is Wires And Cables?

Wires and cables are essential components used for electrical transmission and distribution. They are utilized in various applications, including residential, commercial, and industrial sectors for power supply and communication.

What are the key players in the Mexico Wires And Cables Market?

Key players in the Mexico Wires And Cables Market include Nexans, Prysmian Group, and General Cable, among others. These companies are known for their extensive product offerings and innovation in cable technology.

What are the growth factors driving the Mexico Wires And Cables Market?

The Mexico Wires And Cables Market is driven by increasing infrastructure development, rising demand for renewable energy sources, and the expansion of telecommunication networks. These factors contribute to the growing need for efficient wiring solutions.

What challenges does the Mexico Wires And Cables Market face?

Challenges in the Mexico Wires And Cables Market include fluctuating raw material prices and stringent regulatory standards. These factors can impact production costs and market accessibility for manufacturers.

What opportunities exist in the Mexico Wires And Cables Market?

Opportunities in the Mexico Wires And Cables Market include advancements in smart grid technology and the increasing adoption of electric vehicles. These trends are expected to create new demand for specialized wiring solutions.

What trends are shaping the Mexico Wires And Cables Market?

Trends in the Mexico Wires And Cables Market include the shift towards environmentally friendly materials and the integration of IoT in cable systems. These innovations aim to enhance performance and sustainability in electrical applications.

Mexico Wires And Cables Market

| Segmentation Details | Description |

|---|---|

| Product Type | Low Voltage, Medium Voltage, High Voltage, Specialty Cables |

| Material | Copper, Aluminum, Fiber Optic, PVC |

| End User | Construction, Telecommunications, Automotive, Industrial |

| Installation | Indoor, Outdoor, Underground, Aerial |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Wires And Cables Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at