444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico wind energy system market represents one of Latin America’s most dynamic renewable energy sectors, experiencing unprecedented growth driven by favorable government policies, abundant wind resources, and increasing private sector investment. Mexico’s strategic location provides exceptional wind corridors, particularly in the Isthmus of Tehuantepec, making it an ideal destination for large-scale wind energy development. The market encompasses wind turbines, supporting infrastructure, maintenance services, and grid integration technologies that collectively form a comprehensive ecosystem for wind power generation.

Market dynamics indicate robust expansion across multiple regions, with the country achieving approximately 12.8% growth rate in wind energy capacity additions over recent years. Government initiatives including renewable energy auctions and clean energy certificates have created a favorable investment climate, attracting both domestic and international developers. The market benefits from Mexico’s commitment to generating 35% of electricity from clean energy sources, positioning wind energy as a cornerstone of the nation’s energy transition strategy.

Regional distribution shows concentrated development in key wind corridors, with Oaxaca leading installations followed by Tamaulipas, Nuevo León, and other strategic locations. Industrial demand from manufacturing sectors, particularly automotive and steel industries, drives significant corporate procurement of wind energy through power purchase agreements. The market’s maturation reflects Mexico’s evolution from an emerging wind market to a established regional leader in renewable energy deployment.

The Mexico wind energy system market refers to the comprehensive ecosystem of technologies, services, and infrastructure dedicated to harnessing wind resources for electricity generation within Mexican territory. This market encompasses wind turbine manufacturing, project development, installation services, grid integration systems, and ongoing maintenance operations that collectively enable the conversion of wind kinetic energy into electrical power for commercial, industrial, and residential consumption.

Wind energy systems in Mexico include onshore wind farms utilizing modern turbine technologies, supporting electrical infrastructure, transmission systems, and energy storage solutions. The market covers the entire value chain from initial site assessment and environmental studies through construction, commissioning, and long-term operation of wind power facilities. System components include wind turbines, towers, foundations, electrical systems, substations, and control technologies that work together to optimize energy capture and grid integration.

Market scope extends beyond hardware to include specialized services such as wind resource assessment, project financing, regulatory compliance, environmental impact management, and community engagement programs. The definition encompasses both utility-scale wind farms and distributed wind systems, reflecting Mexico’s diverse approach to wind energy deployment across different market segments and geographic regions.

Mexico’s wind energy sector has emerged as a cornerstone of the country’s renewable energy transformation, driven by exceptional wind resources, supportive regulatory frameworks, and growing demand from industrial consumers. The market demonstrates strong fundamentals with consistent capacity additions, technological advancement, and increasing cost competitiveness against conventional energy sources. Strategic advantages include world-class wind resources, proximity to major consumption centers, and established transmission infrastructure that facilitates efficient energy delivery.

Key market drivers include Mexico’s clean energy mandates, corporate sustainability commitments, and the economic attractiveness of wind power compared to fossil fuel alternatives. The sector benefits from approximately 78% capacity factor in prime wind locations, making Mexican wind projects among the most productive globally. Investment flows continue to strengthen the market, with international developers, equipment manufacturers, and financial institutions maintaining strong confidence in Mexico’s wind energy potential.

Market challenges include transmission constraints in certain regions, regulatory uncertainties, and the need for continued grid modernization to accommodate increasing renewable energy penetration. Despite these considerations, the market outlook remains positive with sustained growth expected across multiple segments. Technological evolution toward larger, more efficient turbines and improved grid integration capabilities positions Mexico’s wind energy sector for continued expansion and enhanced contribution to national energy security.

Strategic market positioning reveals Mexico’s emergence as Latin America’s second-largest wind energy market, benefiting from exceptional natural resources and progressive energy policies. The market demonstrates several critical insights that define its current trajectory and future potential:

Government policy initiatives serve as primary market drivers, with Mexico’s energy reform creating competitive markets and renewable energy mandates that require utilities to source increasing percentages of electricity from clean sources. Clean Energy Certificate requirements compel load-serving entities to demonstrate compliance through renewable energy procurement, creating sustained demand for wind power projects. The regulatory framework provides long-term market visibility that encourages investment and development activities.

Corporate sustainability commitments drive significant market demand as multinational corporations operating in Mexico seek to reduce carbon footprints and meet global environmental targets. Industrial consumers including automotive manufacturers, steel producers, and technology companies actively procure wind energy through direct power purchase agreements. This corporate demand provides stable, long-term revenue streams that support project financing and development.

Economic competitiveness positions wind energy as an attractive alternative to conventional power sources, with declining technology costs and improving efficiency making wind power increasingly cost-effective. Financing availability from international development banks, commercial lenders, and institutional investors supports project development across multiple scales. The combination of favorable economics and accessible financing creates positive market conditions for continued expansion.

Energy security considerations motivate diversification away from fossil fuel dependence, with wind energy contributing to national energy independence and price stability. Environmental awareness and climate change commitments drive policy support and public acceptance of renewable energy development. These fundamental drivers create a supportive environment for sustained market growth and technological advancement.

Transmission infrastructure limitations present significant constraints in high-potential wind regions, where existing grid capacity may be insufficient to accommodate large-scale wind development. Grid connection delays and transmission bottlenecks can impact project timelines and economic viability, particularly in remote areas with exceptional wind resources but limited electrical infrastructure. These infrastructure challenges require coordinated planning and substantial investment to resolve.

Regulatory uncertainties periodically impact market confidence, with changes in energy policy, permitting processes, or support mechanisms creating development risks for project investors and developers. Permitting complexities involving multiple government agencies and lengthy approval processes can delay project implementation and increase development costs. Regulatory consistency and streamlined processes remain important for sustained market growth.

Social and environmental considerations require careful management, including community engagement, environmental impact mitigation, and land use coordination with local stakeholders. Grid stability concerns related to renewable energy integration necessitate investments in grid modernization and energy storage technologies. These technical challenges require ongoing attention and investment to maintain system reliability.

Competition for land and resources in prime wind corridors can increase development costs and complexity, particularly as the market matures and optimal sites become scarce. Currency fluctuations and economic volatility can impact project economics, especially for projects with significant imported equipment components. These market restraints require strategic management and risk mitigation approaches.

Untapped wind resources across Mexico’s extensive coastlines and highland regions present substantial expansion opportunities beyond currently developed corridors. Offshore wind potential along Mexico’s Pacific and Gulf coasts offers long-term development possibilities as technology costs decline and regulatory frameworks evolve. These emerging opportunities could significantly expand the addressable market for wind energy development.

Grid modernization initiatives create opportunities for enhanced wind energy integration through smart grid technologies, energy storage systems, and improved transmission infrastructure. Distributed wind systems for commercial and industrial applications represent an underexplored market segment with significant potential for growth. These technological opportunities enable new market segments and improved system performance.

Export opportunities to neighboring countries through regional energy integration could expand market demand beyond domestic consumption. Green hydrogen production using wind energy presents emerging opportunities as hydrogen markets develop globally. Energy storage integration with wind projects offers enhanced grid services and improved project economics through optimized energy delivery.

Manufacturing localization opportunities exist for wind turbine components, towers, and supporting equipment as the market scales and supply chain optimization becomes economically attractive. Service sector development including specialized maintenance, training, and consulting services creates additional market opportunities. These value chain opportunities support local economic development and market sustainability.

Supply and demand dynamics in Mexico’s wind energy market reflect the interaction between abundant natural resources, growing electricity demand, and evolving energy policies. Demand drivers include industrial growth, urbanization, and renewable energy mandates that create sustained market pull for wind power projects. Supply factors encompass wind resource availability, technology advancement, and manufacturing capacity that determine market development potential.

Competitive dynamics involve international and domestic developers competing for prime wind sites, grid connections, and power purchase agreements. Technology competition drives continuous improvement in turbine efficiency, reliability, and cost-effectiveness as manufacturers seek market share in Mexico’s growing wind sector. This competition benefits the overall market through improved technology offerings and competitive pricing.

Investment dynamics reflect the interaction between project returns, financing costs, and risk perceptions that influence capital allocation decisions. Policy dynamics create market cycles based on regulatory changes, auction schedules, and support mechanism adjustments. According to MarkWide Research analysis, these dynamic interactions create both opportunities and challenges that shape market development patterns.

Regional dynamics vary across Mexico’s different wind corridors, with each region presenting unique resource characteristics, infrastructure conditions, and development challenges. Seasonal dynamics influence wind energy production patterns and grid integration requirements, necessitating flexible system operations and complementary energy sources. These multifaceted dynamics require sophisticated market understanding and adaptive strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Mexico’s wind energy system market. Primary research includes structured interviews with industry executives, project developers, government officials, and technology providers to gather firsthand market intelligence and validate market trends. This direct engagement provides qualitative insights that complement quantitative data analysis.

Secondary research encompasses analysis of government databases, industry reports, regulatory filings, and public company disclosures to establish market baselines and identify development patterns. Data triangulation methods cross-reference multiple sources to ensure accuracy and reliability of market insights. Statistical analysis techniques identify correlations and trends that inform market projections and strategic recommendations.

Field research includes site visits to operational wind farms, interviews with local communities, and assessment of infrastructure conditions to understand practical market realities. Expert consultation with technical specialists, financial analysts, and policy experts provides specialized knowledge that enhances research depth and accuracy. This multi-faceted approach ensures comprehensive market coverage and reliable insights.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, and scenario modeling to evaluate different market development pathways. Validation processes involve peer review, stakeholder feedback, and cross-verification of key findings to maintain research quality standards. These rigorous methodologies support evidence-based conclusions and actionable market intelligence.

Oaxaca region dominates Mexico’s wind energy landscape, accounting for approximately 55% of national installed capacity due to exceptional wind resources in the Isthmus of Tehuantepec. La Ventosa corridor within Oaxaca hosts numerous large-scale wind farms that benefit from consistent high-velocity winds and established transmission infrastructure. The region’s mature development ecosystem includes experienced local contractors, established supply chains, and proven regulatory processes that facilitate continued expansion.

Tamaulipas state represents the second-largest wind energy market, leveraging Gulf Coast wind resources and proximity to major industrial centers. Northern regions including Nuevo León and Coahuila demonstrate growing wind development activity, supported by industrial demand and improving transmission connectivity. These emerging regions offer diversification opportunities and reduced geographic concentration risks for the overall market.

Yucatan Peninsula presents significant untapped potential with excellent wind resources along coastal areas, though development has been limited by transmission constraints and environmental considerations. Baja California offers unique opportunities for wind development serving both domestic demand and potential export to California markets. Regional development patterns reflect the interaction between resource quality, infrastructure availability, and market demand.

Central Mexico regions including Puebla and Hidalgo show emerging wind development activity, particularly for distributed applications serving local industrial demand. Regional specialization is developing with different areas focusing on utility-scale projects, industrial applications, or specific technology segments. This geographic diversification strengthens market resilience and creates multiple growth centers across the country.

International developers maintain strong market positions through established project portfolios, financing capabilities, and technical expertise. The competitive landscape encompasses both large-scale utility developers and specialized renewable energy companies that focus specifically on wind energy projects.

Equipment manufacturers including Vestas, General Electric, Siemens Gamesa, and Nordex maintain significant market presence through technology supply and service agreements. Competitive differentiation occurs through technology performance, financing capabilities, local partnerships, and project execution expertise. Market competition drives innovation and cost reduction that benefits overall sector development.

By Technology Type:

By Application:

By Ownership Structure:

By Turbine Capacity:

Utility-scale wind projects represent the largest market category, driven by competitive electricity auctions and renewable energy mandates that create sustained demand for large-scale wind development. Project characteristics typically include capacities exceeding 50 MW, long-term power purchase agreements, and integration with transmission systems. This category benefits from economies of scale, established financing mechanisms, and proven technology performance that supports continued market growth.

Industrial wind applications demonstrate strong growth potential as manufacturing companies seek energy cost reduction and sustainability benefits through direct wind energy procurement. Corporate buyers including automotive manufacturers, steel producers, and technology companies drive demand through power purchase agreements and on-site generation projects. This category offers stable, long-term revenue streams and reduced market risks through direct customer relationships.

Distributed wind systems represent an emerging category with significant potential for commercial and small industrial applications. Technology advancement in smaller turbines and improved grid integration capabilities support market development for distributed applications. This category benefits from reduced transmission requirements, enhanced energy security, and alignment with distributed generation trends across Mexico’s electricity sector.

Service and maintenance categories show growing importance as Mexico’s wind fleet matures and requires ongoing operational support. Specialized services including predictive maintenance, performance optimization, and component replacement create substantial market opportunities. This category supports long-term market sustainability through enhanced project performance and extended asset life cycles.

Project developers benefit from Mexico’s exceptional wind resources, supportive regulatory framework, and growing market demand that create attractive investment opportunities. Revenue stability through long-term power purchase agreements and clean energy certificate sales provides predictable cash flows that support project financing and development. The market offers diversification opportunities across different regions, applications, and customer segments that enhance portfolio resilience.

Equipment manufacturers gain access to a large and growing market with sustained demand for wind turbines, components, and supporting equipment. Local manufacturing opportunities emerge as market scale justifies supply chain localization and cost optimization strategies. Technology providers benefit from Mexico’s focus on advanced, efficient wind systems that drive demand for cutting-edge equipment and services.

Financial institutions find attractive investment opportunities in Mexico’s wind sector through project finance, corporate lending, and infrastructure investment vehicles. Risk mitigation through government support mechanisms, established legal frameworks, and proven technology performance enhances investment attractiveness. The market provides portfolio diversification benefits and exposure to growing renewable energy sector trends.

Corporate energy buyers achieve cost savings, sustainability objectives, and energy security benefits through wind energy procurement and development. Competitive electricity prices from wind projects support industrial competitiveness and operational cost management. Companies benefit from enhanced environmental credentials and alignment with global sustainability trends that support market positioning and stakeholder relations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology advancement drives market evolution toward larger, more efficient wind turbines that maximize energy capture and reduce levelized costs. Turbine scaling trends show increasing adoption of systems exceeding 3 MW capacity with enhanced performance characteristics optimized for Mexican wind conditions. These technological improvements support improved project economics and enhanced competitiveness against conventional energy sources.

Corporate procurement trends demonstrate growing direct engagement between industrial consumers and wind energy developers through sophisticated power purchase agreements. Sustainability commitments from multinational corporations operating in Mexico drive structured demand for renewable energy that supports long-term market development. This trend creates stable revenue streams and reduces market risks through direct customer relationships.

Digitalization trends encompass advanced monitoring systems, predictive maintenance technologies, and data analytics that optimize wind farm performance and reduce operational costs. Smart grid integration enables enhanced wind energy utilization through improved forecasting, grid services, and demand response capabilities. These digital trends support market maturation and operational excellence across the wind energy value chain.

Financial innovation includes green bonds, sustainability-linked financing, and institutional investment vehicles that expand capital availability for wind energy projects. Risk management evolution through weather derivatives, performance guarantees, and insurance products supports project bankability and investor confidence. According to MWR analysis, these financial trends facilitate continued market growth and development scale expansion.

Major project announcements continue to demonstrate market momentum with several large-scale wind developments advancing through permitting and construction phases across key Mexican regions. Technology partnerships between international equipment manufacturers and local developers create integrated solutions that optimize project performance and cost-effectiveness. These developments reflect sustained market confidence and continued investment in Mexico’s wind energy sector.

Grid infrastructure investments by government agencies and private transmission companies support enhanced wind energy integration and reduced development constraints in high-potential regions. Regulatory streamlining initiatives aim to reduce permitting timelines and administrative complexity for renewable energy projects. These infrastructure and regulatory developments address key market constraints and support accelerated development.

Corporate sustainability initiatives from major industrial companies create structured demand for wind energy through long-term procurement commitments and direct investment in renewable energy projects. Financial sector engagement includes new green financing products, institutional investment vehicles, and risk management tools specifically designed for renewable energy applications. These market developments strengthen the foundation for continued sector growth.

International collaboration through technology transfer agreements, joint ventures, and knowledge sharing initiatives enhances Mexico’s wind energy capabilities and market sophistication. Supply chain localization efforts by equipment manufacturers and service providers create local economic benefits and reduce project costs through optimized logistics and reduced import dependence.

Strategic diversification across multiple wind corridors and market segments can reduce concentration risks and enhance portfolio resilience for developers and investors. Early engagement with transmission planning processes and grid modernization initiatives supports optimal project siting and reduced infrastructure constraints. Market participants should prioritize regions with both strong wind resources and adequate transmission capacity or planned infrastructure improvements.

Technology optimization through advanced turbine selection, site-specific design, and performance monitoring systems can maximize energy capture and project returns in Mexico’s diverse wind environments. Local partnership development with experienced Mexican companies, communities, and service providers supports project success and regulatory compliance. These strategic approaches enhance project viability and stakeholder acceptance.

Financial structuring should incorporate currency hedging, political risk insurance, and diversified funding sources to manage Mexico-specific risks and optimize capital costs. Regulatory monitoring and active engagement with policy development processes helps anticipate market changes and position for emerging opportunities. Proactive risk management supports long-term investment success and market participation.

Innovation adoption in digital technologies, energy storage integration, and grid services can create competitive advantages and additional revenue streams beyond basic energy sales. Sustainability integration through comprehensive environmental and social programs supports community acceptance and aligns with global ESG investment trends. These forward-looking strategies position market participants for long-term success in Mexico’s evolving wind energy landscape.

Market expansion is expected to continue with sustained growth driven by renewable energy mandates, corporate procurement, and improving cost competitiveness of wind energy systems. Geographic diversification will likely expand beyond current concentration areas as transmission infrastructure develops and new regions become economically viable for wind development. The market trajectory suggests continued capacity additions with approximately 15-20% annual growth in favorable policy scenarios.

Technology evolution toward larger, more efficient turbines and enhanced grid integration capabilities will support improved project economics and expanded market opportunities. Offshore wind development represents a significant long-term opportunity as technology costs decline and regulatory frameworks evolve to support marine wind projects. These technological advances will expand the addressable market and enhance Mexico’s renewable energy potential.

Policy stability and continued government support for renewable energy development remain critical factors for sustained market growth and investor confidence. Regional integration opportunities through cross-border transmission and energy trading could expand market demand beyond domestic consumption requirements. According to MarkWide Research projections, these factors support positive long-term market outlook with sustained investment and development activity.

Market maturation will likely bring enhanced competition, improved efficiency, and specialized market segments that create opportunities for different types of market participants. Sustainability focus and climate commitments will continue driving demand for wind energy as Mexico pursues decarbonization objectives and international climate goals. The future outlook indicates a dynamic, growing market with substantial opportunities for strategic participants across the wind energy value chain.

Mexico’s wind energy system market represents one of Latin America’s most promising renewable energy sectors, characterized by exceptional natural resources, supportive policy frameworks, and growing demand from industrial and utility customers. The market demonstrates strong fundamentals with consistent capacity additions, technological advancement, and increasing cost competitiveness that position wind energy as a cornerstone of Mexico’s energy transition strategy.

Strategic advantages including world-class wind corridors, established transmission infrastructure, and proximity to major consumption centers create attractive conditions for continued market development. While challenges exist in transmission constraints, regulatory complexity, and geographic concentration, ongoing infrastructure investments and policy support address these limitations and support market expansion across new regions and applications.

Future prospects remain positive with sustained growth expected across utility-scale projects, industrial applications, and emerging distributed generation segments. Technology evolution, financial innovation, and corporate sustainability commitments provide multiple drivers for continued market development. Mexico’s wind energy sector is well-positioned to play an increasingly important role in the country’s energy system while contributing to economic development, environmental objectives, and energy security goals through continued strategic investment and development activities.

What is Wind Energy System?

Wind Energy System refers to the technology and infrastructure used to convert wind energy into electricity. This includes wind turbines, generators, and the necessary grid connections to distribute the generated power.

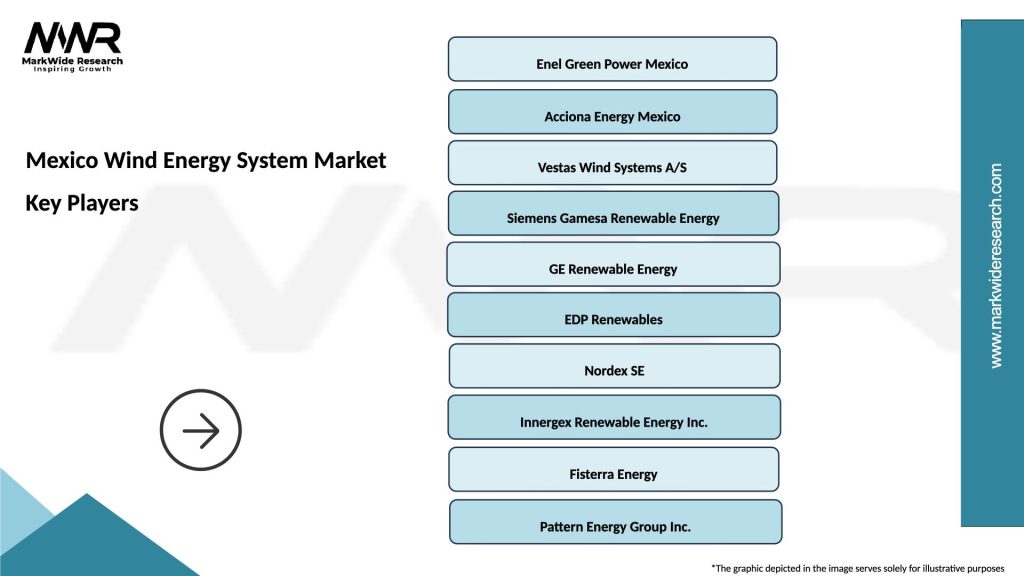

What are the key players in the Mexico Wind Energy System Market?

Key players in the Mexico Wind Energy System Market include companies like Enel Green Power, Acciona Energy, and Vestas, which are involved in the development and operation of wind farms, among others.

What are the growth factors driving the Mexico Wind Energy System Market?

The Mexico Wind Energy System Market is driven by factors such as increasing energy demand, government incentives for renewable energy, and advancements in wind turbine technology that enhance efficiency and reduce costs.

What challenges does the Mexico Wind Energy System Market face?

Challenges in the Mexico Wind Energy System Market include regulatory hurdles, land acquisition issues, and competition from other energy sources, which can impact project development and investment.

What opportunities exist in the Mexico Wind Energy System Market?

Opportunities in the Mexico Wind Energy System Market include the potential for offshore wind projects, increased investment in renewable energy infrastructure, and the growing demand for sustainable energy solutions.

What trends are shaping the Mexico Wind Energy System Market?

Trends in the Mexico Wind Energy System Market include the integration of smart grid technologies, the rise of community wind projects, and a focus on sustainability and environmental impact assessments.

Mexico Wind Energy System Market

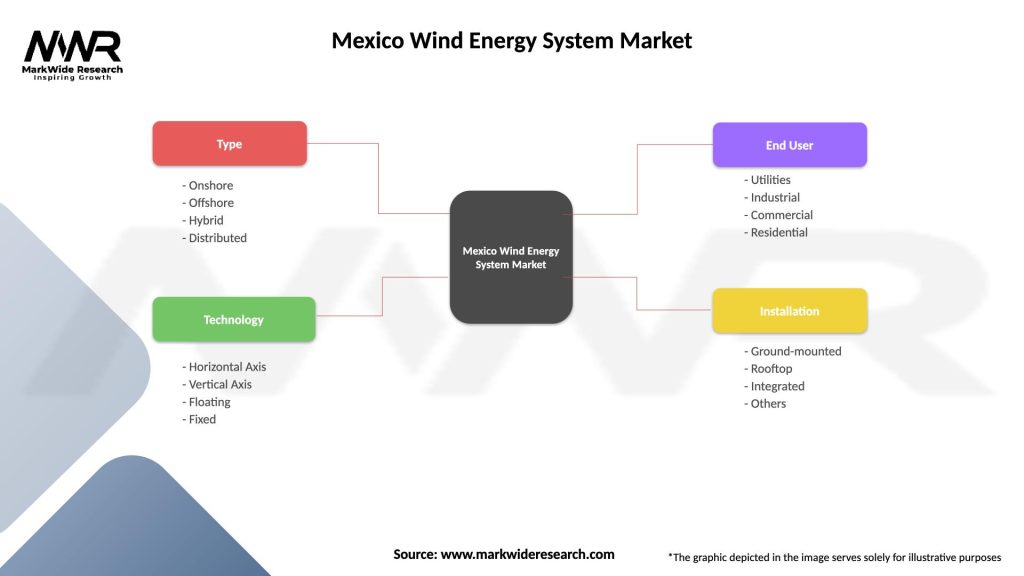

| Segmentation Details | Description |

|---|---|

| Type | Onshore, Offshore, Hybrid, Distributed |

| Technology | Horizontal Axis, Vertical Axis, Floating, Fixed |

| End User | Utilities, Industrial, Commercial, Residential |

| Installation | Ground-mounted, Rooftop, Integrated, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Wind Energy System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at