444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico refrigerated truck market represents a critical component of the nation’s cold chain logistics infrastructure, serving as the backbone for temperature-sensitive cargo transportation across diverse industries. Market dynamics indicate substantial growth driven by expanding food and pharmaceutical sectors, with the market experiencing robust expansion at a compound annual growth rate (CAGR) of 8.2% during the forecast period. The increasing demand for fresh produce, frozen foods, and temperature-controlled pharmaceutical products has positioned Mexico as a key player in the North American cold chain logistics ecosystem.

Regional distribution shows concentrated activity in major metropolitan areas including Mexico City, Guadalajara, and Monterrey, which collectively account for approximately 65% of market activity. The market encompasses various vehicle configurations, from small delivery vans to large semi-trailers, each designed to meet specific temperature requirements ranging from chilled to deep-frozen applications. Technological advancement in refrigeration systems, telematics integration, and energy-efficient solutions continues to reshape the competitive landscape.

Industry stakeholders include fleet operators, logistics service providers, food distributors, and pharmaceutical companies, all contributing to the market’s sustained growth trajectory. The integration of advanced monitoring systems and GPS tracking capabilities has enhanced operational efficiency by approximately 35%, making refrigerated transportation more reliable and cost-effective for businesses across Mexico.

The Mexico refrigerated truck market refers to the comprehensive ecosystem of temperature-controlled commercial vehicles, supporting equipment, and related services designed to maintain specific temperature ranges during the transportation of perishable goods throughout Mexican territory. This market encompasses the manufacturing, distribution, leasing, and maintenance of refrigerated trucks, also known as reefer trucks, which utilize specialized cooling systems to preserve product integrity during transit.

Core components of this market include the refrigeration units, insulated cargo compartments, temperature monitoring systems, and power generation equipment necessary for maintaining consistent cold chain conditions. The market serves multiple industries including food and beverage, pharmaceuticals, chemicals, and agricultural products, ensuring that temperature-sensitive goods reach their destinations with maintained quality and safety standards.

Market participants range from truck manufacturers and refrigeration equipment suppliers to fleet operators and logistics service providers. The definition extends beyond vehicle sales to encompass rental services, maintenance contracts, and technological solutions that support efficient cold chain operations across Mexico’s diverse geographical and climatic conditions.

Strategic analysis reveals that Mexico’s refrigerated truck market is experiencing unprecedented growth, driven by evolving consumer preferences for fresh and frozen products, expanding pharmaceutical distribution networks, and increasing international trade activities. The market demonstrates strong fundamentals with agricultural exports contributing significantly to demand, as Mexico ranks among the world’s leading exporters of fresh produce to North American markets.

Key growth drivers include the modernization of retail food chains, expansion of e-commerce grocery delivery services, and stringent regulatory requirements for pharmaceutical cold chain compliance. The market benefits from Mexico’s strategic geographic position, serving as a crucial link between Central American producers and North American consumers, with cross-border trade accounting for approximately 40% of refrigerated transport activity.

Technological innovation continues to transform the market landscape, with advanced telematics systems, IoT-enabled monitoring, and energy-efficient refrigeration technologies gaining widespread adoption. Fleet operators are increasingly investing in modern equipment to meet sustainability goals and operational efficiency targets, resulting in improved fuel economy and reduced environmental impact across the transportation network.

Market intelligence indicates several critical insights that define the current state and future trajectory of Mexico’s refrigerated truck market:

Primary market drivers propelling the Mexico refrigerated truck market forward include the rapid expansion of organized retail chains and supermarket networks across urban and semi-urban areas. The proliferation of modern retail formats has created substantial demand for reliable cold chain logistics, as retailers require consistent supply of fresh and frozen products to meet consumer expectations. Consumer behavior shifts toward convenience foods, ready-to-eat meals, and premium fresh produce have further amplified this demand.

Agricultural sector growth represents another significant driver, with Mexico’s position as a major exporter of fresh fruits, vegetables, and agricultural products to international markets. The country’s diverse agricultural production, spanning from tropical fruits in the south to vegetables in the north, requires extensive refrigerated transportation networks to maintain product quality during domestic distribution and export activities. Seasonal production cycles create consistent demand for flexible refrigerated transport capacity.

Pharmaceutical industry expansion contributes substantially to market growth, driven by increasing healthcare spending, aging population demographics, and stringent regulatory requirements for temperature-controlled drug distribution. The COVID-19 pandemic highlighted the critical importance of reliable cold chain infrastructure for vaccine distribution, leading to significant investments in refrigerated transport capabilities. Regulatory compliance requirements continue to drive adoption of advanced monitoring and documentation systems.

E-commerce growth in the grocery and food delivery segments has created new demand patterns for smaller, more flexible refrigerated vehicles capable of last-mile delivery operations. Online grocery platforms and food delivery services require specialized cold chain solutions to maintain product integrity during the final delivery phase, driving innovation in urban refrigerated transport solutions.

Capital investment requirements represent a significant barrier to market entry and expansion, as refrigerated trucks command premium pricing compared to standard commercial vehicles. The specialized refrigeration equipment, insulated cargo compartments, and auxiliary power systems substantially increase initial purchase costs, creating financial challenges for smaller fleet operators and new market entrants. Financing constraints particularly affect small and medium-sized logistics companies seeking to expand their cold chain capabilities.

Operational complexity associated with refrigerated transport operations creates ongoing challenges for fleet managers and drivers. Maintaining precise temperature control, managing fuel consumption for refrigeration systems, and ensuring compliance with food safety regulations require specialized knowledge and training. Technical expertise shortages in refrigeration system maintenance and repair can lead to increased downtime and operational disruptions.

Infrastructure limitations in certain regions of Mexico pose challenges for efficient refrigerated transport operations. Inadequate road conditions, limited access to reliable electrical power for pre-cooling operations, and insufficient maintenance facilities can impact service quality and operational efficiency. Rural connectivity issues particularly affect agricultural regions where refrigerated transport is most needed.

Regulatory compliance costs continue to increase as government agencies implement stricter food safety standards and environmental regulations. Fleet operators must invest in documentation systems, driver training programs, and equipment upgrades to maintain compliance, adding to operational expenses. Cross-border regulations for international transport create additional complexity and compliance costs for operators serving export markets.

Emerging opportunities in Mexico’s refrigerated truck market center around the rapid digitalization of supply chain operations and the integration of Internet of Things (IoT) technologies. Fleet operators can leverage real-time monitoring systems, predictive maintenance algorithms, and route optimization software to significantly improve operational efficiency and reduce costs. Digital transformation initiatives offer substantial potential for competitive differentiation and service enhancement.

Sustainability initiatives present significant growth opportunities as environmental regulations become more stringent and corporate sustainability goals drive demand for cleaner transportation solutions. Electric and hybrid refrigerated trucks, solar-powered refrigeration systems, and alternative fuel technologies represent emerging market segments with substantial growth potential. Green logistics solutions appeal to environmentally conscious customers and can command premium pricing.

Market expansion into underserved regions and industry segments offers substantial growth potential. Rural areas with developing agricultural sectors require improved cold chain infrastructure, while emerging industries such as biotechnology and specialty chemicals create new demand for temperature-controlled transportation. Geographic diversification strategies can help operators capture growth in developing markets.

Service integration opportunities allow refrigerated truck operators to expand beyond basic transportation services into comprehensive cold chain management solutions. Value-added services including inventory management, quality assurance, and supply chain consulting can generate additional revenue streams and strengthen customer relationships. Partnership strategies with technology providers and logistics companies can accelerate service expansion.

Competitive dynamics within Mexico’s refrigerated truck market reflect a complex interplay between established fleet operators, emerging technology providers, and evolving customer requirements. The market demonstrates characteristics of both consolidation and fragmentation, with large operators acquiring smaller companies to achieve economies of scale while specialized niche players focus on specific industry segments or geographic regions. Market concentration varies significantly across different regions and application segments.

Technology disruption continues to reshape competitive positioning as traditional transportation companies compete with technology-enabled logistics providers. Companies investing in advanced telematics, artificial intelligence, and automated systems gain competitive advantages through improved operational efficiency and service quality. Innovation cycles are accelerating as customer expectations for real-time visibility and service reliability increase.

Supply chain integration trends are driving closer collaboration between refrigerated truck operators, shippers, and technology providers. Integrated service offerings that combine transportation, warehousing, and inventory management create stronger customer relationships and higher barriers to entry. Partnership ecosystems are becoming increasingly important for market success.

Regulatory evolution continues to influence market dynamics as government agencies implement new safety standards, environmental regulations, and cross-border trade requirements. Companies that proactively adapt to regulatory changes gain competitive advantages, while those that lag behind face compliance risks and potential market share losses. Regulatory compliance capabilities are becoming key differentiators in customer selection processes.

Comprehensive research approach employed for analyzing Mexico’s refrigerated truck market incorporates both primary and secondary research methodologies to ensure accuracy and completeness of market insights. Primary research activities include structured interviews with industry executives, fleet operators, equipment manufacturers, and logistics service providers to gather firsthand perspectives on market trends, challenges, and opportunities. Stakeholder engagement provides qualitative insights that complement quantitative data analysis.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and company financial statements to establish market baselines and validate primary research findings. Data sources include transportation ministry records, customs and trade statistics, and industry association publications. Data triangulation methods ensure consistency and reliability of research conclusions.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify growth opportunities. Regression analysis, time series modeling, and correlation studies help establish relationships between market drivers and performance indicators. Analytical frameworks incorporate economic indicators, demographic trends, and industry-specific factors.

Quality assurance processes include peer review of research findings, validation of data sources, and cross-verification of market estimates through multiple analytical approaches. Expert panels and industry advisory groups provide additional validation of research conclusions and market projections. Continuous monitoring ensures research findings remain current and relevant to market developments.

Northern Mexico dominates the refrigerated truck market, accounting for approximately 50% of total market activity due to its strategic location along the US border and concentration of manufacturing and agricultural activities. States including Nuevo León, Chihuahua, and Sonora serve as major hubs for cross-border trade, with significant volumes of fresh produce, processed foods, and manufactured goods requiring temperature-controlled transportation. Border infrastructure investments continue to enhance trade facilitation and logistics efficiency.

Central Mexico represents the second-largest regional market, centered around Mexico City and surrounding metropolitan areas. The region’s large population concentration, extensive retail networks, and food processing industries create substantial demand for refrigerated transportation services. Urban logistics challenges drive innovation in smaller, more maneuverable refrigerated vehicles designed for city delivery operations.

Western Mexico demonstrates strong growth potential, driven by agricultural production in states such as Jalisco, Michoacán, and Sinaloa. The region’s diverse agricultural output, including avocados, berries, and vegetables, requires extensive cold chain infrastructure for both domestic distribution and export markets. Port connectivity through Pacific coast facilities enhances international trade opportunities.

Southern and Eastern Mexico represent emerging markets with significant growth potential as infrastructure development and economic activity expand. Agricultural production in tropical regions creates demand for specialized refrigerated transport solutions capable of handling high-temperature, high-humidity conditions. Infrastructure investments in road networks and logistics facilities support market development in these regions.

Market leadership in Mexico’s refrigerated truck market is distributed among several key categories of participants, each bringing distinct capabilities and competitive advantages to the marketplace:

Competitive strategies focus on technology integration, service quality, geographic coverage, and industry specialization. Leading companies invest heavily in telematics systems, driver training programs, and customer service capabilities to differentiate their offerings and maintain market position.

Vehicle type segmentation reveals distinct market categories based on size, capacity, and application requirements:

Application-based segmentation demonstrates diverse market requirements across industry sectors:

Temperature range segmentation addresses specific cooling requirements:

Food and beverage category represents the largest segment of Mexico’s refrigerated truck market, driven by the country’s significant agricultural production and growing food processing industry. Fresh produce transportation, particularly for export markets, requires sophisticated cold chain solutions to maintain product quality during extended transit times. Seasonal variations in agricultural production create fluctuating demand patterns that influence fleet utilization and capacity planning strategies.

Pharmaceutical category demonstrates the highest growth rate and most stringent operational requirements, driven by expanding healthcare access and regulatory compliance mandates. Temperature excursions can render pharmaceutical products ineffective or dangerous, making reliable refrigerated transportation critical for patient safety. Regulatory oversight requires comprehensive documentation, validation protocols, and quality assurance systems.

Retail distribution category encompasses supermarket chains, convenience stores, and food service establishments requiring regular delivery of temperature-controlled products. The growth of modern retail formats and consumer preferences for fresh products drive consistent demand for refrigerated transportation services. Urban logistics challenges require innovative solutions for efficient city delivery operations.

Export category leverages Mexico’s strategic geographic position and trade agreements to serve North American markets with fresh agricultural products. Cross-border transportation requires specialized equipment, documentation systems, and compliance capabilities to meet international trade requirements. Trade relationships with the United States and Canada create substantial opportunities for refrigerated transport operators.

Fleet operators benefit from expanding market opportunities driven by growing demand for temperature-controlled transportation across multiple industry sectors. Advanced refrigeration technologies and telematics systems enable improved operational efficiency, reduced fuel consumption, and enhanced service quality. Revenue diversification opportunities through value-added services and specialized applications strengthen business models and competitive positioning.

Shippers and logistics customers gain access to reliable cold chain solutions that protect product integrity, reduce waste, and ensure regulatory compliance. Modern refrigerated truck services provide real-time visibility, temperature monitoring, and documentation capabilities that support quality assurance and supply chain optimization. Service reliability improvements reduce inventory carrying costs and improve customer satisfaction.

Equipment manufacturers benefit from growing demand for advanced refrigeration systems, telematics solutions, and energy-efficient technologies. Innovation opportunities in electric and hybrid refrigeration systems, IoT integration, and sustainable technologies create new product development and market expansion possibilities. Technology partnerships with fleet operators drive collaborative innovation and market growth.

Government and regulatory agencies benefit from improved food safety, reduced product waste, and enhanced trade facilitation capabilities. Modern refrigerated truck fleets support economic development, export competitiveness, and public health objectives. Infrastructure investments in cold chain capabilities strengthen Mexico’s position in international trade and agricultural markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Mexico’s refrigerated truck market, with fleet operators increasingly adopting IoT sensors, GPS tracking, and cloud-based management systems. These technologies enable real-time monitoring of temperature conditions, vehicle location, and operational performance, providing unprecedented visibility into cold chain operations. Data analytics capabilities allow operators to optimize routes, predict maintenance needs, and improve customer service quality.

Sustainability focus drives growing interest in electric and hybrid refrigerated trucks, solar-powered refrigeration systems, and alternative fuel technologies. Environmental regulations and corporate sustainability goals are pushing fleet operators to explore cleaner transportation solutions. Energy efficiency improvements in refrigeration systems and vehicle design contribute to reduced operational costs and environmental impact.

Last-mile delivery specialization emerges as e-commerce growth creates demand for smaller, more agile refrigerated vehicles capable of urban delivery operations. Food delivery services, online grocery platforms, and direct-to-consumer businesses require specialized cold chain solutions for final delivery phases. Urban logistics innovations address challenges of city delivery while maintaining temperature control requirements.

Service integration trends see refrigerated truck operators expanding beyond basic transportation to offer comprehensive cold chain management solutions. Integrated services including warehousing, inventory management, and quality assurance create stronger customer relationships and higher value propositions. Partnership strategies with technology providers and logistics companies accelerate service expansion capabilities.

Technology partnerships between refrigerated truck operators and technology companies are accelerating innovation in cold chain solutions. Recent collaborations focus on developing AI-powered route optimization, predictive maintenance algorithms, and automated temperature control systems. Innovation investments by leading fleet operators demonstrate commitment to technological advancement and competitive differentiation.

Infrastructure investments by government agencies and private companies are expanding cold chain capabilities across Mexico. New refrigerated warehouses, improved road networks, and enhanced border crossing facilities support market growth and operational efficiency. Public-private partnerships facilitate infrastructure development and technology adoption initiatives.

Regulatory developments include updated food safety standards, environmental regulations, and cross-border trade requirements that influence market operations. Recent regulatory changes emphasize temperature monitoring, documentation requirements, and driver training standards. Compliance initiatives by industry associations support regulatory adaptation and best practice implementation.

Market consolidation activities include strategic acquisitions, partnerships, and joint ventures that reshape competitive dynamics. Leading operators acquire smaller companies to expand geographic coverage and service capabilities, while technology companies partner with fleet operators to accelerate solution deployment. Strategic alliances create synergies and competitive advantages in the evolving market landscape.

MarkWide Research recommends that refrigerated truck operators prioritize technology investments to remain competitive in the evolving market landscape. Fleet management systems, telematics integration, and real-time monitoring capabilities are becoming essential for operational efficiency and customer satisfaction. Digital transformation initiatives should focus on solutions that provide measurable returns on investment and competitive differentiation.

Strategic partnerships with technology providers, logistics companies, and industry specialists can accelerate capability development and market expansion. Collaborative approaches to innovation, service development, and market entry reduce risks and resource requirements while enhancing competitive positioning. Partnership strategies should align with long-term business objectives and market opportunities.

Geographic expansion into underserved regions and emerging markets offers significant growth potential for established operators. Rural areas with developing agricultural sectors and growing urban centers represent opportunities for market share expansion. Market entry strategies should consider local infrastructure conditions, competitive dynamics, and customer requirements.

Sustainability initiatives including electric vehicles, alternative fuels, and energy-efficient technologies will become increasingly important for regulatory compliance and customer preferences. Early adoption of sustainable technologies can provide competitive advantages and support long-term market positioning. Environmental strategies should balance operational requirements with sustainability objectives and cost considerations.

Market projections indicate continued robust growth for Mexico’s refrigerated truck market, driven by expanding food and pharmaceutical sectors, increasing international trade, and evolving consumer preferences. The market is expected to maintain strong momentum with projected growth rates of 8.5% CAGR over the next five years, supported by infrastructure investments and technology adoption initiatives.

Technology evolution will continue to transform market dynamics, with autonomous vehicles, artificial intelligence, and advanced refrigeration systems reshaping operational capabilities. Electric and hybrid refrigerated trucks are expected to achieve 15% market penetration within the next decade as technology costs decrease and charging infrastructure expands. Innovation cycles will accelerate as customer expectations for service quality and sustainability increase.

Regulatory environment evolution will drive continued investment in compliance systems, safety technologies, and environmental solutions. Stricter food safety standards and environmental regulations will favor operators with advanced monitoring and documentation capabilities. Compliance requirements will become increasingly sophisticated, requiring ongoing investment in technology and training.

Market consolidation trends are expected to continue as larger operators acquire smaller companies to achieve economies of scale and expand service capabilities. Technology-enabled logistics providers may disrupt traditional market structures through innovative service models and operational efficiencies. Competitive dynamics will favor companies that successfully integrate technology, sustainability, and customer service excellence.

Mexico’s refrigerated truck market represents a dynamic and rapidly evolving sector with substantial growth potential driven by expanding food and pharmaceutical industries, increasing international trade, and technological innovation. The market demonstrates strong fundamentals supported by the country’s strategic geographic position, diverse agricultural production, and growing consumer demand for temperature-controlled products.

Key success factors for market participants include technology adoption, operational efficiency, regulatory compliance, and customer service excellence. Companies that invest in advanced refrigeration systems, telematics integration, and sustainability initiatives are positioned to capture growing market opportunities and maintain competitive advantages. Strategic planning should emphasize long-term capability development and market positioning.

Future market development will be shaped by continued digitalization, sustainability requirements, and evolving customer expectations. The integration of IoT technologies, electric vehicles, and AI-powered optimization systems will transform operational capabilities and service delivery models. Innovation leadership will become increasingly important for competitive differentiation and market success in the evolving cold chain logistics landscape.

What is Refrigerated Truck?

Refrigerated trucks are specialized vehicles designed to transport temperature-sensitive goods, such as food, pharmaceuticals, and chemicals, while maintaining a controlled environment. They are equipped with refrigeration units to ensure the integrity of perishable items during transit.

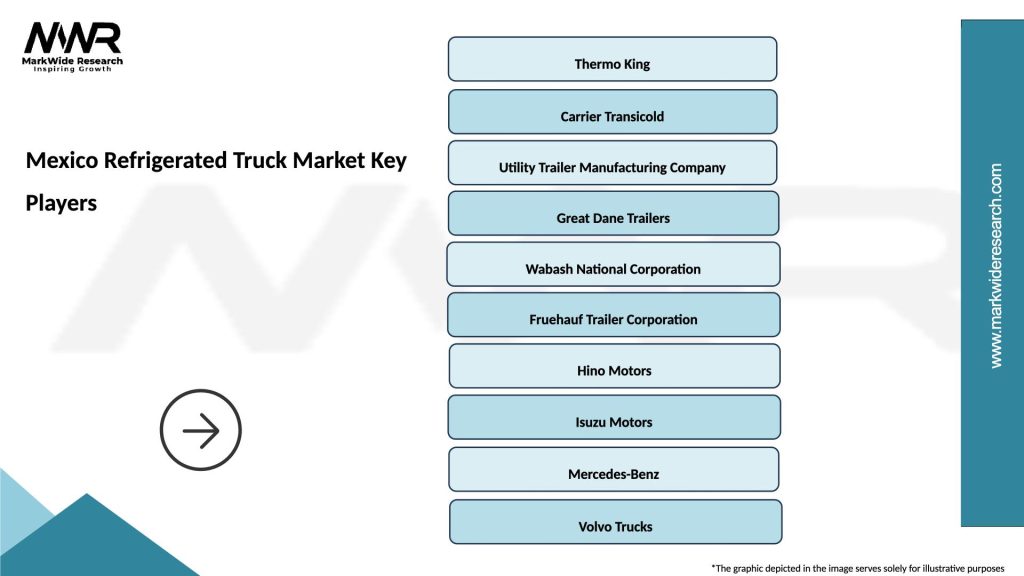

What are the key players in the Mexico Refrigerated Truck Market?

Key players in the Mexico Refrigerated Truck Market include Thermo King, Carrier Transicold, and Frigoblock, which provide advanced refrigeration solutions for transportation. These companies focus on innovation and efficiency to meet the growing demand for refrigerated logistics, among others.

What are the growth factors driving the Mexico Refrigerated Truck Market?

The Mexico Refrigerated Truck Market is driven by the increasing demand for fresh food products, the growth of the e-commerce sector, and the rising need for efficient cold chain logistics. Additionally, regulatory requirements for food safety are pushing companies to invest in refrigerated transport solutions.

What challenges does the Mexico Refrigerated Truck Market face?

Challenges in the Mexico Refrigerated Truck Market include high operational costs, maintenance of refrigeration units, and the need for skilled drivers. Additionally, fluctuating fuel prices can impact the overall profitability of refrigerated transport services.

What opportunities exist in the Mexico Refrigerated Truck Market?

Opportunities in the Mexico Refrigerated Truck Market include the expansion of the food delivery sector, advancements in refrigeration technology, and the increasing focus on sustainability in logistics. Companies are exploring electric refrigerated trucks and alternative fuels to reduce their carbon footprint.

What trends are shaping the Mexico Refrigerated Truck Market?

Trends in the Mexico Refrigerated Truck Market include the adoption of IoT technology for real-time monitoring of temperature and location, as well as the integration of automation in logistics. These innovations are enhancing efficiency and ensuring compliance with safety standards.

Mexico Refrigerated Truck Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Light Duty, Medium Duty, Heavy Duty, Trailer |

| Temperature Control | Single Temperature, Multi-Temperature, Thermo King, Carrier |

| End User | Food & Beverage, Pharmaceuticals, Agriculture, Logistics |

| Fuel Type | Diesel, Electric, Hybrid, Gasoline |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Refrigerated Truck Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at