444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico plant based food and beverage industry market represents one of the most dynamic and rapidly evolving sectors within the Latin American region. Market dynamics indicate substantial growth momentum driven by increasing consumer awareness of health benefits, environmental sustainability concerns, and evolving dietary preferences among Mexican consumers. The industry encompasses a diverse range of products including plant-based meat alternatives, dairy substitutes, protein beverages, and innovative food formulations derived from legumes, grains, and alternative protein sources.

Consumer adoption rates have accelerated significantly, with urban populations leading the transition toward plant-based alternatives. The market demonstrates robust expansion across multiple product categories, with dairy alternatives showing particularly strong penetration rates of approximately 23% growth annually. Regional distribution patterns reveal concentrated demand in metropolitan areas including Mexico City, Guadalajara, and Monterrey, where health-conscious consumers drive innovation and market acceptance.

Industry transformation reflects broader global trends while maintaining distinct characteristics specific to Mexican culinary traditions and preferences. Local manufacturers increasingly collaborate with international brands to develop products that resonate with traditional flavors while meeting modern nutritional expectations. The sector benefits from Mexico’s agricultural diversity, providing abundant raw materials for plant-based product development and manufacturing scalability.

The Mexico plant based food and beverage industry market refers to the comprehensive ecosystem of companies, products, and services focused on developing, manufacturing, and distributing food and beverage alternatives derived entirely from plant sources rather than animal products. This market encompasses meat substitutes, dairy alternatives, plant-based proteins, and innovative beverage formulations designed to replicate traditional animal-based products while offering enhanced nutritional profiles and sustainability benefits.

Market scope includes established categories such as soy-based products, almond and oat milk alternatives, legume-based protein products, and emerging innovations in cellular agriculture and fermentation technologies. The industry serves diverse consumer segments ranging from committed vegans and vegetarians to flexitarians and health-conscious omnivores seeking to reduce animal product consumption without compromising taste or nutritional value.

Economic significance extends beyond direct product sales to encompass supply chain development, agricultural innovation, retail transformation, and foodservice adaptation. The market influences traditional food manufacturing, packaging innovation, distribution networks, and consumer education initiatives that collectively reshape Mexico’s food landscape toward more sustainable and health-oriented consumption patterns.

Strategic analysis reveals the Mexico plant based food and beverage industry market as a high-growth sector experiencing unprecedented expansion driven by demographic shifts, health consciousness, and environmental awareness. Market penetration accelerates across urban centers with younger demographics leading adoption trends and influencing broader consumer behavior patterns throughout the country.

Product innovation focuses on taste improvement, nutritional enhancement, and price competitiveness to attract mainstream consumers beyond traditional plant-based enthusiasts. Key success factors include authentic flavor profiles that complement Mexican cuisine, accessible pricing strategies, and widespread retail availability across traditional and modern trade channels.

Competitive landscape features a mix of international brands establishing local presence, domestic manufacturers expanding plant-based portfolios, and innovative startups developing region-specific products. Market leaders invest heavily in consumer education, product development, and distribution network expansion to capture growing demand and establish long-term market positions.

Growth trajectory indicates sustained expansion with increasing mainstream acceptance, retail space allocation, and foodservice integration. Industry projections suggest continued momentum driven by generational preferences, health trends, and environmental considerations that align with global sustainability movements while respecting local culinary traditions.

Consumer behavior analysis reveals significant shifts in purchasing patterns and dietary preferences across Mexican demographics. The following insights highlight critical market developments:

Health consciousness emerges as the predominant driver propelling market expansion throughout Mexico. Rising awareness of chronic diseases, obesity rates, and nutritional deficiencies motivates consumers to seek healthier dietary alternatives. Medical recommendations increasingly support plant-based diets for cardiovascular health, diabetes management, and weight control, creating strong consumer motivation for product adoption.

Environmental sustainability concerns resonate strongly with educated urban consumers who understand the environmental impact of traditional animal agriculture. Climate change awareness drives demand for products with lower carbon footprints, reduced water consumption, and minimal land use requirements. Educational campaigns highlighting environmental benefits create additional consumer motivation beyond personal health considerations.

Demographic transitions favor plant-based product adoption as younger generations prioritize ethical consumption, health optimization, and environmental responsibility. Urbanization trends concentrate environmentally conscious consumers in metropolitan areas where plant-based products achieve greater availability and social acceptance.

Product innovation continuously improves taste, texture, and nutritional profiles, addressing historical barriers to mainstream adoption. Technology advancement enables manufacturers to create products that closely replicate traditional animal-based alternatives while offering superior nutritional benefits and ingredient transparency that appeals to health-conscious consumers.

Price premiums represent the most significant barrier limiting widespread market adoption across diverse socioeconomic segments. Manufacturing costs for plant-based alternatives often exceed conventional products due to specialized ingredients, processing technologies, and smaller production scales that prevent economies of scale benefits.

Cultural resistance persists among traditional consumers who associate meat consumption with cultural identity, social status, and culinary authenticity. Generational preferences create market segmentation challenges as older demographics demonstrate lower acceptance rates for plant-based alternatives, limiting overall market penetration potential.

Infrastructure limitations constrain distribution efficiency and product availability, particularly in rural areas and smaller cities where cold chain logistics and specialized storage requirements increase operational costs. Supply chain complexity for specialized ingredients creates vulnerability to disruptions and price volatility.

Regulatory uncertainty regarding labeling requirements, nutritional claims, and product classifications creates compliance challenges for manufacturers and potential consumer confusion. Quality standardization lacks comprehensive frameworks, leading to inconsistent product experiences that may undermine consumer confidence and repeat purchase behavior.

Foodservice integration presents substantial growth opportunities as restaurants, cafeterias, and institutional food providers increasingly incorporate plant-based options to meet evolving consumer demands. Menu diversification strategies enable foodservice operators to attract health-conscious customers while differentiating their offerings in competitive markets.

Export potential emerges as Mexican manufacturers develop expertise in plant-based product development and manufacturing. Regional expansion opportunities exist throughout Latin America where similar cultural and dietary patterns create natural market extensions for successful Mexican plant-based brands.

Agricultural integration offers vertical integration opportunities for companies to secure supply chains while supporting local farmers transitioning to plant-based ingredient production. Sustainable sourcing initiatives create competitive advantages and align with consumer values regarding environmental responsibility and social impact.

Technology partnerships with international companies provide access to advanced processing technologies, product formulations, and market expertise that accelerate local market development. Innovation collaboration enables Mexican companies to develop products specifically tailored to local tastes while leveraging global best practices and technological advancement.

Supply chain evolution transforms traditional food distribution networks to accommodate specialized storage, handling, and logistics requirements for plant-based products. Cold chain infrastructure expansion supports product quality maintenance while enabling broader geographic distribution and extended shelf life capabilities.

Competitive intensity increases as established food manufacturers launch plant-based product lines to compete with specialized plant-based companies. Market consolidation trends emerge through acquisitions, partnerships, and licensing agreements that combine traditional food industry expertise with plant-based innovation capabilities.

Consumer education initiatives drive market awareness and product trial rates through sampling programs, nutritional information campaigns, and cooking demonstrations that address taste and preparation concerns. Influencer marketing leverages social media platforms to reach target demographics and build brand awareness among younger consumers.

Retail transformation includes dedicated plant-based sections, improved product placement, and enhanced merchandising strategies that increase product visibility and purchase consideration. E-commerce growth provides alternative distribution channels that reach consumers in underserved geographic areas while offering convenient subscription and bulk purchasing options.

Primary research encompasses comprehensive consumer surveys, focus groups, and in-depth interviews with industry stakeholders including manufacturers, retailers, distributors, and foodservice operators. Data collection methods utilize both quantitative and qualitative approaches to capture market trends, consumer preferences, and industry dynamics across diverse geographic and demographic segments.

Secondary research incorporates industry reports, government statistics, trade association data, and academic studies to provide comprehensive market context and historical trend analysis. Market intelligence gathering includes monitoring of product launches, pricing strategies, distribution partnerships, and competitive positioning across the plant-based food and beverage landscape.

Analytical framework employs statistical modeling, trend analysis, and forecasting methodologies to project market development scenarios and identify growth opportunities. Validation processes ensure data accuracy through cross-referencing multiple sources and expert consultation to maintain research reliability and credibility.

Geographic coverage includes major metropolitan areas, secondary cities, and rural regions to capture comprehensive market dynamics and regional variation patterns. Temporal analysis tracks market evolution over multiple years to identify sustainable trends versus temporary fluctuations in consumer behavior and market performance.

Mexico City dominates the national plant-based market with approximately 35% market share, driven by high consumer awareness, diverse retail options, and strong foodservice adoption. Urban sophistication creates favorable conditions for premium plant-based products while supporting innovative brands and specialized retailers focused on health-conscious consumers.

Guadalajara region demonstrates rapid growth with 18% market share, benefiting from strong manufacturing presence and proximity to agricultural production areas. Industrial development supports local plant-based manufacturing while cultural openness to culinary innovation facilitates consumer acceptance of alternative protein products.

Monterrey metropolitan area captures 15% market share through high disposable income levels and health-conscious consumer demographics. Business community influence drives corporate wellness programs and institutional food service adoption of plant-based alternatives in office environments and corporate cafeterias.

Coastal regions including Cancun, Puerto Vallarta, and Playa del Carmen show emerging growth driven by tourism industry demands and international visitor preferences. Resort integration creates opportunities for plant-based menu options while exposing domestic consumers to international plant-based food trends and products.

Secondary cities demonstrate increasing market potential as distribution networks expand and consumer awareness grows through digital marketing and social media influence. Market penetration accelerates in cities with university populations and growing middle-class demographics that prioritize health and environmental considerations.

Market leadership features a dynamic mix of international brands, domestic manufacturers, and innovative startups competing across multiple product categories and distribution channels. The competitive environment emphasizes product innovation, brand positioning, and strategic partnerships to capture growing consumer demand.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Plant-Based Dairy Alternatives demonstrate the strongest market performance with consistent growth across milk, cheese, and yogurt categories. Oat milk products show particularly strong consumer acceptance due to creamy texture and neutral taste that complements Mexican coffee culture. Almond-based products maintain premium positioning while soy alternatives offer value-oriented options for price-sensitive consumers.

Meat Alternative Products face greater consumer resistance due to taste and texture expectations, requiring significant investment in product development and consumer education. Ground meat substitutes achieve higher acceptance rates in traditional Mexican dishes where spices and preparation methods mask texture differences. Burger patties target younger demographics through foodservice channels and modern retail positioning.

Plant-Based Beverages capitalize on growing health consciousness and convenience trends, with protein smoothies and functional drinks showing strong growth potential. Ready-to-drink formats appeal to busy urban consumers while powder-based products offer value and customization options. Nutritional enhancement through vitamin fortification and superfood ingredients creates premium positioning opportunities.

Snack Categories provide entry-level opportunities for plant-based trial among mainstream consumers through familiar formats and accessible pricing. Protein bars target fitness-conscious demographics while plant-based chips and convenience foods offer broader market appeal through traditional snacking occasions and impulse purchase behavior.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and alignment with global sustainability trends that enhance brand reputation and consumer loyalty. Product differentiation enables companies to capture market share in growing categories while leveraging existing manufacturing capabilities and distribution networks for plant-based product lines.

Retailers gain competitive advantages through comprehensive plant-based product assortments that attract health-conscious consumers and increase basket size through premium pricing. Category management opportunities include dedicated plant-based sections, cross-merchandising strategies, and private label development that enhance profit margins and customer retention.

Consumers access improved health outcomes, environmental impact reduction, and expanded dietary choices that align with personal values and lifestyle preferences. Nutritional benefits include reduced saturated fat intake, increased fiber consumption, and enhanced vitamin and mineral profiles compared to traditional animal-based alternatives.

Agricultural Stakeholders discover new crop opportunities, value-added processing potential, and sustainable farming practices that support environmental stewardship while generating economic returns. Supply chain integration creates opportunities for farmers to participate in higher-value plant-based ingredient production and processing activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Flavor Localization emerges as a critical trend with manufacturers developing plant-based products that incorporate traditional Mexican spices, seasonings, and flavor profiles. Culinary authenticity becomes essential for mainstream acceptance as consumers expect plant-based alternatives to complement familiar dishes and cooking methods rather than requiring dietary adaptation.

Functional Nutrition drives product development toward enhanced nutritional profiles that exceed conventional alternatives through protein fortification, vitamin supplementation, and superfood ingredient integration. Health positioning emphasizes specific benefits such as heart health, digestive wellness, and athletic performance to target distinct consumer segments with tailored messaging.

Sustainable Packaging reflects consumer environmental consciousness through biodegradable materials, reduced packaging waste, and recyclable containers that align with plant-based product sustainability messaging. Eco-friendly branding creates comprehensive sustainability stories that resonate with environmentally conscious consumers across all touchpoints.

Direct-to-Consumer Growth accelerates through e-commerce platforms, subscription services, and social media marketing that enable brands to build direct relationships with consumers while gathering valuable feedback for product development. Digital engagement facilitates consumer education, recipe sharing, and community building around plant-based lifestyle adoption.

Manufacturing Investments include new production facilities, equipment upgrades, and capacity expansion projects that support growing demand while improving operational efficiency. Technology adoption focuses on advanced processing methods, quality control systems, and automation solutions that enhance product consistency and reduce manufacturing costs.

Strategic Partnerships between international plant-based companies and Mexican manufacturers create market entry opportunities while providing local expertise and distribution access. Joint ventures combine global product development capabilities with regional market knowledge to accelerate growth and consumer acceptance.

Retail Expansion initiatives include dedicated plant-based sections in major supermarket chains, specialty store partnerships, and convenience store pilot programs that increase product accessibility. Merchandising innovations feature improved product placement, educational materials, and sampling programs that drive consumer trial and adoption.

Regulatory Developments encompass labeling standardization, nutritional claim guidelines, and food safety protocols that provide industry clarity while protecting consumer interests. Government initiatives supporting sustainable agriculture and healthy eating may create favorable policy environments for plant-based market development.

MarkWide Research recommends that companies prioritize taste optimization and price competitiveness to accelerate mainstream market adoption. Product development should focus on achieving taste parity with conventional alternatives while maintaining nutritional advantages that justify premium positioning among health-conscious consumers.

Distribution strategy should emphasize multi-channel approaches that combine modern trade expansion with traditional retail partnerships to maximize market coverage. Geographic expansion should prioritize secondary cities with growing middle-class populations and university communities that demonstrate higher plant-based adoption rates.

Consumer education initiatives require sustained investment in sampling programs, cooking demonstrations, and digital content that address taste concerns and preparation methods. Influencer partnerships with chefs, nutritionists, and lifestyle advocates can accelerate consumer awareness and trial among target demographics.

Supply chain optimization should focus on local ingredient sourcing, cold chain infrastructure development, and strategic inventory management to reduce costs while ensuring product quality and availability. Vertical integration opportunities may provide competitive advantages through better cost control and quality assurance.

Market trajectory indicates sustained growth momentum with accelerating mainstream adoption as product quality improvements and price reductions expand consumer accessibility. Demographic shifts favor continued expansion as younger generations with strong plant-based preferences represent increasing portions of the consumer base and purchasing power.

Innovation pipeline includes advanced protein technologies, improved texture solutions, and novel ingredient applications that will enhance product appeal and nutritional profiles. Manufacturing scale economies will gradually reduce production costs and enable more competitive pricing strategies that attract price-sensitive consumer segments.

MWR projections suggest the market will experience robust growth with compound annual growth rates exceeding 25% over the next five years, driven by expanding distribution, improving product quality, and increasing consumer acceptance. Category diversification will create opportunities in emerging segments including plant-based seafood alternatives, fermented products, and functional foods.

Industry maturation will bring consolidation opportunities, standardization improvements, and enhanced supply chain efficiency that support sustainable long-term growth. Export development may position Mexico as a regional hub for plant-based product manufacturing and distribution throughout Latin America, leveraging agricultural advantages and manufacturing expertise.

The Mexico plant based food and beverage industry market represents a transformative opportunity within the country’s evolving food landscape, driven by powerful demographic, health, and environmental trends that align with global sustainability movements. Market fundamentals demonstrate strong growth potential supported by increasing consumer awareness, improving product quality, and expanding distribution networks that collectively create favorable conditions for sustained expansion.

Strategic success in this dynamic market requires comprehensive understanding of local consumer preferences, investment in taste and texture optimization, and development of accessible pricing strategies that enable mainstream adoption. Industry participants who effectively balance innovation with cultural sensitivity while building robust distribution capabilities will capture the greatest opportunities in this rapidly evolving sector.

Long-term prospects remain highly positive as generational preferences, health consciousness, and environmental awareness continue driving consumer behavior toward plant-based alternatives. The Mexico plant based food and beverage industry market stands positioned for significant growth that will reshape the country’s food industry while contributing to global sustainability objectives and improved public health outcomes.

What is Plant Based Food & Beverage?

Plant Based Food & Beverage refers to products made primarily from plants, including fruits, vegetables, grains, nuts, and seeds, designed to provide alternatives to traditional animal-based food and drink options.

What are the key players in the Mexico Plant Based Food & Beverage Industry Market?

Key players in the Mexico Plant Based Food & Beverage Industry Market include companies like Alpro, Beyond Meat, and Oatly, which are known for their innovative plant-based products, among others.

What are the growth factors driving the Mexico Plant Based Food & Beverage Industry Market?

The Mexico Plant Based Food & Beverage Industry Market is driven by increasing consumer demand for healthier options, rising awareness of environmental sustainability, and the growing trend of veganism and vegetarianism.

What challenges does the Mexico Plant Based Food & Beverage Industry Market face?

Challenges in the Mexico Plant Based Food & Beverage Industry Market include competition from traditional food products, potential supply chain issues, and consumer skepticism regarding the taste and nutritional value of plant-based alternatives.

What opportunities exist in the Mexico Plant Based Food & Beverage Industry Market?

Opportunities in the Mexico Plant Based Food & Beverage Industry Market include expanding product lines to cater to diverse dietary preferences, increasing distribution channels, and leveraging social media for marketing to health-conscious consumers.

What trends are shaping the Mexico Plant Based Food & Beverage Industry Market?

Trends in the Mexico Plant Based Food & Beverage Industry Market include the rise of clean label products, innovative flavor profiles, and the incorporation of functional ingredients that enhance health benefits.

Mexico Plant Based Food & Beverage Industry Market

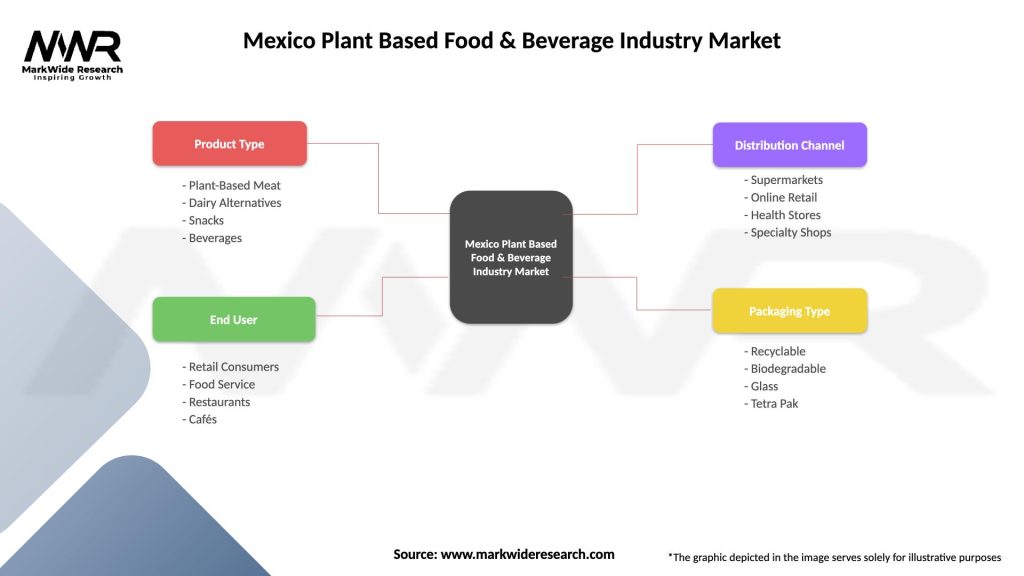

| Segmentation Details | Description |

|---|---|

| Product Type | Plant-Based Meat, Dairy Alternatives, Snacks, Beverages |

| End User | Retail Consumers, Food Service, Restaurants, Cafés |

| Distribution Channel | Supermarkets, Online Retail, Health Stores, Specialty Shops |

| Packaging Type | Recyclable, Biodegradable, Glass, Tetra Pak |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Plant Based Food & Beverage Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at