444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico OOH and DOOH market represents one of the most dynamic and rapidly evolving advertising landscapes in Latin America. Out-of-home advertising has undergone a significant transformation in Mexico, with traditional billboards and static displays increasingly being replaced by sophisticated digital out-of-home solutions. The market encompasses a diverse range of advertising formats, from traditional roadside billboards and transit advertising to cutting-edge digital displays and interactive kiosks positioned in high-traffic urban areas.

Digital transformation has become the cornerstone of Mexico’s OOH advertising evolution, with DOOH installations experiencing remarkable growth rates of approximately 12.5% annually. Major metropolitan areas including Mexico City, Guadalajara, and Monterrey have emerged as primary drivers of this digital advertising revolution. The integration of advanced technologies such as programmatic advertising, real-time content management, and audience analytics has positioned Mexico as a leading market for innovative outdoor advertising solutions in the region.

Market dynamics indicate that Mexico’s strategic geographic position, growing urbanization, and increasing consumer spending power have created favorable conditions for OOH and DOOH market expansion. The country’s robust retail sector, thriving tourism industry, and expanding transportation infrastructure have contributed to increased demand for strategic outdoor advertising placements. Advertiser adoption of digital outdoor solutions has accelerated significantly, with brands recognizing the enhanced targeting capabilities and measurable impact of DOOH campaigns.

The Mexico OOH and DOOH market refers to the comprehensive ecosystem of outdoor advertising solutions deployed across Mexican territories, encompassing both traditional static displays and advanced digital advertising platforms. Out-of-home advertising includes all advertising formats that reach consumers while they are outside their homes, including billboards, transit advertising, street furniture, and venue-based displays positioned in strategic locations throughout Mexico’s urban and suburban landscapes.

Digital out-of-home advertising represents the technological evolution of traditional outdoor advertising, incorporating LED displays, LCD screens, interactive kiosks, and smart advertising solutions capable of delivering dynamic, targeted content. These digital platforms enable real-time content updates, programmatic advertising capabilities, and sophisticated audience measurement tools that provide advertisers with unprecedented campaign optimization opportunities.

Market scope encompasses various advertising formats including roadside billboards, transit advertising systems, shopping mall displays, airport advertising networks, and urban furniture advertising solutions. The integration of mobile connectivity, IoT sensors, and data analytics platforms has transformed traditional outdoor advertising into a sophisticated, measurable, and highly targeted advertising medium that delivers enhanced return on investment for advertisers across diverse industry sectors.

Mexico’s OOH and DOOH market has established itself as a cornerstone of the country’s advertising landscape, driven by rapid urbanization, technological advancement, and evolving consumer behavior patterns. The market demonstrates robust growth momentum, with digital adoption rates reaching approximately 38% of total OOH inventory across major metropolitan areas. This digital transformation has been accelerated by advertiser demand for more flexible, measurable, and engaging outdoor advertising solutions.

Key market drivers include Mexico’s expanding middle class, increased infrastructure development, and growing retail sector expansion. The integration of programmatic advertising technologies has revolutionized campaign planning and execution, enabling advertisers to implement data-driven strategies that maximize audience reach and engagement. Mobile integration and interactive capabilities have enhanced the effectiveness of DOOH campaigns, creating seamless omnichannel advertising experiences.

Competitive landscape features a mix of international outdoor advertising companies and local market leaders who have established extensive networks across Mexico’s diverse geographic regions. The market benefits from supportive regulatory frameworks, continued infrastructure investment, and increasing recognition of outdoor advertising’s role in comprehensive marketing strategies. Future growth prospects remain strong, supported by ongoing urbanization trends and continued digital technology adoption across the advertising ecosystem.

Strategic market insights reveal several critical trends shaping Mexico’s OOH and DOOH landscape. The market demonstrates strong resilience and adaptability, with operators successfully navigating economic fluctuations while maintaining growth trajectories through innovative service offerings and strategic partnerships.

Urbanization acceleration serves as the primary driver of Mexico’s OOH and DOOH market expansion. The country’s continued urban population growth, with urban concentration rates reaching approximately 81% of total population, creates dense consumer audiences that make outdoor advertising highly effective and economically viable. Major metropolitan areas continue to expand, creating new high-traffic locations suitable for strategic advertising placements.

Digital technology advancement has revolutionized the outdoor advertising landscape, enabling operators to offer sophisticated targeting capabilities, real-time content management, and comprehensive performance analytics. The declining costs of LED display technology and improved energy efficiency have made digital outdoor advertising more accessible and profitable for operators across diverse market segments.

Consumer behavior evolution has increased the effectiveness of outdoor advertising, with mobile device integration creating opportunities for enhanced engagement and immediate response mechanisms. The growing importance of experiential marketing and brand awareness campaigns has positioned OOH and DOOH as essential components of comprehensive advertising strategies.

Economic growth and expanding consumer spending power have increased advertiser budgets allocated to outdoor advertising campaigns. The diversification of Mexico’s economy and growth in retail, tourism, and service sectors has created sustained demand for strategic outdoor advertising placements across various industry verticals.

Regulatory challenges present ongoing constraints for OOH and DOOH market expansion, with varying municipal regulations across different Mexican states creating complexity for operators seeking to establish comprehensive advertising networks. Permit acquisition processes can be time-consuming and costly, particularly for digital installations that require additional technical approvals and compliance certifications.

Infrastructure limitations in certain regions restrict the deployment of advanced DOOH solutions, particularly in areas with unreliable power supply or limited internet connectivity. The high initial capital investment required for digital display installations can be prohibitive for smaller operators or in markets with uncertain return on investment prospects.

Economic volatility can impact advertiser spending patterns, with outdoor advertising budgets often subject to reduction during economic downturns. Currency fluctuations affect the cost of imported display technology and equipment, creating pricing pressures for operators and potentially limiting market expansion in price-sensitive segments.

Competition from digital media continues to challenge traditional advertising allocation patterns, with some advertisers shifting budgets toward online and social media platforms. The need for continuous technology updates and maintenance of digital installations creates ongoing operational expenses that can impact profitability for DOOH operators.

Smart city initiatives across Mexico present significant opportunities for DOOH integration, with municipal governments increasingly recognizing the potential for digital advertising infrastructure to support urban communication and revenue generation. Public-private partnerships for smart city development create opportunities for innovative advertising solutions that combine commercial messaging with public information services.

Retail expansion throughout Mexico’s growing consumer markets creates demand for strategic advertising placements that support brand awareness and drive foot traffic to commercial locations. The development of new shopping centers, retail districts, and entertainment venues provides opportunities for comprehensive DOOH network deployment.

Transportation infrastructure development including new highways, airports, and public transit systems creates premium advertising inventory opportunities. The expansion of Mexico’s transportation networks increases the potential audience reach for outdoor advertising campaigns while creating new high-value advertising locations.

Technology integration opportunities include the development of interactive advertising experiences, augmented reality capabilities, and IoT-enabled audience measurement systems. Programmatic advertising expansion offers opportunities for automated campaign management and optimization, increasing operational efficiency while enhancing advertiser value propositions.

Competitive dynamics within Mexico’s OOH and DOOH market reflect a balance between established international operators and innovative local companies that understand regional market nuances. Market consolidation trends have created opportunities for strategic partnerships and acquisitions that enhance network coverage and operational efficiency.

Technology evolution continues to reshape market dynamics, with operators investing in advanced display technologies, content management systems, and audience analytics platforms. The integration of artificial intelligence and machine learning capabilities enables more sophisticated campaign optimization and audience targeting, creating competitive advantages for technologically advanced operators.

Advertiser expectations have evolved to demand greater campaign transparency, detailed performance metrics, and flexible content management capabilities. MarkWide Research analysis indicates that advertisers increasingly prioritize measurable outcomes and real-time campaign optimization capabilities when selecting outdoor advertising partners.

Regulatory evolution continues to shape market dynamics, with government agencies developing frameworks that balance commercial advertising opportunities with urban planning objectives and public interest considerations. The establishment of clear regulatory guidelines supports market growth while ensuring responsible development of outdoor advertising infrastructure.

Comprehensive market analysis for Mexico’s OOH and DOOH market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with industry stakeholders, including outdoor advertising operators, technology providers, advertisers, and regulatory officials across Mexico’s major metropolitan areas.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and financial information from publicly traded companies operating in Mexico’s outdoor advertising market. Market sizing methodologies utilize bottom-up analysis of advertising inventory, pricing trends, and utilization rates across different market segments and geographic regions.

Data validation processes include cross-referencing multiple information sources, conducting follow-up interviews with key market participants, and analyzing historical trends to ensure consistency and accuracy of market projections. Quantitative analysis incorporates statistical modeling techniques to identify market trends, growth patterns, and competitive dynamics.

Geographic coverage includes detailed analysis of major metropolitan markets including Mexico City, Guadalajara, Monterrey, Puebla, and Tijuana, as well as emerging markets in secondary cities. Segmentation analysis examines market dynamics across different advertising formats, technology types, and industry verticals to provide comprehensive market understanding.

Mexico City metropolitan area dominates the national OOH and DOOH market, accounting for approximately 42% of total market activity. The capital region’s dense population, extensive transportation networks, and concentration of commercial activity create ideal conditions for outdoor advertising deployment. Digital adoption rates in Mexico City exceed national averages, with premium locations featuring advanced DOOH installations that command premium pricing.

Guadalajara region represents the second-largest market, benefiting from strong economic growth, expanding industrial activity, and growing consumer spending power. The city’s strategic location and role as a technology hub have attracted significant investment in digital outdoor advertising infrastructure. Market share for Guadalajara reaches approximately 18% of national OOH activity.

Monterrey metropolitan area demonstrates strong market performance driven by industrial growth, cross-border trade activity, and expanding retail development. The region’s proximity to the United States creates opportunities for international advertising campaigns and premium brand placements. Northern border regions including Tijuana and Ciudad Juárez benefit from cross-border consumer traffic and international brand presence.

Emerging regional markets including Puebla, León, and Mérida show significant growth potential, with expanding urban populations and increasing commercial development creating new opportunities for outdoor advertising deployment. These secondary markets often offer attractive investment opportunities with lower competition and growing advertiser demand.

Market leadership in Mexico’s OOH and DOOH sector features a diverse mix of international outdoor advertising companies and established local operators who have built extensive networks across the country’s major markets. Competitive positioning is determined by factors including network coverage, technology capabilities, advertiser relationships, and operational efficiency.

Competitive strategies focus on network expansion, technology advancement, and service diversification to meet evolving advertiser requirements. Strategic partnerships between operators and technology providers enable enhanced service offerings and operational efficiency improvements.

Format-based segmentation reveals distinct market dynamics across different outdoor advertising categories. Billboard advertising continues to represent the largest segment, encompassing both traditional static displays and digital billboard installations positioned along major highways and urban arterials.

By Technology:

By Location Type:

Digital billboard category demonstrates the strongest growth momentum, with annual expansion rates reaching approximately 15.2% as advertisers increasingly recognize the flexibility and impact of dynamic digital content. Premium digital locations in major metropolitan areas command significant pricing premiums while delivering enhanced audience engagement and campaign effectiveness.

Transit advertising segment benefits from Mexico’s expanding public transportation infrastructure and growing urban mobility requirements. Airport advertising represents a particularly attractive category, with Mexico’s growing tourism industry and business travel creating high-value audience opportunities for premium brand campaigns.

Shopping center advertising has evolved to incorporate advanced digital displays and interactive experiences that enhance the retail environment while providing targeted advertising opportunities. Integration with mobile technology enables seamless omnichannel campaigns that bridge outdoor advertising with digital marketing initiatives.

Street furniture advertising continues to provide consistent revenue streams while offering opportunities for digital upgrade and enhanced functionality. Smart city integration creates opportunities for advertising solutions that combine commercial messaging with public information services, creating additional value for municipal partners.

Advertisers benefit from Mexico’s OOH and DOOH market through enhanced brand visibility, targeted audience reach, and measurable campaign performance. Digital capabilities enable real-time campaign optimization, dynamic content delivery, and sophisticated audience analytics that maximize advertising return on investment.

Media operators enjoy multiple revenue streams, scalable business models, and opportunities for technology-driven service differentiation. Digital transformation enables operators to offer premium services, automated campaign management, and comprehensive performance reporting that enhance client relationships and support pricing optimization.

Technology providers benefit from growing demand for advanced display systems, content management platforms, and audience analytics solutions. Innovation opportunities include development of interactive advertising experiences, AI-powered content optimization, and IoT-enabled audience measurement systems.

Municipal governments gain from outdoor advertising through permit revenues, enhanced urban communication capabilities, and opportunities for public-private partnerships that support smart city initiatives. Regulatory frameworks that balance commercial opportunities with urban planning objectives create sustainable market growth while supporting public interests.

Strengths:

Weaknesses:

Opportunities:

Threats:

Programmatic advertising integration represents the most significant trend reshaping Mexico’s OOH and DOOH market, with automated buying platforms enabling real-time campaign optimization and enhanced targeting precision. Data-driven advertising approaches are becoming standard practice, with operators investing in sophisticated audience analytics and performance measurement capabilities.

Mobile integration trends continue to evolve, with DOOH campaigns increasingly incorporating QR codes, NFC technology, and location-based mobile advertising to create seamless omnichannel experiences. Interactive advertising experiences are gaining popularity, particularly in high-traffic retail and entertainment venues where consumer engagement opportunities are maximized.

Sustainability initiatives are becoming increasingly important, with operators investing in energy-efficient LED displays, solar power systems, and environmentally responsible advertising practices. MWR research indicates that sustainability considerations are influencing advertiser partner selection and municipal permit approval processes.

Content personalization capabilities are advancing rapidly, with AI-powered systems enabling dynamic content optimization based on audience demographics, weather conditions, traffic patterns, and real-time events. Cross-platform integration trends include coordination between outdoor advertising campaigns and social media, online advertising, and mobile marketing initiatives.

Technology partnerships between outdoor advertising operators and leading technology companies have accelerated the deployment of advanced DOOH solutions across Mexico’s major markets. Strategic acquisitions have consolidated market leadership while expanding network coverage and operational capabilities.

Regulatory developments include the establishment of clearer guidelines for digital advertising installations and streamlined permit processes in several major metropolitan areas. Municipal partnerships for smart city initiatives have created new opportunities for integrated advertising and public information systems.

Infrastructure investments by major operators include comprehensive network upgrades, advanced content management systems, and sophisticated audience measurement platforms. International expansion by Mexican operators into other Latin American markets demonstrates the maturity and expertise developed within the domestic market.

Innovation initiatives include pilot programs for augmented reality advertising experiences, voice-activated interactive displays, and AI-powered content optimization systems. Sustainability programs encompass renewable energy adoption, recycling initiatives, and carbon footprint reduction strategies across major operator networks.

Strategic recommendations for market participants include prioritizing digital transformation initiatives that enhance operational efficiency and advertiser value propositions. Investment priorities should focus on advanced display technologies, programmatic advertising capabilities, and comprehensive audience analytics platforms that support data-driven campaign optimization.

Geographic expansion strategies should target emerging secondary markets where competition is limited and growth potential remains strong. Partnership development with retail chains, transportation authorities, and municipal governments can create sustainable competitive advantages and revenue diversification opportunities.

Technology adoption should emphasize solutions that enable automated campaign management, real-time content optimization, and detailed performance reporting. MarkWide Research analysis suggests that operators investing in advanced technology capabilities achieve superior financial performance and client retention rates.

Regulatory engagement remains critical for sustainable market development, with operators encouraged to participate actively in policy development processes and maintain positive relationships with municipal authorities. Sustainability initiatives should be integrated into core business strategies to meet evolving stakeholder expectations and regulatory requirements.

Long-term growth prospects for Mexico’s OOH and DOOH market remain highly positive, supported by continued urbanization, economic development, and technology advancement. Digital adoption rates are projected to reach approximately 55% of total inventory within the next five years, driven by declining technology costs and increasing advertiser demand for dynamic content capabilities.

Market evolution will be characterized by increased integration with digital marketing ecosystems, enhanced audience targeting capabilities, and sophisticated performance measurement systems. Smart city initiatives are expected to create new opportunities for innovative advertising solutions that combine commercial messaging with public services.

Technology trends including artificial intelligence, augmented reality, and IoT integration will continue to enhance the effectiveness and appeal of outdoor advertising solutions. Programmatic advertising adoption is expected to accelerate, with automated buying platforms becoming standard practice for campaign management and optimization.

Competitive dynamics will likely favor operators with strong technology capabilities, comprehensive network coverage, and sophisticated service offerings. Market consolidation may continue as operators seek to achieve economies of scale and enhance their competitive positioning in an increasingly sophisticated marketplace.

Mexico’s OOH and DOOH market represents a dynamic and rapidly evolving advertising landscape that offers significant opportunities for growth and innovation. The market’s transformation from traditional static displays to sophisticated digital advertising platforms reflects broader trends in technology adoption, consumer behavior evolution, and advertiser demand for measurable, targeted advertising solutions.

Key success factors for market participants include strategic technology investment, comprehensive network development, and strong relationships with advertisers and regulatory authorities. The integration of advanced analytics, programmatic advertising capabilities, and mobile connectivity creates opportunities for enhanced campaign effectiveness and operational efficiency.

Future market development will be driven by continued urbanization, economic growth, and technology advancement, with digital solutions becoming increasingly dominant across all market segments. The emphasis on sustainability, smart city integration, and data-driven advertising approaches will shape competitive strategies and investment priorities for operators seeking long-term market leadership in Mexico’s evolving OOH and DOOH landscape.

What is OOH and DOOH?

OOH stands for Out-Of-Home advertising, which includes any advertising that reaches the consumer while they are outside their home. DOOH, or Digital Out-Of-Home, refers to digital displays used in public spaces to deliver advertising content, enhancing engagement through dynamic visuals.

What are the key players in the Mexico OOH And DOOH Market?

Key players in the Mexico OOH And DOOH Market include companies like Grupo Expansión, Clear Channel Outdoor, and JCDecaux, which provide various advertising solutions across urban environments and transportation hubs, among others.

What are the growth factors driving the Mexico OOH And DOOH Market?

The Mexico OOH And DOOH Market is driven by increasing urbanization, the rise of digital technology, and the growing demand for targeted advertising. Additionally, the integration of data analytics in advertising strategies enhances campaign effectiveness.

What challenges does the Mexico OOH And DOOH Market face?

The Mexico OOH And DOOH Market faces challenges such as regulatory restrictions on outdoor advertising, competition from digital media, and the need for continuous innovation to capture consumer attention in a crowded marketplace.

What opportunities exist in the Mexico OOH And DOOH Market?

Opportunities in the Mexico OOH And DOOH Market include the expansion of smart city initiatives, increased investment in digital infrastructure, and the potential for interactive advertising experiences that engage consumers more effectively.

What trends are shaping the Mexico OOH And DOOH Market?

Trends shaping the Mexico OOH And DOOH Market include the growing use of programmatic advertising, the incorporation of augmented reality in campaigns, and the shift towards sustainability in advertising practices, reflecting consumer preferences for eco-friendly solutions.

Mexico OOH And DOOH Market

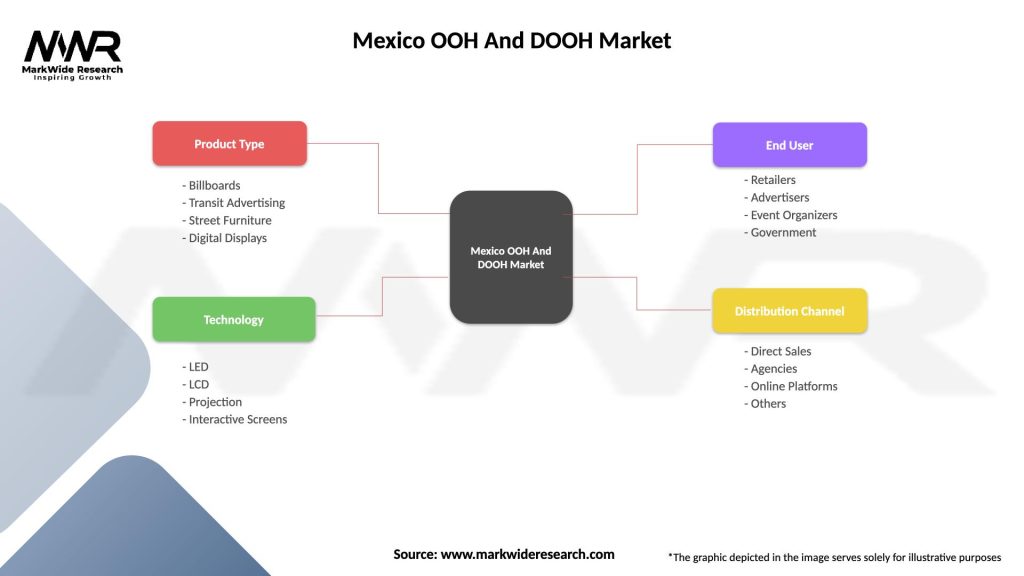

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Street Furniture, Digital Displays |

| Technology | LED, LCD, Projection, Interactive Screens |

| End User | Retailers, Advertisers, Event Organizers, Government |

| Distribution Channel | Direct Sales, Agencies, Online Platforms, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico OOH And DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at