444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico MVNO market represents a dynamic and rapidly evolving segment of the country’s telecommunications landscape, characterized by innovative service offerings and competitive pricing strategies. Mobile Virtual Network Operators in Mexico have emerged as significant disruptors, leveraging existing network infrastructure to provide specialized telecommunications services without owning physical network assets. The market demonstrates robust growth potential, with MVNO penetration rates reaching approximately 12% of the total mobile subscriber base, indicating substantial room for expansion compared to mature markets.

Market dynamics in Mexico’s MVNO sector are driven by increasing consumer demand for affordable mobile services, regulatory support for market competition, and technological advancements in network virtualization. The sector benefits from Mexico’s large population base of over 128 million people and growing smartphone adoption rates exceeding 85% among mobile users. Digital transformation initiatives across various industries have created new opportunities for specialized MVNO services targeting specific customer segments and use cases.

Competitive landscape features both domestic and international players, with established telecommunications companies, technology firms, and startup ventures entering the market through various business models. The regulatory environment, overseen by the Federal Telecommunications Institute (IFT), continues to evolve to support market competition while ensuring service quality and consumer protection standards.

The Mexico MVNO market refers to the ecosystem of mobile virtual network operators that provide telecommunications services to Mexican consumers and businesses without owning the underlying radio spectrum or network infrastructure. MVNOs operate by purchasing wholesale access to network capacity from established mobile network operators (MNOs) and then reselling these services under their own brand names with differentiated value propositions.

Virtual network operators in Mexico typically focus on specific market segments, offering specialized services such as prepaid plans for price-sensitive consumers, enterprise solutions for businesses, or niche services for particular demographics. These operators leverage their agility and focused approach to compete effectively against traditional carriers by providing innovative pricing models, enhanced customer service, or unique service bundles.

Business models within the Mexican MVNO market vary significantly, ranging from full MVNOs that maintain complete control over their customer relationships and billing systems to light MVNOs that primarily focus on marketing and customer acquisition while relying on host network operators for technical operations.

Mexico’s MVNO market demonstrates exceptional growth momentum, driven by favorable regulatory conditions, increasing consumer price sensitivity, and expanding opportunities in enterprise and IoT segments. The market benefits from Mexico’s position as Latin America’s second-largest economy and its growing digital economy, which creates demand for innovative telecommunications solutions.

Key growth drivers include the government’s commitment to telecommunications infrastructure development, rising smartphone penetration rates, and increasing demand for data services. The market shows particular strength in prepaid services, which account for approximately 78% of total mobile subscriptions in Mexico, creating opportunities for MVNOs to offer competitive alternatives to traditional carriers.

Technological advancement in areas such as 5G network deployment, edge computing, and IoT connectivity presents new opportunities for specialized MVNO services. The market also benefits from Mexico’s strategic location for serving both domestic and regional markets, with several MVNOs exploring expansion opportunities across Latin America.

Investment activity in the sector remains robust, with both domestic and international investors recognizing the potential for disruptive business models in Mexico’s telecommunications market. The regulatory framework continues to support market competition while ensuring adequate consumer protection and service quality standards.

Strategic positioning within Mexico’s MVNO market reveals several critical insights that define the competitive landscape and growth opportunities:

Regulatory environment serves as a primary catalyst for Mexico’s MVNO market growth, with the Federal Telecommunications Institute implementing policies that promote competition and reduce barriers to market entry. Wholesale access regulations ensure that MVNOs can obtain network capacity at competitive rates, enabling sustainable business models and encouraging innovation in service delivery.

Consumer demand patterns strongly favor affordable telecommunications services, with Mexican consumers demonstrating high price sensitivity and willingness to switch providers for better value propositions. This market dynamic creates substantial opportunities for MVNOs to capture market share through competitive pricing strategies and innovative service bundles that address specific customer needs.

Technological infrastructure development across Mexico supports MVNO growth through improved network quality, expanded coverage areas, and enhanced service capabilities. The ongoing deployment of 4G and 5G networks provides MVNOs with access to advanced telecommunications technologies that enable new service offerings and improved customer experiences.

Digital transformation initiatives across various industry sectors create demand for specialized connectivity solutions that traditional carriers may not adequately address. MVNOs can leverage their agility and focus to develop tailored services for specific industries, such as agriculture, manufacturing, and retail, driving market expansion and revenue growth.

Economic growth in Mexico’s digital economy generates increased demand for mobile data services, cloud connectivity, and IoT applications. This economic expansion creates opportunities for MVNOs to serve emerging market segments and develop innovative service models that capitalize on growing digital adoption rates.

Infrastructure dependencies represent a significant constraint for Mexico’s MVNO market, as virtual operators must rely on host network operators for network access and service quality. This dependency can limit MVNOs’ ability to differentiate their services and may result in service disruptions or quality issues beyond their direct control.

Regulatory complexity in Mexico’s telecommunications sector can create challenges for new market entrants, particularly smaller MVNOs that may lack the resources to navigate complex compliance requirements. Evolving regulations and licensing procedures can increase operational costs and create uncertainty for business planning and investment decisions.

Market saturation concerns in certain segments, particularly in urban areas with high mobile penetration rates, may limit growth opportunities for new MVNO entrants. Intense competition among existing operators can result in price pressures and reduced profit margins, making it challenging for smaller players to achieve sustainable profitability.

Capital requirements for establishing and scaling MVNO operations can be substantial, particularly for operators seeking to develop comprehensive service offerings or expand into multiple market segments. Limited access to financing and investment capital may constrain growth opportunities for emerging MVNO operators.

Technical complexity associated with MVNO operations, including billing systems, customer management platforms, and network integration requirements, can create operational challenges and increase costs for market participants. These technical requirements may limit the ability of smaller operators to compete effectively against established players.

Enterprise connectivity solutions present substantial growth opportunities for Mexican MVNOs, as businesses increasingly seek specialized telecommunications services that address specific operational requirements. IoT connectivity services for industrial applications, fleet management, and smart city initiatives represent particularly promising market segments with high growth potential and attractive profit margins.

Financial services integration offers significant opportunities for MVNOs to develop comprehensive service offerings that combine telecommunications and fintech capabilities. Mexico’s large unbanked population and growing adoption of digital payment solutions create demand for integrated services that can address both connectivity and financial inclusion needs.

Rural market expansion represents a substantial untapped opportunity, as many rural areas in Mexico remain underserved by traditional telecommunications providers. MVNOs can develop specialized service models and pricing strategies that make mobile services more accessible to rural communities while generating sustainable revenue streams.

Cross-border services leverage Mexico’s strategic geographic position to serve customers with connectivity needs spanning multiple countries. This opportunity is particularly relevant for businesses engaged in international trade and individuals with cross-border mobility requirements.

Vertical market specialization enables MVNOs to develop deep expertise in specific industries such as agriculture, mining, tourism, or healthcare. By focusing on particular sectors, MVNOs can create highly differentiated service offerings that command premium pricing and generate strong customer loyalty.

Competitive intensity within Mexico’s MVNO market continues to increase as new entrants recognize the sector’s growth potential and established players expand their service offerings. This competitive environment drives innovation in pricing models, service delivery, and customer experience, ultimately benefiting consumers through improved value propositions and service quality.

Technology evolution significantly impacts market dynamics, with advances in network virtualization, cloud computing, and artificial intelligence enabling MVNOs to develop more sophisticated and cost-effective service offerings. 5G network deployment creates new opportunities for high-value services while also increasing the complexity and cost of network operations.

Customer expectations continue to evolve, with Mexican consumers increasingly demanding seamless digital experiences, flexible service plans, and responsive customer support. MVNOs must continuously adapt their service offerings and operational capabilities to meet these changing expectations while maintaining competitive pricing.

Partnership strategies play an increasingly important role in market dynamics, as MVNOs seek to leverage relationships with technology providers, content companies, and other service providers to create differentiated value propositions. Strategic partnerships enable MVNOs to access new capabilities and market segments without significant capital investment.

Regulatory evolution continues to shape market dynamics, with ongoing policy developments affecting wholesale access terms, spectrum allocation, and consumer protection requirements. MVNOs must remain agile in responding to regulatory changes while advocating for policies that support market competition and innovation.

Comprehensive market analysis for Mexico’s MVNO sector employs multiple research methodologies to ensure accurate and actionable insights. Primary research activities include extensive interviews with industry executives, regulatory officials, and market participants to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of regulatory filings, financial reports, industry publications, and government statistics to establish quantitative baselines and identify market patterns. This research approach ensures comprehensive coverage of market dynamics while maintaining objectivity and analytical rigor.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings and assumptions. This methodology ensures that research conclusions are based on reliable and current information that accurately reflects market conditions.

Market modeling techniques utilize statistical analysis and forecasting methods to project future market trends and identify potential growth scenarios. These analytical approaches consider various factors including regulatory changes, technological developments, and economic conditions that may impact market evolution.

Stakeholder engagement throughout the research process ensures that findings reflect the perspectives and experiences of various market participants, including MVNO operators, network providers, regulators, and end customers. This comprehensive approach provides a balanced and nuanced understanding of market dynamics.

Mexico City metropolitan area represents the largest and most competitive segment of the country’s MVNO market, accounting for approximately 35% of total MVNO subscribers. The region’s high population density, advanced telecommunications infrastructure, and concentrated business activity create favorable conditions for MVNO operations and service innovation.

Northern border states including Nuevo León, Chihuahua, and Tamaulipas demonstrate strong MVNO adoption rates driven by cross-border business activity and higher income levels. These regions benefit from proximity to the United States market and advanced manufacturing sectors that generate demand for specialized connectivity solutions.

Central Mexico regions encompassing states such as Jalisco, Puebla, and Estado de México show significant growth potential for MVNO services, supported by expanding urban populations and growing industrial activity. The region’s diverse economic base creates opportunities for both consumer and enterprise-focused MVNO services.

Southern and southeastern states present emerging opportunities for MVNO expansion, particularly in serving underserved rural communities and supporting agricultural and tourism sectors. While these regions currently represent smaller market shares, they offer substantial long-term growth potential as telecommunications infrastructure continues to expand.

Coastal regions along both Pacific and Gulf coasts demonstrate unique market characteristics driven by tourism, fishing, and energy industries. MVNOs can develop specialized services for these sectors while also serving the growing residential populations in coastal urban centers.

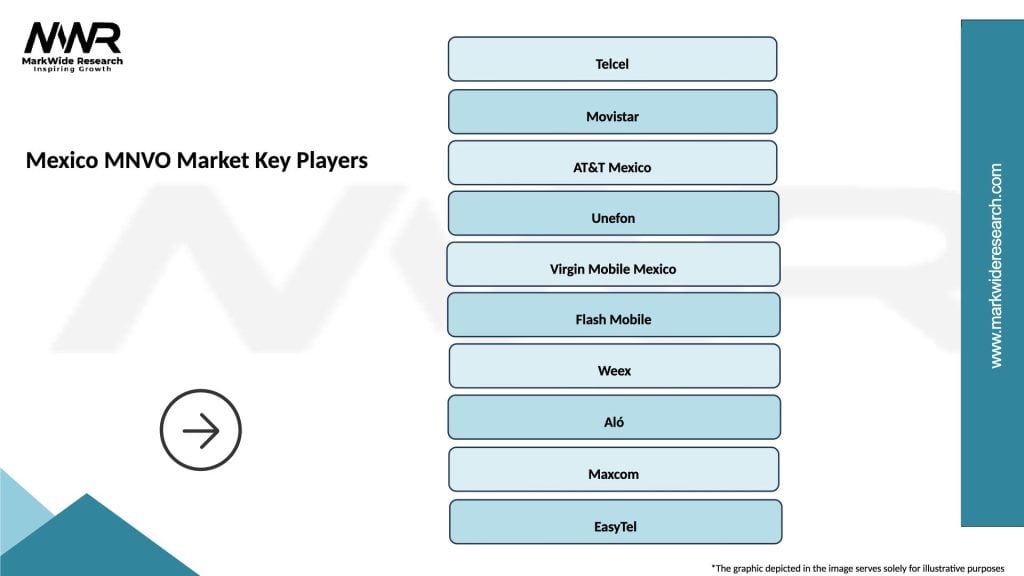

Market leadership in Mexico’s MVNO sector features a diverse mix of operators with varying business models and market positioning strategies:

Competitive strategies vary significantly among market participants, with some operators focusing on price competition while others emphasize service differentiation, customer experience, or specialized market segments. The competitive landscape continues to evolve as new entrants identify market opportunities and existing players adapt their strategies.

Market consolidation trends are beginning to emerge as smaller operators seek partnerships or acquisition opportunities to achieve greater scale and operational efficiency. This consolidation activity may reshape the competitive landscape while creating opportunities for remaining independent operators to capture market share.

By Service Type:

By Technology Platform:

By Customer Segment:

Consumer MVNO services dominate the Mexican market, with operators focusing on competitive pricing and simplified service offerings to attract price-sensitive customers. This segment benefits from high smartphone adoption rates and increasing data consumption patterns, creating opportunities for MVNOs to offer attractive data packages and digital services.

Enterprise MVNO solutions represent a high-growth segment with significant profit potential, as businesses increasingly seek specialized connectivity services that traditional carriers may not adequately address. IoT connectivity services within this category show particularly strong growth, with adoption rates increasing by approximately 40% annually across various industry sectors.

Wholesale MVNO services provide essential infrastructure access for smaller operators and specialized service providers, creating a foundation for market competition and innovation. This segment enables new market entrants to launch services without significant infrastructure investment while providing revenue opportunities for network operators.

Niche market services targeting specific demographics or use cases demonstrate strong growth potential, with operators developing specialized offerings for sectors such as agriculture, tourism, and cross-border commerce. These focused approaches enable MVNOs to command premium pricing while building strong customer relationships.

Hybrid service models combining telecommunications with other services such as financial products, content, or e-commerce create additional value streams and competitive differentiation. According to MarkWide Research analysis, integrated service offerings show customer retention rates exceeding 85% compared to traditional telecommunications-only services.

MVNO operators benefit from reduced capital requirements compared to traditional network operators, enabling faster market entry and more agile service development. This operational model allows MVNOs to focus resources on customer acquisition, service innovation, and market differentiation rather than infrastructure investment and maintenance.

Consumers gain access to more competitive pricing, innovative service offerings, and specialized solutions that address specific needs and preferences. The increased competition in Mexico’s telecommunications market resulting from MVNO participation drives overall service quality improvements and pricing benefits across the sector.

Enterprise customers benefit from specialized connectivity solutions that traditional carriers may not provide, including customized service levels, dedicated support, and integrated technology platforms. MVNOs can offer more flexible and responsive service delivery models that align with specific business requirements and operational needs.

Network operators generate additional revenue streams through wholesale services while maximizing utilization of their infrastructure investments. This wholesale model enables network operators to serve market segments they might not otherwise address directly while maintaining focus on their core operations.

Technology providers find new market opportunities through partnerships with MVNOs seeking to differentiate their services through innovative technology integration. These relationships create demand for specialized platforms, applications, and services that support MVNO operations and customer experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration across Mexican businesses and consumers drives increased demand for advanced connectivity solutions and integrated digital services. MVNOs are responding by developing comprehensive service portfolios that combine traditional telecommunications with cloud services, digital applications, and IoT connectivity.

5G network deployment creates new opportunities for MVNOs to offer high-speed, low-latency services that enable advanced applications such as augmented reality, autonomous systems, and real-time analytics. Early adopters in the MVNO sector are positioning themselves to capitalize on these emerging technology capabilities.

Sustainability focus influences MVNO operations and service development, with operators implementing environmentally responsible practices and offering services that support customer sustainability goals. This trend includes energy-efficient network operations and services that enable remote work and digital collaboration.

Financial services integration represents a significant trend, with MVNOs partnering with fintech companies or developing their own financial service capabilities to serve Mexico’s large unbanked population. These integrated offerings create additional revenue streams while addressing important social and economic needs.

Artificial intelligence adoption in MVNO operations improves customer service, network optimization, and service personalization. AI-powered systems enable MVNOs to operate more efficiently while providing enhanced customer experiences that differentiate their services from traditional carriers.

Regulatory framework evolution continues to shape Mexico’s MVNO market, with recent policy changes designed to promote competition and improve consumer access to telecommunications services. The Federal Telecommunications Institute has implemented new wholesale access regulations that provide MVNOs with better terms and conditions for network access.

Infrastructure investment acceleration by major network operators creates improved conditions for MVNO operations, with enhanced network coverage and capacity supporting better service quality and new service opportunities. These infrastructure improvements particularly benefit rural and underserved areas where MVNOs can provide essential connectivity services.

International expansion initiatives by successful Mexican MVNOs demonstrate the sector’s maturity and growth potential, with several operators exploring opportunities in other Latin American markets. These expansion efforts leverage operational expertise developed in Mexico while accessing new customer bases and revenue opportunities.

Technology partnership agreements between MVNOs and international technology providers bring advanced capabilities and global best practices to the Mexican market. These partnerships enable local operators to offer sophisticated services while benefiting from proven technologies and operational models.

Merger and acquisition activity in the sector reflects ongoing market consolidation trends, with larger operators acquiring smaller competitors to achieve greater scale and market coverage. This consolidation activity creates opportunities for remaining independent operators while potentially reducing overall market competition.

Market entry strategies for new MVNO operators should focus on identifying underserved market segments or developing highly differentiated service offerings that address specific customer needs. MWR analysis indicates that successful market entrants typically achieve customer acquisition rates exceeding 15% annually by focusing on niche markets rather than competing directly with established players.

Technology investment priorities should emphasize customer experience platforms, automated operations systems, and data analytics capabilities that enable efficient operations and personalized service delivery. These technology investments provide competitive advantages while supporting scalable business growth.

Partnership development represents a critical success factor for MVNO operators, with strategic alliances enabling access to new capabilities, market segments, and revenue opportunities. Successful partnerships should align with core business objectives while providing mutual benefits for all participants.

Regulatory engagement requires ongoing attention from MVNO operators to ensure favorable policy development and compliance with evolving requirements. Active participation in industry associations and regulatory proceedings helps protect operator interests while contributing to positive market development.

Customer retention strategies should focus on service quality, customer support excellence, and value-added services that create switching costs and build customer loyalty. Operators achieving high retention rates typically invest significantly in customer experience and service differentiation.

Growth trajectory for Mexico’s MVNO market remains strongly positive, with continued expansion expected across all major market segments. Market penetration rates are projected to reach 20% of total mobile subscribers within the next five years, driven by increasing consumer acceptance and expanding service offerings.

Technology evolution will continue to create new opportunities for MVNO operators, particularly in areas such as 5G services, IoT connectivity, and edge computing applications. Early adopters of these technologies are expected to capture significant market share and establish competitive advantages in high-value market segments.

Market consolidation trends are likely to continue, with successful operators expanding through organic growth and strategic acquisitions. This consolidation will create larger, more capable MVNO operators while potentially reducing the total number of market participants.

International expansion opportunities will become increasingly attractive for successful Mexican MVNO operators, with the potential to leverage operational expertise and technology platforms across multiple Latin American markets. These expansion initiatives could significantly increase the scale and scope of leading operators.

Regulatory support for market competition is expected to continue, with ongoing policy development designed to promote innovation and consumer choice in Mexico’s telecommunications sector. This supportive regulatory environment provides a foundation for continued MVNO market growth and development.

Mexico’s MVNO market represents a dynamic and rapidly growing segment of the country’s telecommunications industry, characterized by innovation, competition, and significant growth potential. The market benefits from favorable regulatory conditions, increasing consumer demand for affordable services, and expanding opportunities in enterprise and IoT segments.

Key success factors for MVNO operators include strategic market positioning, technology investment, customer experience excellence, and effective partnership development. Operators that successfully address these factors are well-positioned to capture market share and achieve sustainable profitability in Mexico’s competitive telecommunications environment.

Future prospects for the sector remain highly positive, with continued growth expected across all major market segments and new opportunities emerging from technological advancement and market evolution. The Mexico MVNO market is positioned to play an increasingly important role in the country’s telecommunications landscape while contributing to improved service access and competition for Mexican consumers and businesses.

What is MNVO?

MNVO stands for Mobile Network Virtual Operator, which refers to a telecommunications service provider that does not own its own network infrastructure but instead leases network access from existing mobile network operators. This model allows MNVOs to offer mobile services under their own brand while utilizing the infrastructure of established carriers.

What are the key players in the Mexico MNVO Market?

The Mexico MNVO Market features several key players, including companies like Virgin Mobile, Unefon, and FreedomPop. These companies leverage existing network infrastructure to provide competitive mobile services, targeting various consumer segments and needs, among others.

What are the growth factors driving the Mexico MNVO Market?

The Mexico MNVO Market is driven by factors such as increasing smartphone penetration, a growing demand for affordable mobile services, and the rise of digital communication. Additionally, the flexibility and customization offered by MNVOs attract a diverse range of consumers.

What challenges does the Mexico MNVO Market face?

The Mexico MNVO Market faces challenges such as intense competition from established mobile network operators and regulatory hurdles that can impact operational flexibility. Additionally, customer retention can be difficult in a market with numerous options available to consumers.

What opportunities exist in the Mexico MNVO Market?

The Mexico MNVO Market presents opportunities for growth through niche targeting, such as catering to specific demographics or offering unique service bundles. Innovations in mobile technology and partnerships with content providers can also enhance service offerings and attract new customers.

What trends are shaping the Mexico MNVO Market?

Trends in the Mexico MNVO Market include the increasing adoption of eSIM technology, which allows for easier switching between providers, and the rise of data-centric plans that cater to the growing demand for mobile internet. Additionally, sustainability initiatives are becoming more prominent as consumers seek eco-friendly options.

Mexico MNVO Market

| Segmentation Details | Description |

|---|---|

| Service Type | Voice, Data, SMS, Roaming |

| Customer Type | Prepaid, Postpaid, Enterprise, Individual |

| Technology | GSM, CDMA, LTE, 5G |

| Distribution Channel | Retail Stores, Online, Wholesalers, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico MNVO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at