444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico glaucoma surgery market represents a rapidly evolving segment within the country’s ophthalmology healthcare sector, driven by increasing awareness of glaucoma as a leading cause of irreversible blindness. Glaucoma surgery encompasses various surgical interventions designed to reduce intraocular pressure and preserve vision in patients with this progressive eye condition. The Mexican healthcare landscape has witnessed significant transformation in recent years, with enhanced focus on specialized ophthalmic procedures and advanced surgical technologies.

Market dynamics in Mexico reflect a growing demand for both traditional and minimally invasive glaucoma surgical procedures. The adoption rate of modern glaucoma surgery techniques has increased by approximately 12% annually, indicating strong market momentum. Healthcare infrastructure improvements across major metropolitan areas, including Mexico City, Guadalajara, and Monterrey, have facilitated better access to specialized glaucoma treatment centers.

Demographic trends significantly influence market development, with Mexico’s aging population contributing to higher glaucoma prevalence rates. The country’s healthcare system has responded with increased investment in ophthalmic equipment and specialized training programs for surgeons. Private healthcare facilities have emerged as key drivers of market growth, offering advanced surgical options and shorter waiting times compared to public institutions.

The Mexico glaucoma surgery market refers to the comprehensive ecosystem of surgical interventions, medical devices, healthcare facilities, and professional services dedicated to treating glaucoma through operative procedures within Mexico’s healthcare system. Glaucoma surgery encompasses various techniques including trabeculectomy, tube shunt procedures, laser treatments, and minimally invasive glaucoma surgery (MIGS) designed to lower intraocular pressure and prevent vision loss.

Market scope includes both the public and private healthcare sectors, encompassing hospitals, specialized eye clinics, ambulatory surgical centers, and academic medical institutions. The market involves multiple stakeholders including ophthalmic surgeons, medical device manufacturers, pharmaceutical companies providing adjunctive therapies, and healthcare administrators managing surgical programs.

Technological integration within this market includes advanced surgical instruments, intraocular pressure monitoring devices, imaging systems for surgical planning, and post-operative care equipment. The market also encompasses training and education services, surgical consumables, and ongoing patient management systems that support comprehensive glaucoma care throughout Mexico.

Market performance in Mexico’s glaucoma surgery sector demonstrates robust growth driven by increasing disease prevalence, technological advancement, and improved healthcare accessibility. The market has experienced steady expansion with surgical volume growth rates reaching approximately 8.5% annually across major metropolitan areas. Private healthcare facilities have captured significant market share by offering advanced surgical options and reduced waiting times.

Key market drivers include rising awareness of glaucoma as a silent vision thief, government initiatives to improve eye care access, and increasing adoption of minimally invasive surgical techniques. The integration of advanced technologies such as micro-invasive glaucoma surgery devices has enhanced treatment outcomes and patient satisfaction rates. Healthcare infrastructure development has facilitated market expansion beyond traditional urban centers.

Competitive landscape features both international medical device companies and domestic healthcare providers working to establish comprehensive glaucoma surgery programs. Market penetration of advanced surgical technologies has reached approximately 35% in major cities, with continued expansion expected in secondary markets. Regulatory environment improvements have streamlined device approval processes and enhanced market accessibility for innovative surgical solutions.

Primary market insights reveal several critical factors shaping Mexico’s glaucoma surgery landscape:

Demographic transformation serves as the primary driver of Mexico’s glaucoma surgery market growth. The country’s rapidly aging population, combined with increased life expectancy, has resulted in higher glaucoma prevalence rates across all socioeconomic segments. Healthcare awareness campaigns have significantly improved early detection rates, leading to more timely surgical interventions and better patient outcomes.

Technological advancement in surgical techniques has revolutionized glaucoma treatment options available to Mexican patients. The introduction of micro-invasive glaucoma surgery (MIGS) devices has provided surgeons with less traumatic alternatives to traditional procedures. Medical device accessibility has improved through enhanced distribution networks and regulatory streamlining, making advanced surgical tools more readily available.

Healthcare infrastructure development across Mexico has facilitated market expansion through improved surgical facilities and specialized equipment availability. Government initiatives to modernize healthcare delivery systems have supported the establishment of dedicated eye care centers. Private sector investment has accelerated the adoption of cutting-edge surgical technologies and enhanced patient care capabilities.

Medical tourism growth has emerged as a significant market driver, with international patients seeking high-quality, cost-effective glaucoma surgery in Mexico. The combination of skilled surgeons, modern facilities, and competitive pricing has attracted patients from North America and other regions. Insurance coverage expansion has also improved access to surgical treatments for Mexican citizens through both public and private healthcare plans.

Economic constraints represent a significant challenge for market expansion, particularly in rural and underserved communities where access to specialized surgical care remains limited. The high cost of advanced surgical equipment and ongoing maintenance requirements can strain healthcare facility budgets. Healthcare disparities between urban and rural areas continue to limit equitable access to glaucoma surgery across Mexico’s diverse geographic landscape.

Surgeon availability remains a critical restraint, with specialized glaucoma surgeons concentrated primarily in major metropolitan areas. The lengthy training requirements for advanced surgical techniques create bottlenecks in expanding surgical capacity. Infrastructure limitations in smaller cities and rural regions restrict the establishment of comprehensive glaucoma surgery programs.

Regulatory complexities can delay the introduction of innovative surgical devices and technologies, potentially limiting treatment options for patients and surgeons. Import regulations and approval processes for medical devices may create barriers to accessing the latest surgical innovations. Reimbursement challenges within public healthcare systems can limit patient access to newer, more expensive surgical procedures and devices.

Patient awareness gaps persist in certain populations, leading to delayed diagnosis and treatment of glaucoma. Cultural factors and limited health literacy in some communities may result in patients seeking surgical intervention only after significant vision loss has occurred. Follow-up care challenges can impact surgical outcomes, particularly for patients in remote areas with limited access to ongoing ophthalmologic monitoring.

Telemedicine integration presents substantial opportunities for expanding glaucoma surgery market reach through remote consultation and post-operative monitoring capabilities. The development of mobile health applications and remote monitoring devices could improve patient outcomes and reduce the need for frequent in-person visits. Digital health platforms can facilitate better coordination between primary care providers and glaucoma specialists.

Medical device innovation continues to create opportunities for market growth through the development of more effective and less invasive surgical options. The emergence of drug-eluting implants and sustained-release delivery systems offers potential for improved long-term outcomes. Artificial intelligence applications in surgical planning and outcome prediction represent emerging opportunities for enhanced precision and success rates.

Public-private partnerships offer significant potential for expanding access to glaucoma surgery across Mexico’s diverse healthcare landscape. Collaborative initiatives between government agencies and private healthcare providers can leverage resources and expertise. International cooperation programs with medical institutions in other countries can facilitate knowledge transfer and technology adoption.

Training and education expansion opportunities exist through the development of specialized fellowship programs and continuing medical education initiatives. The establishment of regional training centers could help address surgeon availability challenges. Research collaboration between academic institutions and industry partners can drive innovation and improve surgical techniques tailored to Mexican patient populations.

Supply chain dynamics in Mexico’s glaucoma surgery market reflect a complex interplay between international medical device manufacturers, domestic distributors, and healthcare providers. The market has witnessed improved efficiency in device procurement and distribution, with lead times for specialized surgical equipment decreasing by approximately 20% over recent years. Inventory management systems have become more sophisticated, ensuring better availability of critical surgical supplies.

Competitive dynamics continue to evolve as both established international companies and emerging domestic players vie for market share. The introduction of innovative surgical devices has intensified competition while simultaneously expanding treatment options for patients and surgeons. Price competition has made certain surgical procedures more accessible while maintaining quality standards.

Regulatory dynamics have shown positive trends toward streamlined approval processes for medical devices and surgical equipment. Mexican health authorities have worked to align regulatory standards with international best practices while maintaining appropriate safety oversight. Quality assurance requirements have strengthened, ensuring that surgical devices and procedures meet rigorous safety and efficacy standards.

Technology adoption dynamics demonstrate accelerating integration of advanced surgical techniques and devices across Mexico’s healthcare system. The transition from traditional surgical approaches to minimally invasive procedures has gained momentum, with adoption rates increasing significantly in major medical centers. Training dynamics have adapted to support this technological evolution through enhanced educational programs and hands-on learning opportunities.

Comprehensive market analysis for Mexico’s glaucoma surgery market employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research included extensive interviews with key stakeholders including ophthalmic surgeons, hospital administrators, medical device distributors, and healthcare policy experts across major Mexican metropolitan areas.

Secondary research encompassed analysis of government healthcare statistics, medical literature review, industry reports, and regulatory documentation. Data collection focused on surgical volume trends, device adoption rates, patient demographics, and healthcare infrastructure development. Market intelligence gathering included monitoring of competitive activities, pricing trends, and technological innovations.

Data validation processes involved cross-referencing information from multiple sources and conducting follow-up interviews with industry experts to confirm key findings. Statistical analysis employed both quantitative and qualitative methodologies to identify market trends and growth patterns. Regional analysis incorporated geographic segmentation to understand market variations across different Mexican states and metropolitan areas.

Analytical framework utilized established market research principles while adapting to the unique characteristics of Mexico’s healthcare system and regulatory environment. MarkWide Research methodologies ensured comprehensive coverage of market dynamics while maintaining objectivity and analytical rigor throughout the research process.

Mexico City metropolitan area dominates the glaucoma surgery market, accounting for approximately 35% of total surgical procedures performed nationwide. The capital region benefits from the highest concentration of specialized eye care facilities, experienced surgeons, and advanced medical technology. Healthcare infrastructure in Mexico City includes both world-class private hospitals and well-equipped public institutions offering comprehensive glaucoma surgery services.

Guadalajara region represents the second-largest market segment, with strong growth in both private and public sector surgical capabilities. The area has witnessed significant investment in ophthalmic equipment and surgeon training programs. Medical tourism has contributed to market expansion, with patients from smaller cities and international visitors seeking specialized care.

Monterrey metropolitan area has emerged as a key market hub, particularly for advanced surgical techniques and medical device adoption. The region’s proximity to the United States has facilitated technology transfer and international collaboration in glaucoma surgery development. Industrial healthcare programs have contributed to increased awareness and early detection of glaucoma among working populations.

Secondary markets including Puebla, Tijuana, and Cancun have shown promising growth potential, with expanding healthcare infrastructure and increasing surgeon availability. These regions benefit from growing medical tourism sectors and improved access to specialized equipment. Rural market penetration remains limited but shows gradual improvement through government healthcare initiatives and telemedicine programs.

Market leadership in Mexico’s glaucoma surgery sector features a diverse mix of international medical device companies and domestic healthcare providers. The competitive environment has intensified with the introduction of innovative surgical technologies and expanded treatment options.

Competitive strategies focus on technology innovation, surgeon education, and improved patient outcomes. Companies invest heavily in training programs and clinical support to differentiate their offerings. Market consolidation trends have emerged as larger players acquire specialized technology companies and expand their product portfolios.

By Surgery Type:

By Healthcare Setting:

By Patient Demographics:

Traditional Filtration Surgery continues to represent the largest segment of Mexico’s glaucoma surgery market, with trabeculectomy procedures accounting for approximately 45% of total surgical volume. These established techniques remain the gold standard for advanced glaucoma cases requiring significant intraocular pressure reduction. Surgeon expertise in traditional procedures is well-established across Mexico’s major medical centers.

Minimally Invasive Glaucoma Surgery has emerged as the fastest-growing segment, with adoption rates increasing by approximately 25% annually among Mexican ophthalmologists. MIGS procedures offer reduced surgical trauma and faster recovery times, making them attractive options for both patients and surgeons. Device innovation in this category continues to expand treatment options and improve outcomes.

Laser Surgery represents a significant portion of glaucoma interventions, particularly for early-stage disease management and as adjunctive therapy. The accessibility and repeatability of laser procedures make them valuable tools in comprehensive glaucoma management. Technology advancement has improved laser precision and reduced treatment-related complications.

Combined Procedures addressing both cataract and glaucoma simultaneously have gained popularity due to efficiency and patient convenience. These procedures optimize surgical outcomes while reducing overall healthcare costs and patient burden. Surgical expertise in combined procedures requires specialized training and advanced equipment capabilities.

Healthcare Providers benefit from expanded treatment options and improved patient outcomes through access to advanced glaucoma surgery technologies. Enhanced surgical capabilities enable providers to offer comprehensive eye care services and attract patients seeking specialized treatment. Revenue diversification through glaucoma surgery programs supports financial sustainability and growth.

Patients gain access to innovative surgical treatments that preserve vision and improve quality of life. Minimally invasive procedures offer reduced recovery times and lower complication rates compared to traditional approaches. Treatment accessibility has improved through expanded healthcare coverage and facility availability.

Medical Device Companies benefit from growing market demand and opportunities for technology innovation. The Mexican market provides a platform for introducing new surgical devices and expanding global market reach. Partnership opportunities with local healthcare providers facilitate market penetration and sustainable growth.

Surgeons benefit from access to advanced surgical technologies and comprehensive training programs that enhance their clinical capabilities. Professional development opportunities through specialized education and research collaboration support career advancement. Patient outcomes improvement through better surgical tools enhances professional satisfaction and reputation.

Government and Policymakers benefit from improved public health outcomes and reduced long-term healthcare costs associated with blindness prevention. Economic benefits include job creation in healthcare sectors and medical tourism revenue generation. Healthcare system efficiency improves through better resource allocation and treatment effectiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Minimally Invasive Surgery Adoption represents the most significant trend transforming Mexico’s glaucoma surgery landscape. Surgeons increasingly prefer MIGS procedures due to reduced patient trauma and faster recovery times. Technology integration has made these procedures more accessible and cost-effective for healthcare providers.

Digital Health Integration is revolutionizing patient care through electronic health records, telemedicine consultations, and remote monitoring capabilities. Healthcare providers are investing in digital platforms to improve patient engagement and surgical outcomes. Artificial intelligence applications in surgical planning and outcome prediction are gaining traction among leading medical centers.

Medical Tourism Growth continues to drive market expansion as international patients seek high-quality, affordable glaucoma surgery in Mexico. Healthcare facilities are developing specialized programs to attract and serve international patients. Quality accreditation from international organizations enhances Mexico’s reputation as a medical tourism destination.

Personalized Medicine Approaches are emerging through genetic testing and customized surgical planning based on individual patient characteristics. Surgeons are increasingly tailoring surgical approaches to optimize outcomes for specific patient populations. Precision surgery techniques are becoming more sophisticated and widely adopted.

Sustainability Initiatives are influencing healthcare facility operations and medical device selection. Environmental considerations are becoming important factors in surgical equipment procurement and facility design. Cost optimization strategies focus on long-term sustainability and resource efficiency.

Regulatory Modernization has streamlined medical device approval processes, facilitating faster introduction of innovative glaucoma surgery technologies. Mexican health authorities have implemented risk-based approval pathways that balance safety with accessibility. International harmonization efforts have aligned Mexican standards with global best practices.

Training Program Expansion has increased the number of qualified glaucoma surgeons through specialized fellowship programs and continuing education initiatives. Academic medical centers have partnered with international institutions to enhance training quality. Simulation technology integration has improved surgical education and skill development.

Technology Partnerships between international medical device companies and Mexican healthcare providers have accelerated innovation adoption. These collaborations facilitate technology transfer and local expertise development. Research initiatives are generating clinical evidence specific to Mexican patient populations.

Infrastructure Investment has modernized surgical facilities and expanded access to advanced glaucoma surgery across Mexico. Both public and private sectors have invested significantly in equipment upgrades and facility expansion. Regional development initiatives are extending specialized surgical capabilities beyond major metropolitan areas.

Quality Improvement Programs have enhanced surgical outcomes and patient safety through standardized protocols and performance monitoring. Healthcare facilities are implementing comprehensive quality management systems. Outcome tracking systems provide data-driven insights for continuous improvement.

Market expansion strategies should focus on developing comprehensive glaucoma surgery programs that integrate advanced technology with skilled surgical teams. Healthcare providers should invest in surgeon training and equipment upgrades to remain competitive. MarkWide Research analysis suggests that facilities offering both traditional and minimally invasive surgical options will capture larger market shares.

Technology adoption should prioritize devices and systems that demonstrate clear clinical benefits and cost-effectiveness. Healthcare administrators should evaluate surgical technologies based on patient outcomes, surgeon satisfaction, and long-term financial impact. Phased implementation approaches can help manage costs while building surgical capabilities.

Geographic expansion opportunities exist in secondary markets where surgical access remains limited. Healthcare providers should consider establishing satellite facilities or mobile surgical programs to serve underserved populations. Telemedicine integration can support remote consultation and follow-up care delivery.

Partnership development with international medical device companies can provide access to cutting-edge technologies and training resources. Healthcare facilities should seek strategic alliances that support long-term capability building. Academic partnerships can enhance research capabilities and surgeon education programs.

Quality focus should remain paramount in all market development activities, with emphasis on patient safety and surgical outcomes. Healthcare providers should implement robust quality management systems and outcome tracking capabilities. Continuous improvement processes will differentiate successful market participants.

Market growth trajectory for Mexico’s glaucoma surgery sector appears robust, with continued expansion expected across all major segments. Demographic trends supporting an aging population will sustain demand for surgical interventions. Technology advancement will continue to drive market evolution through improved surgical techniques and devices.

Innovation pipeline includes next-generation MIGS devices, drug-eluting implants, and artificial intelligence-guided surgical systems. These technologies promise to further improve surgical outcomes while reducing procedure complexity. Research and development investments will accelerate the introduction of breakthrough surgical solutions.

Access expansion initiatives will extend glaucoma surgery availability to underserved populations through government programs and private sector initiatives. Telemedicine integration will support remote consultation and post-operative care delivery. Healthcare infrastructure development will continue in secondary markets and rural regions.

International collaboration will strengthen Mexico’s position as a regional leader in glaucoma surgery through knowledge sharing and technology transfer. Medical tourism growth will contribute to market expansion and facility modernization. Quality standards will continue to improve through international accreditation and best practice adoption.

Market maturation over the next decade will see increased standardization of surgical procedures and outcome measurement. Healthcare providers will focus on efficiency optimization and cost management while maintaining quality standards. Sustainable growth models will balance accessibility with financial viability across all market segments.

Mexico’s glaucoma surgery market represents a dynamic and rapidly evolving healthcare sector with significant growth potential driven by demographic trends, technological advancement, and improved healthcare accessibility. The market has demonstrated resilience and adaptability in embracing innovative surgical techniques while maintaining focus on patient outcomes and safety.

Key success factors for market participants include investment in advanced surgical technologies, comprehensive surgeon training programs, and patient-centered care delivery models. The integration of minimally invasive surgical techniques has transformed treatment options and improved patient experiences across Mexico’s healthcare system.

Future market development will be characterized by continued technology innovation, expanded access to specialized care, and strengthened quality management systems. Healthcare providers that successfully balance innovation adoption with cost management will capture the greatest market opportunities. The Mexico glaucoma surgery market is positioned for sustained growth and continued improvement in patient outcomes, making it an attractive sector for healthcare investment and development initiatives.

What is Glaucoma Surgery?

Glaucoma surgery refers to various surgical procedures aimed at lowering intraocular pressure in patients with glaucoma. These procedures can include trabeculectomy, tube shunt surgery, and minimally invasive glaucoma surgeries, which help preserve vision and manage the disease effectively.

What are the key players in the Mexico Glaucoma Surgery Market?

Key players in the Mexico Glaucoma Surgery Market include Alcon, Johnson & Johnson Vision, Bausch + Lomb, and Carl Zeiss AG, among others. These companies are involved in developing innovative surgical techniques and devices to improve patient outcomes.

What are the growth factors driving the Mexico Glaucoma Surgery Market?

The Mexico Glaucoma Surgery Market is driven by factors such as the increasing prevalence of glaucoma, advancements in surgical techniques, and the growing aging population. Additionally, rising awareness about eye health and the availability of advanced surgical equipment contribute to market growth.

What challenges does the Mexico Glaucoma Surgery Market face?

Challenges in the Mexico Glaucoma Surgery Market include the high cost of advanced surgical procedures, limited access to specialized care in rural areas, and the need for skilled surgeons. These factors can hinder the adoption of glaucoma surgeries among patients.

What opportunities exist in the Mexico Glaucoma Surgery Market?

Opportunities in the Mexico Glaucoma Surgery Market include the potential for growth in telemedicine for pre- and post-operative care, the introduction of new minimally invasive surgical techniques, and increased investment in healthcare infrastructure. These factors can enhance patient access to glaucoma treatments.

What trends are shaping the Mexico Glaucoma Surgery Market?

Trends in the Mexico Glaucoma Surgery Market include the rise of minimally invasive surgical options, the integration of advanced imaging technologies, and the development of personalized treatment plans. These trends aim to improve surgical outcomes and patient satisfaction.

Mexico Glaucoma Surgery Market

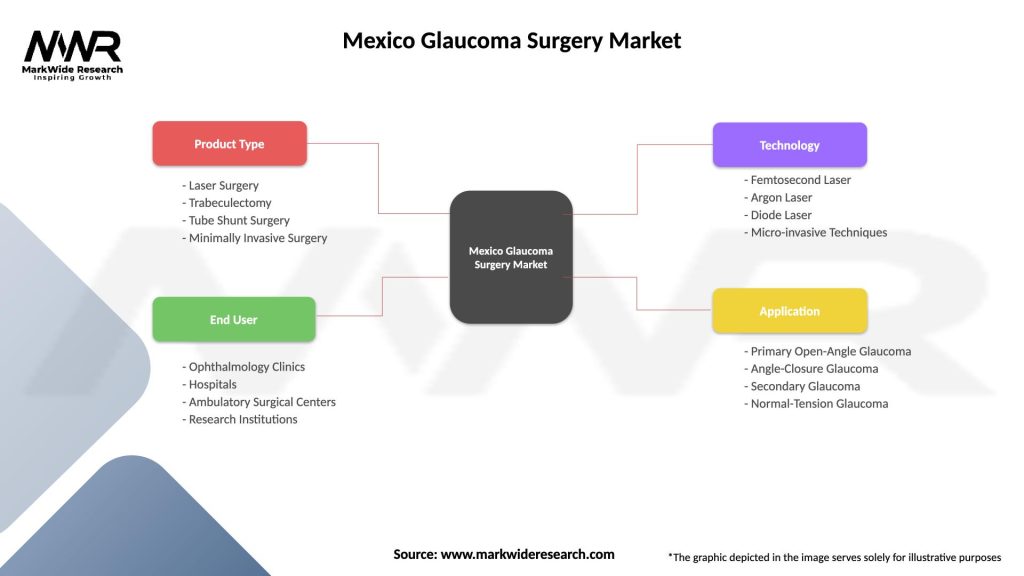

| Segmentation Details | Description |

|---|---|

| Product Type | Laser Surgery, Trabeculectomy, Tube Shunt Surgery, Minimally Invasive Surgery |

| End User | Ophthalmology Clinics, Hospitals, Ambulatory Surgical Centers, Research Institutions |

| Technology | Femtosecond Laser, Argon Laser, Diode Laser, Micro-invasive Techniques |

| Application | Primary Open-Angle Glaucoma, Angle-Closure Glaucoma, Secondary Glaucoma, Normal-Tension Glaucoma |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Glaucoma Surgery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at