444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico fruits and vegetables market represents one of the most dynamic and rapidly expanding agricultural sectors in Latin America, driven by favorable climatic conditions, strategic geographical positioning, and increasing global demand for fresh produce. Mexico’s agricultural landscape benefits from diverse growing regions that enable year-round production of a wide variety of fruits and vegetables, making it a crucial supplier to both domestic and international markets.

Market dynamics indicate that Mexico has established itself as a leading exporter of fresh produce, particularly to North American markets, with the sector experiencing robust growth at approximately 6.2% CAGR over recent years. The country’s strategic location provides significant advantages for trade with the United States and Canada, while also serving growing demand in European and Asian markets.

Agricultural innovation and modernization efforts have transformed traditional farming practices, with increased adoption of greenhouse technologies, precision agriculture, and sustainable farming methods. These developments have enhanced productivity, improved quality standards, and extended growing seasons, contributing to Mexico’s competitive position in the global fresh produce market.

Regional specialization across different states has created distinct production clusters, with each region focusing on crops best suited to their specific climatic and soil conditions. This geographical diversity enables Mexico to offer a comprehensive portfolio of fruits and vegetables throughout the year, meeting diverse consumer preferences and seasonal demands.

The Mexico fruits and vegetables market refers to the comprehensive agricultural sector encompassing the production, processing, distribution, and export of fresh and processed fruits and vegetables within Mexico’s territory. This market includes both traditional crops that have been cultivated for centuries and newer varieties introduced to meet evolving consumer preferences and export opportunities.

Market scope extends beyond simple agricultural production to include value-added processing, packaging, logistics, and distribution networks that connect Mexican producers with domestic consumers and international buyers. The sector encompasses small-scale family farms, medium-sized commercial operations, and large-scale agribusiness enterprises that collectively contribute to Mexico’s position as a major global produce supplier.

Economic significance of this market extends far beyond agricultural output, supporting millions of jobs across the value chain from farm workers and processors to transporters and retailers. The sector plays a crucial role in rural development, foreign exchange earnings, and food security for the Mexican population.

Mexico’s fruits and vegetables market demonstrates exceptional growth potential driven by expanding export opportunities, increasing domestic consumption, and ongoing agricultural modernization initiatives. The sector benefits from Mexico’s membership in key trade agreements, including USMCA, which provides preferential access to major North American markets.

Production diversity remains a key strength, with Mexico ranking among the world’s top producers of avocados, tomatoes, peppers, berries, and citrus fruits. The country’s ability to supply fresh produce year-round has made it an indispensable partner for retailers and food service operators in temperature-zone countries where seasonal production limitations exist.

Technological advancement in agricultural practices has resulted in approximately 35% improvement in crop yields over the past decade, while sustainable farming initiatives have gained momentum with 28% of producers adopting environmentally friendly practices. These developments position Mexico favorably for meeting growing global demand for sustainably produced fresh foods.

Market challenges include water scarcity in certain regions, climate change impacts, and the need for continued infrastructure development to support expanding production and export activities. However, government initiatives and private sector investments are addressing these challenges through innovative solutions and strategic planning.

Strategic positioning in global markets has established Mexico as the primary supplier of fresh produce to the United States during winter months, while year-round production capabilities support consistent export flows. The following insights highlight critical market dynamics:

Consumer trends toward healthy eating and fresh food consumption continue to drive demand growth, while increasing awareness of food safety and traceability requirements has prompted industry-wide improvements in quality control and certification processes.

Geographic advantages represent the primary driver of Mexico’s fruits and vegetables market growth, with the country’s location providing optimal access to major consumer markets while offering diverse climatic zones suitable for year-round production. This positioning enables Mexican producers to serve as reliable suppliers when domestic production in importing countries is limited by seasonal constraints.

Trade agreement benefits have significantly enhanced market access, with USMCA providing preferential treatment for Mexican agricultural exports to the United States and Canada. These agreements have reduced trade barriers, streamlined customs procedures, and provided certainty for long-term investment planning in agricultural infrastructure and production capacity.

Consumer health consciousness in target markets drives increasing demand for fresh fruits and vegetables, with health-aware consumers seeking year-round access to nutritious produce. This trend has been accelerated by growing awareness of the connection between diet and health outcomes, particularly following global health challenges that highlighted the importance of immune system support through proper nutrition.

Technological innovation in agricultural practices has enabled significant productivity improvements, with precision agriculture, drip irrigation systems, and greenhouse technologies allowing producers to optimize resource utilization while maximizing yields. These advances have made Mexican produce more competitive in global markets while supporting sustainable production practices.

Investment in infrastructure continues to enhance the sector’s capabilities, with improvements in cold storage facilities, transportation networks, and processing capabilities supporting quality preservation and market reach expansion. Government and private sector investments have focused on creating integrated supply chains that maintain product quality from farm to consumer.

Water scarcity challenges pose significant constraints in certain regions, particularly in northern states where agricultural production competes with urban and industrial water demands. Climate change has exacerbated these challenges, requiring innovative water management solutions and potentially limiting expansion in water-stressed areas.

Climate variability and extreme weather events create production risks that can impact both yield and quality outcomes. Increasing frequency of droughts, floods, and temperature extremes requires adaptive strategies and risk management approaches that may increase production costs and complexity.

Labor availability and costs present ongoing challenges, particularly during peak harvest seasons when demand for agricultural workers exceeds supply in certain regions. Seasonal migration patterns and competition from other economic sectors can create labor shortages that impact harvesting efficiency and costs.

Regulatory compliance requirements in export markets continue to evolve, with increasing emphasis on food safety, traceability, and environmental standards. Meeting these requirements necessitates ongoing investments in certification processes, quality control systems, and documentation procedures that can increase operational complexity and costs.

Transportation and logistics constraints can limit market access, particularly for producers in remote areas or those seeking to reach distant markets. Infrastructure limitations, border crossing delays, and transportation cost fluctuations can impact competitiveness and profitability for market participants.

Organic produce demand presents substantial growth opportunities, with consumer preferences increasingly favoring organically grown fruits and vegetables. The organic segment commands premium pricing while addressing environmental concerns, creating opportunities for producers willing to invest in organic certification and sustainable farming practices.

Value-added processing offers potential for margin enhancement through product differentiation and extended shelf life. Opportunities exist in areas such as pre-cut vegetables, frozen products, dried fruits, and specialty preparations that cater to convenience-oriented consumers and food service operators.

Market diversification beyond traditional North American destinations presents growth potential, with emerging markets in Asia, Europe, and other Latin American countries showing increasing demand for Mexican produce. Developing these markets can reduce dependence on single destinations while capturing growth in regions with expanding middle-class populations.

Technology integration continues to offer opportunities for efficiency improvements and quality enhancement. Areas such as automated harvesting, blockchain traceability, and artificial intelligence applications in crop management present potential for competitive advantage and operational optimization.

Greenhouse expansion enables year-round production with controlled environmental conditions, offering opportunities to extend growing seasons, improve quality consistency, and reduce weather-related risks. Protected agriculture can also enable production in areas with challenging outdoor growing conditions.

Supply chain evolution continues to reshape the Mexico fruits and vegetables market, with increasing integration between producers, processors, distributors, and retailers. This integration enables better coordination of production planning, quality control, and market responsiveness while reducing transaction costs and improving efficiency throughout the value chain.

Seasonal demand patterns create dynamic pricing and volume fluctuations that require sophisticated planning and risk management strategies. Producers must balance production timing with market demand cycles while managing storage and logistics capabilities to optimize revenue opportunities during peak demand periods.

Quality standards evolution reflects changing consumer expectations and regulatory requirements, with increasing emphasis on appearance, taste, nutritional content, and safety attributes. Meeting these evolving standards requires continuous improvement in production practices, post-harvest handling, and supply chain management.

Competitive landscape dynamics involve both domestic competition among Mexican producers and international competition from other producing countries. Success requires differentiation through quality, reliability, service, or cost advantages while maintaining relationships with key buyers and distribution channels.

Currency fluctuations impact export competitiveness and profitability, with peso-dollar exchange rates affecting the relative pricing of Mexican produce in international markets. Producers must manage currency risk while maintaining competitive positioning across different market cycles.

Comprehensive data collection approaches were employed to analyze the Mexico fruits and vegetables market, incorporating both primary and secondary research methodologies to ensure accuracy and completeness of market insights. The research framework encompassed production statistics, trade data, consumer surveys, and industry expert interviews to provide a holistic view of market dynamics.

Primary research activities included structured interviews with key stakeholders across the value chain, including producers, processors, distributors, exporters, and retail buyers. These interviews provided qualitative insights into market trends, challenges, and opportunities while validating quantitative findings from secondary sources.

Secondary research sources encompassed government agricultural statistics, trade association reports, customs data, and industry publications to establish baseline market parameters and historical trends. International trade databases provided export-import statistics while agricultural census data supported production and area analysis.

Market segmentation analysis employed statistical techniques to identify distinct product categories, geographic regions, and market channels while analyzing their respective growth patterns and competitive dynamics. This segmentation approach enabled detailed analysis of market opportunities and challenges across different market segments.

Validation processes included cross-referencing multiple data sources, expert review of findings, and sensitivity analysis of key assumptions to ensure research reliability and accuracy. The methodology incorporated feedback from industry participants to refine analysis and enhance practical relevance of insights.

Northern Mexico regions dominate vegetable production, particularly in states like Sinaloa, Sonora, and Baja California, which benefit from favorable climate conditions and proximity to U.S. markets. These regions account for approximately 45% of total vegetable exports and specialize in crops such as tomatoes, peppers, cucumbers, and leafy greens that thrive in arid and semi-arid conditions.

Central Mexico areas including Michoacán, Jalisco, and Guanajuato serve as major fruit production centers, with Michoacán alone producing over 75% of Mexico’s avocados. These regions benefit from volcanic soils, adequate rainfall, and elevation variations that create microclimates suitable for diverse fruit crops including berries, stone fruits, and tropical varieties.

Southern and southeastern regions including Chiapas, Veracruz, and Yucatan focus on tropical fruit production, taking advantage of high humidity, consistent temperatures, and abundant rainfall. These areas specialize in crops such as bananas, pineapples, mangoes, and papayas that require tropical growing conditions.

Coastal regions along both Pacific and Gulf coasts provide unique growing environments for specialty crops, with sea-level production areas offering extended growing seasons and consistent temperatures. These regions contribute significantly to winter vegetable production when inland areas experience cooler temperatures.

Regional specialization has created clusters of expertise and infrastructure that support specific crop categories, with each region developing specialized knowledge, processing facilities, and distribution networks tailored to their primary crops. This specialization enhances efficiency and quality while creating regional competitive advantages.

Market structure in Mexico’s fruits and vegetables sector encompasses a diverse range of participants, from small family farms to large multinational agribusiness operations. The competitive landscape reflects this diversity, with different competitive dynamics operating across various market segments and geographic regions.

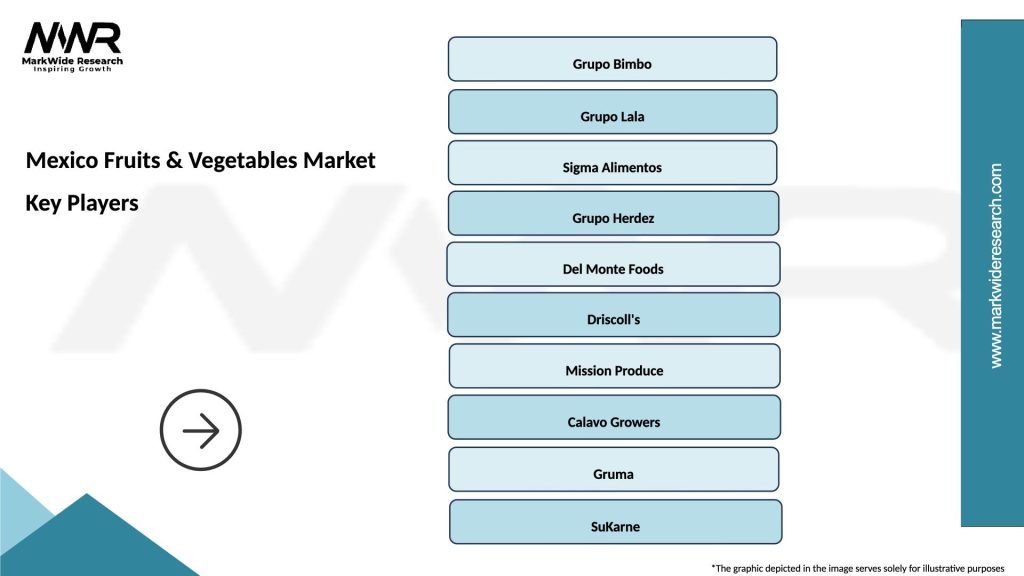

Leading market participants include both domestic and international companies that have established significant presence in Mexican agriculture:

Competitive strategies focus on differentiation through quality, sustainability, technology adoption, and supply chain integration. Leading companies invest in research and development, sustainable farming practices, and advanced logistics capabilities to maintain competitive advantages in increasingly demanding markets.

Market consolidation trends have led to increased vertical integration, with larger companies acquiring production, processing, and distribution assets to control quality and costs throughout the value chain. This consolidation enables better coordination of supply chain activities while providing resources for technology investments and market development.

Product category segmentation reveals distinct market dynamics across different types of fruits and vegetables, with each category exhibiting unique growth patterns, competitive structures, and market requirements. The segmentation analysis provides insights into market opportunities and strategic positioning across various produce categories.

By Product Type:

By Distribution Channel:

By Production Method:

Avocado segment represents Mexico’s most successful agricultural export story, with the country maintaining dominant global market position through superior quality, year-round availability, and strong brand recognition. The segment benefits from increasing global consumption trends and Mexico’s unique ability to supply consistent volumes throughout the year from different growing regions.

Tomato category demonstrates Mexico’s competitive advantages in vegetable production, with greenhouse technologies enabling high-quality production that meets stringent export market requirements. The segment has evolved toward specialty varieties and premium products that command higher prices while meeting specific consumer preferences in target markets.

Berry production has emerged as a high-value growth category, with Mexico becoming a major supplier of strawberries, blueberries, and raspberries to North American markets. The segment benefits from Mexico’s ability to extend the North American berry season while providing consistent quality through advanced production techniques.

Pepper varieties showcase Mexico’s diversity in vegetable production, ranging from bell peppers to specialty hot peppers that serve both fresh and processed market segments. The category benefits from growing consumer interest in ethnic cuisines and spicy foods while leveraging Mexico’s traditional expertise in pepper cultivation.

Citrus fruits represent a traditional strength with modern applications, as Mexican limes, oranges, and grapefruits serve both domestic and export markets. The segment has adapted to changing consumer preferences through organic production, specialty varieties, and value-added processing opportunities.

Producer advantages in the Mexico fruits and vegetables market include access to diverse growing environments, proximity to major consumer markets, and favorable trade agreements that reduce export barriers. These advantages enable Mexican producers to compete effectively in global markets while serving growing domestic demand.

Economic benefits extend throughout rural communities, with agricultural employment supporting millions of families while generating foreign exchange earnings that contribute to national economic development. The sector provides opportunities for skill development, technology adoption, and entrepreneurship in rural areas.

Consumer benefits include year-round availability of fresh, high-quality produce at competitive prices, with Mexican production helping to stabilize prices and supply in North American markets during winter months. Consumers also benefit from increasing variety and quality improvements driven by competitive pressures.

Environmental advantages emerge from Mexico’s natural growing conditions that often require fewer inputs than production in less suitable climates. Additionally, shorter transportation distances to major markets reduce carbon footprints compared to alternative supply sources.

Supply chain benefits include reduced seasonality risks for buyers, consistent quality standards, and established logistics networks that ensure reliable delivery. Long-term relationships between Mexican producers and international buyers create stability and predictability for both parties.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability focus has become a dominant trend, with increasing adoption of environmentally friendly farming practices, water conservation technologies, and organic production methods. According to MarkWide Research analysis, approximately 32% of producers have implemented sustainable farming practices, driven by both consumer demand and regulatory requirements.

Technology integration continues accelerating across the sector, with precision agriculture, drone monitoring, and automated irrigation systems becoming more widespread. These technologies enable better resource management, yield optimization, and quality control while reducing environmental impact and production costs.

Traceability requirements are driving investment in blockchain and digital tracking systems that enable complete supply chain visibility from farm to consumer. This trend responds to increasing consumer demand for transparency and regulatory requirements for food safety documentation.

Premium product development focuses on specialty varieties, organic certification, and value-added products that command higher prices in target markets. Producers are increasingly differentiating their offerings through unique varieties, superior quality, or special certifications.

Direct-to-consumer channels are expanding through e-commerce platforms and subscription services that connect producers directly with end consumers, enabling better margins and customer relationships while providing consumers with fresher products and origin transparency.

Infrastructure investments have accelerated significantly, with both government and private sector funding supporting expansion of cold storage facilities, transportation networks, and processing capabilities. These investments address bottlenecks that have historically limited market access and quality preservation.

Technology partnerships between Mexican producers and international technology companies are introducing advanced agricultural solutions including precision farming equipment, climate control systems, and post-harvest handling technologies. These partnerships enable access to cutting-edge solutions while building local technical expertise.

Certification programs have expanded to include sustainability, fair trade, and quality assurance standards that meet evolving buyer requirements. These programs help Mexican producers access premium market segments while demonstrating commitment to responsible production practices.

Research and development initiatives focus on developing new varieties suited to Mexican growing conditions while meeting market demands for improved taste, appearance, and shelf life. Collaboration between universities, government agencies, and private companies supports innovation in crop development and production techniques.

Market diversification efforts include trade missions, promotional campaigns, and market development activities targeting new geographic markets beyond traditional North American destinations. These efforts aim to reduce market concentration risk while capturing growth opportunities in emerging markets.

Investment priorities should focus on water-efficient technologies, renewable energy systems, and climate-resilient infrastructure that address long-term sustainability challenges while maintaining competitiveness. Producers should prioritize investments that provide both immediate operational benefits and long-term strategic advantages.

Market diversification strategies require systematic development of new export destinations through market research, relationship building, and compliance with destination-specific requirements. Companies should balance market expansion with maintaining strong positions in established markets.

Technology adoption should be approached strategically, with emphasis on solutions that provide measurable returns on investment while building capabilities for future competitiveness. Producers should consider collaborative approaches to technology acquisition and implementation to share costs and risks.

Supply chain integration opportunities should be evaluated to capture additional value and improve market positioning. Vertical integration or strategic partnerships can provide better control over quality, costs, and market access while reducing transaction costs.

Sustainability initiatives should be implemented proactively to meet evolving market requirements while potentially accessing premium pricing opportunities. Early adoption of sustainable practices can provide competitive advantages as requirements become more stringent.

Growth trajectory for Mexico’s fruits and vegetables market remains positive, with MWR projecting continued expansion driven by increasing global demand, technological advancement, and market diversification efforts. The sector is expected to maintain its growth momentum at approximately 5.8% CAGR over the next five years, supported by both domestic consumption growth and export market expansion.

Technology transformation will accelerate, with increased adoption of precision agriculture, automation, and digital technologies that enhance productivity while reducing environmental impact. These technological advances will be essential for maintaining competitiveness as labor costs rise and environmental regulations become more stringent.

Market evolution toward premium and specialty products will continue, with consumers increasingly willing to pay higher prices for quality, sustainability, and unique characteristics. This trend creates opportunities for Mexican producers to move beyond commodity production toward higher-value market segments.

Sustainability requirements will become increasingly important, with buyers and consumers demanding greater transparency and environmental responsibility. Producers who proactively adopt sustainable practices will be better positioned for long-term success in evolving markets.

Geographic expansion of production areas will likely occur as technology enables cultivation in previously unsuitable locations while climate change may shift optimal growing regions. Adaptive strategies will be essential for maintaining production stability and market supply reliability.

Mexico’s fruits and vegetables market represents a dynamic and strategically important sector that combines natural advantages with technological innovation to serve growing global demand for fresh produce. The market’s strong fundamentals, including favorable climate conditions, strategic location, and established trade relationships, provide a solid foundation for continued growth and development.

Strategic positioning in global markets has been achieved through decades of investment in production capabilities, quality improvement, and market development. Mexican producers have successfully established themselves as reliable suppliers of high-quality produce to demanding international markets while serving growing domestic consumption needs.

Future success will depend on continued adaptation to evolving market requirements, including sustainability standards, technology adoption, and quality expectations. The sector’s ability to balance growth with environmental responsibility while maintaining cost competitiveness will determine long-term market position and profitability.

Investment opportunities remain abundant across the value chain, from production technology and infrastructure to processing and distribution capabilities. The sector’s growth potential, combined with Mexico’s strategic advantages, creates attractive prospects for stakeholders willing to commit to long-term development and continuous improvement initiatives that will define the future of Mexican agriculture.

What is Fruits & Vegetables?

Fruits & Vegetables refer to the edible products of plants that are consumed for their nutritional value, flavor, and health benefits. This category includes a wide variety of produce such as apples, tomatoes, carrots, and leafy greens.

What are the key companies in the Mexico Fruits & Vegetables Market?

Key companies in the Mexico Fruits & Vegetables Market include Grupo Bimbo, Del Monte Foods, and Fresh Del Monte Produce, among others.

What are the growth factors driving the Mexico Fruits & Vegetables Market?

The Mexico Fruits & Vegetables Market is driven by increasing health consciousness among consumers, rising demand for organic produce, and the expansion of retail channels such as supermarkets and online grocery stores.

What challenges does the Mexico Fruits & Vegetables Market face?

Challenges in the Mexico Fruits & Vegetables Market include issues related to supply chain logistics, seasonal fluctuations in production, and competition from imported products.

What opportunities exist in the Mexico Fruits & Vegetables Market?

Opportunities in the Mexico Fruits & Vegetables Market include the growing trend of plant-based diets, potential for export to international markets, and innovations in sustainable farming practices.

What trends are shaping the Mexico Fruits & Vegetables Market?

Trends in the Mexico Fruits & Vegetables Market include the rise of e-commerce for fresh produce, increasing consumer preference for locally sourced products, and advancements in agricultural technology to enhance yield and quality.

Mexico Fruits & Vegetables Market

| Segmentation Details | Description |

|---|---|

| Product Type | Citrus Fruits, Leafy Greens, Root Vegetables, Berries |

| Distribution Channel | Supermarkets, Farmers’ Markets, Online Retail, Wholesalers |

| End User | Food Service, Retailers, Exporters, Households |

| Packaging Type | Bulk Packaging, Retail Packaging, Eco-Friendly Packaging, Modified Atmosphere Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Fruits & Vegetables Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at