444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico electrocardiograph (ECG) market represents a rapidly expanding segment within the country’s healthcare technology landscape, driven by increasing cardiovascular disease prevalence and growing healthcare infrastructure investments. Mexico’s ECG market has experienced substantial growth momentum, with healthcare facilities across the nation adopting advanced cardiac monitoring technologies to address the rising burden of heart-related conditions.

Market dynamics indicate that Mexico’s ECG sector is benefiting from government healthcare initiatives, expanding private medical facilities, and increasing awareness of preventive cardiac care. The market encompasses various ECG device types, from traditional 12-lead systems to advanced portable and wireless monitoring solutions, serving hospitals, clinics, diagnostic centers, and home healthcare applications.

Growth projections suggest the Mexican ECG market is expanding at a compound annual growth rate (CAGR) of 8.2%, reflecting strong demand across both public and private healthcare sectors. The market’s expansion is particularly notable in urban centers like Mexico City, Guadalajara, and Monterrey, where healthcare infrastructure development has accelerated significantly.

Technological advancement plays a crucial role in market evolution, with digital ECG systems, cloud-based monitoring platforms, and artificial intelligence-enhanced diagnostic capabilities gaining traction among Mexican healthcare providers. The integration of telemedicine solutions has further accelerated ECG technology adoption, especially following the COVID-19 pandemic’s impact on healthcare delivery models.

The Mexico electrocardiograph (ECG) market refers to the comprehensive ecosystem of cardiac monitoring devices, systems, and related services utilized across Mexican healthcare facilities to diagnose and monitor heart conditions. This market encompasses the manufacturing, distribution, sales, and maintenance of ECG equipment specifically within Mexico’s healthcare infrastructure.

ECG technology in the Mexican context includes various device categories ranging from basic single-channel monitors to sophisticated multi-lead systems capable of continuous cardiac monitoring. The market definition extends beyond hardware to include software solutions, data management platforms, and integrated healthcare information systems that support cardiac care delivery.

Market scope covers both domestic and international manufacturers serving Mexican healthcare providers, including public hospitals, private medical centers, specialized cardiac clinics, and emerging home healthcare applications. The definition also encompasses the growing segment of portable and wearable ECG devices that enable remote patient monitoring and telemedicine applications.

Mexico’s electrocardiograph market demonstrates robust growth potential driven by demographic shifts, healthcare modernization efforts, and increasing cardiovascular disease awareness. The market benefits from Mexico’s expanding healthcare infrastructure, government investment in medical technology, and growing middle-class population seeking quality cardiac care services.

Key market drivers include the rising prevalence of cardiovascular diseases, which affects approximately 70% of Mexico’s adult population in various forms, creating substantial demand for ECG monitoring solutions. Healthcare digitization initiatives and the adoption of electronic health records have further accelerated ECG technology integration across Mexican medical facilities.

Competitive landscape features a mix of international medical device manufacturers and emerging local players, with market leadership concentrated among established brands offering comprehensive cardiac monitoring solutions. The market shows particular strength in urban areas, where healthcare spending and technology adoption rates exceed national averages.

Future outlook remains positive, with market expansion expected to continue as Mexico’s healthcare system modernizes and preventive care awareness increases. The integration of artificial intelligence, mobile health applications, and telemedicine platforms presents significant growth opportunities for ECG technology providers.

Strategic market insights reveal several critical factors shaping Mexico’s ECG market development:

Cardiovascular disease prevalence serves as the primary market driver, with heart-related conditions representing the leading cause of mortality in Mexico. The increasing incidence of hypertension, diabetes, and obesity creates substantial demand for cardiac monitoring solutions across healthcare facilities nationwide.

Healthcare modernization initiatives launched by the Mexican government significantly boost ECG market growth. Public hospital upgrades, new medical facility construction, and technology standardization programs create consistent demand for advanced cardiac monitoring equipment.

Aging population demographics contribute substantially to market expansion, as older adults require more frequent cardiac monitoring and preventive care services. Mexico’s demographic transition toward an older population structure increases healthcare utilization rates and ECG technology demand.

Insurance coverage expansion enhances market accessibility by improving patient access to cardiac diagnostic services. Both public and private insurance programs increasingly cover ECG procedures, reducing financial barriers and expanding the addressable market.

Technological advancement drives market growth through improved diagnostic capabilities, user-friendly interfaces, and enhanced connectivity features. Healthcare providers increasingly adopt advanced ECG systems to improve patient care quality and operational efficiency.

Preventive healthcare awareness among Mexican consumers creates growing demand for routine cardiac screening and monitoring services. Health education campaigns and physician recommendations increase ECG procedure utilization rates across demographic segments.

High equipment costs present significant barriers for smaller healthcare facilities and rural clinics seeking to implement advanced ECG technology. Initial investment requirements and ongoing maintenance expenses can limit market penetration in cost-sensitive segments.

Healthcare infrastructure limitations in rural and underserved areas restrict ECG market expansion. Limited electricity reliability, inadequate facility space, and insufficient technical support infrastructure create implementation challenges for sophisticated cardiac monitoring systems.

Skilled personnel shortage affects ECG technology adoption, as healthcare facilities require trained technicians and clinicians capable of operating advanced cardiac monitoring equipment. Training costs and staff retention challenges compound this restraint.

Regulatory compliance requirements can delay market entry for new ECG technologies and increase costs for manufacturers seeking Mexican market access. COFEPRIS approval processes and quality certification requirements create barriers for smaller device manufacturers.

Economic volatility impacts healthcare spending patterns and can delay ECG equipment purchases, particularly in public healthcare facilities dependent on government budgets. Currency fluctuations affect imported device costs and market pricing strategies.

Maintenance and service challenges in remote areas limit ECG system reliability and performance. Limited technical support availability and spare parts distribution networks can reduce equipment uptime and user satisfaction.

Telemedicine expansion creates substantial opportunities for portable and wireless ECG devices, enabling remote patient monitoring and consultation services. The growing acceptance of telehealth solutions opens new market segments and revenue streams for ECG technology providers.

Home healthcare growth presents emerging opportunities for consumer-grade ECG devices and monitoring services. Aging population preferences for home-based care and technology miniaturization enable new market applications beyond traditional clinical settings.

Artificial intelligence integration offers significant opportunities for ECG manufacturers to differentiate their products through advanced diagnostic capabilities. AI-powered interpretation, automated reporting, and predictive analytics create value-added service opportunities.

Public-private partnerships in healthcare infrastructure development create opportunities for ECG suppliers to participate in large-scale modernization projects. Government initiatives seeking private sector expertise and financing open new market channels.

Medical tourism growth in Mexico creates demand for high-quality cardiac diagnostic services and advanced ECG technology. International patients seeking affordable healthcare drive quality improvements and technology upgrades in participating facilities.

Rural healthcare initiatives supported by government and international organizations present opportunities for portable and cost-effective ECG solutions. Mobile health programs and community clinic development expand addressable market segments.

Supply chain dynamics in Mexico’s ECG market involve complex interactions between international manufacturers, local distributors, and healthcare end-users. Import dependency for advanced ECG technology creates supply chain vulnerabilities while presenting opportunities for local assembly and service operations.

Competitive dynamics feature intense rivalry among established medical device manufacturers seeking market share growth. Price competition, technology differentiation, and service quality become critical success factors in winning healthcare facility contracts and tenders.

Regulatory dynamics continue evolving as COFEPRIS adapts approval processes for emerging ECG technologies, including AI-powered systems and cloud-based platforms. Regulatory clarity and streamlined approval processes can accelerate market growth and innovation adoption.

Technology dynamics drive continuous market evolution through digitization, connectivity improvements, and integration capabilities. Healthcare providers increasingly demand ECG systems that integrate seamlessly with electronic health records and hospital information systems.

Economic dynamics influence market growth through healthcare spending patterns, currency exchange rates, and government budget allocations. Economic stability and healthcare investment priorities significantly impact ECG market expansion rates and technology adoption timelines.

Market research methodology for Mexico’s ECG market analysis employs comprehensive primary and secondary research approaches to ensure data accuracy and market insight reliability. MarkWide Research utilizes established healthcare industry research protocols and validated data collection methods.

Primary research includes structured interviews with healthcare facility administrators, cardiac care specialists, medical device distributors, and ECG technology manufacturers operating in Mexico. Survey methodologies capture quantitative data on market size, growth rates, and technology adoption patterns.

Secondary research encompasses analysis of government healthcare statistics, medical device import/export data, healthcare facility databases, and industry publications. Regulatory filings, company financial reports, and market intelligence databases provide additional data sources.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research accuracy. Market sizing methodologies employ bottom-up and top-down approaches to validate findings and projections.

Regional analysis methodology segments Mexico by states and major metropolitan areas to identify geographic market variations and opportunities. Healthcare infrastructure mapping and demographic analysis support regional market assessments.

Central Mexico region, anchored by Mexico City and surrounding states, dominates the ECG market with approximately 35% market share. The region’s concentration of major hospitals, specialty cardiac centers, and healthcare infrastructure creates the largest addressable market for ECG technology.

Northern Mexico demonstrates strong ECG market growth, particularly in Monterrey, Tijuana, and border cities benefiting from proximity to U.S. healthcare markets. The region accounts for roughly 25% of national ECG demand, driven by industrial growth and expanding private healthcare facilities.

Western Mexico, including Guadalajara and surrounding areas, represents a significant ECG market segment with approximately 20% market share. The region’s growing healthcare infrastructure and medical device manufacturing presence support sustained market expansion.

Southern and Eastern Mexico regions show emerging ECG market potential, though infrastructure limitations and economic factors currently restrict growth. These areas represent approximately 20% combined market share but demonstrate improving healthcare access and technology adoption.

Coastal regions including tourist destinations show specialized ECG market segments serving both local populations and medical tourism. These markets emphasize high-quality cardiac care services and advanced diagnostic capabilities to attract international patients.

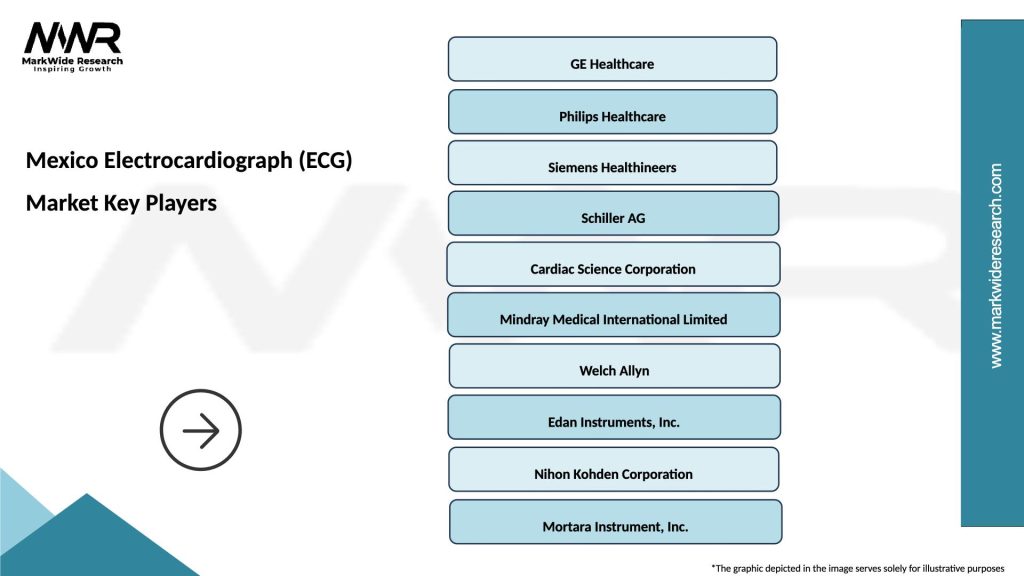

Market leadership in Mexico’s ECG sector is concentrated among established international medical device manufacturers with strong local presence and distribution networks:

Competitive strategies focus on technology differentiation, local service capabilities, pricing optimization, and strategic partnerships with healthcare distributors and facility management companies.

By Product Type:

By End User:

By Technology:

Resting ECG Systems dominate the Mexican market, representing the largest segment due to widespread clinical adoption and standard diagnostic requirements. These systems serve as the foundation for cardiac care across healthcare facilities, with demand driven by routine screening and diagnostic protocols.

Portable ECG Devices show the fastest growth rates, expanding at approximately 12% annually as healthcare providers adopt mobile diagnostic capabilities. The segment benefits from telemedicine growth, home healthcare expansion, and the need for flexible cardiac monitoring solutions.

Hospital Segment maintains the largest end-user market share, accounting for roughly 45% of ECG device demand. Large medical centers drive high-volume purchases and prefer integrated systems that connect with existing healthcare information technology infrastructure.

Digital ECG Technology increasingly dominates new purchases, with healthcare facilities transitioning from analog systems to digital platforms offering enhanced data management, analysis capabilities, and integration features. Digital systems now represent over 75% of new ECG installations.

Wireless ECG Solutions emerge as a high-growth category, particularly in urban markets where healthcare providers seek flexible, mobile-friendly diagnostic tools. This segment appeals to both clinical applications and emerging home healthcare markets.

Healthcare Providers benefit from improved diagnostic capabilities, enhanced patient care quality, and operational efficiency gains through advanced ECG technology adoption. Modern systems reduce interpretation time, improve accuracy, and support better clinical decision-making processes.

Patients gain access to more accurate cardiac diagnostics, faster test results, and improved monitoring capabilities that enable early detection and treatment of heart conditions. Portable ECG options provide convenience and reduce healthcare facility visits.

Medical Device Manufacturers access a growing market with substantial expansion potential, driven by healthcare modernization and increasing cardiovascular disease prevalence. Mexico’s strategic location enables efficient distribution across Latin American markets.

Healthcare Distributors benefit from expanding product portfolios, growing customer bases, and opportunities for value-added services including training, maintenance, and technical support. The market’s growth creates sustainable revenue streams.

Government Healthcare Systems achieve improved population health outcomes, enhanced diagnostic capabilities in public facilities, and better resource utilization through modern ECG technology deployment. Cost-effective solutions support healthcare accessibility goals.

Medical Professionals gain access to advanced diagnostic tools, improved workflow efficiency, and enhanced clinical capabilities that support better patient care delivery. Training opportunities and technology advancement support professional development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Health Integration represents a dominant trend as healthcare facilities adopt electronic health records and integrated healthcare information systems. ECG devices increasingly feature connectivity capabilities and data integration functions to support seamless clinical workflows.

Artificial Intelligence Adoption accelerates across Mexico’s ECG market, with AI-powered interpretation, automated reporting, and predictive analytics becoming standard features. Healthcare providers seek ECG systems that reduce interpretation time and improve diagnostic accuracy.

Portable and Wireless Solutions gain significant traction as healthcare delivery models evolve toward mobile and remote care applications. The trend toward miniaturization and wireless connectivity enables new clinical applications and patient monitoring approaches.

Telemedicine Integration drives demand for ECG systems compatible with remote consultation platforms and telehealth applications. The COVID-19 pandemic accelerated this trend, creating lasting changes in healthcare delivery preferences.

Cost-Effective Solutions become increasingly important as healthcare facilities seek to balance advanced capabilities with budget constraints. Manufacturers focus on developing affordable ECG systems without compromising essential diagnostic features.

Training and Education Focus emerges as healthcare providers recognize the importance of proper ECG technology utilization. Comprehensive training programs and ongoing education support become key differentiators for ECG suppliers.

Regulatory Modernization by COFEPRIS streamlines ECG device approval processes while maintaining safety standards. Recent regulatory updates facilitate faster market entry for innovative cardiac monitoring technologies and support digital health integration.

Public Hospital Modernization programs across Mexico create substantial ECG procurement opportunities. Government initiatives to upgrade medical equipment in public healthcare facilities drive consistent demand for advanced cardiac monitoring systems.

Private Healthcare Expansion continues with new hospital construction and clinic network development, particularly in urban areas. Private healthcare growth creates premium market segments seeking advanced ECG technology and comprehensive cardiac care capabilities.

Technology Partnerships between international ECG manufacturers and Mexican distributors strengthen market presence and service capabilities. Strategic alliances enable better customer support, training programs, and technical assistance across the country.

Medical Device Manufacturing initiatives in Mexico attract international companies to establish local production facilities. These developments reduce costs, improve supply chain reliability, and create opportunities for technology transfer and innovation.

Healthcare Digitization accelerates across Mexican medical facilities, driving demand for ECG systems with advanced connectivity and data management capabilities. Digital transformation initiatives support integrated healthcare delivery and improved patient outcomes.

Market Entry Strategy recommendations emphasize the importance of establishing strong local partnerships with experienced healthcare distributors and service providers. MWR analysis suggests that successful market penetration requires comprehensive understanding of regional healthcare needs and regulatory requirements.

Product Development Focus should prioritize cost-effective solutions with essential diagnostic capabilities to address price-sensitive market segments. Manufacturers should consider developing ECG systems specifically designed for emerging market requirements and infrastructure limitations.

Service Capability Investment becomes critical for long-term success in Mexico’s ECG market. Companies should establish local technical support, training programs, and maintenance services to differentiate from competitors and build customer loyalty.

Technology Integration strategies should emphasize compatibility with existing healthcare information systems and electronic health records. ECG manufacturers should prioritize interoperability and data integration capabilities to meet healthcare facility requirements.

Regional Market Approach requires tailored strategies for different geographic areas within Mexico. Urban markets demand advanced technology features, while rural areas prioritize reliability, simplicity, and cost-effectiveness in ECG solutions.

Partnership Development with healthcare facility management companies, group purchasing organizations, and government procurement agencies can accelerate market penetration and create sustainable revenue streams for ECG suppliers.

Long-term growth prospects for Mexico’s ECG market remain highly positive, driven by demographic trends, healthcare infrastructure development, and increasing cardiovascular disease awareness. MarkWide Research projects continued market expansion with sustained growth rates exceeding 8% annually over the next five years.

Technology evolution will continue shaping market dynamics, with artificial intelligence, cloud computing, and mobile health applications becoming standard features in ECG systems. Healthcare providers will increasingly demand integrated solutions that support comprehensive cardiac care delivery.

Market consolidation may occur as smaller players struggle to compete with established manufacturers offering comprehensive product portfolios and service capabilities. Strategic acquisitions and partnerships will likely reshape the competitive landscape.

Regulatory environment evolution will support innovation while maintaining safety standards, potentially accelerating approval processes for advanced ECG technologies. Digital health regulations will continue developing to support telemedicine and remote monitoring applications.

Healthcare accessibility improvements through government initiatives and private sector investment will expand ECG market reach into underserved areas. Rural healthcare development programs will create new market segments and growth opportunities.

International expansion opportunities may emerge as Mexican ECG market participants develop expertise and capabilities that can be leveraged across Latin American markets. Mexico’s strategic position supports regional market development initiatives.

Mexico’s electrocardiograph market presents substantial growth opportunities driven by demographic trends, healthcare modernization, and increasing cardiovascular disease prevalence. The market’s expansion reflects broader healthcare system development and growing recognition of cardiac care importance across Mexican society.

Key success factors for market participants include establishing strong local partnerships, developing cost-effective solutions, and providing comprehensive service capabilities. The market rewards companies that understand regional healthcare needs and can adapt their offerings to diverse facility requirements and budget constraints.

Future market development will be shaped by technology integration, regulatory evolution, and changing healthcare delivery models. Companies that invest in innovation, service capabilities, and market understanding will be best positioned to capitalize on Mexico’s expanding ECG market opportunities and contribute to improved cardiac care outcomes nationwide.

What is Electrocardiograph (ECG)?

An Electrocardiograph (ECG) is a medical device that records the electrical activity of the heart over a period of time. It is commonly used to diagnose heart conditions, monitor heart health, and assess the effectiveness of treatments.

What are the key companies in the Mexico Electrocardiograph (ECG) Market?

Key companies in the Mexico Electrocardiograph (ECG) Market include GE Healthcare, Philips Healthcare, and Siemens Healthineers, among others.

What are the growth factors driving the Mexico Electrocardiograph (ECG) Market?

The Mexico Electrocardiograph (ECG) Market is driven by the increasing prevalence of cardiovascular diseases, advancements in ECG technology, and the growing demand for remote patient monitoring solutions.

What challenges does the Mexico Electrocardiograph (ECG) Market face?

Challenges in the Mexico Electrocardiograph (ECG) Market include high costs of advanced ECG systems, regulatory hurdles, and the need for skilled professionals to operate and interpret ECG results.

What opportunities exist in the Mexico Electrocardiograph (ECG) Market?

Opportunities in the Mexico Electrocardiograph (ECG) Market include the expansion of telemedicine services, increasing investments in healthcare infrastructure, and the development of portable ECG devices for home use.

What trends are shaping the Mexico Electrocardiograph (ECG) Market?

Trends in the Mexico Electrocardiograph (ECG) Market include the integration of artificial intelligence for improved diagnostics, the rise of wearable ECG monitors, and a focus on patient-centric healthcare solutions.

Mexico Electrocardiograph (ECG) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable ECG, Holter Monitor, Stress ECG, Resting ECG |

| End User | Cardiology Clinics, Hospitals, Home Care, Diagnostic Centers |

| Technology | Wireless ECG, Digital ECG, Analog ECG, Telemetry ECG |

| Application | Arrhythmia Detection, Heart Rate Monitoring, Cardiac Event Recording, Patient Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Electrocardiograph (ECG) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at