444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico electric bus market represents a transformative shift in the country’s public transportation landscape, driven by environmental concerns, government initiatives, and technological advancements. Mexico’s commitment to sustainable mobility solutions has positioned the electric bus sector as a critical component of urban transportation modernization across major metropolitan areas including Mexico City, Guadalajara, and Monterrey.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 18.5% as cities prioritize clean transportation alternatives. The transition from conventional diesel buses to electric alternatives reflects Mexico’s broader environmental strategy and alignment with global sustainability trends. Government support through subsidies, tax incentives, and infrastructure development programs has accelerated market adoption significantly.

Urban air quality concerns have become a primary catalyst for electric bus deployment, particularly in densely populated areas where traditional public transportation contributes substantially to emissions. The market encompasses various electric bus configurations, including battery electric buses (BEVs), hybrid electric buses, and fuel cell electric buses, each serving specific operational requirements and route characteristics.

The Mexico electric bus market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, deployment, and operation of electrically powered public transportation vehicles within Mexican territory. This market includes battery electric buses, hybrid electric systems, charging infrastructure, maintenance services, and supporting technologies that enable sustainable mass transit solutions.

Electric buses utilize electric motors powered by rechargeable battery systems, eliminating direct emissions and reducing operational noise compared to conventional diesel-powered vehicles. The market definition extends beyond vehicle manufacturing to include charging station networks, energy management systems, fleet management software, and specialized maintenance facilities required for comprehensive electric bus operations.

Market scope encompasses both public and private transportation operators, including municipal transit authorities, private bus companies, and intercity transportation providers. The sector integrates with Mexico’s broader electrification strategy, connecting with renewable energy initiatives and smart city development programs across various urban centers.

Mexico’s electric bus market demonstrates exceptional growth momentum, driven by environmental regulations, urbanization pressures, and technological maturation. The sector has evolved from pilot programs to commercial-scale deployments, with major cities implementing comprehensive electrification strategies for their public transportation fleets.

Key market drivers include government mandates for emission reductions, declining battery costs, and improved charging infrastructure availability. Mexican cities are experiencing a 65% increase in electric bus procurement compared to previous years, reflecting accelerated adoption rates and expanded fleet replacement programs.

Competitive landscape features both international manufacturers and emerging domestic players, creating a dynamic market environment with diverse technology offerings. The market benefits from Mexico’s strategic location, enabling efficient supply chain management and regional manufacturing capabilities that support cost-effective electric bus production and deployment.

Investment flows into charging infrastructure and fleet modernization programs indicate sustained market expansion, with public-private partnerships facilitating large-scale electric bus implementations across multiple metropolitan areas.

Strategic market insights reveal several critical trends shaping Mexico’s electric bus landscape:

Environmental regulations serve as the primary catalyst for electric bus adoption, with Mexican authorities implementing stringent emission standards for public transportation. The National Climate Change Strategy establishes clear targets for transportation sector decarbonization, creating mandatory requirements for electric vehicle integration in public fleets.

Government incentives provide substantial financial support for electric bus procurement, including tax exemptions, import duty reductions, and direct subsidies for fleet operators. These programs have resulted in a 45% cost reduction for electric bus acquisition compared to unsubsidized purchases, making electric alternatives economically competitive with conventional vehicles.

Urbanization pressures in major Mexican cities necessitate efficient, clean transportation solutions to serve growing populations while maintaining air quality standards. The concentration of population in metropolitan areas creates optimal conditions for electric bus deployment, with high passenger volumes justifying infrastructure investments.

Technological advancements in battery technology, charging systems, and vehicle efficiency have improved electric bus performance while reducing total cost of ownership. Enhanced battery life, faster charging capabilities, and improved energy density make electric buses increasingly practical for diverse route requirements and operational conditions.

High initial capital requirements represent a significant barrier for many transportation operators, particularly smaller municipal systems with limited budgets. The upfront investment for electric buses and supporting infrastructure often exceeds conventional vehicle costs, requiring substantial financial planning and funding arrangements.

Charging infrastructure limitations in certain regions constrain electric bus deployment, particularly in areas lacking adequate electrical grid capacity or strategic charging locations. The need for specialized charging equipment and electrical upgrades can delay implementation timelines and increase project complexity.

Technical expertise shortages in electric vehicle maintenance and operation create operational challenges for fleet operators transitioning from conventional vehicles. The specialized knowledge required for electric bus systems necessitates comprehensive training programs and skilled technician development.

Range limitations for certain electric bus configurations may restrict route flexibility, particularly for long-distance or high-frequency services. Battery capacity constraints and charging time requirements can impact operational efficiency and service reliability in demanding applications.

Infrastructure development presents substantial opportunities for companies specializing in charging systems, electrical grid upgrades, and energy management solutions. The expanding electric bus market creates demand for comprehensive charging networks, smart grid integration, and renewable energy connections.

Manufacturing localization offers opportunities for domestic production facilities, component suppliers, and assembly operations. Mexico’s strategic location and manufacturing capabilities position the country as a potential regional hub for electric bus production serving North American and Latin American markets.

Service sector expansion creates opportunities in maintenance, fleet management, driver training, and technical support services. The specialized requirements of electric bus operations generate demand for expert service providers and comprehensive support solutions.

Technology innovation opportunities exist in battery technology, charging systems, vehicle efficiency improvements, and integrated mobility solutions. The evolving market rewards companies developing advanced technologies that enhance electric bus performance and reduce operational costs.

Supply chain dynamics in Mexico’s electric bus market reflect a complex interplay between international manufacturers, domestic suppliers, and government procurement policies. The market benefits from Mexico’s established automotive manufacturing base, which provides skilled workforce and supply chain infrastructure adaptable to electric vehicle production.

Competitive dynamics feature intense competition between established bus manufacturers and emerging electric vehicle specialists. Traditional diesel bus manufacturers are investing heavily in electric technology development, while new entrants focus on innovative electric-specific designs and advanced battery systems.

Regulatory dynamics continue evolving as authorities refine emission standards, safety requirements, and operational guidelines for electric buses. The regulatory environment increasingly favors electric alternatives through preferential treatment in procurement processes and operational advantages in restricted emission zones.

Economic dynamics demonstrate improving cost competitiveness for electric buses, with declining battery costs and operational savings offsetting higher initial investments. Total cost of ownership calculations increasingly favor electric alternatives, particularly for high-utilization urban routes.

Market research methodology employed comprehensive data collection approaches combining primary and secondary research sources to ensure accurate market assessment. The research framework incorporated quantitative analysis of market trends, competitive positioning, and growth projections alongside qualitative insights from industry stakeholders.

Primary research included extensive interviews with fleet operators, government officials, manufacturers, and technology providers to gather firsthand insights into market conditions, challenges, and opportunities. Survey methodologies captured operational data, cost structures, and performance metrics from active electric bus deployments across Mexico.

Secondary research utilized government databases, industry reports, regulatory documents, and company financial statements to establish market baselines and validate primary research findings. MarkWide Research analytical frameworks provided structured approaches to market segmentation and competitive analysis.

Data validation processes ensured research accuracy through cross-referencing multiple sources, statistical analysis, and expert review procedures. The methodology incorporated regional variations, seasonal factors, and operational differences to provide comprehensive market understanding.

Mexico City metropolitan area dominates the electric bus market, accounting for approximately 55% of national deployment due to its large population, extensive public transportation network, and stringent environmental regulations. The capital region’s advanced infrastructure and government support create optimal conditions for large-scale electric bus implementation.

Guadalajara region represents the second-largest market segment, with significant investments in Bus Rapid Transit (BRT) systems and electric vehicle infrastructure. The city’s commitment to sustainable transportation has resulted in comprehensive electric bus procurement programs and supporting charging networks.

Monterrey metropolitan area demonstrates strong growth potential with industrial development driving transportation demand and environmental awareness. The region’s economic prosperity supports investment in modern transportation technologies and infrastructure development.

Secondary cities including Puebla, Tijuana, and León are emerging as important market segments, with 25% market share growth as electric bus technology becomes more accessible and cost-effective for smaller urban areas. These markets benefit from federal programs supporting sustainable transportation adoption across diverse geographic regions.

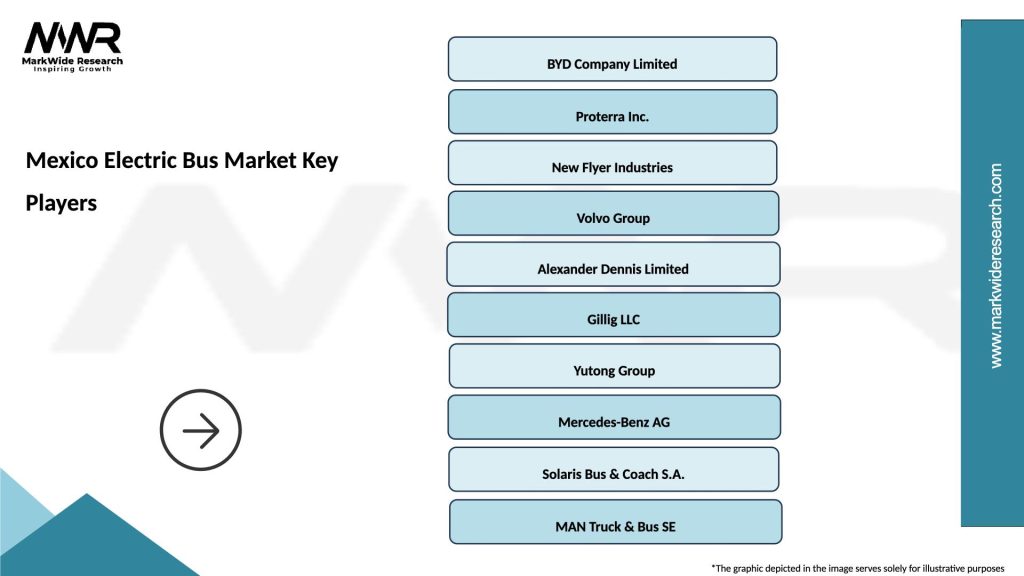

Market competition features diverse participants ranging from established international manufacturers to innovative domestic companies:

Competitive strategies emphasize technological innovation, local partnerships, and comprehensive service offerings to differentiate market positions and capture growth opportunities.

By Technology:

By Application:

By Bus Length:

Battery Electric Buses dominate market adoption due to their operational simplicity, zero direct emissions, and declining battery costs. These vehicles excel in urban environments with predictable routes and adequate charging infrastructure, offering the lowest operational complexity and maintenance requirements.

Hybrid Electric Buses serve as transitional technology for operators requiring extended range or operating in areas with limited charging infrastructure. These systems combine electric propulsion with conventional engines, providing operational flexibility while reducing emissions compared to traditional diesel buses.

Urban Transit Applications represent the largest market segment, with municipal transportation authorities leading electric bus adoption. These applications benefit from predictable routes, centralized maintenance facilities, and government support for sustainable transportation initiatives.

BRT Systems create specialized market opportunities requiring high-capacity vehicles and dedicated infrastructure. Electric buses in BRT applications demonstrate exceptional efficiency and environmental benefits while serving high-passenger volumes in dedicated corridors.

Fleet Operators benefit from reduced operational costs, lower maintenance requirements, and improved operational efficiency. Electric buses offer 60% reduction in fuel costs and significantly lower maintenance expenses due to fewer moving parts and simplified drivetrain systems.

Passengers experience improved comfort through reduced noise levels, smoother acceleration, and better air quality in urban areas. Electric buses provide superior ride quality and contribute to more pleasant public transportation experiences.

Government Authorities achieve environmental goals, improve public health outcomes, and demonstrate leadership in sustainable transportation. Electric bus deployment supports climate commitments while providing visible examples of environmental stewardship.

Local Communities benefit from improved air quality, reduced noise pollution, and economic development through job creation in manufacturing, maintenance, and infrastructure development sectors.

Manufacturers access growing market opportunities, develop advanced technologies, and establish competitive positions in the expanding electric vehicle sector. The market provides platforms for innovation and technological advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Charging Infrastructure Expansion represents a critical trend with rapid deployment of fast-charging stations and depot charging facilities. Advanced charging technologies including wireless charging and ultra-fast charging systems are being tested and implemented to improve operational efficiency.

Battery Technology Advancement continues driving market evolution with improved energy density, faster charging capabilities, and extended battery life. Solid-state batteries and advanced lithium-ion technologies promise further performance improvements and cost reductions.

Smart Fleet Management integration enables optimized route planning, predictive maintenance, and energy management through advanced telematics and data analytics. These systems maximize electric bus efficiency while minimizing operational costs and downtime.

Renewable Energy Integration connects electric bus operations with solar and wind power generation, creating comprehensive sustainable transportation ecosystems. This trend supports Mexico’s broader renewable energy goals while reducing operational costs.

Manufacturing Localization accelerates with international manufacturers establishing Mexican production facilities and domestic companies developing electric bus capabilities. This trend reduces costs and improves supply chain resilience.

Major procurement programs have been announced across multiple Mexican cities, with comprehensive fleet replacement initiatives targeting thousands of conventional buses. These programs represent substantial market opportunities and demonstrate sustained commitment to electric transportation.

Infrastructure investments include significant charging network expansions, electrical grid upgrades, and maintenance facility modernization. Public-private partnerships facilitate these developments while sharing investment risks and operational responsibilities.

Technology partnerships between international manufacturers and Mexican companies accelerate local capability development and market penetration. These collaborations combine global expertise with local market knowledge and manufacturing capabilities.

Regulatory developments continue evolving with updated emission standards, safety requirements, and operational guidelines specifically addressing electric bus deployment. MWR analysis indicates these regulatory changes increasingly favor electric alternatives over conventional vehicles.

Strategic recommendations for market participants emphasize the importance of comprehensive planning and stakeholder collaboration. Fleet operators should develop detailed transition strategies addressing infrastructure requirements, operational changes, and workforce training needs.

Investment priorities should focus on charging infrastructure development, technical capability building, and strategic partnerships with technology providers. Early investment in these areas creates competitive advantages and operational efficiency.

Technology selection requires careful evaluation of route requirements, operational patterns, and infrastructure availability. Operators should conduct pilot programs to validate electric bus performance in specific operating conditions before large-scale deployment.

Partnership strategies with manufacturers, technology providers, and government agencies facilitate successful electric bus implementation. Collaborative approaches share risks while leveraging complementary expertise and resources.

Market timing considerations suggest optimal entry points vary by region and application. Secondary cities may offer attractive opportunities with less competition and supportive government programs.

Long-term market prospects indicate sustained growth driven by environmental regulations, technology improvements, and cost reductions. The electric bus market is expected to achieve mainstream adoption rates exceeding 80% for new urban bus procurement within the next decade.

Technology evolution will continue improving electric bus performance, with next-generation batteries offering extended range and faster charging capabilities. Autonomous driving technology integration may further enhance electric bus value propositions and operational efficiency.

Market expansion beyond major metropolitan areas will accelerate as technology costs decline and infrastructure availability improves. Regional transportation networks and smaller cities represent significant growth opportunities for electric bus deployment.

Industry consolidation may occur as the market matures, with successful companies expanding market share while others exit or merge. This consolidation could improve technology standardization and reduce costs through economies of scale.

MarkWide Research projections indicate the Mexican electric bus market will achieve significant penetration across all major urban areas, supported by continued government commitment and improving economic competitiveness compared to conventional alternatives.

Mexico’s electric bus market represents a transformative opportunity in sustainable transportation, driven by environmental imperatives, government support, and technological advancement. The market demonstrates strong growth potential with expanding deployment across major urban centers and emerging opportunities in secondary cities.

Key success factors include comprehensive infrastructure development, strategic partnerships, and careful attention to operational requirements and local market conditions. Companies entering this market must balance technological innovation with practical implementation considerations and stakeholder collaboration.

Future market development will depend on continued government support, technology cost reductions, and successful operational demonstrations proving electric bus viability across diverse applications. The market’s evolution toward mainstream adoption appears inevitable, with timing and competitive positioning determining individual participant success.

Strategic implications suggest that early market entrants with comprehensive solutions and strong local partnerships will capture the greatest opportunities in Mexico’s expanding electric bus market, contributing to the country’s sustainable transportation transformation while achieving commercial success.

What is Electric Bus?

Electric buses are vehicles powered by electric motors instead of traditional internal combustion engines. They are designed to reduce emissions and improve air quality in urban environments, making them a sustainable alternative for public transportation.

What are the key players in the Mexico Electric Bus Market?

Key players in the Mexico Electric Bus Market include companies like BYD, Daimler AG, and Solaris Bus & Coach, which are known for their innovative electric bus solutions and commitment to sustainable transport, among others.

What are the growth factors driving the Mexico Electric Bus Market?

The Mexico Electric Bus Market is driven by factors such as government initiatives promoting clean energy, increasing urbanization leading to higher public transport demand, and advancements in battery technology enhancing electric bus performance.

What challenges does the Mexico Electric Bus Market face?

Challenges in the Mexico Electric Bus Market include high initial investment costs, limited charging infrastructure, and concerns regarding battery life and range, which can hinder widespread adoption.

What opportunities exist in the Mexico Electric Bus Market?

Opportunities in the Mexico Electric Bus Market include the potential for partnerships between public and private sectors, advancements in renewable energy integration, and increasing consumer demand for sustainable transportation options.

What trends are shaping the Mexico Electric Bus Market?

Trends in the Mexico Electric Bus Market include the rise of smart transportation systems, the integration of autonomous driving technology, and a growing focus on reducing carbon footprints in urban areas.

Mexico Electric Bus Market

| Segmentation Details | Description |

|---|---|

| Product Type | Battery Electric Bus, Plug-in Hybrid Bus, Fuel Cell Bus, Others |

| End User | Public Transport Authorities, Private Operators, Educational Institutions, Corporate Fleets |

| Technology | Fast Charging, Wireless Charging, Regenerative Braking, Smart Grid Integration |

| Deployment | Urban Areas, Suburban Areas, Intercity Routes, Campus Transport |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Electric Bus Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at