444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico diabetes medication market represents a critical healthcare sector experiencing unprecedented growth driven by rising diabetes prevalence and evolving treatment paradigms. Mexico faces one of the highest diabetes rates globally, with approximately 12.8% of adults living with the condition, creating substantial demand for innovative therapeutic solutions. The market encompasses various medication categories including insulin products, oral antidiabetic drugs, GLP-1 receptor agonists, and emerging combination therapies.

Healthcare infrastructure improvements and increased government investment in diabetes management programs have significantly enhanced market accessibility. The Mexican healthcare system’s dual structure, combining public institutions like IMSS and ISSSTE with private healthcare providers, creates diverse distribution channels for diabetes medications. Market dynamics indicate robust growth potential, with the sector expanding at a compound annual growth rate of 8.2% as healthcare awareness increases and treatment options diversify.

Pharmaceutical companies are increasingly focusing on Mexico as a strategic market due to its large patient population and growing healthcare expenditure. The market benefits from favorable regulatory frameworks and government initiatives promoting diabetes prevention and management. Innovation trends include the introduction of biosimilar insulin products, advanced delivery systems, and personalized treatment approaches that cater to Mexico’s diverse demographic needs.

The Mexico diabetes medication market refers to the comprehensive ecosystem of pharmaceutical products, therapeutic solutions, and healthcare services designed to manage and treat diabetes mellitus within Mexico’s healthcare landscape. This market encompasses prescription medications, over-the-counter supplements, medical devices for drug delivery, and associated healthcare services that support diabetes management across the country’s diverse population.

Market scope includes various therapeutic categories such as rapid-acting insulin, long-acting insulin formulations, metformin-based treatments, sulfonylureas, DPP-4 inhibitors, SGLT-2 inhibitors, and newer classes like GLP-1 receptor agonists. The market also incorporates biosimilar products, combination therapies, and innovative delivery mechanisms including insulin pens, pumps, and continuous glucose monitoring systems that enhance patient compliance and treatment outcomes.

Healthcare stakeholders within this market include pharmaceutical manufacturers, healthcare providers, government institutions, insurance companies, and patient advocacy groups working collaboratively to address Mexico’s diabetes epidemic. The market operates within regulatory frameworks established by COFEPRIS and integrates with national health programs aimed at improving diabetes care accessibility and affordability across urban and rural communities.

Mexico’s diabetes medication market stands as a rapidly expanding healthcare sector driven by alarming diabetes prevalence rates and increasing healthcare awareness among the population. The market demonstrates significant growth momentum with Type 2 diabetes accounting for approximately 95% of all diabetes cases in the country, creating substantial demand for oral antidiabetic medications and insulin therapies.

Key market drivers include rising obesity rates, sedentary lifestyles, genetic predisposition, and an aging population contributing to increased diabetes incidence. Government initiatives such as the National Strategy for Prevention and Control of Overweight, Obesity and Diabetes have enhanced market growth by improving treatment accessibility and promoting early diagnosis programs.

Competitive landscape features both international pharmaceutical giants and domestic manufacturers competing across various therapeutic segments. The market benefits from increasing healthcare expenditure, with diabetes-related spending representing approximately 15% of total healthcare costs in Mexico. Innovation focus centers on developing cost-effective treatments, improving drug delivery systems, and creating culturally appropriate patient education programs.

Future prospects indicate continued market expansion driven by technological advancements, regulatory improvements, and growing emphasis on preventive healthcare. The integration of digital health solutions and telemedicine platforms is expected to further enhance market accessibility and patient outcomes across Mexico’s diverse geographic regions.

Market penetration analysis reveals significant opportunities for growth, particularly in rural areas where diabetes medication accessibility remains limited. The following insights highlight critical market dynamics:

Epidemiological factors serve as the primary catalyst for Mexico’s diabetes medication market growth. The country’s diabetes prevalence rate of 12.8% among adults creates substantial and sustained demand for therapeutic interventions. Lifestyle changes associated with urbanization, including increased consumption of processed foods and reduced physical activity, continue driving diabetes incidence rates upward across all demographic segments.

Government initiatives significantly impact market expansion through comprehensive diabetes management programs and increased healthcare funding. The Mexican government’s commitment to addressing the diabetes epidemic through national health strategies has resulted in improved medication accessibility and enhanced treatment protocols. Healthcare infrastructure development, including the expansion of specialized diabetes clinics and training programs for healthcare providers, creates additional market opportunities.

Technological advancements in diabetes care, including continuous glucose monitoring systems, insulin delivery devices, and digital health platforms, drive demand for integrated treatment solutions. Pharmaceutical innovation continues introducing new therapeutic options with improved efficacy profiles and reduced side effects, attracting both healthcare providers and patients seeking better treatment outcomes.

Economic factors including rising disposable income among middle-class populations and expanded health insurance coverage contribute to increased medication accessibility. Awareness campaigns conducted by healthcare organizations and pharmaceutical companies have significantly improved diabetes recognition and treatment-seeking behavior among the Mexican population.

Economic barriers represent significant challenges for diabetes medication market growth in Mexico. High medication costs, particularly for newer therapeutic classes and branded products, limit accessibility for substantial portions of the population. Healthcare inequality between urban and rural areas creates disparities in treatment availability and quality, with remote regions often lacking adequate healthcare infrastructure and specialized diabetes care services.

Regulatory complexities and lengthy approval processes for new medications can delay market entry of innovative treatments. COFEPRIS requirements for clinical trials and safety data, while necessary for patient protection, may slow the introduction of potentially beneficial therapies. Reimbursement limitations within public healthcare systems restrict access to expensive medications, forcing patients to rely on older, less effective treatment options.

Cultural factors including traditional medicine preferences and skepticism toward pharmaceutical interventions can impede medication adherence and market growth. Healthcare provider shortages, particularly endocrinologists and diabetes educators, limit proper patient management and medication optimization. Supply chain challenges in remote areas can result in medication shortages and inconsistent availability of essential diabetes treatments.

Patient education deficits regarding diabetes management and medication importance contribute to poor treatment compliance and suboptimal health outcomes. Side effect concerns and fear of insulin dependency among patients can create resistance to appropriate treatment escalation when needed.

Biosimilar expansion presents substantial opportunities for market growth and improved medication accessibility. As patents expire for major insulin products and other diabetes medications, biosimilar manufacturers can provide cost-effective alternatives that maintain therapeutic efficacy while reducing treatment costs. This trend particularly benefits Mexico’s price-sensitive healthcare market and public health institutions.

Digital health integration offers innovative approaches to diabetes management through telemedicine platforms, mobile health applications, and remote monitoring systems. Technology adoption can bridge healthcare gaps in rural areas and provide continuous patient support, potentially improving medication adherence and treatment outcomes across diverse populations.

Combination therapies represent growing opportunities as healthcare providers seek simplified treatment regimens that improve patient compliance. Fixed-dose combinations of complementary diabetes medications can reduce pill burden and enhance therapeutic effectiveness. Personalized medicine approaches using genetic testing and biomarker analysis may enable more targeted and effective treatment strategies.

Public-private partnerships create opportunities for expanded market reach through collaborative healthcare initiatives. Government cooperation with pharmaceutical companies can facilitate medication access programs, patient education initiatives, and healthcare infrastructure development. Export potential to other Latin American markets positions Mexico as a regional hub for diabetes medication manufacturing and distribution.

Supply and demand dynamics in Mexico’s diabetes medication market reflect the complex interplay between rising disease prevalence and healthcare system capacity. Demand drivers include increasing diabetes diagnosis rates, aging population demographics, and growing awareness of treatment importance. The market experiences consistent demand growth with annual increases of approximately 6-8% in medication consumption across various therapeutic categories.

Competitive dynamics involve both international pharmaceutical companies and domestic manufacturers vying for market share across different price segments. Market leaders focus on innovation and brand recognition, while generic manufacturers compete primarily on cost-effectiveness and accessibility. Pricing pressures from government procurement policies and insurance reimbursement limitations influence competitive strategies and product positioning.

Regulatory dynamics shape market entry strategies and product development priorities. COFEPRIS policies regarding biosimilar approvals, generic substitution, and safety monitoring create both opportunities and challenges for market participants. Healthcare policy changes related to diabetes management protocols and medication coverage directly impact market demand patterns.

Distribution dynamics involve complex networks spanning public hospitals, private clinics, retail pharmacies, and specialized diabetes centers. Channel optimization strategies focus on improving medication availability and reducing distribution costs while maintaining product quality and patient access across Mexico’s diverse geographic landscape.

Market research for Mexico’s diabetes medication sector employs comprehensive methodological approaches combining primary and secondary data sources to ensure accuracy and reliability. Primary research involves extensive interviews with healthcare professionals, pharmaceutical executives, regulatory officials, and patient advocacy groups to gather firsthand insights into market dynamics and trends.

Secondary research incorporates analysis of government health statistics, pharmaceutical industry reports, academic publications, and regulatory filings to establish market baselines and identify growth patterns. Data collection methods include surveys of healthcare providers, patient interviews, and analysis of prescription patterns across different healthcare institutions and geographic regions.

Quantitative analysis utilizes statistical modeling techniques to project market trends, assess competitive positioning, and evaluate the impact of various market drivers and restraints. Qualitative research provides contextual understanding of cultural factors, healthcare practices, and patient behaviors that influence medication adoption and adherence patterns.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert consultations, and peer review procedures. MarkWide Research methodology incorporates real-time market monitoring and continuous data updates to maintain research relevance and accuracy in the rapidly evolving diabetes medication landscape.

Mexico City and surrounding metropolitan areas represent the largest regional market for diabetes medications, accounting for approximately 25% of national consumption. The capital region benefits from concentrated healthcare infrastructure, higher income levels, and greater access to specialized diabetes care services. Private healthcare penetration is highest in this region, driving demand for premium and innovative diabetes treatments.

Northern states including Nuevo León, Chihuahua, and Sonora demonstrate strong market growth driven by industrial development, higher employment rates, and proximity to the United States healthcare market. These regions show above-average adoption rates for newer diabetes medications and medical devices. Cross-border healthcare activities influence medication preferences and treatment protocols in these areas.

Central regions encompassing Jalisco, Guanajuato, and Puebla represent significant market opportunities with growing urban populations and expanding healthcare infrastructure. Regional healthcare initiatives and university medical centers contribute to improved diabetes care standards and medication accessibility.

Southern states including Oaxaca, Chiapas, and Guerrero face unique challenges related to healthcare access, economic limitations, and cultural factors affecting diabetes medication adoption. Government programs targeting these regions focus on improving basic healthcare services and medication availability. Rural healthcare initiatives aim to bridge treatment gaps and improve patient outcomes in underserved communities.

Market leadership in Mexico’s diabetes medication sector is characterized by intense competition among established pharmaceutical companies and emerging biosimilar manufacturers. The competitive environment reflects diverse strategies ranging from innovation-focused approaches to cost-effective generic alternatives.

By Product Type: The Mexico diabetes medication market demonstrates clear segmentation patterns based on therapeutic mechanisms and patient needs. Insulin products represent the largest segment, subdivided into rapid-acting, short-acting, intermediate-acting, and long-acting formulations. Oral antidiabetic drugs constitute the second-largest segment, including metformin, sulfonylureas, DPP-4 inhibitors, SGLT-2 inhibitors, and thiazolidinediones.

By Diabetes Type: Market segmentation reflects the epidemiological distribution of diabetes types in Mexico. Type 2 diabetes medications dominate market share at approximately 95% of total consumption, while Type 1 diabetes treatments represent a smaller but critical market segment requiring specialized insulin therapies and delivery systems.

By Distribution Channel: The market operates through diverse distribution networks including public hospitals, private clinics, retail pharmacies, and specialized diabetes centers. Public healthcare institutions account for the majority of medication distribution, while private pharmacies serve patients with insurance coverage and higher disposable income.

By Patient Demographics: Age-based segmentation reveals distinct medication preferences and treatment patterns. Adult patients aged 45-65 represent the largest consumer group, while elderly patients over 65 require specialized treatment considerations due to comorbidities and medication interactions.

Insulin Category: The insulin segment demonstrates robust growth with long-acting insulin formulations gaining market share due to improved patient convenience and compliance. Biosimilar insulin products are increasingly penetrating the market, offering cost-effective alternatives to branded products while maintaining therapeutic equivalence. Insulin delivery systems including pens and pumps are becoming more popular among patients seeking improved treatment convenience.

Oral Antidiabetic Category: Metformin-based treatments remain the foundation of Type 2 diabetes management, with combination products gaining popularity for their simplified dosing regimens. DPP-4 inhibitors show strong growth due to their favorable safety profiles and low hypoglycemia risk. SGLT-2 inhibitors are experiencing rapid adoption driven by their cardiovascular and renal protective benefits.

GLP-1 Receptor Agonists: This newer therapeutic class demonstrates exceptional growth potential with weekly injection formulations improving patient acceptance and adherence. Weight loss benefits associated with GLP-1 agonists make them particularly attractive for obese diabetic patients prevalent in Mexico’s population.

Combination Therapies: Fixed-dose combinations are gaining market traction as healthcare providers seek to simplify treatment regimens and improve patient compliance. Insulin-GLP-1 combinations represent emerging opportunities for comprehensive diabetes management in advanced disease stages.

Pharmaceutical Companies benefit from Mexico’s large and growing diabetes patient population, creating substantial market opportunities for both innovative and generic medications. Market expansion potential remains significant given the underdiagnosed diabetes prevalence and improving healthcare access. Regulatory environment supports both innovation and generic competition, enabling diverse market entry strategies.

Healthcare Providers gain access to expanding therapeutic options that improve patient outcomes and treatment satisfaction. Professional development opportunities through pharmaceutical company education programs enhance diabetes care capabilities. Patient management tools and support programs provided by industry participants facilitate better clinical outcomes.

Patients benefit from increased medication accessibility, improved treatment options, and enhanced support services. Cost reduction through generic and biosimilar availability makes diabetes management more affordable. Innovation access provides opportunities for better disease control and quality of life improvements.

Government Healthcare Systems achieve improved population health outcomes while managing healthcare costs through competitive medication pricing. Public-private partnerships enable enhanced healthcare service delivery and patient education programs. Economic benefits include reduced long-term diabetes complications and associated healthcare costs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized Medicine emerges as a significant trend with healthcare providers increasingly utilizing genetic testing and biomarker analysis to optimize diabetes treatment selection. Precision therapy approaches enable more targeted medication choices based on individual patient characteristics and treatment response patterns. This trend particularly benefits patients with complex diabetes presentations or multiple comorbidities.

Digital Health Integration transforms diabetes management through mobile applications, continuous glucose monitoring systems, and telemedicine platforms. Remote monitoring capabilities enable healthcare providers to track patient progress and adjust medications without requiring frequent clinic visits. Artificial intelligence applications assist in predicting treatment outcomes and optimizing medication regimens.

Combination Therapy Adoption accelerates as healthcare providers recognize the benefits of simplified treatment regimens for patient compliance. Fixed-dose combinations reduce pill burden while maintaining therapeutic effectiveness. Injectable combinations combining insulin with GLP-1 receptor agonists offer comprehensive diabetes management in single formulations.

Biosimilar Market Expansion continues reshaping the competitive landscape with cost-effective alternatives to branded insulin and other diabetes medications. Regulatory support for biosimilar approvals encourages market entry and competition. Healthcare system adoption of biosimilars helps control medication costs while maintaining treatment quality.

Regulatory Approvals for innovative diabetes medications continue expanding treatment options for Mexican patients. Recent COFEPRIS approvals include new GLP-1 receptor agonists, SGLT-2 inhibitors, and combination therapies that offer improved efficacy and safety profiles. Biosimilar approvals for major insulin products increase market competition and improve medication accessibility.

Manufacturing Investments by pharmaceutical companies strengthen Mexico’s position as a regional production hub for diabetes medications. Local manufacturing facilities reduce supply chain risks and improve medication availability while creating employment opportunities. Technology transfers enhance domestic pharmaceutical capabilities and support market growth.

Healthcare Partnerships between pharmaceutical companies and Mexican healthcare institutions facilitate improved patient care and medication access. Patient assistance programs provide medication support for underinsured populations. Educational initiatives enhance healthcare provider knowledge and patient awareness of diabetes management options.

Digital Health Initiatives introduce innovative patient management tools and medication adherence solutions. Mobile health platforms connect patients with healthcare providers and provide medication reminders and educational resources. Data analytics applications help optimize treatment protocols and improve patient outcomes across diverse populations.

Market Entry Strategies should focus on addressing Mexico’s unique healthcare challenges and patient needs. MarkWide Research analysis suggests that successful market participants must balance innovation with affordability to capture both private and public healthcare segments. Local partnerships with Mexican healthcare institutions and pharmaceutical distributors can accelerate market penetration and improve patient access.

Product Development priorities should emphasize combination therapies, biosimilar alternatives, and culturally appropriate patient education materials. Cost-effective formulations that maintain therapeutic efficacy while reducing treatment costs align with Mexico’s healthcare economic realities. Delivery system innovations that improve patient convenience and compliance offer competitive advantages.

Distribution Optimization requires comprehensive strategies addressing both urban and rural market needs. Supply chain investments in remote areas can capture underserved market segments while supporting public health objectives. Digital distribution channels including telemedicine and online pharmacies present opportunities for expanded market reach.

Regulatory Engagement with COFEPRIS and healthcare authorities facilitates smoother market entry and product approvals. Clinical trial investments in Mexican populations provide valuable safety and efficacy data while supporting regulatory submissions. Pharmacovigilance systems ensure ongoing product safety monitoring and regulatory compliance.

Market growth projections indicate continued expansion driven by rising diabetes prevalence and improving healthcare access across Mexico. Demographic trends including population aging and urbanization will sustain long-term demand for diabetes medications. The market is expected to maintain growth rates of 7-9% annually over the next five years, supported by government healthcare initiatives and pharmaceutical innovation.

Technology integration will increasingly influence diabetes care delivery and medication management. Artificial intelligence applications in treatment optimization and patient monitoring will become standard practice. Digital therapeutics combining medication therapy with behavioral interventions will emerge as comprehensive treatment solutions.

Regulatory evolution toward streamlined approval processes for biosimilars and generic medications will enhance market competition and patient access. International harmonization of regulatory standards may facilitate faster introduction of innovative treatments. Pricing regulations will continue balancing innovation incentives with healthcare affordability requirements.

MWR projections suggest that combination therapies and personalized medicine approaches will capture increasing market share as healthcare providers seek more effective and convenient treatment options. Biosimilar penetration is expected to reach 45-50% market share in insulin segments by 2028, significantly improving medication affordability and accessibility across Mexico’s diverse population.

Mexico’s diabetes medication market represents a dynamic and rapidly expanding healthcare sector driven by significant epidemiological challenges and evolving treatment paradigms. The market’s substantial growth potential stems from high diabetes prevalence rates, improving healthcare infrastructure, and increasing government commitment to addressing the diabetes epidemic through comprehensive healthcare initiatives.

Key success factors for market participants include developing cost-effective treatment solutions, establishing strong distribution networks, and creating culturally appropriate patient education programs. The competitive landscape continues evolving with biosimilar expansion, digital health integration, and innovative combination therapies reshaping treatment approaches and market dynamics.

Future opportunities lie in addressing healthcare disparities between urban and rural areas, developing personalized treatment approaches, and leveraging technology to improve patient outcomes and medication adherence. The market’s long-term sustainability depends on balancing innovation with affordability while ensuring equitable access to essential diabetes medications across Mexico’s diverse population segments.

Strategic investments in local manufacturing, healthcare partnerships, and patient support programs will determine competitive success in this critical healthcare market. As Mexico continues addressing its diabetes challenges, the medication market will play an increasingly vital role in improving population health outcomes and reducing the economic burden of diabetes-related complications.

What is Diabetes Medication?

Diabetes medication refers to various pharmaceutical treatments used to manage blood sugar levels in individuals with diabetes. These medications can include insulin, oral hypoglycemics, and other injectable agents that help control glucose levels and prevent complications associated with diabetes.

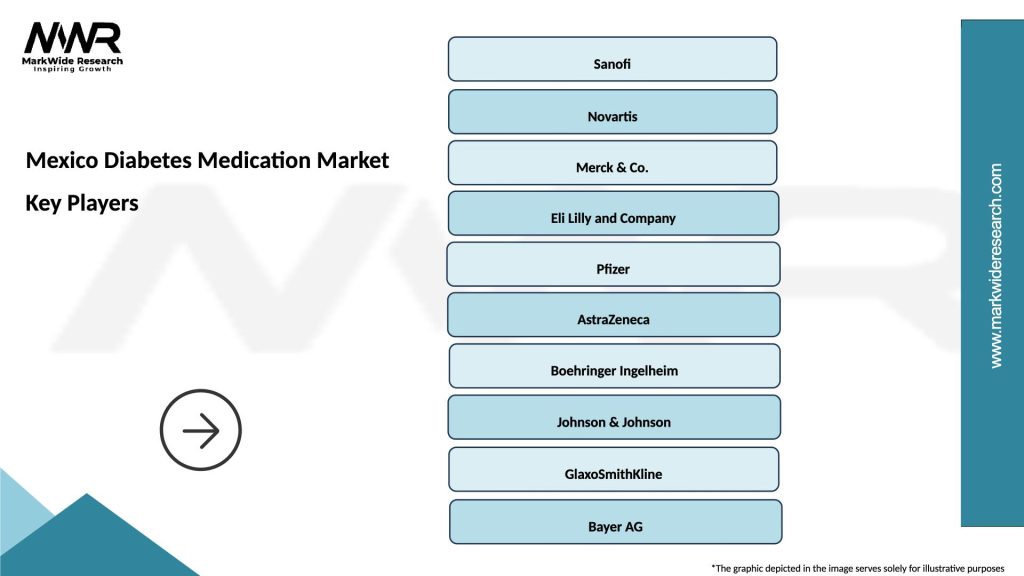

What are the key players in the Mexico Diabetes Medication Market?

Key players in the Mexico Diabetes Medication Market include Sanofi, Novo Nordisk, and Merck, which are known for their innovative diabetes treatments and extensive product portfolios. These companies focus on developing new medications and improving existing therapies to meet the needs of diabetic patients, among others.

What are the growth factors driving the Mexico Diabetes Medication Market?

The Mexico Diabetes Medication Market is driven by increasing diabetes prevalence, rising awareness about diabetes management, and advancements in medication technology. Additionally, the growing aging population and lifestyle changes contribute to the demand for effective diabetes treatments.

What challenges does the Mexico Diabetes Medication Market face?

The Mexico Diabetes Medication Market faces challenges such as high medication costs, limited access to healthcare in rural areas, and the need for better patient education. These factors can hinder effective diabetes management and medication adherence among patients.

What opportunities exist in the Mexico Diabetes Medication Market?

Opportunities in the Mexico Diabetes Medication Market include the development of new drug formulations, increasing investment in healthcare infrastructure, and the potential for telemedicine solutions to enhance patient access to diabetes care. These factors can lead to improved treatment outcomes and patient engagement.

What trends are shaping the Mexico Diabetes Medication Market?

Trends shaping the Mexico Diabetes Medication Market include the rise of personalized medicine, the integration of digital health technologies, and a focus on preventive care. These trends aim to enhance treatment efficacy and improve patient quality of life.

Mexico Diabetes Medication Market

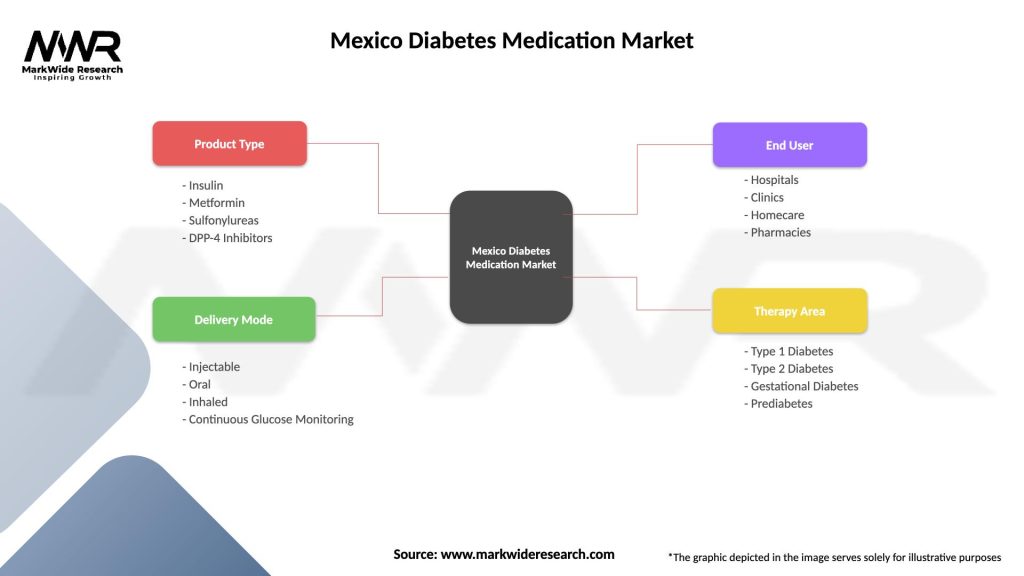

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Metformin, Sulfonylureas, DPP-4 Inhibitors |

| Delivery Mode | Injectable, Oral, Inhaled, Continuous Glucose Monitoring |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Diabetes Medication Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at