444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico dentists market represents a dynamic and rapidly evolving healthcare sector that has experienced substantial transformation over the past decade. Mexico’s dental industry has emerged as a significant player in both domestic healthcare delivery and international dental tourism, attracting patients from across North America seeking high-quality, affordable dental care. The market encompasses a diverse range of dental professionals, from general practitioners to specialized orthodontists, oral surgeons, and cosmetic dentists operating across urban centers and rural communities.

Market dynamics indicate robust growth driven by increasing healthcare awareness, rising disposable incomes, and expanding insurance coverage. The sector benefits from Mexico’s strategic geographic location, particularly along the U.S. border, where dental tourism has flourished with growth rates exceeding 12% annually. Urban markets like Mexico City, Guadalajara, and Monterrey demonstrate sophisticated dental infrastructure, while border cities such as Tijuana, Mexicali, and Ciudad Juárez have become international destinations for dental procedures.

Professional development within the market has accelerated significantly, with Mexican dental schools producing approximately 3,500 new dentists annually, contributing to a growing workforce that serves both domestic and international patients. The integration of advanced technologies, digital dentistry solutions, and modern treatment methodologies has positioned Mexican dental professionals as competitive alternatives to their North American counterparts while maintaining cost advantages of up to 70% lower treatment costs.

The Mexico dentists market refers to the comprehensive ecosystem of dental healthcare professionals, services, and infrastructure operating throughout Mexico’s 32 states and federal districts. This market encompasses licensed dental practitioners providing preventive, restorative, cosmetic, and specialized dental treatments to both domestic patients and international dental tourists seeking affordable, high-quality oral healthcare solutions.

Market scope includes general dentistry practices, specialized dental clinics, dental hospitals, mobile dental units, and teledentistry services. The sector integrates traditional dental care delivery with modern technological innovations, including digital imaging, computer-aided design and manufacturing, laser dentistry, and minimally invasive treatment protocols. Professional categories within the market range from general practitioners and pediatric dentists to oral and maxillofacial surgeons, orthodontists, periodontists, and cosmetic dentistry specialists.

Geographic distribution spans urban metropolitan areas with concentrated dental infrastructure to rural communities served by government health programs and mobile dental clinics. The market’s unique positioning leverages Mexico’s proximity to the United States and Canada, creating a cross-border healthcare dynamic that has established certain regions as international dental tourism hubs while maintaining robust domestic healthcare delivery systems.

Mexico’s dental market demonstrates exceptional growth potential driven by demographic trends, technological advancement, and international recognition for quality dental care delivery. The sector has evolved from primarily serving domestic needs to becoming a significant player in global dental tourism, with border regions experiencing patient volume increases of 15% year-over-year. Professional competency has reached international standards through enhanced education programs, continuing professional development, and adoption of cutting-edge dental technologies.

Market segmentation reveals diverse service offerings across preventive care, restorative treatments, cosmetic procedures, and specialized surgical interventions. The integration of digital dentistry has revolutionized treatment planning and delivery, with approximately 45% of urban dental practices incorporating advanced digital workflows. Insurance penetration continues expanding, with private dental insurance coverage growing alongside government healthcare initiatives targeting underserved populations.

Competitive landscape features both independent practitioners and corporate dental chains, with increasing consolidation in major metropolitan markets. The sector benefits from favorable regulatory environments, streamlined licensing procedures for international patients, and government support for medical tourism initiatives. Future projections indicate sustained growth driven by aging demographics, increased health consciousness, and continued technological innovation in dental care delivery methods.

Strategic market insights reveal several critical factors driving Mexico’s dental sector transformation and growth trajectory:

Market maturation indicators suggest the sector is transitioning from growth phase to optimization phase, with established practices focusing on service differentiation, technology upgrades, and patient experience enhancement. Regional variations demonstrate different development stages, with border cities leading in international patient services while interior markets focus on domestic healthcare delivery improvement.

Primary market drivers propelling Mexico’s dental sector growth encompass demographic, economic, and technological factors creating favorable conditions for sustained expansion. Population demographics play a crucial role, with Mexico’s aging population requiring increased dental care services while younger generations demonstrate higher health consciousness and preventive care adoption rates.

Economic factors significantly influence market dynamics, including rising disposable incomes, expanding middle class, and increased healthcare spending allocation. The dental tourism phenomenon has emerged as a major driver, with international patients seeking cost-effective treatments contributing substantially to sector revenues. Government initiatives supporting healthcare infrastructure development and medical tourism promotion have created enabling environments for practice expansion and modernization.

Technological advancement serves as a critical growth catalyst, with digital dentistry adoption improving treatment efficiency, accuracy, and patient outcomes. Educational improvements in dental schools and continuing professional development programs have enhanced practitioner competency levels, building patient confidence and market credibility. Insurance market expansion has increased treatment accessibility, with private insurance coverage growing alongside government healthcare program enhancements targeting underserved populations.

Cultural shifts toward preventive healthcare and aesthetic consciousness have expanded demand beyond traditional restorative treatments to include cosmetic procedures, orthodontics, and preventive care services. Cross-border healthcare integration has created unique market opportunities, particularly in border regions where Mexican dental practices serve both domestic and international patient populations with specialized service offerings.

Market restraints affecting Mexico’s dental sector include regulatory challenges, economic disparities, and infrastructure limitations that constrain growth potential in certain regions and market segments. Regulatory complexity surrounding cross-border healthcare delivery and international patient treatment creates administrative burdens for practices serving dental tourism markets.

Economic inequality remains a significant constraint, with substantial portions of Mexico’s population lacking access to private dental care due to income limitations and insufficient insurance coverage. Geographic disparities in healthcare infrastructure create uneven service distribution, with rural and remote areas experiencing limited access to specialized dental services and modern treatment technologies.

Professional workforce challenges include uneven distribution of dental practitioners, with urban concentration leaving rural areas underserved. Technology adoption barriers affect smaller practices and rural clinics that lack capital resources for advanced equipment investments and digital dentistry integration. Competition from established markets in the United States and Canada creates pressure on pricing and service differentiation for practices targeting international patients.

Infrastructure limitations in certain regions affect practice operations and patient access, including transportation challenges, limited laboratory services, and inconsistent utilities. Currency fluctuation impacts international patient volumes and practice revenues, particularly for dental tourism-dependent businesses. Regulatory compliance costs for maintaining international standards and certifications create financial pressures on smaller practices seeking to compete in global markets.

Emerging opportunities within Mexico’s dental market present significant potential for sector expansion and innovation across multiple dimensions. Digital transformation opportunities include teledentistry implementation, artificial intelligence integration for diagnosis and treatment planning, and digital workflow optimization that can improve efficiency and patient outcomes while reducing operational costs.

Dental tourism expansion represents substantial growth potential, particularly in developing specialized treatment centers, luxury dental facilities, and comprehensive medical tourism packages combining dental care with recovery and leisure activities. Market penetration opportunities exist in underserved rural areas through mobile dental clinics, satellite practice locations, and government partnership programs addressing healthcare access gaps.

Specialization opportunities include developing centers of excellence for complex procedures, aesthetic dentistry, implantology, and orthodontics that can attract both domestic and international patients seeking specialized treatments. Technology integration presents opportunities for practices to differentiate through advanced treatment capabilities, improved patient experiences, and enhanced treatment outcomes using cutting-edge dental technologies.

Partnership opportunities with international healthcare organizations, insurance companies, and medical tourism facilitators can expand patient referral networks and market reach. Educational collaboration with international dental schools and professional organizations can enhance practitioner training and establish Mexico as a regional center for dental education excellence. Government healthcare initiatives create opportunities for private sector participation in public health programs, expanding service delivery while building sustainable business models.

Market dynamics within Mexico’s dental sector reflect complex interactions between supply and demand factors, regulatory influences, and competitive pressures shaping industry evolution. Supply-side dynamics include increasing numbers of qualified dental professionals, expanding practice capacity, and technological capability enhancement across urban and rural markets.

Demand-side factors encompass growing health consciousness, aging population demographics, increased disposable income, and expanding insurance coverage driving treatment volume growth. Cross-border dynamics create unique market conditions where Mexican dental practices compete globally while serving domestic populations, requiring balanced service delivery strategies and pricing models.

Competitive dynamics feature increasing consolidation in metropolitan markets, with corporate dental chains expanding alongside independent practitioners adapting through specialization and service differentiation. Technology dynamics drive continuous innovation adoption, with practices investing in digital dentistry capabilities to maintain competitiveness and improve treatment outcomes.

Regulatory dynamics influence market operations through licensing requirements, quality standards, and international patient treatment protocols that ensure safety while facilitating cross-border healthcare delivery. Economic dynamics affect patient spending patterns, insurance coverage expansion, and practice investment capabilities, with currency fluctuations impacting international patient volumes and revenue stability. Social dynamics include changing patient expectations, increased quality awareness, and growing demand for aesthetic treatments driving service portfolio expansion across the sector.

Research methodology employed for analyzing Mexico’s dental market incorporates comprehensive primary and secondary research approaches designed to provide accurate, current, and actionable market intelligence. Primary research includes structured interviews with dental practitioners, clinic administrators, industry associations, and regulatory officials across major metropolitan areas and border regions to capture diverse market perspectives and operational insights.

Secondary research encompasses analysis of government healthcare statistics, professional association reports, academic studies, and industry publications to establish market baseline data and trend identification. Data collection methods include practitioner surveys, patient satisfaction studies, treatment volume analysis, and competitive landscape mapping to understand market structure and dynamics comprehensively.

Analytical frameworks applied include market segmentation analysis, competitive positioning assessment, and growth driver evaluation to identify key market trends and opportunities. Validation processes ensure data accuracy through cross-referencing multiple sources, expert consultation, and statistical verification methods. Geographic coverage spans all major metropolitan areas, border regions, and representative rural markets to capture regional variations and market diversity.

Temporal analysis examines historical trends, current market conditions, and future projections to provide comprehensive market understanding and strategic insights. Stakeholder engagement includes input from dental professionals, patients, industry suppliers, and regulatory bodies to ensure balanced perspective and comprehensive market coverage in research findings and recommendations.

Regional market analysis reveals significant variations in dental service delivery, practitioner distribution, and market development across Mexico’s diverse geographic regions. Northern Border Region demonstrates the highest concentration of dental tourism activity, with cities like Tijuana, Mexicali, and Ciudad Juárez capturing approximately 60% of international dental patients seeking treatment in Mexico.

Central Mexico Region, anchored by Mexico City, Guadalajara, and Puebla, represents the largest domestic dental market with sophisticated infrastructure and comprehensive service offerings. This region accounts for nearly 40% of Mexico’s total dental practitioners and features the highest concentration of specialized dental services and advanced treatment capabilities.

Gulf Coast Region, including Veracruz and Tampico, shows emerging growth in dental tourism targeting patients from the southeastern United States, with market development supported by improved transportation infrastructure and competitive pricing strategies. Pacific Coast Region demonstrates strong domestic market growth driven by tourism industry development and increasing local population prosperity in destinations like Puerto Vallarta and Mazatlán.

Southern Mexico Region faces challenges in dental service accessibility but presents opportunities for market expansion through government healthcare initiatives and mobile dental service programs. Yucatan Peninsula has emerged as a growing dental tourism destination, leveraging its established tourism infrastructure and proximity to U.S. markets, with patient volumes growing at 18% annually. Regional disparities in practitioner distribution and service availability create both challenges and opportunities for market development and healthcare access improvement initiatives.

Competitive landscape within Mexico’s dental market features diverse participants ranging from individual practitioners to large corporate dental chains, each serving different market segments and patient populations. Market leaders have established strong positions through service quality, technology adoption, and strategic location selection.

Competitive strategies include technology differentiation, service specialization, geographic expansion, and patient experience enhancement. Market consolidation trends show increasing corporate chain development alongside independent practitioner adaptation through specialization and niche market focus.

Market segmentation within Mexico’s dental sector reveals distinct categories based on service types, patient demographics, geographic regions, and practice models. By Service Type, the market divides into preventive care, restorative treatments, cosmetic procedures, orthodontics, oral surgery, and specialized treatments, each serving different patient needs and market segments.

By Patient Demographics:

By Geographic Distribution:

By Practice Model:

Category-wise analysis provides detailed insights into specific segments driving Mexico’s dental market growth and development. Preventive Dentistry represents the foundation of dental practice, with increasing emphasis on patient education, regular checkups, and early intervention strategies that improve long-term oral health outcomes while building sustainable practice relationships.

Restorative Dentistry encompasses traditional treatments including fillings, crowns, bridges, and dentures, representing the largest treatment volume category. Technology integration in restorative procedures has improved treatment durability and patient comfort while reducing treatment time and costs. Digital impression systems and computer-aided manufacturing have revolutionized crown and bridge fabrication, with same-day treatment capabilities becoming increasingly common.

Cosmetic Dentistry has emerged as a high-growth segment, driven by increasing aesthetic consciousness and social media influence on appearance standards. Popular procedures include teeth whitening, veneers, smile makeovers, and aesthetic orthodontics, with Mexican practices offering significant cost advantages while maintaining quality standards. Orthodontics shows strong growth across all age groups, with clear aligner therapy and accelerated treatment options expanding market appeal beyond traditional metal braces.

Oral Surgery and specialized treatments represent high-value service categories, including dental implants, wisdom tooth extraction, and complex reconstructive procedures. Implant dentistry has experienced particularly strong growth, with Mexican practices offering comprehensive implant solutions at competitive prices while utilizing advanced surgical techniques and premium implant systems from international manufacturers.

Industry participants in Mexico’s dental market enjoy numerous advantages that contribute to professional success and business sustainability. Dental practitioners benefit from growing patient demand, diverse revenue opportunities, and professional development resources that support career advancement and practice growth.

Key Benefits for Dental Professionals:

Benefits for Patients:

Stakeholder Benefits:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Mexico’s dental sector reflect evolving patient expectations, technological advancement, and industry maturation. Digital dentistry adoption has accelerated significantly, with practices implementing digital impression systems, computer-aided treatment planning, and 3D printing technologies to improve treatment accuracy and efficiency.

Minimally invasive dentistry represents a growing trend, with practitioners adopting techniques that preserve natural tooth structure while achieving optimal treatment outcomes. Laser dentistry applications have expanded across multiple treatment categories, offering patients reduced discomfort, faster healing, and improved treatment precision. Same-day dentistry has gained popularity, particularly among dental tourism patients seeking efficient treatment completion during short visits.

Aesthetic dentistry emphasis continues growing, with patients increasingly seeking smile enhancement procedures and cosmetic treatments. Clear aligner therapy has revolutionized orthodontic treatment, with Mexican practices offering competitive alternatives to traditional braces using advanced aligner systems. Implant dentistry advancement includes immediate loading protocols, guided surgery techniques, and premium implant systems that improve treatment predictability and patient satisfaction.

Patient experience enhancement has become a key differentiator, with practices investing in comfort amenities, multilingual staff, and comprehensive patient communication systems. Teledentistry integration enables remote consultations, treatment planning, and follow-up care, particularly valuable for international patients and underserved populations. Sustainable dentistry practices are emerging, with environmentally conscious treatment approaches and eco-friendly practice operations gaining importance among environmentally aware patients.

Recent industry developments demonstrate Mexico’s dental sector evolution and increasing sophistication in service delivery and market positioning. Technology partnerships between Mexican dental practices and international equipment manufacturers have accelerated advanced technology adoption and training program development.

Educational collaborations with U.S. and Canadian dental schools have enhanced practitioner training and established Mexico as a regional center for dental education excellence. Certification programs through international dental organizations have improved quality standards and patient confidence in Mexican dental services. Government initiatives supporting medical tourism infrastructure development have improved transportation, accommodation, and patient support services.

Corporate consolidation has increased in metropolitan markets, with dental service organizations expanding through acquisition and partnership strategies. Insurance market development includes new dental insurance products and expanded coverage options improving patient access to dental care. Research collaborations between Mexican dental institutions and international universities have advanced clinical research and treatment protocol development.

Digital platform development has improved patient communication, appointment scheduling, and treatment coordination, particularly for international patients requiring comprehensive care planning. Quality assurance programs have been implemented across the sector, with standardized protocols and outcome measurement systems improving treatment consistency and patient satisfaction. Regulatory improvements have streamlined licensing procedures and quality oversight while maintaining safety standards for both domestic and international patients.

Strategic recommendations for Mexico’s dental market participants focus on sustainable growth, quality improvement, and competitive positioning in an evolving healthcare landscape. MarkWide Research analysis suggests that practices should prioritize technology investment, particularly in digital dentistry capabilities that improve treatment efficiency and patient outcomes while reducing operational costs.

Market positioning strategies should emphasize quality differentiation rather than price competition alone, with practices developing specialized expertise and premium service offerings that justify value propositions. Geographic expansion opportunities exist in underserved markets, but require careful market analysis and appropriate service delivery models adapted to local conditions and patient needs.

Partnership development with international healthcare organizations, insurance companies, and medical tourism facilitators can expand patient referral networks and market reach while providing operational support and quality assurance. Professional development investment in continuing education, certification programs, and technology training ensures practitioners maintain competitive competency levels and adapt to evolving treatment standards.

Patient experience enhancement should focus on comprehensive service delivery, cultural sensitivity, and communication excellence, particularly for international patients requiring specialized support services. Quality assurance implementation through standardized protocols, outcome measurement, and continuous improvement processes builds patient confidence and supports sustainable practice growth. Digital transformation should include teledentistry capabilities, online patient engagement platforms, and integrated practice management systems that improve operational efficiency and patient satisfaction.

Future market projections for Mexico’s dental sector indicate sustained growth driven by demographic trends, technological advancement, and increasing healthcare accessibility. Market expansion is expected to continue at robust rates, with dental tourism volumes projected to grow by 10-12% annually over the next five years, supported by infrastructure improvements and service quality enhancement.

Technology integration will accelerate, with artificial intelligence, robotics, and advanced materials revolutionizing treatment delivery and patient outcomes. Teledentistry adoption is projected to increase significantly, particularly for consultation, treatment planning, and follow-up care, expanding access to dental services in underserved areas. Specialization trends will continue, with practices developing centers of excellence for complex procedures and niche treatments that attract both domestic and international patients.

Market consolidation is expected to increase in metropolitan areas, with corporate dental chains expanding through strategic acquisitions and partnerships while independent practitioners adapt through specialization and service differentiation. Insurance market expansion will improve patient access to dental care, with private insurance coverage projected to grow alongside government healthcare program enhancements.

Regulatory evolution will focus on quality standardization, patient safety enhancement, and cross-border healthcare facilitation while maintaining competitive advantages for Mexican dental services. MWR projections suggest that Mexico’s position as a leading dental tourism destination will strengthen, with market share gains in North American dental tourism markets expected to reach 25% by 2028. Sustainability initiatives will become increasingly important, with environmentally conscious practices and green dentistry approaches gaining market acceptance and regulatory support.

Mexico’s dental market represents a dynamic and rapidly evolving healthcare sector positioned for sustained growth and international recognition. The combination of geographic advantages, cost competitiveness, professional competency, and technological advancement has established Mexico as a leading destination for both domestic dental care and international dental tourism. Market fundamentals remain strong, supported by favorable demographics, increasing healthcare awareness, and expanding insurance coverage that drives patient demand across all service categories.

Strategic positioning of Mexican dental practices has evolved from primarily cost-based competition to value-based differentiation emphasizing quality, technology, and patient experience. The sector’s ability to serve diverse patient populations while maintaining competitive pricing and quality standards demonstrates market maturity and professional excellence. Future growth prospects remain robust, with opportunities for expansion in underserved markets, technology integration, and specialized service development.

Industry transformation through digital dentistry adoption, minimally invasive treatment protocols, and patient-centered care delivery has positioned Mexico’s dental sector for continued success in competitive global healthcare markets. The integration of advanced technologies, professional development programs, and quality assurance initiatives ensures sustainable growth while maintaining the cost advantages that initially established Mexico’s market position. Long-term outlook indicates that Mexico’s dental market will continue expanding its role in regional healthcare delivery while strengthening its position as a preferred destination for international patients seeking high-quality, affordable dental care solutions.

What is Dentistry?

Dentistry is a branch of medicine that focuses on the diagnosis, prevention, and treatment of oral diseases and conditions. It encompasses various practices including orthodontics, periodontics, and oral surgery, among others.

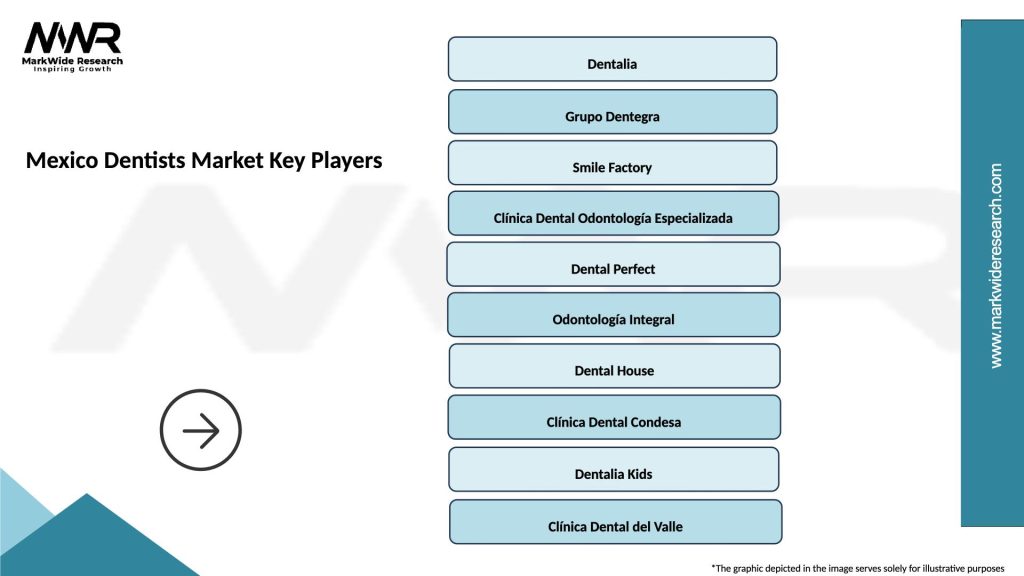

What are the key players in the Mexico Dentists Market?

Key players in the Mexico Dentists Market include Grupo Dental, Dentistas Sin Fronteras, and Dentalia, among others. These companies provide a range of dental services and products, catering to both local and international patients.

What are the growth factors driving the Mexico Dentists Market?

The Mexico Dentists Market is driven by increasing awareness of oral health, a growing aging population, and advancements in dental technology. Additionally, the rise in dental tourism is contributing to market growth.

What challenges does the Mexico Dentists Market face?

Challenges in the Mexico Dentists Market include regulatory hurdles, varying standards of care, and competition from international dental service providers. These factors can impact the quality and accessibility of dental care.

What opportunities exist in the Mexico Dentists Market?

Opportunities in the Mexico Dentists Market include expanding tele-dentistry services, increasing investment in dental education, and the potential for growth in cosmetic dentistry. These trends can enhance patient access and service offerings.

What trends are shaping the Mexico Dentists Market?

Trends in the Mexico Dentists Market include the adoption of digital dentistry technologies, such as CAD/CAM systems and teledentistry platforms. Additionally, there is a growing focus on preventive care and holistic dental practices.

Mexico Dentists Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dental Implants, Orthodontic Appliances, Restorative Materials, Preventive Products |

| End User | Private Clinics, Dental Hospitals, Community Health Centers, Mobile Dental Units |

| Technology | 3D Printing, CAD/CAM Systems, Digital Radiography, Laser Dentistry |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Dentists Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at