444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico data center construction market represents a rapidly expanding sector driven by digital transformation initiatives, cloud adoption, and increasing demand for data processing capabilities across Latin America. Mexico’s strategic position as a gateway between North and South America has positioned the country as a critical hub for data center infrastructure development. The market is experiencing robust growth with a projected compound annual growth rate of 12.5% over the forecast period, reflecting the nation’s commitment to digital infrastructure modernization.

Key market dynamics include substantial investments from international hyperscale operators, government initiatives supporting digital infrastructure, and growing enterprise demand for colocation services. The market encompasses various construction types including hyperscale facilities, enterprise data centers, colocation facilities, and edge computing infrastructure. Mexico City, Guadalajara, and Monterrey emerge as primary construction hubs, accounting for approximately 75% of total market activity.

Infrastructure development is accelerating due to increased internet penetration, which has reached 78% of the population, and growing cloud service adoption among Mexican enterprises. The construction market benefits from favorable government policies, including tax incentives for technology infrastructure investments and streamlined permitting processes for data center projects.

The Mexico data center construction market refers to the comprehensive ecosystem of planning, designing, building, and commissioning data center facilities across Mexico to support digital infrastructure requirements for enterprises, cloud service providers, and telecommunications operators. This market encompasses all aspects of data center development from site selection and architectural design to mechanical, electrical, and plumbing systems installation.

Data center construction in Mexico involves specialized building practices that ensure optimal performance, energy efficiency, and reliability for mission-critical computing infrastructure. The market includes construction of various facility types ranging from small enterprise server rooms to large-scale hyperscale facilities capable of supporting thousands of servers and networking equipment.

Construction activities encompass site preparation, structural engineering, power infrastructure development, cooling system installation, fire suppression systems, security implementations, and telecommunications connectivity. The market also includes renovation and expansion projects of existing facilities to meet evolving capacity and technology requirements.

Mexico’s data center construction market is experiencing unprecedented growth driven by digital transformation across industries and increasing demand for cloud services. The market demonstrates strong fundamentals with consistent project pipeline development and substantial capital investment from both domestic and international players. Construction activity has intensified significantly, with project completion rates increasing by 35% compared to previous periods.

Market expansion is supported by Mexico’s advantageous geographic location, competitive labor costs, and improving regulatory environment for technology infrastructure development. The construction sector benefits from established supply chains, skilled workforce availability, and government support for digital infrastructure initiatives. Enterprise adoption of colocation services has grown by 28%, driving demand for new facility construction.

Investment trends indicate strong confidence in Mexico’s data center market, with international operators establishing significant presence through large-scale construction projects. The market is characterized by increasing sophistication in design standards, energy efficiency requirements, and sustainability considerations. Future growth prospects remain robust with continued digital transformation and expanding cloud service requirements across Mexican enterprises.

Strategic market insights reveal several critical factors shaping Mexico’s data center construction landscape:

Market maturation is evident through improved construction standards, standardized design practices, and enhanced project management capabilities. The insights indicate a market transitioning from basic infrastructure development to sophisticated, technology-driven construction approaches that meet international standards for reliability and efficiency.

Digital transformation initiatives across Mexican enterprises serve as the primary driver for data center construction demand. Organizations are modernizing their IT infrastructure to support cloud computing, big data analytics, and digital business processes, creating substantial demand for new data center facilities. Enterprise digitalization has accelerated construction requirements by approximately 40% as companies seek reliable, scalable infrastructure solutions.

Cloud service adoption continues expanding rapidly among Mexican businesses, driving demand for colocation and cloud infrastructure facilities. The growth in Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS) consumption requires substantial data center capacity expansion. Cloud adoption rates have increased significantly, with small and medium enterprises showing particularly strong growth in cloud service utilization.

Government digitalization programs create additional construction demand through public sector modernization initiatives. Smart city projects, digital government services, and e-governance implementations require robust data center infrastructure. Regulatory compliance requirements for data localization and privacy protection further drive domestic data center construction needs.

Internet penetration growth and increasing mobile device usage generate substantial data traffic requiring processing and storage infrastructure. The expansion of 5G networks and Internet of Things (IoT) applications creates additional demand for edge computing facilities and distributed data center infrastructure.

High capital investment requirements present significant barriers for data center construction projects in Mexico. The substantial upfront costs for land acquisition, specialized construction, and advanced technology infrastructure can limit market entry for smaller operators. Construction costs have increased due to specialized equipment requirements and skilled labor premiums, impacting project feasibility for some developers.

Power infrastructure limitations in certain regions constrain data center construction opportunities. Reliable, high-capacity electrical supply is essential for data center operations, and grid limitations in some areas require substantial additional investment in power infrastructure development. Energy costs and availability concerns can impact site selection and project economics.

Skilled workforce shortages in specialized data center construction trades can delay project timelines and increase labor costs. The technical complexity of modern data center construction requires experienced professionals in areas such as critical power systems, advanced cooling technologies, and network infrastructure installation.

Regulatory complexity and permitting processes can extend project development timelines. While government support exists, navigating various regulatory requirements across federal, state, and local levels can create challenges for construction project management. Environmental regulations and building codes require careful compliance planning throughout the construction process.

Hyperscale facility development presents substantial opportunities for large-scale construction projects as international cloud service providers establish Mexican operations. These facilities require specialized construction expertise and create opportunities for local contractors to develop hyperscale construction capabilities. Hyperscale investments are driving construction activity with multiple large-scale projects in development phases.

Edge computing infrastructure creates opportunities for distributed data center construction across secondary markets. As latency-sensitive applications require local processing capabilities, construction demand extends beyond major metropolitan areas. Edge deployment strategies are expanding construction opportunities to previously underserved regions.

Sustainability and green construction practices offer differentiation opportunities for construction companies developing expertise in energy-efficient data center design. Green building certifications and renewable energy integration become competitive advantages in the construction market. Sustainable construction approaches are increasingly required by enterprise customers and international operators.

Modular and prefabricated construction technologies present opportunities for faster, more cost-effective data center development. These innovative construction approaches can reduce project timelines and improve quality control while meeting growing demand for rapid capacity deployment.

Supply and demand dynamics in Mexico’s data center construction market reflect strong underlying growth drivers balanced against capacity constraints and resource limitations. Construction demand consistently exceeds available capacity, creating favorable conditions for construction companies and driving project pipeline development. The market demonstrates resilience through economic cycles due to essential nature of digital infrastructure requirements.

Competitive dynamics are intensifying as international construction firms establish Mexican operations alongside domestic contractors. This competition drives innovation in construction methodologies, project delivery approaches, and cost optimization strategies. Market consolidation trends are emerging as larger firms acquire specialized capabilities and expand geographic coverage.

Technology evolution continuously impacts construction requirements as data center operators demand more sophisticated infrastructure capabilities. Advanced cooling systems, higher power densities, and enhanced security features require construction companies to continuously upgrade their technical capabilities and expertise.

Economic factors including currency fluctuations, interest rates, and material costs influence project economics and construction activity levels. The market demonstrates relative stability due to long-term nature of data center infrastructure investments and essential service characteristics of digital infrastructure.

Comprehensive market research for Mexico’s data center construction market employs multiple data collection and analysis methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with construction companies, data center operators, real estate developers, and government officials involved in infrastructure development planning.

Secondary research encompasses analysis of construction permits, project announcements, industry reports, and government infrastructure development plans. MarkWide Research utilizes proprietary databases and industry connections to gather comprehensive market intelligence across all major metropolitan areas and emerging markets.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and analyzing historical trends to ensure accuracy and reliability. Market sizing methodologies incorporate bottom-up analysis of individual projects and top-down analysis of overall market trends and drivers.

Quantitative analysis includes statistical modeling of growth trends, correlation analysis of market drivers, and forecasting methodologies based on historical performance and forward-looking indicators. The research methodology ensures comprehensive coverage of all market segments and geographic regions within Mexico.

Mexico City metropolitan area dominates the data center construction market, accounting for approximately 45% of total construction activity. The capital region benefits from established telecommunications infrastructure, skilled workforce availability, and proximity to major enterprise customers. Construction projects in Mexico City tend to be larger scale and more technologically sophisticated, reflecting the concentration of international operators and enterprise headquarters.

Guadalajara emerges as the second-largest construction market, representing roughly 20% of national activity. The city’s technology sector concentration and manufacturing base drive substantial data center construction demand. Guadalajara’s advantages include competitive real estate costs, available land for large-scale development, and strong telecommunications connectivity.

Monterrey accounts for approximately 15% of construction market share, driven by its industrial base and proximity to the United States border. The city attracts construction projects focused on supporting cross-border business operations and manufacturing sector digitalization. Monterrey’s strategic location makes it attractive for companies requiring low-latency connectivity to U.S. markets.

Secondary markets including Tijuana, Puebla, and Querétaro are experiencing growing construction activity as edge computing requirements and regional business growth drive demand for local data center infrastructure. These markets collectively represent the remaining 20% of construction activity but show the highest growth rates as the market matures and expands geographically.

Market competition in Mexico’s data center construction sector includes both international construction firms and domestic contractors with specialized data center expertise:

Competitive differentiation occurs through specialized expertise in critical systems, project delivery speed, sustainability practices, and cost optimization capabilities. Companies are investing in training programs, technology partnerships, and equipment acquisitions to enhance their data center construction capabilities and market competitiveness.

By Facility Type:

By Construction Type:

By End User:

Hyperscale construction represents the fastest-growing segment with construction projects typically exceeding 100,000 square feet and requiring specialized expertise in high-density power distribution, advanced cooling systems, and large-scale mechanical infrastructure. Hyperscale facilities demand construction companies capable of managing complex, fast-track project schedules while maintaining strict quality standards.

Colocation facility construction focuses on flexible, multi-tenant designs that accommodate diverse customer requirements while optimizing operational efficiency. These projects require expertise in modular design approaches, diverse power and cooling zones, and sophisticated security and access control systems. Colocation construction emphasizes standardization and scalability to support future expansion requirements.

Enterprise data center construction involves customized solutions tailored to specific organizational requirements and compliance standards. These projects often include specialized features such as enhanced security measures, specific environmental controls, and integration with existing corporate infrastructure. Enterprise construction requires close collaboration with IT teams and detailed understanding of business requirements.

Edge computing construction focuses on smaller, distributed facilities that require standardized designs for rapid deployment across multiple locations. These projects emphasize prefabrication, modular approaches, and remote monitoring capabilities to support efficient operations with minimal on-site personnel.

Construction companies benefit from growing market demand, premium pricing for specialized expertise, and opportunities to develop long-term relationships with data center operators. The market provides stable revenue streams through multi-phase projects and ongoing maintenance contracts. Specialized contractors can command higher margins due to technical complexity and limited competition in certain expertise areas.

Data center operators benefit from improved construction quality, faster project delivery times, and enhanced facility capabilities through competition among construction providers. Operational efficiency improvements result from modern construction techniques and advanced building systems integration.

Real estate developers benefit from premium land values and development opportunities in areas suitable for data center construction. The market creates opportunities for specialized real estate development focused on data center requirements including power availability, connectivity, and zoning considerations.

Local communities benefit from job creation, tax revenue generation, and infrastructure improvements associated with data center construction projects. Economic development impacts include direct construction employment and indirect benefits through supply chain activities and ongoing operations.

Technology suppliers benefit from growing demand for specialized data center construction materials, equipment, and systems. The market creates opportunities for companies providing critical power systems, cooling equipment, fire suppression systems, and building automation technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability and green construction practices are becoming standard requirements for data center construction projects in Mexico. Operators increasingly demand LEED certification, renewable energy integration, and energy-efficient design features. Green building adoption has increased by approximately 55% as environmental considerations become integral to construction planning and design processes.

Modular and prefabricated construction approaches are gaining popularity due to faster deployment times, improved quality control, and cost optimization benefits. These innovative construction methods enable rapid capacity expansion while maintaining consistent quality standards across multiple projects.

Edge computing infrastructure development is driving construction activity beyond traditional metropolitan centers. The trend toward distributed computing requires smaller, standardized facilities that can be deployed quickly across diverse geographic locations to support low-latency applications.

Hyperscale facility construction continues expanding as international cloud service providers establish significant Mexican operations. These large-scale projects require specialized construction expertise and drive innovation in construction methodologies and project management approaches.

Smart building integration is becoming standard in new data center construction, incorporating advanced building automation systems, IoT sensors, and predictive maintenance capabilities. These technologies enhance operational efficiency and reduce long-term operational costs for facility operators.

Major construction projects announced by international operators are driving market expansion and establishing Mexico as a significant data center hub. Recent project announcements include multiple hyperscale facilities in development across major metropolitan areas, representing substantial construction opportunities for qualified contractors.

Government infrastructure initiatives are supporting data center construction through improved permitting processes, tax incentives, and infrastructure development programs. These initiatives facilitate faster project development and reduce regulatory barriers for construction companies and data center operators.

Technology partnerships between construction companies and equipment suppliers are enhancing construction capabilities and enabling more sophisticated facility development. These collaborations improve construction quality while reducing project timelines and costs.

Workforce development programs are addressing skilled labor shortages through specialized training initiatives focused on data center construction trades. Industry associations and educational institutions are collaborating to develop curriculum and certification programs for critical construction skills.

Sustainability certifications are becoming standard requirements for new construction projects, driving adoption of green building practices and renewable energy integration. Construction companies are investing in sustainability expertise to meet growing market demands for environmentally responsible construction practices.

Construction companies should invest in specialized data center construction capabilities through training programs, equipment acquisitions, and strategic partnerships. MWR analysis indicates that companies with demonstrated hyperscale construction experience will capture the majority of high-value project opportunities in the expanding market.

Market entry strategies should focus on developing relationships with international data center operators and cloud service providers establishing Mexican operations. These relationships provide access to large-scale construction projects and opportunities for long-term partnership development.

Geographic expansion into secondary markets presents opportunities for construction companies as edge computing and regional business growth drive demand beyond major metropolitan areas. Early market entry in emerging regions can establish competitive advantages and market leadership positions.

Sustainability expertise development is essential for construction companies seeking to compete for premium projects. Green building certifications, renewable energy integration capabilities, and energy-efficient construction practices are becoming standard requirements rather than optional features.

Technology adoption in construction processes including Building Information Modeling (BIM), project management software, and quality control systems will become increasingly important for maintaining competitiveness and meeting customer expectations for project delivery excellence.

Long-term growth prospects for Mexico’s data center construction market remain highly positive, driven by continued digital transformation, cloud adoption, and the country’s strategic position in the global digital economy. Market expansion is expected to accelerate with projected growth rates of 15% annually over the next five years as demand for digital infrastructure continues increasing across all sectors.

Technology evolution will continue driving construction requirements toward more sophisticated, energy-efficient, and highly automated facilities. Future construction projects will incorporate advanced cooling technologies, higher power densities, and enhanced automation systems to meet evolving operator requirements and efficiency standards.

Geographic expansion will extend construction opportunities beyond current major markets as edge computing requirements and regional business growth drive demand for distributed data center infrastructure. MarkWide Research projects that secondary markets will account for an increasing share of total construction activity as the market matures.

International investment will continue supporting market growth as global technology companies establish Mexican operations to serve Latin American markets. These investments will drive demand for large-scale construction projects and create opportunities for local construction companies to develop hyperscale construction capabilities.

Sustainability requirements will become increasingly stringent, driving innovation in green construction practices and renewable energy integration. Future construction projects will need to meet enhanced environmental standards while maintaining cost competitiveness and operational efficiency.

Mexico’s data center construction market represents a dynamic and rapidly expanding sector with substantial opportunities for growth and development. The market benefits from strong underlying demand drivers including digital transformation, cloud adoption, and Mexico’s strategic geographic position serving both North and South American markets. Construction activity is accelerating across multiple facility types and geographic regions, creating diverse opportunities for industry participants.

Market fundamentals remain robust with consistent project pipeline development, substantial capital investment, and government support for digital infrastructure development. The competitive landscape is evolving as international construction firms establish Mexican operations while domestic contractors develop specialized data center construction capabilities. Technology advancement and sustainability requirements are driving innovation in construction practices and facility design standards.

Future prospects indicate continued strong growth driven by expanding digital economy requirements, international operator investments, and emerging technologies such as edge computing and 5G networks. Success in this market will require specialized expertise, strategic partnerships, and continuous adaptation to evolving technology and sustainability requirements. The Mexico data center construction market is positioned for sustained expansion as digital infrastructure becomes increasingly critical to economic development and business operations across all sectors.

What is Data Center Construction?

Data Center Construction refers to the process of building facilities that house computer systems and associated components, such as telecommunications and storage systems. These facilities are designed to support the growing demand for data processing and storage in various industries.

What are the key players in the Mexico Data Center Construction Market?

Key players in the Mexico Data Center Construction Market include companies like KIO Networks, Alestra, and Digital Realty, which are involved in the design, construction, and operation of data centers. These companies focus on providing reliable infrastructure to support cloud computing and data storage needs, among others.

What are the growth factors driving the Mexico Data Center Construction Market?

The Mexico Data Center Construction Market is driven by factors such as the increasing demand for cloud services, the rise of big data analytics, and the expansion of e-commerce. Additionally, the need for improved data security and compliance with regulations is propelling market growth.

What challenges does the Mexico Data Center Construction Market face?

Challenges in the Mexico Data Center Construction Market include high construction costs, regulatory hurdles, and the need for skilled labor. Additionally, environmental concerns and the demand for energy-efficient designs pose significant challenges for developers.

What opportunities exist in the Mexico Data Center Construction Market?

Opportunities in the Mexico Data Center Construction Market include the potential for investment in green data centers and the adoption of advanced technologies like AI and IoT. The growing trend of digital transformation across various sectors also presents significant opportunities for new construction projects.

What trends are shaping the Mexico Data Center Construction Market?

Trends in the Mexico Data Center Construction Market include the increasing focus on sustainability, the integration of modular construction techniques, and the rise of edge computing facilities. These trends reflect the industry’s response to evolving technological demands and environmental considerations.

Mexico Data Center Construction Market

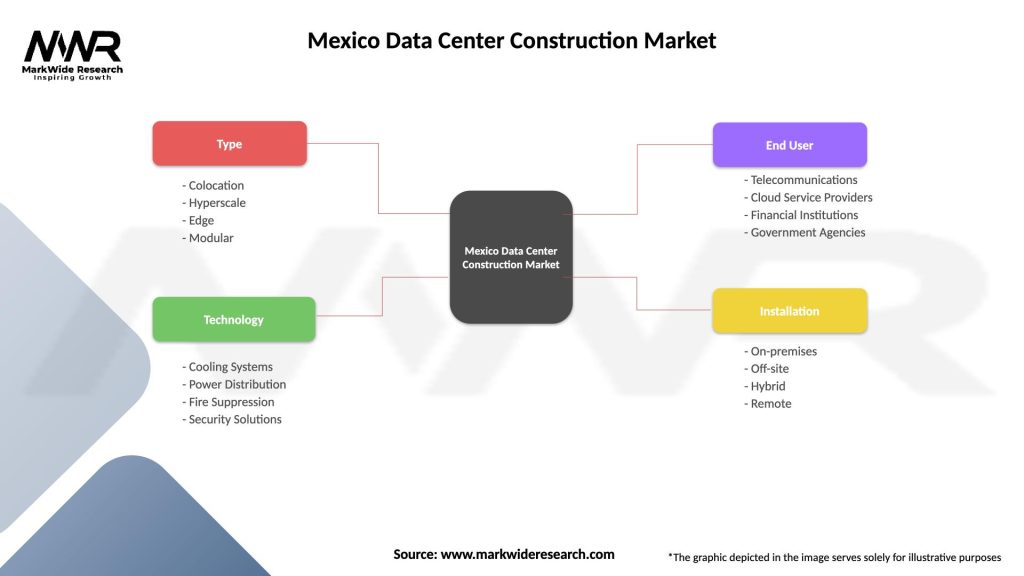

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Hyperscale, Edge, Modular |

| Technology | Cooling Systems, Power Distribution, Fire Suppression, Security Solutions |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Installation | On-premises, Off-site, Hybrid, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Data Center Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at