444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico continuous glucose monitoring market represents a rapidly expanding healthcare technology sector that has gained significant momentum in recent years. This market encompasses advanced medical devices designed to provide real-time glucose level monitoring for individuals with diabetes, offering a revolutionary approach to diabetes management compared to traditional fingerstick methods. Market dynamics indicate substantial growth potential driven by increasing diabetes prevalence, technological advancements, and growing awareness about continuous monitoring benefits.

Healthcare transformation in Mexico has accelerated the adoption of innovative diabetes management solutions, with continuous glucose monitoring systems emerging as a preferred choice among healthcare providers and patients. The market demonstrates robust growth patterns with adoption rates increasing by approximately 23% annually across major metropolitan areas. Technology integration has become increasingly sophisticated, featuring smartphone connectivity, cloud-based data management, and artificial intelligence-powered analytics.

Regional distribution shows concentrated market activity in urban centers, with Mexico City, Guadalajara, and Monterrey accounting for approximately 68% of total market penetration. The expanding middle class and improved healthcare infrastructure contribute to accelerated market development, while government healthcare initiatives support broader accessibility to advanced diabetes management technologies.

The Mexico continuous glucose monitoring market refers to the comprehensive ecosystem of medical devices, software platforms, and healthcare services that enable real-time tracking and analysis of blood glucose levels in diabetic patients throughout Mexico. This market encompasses sensor-based monitoring systems that provide continuous data streams, eliminating the need for frequent fingerstick testing while offering superior diabetes management capabilities.

Continuous glucose monitoring technology represents a paradigm shift from traditional glucose testing methods, utilizing subcutaneous sensors that measure interstitial glucose levels every few minutes. These advanced systems provide comprehensive glucose trend information, predictive alerts for hypoglycemic and hyperglycemic events, and detailed historical data analysis capabilities that enable more precise diabetes management strategies.

Market scope includes various device categories ranging from real-time continuous glucose monitors to flash glucose monitoring systems, along with associated mobile applications, data management platforms, and healthcare provider integration tools. The technology serves both Type 1 and Type 2 diabetes patients, offering personalized monitoring solutions that adapt to individual lifestyle requirements and medical needs.

Market expansion in Mexico’s continuous glucose monitoring sector demonstrates exceptional growth trajectory, driven by increasing diabetes prevalence and technological advancement adoption. The market benefits from supportive regulatory frameworks, expanding healthcare coverage, and growing physician acceptance of continuous monitoring technologies as standard diabetes care protocols.

Key growth drivers include rising diabetes incidence rates, estimated at approximately 12.8% of the adult population, along with increasing awareness about diabetes complications and the importance of continuous glucose monitoring. Healthcare digitization initiatives and telemedicine expansion have further accelerated market adoption, particularly following recent healthcare system transformations.

Technology evolution continues to shape market dynamics, with next-generation sensors offering extended wear periods, improved accuracy, and enhanced connectivity features. Integration with insulin delivery systems and artificial pancreas technologies represents significant market opportunities, while smartphone-based monitoring solutions drive consumer accessibility and engagement.

Competitive landscape features both international medical device manufacturers and emerging local technology companies, creating a dynamic market environment that promotes innovation and competitive pricing strategies. Strategic partnerships between device manufacturers and healthcare providers facilitate market penetration and patient education initiatives.

Market intelligence reveals several critical insights that define the Mexico continuous glucose monitoring landscape. MarkWide Research analysis indicates that market penetration varies significantly across different demographic segments, with urban populations showing higher adoption rates compared to rural communities.

Diabetes prevalence escalation serves as the primary market driver, with Mexico ranking among countries with highest diabetes rates globally. The increasing incidence of both Type 1 and Type 2 diabetes creates substantial demand for advanced monitoring solutions that provide superior glucose management capabilities compared to traditional testing methods.

Healthcare system modernization initiatives throughout Mexico promote adoption of digital health technologies, including continuous glucose monitoring systems. Government healthcare programs increasingly recognize the long-term cost benefits of continuous monitoring in preventing diabetes complications, leading to expanded coverage policies and reimbursement frameworks.

Technology advancement continues driving market growth through improved sensor accuracy, extended wear periods, and enhanced user experience features. Integration with smartphone applications and cloud-based data platforms appeals to tech-savvy consumers while providing healthcare providers with comprehensive patient monitoring capabilities.

Patient education initiatives and diabetes awareness campaigns contribute significantly to market expansion by highlighting the benefits of continuous glucose monitoring. Healthcare provider training programs and patient support services facilitate adoption while ensuring optimal device utilization and clinical outcomes.

Economic factors including rising disposable income levels and expanding middle-class population create favorable market conditions for premium healthcare technologies. Additionally, the growing medical tourism sector in Mexico drives demand for advanced diabetes management solutions among international patients.

Cost considerations represent the most significant market restraint, as continuous glucose monitoring systems require substantial upfront investment and ongoing sensor replacement costs. Many patients, particularly those without comprehensive insurance coverage, find the technology financially prohibitive despite its clinical benefits.

Healthcare infrastructure limitations in rural and underserved areas restrict market penetration, as continuous glucose monitoring requires adequate healthcare provider support and patient education resources. Limited internet connectivity and smartphone penetration in certain regions further constrain technology adoption.

Regulatory challenges and approval processes for new continuous glucose monitoring technologies can create market entry barriers for innovative solutions. Complex regulatory requirements and lengthy approval timelines may delay the introduction of advanced monitoring systems to the Mexican market.

Cultural factors and traditional healthcare practices sometimes resist adoption of new technologies, particularly among older patient populations who prefer familiar glucose testing methods. Patient education and healthcare provider advocacy remain essential for overcoming cultural barriers to technology adoption.

Technical limitations including sensor accuracy variations, calibration requirements, and occasional connectivity issues may impact user confidence and long-term adoption rates. Additionally, the need for smartphone compatibility and digital literacy can exclude certain patient populations from accessing continuous monitoring benefits.

Telemedicine integration presents substantial market opportunities as healthcare systems increasingly adopt remote patient monitoring capabilities. Continuous glucose monitoring data integration with telemedicine platforms enables comprehensive diabetes management while reducing healthcare costs and improving patient outcomes.

Artificial intelligence applications offer significant potential for market expansion through predictive analytics, personalized treatment recommendations, and automated insulin dosing systems. AI-powered continuous glucose monitoring solutions can provide superior diabetes management while reducing the burden on healthcare providers.

Pediatric market expansion represents an underserved segment with substantial growth potential, as continuous glucose monitoring technology becomes more child-friendly and family-oriented. Specialized pediatric solutions and family engagement platforms can drive market penetration in younger demographics.

Rural healthcare initiatives and mobile health programs create opportunities for expanding continuous glucose monitoring access to underserved populations. Partnerships with community health centers and mobile clinic programs can facilitate technology adoption in remote areas.

Insurance coverage expansion and government healthcare program inclusion present significant market opportunities. Advocacy efforts and clinical evidence demonstrating cost-effectiveness of continuous monitoring may lead to broader reimbursement policies and increased patient access.

Supply chain dynamics in the Mexico continuous glucose monitoring market reflect complex interactions between international device manufacturers, local distributors, and healthcare providers. Market dynamics are influenced by regulatory requirements, import policies, and currency fluctuations that affect device pricing and availability.

Competitive dynamics intensify as established medical device companies compete with emerging technology startups and local manufacturers. Innovation cycles accelerate as companies develop next-generation sensors with improved accuracy, longer wear periods, and enhanced connectivity features to gain competitive advantages.

Healthcare provider dynamics show increasing acceptance of continuous glucose monitoring as standard diabetes care, with endocrinologists and primary care physicians incorporating these technologies into treatment protocols. Training programs and clinical education initiatives support healthcare provider adoption and optimal device utilization.

Patient dynamics demonstrate growing demand for personalized diabetes management solutions that integrate with lifestyle preferences and daily routines. Social media influence and peer recommendations significantly impact patient adoption decisions, while online communities provide support and education resources.

Regulatory dynamics continue evolving as health authorities adapt approval processes for innovative continuous glucose monitoring technologies. Streamlined approval pathways and international harmonization efforts may accelerate market entry for advanced monitoring solutions.

Primary research methodology encompasses comprehensive data collection through structured interviews with healthcare providers, diabetes specialists, and continuous glucose monitoring users across major Mexican metropolitan areas. Survey instruments capture quantitative adoption data, user satisfaction metrics, and technology preference insights from diverse patient populations.

Secondary research approaches include analysis of healthcare databases, medical device registration records, and clinical literature specific to continuous glucose monitoring adoption in Mexico. Government health statistics, diabetes prevalence studies, and healthcare expenditure data provide essential market context and trend analysis.

Market analysis techniques utilize statistical modeling to project market growth trajectories, technology adoption curves, and competitive landscape evolution. Demographic analysis and socioeconomic factors inform market segmentation strategies and opportunity identification across different patient populations.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert consultation, and peer review procedures. Industry stakeholder feedback and clinical expert validation confirm research findings and market projections accuracy.

Data collection standards maintain consistency across research phases while ensuring compliance with privacy regulations and ethical research guidelines. Continuous monitoring of market developments and technology advancements ensures research currency and relevance.

Central Mexico region, anchored by Mexico City and surrounding metropolitan areas, dominates the continuous glucose monitoring market with approximately 35% of national adoption. This region benefits from concentrated healthcare infrastructure, higher income levels, and greater technology acceptance among urban populations.

Northern Mexico states including Nuevo León, Chihuahua, and Sonora demonstrate robust market growth driven by proximity to the United States healthcare market and higher economic development levels. Cross-border healthcare utilization and medical device accessibility contribute to accelerated technology adoption in these regions.

Western Mexico, particularly Jalisco and its capital Guadalajara, shows strong market potential with growing healthcare technology sector and increasing diabetes awareness initiatives. The region’s technology industry presence supports digital health adoption and continuous glucose monitoring integration.

Southern and southeastern regions present significant market opportunities despite current lower adoption rates due to economic and infrastructure constraints. Government healthcare initiatives and rural health programs may drive future market expansion in these underserved areas.

Coastal regions including Veracruz and Yucatán show moderate market development with potential for growth through medical tourism and expanding private healthcare facilities. Tourism-related healthcare services create unique market dynamics and international patient populations.

Market leadership in Mexico’s continuous glucose monitoring sector features established international medical device manufacturers competing alongside emerging technology companies and local distributors. The competitive environment promotes innovation while driving cost reduction and accessibility improvements.

Strategic partnerships between device manufacturers and healthcare providers facilitate market penetration through clinical education, patient training programs, and integrated care delivery models. Collaboration with insurance companies and government healthcare programs expands patient access and reimbursement coverage.

By Technology Type:

By Patient Type:

By Age Group:

By Distribution Channel:

Real-time Continuous Glucose Monitoring category demonstrates premium market positioning with advanced features including smartphone connectivity, predictive alerts, and comprehensive data analytics. This segment appeals to technology-savvy patients and those requiring intensive glucose management, though higher costs limit broader market penetration.

Flash Glucose Monitoring represents the largest market segment due to cost-effectiveness and ease of use, making continuous monitoring accessible to broader patient populations. The category benefits from simplified operation, reduced calibration requirements, and growing insurance coverage acceptance.

Integrated Monitoring Systems show significant growth potential as artificial pancreas technologies advance and become commercially available. This category targets patients requiring comprehensive diabetes management solutions with automated insulin delivery capabilities.

Pediatric-specific Solutions emerge as a specialized category addressing unique requirements of children and adolescents with diabetes. Family engagement features, colorful designs, and simplified interfaces drive adoption in younger patient populations.

Professional Monitoring Systems serve healthcare providers requiring temporary patient monitoring for diagnosis, treatment optimization, and clinical research applications. This category supports evidence-based diabetes care and treatment protocol development.

Healthcare Providers benefit from continuous glucose monitoring through improved patient outcomes, reduced emergency interventions, and enhanced treatment optimization capabilities. Real-time glucose data enables proactive diabetes management and evidence-based treatment adjustments.

Patients experience significant quality of life improvements through reduced fingerstick testing, better glucose control, and increased confidence in daily activities. Continuous monitoring provides freedom from traditional testing constraints while offering superior diabetes management capabilities.

Healthcare Systems realize long-term cost savings through reduced diabetes complications, fewer hospitalizations, and improved population health outcomes. Continuous monitoring supports preventive care strategies and chronic disease management efficiency.

Insurance Companies benefit from reduced claims costs related to diabetes complications while supporting evidence-based coverage decisions. Continuous monitoring data provides valuable insights for risk assessment and patient management programs.

Device Manufacturers access expanding market opportunities through technological innovation, strategic partnerships, and growing patient demand for advanced diabetes management solutions. Market growth supports research and development investments in next-generation monitoring technologies.

Government Healthcare Programs achieve improved population health outcomes while optimizing healthcare resource allocation through continuous monitoring adoption. Technology integration supports national diabetes management strategies and healthcare system modernization goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a transformative trend, with continuous glucose monitoring systems incorporating machine learning algorithms for predictive analytics, personalized treatment recommendations, and automated insulin dosing optimization. AI-powered platforms analyze glucose patterns to provide actionable insights for both patients and healthcare providers.

Smartphone-Centric Solutions dominate market development as manufacturers focus on mobile app integration, cloud-based data management, and social connectivity features. Smartphone compatibility enables real-time data sharing with healthcare providers and family members while supporting telemedicine consultations.

Extended Wear Technology represents a significant trend toward longer sensor life and reduced replacement frequency. Next-generation sensors offer 14-day or longer wear periods, improving patient convenience while reducing long-term monitoring costs.

Personalized Medicine Approaches drive development of customizable monitoring solutions that adapt to individual patient needs, lifestyle preferences, and clinical requirements. Personalization includes adjustable alert thresholds, customized reporting formats, and tailored educational content.

Healthcare Ecosystem Integration shows continuous glucose monitoring systems connecting with electronic health records, pharmacy management systems, and insurance platforms. Integrated workflows streamline patient care while supporting population health management initiatives.

Miniaturization and Comfort trends focus on smaller, more comfortable sensors with improved adhesion and reduced skin irritation. Enhanced comfort features support longer wear periods and better patient compliance with continuous monitoring protocols.

Regulatory Approvals for next-generation continuous glucose monitoring systems accelerate market innovation, with health authorities streamlining approval processes for devices demonstrating superior accuracy and safety profiles. Recent approvals include extended-wear sensors and integrated insulin delivery systems.

Strategic Partnerships between device manufacturers and healthcare providers expand market reach through clinical integration programs, patient education initiatives, and comprehensive diabetes care delivery models. MWR analysis indicates partnership-driven growth strategies becoming increasingly important for market success.

Technology Acquisitions reshape the competitive landscape as established medical device companies acquire innovative startups and technology platforms to enhance their continuous monitoring portfolios. Consolidation activities accelerate innovation while expanding market access capabilities.

Insurance Coverage Expansions mark significant industry developments as major insurance providers and government healthcare programs expand reimbursement policies for continuous glucose monitoring systems. Coverage expansions significantly impact market accessibility and patient adoption rates.

Clinical Research Advances demonstrate continuous glucose monitoring benefits in diverse patient populations, supporting expanded clinical indications and treatment protocols. Research findings influence physician adoption and healthcare policy decisions regarding technology integration.

Manufacturing Investments in Mexico and Latin America region indicate growing market confidence and commitment to local market development. Manufacturing presence supports supply chain optimization while reducing device costs and improving market accessibility.

Market Entry Strategies should focus on partnerships with established healthcare providers and diabetes specialists to build clinical credibility and patient referral networks. New market entrants benefit from comprehensive patient education programs and healthcare provider training initiatives.

Technology Development Priorities should emphasize cost reduction, improved accuracy, and enhanced user experience to address primary market barriers. Innovation investments in extended-wear sensors and simplified calibration procedures can drive broader market adoption.

Geographic Expansion strategies should prioritize urban markets with established healthcare infrastructure while developing rural market access programs through mobile health initiatives and community partnerships. Phased expansion approaches optimize resource allocation and market penetration effectiveness.

Insurance Collaboration represents a critical success factor, with companies needing to develop comprehensive health economics data and clinical evidence to support reimbursement decisions. Value-based care partnerships can demonstrate cost-effectiveness and improve coverage policies.

Patient Education Investments should focus on diabetes awareness campaigns, technology training programs, and peer support networks to drive adoption and ensure optimal device utilization. Educational initiatives significantly impact long-term market success and patient satisfaction.

Regulatory Strategy development should anticipate evolving approval requirements while maintaining compliance with international standards. Proactive regulatory engagement supports faster market entry and competitive positioning for innovative technologies.

Market trajectory for Mexico’s continuous glucose monitoring sector indicates sustained growth driven by technological advancement, expanding healthcare coverage, and increasing diabetes prevalence. The market is projected to experience robust expansion with adoption rates potentially reaching 18-22% annually over the next five years.

Technology evolution will likely focus on artificial intelligence integration, non-invasive monitoring methods, and comprehensive diabetes management platforms that combine continuous monitoring with automated treatment delivery. Next-generation solutions may achieve 95% or higher accuracy rates while extending sensor wear periods beyond current limitations.

Healthcare integration trends suggest continuous glucose monitoring will become standard diabetes care across Mexico’s healthcare system, with government programs potentially expanding coverage to reach underserved populations. Telemedicine integration may increase accessibility by 40-50% in rural areas.

Market accessibility improvements through cost reduction initiatives, insurance coverage expansion, and government healthcare programs may significantly broaden patient access to continuous monitoring technologies. Affordability improvements could expand the addressable patient population substantially.

Innovation pipeline developments including non-invasive glucose monitoring, extended-wear sensors, and artificial pancreas systems represent significant market opportunities. These technologies may revolutionize diabetes management while creating new market segments and growth opportunities.

Mexico’s continuous glucose monitoring market represents a dynamic and rapidly expanding healthcare technology sector with substantial growth potential driven by increasing diabetes prevalence, technological innovation, and evolving healthcare delivery models. The market demonstrates strong fundamentals with growing physician acceptance, expanding insurance coverage, and increasing patient demand for advanced diabetes management solutions.

Strategic opportunities abound for industry participants willing to invest in technology development, patient education, and healthcare provider partnerships. Success factors include cost-effective solutions, comprehensive patient support programs, and integration with existing healthcare infrastructure to maximize market penetration and clinical impact.

Future market development will likely be shaped by artificial intelligence integration, telemedicine expansion, and government healthcare initiatives that prioritize chronic disease management and preventive care strategies. Companies that align with these trends while addressing current market barriers will be well-positioned for long-term success in Mexico’s evolving continuous glucose monitoring landscape.

What is Continuous Glucose Monitoring?

Continuous Glucose Monitoring (CGM) refers to a method of tracking glucose levels in real-time using a small sensor placed under the skin. This technology is essential for individuals with diabetes, as it provides continuous data to help manage their condition effectively.

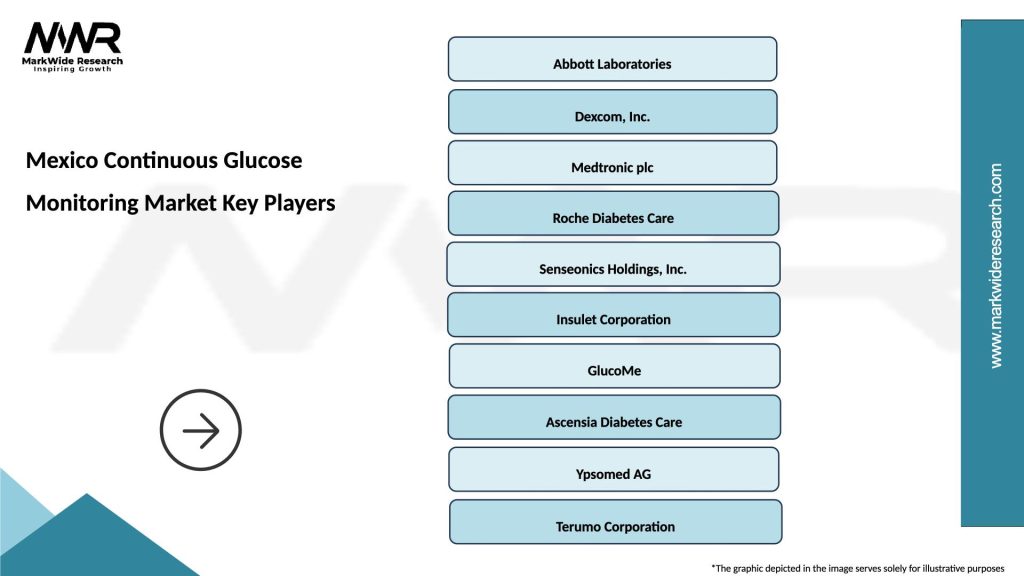

What are the key players in the Mexico Continuous Glucose Monitoring Market?

Key players in the Mexico Continuous Glucose Monitoring Market include Abbott Laboratories, Dexcom, and Medtronic, among others. These companies are known for their innovative CGM systems that enhance diabetes management.

What are the growth factors driving the Mexico Continuous Glucose Monitoring Market?

The Mexico Continuous Glucose Monitoring Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in CGM technology. These factors contribute to a growing demand for effective monitoring solutions.

What challenges does the Mexico Continuous Glucose Monitoring Market face?

Challenges in the Mexico Continuous Glucose Monitoring Market include high costs of CGM devices, limited access in rural areas, and the need for user training. These factors can hinder widespread adoption of CGM technology.

What opportunities exist in the Mexico Continuous Glucose Monitoring Market?

Opportunities in the Mexico Continuous Glucose Monitoring Market include the development of more affordable CGM devices, integration with mobile health applications, and potential partnerships with healthcare providers. These advancements can enhance patient engagement and monitoring.

What trends are shaping the Mexico Continuous Glucose Monitoring Market?

Trends in the Mexico Continuous Glucose Monitoring Market include the rise of smartphone-compatible CGM systems, increased focus on data analytics for personalized diabetes management, and the growing interest in telehealth solutions. These trends are transforming how diabetes care is delivered.

Mexico Continuous Glucose Monitoring Market

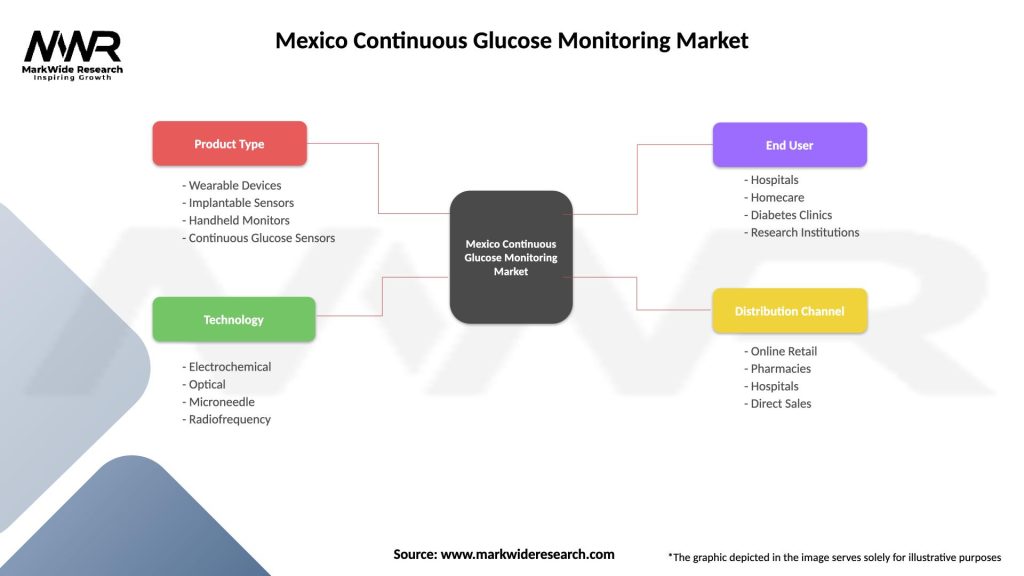

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Implantable Sensors, Handheld Monitors, Continuous Glucose Sensors |

| Technology | Electrochemical, Optical, Microneedle, Radiofrequency |

| End User | Hospitals, Homecare, Diabetes Clinics, Research Institutions |

| Distribution Channel | Online Retail, Pharmacies, Hospitals, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Continuous Glucose Monitoring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at