444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico commercial printing market represents a dynamic and evolving sector within the country’s manufacturing landscape, driven by increasing demand for packaging solutions, promotional materials, and digital printing services. Market dynamics indicate robust growth potential as businesses across various industries seek high-quality printing solutions to enhance their brand presence and marketing effectiveness. The sector encompasses traditional offset printing, digital printing technologies, and specialized printing applications serving diverse commercial needs.

Growth trajectories in the Mexican commercial printing industry reflect the country’s expanding economy and increasing consumer spending patterns. The market benefits from Mexico’s strategic position as a manufacturing hub for North American markets, with significant expansion in packaging printing driven by the food and beverage, pharmaceutical, and consumer goods sectors. Digital transformation initiatives have accelerated adoption of advanced printing technologies, enabling shorter run lengths and customized printing solutions.

Regional distribution shows concentrated activity in major metropolitan areas including Mexico City, Guadalajara, and Monterrey, where industrial infrastructure and customer demand converge. The market demonstrates resilient performance with growing at approximately 6.2% CAGR over recent years, supported by increasing foreign investment and modernization of printing facilities across the country.

The Mexico commercial printing market refers to the comprehensive ecosystem of printing services and solutions provided to businesses, organizations, and institutions across various industries within Mexican territory. This market encompasses the production of marketing materials, packaging solutions, corporate communications, labels, books, magazines, and specialized printed products using diverse printing technologies and methodologies.

Commercial printing in Mexico includes both traditional printing methods such as offset lithography and flexography, as well as modern digital printing technologies including inkjet and laser printing systems. The market serves multiple end-user segments including retail, food and beverage, pharmaceutical, automotive, and publishing industries, providing customized printing solutions tailored to specific business requirements and regulatory compliance needs.

Market scope extends beyond basic printing services to include value-added offerings such as design consultation, pre-press services, finishing operations, and logistics support. The sector plays a crucial role in supporting Mexico’s export-oriented manufacturing economy by providing packaging and labeling solutions that meet international quality standards and regulatory requirements for global markets.

Strategic positioning of Mexico’s commercial printing market reflects the country’s emergence as a preferred destination for nearshoring manufacturing operations, driving increased demand for packaging and promotional printing services. The market benefits from favorable trade agreements, competitive labor costs, and proximity to major North American consumer markets, creating substantial opportunities for growth and expansion.

Technology adoption trends show accelerating investment in digital printing capabilities, with approximately 38% of printing facilities incorporating hybrid digital-offset workflows to enhance operational flexibility and reduce turnaround times. Sustainability initiatives are gaining momentum as environmental regulations tighten and customer preferences shift toward eco-friendly printing solutions and recyclable materials.

Market consolidation patterns indicate increasing merger and acquisition activity as larger printing companies seek to expand their service capabilities and geographic reach. The sector demonstrates strong resilience despite global supply chain challenges, with domestic production capabilities reducing dependence on imported printing materials and equipment. Future prospects remain positive with projected growth driven by e-commerce expansion, pharmaceutical sector growth, and increasing demand for customized packaging solutions.

Primary market drivers include Mexico’s strategic geographic location, competitive manufacturing costs, and growing domestic consumer market that supports diverse printing applications across multiple industry verticals.

Market maturation indicators suggest the sector is transitioning from traditional high-volume printing toward more specialized, value-added services that command higher margins and provide greater customer differentiation opportunities.

Economic expansion in Mexico continues to fuel demand for commercial printing services as businesses invest in marketing materials, packaging solutions, and corporate communications to support growth initiatives. The country’s stable economic environment and favorable business climate attract foreign investment, creating additional demand for printing services from multinational corporations establishing operations in Mexico.

E-commerce growth represents a significant driver for packaging printing demand, with online retail expansion requiring innovative packaging solutions that protect products during shipping while providing attractive unboxing experiences for consumers. Digital transformation initiatives across industries drive demand for variable data printing, personalized marketing materials, and short-run printing applications that traditional offset printing cannot efficiently serve.

Pharmaceutical sector expansion creates substantial opportunities for specialized printing applications including drug labeling, packaging inserts, and regulatory compliance documentation. The sector’s stringent quality requirements and regulatory standards drive demand for high-precision printing capabilities and traceability systems. Automotive industry growth in Mexico generates demand for technical documentation, parts labeling, and promotional materials supporting the country’s position as a major automotive manufacturing hub.

Tourism industry recovery following global disruptions drives demand for promotional materials, brochures, and hospitality-related printing applications as Mexico’s tourism sector rebounds and expands its marketing efforts to attract international visitors.

Raw material costs present ongoing challenges for Mexican commercial printing companies, with paper, ink, and chemical prices subject to global commodity market fluctuations and supply chain disruptions. Currency volatility affects import costs for printing equipment and materials, creating margin pressure and operational planning difficulties for printing companies relying on foreign suppliers.

Skilled labor shortages in technical printing positions limit growth potential as the industry requires specialized knowledge of printing technologies, color management, and quality control processes. Environmental regulations impose additional compliance costs and operational constraints, particularly regarding waste management, chemical handling, and emissions control requirements.

Digital media competition continues to impact traditional print applications as businesses shift marketing budgets toward digital channels and electronic communications. Infrastructure limitations in certain regions of Mexico restrict market expansion opportunities and increase logistics costs for serving customers in remote areas.

Technology investment requirements create barriers for smaller printing companies seeking to modernize equipment and compete with larger, well-capitalized competitors. The rapid pace of technological change requires continuous investment in new equipment and training, straining financial resources for many market participants.

Nearshoring trends present substantial opportunities as North American companies relocate manufacturing operations to Mexico, creating demand for packaging, labeling, and promotional printing services. Export market expansion offers growth potential for Mexican printing companies capable of meeting international quality standards and serving customers across Latin America and North American markets.

Sustainable printing solutions represent an emerging opportunity as environmental consciousness increases among consumers and businesses. Companies investing in eco-friendly printing technologies, recyclable materials, and carbon-neutral operations can differentiate themselves and capture environmentally conscious customers. Digital printing expansion enables new service offerings including variable data printing, personalized marketing materials, and on-demand printing solutions.

Pharmaceutical market growth creates opportunities for specialized printing applications requiring high precision, regulatory compliance, and security features. Food and beverage sector expansion drives demand for innovative packaging solutions that extend shelf life, enhance product appeal, and meet evolving consumer preferences for convenience and sustainability.

Technology partnerships with international printing equipment manufacturers can provide access to advanced technologies and technical support while creating opportunities for technology transfer and skill development. Value-added services including design consultation, logistics support, and inventory management can increase customer retention and improve profit margins.

Competitive intensity in the Mexico commercial printing market reflects a fragmented landscape with numerous small to medium-sized players competing alongside larger, well-established companies. Market consolidation trends indicate increasing merger and acquisition activity as companies seek economies of scale and expanded service capabilities to compete more effectively.

Technology evolution drives continuous change in market dynamics, with digital printing technologies enabling new business models and service offerings while challenging traditional offset printing applications. Customer expectations continue to evolve toward faster turnaround times, higher quality standards, and more sustainable printing solutions, forcing market participants to adapt their operations and service offerings.

Supply chain dynamics show increasing focus on local sourcing and supplier development to reduce dependency on imports and improve supply chain resilience. Pricing pressures from competitive bidding and customer cost reduction initiatives require printing companies to improve operational efficiency and identify new revenue streams to maintain profitability.

Regulatory environment changes impact market dynamics through environmental standards, labor regulations, and trade policies that affect operational costs and competitive positioning. Market segmentation trends show increasing specialization as printing companies focus on specific industry verticals or printing applications to develop expertise and competitive advantages.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Mexico commercial printing market. Primary research includes structured interviews with industry executives, printing company owners, equipment suppliers, and end-user customers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements to validate primary research findings and identify quantitative market trends. Market surveys conducted among printing companies of various sizes provide insights into technology adoption patterns, investment priorities, and competitive strategies.

Data triangulation methods ensure research accuracy by comparing findings from multiple sources and methodologies to identify consistent trends and eliminate potential biases. Expert validation involves consultation with industry specialists and technical experts to verify research conclusions and ensure practical relevance of findings.

Quantitative analysis includes statistical modeling of market trends, growth projections, and segmentation patterns based on historical data and current market indicators. Qualitative assessment provides context and interpretation for quantitative findings through analysis of market dynamics, competitive positioning, and strategic implications for market participants.

Central Mexico region dominates the commercial printing market with approximately 45% market share, centered around Mexico City and surrounding metropolitan areas where major corporate headquarters and manufacturing facilities create substantial demand for printing services. The region benefits from excellent transportation infrastructure, skilled workforce availability, and proximity to key customer markets.

Northern Mexico represents the second-largest regional market with strong growth driven by maquiladora manufacturing operations and cross-border trade activities. Cities including Monterrey, Tijuana, and Ciudad Juárez serve as major printing centers supporting automotive, electronics, and consumer goods industries. Regional growth rates exceed national averages due to nearshoring trends and foreign investment flows.

Western Mexico shows robust market development centered around Guadalajara, which serves as a technology and manufacturing hub attracting electronics companies and supporting industries. The region demonstrates strong growth in packaging printing driven by food and beverage industry expansion and agricultural product processing activities.

Southern and Eastern regions represent emerging markets with significant growth potential as infrastructure development and industrial expansion create new opportunities for commercial printing services. Regional disparities in market development reflect differences in industrial concentration, infrastructure quality, and economic development levels across Mexico’s diverse geographic regions.

Market leadership in Mexico’s commercial printing sector includes both domestic companies with deep local market knowledge and international players bringing advanced technology and global best practices to the market.

Competitive strategies focus on technology modernization, service diversification, and geographic expansion to capture market share and improve operational efficiency. Market positioning varies from high-volume, low-cost providers to specialized, high-value service companies targeting specific industry verticals.

By Technology:

By Application:

By End-User Industry:

Packaging printing category demonstrates the strongest growth momentum with approximately 8.5% annual growth driven by expanding consumer goods markets and e-commerce packaging requirements. Flexible packaging applications show particular strength as manufacturers seek lightweight, cost-effective packaging solutions that reduce transportation costs and environmental impact.

Digital printing applications continue expanding market share as technology improvements reduce per-unit costs and enable new service offerings including variable data printing and personalized marketing materials. Hybrid printing operations combining digital and traditional technologies provide operational flexibility and enable companies to serve diverse customer requirements efficiently.

Label printing segment benefits from regulatory requirements in pharmaceutical and food industries requiring detailed product information and traceability features. Security printing applications show steady demand from financial institutions and government agencies requiring anti-counterfeiting features and document security measures.

Commercial printing category faces ongoing challenges from digital media competition but maintains relevance through specialized applications and high-quality printing requirements that digital alternatives cannot match. Publication printing continues declining but maintains niche markets in educational materials and specialty publications requiring high-quality reproduction.

Printing companies benefit from Mexico’s growing economy and strategic location providing access to both domestic and export markets. Operational advantages include competitive labor costs, favorable trade agreements, and proximity to major North American consumer markets enabling efficient supply chain management and reduced logistics costs.

Equipment suppliers find expanding opportunities as Mexican printing companies modernize facilities and adopt advanced technologies to improve competitiveness. Technology partnerships provide mutual benefits through knowledge transfer, technical support, and market development activities that strengthen both supplier and customer relationships.

End-user customers benefit from competitive pricing, improved service quality, and shorter lead times as the Mexican printing industry modernizes and expands capacity. Supply chain advantages include reduced dependency on imports and improved supply chain resilience through local sourcing options.

Investors find attractive opportunities in a growing market supported by favorable economic trends and increasing demand for printing services. Government stakeholders benefit from job creation, export revenue generation, and industrial development supporting broader economic growth objectives.

Environmental benefits emerge as the industry adopts sustainable practices, reduces waste, and implements eco-friendly technologies that support Mexico’s environmental protection goals while meeting customer sustainability requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital integration represents the most significant trend transforming Mexico’s commercial printing landscape, with companies investing in hybrid workflows combining traditional and digital printing technologies. Automation adoption accelerates as printing companies seek to improve efficiency, reduce labor costs, and enhance quality consistency across production runs.

Sustainability initiatives gain momentum as environmental regulations tighten and customer preferences shift toward eco-friendly printing solutions. Circular economy principles influence business models with increasing focus on recyclable materials, waste reduction, and energy-efficient production processes.

Customization demand drives investment in variable data printing capabilities and short-run production systems enabling personalized marketing materials and customized packaging solutions. Supply chain localization trends show companies developing local supplier networks to reduce import dependency and improve supply chain resilience.

Value-added services expansion includes design consultation, logistics support, and inventory management as printing companies seek to differentiate themselves and improve customer retention. Quality certification becomes increasingly important as customers require compliance with international standards and regulatory requirements for global market access.

Technology investments accelerate across the Mexican printing industry with major companies upgrading equipment and implementing advanced printing technologies to improve competitiveness. MarkWide Research analysis indicates significant capital expenditure increases as companies modernize facilities and expand production capabilities.

Strategic partnerships between Mexican printing companies and international technology providers facilitate knowledge transfer and access to advanced printing solutions. Merger and acquisition activity increases as larger companies seek to expand market presence and achieve economies of scale in competitive markets.

Sustainability certifications become standard requirements as printing companies pursue environmental management system certifications and sustainable forestry certifications to meet customer and regulatory requirements. Workforce development programs expand through partnerships with educational institutions and technical training providers to address skilled labor shortages.

Export market expansion initiatives focus on developing capabilities to serve international customers and meet global quality standards. Digital transformation projects encompass not only printing technology but also business systems, customer relationship management, and supply chain optimization to improve overall operational efficiency.

Technology modernization should remain the top priority for Mexican printing companies seeking to maintain competitiveness and capture growth opportunities. Investment strategies should focus on digital printing capabilities, automation systems, and quality control technologies that enable operational flexibility and improved customer service.

Market positioning strategies should emphasize specialization in high-value applications and industry verticals where technical expertise and quality standards create competitive advantages. Sustainability initiatives require immediate attention as environmental regulations and customer preferences increasingly favor eco-friendly printing solutions.

Workforce development investments are essential to address skilled labor shortages and support technology adoption initiatives. Supply chain optimization should focus on developing local supplier networks and reducing dependency on imported materials to improve cost competitiveness and supply chain resilience.

Customer relationship management systems and value-added services can improve customer retention and enable premium pricing strategies. Export market development represents significant growth opportunities for companies capable of meeting international quality standards and regulatory requirements.

Growth projections for Mexico’s commercial printing market remain positive with anticipated expansion driven by nearshoring trends, domestic economic growth, and increasing demand for packaging solutions. MWR projections indicate continued market expansion with growth rates of approximately 7.1% CAGR over the next five years, supported by technology modernization and market diversification initiatives.

Technology evolution will continue transforming the industry with digital printing technologies gaining market share and enabling new business models focused on customization and short-run production. Sustainability requirements will become increasingly important competitive factors as environmental regulations strengthen and customer preferences shift toward eco-friendly solutions.

Market consolidation trends are expected to continue as larger companies acquire smaller competitors to achieve economies of scale and expand service capabilities. International expansion opportunities will grow as Mexican printing companies develop capabilities to serve global markets and meet international quality standards.

Industry transformation toward value-added services and specialized applications will create opportunities for companies willing to invest in technology and workforce development. Supply chain evolution will emphasize local sourcing and supplier development to reduce import dependency and improve operational resilience in an increasingly uncertain global environment.

Mexico’s commercial printing market demonstrates strong growth potential supported by favorable economic trends, strategic geographic advantages, and increasing demand for packaging and promotional printing services. The market benefits from nearshoring trends, competitive operational costs, and proximity to major North American consumer markets, creating substantial opportunities for both domestic and international market participants.

Technology modernization represents the key success factor for companies seeking to capitalize on market opportunities and maintain competitive positioning. Digital printing adoption, automation implementation, and sustainability initiatives will determine long-term market success as customer requirements evolve and competitive pressures intensify.

Strategic focus on specialization, value-added services, and export market development will enable Mexican printing companies to differentiate themselves and achieve sustainable growth in an increasingly competitive marketplace. The market outlook remains positive with continued expansion expected across multiple segments and applications, supported by Mexico’s growing economy and strategic position in global supply chains.

What is Commercial Printing?

Commercial printing refers to the process of producing printed materials for businesses and organizations, including brochures, business cards, and promotional materials. It encompasses various printing techniques and technologies tailored to meet the specific needs of clients.

What are the key players in the Mexico Commercial Printing Market?

Key players in the Mexico Commercial Printing Market include Grupo Gondi, Vistaprint, and Printful, among others. These companies offer a range of services from digital printing to large format printing, catering to diverse customer needs.

What are the growth factors driving the Mexico Commercial Printing Market?

The Mexico Commercial Printing Market is driven by factors such as the increasing demand for customized marketing materials, the growth of e-commerce, and advancements in printing technology. These elements contribute to a more dynamic and competitive landscape.

What challenges does the Mexico Commercial Printing Market face?

Challenges in the Mexico Commercial Printing Market include rising raw material costs, competition from digital media, and the need for sustainable practices. These factors can impact profitability and operational efficiency for printing companies.

What opportunities exist in the Mexico Commercial Printing Market?

Opportunities in the Mexico Commercial Printing Market include the expansion of online printing services, the rise of eco-friendly printing solutions, and the growing demand for packaging materials. These trends present avenues for innovation and growth.

What trends are shaping the Mexico Commercial Printing Market?

Trends in the Mexico Commercial Printing Market include the adoption of digital printing technologies, increased personalization in print products, and a focus on sustainability. These trends are influencing how companies approach their printing needs.

Mexico Commercial Printing Market

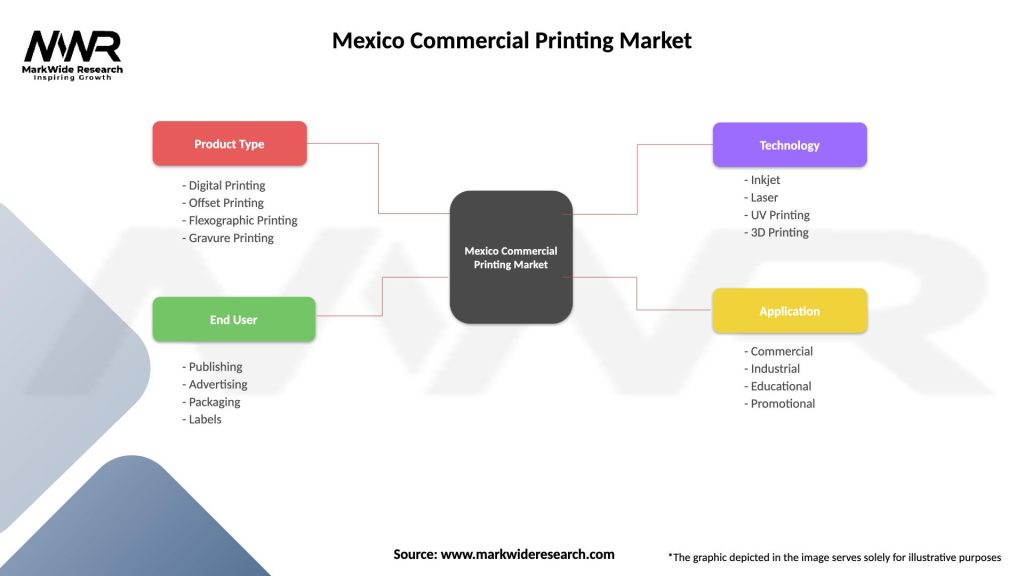

| Segmentation Details | Description |

|---|---|

| Product Type | Digital Printing, Offset Printing, Flexographic Printing, Gravure Printing |

| End User | Publishing, Advertising, Packaging, Labels |

| Technology | Inkjet, Laser, UV Printing, 3D Printing |

| Application | Commercial, Industrial, Educational, Promotional |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Commercial Printing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at