444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Mexico automotive OEM coatings market refers to the sector responsible for providing coatings and finishes for original equipment manufacturers (OEMs) in the automotive industry. These coatings are used to protect and enhance the aesthetics of vehicles during the manufacturing process. The market in Mexico has witnessed significant growth in recent years, driven by the booming automotive industry in the region.

Meaning

Automotive OEM coatings are specialized products designed to meet the unique requirements of the automotive manufacturing sector. These coatings provide protection against corrosion, UV radiation, and environmental factors while improving the appearance and durability of vehicles. The coatings are applied to various automotive parts, including the body, chassis, interior components, and underbody.

Executive Summary

The Mexico automotive OEM coatings market has experienced robust growth in the past decade, primarily due to the country’s strong presence in the automotive manufacturing sector. The market is characterized by the presence of several major coating manufacturers and suppliers catering to the demands of OEMs. The increasing production of vehicles in Mexico, coupled with the growing adoption of advanced coating technologies, has fueled market expansion.

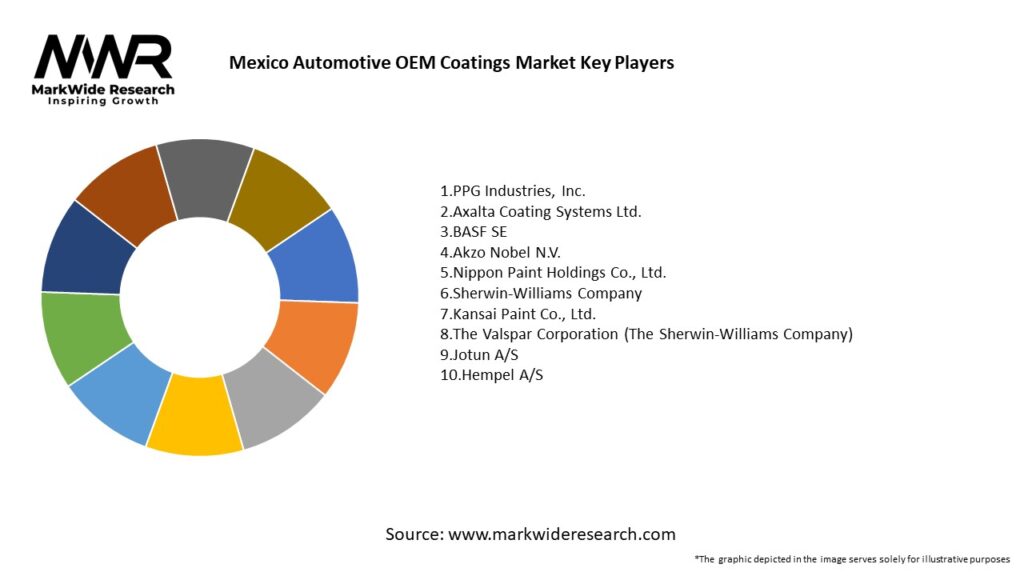

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Mexico automotive OEM coatings market is influenced by several dynamic factors. The market dynamics are driven by evolving customer preferences, technological advancements, regulatory developments, and competitive strategies. The market is characterized by continuous innovation, product differentiation, and expansion into new application areas.

Regional Analysis

The Mexico automotive OEM coatings market is geographically divided into different regions, including major automotive manufacturing hubs such as Mexico City, Monterrey, Guadalajara, and Puebla. These regions witness significant automotive production and provide a favorable market environment for OEM coatings suppliers. The regions are supported by a robust infrastructure, skilled labor, and established automotive supply chains.

Competitive Landscape

Leading Companies in the Mexico Automotive OEM Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Mexico automotive OEM coatings market can be segmented based on product type, technology, and end-use application.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Mexico automotive OEM coatings market. The automotive industry experienced a temporary slowdown due to supply chain disruptions, production halts, and reduced consumer demand. However, the market has shown resilience and is expected to recover as the industry bounces back and consumer confidence returns. The pandemic has also highlighted the importance of hygiene and antimicrobial coatings, which may drive demand in the post-pandemic period.

Key Industry Developments

Key developments in the Mexico Automotive OEM Coatings Market include:

Analyst Suggestions

Future Outlook

The Mexico automotive OEM coatings market is expected to witness steady growth in the coming years. The market will be driven by the increasing automotive production, the adoption of advanced coating technologies, and the emphasis on sustainability. The demand for custom colors, special effects, and eco-friendly coatings will continue to shape market trends. Collaboration between manufacturers, suppliers, and OEMs will be crucial for innovation and market expansion.

Conclusion

The Mexico automotive OEM coatings market is experiencing significant growth due to the booming automotive industry in the country. The market is driven by factors such as increased automotive production, technological advancements, and the shift towards eco-friendly coatings. The market offers opportunities for innovation, collaboration, and expansion into new application areas.

What is Automotive OEM Coatings?

Automotive OEM Coatings refer to the specialized paints and finishes applied to vehicles during the manufacturing process. These coatings enhance the aesthetic appeal, durability, and protection of vehicles against environmental factors.

What are the key players in the Mexico Automotive OEM Coatings Market?

Key players in the Mexico Automotive OEM Coatings Market include PPG Industries, Axalta Coating Systems, BASF, and Sherwin-Williams, among others. These companies are known for their innovative coating solutions tailored for automotive applications.

What are the growth factors driving the Mexico Automotive OEM Coatings Market?

The Mexico Automotive OEM Coatings Market is driven by the increasing demand for lightweight vehicles, advancements in coating technologies, and the growing automotive production in the region. Additionally, the focus on enhancing vehicle aesthetics and durability contributes to market growth.

What challenges does the Mexico Automotive OEM Coatings Market face?

Challenges in the Mexico Automotive OEM Coatings Market include stringent environmental regulations, fluctuating raw material prices, and the need for continuous innovation to meet evolving consumer preferences. These factors can impact production costs and market dynamics.

What opportunities exist in the Mexico Automotive OEM Coatings Market?

Opportunities in the Mexico Automotive OEM Coatings Market include the rising trend of electric vehicles, which require specialized coatings, and the increasing adoption of sustainable coating solutions. Additionally, expanding automotive manufacturing facilities in Mexico presents growth potential.

What trends are shaping the Mexico Automotive OEM Coatings Market?

Trends in the Mexico Automotive OEM Coatings Market include the shift towards eco-friendly coatings, the use of advanced technologies like nanocoatings, and the growing emphasis on customization in vehicle finishes. These trends reflect the industry’s response to consumer demands and environmental concerns.

Mexico Automotive OEM Coatings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Waterborne Coatings, Solventborne Coatings, Powder Coatings, UV-Cured Coatings |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Application | Exterior Coatings, Interior Coatings, Underbody Coatings, Engine Coatings |

| Technology | Electrostatic Spray, Airless Spray, Roller Coating, Dip Coating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Mexico Automotive OEM Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at