444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico automotive lubricant market represents a dynamic and rapidly evolving sector within the country’s automotive industry ecosystem. Mexico’s strategic position as a major automotive manufacturing hub in North America has significantly influenced the demand for high-quality automotive lubricants across various vehicle segments. The market encompasses engine oils, transmission fluids, brake fluids, gear oils, and specialty lubricants designed for passenger cars, commercial vehicles, and industrial applications.

Market dynamics indicate robust growth driven by increasing vehicle production, expanding automotive manufacturing facilities, and rising consumer awareness about vehicle maintenance. The sector benefits from Mexico’s position as a key automotive export destination, with major international manufacturers establishing production facilities throughout the country. Growth projections suggest the market will experience a compound annual growth rate of 6.2% over the forecast period, supported by technological advancements and evolving consumer preferences.

Regional distribution shows concentrated activity in automotive manufacturing clusters, particularly in states like Guanajuato, Puebla, and Nuevo León. The market structure reflects a combination of international lubricant manufacturers and domestic players, creating a competitive landscape that drives innovation and product development. Premium lubricant adoption has increased by 28% among Mexican consumers, indicating a shift toward higher-quality products that offer enhanced engine protection and fuel efficiency benefits.

The Mexico automotive lubricant market refers to the comprehensive ecosystem of lubricating products specifically designed for automotive applications within Mexico’s domestic and export-oriented vehicle manufacturing and maintenance sectors. This market encompasses all types of lubricants used in passenger vehicles, commercial trucks, motorcycles, and industrial automotive equipment throughout Mexico’s diverse automotive landscape.

Automotive lubricants serve critical functions in vehicle operation, including reducing friction between moving parts, dissipating heat, preventing corrosion, and maintaining optimal engine performance. The Mexican market specifically addresses the unique requirements of vehicles operating in diverse climatic conditions, from coastal humidity to high-altitude environments, requiring specialized formulations that can perform effectively across various operating conditions.

Market scope includes both original equipment manufacturer (OEM) lubricants used in vehicle assembly and aftermarket products for vehicle maintenance and service. The definition extends to synthetic, semi-synthetic, and conventional lubricants, each serving specific performance requirements and price points within Mexico’s diverse automotive consumer base.

Mexico’s automotive lubricant market demonstrates exceptional growth potential driven by the country’s expanding role as a global automotive manufacturing destination. The market benefits from substantial foreign direct investment in automotive production facilities, creating sustained demand for both OEM and aftermarket lubricant products. Manufacturing expansion has contributed to a 15% increase in lubricant consumption across industrial automotive applications.

Key market drivers include increasing vehicle ownership rates, growing awareness of preventive maintenance benefits, and the expansion of automotive service networks throughout Mexico. The market shows particular strength in premium lubricant segments, where consumers increasingly recognize the value proposition of advanced formulations that extend engine life and improve fuel economy.

Competitive dynamics feature a balanced mix of international brands and domestic manufacturers, with market leadership distributed among several key players who have established strong distribution networks and brand recognition. Synthetic lubricant adoption has grown by 22% annually, reflecting consumer migration toward higher-performance products that offer extended service intervals and superior engine protection.

Future prospects remain highly favorable, supported by continued automotive industry growth, infrastructure development, and evolving consumer preferences toward premium automotive care products. The market is positioned to benefit from Mexico’s strategic trade relationships and its role as a key automotive export hub serving North American and global markets.

Strategic market insights reveal several critical factors shaping the Mexico automotive lubricant landscape:

Market intelligence indicates that consumer education initiatives have significantly impacted purchasing decisions, with informed consumers showing 35% higher likelihood to invest in premium lubricant products that offer superior engine protection and fuel efficiency benefits.

Primary market drivers propelling growth in Mexico’s automotive lubricant sector include several interconnected factors that create sustained demand across multiple market segments. Automotive manufacturing expansion represents the most significant driver, with major international manufacturers continuing to establish and expand production facilities throughout Mexico, creating substantial demand for OEM lubricants and maintenance products.

Vehicle ownership growth continues to accelerate across Mexico’s expanding middle class, driven by improved economic conditions and increased access to automotive financing. This demographic shift creates sustained demand for aftermarket lubricants as consumers seek to maintain their vehicles properly and extend operational life. Urban mobility trends show increasing reliance on personal transportation, particularly in metropolitan areas where public transportation infrastructure remains limited.

Infrastructure development throughout Mexico has improved road networks and transportation corridors, leading to increased commercial vehicle activity and corresponding lubricant demand. The expansion of logistics and freight transportation sectors creates substantial opportunities for commercial lubricant products designed for heavy-duty applications.

Technological advancement in automotive engineering drives demand for specialized lubricants formulated for modern engines with tighter tolerances and advanced emission control systems. Fuel efficiency regulations encourage adoption of low-viscosity lubricants that reduce internal engine friction and improve overall vehicle efficiency.

Market restraints present challenges that could potentially limit growth in Mexico’s automotive lubricant sector. Economic volatility remains a persistent concern, as fluctuations in currency exchange rates and economic uncertainty can impact consumer spending on premium automotive maintenance products. During economic downturns, consumers often defer vehicle maintenance or switch to lower-cost lubricant alternatives.

Price sensitivity among certain consumer segments creates pressure on profit margins and limits market penetration of premium lubricant products. Cost-conscious consumers may prioritize immediate savings over long-term engine protection benefits, particularly in rural markets where disposable income levels remain constrained.

Regulatory complexity presents ongoing challenges as manufacturers must navigate evolving environmental regulations and quality standards. Compliance costs associated with meeting increasingly stringent emission requirements and environmental protection standards can impact product development timelines and market entry strategies.

Counterfeit products pose significant risks to market integrity, as substandard lubricants can damage engines and undermine consumer confidence in legitimate brands. The presence of counterfeit products in certain market segments creates unfair price competition and potential liability issues for consumers and legitimate manufacturers.

Supply chain disruptions can impact product availability and pricing stability, particularly for imported base oils and additive packages essential for lubricant manufacturing. Logistics challenges in reaching remote markets can limit distribution effectiveness and increase operational costs.

Significant market opportunities exist across multiple dimensions of Mexico’s automotive lubricant landscape. Electric vehicle transition creates new product categories for specialized lubricants designed for electric drivetrains, battery cooling systems, and hybrid vehicle applications. This emerging segment offers early-mover advantages for companies that develop appropriate product formulations and market positioning strategies.

Rural market expansion presents substantial growth potential as infrastructure development and economic growth extend automotive ownership into previously underserved regions. Distribution network expansion into rural markets can capture significant market share among price-sensitive consumers who value product availability and local service support.

Premium product migration offers opportunities to capture higher margins as consumers become more educated about lubricant benefits and willing to invest in superior products. Synthetic lubricant adoption continues expanding, with market penetration rates showing 18% annual growth among consumers who recognize extended service interval benefits.

Commercial vehicle growth driven by e-commerce expansion and logistics sector development creates demand for specialized heavy-duty lubricants. The growing freight transportation sector requires high-performance lubricants that can withstand demanding operating conditions while providing extended service life.

Export market development leverages Mexico’s automotive manufacturing capabilities to serve international markets with locally produced lubricants. Cross-border opportunities include both finished product exports and contract manufacturing arrangements with international brands seeking cost-effective production solutions.

Market dynamics in Mexico’s automotive lubricant sector reflect complex interactions between supply-side factors, demand patterns, and competitive forces. Supply chain integration has become increasingly sophisticated, with major lubricant manufacturers establishing local blending facilities to reduce costs and improve responsiveness to market demands. This localization strategy enables better inventory management and faster product customization for specific market requirements.

Competitive intensity varies significantly across market segments, with premium products experiencing less price competition due to brand differentiation and performance benefits. Market consolidation trends show larger players acquiring regional distributors to strengthen market presence and improve distribution efficiency. Brand loyalty patterns indicate that established brands maintain 42% customer retention rates compared to newer market entrants.

Technology adoption cycles influence product development priorities, as manufacturers must balance investment in advanced formulations with market readiness for premium products. Consumer education initiatives play crucial roles in driving adoption of higher-performance lubricants that offer superior engine protection and fuel efficiency benefits.

Seasonal demand patterns create inventory management challenges, with peak demand periods coinciding with vehicle maintenance seasons and new vehicle sales cycles. Economic sensitivity affects different market segments variably, with commercial applications showing more resilience during economic downturns compared to consumer discretionary spending on premium automotive products.

Comprehensive research methodology employed in analyzing Mexico’s automotive lubricant market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, automotive service providers, and consumer focus groups to gather firsthand market intelligence and validate quantitative findings.

Secondary research sources encompass industry publications, government statistical databases, automotive manufacturer reports, and trade association data to establish market baseline information and historical trends. Data triangulation methods cross-reference multiple information sources to verify market size estimates, growth projections, and competitive landscape assessments.

Market segmentation analysis utilizes both top-down and bottom-up approaches to ensure comprehensive coverage of all market segments and applications. Regional analysis methodology incorporates state-level automotive production data, vehicle registration statistics, and economic indicators to assess geographic market distribution and growth potential.

Competitive intelligence gathering includes analysis of company financial reports, product portfolio assessments, and distribution network mapping to understand market positioning and strategic initiatives. Consumer behavior analysis employs survey research and purchasing pattern analysis to identify trends in product preferences and brand loyalty patterns.

Forecasting methodology combines econometric modeling with industry expert insights to develop realistic growth projections that account for both cyclical and structural market factors affecting the automotive lubricant sector in Mexico.

Regional market distribution across Mexico reveals significant concentration in automotive manufacturing centers and major metropolitan areas. Central Mexico dominates market activity, accounting for approximately 38% of total lubricant consumption, driven by the presence of major automotive assembly plants and the Mexico City metropolitan area’s substantial vehicle population.

Northern border states including Nuevo León, Chihuahua, and Coahuila represent critical market regions due to their proximity to U.S. markets and concentration of automotive manufacturing facilities. These regions benefit from cross-border trade relationships and established supply chain infrastructure that supports both domestic consumption and export activities.

Bajío region encompassing Guanajuato, Querétaro, and Aguascalientes has emerged as a significant automotive manufacturing cluster, creating substantial demand for OEM lubricants and aftermarket products. The region’s strategic location and transportation infrastructure make it an attractive destination for automotive investment and related lubricant market development.

Pacific coast regions including Jalisco and coastal states show growing market potential driven by economic development and increasing vehicle ownership rates. Port cities serve as important distribution hubs for imported lubricant base oils and finished products, while also supporting export activities to Central and South American markets.

Southern regions present emerging market opportunities as infrastructure development and economic growth extend automotive ownership into previously underserved areas. Rural market penetration remains limited but shows 12% annual growth as distribution networks expand and consumer purchasing power increases.

Competitive landscape in Mexico’s automotive lubricant market features a diverse mix of international brands, regional players, and domestic manufacturers competing across multiple market segments. Market leadership is distributed among several key players who have established strong brand recognition and comprehensive distribution networks throughout the country.

Competitive strategies emphasize brand differentiation through product performance, extensive distribution networks, and customer education programs. Market share dynamics show international brands controlling 67% of the premium segment, while domestic and regional players maintain stronger positions in value-oriented market segments.

Innovation competition focuses on developing advanced formulations that meet evolving automotive technology requirements while addressing Mexican market-specific needs such as climate adaptability and extended service intervals.

Market segmentation reveals distinct categories based on product type, application, and end-user requirements. By Product Type: Engine oils represent the largest segment, accounting for the majority of market volume, followed by transmission fluids, gear oils, brake fluids, and specialty lubricants for specific automotive applications.

By Viscosity Grade: Multi-grade oils dominate the market due to their versatility across different operating conditions, while single-grade oils maintain presence in specific applications and older vehicle segments. Low-viscosity formulations show increasing adoption driven by fuel efficiency requirements and modern engine designs.

By Base Oil Type:

By Vehicle Type: Passenger cars represent the primary market segment, while commercial vehicles, motorcycles, and off-highway equipment create specialized demand for tailored lubricant formulations. Electric vehicle lubricants represent an emerging segment with significant future growth potential.

By Distribution Channel: Automotive service centers, retail outlets, and OEM channels each serve distinct market segments with different service requirements and customer expectations.

Engine oil category dominates the Mexican automotive lubricant market, representing the core product segment with the highest volume consumption and broadest consumer awareness. Premium engine oils show particularly strong growth as consumers increasingly recognize the value proposition of extended drain intervals and superior engine protection. Synthetic engine oil adoption has increased by 25% among Mexican consumers who prioritize vehicle longevity and performance.

Transmission fluid segment benefits from the growing complexity of modern automotive transmissions and increased consumer awareness of transmission maintenance importance. Automatic transmission fluids show stronger growth compared to manual transmission products, reflecting market trends toward automatic transmission adoption in new vehicles.

Specialty lubricants category including brake fluids, power steering fluids, and differential oils represents a high-margin segment with opportunities for product differentiation and premium positioning. Performance-oriented consumers demonstrate willingness to invest in specialized products that offer enhanced safety and operational benefits.

Commercial vehicle lubricants constitute a distinct category with unique performance requirements and purchasing patterns. Fleet operators prioritize total cost of ownership considerations, creating opportunities for lubricants that offer extended service intervals and reduced maintenance costs.

Motorcycle lubricants represent a specialized segment with specific formulation requirements for two-stroke and four-stroke engines. This category shows steady growth driven by motorcycle popularity as an economical transportation solution in urban areas.

Industry participants in Mexico’s automotive lubricant market benefit from multiple value creation opportunities across the supply chain. Manufacturers gain access to a large and growing market with diverse applications and customer segments, enabling portfolio diversification and revenue growth through both domestic sales and export opportunities.

Distribution partners benefit from stable demand patterns and opportunities to build long-term customer relationships through value-added services such as technical support and maintenance programs. Retail margins in the lubricant sector typically exceed those of other automotive aftermarket products, creating attractive business opportunities for service providers.

Automotive service providers can differentiate their offerings through premium lubricant partnerships and technical expertise, creating customer loyalty and higher service margins. Professional installation and maintenance services add value for consumers while generating additional revenue streams for service centers.

End consumers benefit from improved vehicle performance, extended engine life, and reduced maintenance costs when using appropriate lubricant products. Premium lubricant users report average fuel economy improvements of 3-5% compared to conventional products, providing tangible economic benefits that justify higher initial costs.

OEM partnerships create opportunities for lubricant manufacturers to establish factory-fill relationships and develop co-branded aftermarket programs that leverage automotive manufacturer credibility and distribution networks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Synthetic lubricant adoption represents the most significant trend shaping Mexico’s automotive lubricant market, with consumers increasingly recognizing the superior performance characteristics and extended service intervals offered by advanced formulations. Premium product migration continues accelerating as educated consumers prioritize long-term vehicle protection over initial cost considerations.

Environmental consciousness drives growing demand for bio-based and environmentally friendly lubricant options. Sustainability initiatives by major automotive manufacturers create opportunities for lubricants with reduced environmental impact and improved biodegradability characteristics.

Digital integration transforms customer engagement through mobile applications, online ordering platforms, and digital maintenance reminders. Connected vehicle technologies enable predictive maintenance scheduling and automated lubricant monitoring systems that optimize service intervals and product selection.

Service bundling trends show automotive service providers offering comprehensive maintenance packages that include premium lubricants, creating customer convenience while ensuring proper product application. Subscription-based maintenance models gain traction among fleet operators and individual consumers seeking predictable maintenance costs.

Cross-border integration with North American automotive supply chains creates opportunities for standardized lubricant specifications and bulk distribution efficiencies. Regional harmonization of product standards facilitates market access and reduces complexity for multinational automotive manufacturers.

Recent industry developments highlight significant investments in local manufacturing capabilities and distribution network expansion. Major lubricant manufacturers have announced substantial capacity expansions in Mexico to serve both domestic demand and export markets, reflecting confidence in long-term market growth prospects.

Technology partnerships between lubricant manufacturers and automotive OEMs have resulted in co-developed products specifically formulated for vehicles produced in Mexico. These collaborations ensure optimal performance characteristics while supporting local manufacturing initiatives and supply chain localization strategies.

Sustainability initiatives include investments in bio-based lubricant production facilities and recycling programs for used oil collection and reprocessing. Circular economy principles gain importance as manufacturers seek to reduce environmental impact while creating cost-effective raw material sources.

Digital transformation projects encompass supply chain optimization, customer relationship management systems, and predictive analytics for demand forecasting. E-commerce platforms expand market reach and improve customer convenience, particularly for retail consumers and small automotive service providers.

Regulatory compliance investments address evolving environmental standards and quality requirements, ensuring product formulations meet increasingly stringent performance and environmental criteria while maintaining cost competitiveness in price-sensitive market segments.

Strategic recommendations for market participants emphasize the importance of balancing premium product development with accessibility for price-sensitive consumer segments. MarkWide Research analysis suggests that companies should focus on consumer education initiatives that demonstrate the total cost of ownership benefits of premium lubricants rather than competing solely on initial purchase price.

Distribution strategy optimization should prioritize expansion into underserved rural markets while strengthening relationships with automotive service providers in urban centers. Multi-channel approaches that combine traditional retail distribution with digital platforms can capture diverse customer preferences and improve market penetration efficiency.

Product portfolio diversification should anticipate the transition toward electric and hybrid vehicles while maintaining strong positions in conventional automotive applications. Innovation investments in specialized formulations for emerging automotive technologies can establish early-mover advantages in high-growth market segments.

Partnership development with automotive manufacturers, service chains, and fleet operators can create sustainable competitive advantages through exclusive relationships and co-branded product offerings. Technical support capabilities become increasingly important as automotive technologies evolve and require specialized lubricant expertise.

Sustainability integration should address both environmental performance and cost competitiveness, as consumers increasingly consider environmental impact alongside traditional performance criteria. Supply chain localization can reduce costs while improving responsiveness to market demands and regulatory requirements.

Future market prospects for Mexico’s automotive lubricant sector remain highly favorable, supported by continued automotive industry expansion and evolving consumer preferences toward premium products. Long-term growth projections indicate sustained market expansion driven by increasing vehicle ownership, automotive manufacturing growth, and premium product adoption trends.

Electric vehicle transition will create new product categories and market opportunities, though the timeline for significant market impact extends beyond the immediate forecast period. Hybrid vehicle adoption presents near-term opportunities for specialized lubricants that address unique requirements of dual-powertrain systems.

Market consolidation trends may accelerate as larger players seek to achieve scale advantages and smaller participants face increasing competitive pressure. Strategic acquisitions and partnerships will likely reshape the competitive landscape while creating opportunities for market share gains and geographic expansion.

Technology integration will continue transforming customer engagement and service delivery models, with digital platforms becoming increasingly important for market access and customer relationship management. Predictive maintenance technologies may fundamentally alter lubricant consumption patterns and service scheduling practices.

Export market development presents significant growth opportunities as Mexico leverages its automotive manufacturing capabilities and strategic location to serve broader regional markets. MWR projections suggest that export volumes could increase by 45% over the next five years, driven by regional trade integration and manufacturing cost advantages.

Mexico’s automotive lubricant market represents a dynamic and rapidly evolving sector with substantial growth potential driven by the country’s strategic position as a major automotive manufacturing hub. The market benefits from favorable demographic trends, increasing vehicle ownership, and growing consumer awareness of premium lubricant benefits that justify higher initial investments through superior performance and extended service intervals.

Market dynamics reflect a healthy balance between established international brands and emerging domestic players, creating competitive conditions that drive innovation and customer value. The transition toward premium products, particularly synthetic lubricants, demonstrates market maturation and consumer sophistication that supports sustainable profit margins and continued investment in product development.

Strategic opportunities abound across multiple dimensions, from electric vehicle preparation to rural market expansion and export development. Companies that successfully balance premium product positioning with accessibility for price-sensitive segments while building strong distribution networks and customer relationships are positioned to capture disproportionate market share growth.

Long-term outlook remains highly positive, supported by Mexico’s continued role as a critical automotive manufacturing destination and the ongoing evolution of consumer preferences toward higher-quality automotive maintenance products. The Mexico automotive lubricant market offers compelling opportunities for sustained growth and profitability for participants who understand local market dynamics and execute appropriate strategic initiatives.

What is Automotive Lubricant?

Automotive lubricant refers to substances used to reduce friction between surfaces in automotive engines and machinery, enhancing performance and longevity. These lubricants include engine oils, transmission fluids, and greases, which are essential for the smooth operation of vehicles.

What are the key players in the Mexico Automotive Lubricant Market?

Key players in the Mexico Automotive Lubricant Market include companies such as Pemex, Castrol, and Mobil, which offer a range of products for various automotive applications. These companies compete on quality, innovation, and distribution networks, among others.

What are the growth factors driving the Mexico Automotive Lubricant Market?

The Mexico Automotive Lubricant Market is driven by factors such as the increasing vehicle production and sales, rising awareness of vehicle maintenance, and advancements in lubricant technology. Additionally, the growing demand for high-performance lubricants is contributing to market growth.

What challenges does the Mexico Automotive Lubricant Market face?

Challenges in the Mexico Automotive Lubricant Market include stringent environmental regulations, fluctuating raw material prices, and competition from alternative products. These factors can impact production costs and market dynamics.

What opportunities exist in the Mexico Automotive Lubricant Market?

Opportunities in the Mexico Automotive Lubricant Market include the expansion of electric vehicles, which require specialized lubricants, and the growing trend towards synthetic lubricants. Additionally, increasing investments in automotive infrastructure present further growth potential.

What trends are shaping the Mexico Automotive Lubricant Market?

Trends in the Mexico Automotive Lubricant Market include the shift towards eco-friendly and biodegradable lubricants, advancements in additive technologies, and the increasing use of smart lubricants that enhance performance. These trends reflect a broader move towards sustainability and innovation in the automotive sector.

Mexico Automotive Lubricant Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Gear Oil, Hydraulic Oil |

| End User | OEMs, Aftermarket Providers, Dealerships, Fleet Operators |

| Packaging Type | Drums, Pails, Bottles, Bulk |

| Grade | Mineral, Synthetic, Semi-Synthetic, Bio-Based |

Please note: The segmentation can be entirely customized to align with our client’s needs.

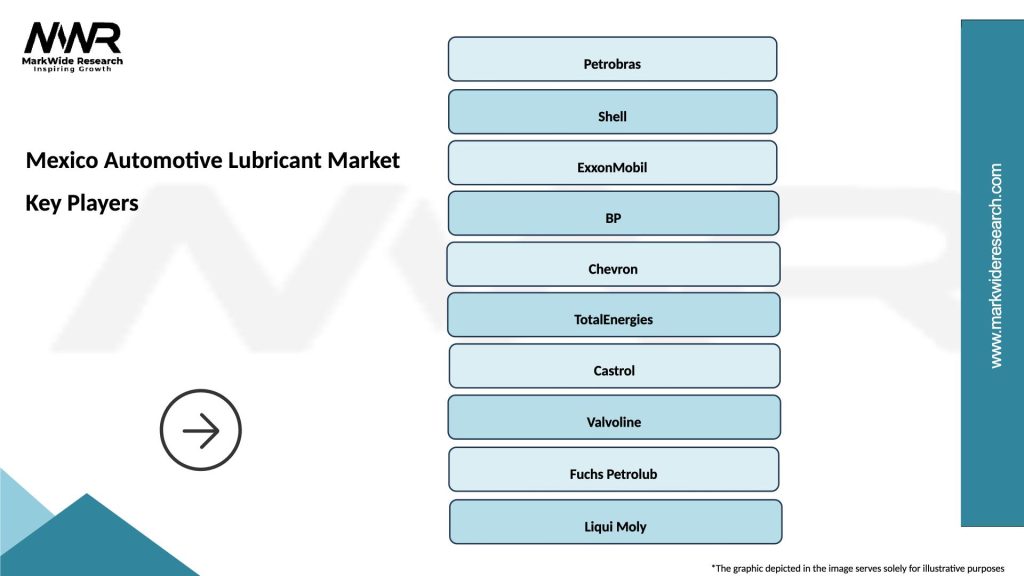

Leading companies in the Mexico Automotive Lubricant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at