444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

The Mexican Intraocular Lens (IOL) market is experiencing significant growth due to advancements in healthcare infrastructure and an aging population. Intraocular lenses are artificial lenses implanted in the eye during cataract surgery or to correct vision problems. As Mexico’s healthcare sector continues to expand, the demand for IOLs is rising steadily. This market analysis delves into the key factors driving growth, market dynamics, regional trends, competitive landscape, and future prospects for the Mexican Intraocular Lens market.

Meaning:

Intraocular lenses (IOLs) are medical devices used to replace the eye’s natural lens when it becomes clouded due to cataracts or other eye disorders. These lenses are made from various materials, including silicone and acrylic, and come in different shapes and sizes to cater to diverse patient needs. The primary goal of IOL implantation is to restore clear vision and enhance visual acuity, reducing the dependence on glasses or contact lenses.

Executive Summary:

The Mexican Intraocular Lens market has experienced steady growth in recent years, driven by factors such as an aging population, increasing prevalence of cataracts, and improvements in healthcare infrastructure. Key industry participants have been focusing on technological advancements and product innovation to gain a competitive edge. This report provides an in-depth analysis of the market dynamics, regional trends, competitive landscape, and key insights for industry participants and stakeholders.

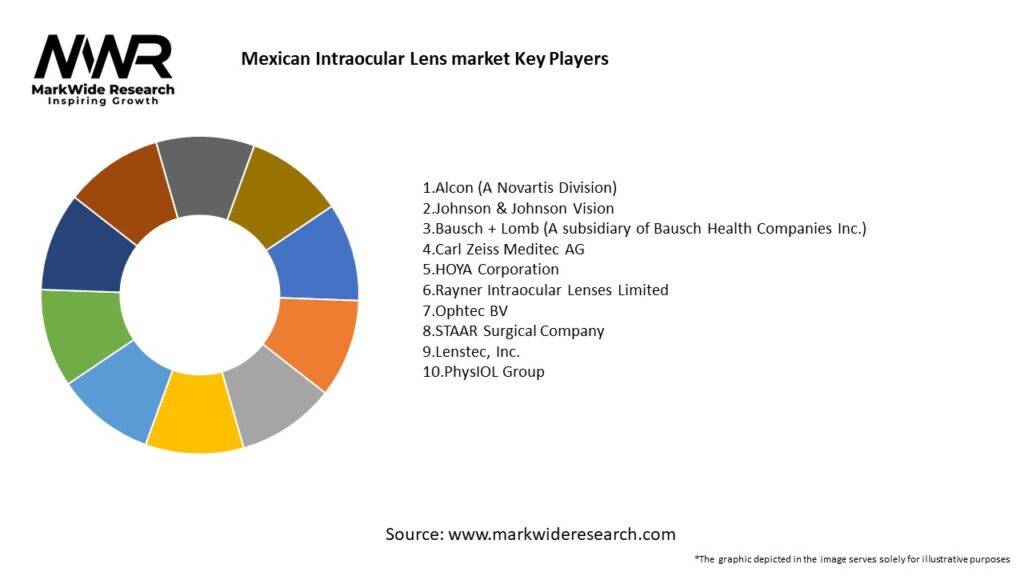

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Mexican Intraocular Lens market is dynamic and evolving, driven by factors like increasing patient awareness, technological innovations, and economic developments. As the healthcare infrastructure continues to improve, more patients will seek IOL implantation, leading to substantial market growth. However, challenges such as high costs and lack of awareness need to be addressed to unlock the full potential of this market.

Regional Analysis:

The demand for Intraocular Lenses in Mexico is not evenly distributed across the country. Metropolitan areas, with better healthcare facilities, account for a significant share of IOL procedures. However, with increasing awareness and government initiatives, rural regions are gradually catching up. Key cities like Mexico City, Guadalajara, and Monterrey are witnessing higher IOL adoption rates due to the concentration of healthcare centers and specialists.

Competitive Landscape:

Leading Companies in the Mexican Intraocular Lens Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The Mexican IOL market can be segmented based on material type, product type, and end-user.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic had a temporary impact on the Mexican IOL market, with elective surgeries being postponed or canceled during the peak of the pandemic. However, as the situation improved and healthcare facilities adapted to safety protocols, the demand for IOLs gradually rebounded.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The Mexican Intraocular Lens market is poised for significant growth in the coming years. As healthcare infrastructure continues to improve and technological advancements drive product innovation, the market will witness increased adoption of IOLs across different patient segments. Efforts to address cost barriers and improve awareness will further fuel market expansion.

Conclusion:

The Mexican Intraocular Lens market is experiencing robust growth, fueled by a growing aging population and advancements in healthcare infrastructure. Key market drivers, such as an increasing prevalence of eye diseases and rising disposable income, are pushing the demand for IOLs upwards. However, challenges like high costs and lack of awareness need to be addressed to unlock the market’s full potential. As technological innovations continue and healthcare access improves, the future outlook for the Mexican IOL market remains promising, offering significant opportunities for industry participants and stakeholders to thrive in this dynamic and evolving market.

Mexican Intraocular Lens market

| Segmentation Details | Description |

|---|---|

| Product Type | Monofocal, Multifocal, Toric, Accommodative |

| End User | Hospitals, Clinics, Ambulatory Surgical Centers, Ophthalmology Practices |

| Material | PMMA, Silicone, Hydrophilic Acrylic, Hydrophobic Acrylic |

| Technology | Conventional, Advanced, Customized, Standard |

Leading Companies in the Mexican Intraocular Lens Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at