444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The metal and metal ores market is a vital sector within the global economy, playing a crucial role in various industries such as construction, automotive, aerospace, and manufacturing. Metals are essential raw materials used in the production of countless products, ranging from vehicles and infrastructure to electronic devices and consumer goods. Metal ores, on the other hand, are minerals that contain valuable metals, which are extracted and processed to obtain the desired metals.

Meaning

The metal and metal ores market refers to the industry involved in the exploration, extraction, processing, and distribution of metals and metal ores. This market encompasses a wide range of metals, including steel, aluminum, copper, gold, silver, iron, and many others. Metal ores are naturally occurring mineral deposits that contain high concentrations of these metals, and they are mined and refined to obtain the pure metals.

Executive Summary

The metal and metal ores market has witnessed significant growth over the years, driven by the increasing demand for metals across various industries. The market is characterized by intense competition among key players, technological advancements in mining and processing methods, and evolving consumer preferences. Despite facing challenges such as environmental concerns and fluctuating metal prices, the market continues to expand due to the rising need for metals in infrastructure development, urbanization, and industrialization.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The metal and metal ores market is characterized by dynamic factors that influence its growth and development. These dynamics include supply and demand patterns, technological advancements, regulatory changes, and market competition.

Supply and demand dynamics drive the market, with fluctuations in demand often affecting metal prices. Technological advancements play a vital role in improving mining and processing methods, reducing costs, and increasing operational efficiency. Additionally, regulatory changes, such as environmental regulations and trade policies, can have a significant impact on the industry’s operations and profitability.

Competition within the market is intense, with major players constantly striving to gain a competitive edge through product innovation, strategic partnerships, and mergers and acquisitions. The market dynamics are further influenced by macroeconomic factors, geopolitical events, and social trends, which can create uncertainties and impact market performance.

Regional Analysis

The metal and metal ores market exhibits regional variations in terms of production, consumption, and market dynamics. Major regions contributing to the market’s growth and development include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America and Europe have well-established metal industries, driven by technological advancements, infrastructure development, and strong manufacturing sectors. These regions also emphasize environmental sustainability, leading to the adoption of cleaner technologies and regulations.

Asia Pacific is a significant player in the metal and metal ores market, with countries like China, India, and Japan driving the demand for metals due to their rapid industrialization and infrastructure projects. The region’s expanding automotive sector and increasing consumer spending contribute to the market’s growth.

Latin America and the Middle East and Africa are emerging markets with abundant mineral resources. These regions offer vast opportunities for metal exploration and extraction, attracting investments from international players. The growth of construction, manufacturing, and automotive industries in these regions also drives the demand for metals.

Competitive Landscape

Leading Companies in the Metal and Metal Ores Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

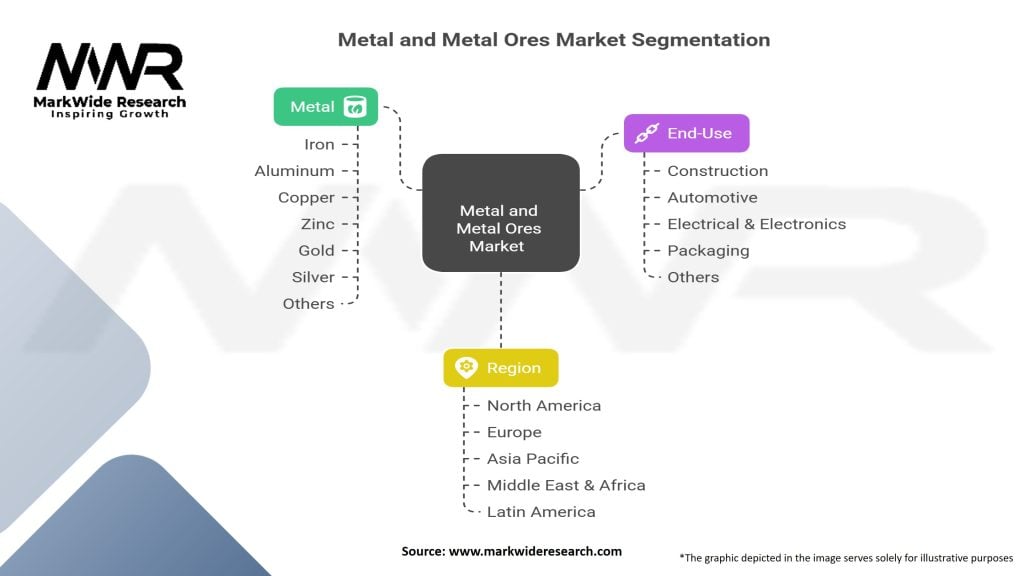

Segmentation

The metal and metal ores market can be segmented based on various factors, including metal type, end-use industry, and geography.

Segmentation provides valuable insights into the market, enabling stakeholders to understand the demand patterns, target specific customer segments, and develop appropriate strategies to cater to their needs.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The metal and metal ores market experienced a significant impact from the COVID-19 pandemic. The pandemic disrupted global supply chains, leading to temporary closures of mines, manufacturing plants, and construction projects. The lockdown measures implemented by many countries resulted in reduced demand for metals from key industries such as automotive, construction, and aerospace.

However, as economies recover and restrictions are lifted, the market is gradually rebounding. Government stimulus packages and infrastructure development projects aimed at economic recovery are driving the demand for metals. The shift towards renewable energy and electric vehicles also presents new opportunities for the market post-pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The metal and metal ores market is expected to witness steady growth in the coming years, driven by factors such as infrastructure development, renewable energy adoption, and technological advancements. The increasing demand for metals in emerging economies, particularly in Asia Pacific and Latin America, will contribute to market expansion.

However, the industry will face challenges related to environmental sustainability, fluctuating metal prices, and the need to meet evolving customer preferences. Market participants will need to adapt to these challenges by embracing sustainable practices, investing in technological innovations, and diversifying their product offerings.

Conclusion

The metal and metal ores market plays a vital role in various industries, supplying the raw materials necessary for infrastructure development, manufacturing, and technological advancements. The market continues to grow, driven by increasing demand from sectors such as construction, automotive, and renewable energy.

While the industry faces challenges related to environmental concerns and price volatility, it also presents numerous opportunities. The transition towards sustainable practices, technological advancements, and emerging markets provide avenues for growth and innovation. To thrive in this dynamic market, industry participants should prioritize sustainability, invest in research and development, and adapt to evolving customer demands. Collaboration and partnerships can foster innovation, and diversification of product portfolios can help mitigate risks and capitalize on emerging trends. Overall, the metal and metal ores market is poised for a promising future, driven by the global need for metals and the industry’s commitment to sustainable and responsible practices.

Metal and Metal Ores Market Segmentation Details:

| Segmentation | Details |

|---|---|

| Metal | Iron, Aluminum, Copper, Zinc, Gold, Silver, Others |

| End-Use | Construction, Automotive, Electrical & Electronics, Packaging, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Metal and Metal Ores Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at