444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

In the realm of industrial and consumer products, the MES surfactants market occupies a vital position, driving the production of diverse goods that touch every aspect of modern life. This market is defined by the demand for surfactants derived from methyl ester sulfonates (MES), renowned for their environmentally friendly nature and biodegradability. As industries worldwide embrace sustainability, MES surfactants play a pivotal role in shaping the future of cleaner, greener chemistry.

Meaning

MES surfactants, short for methyl ester sulfonates surfactants, are a class of surface-active agents derived from renewable sources such as natural oils and fats. These surfactants possess unique properties that enable them to reduce surface tension, facilitating the mixing of water and oil-based substances. What sets MES surfactants apart is their production process, which employs esterification followed by sulfonation, resulting in environmentally benign, biodegradable surfactants.

Executive Summary

The MES surfactants market is experiencing remarkable growth, fueled by the global shift towards sustainable practices and the pursuit of eco-friendly alternatives. These surfactants, known for their effective cleaning properties and reduced environmental impact, have found applications across various industries. As regulatory pressures and consumer preferences align with green chemistry, the MES surfactants market is poised for sustained expansion.

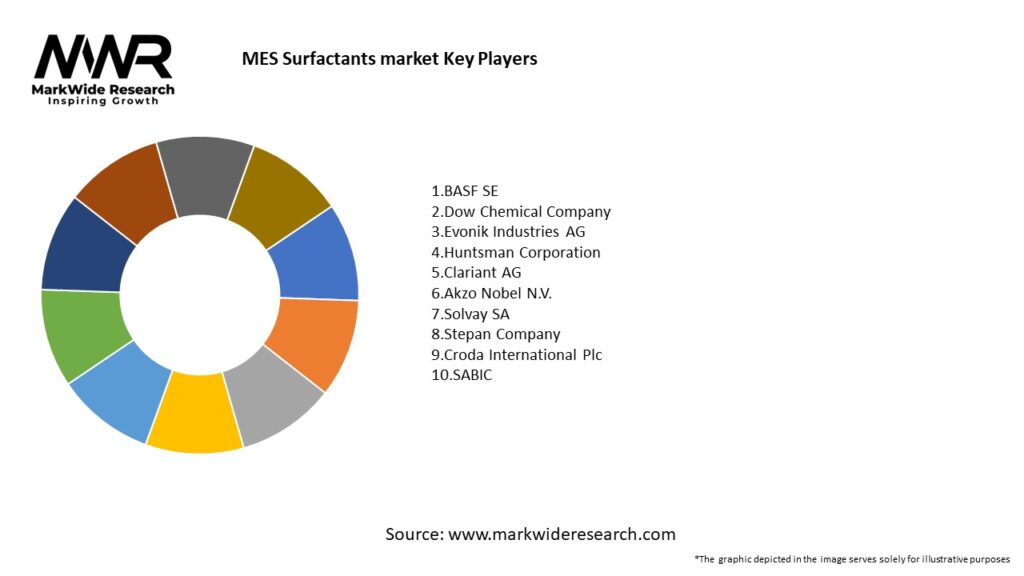

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Environmental regulation acts as a critical driver: as governments phase out less biodegradable surfactants, MES becomes more attractive.

Feedstock alignment matters: regions with strong oilseed or palm oil industries can more competitively produce MES.

Purity and performance tradeoffs define market segments: industrial vs. premium household MES grades differ in demand and margins.

Blends and combinations are essential: MES rarely works alone in all use cases; formulators blend with co-surfactants.

Distribution and scale remain constraints: emerging markets often import MES or formulations due to local capacity gaps.

Market Drivers

Stricter environmental and biodegradability standards: Regulations pushing surfactants to meet higher biodegradation rates favor MES.

Growing cleaning and hygiene demand: Rising consumer awareness, institutional cleaning needs, and healthcare hygiene drive formulation demand.

Sustainability branding among FMCG: Brands increasingly tout “green ingredients,” boosting the appeal of MES-containing products.

Industrial cleaning applications expanding: MES offers effective cleaning in metalworking, process cleaning, and specialty segments.

Integration in green supply chains: Suppliers embedding MES into eco-labeled detergents, home care, and fabric-care systems.

Market Restraints

Feedstock price volatility: MES relies on vegetable oils (or methyl esters) that are subject to agricultural price swings.

Competition from alternative green surfactants: Other “bio-based” surfactants (e.g., sophorolipids, alkyl polyglucosides, sugar esters) vie for formulators’ attention.

Scale and purity constraints: High-purity MES manufacture is more challenging, restricting penetration in premium segments.

Formulation limitations: In highly demanding conditions (e.g., extreme pH or temperature), MES may require blending or stabilizers.

Logistics and distribution costs: Bulk transport, storage, and regional supply chain issues can hinder adoption in remote markets.

Market Opportunities

Development of specialty grades: High-purity, branched-chain, differential-chain MES variants can command premium pricing.

Blended surfactant packages: Offering pre-blended MES + co-surfactants (nonionic, amphoteric) simplifies formulation for FMCG customers.

Green cleaning and eco-label formulations: Position MES-based products for niche premium markets demanding sustainability credentials.

Industrial and institutional expansion: Target sectors such as car care, metal cleaning, food processing, and institutional cleaning.

Emerging markets penetration: As awareness and regulation expand in Asia, Latin America, and Africa, MES uptake can grow.

Market Dynamics

Supply-Side Factors:

Surfactant manufacturers investing in MES production lines.

Integration with local agricultural feedstocks (e.g., palm, rapeseed) to lower raw input costs.

Formulation houses and chemical suppliers bundling MES into detergent systems for easier adoption.

Demand-Side Factors:

FMCG and cleaning brands seeking low-cost green switch options.

Institutional buyers (hospitals, hotels, offices) seeking high-performance, environmentally compliant cleaning agents.

Regulatory or tender-based demand in procurement of “eco-specified” cleaning chemicals.

Economic & Policy Factors:

Subsidies or incentives for green chemical adoption can accelerate MES uptake.

Import duties or trade policies affect competitiveness of local vs. imported MES chemicals.

ESG and corporate responsibility frameworks encourage substitution.

Regional Analysis

Asia-Pacific: A fast-growing region—especially China, India, Southeast Asia—driving MES demand due to cleaning product scale and regulatory pressure.

Europe: Advanced adoption due to strong environmental regulation and mature home-care markets.

North America: Growth in higher-end green cleaning segments and regulatory push for biodegradability.

Latin America: Emerging opportunities where agricultural feedstock availability helps local MES production.

Middle East & Africa: Lower penetration currently but growing as cleaning and hygiene standards rise; regionally, MES may import into Gulf countries.

Competitive Landscape

Leading Companies in the MES Surfactants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Product Grade:

Standard-grade MES

High-purity MES (for personal care or specialty use)

Branched or tailored MES

Blended MES formulations with co-surfactants

By Application:

Household & Laundry Detergents

Dishwashing & Hard Surface Cleaners

Institutional & Industrial Cleaning

Personal Care & Cosmetics

Specialty Applications (car wash, degreasers, emulsion stabilizers)

By Region:

Asia-Pacific

Europe

North America

Latin America

Middle East & Africa

By Distribution Channel:

Direct to large formulators / FMCG firms

Distributors and chemical merchants for small-scale formulators

Blending houses bundling into consumer-ready systems

Category-wise Insights

Household & Laundry: The largest volume segment—MES competes with LAS, AES; cost and performance balance is critical.

Dishwashing & Hard Surface Cleaners: MES offers strong performance in grease removal and mildness; formulators often blend it with builders, enzymes, or co-surfactants.

Institutional & Industrial Cleaning: MES’s cleaning strength and biodegradability appeal in regulated environments requiring higher maintenance.

Personal Care & Cosmetics: Higher-purity MES grades are used in body washes or mild cleansers where skin compatibility matters.

Specialty Applications: MES is used as an emulsifier or dispersant in industrial or formulations requiring robustness.

Key Benefits for Industry Participants and Stakeholders

Cleaner Product Claims: Brands can market biodegradable, more eco-friendly formulas.

Regulatory Compliance Assurance: MES can help meet stricter environmental or discharge standards.

Formulation Flexibility: Its compatibility with many co-surfactants makes it easily integrated into existing systems.

Differentiation & Premium Pricing: High‑purity MES variants support premium and niche product positioning.

Scalable Adoption: Producers can gradually shift portions of surfactant formula toward MES to manage cost-risk.

SWOT Analysis

Strengths:

Strong biodegradability and milder profile relative to many conventional anionics.

Reasonably competitive cost structure when feedstock inputs are favorable.

Broad adoption potential in multiple cleaning segments.

Weaknesses:

Volatility of feedstock (vegetable oil derivatives) affects margin stability.

Manufacturing purity and control complexity for high-grade MES.

Requires formula re-engineering when replacing legacy surfactants.

Opportunities:

Expansion into emerging markets with rising cleaning demand.

Growth in high-purity and specialty MES segments.

Partnerships with FMCG brands seeking green reformulation.

Licensing or toll-manufacturing to expand footprint in new geographies.

Threats:

Alternative “green” surfactants gaining traction and awareness.

Regulatory or trade policy shifts affecting feedstock sourcing or surfactant preference.

Economic downturns lowering demand for premium cleaning products.

Adoption inertia: formulators reluctant to change from established surfactants unless strong value supports change.

Market Key Trends

Blended Surfactant Systems: MES rarely used alone; blends with nonionics, amphoterics, or co-surfactants are becoming standard.

Higher-Purity and Specialty MES: Demand is growing for grades tailored for personal care, low-foam, or ultra-mild applications.

Green Process Innovation: Research into reducing energy use in MES sulfonation, recovery of byproducts, and lower-emission routes.

Feedstock Diversification: Use of non‑palm methyl esters (e.g. from rapeseed, sunflower) or waste oils to reduce risk and improve sustainability credentials.

Digital Support & Sampling Services: MES suppliers offering technical support, sample kits, and co‑development services to brand formulators.

Key Industry Developments

New MES Plant Announcements: Strategic capacity expansions in regions with strong feedstock availability.

Co-Branding with Green FMCG Lines: Brands launching “green” detergent lines leveraging MES for marketing differentiation.

Blending & Logistics Hubs: Development of regional blending facilities to serve emerging markets with MES-based formulations.

R&D on Derivatives: Development of novel sulfosuccinate or sulfo-fatty ester hybrids combining MES with other surfactant chemistries.

Sustainability Certification Push: Suppliers promoting MES-based formulations to qualify for eco-labels or green procurement standards.

Analyst Suggestions

Leverage Feedstock Advantages: Locate MES production near oilseed or methyl ester suppliers to reduce logistics cost.

Target Strategic Markets: Focus on regions or segments where regulatory pressure or consumer demand for green cleaning is highest.

Invest in Specialty Grades: Offer high-value MES variants for skin-sensitive, low-foam, or premium products.

Support Formulators Collaboratively: Provide sample-blends, technical assistance, shelf-life data, and pilot support to ease adoption.

Expand Local Blending Capability: Regional blending hubs reduce transport cost and accelerate supply responsiveness.

Future Outlook

The MES surfactants market will continue to expand gradually, especially in geographies with strong environmental regulation and evolving consumer preferences. Household and institutional cleaning will remain volume drivers, while growth in specialty and personal care applications provide margin expansion.

Blended systems will dominate, and differentiation will come from purity, green sourcing, and integrated support. Regions that develop feedstock, refining, and distribution capacity locally will capture greater market share. Innovation in process efficiency, sustainability credentialing, and performance alignment will define winners moving forward.

Conclusion

The MES Surfactants Market is emerging as a credible, greener alternative in the surfactant world. Its blend of performance, biodegradability, and formulation flexibility make it well suited for modern cleaning and personal care trends. While challenges around feedstock and competition remain, suppliers and formulators that focus on specialty grades, blending support, regional expansion, and sustainability narratives are poised to capture meaningful growth in the market’s next phase.

In conclusion, the MES (Methylethoxy Sulfate) surfactants market plays a vital role in the detergent and personal care industries. The market’s consistent growth can be attributed to the unique properties of MES surfactants that make them effective in various cleansing and emulsifying applications. Their biodegradability and low environmental impact have positioned them as a favorable choice amid increasing sustainability concerns.

MES Surfactants market

| Segmentation Details | Description |

|---|---|

| Product Type | Anionic, Cationic, Nonionic, Amphoteric |

| End Use Industry | Personal Care, Household Cleaning, Industrial Cleaning, Oil & Gas |

| Form | Liquid, Powder, Granule, Paste |

| Application | Emulsifiers, Wetting Agents, Foaming Agents, Dispersants |

Leading Companies in the MES Surfactants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at