444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Mergers and Acquisitions (M&A) in Aerospace and Defense Market is a dynamic and strategically vital segment within the broader aerospace and defense industry. M&A activities in this sector involve the consolidation, acquisition, and merger of aerospace and defense companies, which can encompass aircraft manufacturers, defense contractors, technology providers, and service firms. These transactions aim to enhance capabilities, expand market presence, and drive innovation in the aerospace and defense domain.

Meaning

Mergers and acquisitions in the aerospace and defense sector refer to strategic transactions where companies combine or acquire other firms to achieve various objectives. These objectives may include gaining access to new technologies, diversifying product portfolios, increasing market share, or achieving cost synergies. M&A activities play a pivotal role in shaping the competitive landscape and capabilities of companies within the industry.

Executive Summary

The M&A landscape in the Aerospace and Defense Market is characterized by ongoing strategic transactions aimed at strengthening capabilities, fostering innovation, and addressing evolving customer demands. These activities are driven by factors such as changing geopolitical dynamics, technological advancements, and the need for efficiency in an increasingly competitive global market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

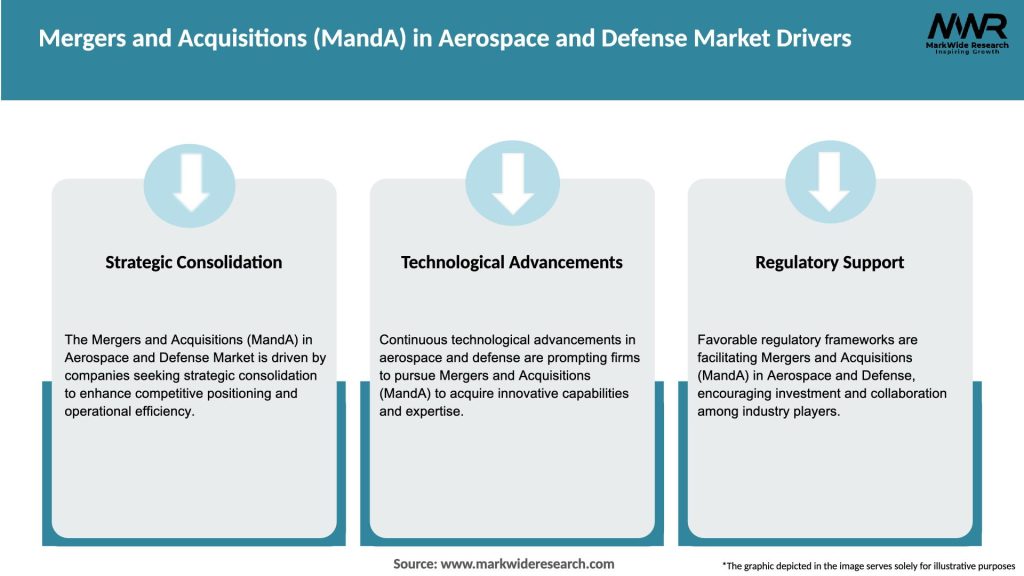

Market Drivers

The following factors are driving M&A activities in the Aerospace and Defense Market:

Market Restraints

Despite its growth, the market faces certain challenges:

Market Opportunities

The M&A in Aerospace and Defense Market offers several growth opportunities:

Market Dynamics

The market’s dynamics are influenced by geopolitical shifts, technological advancements, and evolving customer demands. Successful M&A transactions require thorough due diligence, strategic planning, and effective post-merger integration.

Regional Analysis

The Aerospace and Defense industry is global, with M&A activities spanning regions such as North America, Europe, Asia-Pacific, and the Middle East. Different regions may have unique market dynamics and regulatory considerations that impact M&A transactions.

Competitive Landscape

Leading Companies in Mergers and Acquisitions (M&A) in Aerospace and Defense Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

M&A activities in the Aerospace and Defense Market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had mixed effects on the Aerospace and Defense M&A Market. While some transactions faced delays or changes due to economic uncertainties, others proceeded as companies sought to strengthen their capabilities in response to evolving defense needs and technological opportunities.

Key Industry Developments

Analyst Suggestions

Future Outlook

The M&A in Aerospace and Defense Market is expected to remain active as companies seek to stay competitive through technological advancements, global expansion, and cost efficiencies. The industry will continue to evolve in response to geopolitical developments, changes in defense spending, and the integration of advanced technologies.

Conclusion

Mergers and acquisitions in the Aerospace and Defense Market are strategic tools employed by companies to enhance capabilities, access advanced technologies, and address evolving market demands. These transactions are pivotal in shaping the competitive landscape and driving innovation in the industry. However, they require careful planning, adherence to regulatory requirements, and effective post-merger integration to realize their full potential and create value for stakeholders in the aerospace and defense sector. In conclusion, mergers and acquisitions (M&A) in the Aerospace and Defense (A&D) market have been instrumental in shaping the industry’s landscape, fostering innovation, and addressing the ever-evolving global security and technological challenges. Over the years, we have witnessed a flurry of M&A activity within this sector, driven by factors such as the need for economies of scale, the pursuit of technological synergies, and the desire to expand global footprints.

What is Mergers and Acquisitions (MandA) in Aerospace and Defense?

Mergers and Acquisitions (MandA) in Aerospace and Defense refers to the consolidation of companies within the aerospace and defense sectors through various financial transactions. This can include mergers, where two companies combine to form a new entity, and acquisitions, where one company purchases another to enhance its capabilities or market share.

What are the key players in Mergers and Acquisitions (MandA) in Aerospace and Defense Market?

Key players in the Mergers and Acquisitions (MandA) in Aerospace and Defense Market include Boeing, Lockheed Martin, Northrop Grumman, and Raytheon Technologies. These companies are involved in various segments such as military aircraft, defense systems, and aerospace technologies, among others.

What are the main drivers of Mergers and Acquisitions (MandA) in Aerospace and Defense Market?

The main drivers of Mergers and Acquisitions (MandA) in Aerospace and Defense Market include the need for technological advancements, increased competition, and the pursuit of economies of scale. Companies often seek to enhance their product offerings and expand their market reach through strategic acquisitions.

What challenges does the Mergers and Acquisitions (MandA) in Aerospace and Defense Market face?

Challenges in the Mergers and Acquisitions (MandA) in Aerospace and Defense Market include regulatory hurdles, integration difficulties, and cultural mismatches between merging companies. These factors can complicate the successful execution of M&A transactions.

What opportunities exist in the Mergers and Acquisitions (MandA) in Aerospace and Defense Market?

Opportunities in the Mergers and Acquisitions (MandA) in Aerospace and Defense Market include the potential for innovation through collaboration, access to new markets, and the ability to leverage synergies for cost reduction. Companies are increasingly looking to acquire firms with advanced technologies to stay competitive.

What trends are shaping the Mergers and Acquisitions (MandA) in Aerospace and Defense Market?

Trends shaping the Mergers and Acquisitions (MandA) in Aerospace and Defense Market include a focus on cybersecurity, the integration of artificial intelligence in defense systems, and the consolidation of supply chains. These trends are driving companies to seek partnerships and acquisitions to enhance their capabilities.

Mergers and Acquisitions (MandA) in Aerospace and Defense Market

| Segmentation Details | Description |

|---|---|

| Transaction Type | Buyouts, Mergers, Joint Ventures, Strategic Alliances |

| End User | Government Agencies, Defense Contractors, Aerospace Manufacturers, Research Institutions |

| Investment Stage | Seed, Growth, Expansion, Late Stage |

| Service Type | Consulting, Due Diligence, Valuation, Integration Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Mergers and Acquisitions (M&A) in Aerospace and Defense Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at