444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The MENA (Middle East and North Africa) region has witnessed significant growth in its wealth management market over the past decade. Wealth management refers to the professional services and financial planning solutions offered to high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) to manage and grow their wealth effectively. The MENA region, known for its oil-rich economies and emerging markets, has become a hub for wealth creation and accumulation, attracting both regional and global players in the wealth management industry.

Meaning

Wealth management encompasses a range of personalized financial services, including investment advisory, portfolio management, tax planning, estate planning, and risk management, tailored to the specific needs and goals of affluent clients. As the MENA region continues to experience economic growth and diversification, the demand for sophisticated wealth management solutions has surged, creating a highly competitive market landscape.

Executive Summary

The MENA wealth management market has been witnessing substantial growth, driven by factors such as increasing HNWIs and UHNWIs, favorable government policies, a growing interest in alternative investments, and advancements in financial technology (FinTech). However, the market also faces challenges in terms of regulatory complexities and geopolitical uncertainties.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MENA wealth management market is characterized by intense competition, with domestic and international banks, asset management firms, and independent advisory firms vying for market share. In recent years, there has been a shift from traditional advisory models to hybrid and digital platforms, catering to the preferences of tech-savvy clients. Wealth managers are also focusing on developing personalized and tailored solutions to address the unique needs of their clients.

Regional Analysis

The MENA region comprises diverse economies, each with its own set of opportunities and challenges for the wealth management industry. Countries like the United Arab Emirates (UAE), Saudi Arabia, and Qatar have been at the forefront of wealth creation, driven by their oil-based economies and thriving financial sectors. On the other hand, countries in North Africa, such as Egypt and Morocco, are witnessing a rising affluent class due to economic reforms and increased foreign investments.

Competitive Landscape

Leading Companies in the MENA Wealth Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

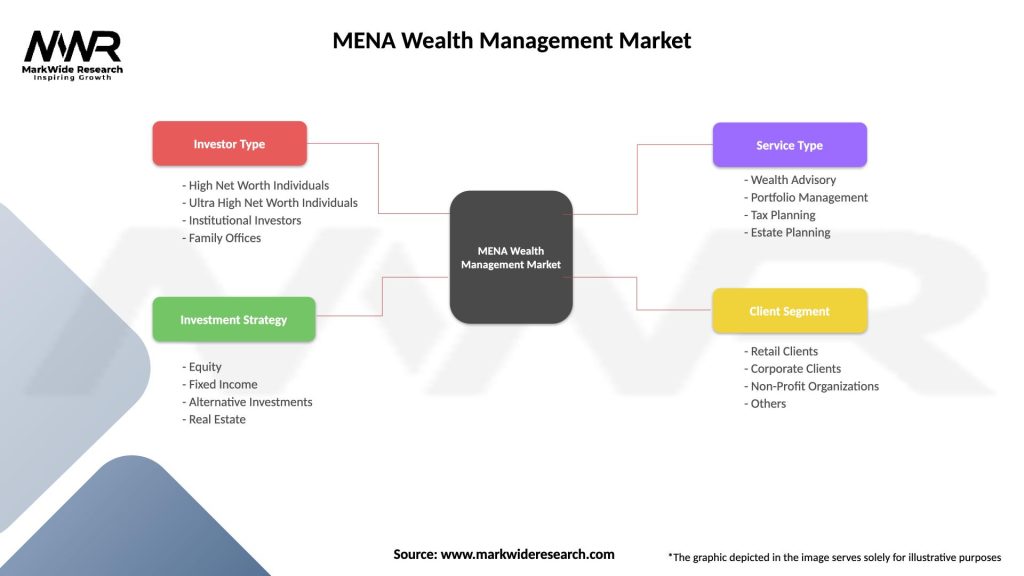

The MENA wealth management market can be segmented based on various factors, including the type of wealth management services offered, client segment targeted, and investment product preferences. Common segments include traditional advisory services, discretionary portfolio management, private banking, and family office services.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the MENA wealth management market, causing short-term disruptions in investment decisions and wealth accumulation. However, the crisis has also highlighted the importance of robust financial planning and risk management, leading to an increased demand for advisory services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The MENA wealth management market is poised for continued growth in the coming years, driven by the region’s economic diversification, increasing wealth, and advancements in financial technology. To remain competitive, industry players must adopt a customer-centric approach, embrace digitalization, and offer a diverse range of investment products and services.

Conclusion

The MENA wealth management market presents a wealth of opportunities for industry participants, with a growing affluent population seeking personalized and sophisticated financial services. However, navigating the evolving landscape requires adaptability, innovation, and a deep understanding of the unique needs and preferences of the region’s wealthy clientele. By embracing technological advancements and addressing regulatory challenges, wealth managers can position themselves for sustainable growth and success in the dynamic MENA market.

What is Wealth Management?

Wealth management refers to a comprehensive financial service that combines investment management, financial planning, and other services to meet the needs of high-net-worth individuals. It encompasses various aspects such as asset allocation, tax planning, and estate planning.

What are the key players in the MENA Wealth Management Market?

Key players in the MENA Wealth Management Market include institutions like Emirates NBD, Qatar National Bank, and Abu Dhabi Commercial Bank, which offer a range of wealth management services tailored to affluent clients, among others.

What are the growth factors driving the MENA Wealth Management Market?

The MENA Wealth Management Market is driven by factors such as increasing high-net-worth individuals, rising disposable incomes, and a growing demand for personalized financial services. Additionally, economic diversification in the region is contributing to market growth.

What challenges does the MENA Wealth Management Market face?

Challenges in the MENA Wealth Management Market include regulatory compliance issues, market volatility, and competition from fintech companies. These factors can impact the ability of traditional wealth management firms to retain clients and grow their assets under management.

What opportunities exist in the MENA Wealth Management Market?

Opportunities in the MENA Wealth Management Market include the expansion of digital wealth management solutions, increasing interest in sustainable investing, and the potential for cross-border wealth management services. These trends can help firms attract a broader client base.

What trends are shaping the MENA Wealth Management Market?

Trends in the MENA Wealth Management Market include the rise of robo-advisors, a focus on ESG (Environmental, Social, and Governance) investments, and the integration of advanced technology in service delivery. These trends are reshaping how wealth management services are offered and consumed.

MENA Wealth Management Market

| Segmentation Details | Description |

|---|---|

| Investor Type | High Net Worth Individuals, Ultra High Net Worth Individuals, Institutional Investors, Family Offices |

| Investment Strategy | Equity, Fixed Income, Alternative Investments, Real Estate |

| Service Type | Wealth Advisory, Portfolio Management, Tax Planning, Estate Planning |

| Client Segment | Retail Clients, Corporate Clients, Non-Profit Organizations, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the MENA Wealth Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at