444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The MENA (Middle East and North Africa) Mobile Virtual Network Operator (MVNO) market has witnessed substantial growth in recent years, driven by the increasing demand for cost-effective and innovative mobile services. MVNOs are companies that do not own their own wireless infrastructure but lease network services from traditional Mobile Network Operators (MNOs) to offer mobile services under their brand. The MENA region, with its diverse and rapidly expanding mobile market, presents significant opportunities for MVNOs to cater to niche segments, offer unique service bundles, and tap into underserved markets. As mobile penetration continues to rise and consumer preferences evolve, the MENA MVNO market is expected to experience steady growth.

Meaning

Mobile Virtual Network Operators (MVNOs) are companies that offer mobile telecommunication services without owning the physical network infrastructure. Instead, they lease network capacity and services from traditional Mobile Network Operators (MNOs) and repackage them under their brand. MVNOs typically target specific market segments, offering specialized service plans and value-added features to differentiate themselves from traditional MNOs. In the MENA region, MVNOs play a crucial role in enhancing competition, providing unique services, and extending mobile coverage to underserved areas.

Executive Summary

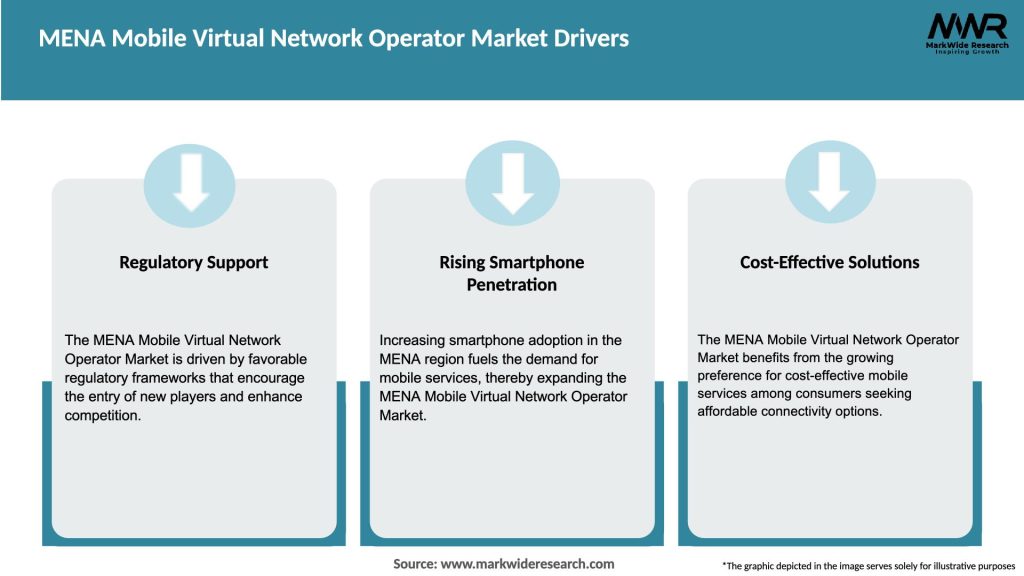

The MENA Mobile Virtual Network Operator (MVNO) market has experienced remarkable growth due to the rising demand for cost-effective and innovative mobile services. MVNOs in the region, through their collaborations with MNOs, are providing unique service offerings and catering to niche customer segments. As mobile penetration rates increase and consumer preferences evolve, the MENA MVNO market is poised for further expansion. The region’s favorable regulatory environment, growing mobile subscriber base, and increasing mobile data consumption are significant drivers for MVNO growth. To thrive in this competitive landscape, MVNOs need to focus on differentiation, value-added services, and strategic partnerships with MNOs.

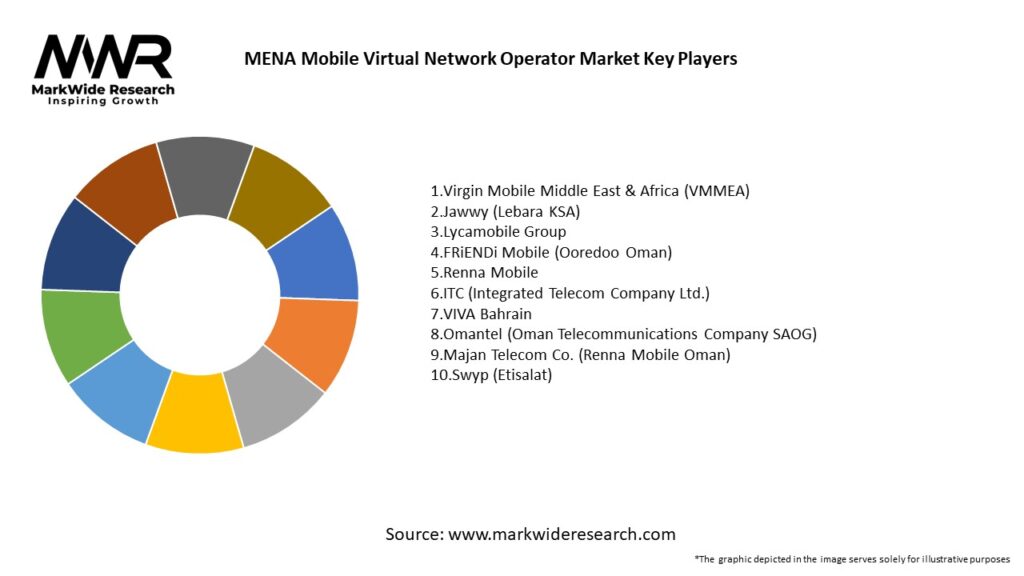

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MENA MVNO market operates in a dynamic environment influenced by factors such as technological advancements, regulatory developments, changing consumer preferences, and strategic partnerships. The market’s growth is driven by the increasing demand for cost-effective mobile services, the rising adoption of mobile data, and the targeting of niche market segments. However, intense competition, network quality challenges, regulatory complexities, and changing consumer behavior are factors that can impact market dynamics and require MVNOs to adapt their strategies.

Regional Analysis

The MENA Mobile Virtual Network Operator (MVNO) market exhibits regional variations due to differences in regulatory frameworks, mobile penetration rates, and consumer preferences. Countries such as the UAE, Saudi Arabia, and Egypt are currently significant markets for MVNOs, driven by favorable regulatory policies and large mobile subscriber bases. Other countries in the region, including Qatar, Oman, and Kuwait, are also witnessing increasing MVNO activity as governments encourage market competition and innovation.

Competitive Landscape

Leading Companies in the MENA Mobile Virtual Network Operator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

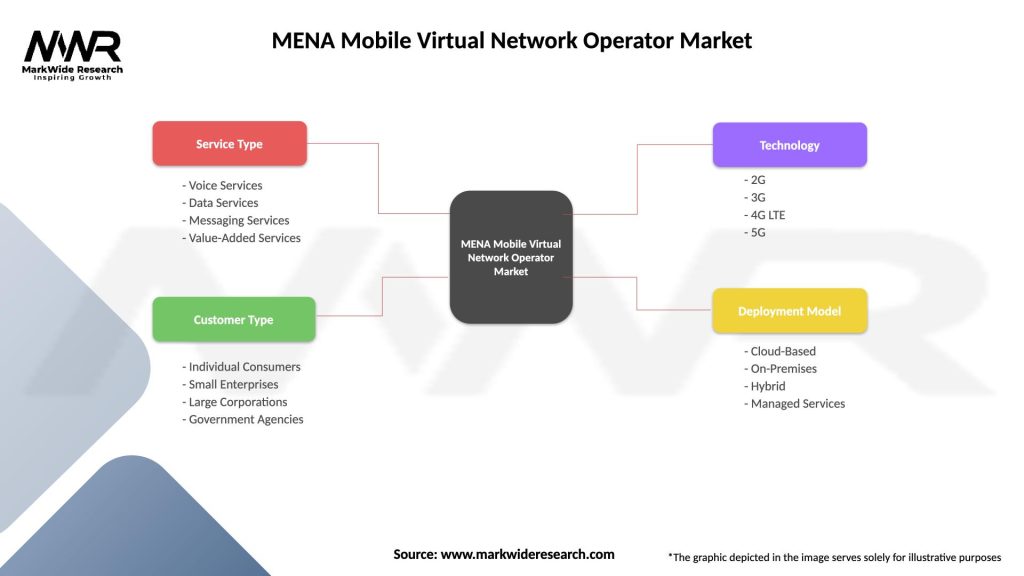

The MENA MVNO market can be segmented based on target market segment, service offerings, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had mixed impacts on the MENA MVNO market. While the pandemic led to supply chain disruptions and reduced consumer spending on non-essential goods and services, the demand for mobile connectivity and data increased due to remote working, online learning, and digital communication. MVNOs offering cost-effective mobile plans and data-centric services experienced increased adoption, while those heavily reliant on specific industry verticals, such as tourism, faced challenges. The pandemic highlighted the significance of mobile connectivity and digital services, encouraging MVNOs to innovate and adapt their offerings to changing consumer behaviors.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the MENA Mobile Virtual Network Operator (MVNO) market is optimistic, with sustained growth expected in the coming years. The region’s favorable regulatory environment, increasing mobile penetration, and rising demand for cost-effective mobile services are key drivers for MVNO expansion.

MVNOs that focus on differentiation, value-added services, strategic partnerships, and IoT/M2M opportunities will be well-positioned to capitalize on the market’s growth potential and shape the future of the MENA MVNO industry.

Conclusion

The MENA Mobile Virtual Network Operator (MVNO) market has experienced remarkable growth, driven by the increasing demand for cost-effective and innovative mobile services. MVNOs in the region, through their partnerships with traditional MNOs, cater to niche market segments and offer specialized service plans. As mobile penetration rates increase and consumer preferences evolve, the MENA MVNO market is poised for further expansion.

The region’s favorable regulatory environment, growing mobile subscriber base, and increasing mobile data consumption present significant opportunities for MVNOs to thrive and offer unique mobile services. However, challenges such as intense competition, network quality considerations, regulatory complexities, and changing consumer behavior require MVNOs to continuously adapt their strategies and prioritize customer-centric approaches.

MVNOs that focus on differentiation, value-added services, strategic partnerships, IoT/M2M opportunities, and rural connectivity expansion will be well-positioned to capitalize on the market’s growth potential and shape the future of the MENA MVNO industry.

What is Mobile Virtual Network Operator?

A Mobile Virtual Network Operator (MVNO) is a company that provides mobile services but does not own the wireless infrastructure. Instead, MVNOs lease network capacity from traditional mobile network operators to offer services to their customers.

What are the key players in the MENA Mobile Virtual Network Operator Market?

Key players in the MENA Mobile Virtual Network Operator Market include companies like Virgin Mobile, du, and Etisalat, which leverage existing network infrastructure to provide competitive mobile services, among others.

What are the growth factors driving the MENA Mobile Virtual Network Operator Market?

The MENA Mobile Virtual Network Operator Market is driven by increasing smartphone penetration, rising demand for affordable mobile services, and the growing trend of digitalization among consumers.

What challenges does the MENA Mobile Virtual Network Operator Market face?

Challenges in the MENA Mobile Virtual Network Operator Market include intense competition from established operators, regulatory hurdles, and the need for continuous technological advancements to meet consumer expectations.

What opportunities exist in the MENA Mobile Virtual Network Operator Market?

Opportunities in the MENA Mobile Virtual Network Operator Market include the potential for partnerships with tech companies, expansion into underserved regions, and the introduction of innovative service offerings tailored to local needs.

What trends are shaping the MENA Mobile Virtual Network Operator Market?

Trends in the MENA Mobile Virtual Network Operator Market include the rise of data-centric plans, the integration of IoT services, and the increasing focus on customer experience through personalized offerings.

MENA Mobile Virtual Network Operator Market

| Segmentation Details | Description |

|---|---|

| Service Type | Voice Services, Data Services, Messaging Services, Value-Added Services |

| Customer Type | Individual Consumers, Small Enterprises, Large Corporations, Government Agencies |

| Technology | 2G, 3G, 4G LTE, 5G |

| Deployment Model | Cloud-Based, On-Premises, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the MENA Mobile Virtual Network Operator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at