444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The membrane technology for food and beverage processing market is witnessing significant growth due to its various advantages over traditional processing methods. Membrane technology offers efficient separation, concentration, and purification of food and beverage products, leading to improved quality, extended shelf life, and reduced energy consumption. This technology is widely used in the dairy, beverage, fruit juice, and wine industries, among others. The market is expected to experience substantial growth in the coming years as food and beverage manufacturers increasingly adopt membrane technology to meet consumer demands for high-quality, safe, and sustainable products.

Meaning

Membrane technology in food and beverage processing refers to the use of selectively permeable membranes to separate and purify various components of food and beverages. These membranes act as barriers that allow certain molecules or ions to pass through while blocking others. By leveraging the different properties of membranes, such as pore size, charge, and solubility, food and beverage manufacturers can effectively separate and concentrate desired components, remove impurities, and enhance product quality.

Executive Summary

The membrane technology for food and beverage processing market is experiencing robust growth worldwide. The market is being driven by increasing consumer demand for healthier, safer, and more sustainable food and beverage products. Membrane technology offers numerous benefits, including improved product quality, extended shelf life, and reduced energy consumption. The market is highly competitive, with several key players offering a wide range of membrane-based solutions for food and beverage processing. The market is expected to witness significant growth in the forecast period, driven by advancements in membrane materials, increased research and development activities, and growing adoption in emerging economies.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The membrane technology for food and beverage processing market is driven by a combination of factors, including consumer demand for high-quality products, regulatory requirements, technological advancements, and sustainability concerns. The market is highly competitive, with key players continuously investing in research and development to improve membrane materials, enhance process efficiency, and expand their product portfolios. Additionally, collaborations and partnerships between membrane technology providers and food and beverage manufacturers are becoming increasingly common, enabling knowledge sharing and customization of solutions based on specific processing requirements.

Regional Analysis

The membrane technology for food and beverage processing market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Among these regions, Asia Pacific is expected to witness significant growth due to the increasing population, rapid urbanization, and changing dietary patterns. The region is witnessing a shift towards processed food and beverages, driving the adoption of membrane technology. Europe and North America are mature markets with established food and beverage processing industries, but they continue to adopt membrane technology to improve efficiency and sustainability. Latin America and the Middle East and Africa are also emerging markets with growing awareness about the benefits of membrane technology.

Competitive Landscape

Leading Companies in the Membrane Technology for Food and Beverage Processing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

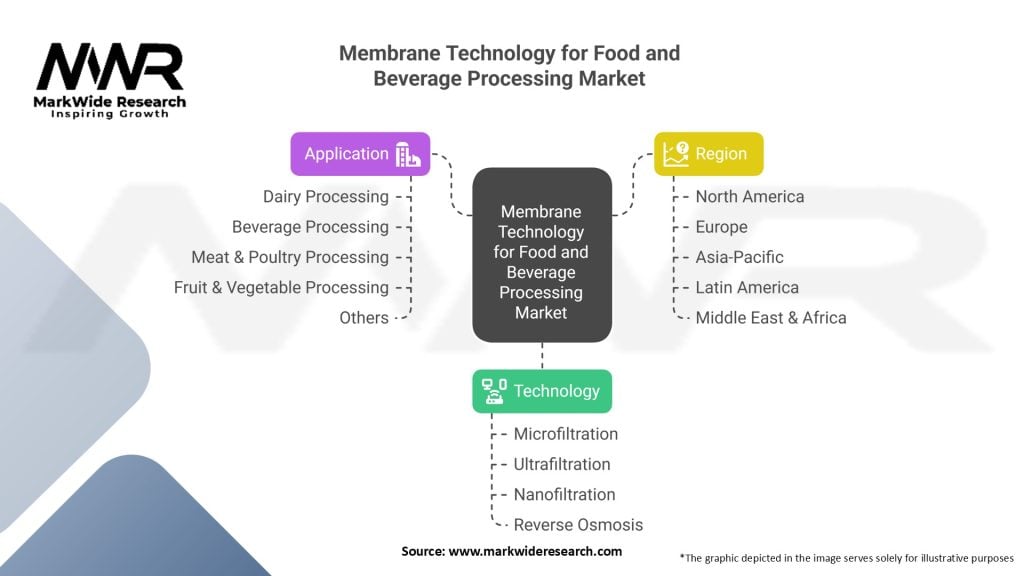

Segmentation

The membrane technology for food and beverage processing market can be segmented based on technology, application, and region.

Based on technology, the market can be segmented into:

Based on application, the market can be segmented into:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the food and beverage industry, including the membrane technology market. While the pandemic led to disruptions in the global supply chain and temporary closures of manufacturing facilities, it also highlighted the importance of food safety and quality. As a result, there has been an increased focus on implementing advanced technologies, such as membrane filtration, to ensure the safety and integrity of food and beverage products.

The pandemic also accelerated the adoption of e-commerce and online grocery shopping, leading to changes in consumer purchasing behavior. Membrane technology can help meet the demand for high-quality and safe products in this evolving market landscape.

However, the pandemic also posed challenges for the membrane technology market, such as delays in project implementation, reduced capital expenditure by food and beverage manufacturers, and logistical constraints. Despite these challenges, the long-term outlook for the membrane technology market remains positive, as the need for advanced food processing technologies continues to grow.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the membrane technology for food and beverage processing market is highly positive. The market is expected to witness significant growth, driven by factors such as increasing consumer demand for high-quality products, regulatory requirements, and sustainability concerns. Technological advancements in membrane materials, system design, and process optimization will further fuel market growth.

The adoption of membrane technology is likely to increase in emerging economies, where processed food consumption is on the rise, and stringent regulations are being implemented. Additionally, the growing trend of clean label and natural products, as well as the increasing popularity of plant-based alternatives, will create new opportunities for membrane technology in food and beverage processing.

Conclusion

Membrane technology is revolutionizing the food and beverage processing industry by offering efficient separation, concentration, and purification of products. It provides numerous benefits, including improved product quality, extended shelf life, and reduced energy consumption. The market is driven by consumer demand for safe, high-quality, and sustainable food and beverages. Despite challenges such as high capital investment and membrane fouling, the market is expected to grow significantly in the coming years.

To stay competitive in this dynamic market, food and beverage manufacturers should consider adopting membrane technology and collaborating with key industry players. Embracing technological advancements, investing in research and development, and ensuring skilled personnel will be crucial for success. The future of membrane technology in food and beverage processing looks promising, with opportunities arising from the demand for natural products, plant-based alternatives, and sustainable production practices.

What is Membrane Technology for Food and Beverage Processing?

Membrane Technology for Food and Beverage Processing refers to the use of semi-permeable membranes to separate components in food and beverage products. This technology is utilized for processes such as filtration, concentration, and purification, enhancing product quality and safety.

What are the key companies in the Membrane Technology for Food and Beverage Processing Market?

Key companies in the Membrane Technology for Food and Beverage Processing Market include Dow Chemical Company, Pall Corporation, and GE Water & Process Technologies, among others.

What are the drivers of growth in the Membrane Technology for Food and Beverage Processing Market?

The growth of the Membrane Technology for Food and Beverage Processing Market is driven by increasing demand for high-quality food products, the need for efficient processing methods, and the rising focus on sustainability in food production.

What challenges does the Membrane Technology for Food and Beverage Processing Market face?

Challenges in the Membrane Technology for Food and Beverage Processing Market include high initial investment costs, membrane fouling issues, and the need for regular maintenance and replacement of membrane systems.

What opportunities exist in the Membrane Technology for Food and Beverage Processing Market?

Opportunities in the Membrane Technology for Food and Beverage Processing Market include advancements in membrane materials, the growing trend of plant-based food products, and increasing applications in wastewater treatment and recovery.

What trends are shaping the Membrane Technology for Food and Beverage Processing Market?

Trends in the Membrane Technology for Food and Beverage Processing Market include the development of more efficient and durable membranes, integration of smart technologies for monitoring, and a shift towards more sustainable processing methods.

Membrane Technology for Food and Beverage Processing Market Segmentation

| Segmentation Details | Information |

|---|---|

| Technology | Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis |

| Application | Dairy Processing, Beverage Processing, Meat & Poultry Processing, Fruit & Vegetable Processing, Others |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Membrane Technology for Food and Beverage Processing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at