444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The medium and heavy duty commercial vehicles (MHCV) market represents a critical segment of the global transportation industry, encompassing trucks, buses, and specialized commercial vehicles designed for demanding operational requirements. This market has experienced substantial growth driven by expanding e-commerce activities, infrastructure development, and increasing freight transportation demands across various industries. The sector demonstrates remarkable resilience and adaptability, with manufacturers continuously innovating to meet evolving regulatory standards and customer expectations.

Market dynamics indicate robust expansion across key regions, with the industry witnessing a 6.2% CAGR in recent years. The integration of advanced technologies, including telematics, autonomous driving features, and alternative fuel systems, has transformed traditional commercial vehicle operations. Electric and hybrid powertrains are gaining significant traction, representing approximately 12% adoption rate in developed markets, while conventional diesel engines continue to dominate in emerging economies.

Regional distribution shows North America and Europe maintaining strong market positions, while Asia-Pacific emerges as the fastest-growing region due to rapid industrialization and urbanization. The market encompasses various vehicle categories, from medium-duty delivery trucks to heavy-duty long-haul tractors, each serving distinct operational requirements and regulatory frameworks.

The medium and heavy duty commercial vehicles market refers to the comprehensive ecosystem of commercial transportation vehicles with gross vehicle weight ratings (GVWR) exceeding 14,000 pounds, including manufacturing, sales, leasing, and aftermarket services. This market encompasses vehicles designed for commercial applications such as freight transportation, construction, municipal services, and specialized industrial operations.

Medium-duty vehicles typically range from Class 4 to Class 6 (14,001 to 26,000 pounds GVWR), while heavy-duty vehicles include Class 7 and Class 8 (26,001 pounds and above GVWR). These vehicles serve as the backbone of modern logistics and supply chain operations, facilitating the movement of goods and materials across local, regional, and international markets. The market includes various stakeholders, from original equipment manufacturers (OEMs) and component suppliers to fleet operators and service providers.

Market leadership in the MHCV sector is characterized by intense competition among established manufacturers and emerging technology providers. The industry faces transformative pressures from environmental regulations, digitalization trends, and changing customer preferences toward sustainable transportation solutions. Electric vehicle adoption has accelerated significantly, with commercial fleets showing 23% increased interest in alternative fuel technologies compared to previous years.

Key market drivers include expanding last-mile delivery requirements, infrastructure modernization projects, and stringent emission standards driving technological innovation. The sector demonstrates strong correlation with economic growth patterns, with freight transportation demand directly linked to industrial production and consumer spending levels. Autonomous driving technologies are gaining momentum, with pilot programs showing 15% efficiency improvements in controlled environments.

Competitive dynamics reveal consolidation trends among traditional manufacturers while new entrants focus on electric and autonomous vehicle technologies. The market structure continues evolving as companies adapt to changing regulatory landscapes and customer demands for more efficient, environmentally friendly transportation solutions.

Strategic insights reveal several critical trends shaping the MHCV market landscape. The industry demonstrates remarkable adaptability to changing operational requirements and regulatory frameworks across different regions.

E-commerce expansion serves as a primary catalyst for MHCV market growth, with online retail driving unprecedented demand for last-mile delivery vehicles and logistics infrastructure. The surge in package deliveries has created substantial opportunities for medium-duty commercial vehicles optimized for urban distribution networks. Urbanization trends further amplify this demand as cities require efficient goods movement solutions.

Infrastructure development projects worldwide generate significant demand for heavy-duty construction and specialized vehicles. Government investments in roads, bridges, and public transportation systems create sustained market opportunities for equipment manufacturers and fleet operators. Mining and energy sector activities also contribute substantially to heavy-duty vehicle demand, particularly in emerging markets with abundant natural resources.

Regulatory mandates for emission reductions and safety improvements drive technological advancement and vehicle replacement cycles. Fleet operators increasingly prioritize fuel efficiency and environmental compliance, creating market opportunities for advanced powertrain technologies. Economic recovery following global disruptions has restored confidence in capital equipment investments, supporting market expansion across various commercial sectors.

High capital costs associated with commercial vehicle acquisition present significant barriers for small and medium-sized fleet operators. The substantial upfront investment required for modern MHCV equipment, particularly electric and hybrid variants, can strain operational budgets and limit market penetration. Financing challenges in certain regions further compound accessibility issues for potential buyers.

Infrastructure limitations pose considerable constraints, especially for alternative fuel vehicles requiring specialized charging or refueling networks. The lack of adequate service and maintenance facilities for advanced technologies creates operational risks and increases total cost of ownership. Skilled technician shortages across the industry limit service capacity and increase maintenance costs for fleet operators.

Economic volatility and supply chain disruptions continue affecting production schedules and component availability. Semiconductor shortages and raw material price fluctuations create uncertainty in manufacturing costs and delivery timelines. Regulatory complexity across different markets requires significant compliance investments and can delay product launches or market entry strategies.

Emerging markets present substantial growth opportunities as developing economies invest in transportation infrastructure and industrial capacity. Countries in Asia-Pacific, Latin America, and Africa demonstrate increasing demand for commercial vehicles to support economic development and urbanization initiatives. Government incentives for clean transportation technologies create favorable conditions for electric and hybrid vehicle adoption.

Autonomous vehicle technologies offer transformative potential for commercial transportation efficiency and safety improvements. Early adoption in controlled environments such as mining operations and port facilities provides valuable testing grounds for broader market deployment. Connectivity solutions enable new business models based on vehicle-as-a-service and predictive maintenance offerings.

Sustainability initiatives across industries drive demand for environmentally friendly transportation solutions. Corporate commitments to carbon neutrality create market opportunities for zero-emission commercial vehicles and supporting infrastructure. Circular economy principles encourage vehicle lifecycle optimization and component remanufacturing services, generating additional revenue streams for industry participants.

Competitive intensity in the MHCV market continues escalating as traditional manufacturers face challenges from technology-focused new entrants. Established companies leverage their manufacturing scale and dealer networks while investing heavily in electrification and autonomous technologies. Strategic partnerships between OEMs and technology companies are becoming increasingly common to accelerate innovation and market deployment.

Customer expectations are evolving rapidly, with fleet operators demanding comprehensive solutions beyond vehicle supply. Total cost of ownership considerations now encompass fuel efficiency, maintenance requirements, driver productivity, and environmental impact. Service integration has become a key differentiator, with manufacturers offering financing, insurance, and fleet management services.

Technology convergence is reshaping traditional industry boundaries as automotive, technology, and energy companies collaborate on next-generation transportation solutions. The integration of artificial intelligence, machine learning, and advanced materials creates opportunities for breakthrough innovations in vehicle performance and efficiency. Data monetization strategies are emerging as vehicles generate valuable operational insights for fleet optimization and predictive analytics services.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the MHCV market landscape. Primary research includes extensive interviews with industry executives, fleet operators, and technology providers across key geographic markets. Secondary research encompasses analysis of company financial reports, industry publications, and regulatory documentation to validate market trends and projections.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth patterns and identify emerging opportunities. Data collection spans production statistics, sales figures, and technology adoption rates from authoritative industry sources. Qualitative assessment incorporates expert opinions and market intelligence to understand competitive dynamics and strategic implications.

Market segmentation analysis examines various dimensions including vehicle class, application, fuel type, and geographic distribution. Cross-referencing multiple data sources ensures consistency and accuracy in market sizing and trend identification. Validation processes include peer review and industry expert consultation to confirm research findings and methodology appropriateness.

North America maintains a dominant position in the MHCV market, accounting for approximately 35% market share globally. The region benefits from mature logistics infrastructure, stringent emission standards driving technology adoption, and strong economic fundamentals supporting commercial vehicle demand. United States leads in electric commercial vehicle deployment, with several states implementing zero-emission vehicle mandates for commercial fleets.

Europe demonstrates strong commitment to sustainable transportation, with the European Union’s Green Deal creating significant opportunities for alternative fuel commercial vehicles. The region shows 28% market share and leads in regulatory innovation, setting global standards for emission controls and safety requirements. Germany, France, and the United Kingdom represent the largest individual markets within the region.

Asia-Pacific emerges as the fastest-growing region, driven by rapid industrialization and infrastructure development in countries like China, India, and Southeast Asian nations. The region accounts for approximately 32% market share and demonstrates the highest growth potential due to expanding manufacturing sectors and urbanization trends. China leads global electric commercial vehicle production and adoption, supported by government incentives and environmental policies.

Latin America and Middle East & Africa represent emerging opportunities with increasing infrastructure investments and economic development initiatives. These regions show growing demand for commercial vehicles to support mining, construction, and logistics operations, though market development remains dependent on economic stability and financing availability.

Market leadership in the MHCV sector is distributed among several established manufacturers with strong regional presence and technological capabilities. The competitive environment continues evolving as companies adapt to changing market demands and regulatory requirements.

By Vehicle Type: The MHCV market encompasses diverse vehicle categories serving different operational requirements and regulatory classifications.

By Fuel Type: Powertrain diversity reflects evolving environmental regulations and operational requirements across different applications.

By Application: Market segmentation reflects diverse end-user requirements and operational characteristics.

Medium-duty segment demonstrates strong growth driven by e-commerce expansion and urban delivery requirements. These vehicles typically serve local and regional distribution networks, with increasing adoption of electric powertrains for environmental compliance and operational cost reduction. Fleet electrification shows particular momentum in this category due to predictable route patterns and return-to-base operations suitable for current battery technology limitations.

Heavy-duty segment remains dominated by diesel powertrains due to range and payload requirements, though alternative fuel technologies are gaining consideration for specific applications. Long-haul trucking represents the largest subsegment, with operators focusing on fuel efficiency improvements and driver comfort features. Autonomous technology development concentrates heavily on this segment due to potential safety and efficiency benefits for highway operations.

Specialty vehicle categories show unique growth patterns based on specific industry requirements and regulatory mandates. Emergency services vehicles prioritize reliability and specialized equipment integration, while refuse collection vehicles increasingly adopt alternative fuel systems for environmental compliance in urban areas. Customization capabilities become critical differentiators in these specialized market segments.

Manufacturers benefit from expanding market opportunities driven by economic growth, infrastructure development, and technology advancement. The transition toward sustainable transportation creates new revenue streams through electric vehicle sales and associated services. Innovation investments in autonomous and connected vehicle technologies position companies for future market leadership and competitive differentiation.

Fleet operators gain access to advanced technologies that improve operational efficiency, reduce maintenance costs, and enhance driver productivity. Modern commercial vehicles offer sophisticated telematics systems providing real-time operational insights and predictive maintenance capabilities. Total cost of ownership improvements through fuel efficiency gains and extended service intervals deliver measurable financial benefits.

Technology suppliers find expanding opportunities as vehicles become increasingly sophisticated and connected. Component manufacturers specializing in electric powertrains, autonomous systems, and connectivity solutions experience growing demand from OEMs seeking technological partnerships. Service providers benefit from increasing complexity requiring specialized maintenance and support capabilities.

End customers receive improved transportation services through enhanced vehicle reliability, efficiency, and environmental performance. Advanced safety systems reduce accident risks while connectivity features enable better shipment tracking and delivery coordination. Sustainability benefits help companies meet environmental commitments and regulatory compliance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification acceleration represents the most significant trend transforming the MHCV market, with battery electric vehicles gaining commercial viability across various applications. Fleet operators increasingly evaluate electric alternatives for urban delivery and regional transportation, driven by environmental regulations and operational cost considerations. Charging infrastructure development accelerates to support growing electric commercial vehicle deployment.

Autonomous driving technology advancement continues reshaping industry expectations and investment priorities. Pilot programs demonstrate potential benefits in controlled environments, while regulatory frameworks evolve to accommodate autonomous commercial vehicle operations. Safety improvements and operational efficiency gains drive continued investment in autonomous systems development.

Connectivity and digitalization transform commercial vehicle operations through advanced telematics, predictive maintenance, and fleet optimization systems. Internet of Things (IoT) integration enables real-time monitoring and data-driven decision making for fleet operators. Data analytics capabilities provide valuable insights for route optimization, fuel efficiency, and maintenance scheduling.

Sustainability focus extends beyond powertrain electrification to encompass entire vehicle lifecycle considerations. Manufacturers adopt circular economy principles in design and manufacturing processes while developing recycling programs for end-of-life vehicles. Carbon footprint reduction becomes a key performance indicator for fleet operators and manufacturers alike.

Strategic partnerships between traditional manufacturers and technology companies accelerate innovation and market deployment of advanced commercial vehicle solutions. Collaborations focus on electric powertrains, autonomous systems, and connectivity platforms to leverage complementary expertise and resources. Joint ventures enable risk sharing and faster technology development cycles.

Manufacturing capacity expansion for electric commercial vehicles reflects growing market confidence and demand projections. Several major manufacturers announce significant investments in dedicated electric vehicle production facilities and battery manufacturing capabilities. Supply chain localization strategies aim to reduce dependency on single-source suppliers and improve production resilience.

Regulatory developments across major markets continue shaping industry direction and investment priorities. Emission standards become increasingly stringent while safety regulations incorporate advanced driver assistance systems requirements. Government incentives for clean transportation technologies support market transition toward sustainable solutions.

Technology acquisitions enable traditional manufacturers to rapidly acquire capabilities in electric powertrains, autonomous systems, and software development. Strategic acquisitions focus on companies with proven technologies and market-ready solutions. Talent acquisition in software engineering and electric vehicle development becomes increasingly competitive across the industry.

MarkWide Research analysis indicates that companies should prioritize electric vehicle technology development and manufacturing capability expansion to capture growing market opportunities. Investment in charging infrastructure partnerships and service network development will be critical for successful electric commercial vehicle deployment. Strategic positioning in emerging markets presents significant long-term growth potential.

Technology integration strategies should focus on comprehensive solutions combining hardware and software capabilities to deliver superior customer value. Companies must balance innovation investments with maintaining profitability in traditional product lines during market transition periods. Partnership approaches can accelerate capability development while managing investment risks.

Market differentiation through service excellence and customer relationship management becomes increasingly important as products become more commoditized. Fleet management services, financing solutions, and comprehensive maintenance programs create competitive advantages and customer loyalty. Digital transformation initiatives should encompass both internal operations and customer-facing services.

Regulatory compliance preparation requires proactive engagement with policymakers and industry associations to influence standards development. Companies should invest in compliance capabilities and certification processes to ensure market access across different regions. Sustainability reporting and environmental performance metrics become essential for corporate reputation and customer relationships.

Market evolution toward sustainable and intelligent commercial transportation solutions will accelerate over the next decade, driven by environmental regulations, technology advancement, and changing customer expectations. Electric commercial vehicles are projected to achieve 25% market penetration in developed markets by 2030, supported by improving battery technology and expanding charging infrastructure.

Autonomous technology deployment will progress gradually from controlled environments to broader commercial applications, with significant safety and efficiency benefits driving adoption. MWR projections indicate that semi-autonomous features will become standard in premium commercial vehicles within five years, while fully autonomous operations remain limited to specific applications and geographic areas.

Industry consolidation may accelerate as companies seek scale advantages and technology capabilities through mergers and acquisitions. Traditional manufacturers will continue adapting business models to compete with technology-focused new entrants while maintaining their manufacturing and service advantages. Collaboration strategies will become increasingly important for accessing required capabilities and market reach.

Emerging markets will drive significant growth as developing economies invest in transportation infrastructure and industrial capacity. Asia-Pacific region is expected to maintain the highest growth rates, while established markets focus on technology advancement and fleet modernization. Global supply chain restructuring will continue as companies balance cost efficiency with resilience and sustainability considerations.

The medium and heavy duty commercial vehicles market stands at a transformative inflection point, with traditional industry dynamics being reshaped by technological innovation, environmental regulations, and evolving customer expectations. The sector demonstrates remarkable adaptability and growth potential, driven by fundamental economic trends including e-commerce expansion, infrastructure development, and global trade growth.

Technology convergence in electrification, autonomous systems, and connectivity creates unprecedented opportunities for industry participants while requiring substantial investments and strategic repositioning. Companies that successfully navigate this transition by balancing innovation with operational excellence will capture the most significant market opportunities. Sustainability considerations have evolved from regulatory compliance to competitive differentiation and customer value creation.

Regional market dynamics reflect varying stages of economic development and regulatory frameworks, with developed markets leading in technology adoption while emerging economies drive volume growth. The industry’s future success depends on collaborative approaches between manufacturers, technology providers, and policymakers to address infrastructure requirements and regulatory frameworks supporting market transition. Strategic agility and customer-centric innovation will determine long-term competitive positioning in this rapidly evolving market landscape.

What is Medium and Heavy Duty Commercial Vehicles?

Medium and Heavy Duty Commercial Vehicles (MHCV) refer to a category of vehicles designed for transporting goods and materials, typically characterized by their larger size and higher weight capacity. These vehicles include trucks, buses, and trailers used in various industries such as logistics, construction, and public transportation.

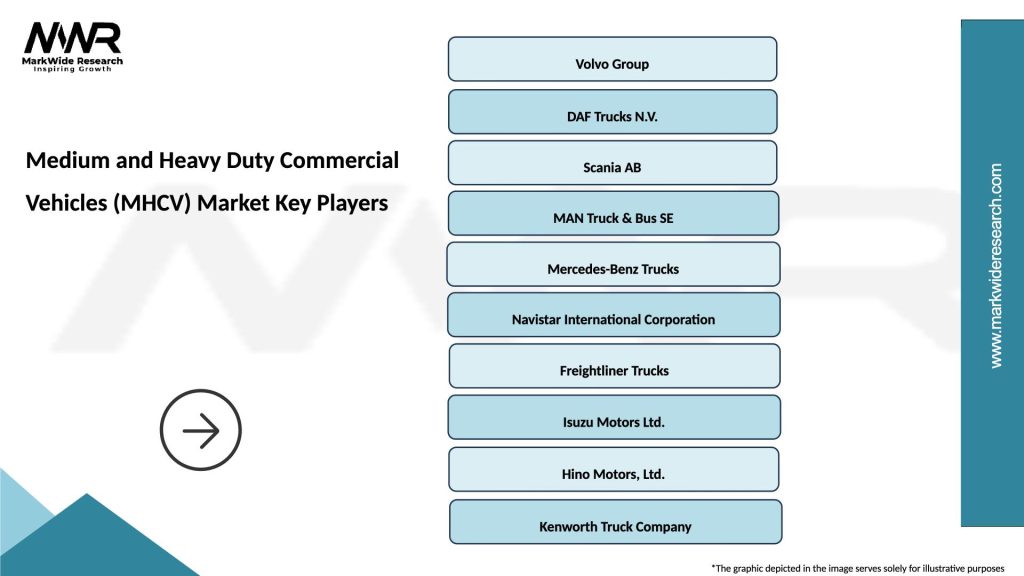

What are the key players in the Medium and Heavy Duty Commercial Vehicles (MHCV) Market?

Key players in the Medium and Heavy Duty Commercial Vehicles (MHCV) Market include companies like Daimler AG, Volvo Group, and MAN Truck & Bus. These companies are known for their innovative vehicle designs and extensive product offerings in the commercial vehicle sector, among others.

What are the main drivers of growth in the Medium and Heavy Duty Commercial Vehicles (MHCV) Market?

The growth of the Medium and Heavy Duty Commercial Vehicles (MHCV) Market is driven by increasing demand for efficient logistics and transportation solutions, urbanization leading to higher freight movement, and advancements in vehicle technology that enhance fuel efficiency and reduce emissions.

What challenges does the Medium and Heavy Duty Commercial Vehicles (MHCV) Market face?

The Medium and Heavy Duty Commercial Vehicles (MHCV) Market faces challenges such as stringent emissions regulations, fluctuating fuel prices, and the need for significant capital investment in vehicle technology and infrastructure. These factors can impact profitability and operational efficiency.

What opportunities exist in the Medium and Heavy Duty Commercial Vehicles (MHCV) Market?

Opportunities in the Medium and Heavy Duty Commercial Vehicles (MHCV) Market include the growing trend towards electric and hybrid vehicles, the expansion of e-commerce requiring efficient delivery solutions, and the potential for smart vehicle technologies that improve fleet management and safety.

What trends are shaping the Medium and Heavy Duty Commercial Vehicles (MHCV) Market?

Trends shaping the Medium and Heavy Duty Commercial Vehicles (MHCV) Market include the increasing adoption of telematics for fleet management, a shift towards sustainable and eco-friendly vehicle designs, and the integration of autonomous driving technologies that promise to enhance operational efficiency.

Medium and Heavy Duty Commercial Vehicles (MHCV) Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Trucks, Buses, Trailers, Vans |

| Fuel Type | Diesel, Electric, Hybrid, Compressed Natural Gas |

| End User | Logistics, Construction, Public Transport, Waste Management |

| Technology | Telematics, Autonomous Driving, Fleet Management, Safety Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Medium and Heavy Duty Commercial Vehicles (MHCV) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at