444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA waterborne adhesives market represents a dynamic and rapidly evolving segment within the Middle East and Africa region’s industrial landscape. Waterborne adhesives have emerged as a critical component across diverse industries, driven by increasing environmental awareness and stringent regulatory frameworks promoting sustainable manufacturing practices. The market encompasses a comprehensive range of adhesive solutions that utilize water as the primary carrier medium, offering superior environmental compatibility compared to traditional solvent-based alternatives.

Regional dynamics in the MEA waterborne adhesives market reflect a growing emphasis on sustainable industrial practices, with countries across the Middle East and Africa implementing progressive environmental policies. The market demonstrates robust growth potential, with industry analysts projecting a compound annual growth rate (CAGR) of 6.8% through the forecast period. This growth trajectory is supported by expanding manufacturing sectors, increasing construction activities, and rising consumer awareness regarding eco-friendly products.

Market penetration varies significantly across different MEA countries, with the UAE, Saudi Arabia, and South Africa leading adoption rates. The packaging industry represents the largest application segment, accounting for approximately 35% of total market consumption, followed by construction and automotive sectors. Technological advancements in waterborne adhesive formulations continue to drive market expansion, enabling enhanced performance characteristics while maintaining environmental sustainability.

The MEA waterborne adhesives market refers to the comprehensive ecosystem of water-based adhesive products, technologies, and services operating within the Middle East and Africa region. These adhesives utilize water as the primary solvent or dispersion medium, distinguishing them from traditional solvent-based formulations through their reduced environmental impact and improved workplace safety profiles.

Waterborne adhesives encompass various chemical compositions, including acrylics, polyurethanes, vinyl acetate ethylene (VAE), and styrene-butadiene rubber (SBR) formulations. The market includes manufacturers, distributors, end-users, and supporting service providers who collectively contribute to the development, production, and application of these sustainable adhesive solutions across diverse industrial sectors.

Regional significance extends beyond mere product distribution, encompassing localized manufacturing capabilities, regulatory compliance frameworks, and market-specific application requirements. The MEA waterborne adhesives market represents a strategic intersection of environmental sustainability, industrial efficiency, and economic development within the region’s evolving manufacturing landscape.

Strategic market positioning within the MEA waterborne adhesives sector reveals a landscape characterized by significant growth opportunities and evolving consumer preferences toward sustainable solutions. The market demonstrates remarkable resilience and adaptability, with key stakeholders successfully navigating regulatory changes while capitalizing on emerging application opportunities across traditional and innovative sectors.

Growth drivers include increasing environmental regulations, expanding packaging industries, and rising construction activities throughout the region. The automotive sector’s transition toward lightweight materials and sustainable manufacturing processes contributes approximately 18% to overall market demand. MarkWide Research analysis indicates that technological innovations in adhesive formulations continue to enhance performance characteristics while maintaining environmental compliance.

Market challenges encompass raw material price volatility, technical performance limitations in extreme climatic conditions, and competition from established solvent-based alternatives. However, ongoing research and development initiatives, coupled with supportive regulatory frameworks, position the market for sustained growth. The woodworking and furniture segments show particular promise, with adoption rates increasing by 12% annually across key MEA markets.

Competitive dynamics reflect a mix of international players and regional specialists, each contributing unique value propositions to meet diverse customer requirements. Market consolidation trends suggest increasing collaboration between technology providers and end-users to develop customized solutions addressing specific regional challenges and opportunities.

Market segmentation analysis reveals distinct patterns of adoption and growth across various application sectors within the MEA region. The following insights provide comprehensive understanding of market dynamics:

Regional variations in market development reflect different stages of industrial maturity and regulatory implementation. Countries with established manufacturing bases demonstrate higher adoption rates, while emerging markets show significant growth potential as industrial infrastructure develops.

Environmental regulations serve as the primary catalyst driving MEA waterborne adhesives market expansion. Governments across the region implement increasingly stringent volatile organic compound (VOC) emission standards, compelling manufacturers to transition toward sustainable adhesive solutions. These regulatory frameworks create substantial market opportunities while promoting industrial environmental responsibility.

Industrial sector expansion throughout the MEA region generates significant demand for advanced adhesive solutions. The packaging industry’s rapid growth, driven by expanding consumer markets and e-commerce development, requires high-performance waterborne adhesives capable of meeting diverse application requirements. Construction activities across Gulf countries, supported by major infrastructure projects and urban development initiatives, create substantial demand for construction-grade adhesive solutions.

Technological advancement in waterborne adhesive formulations addresses traditional performance limitations while maintaining environmental benefits. Enhanced polymer chemistry enables improved heat resistance, moisture tolerance, and bonding strength, making waterborne solutions viable alternatives to solvent-based products across demanding applications. These innovations expand market opportunities and accelerate adoption rates.

Cost optimization benefits associated with waterborne adhesives include reduced workplace safety requirements, simplified storage and handling procedures, and elimination of expensive solvent recovery systems. These economic advantages, combined with environmental benefits, create compelling value propositions for end-users across various industrial sectors.

Performance limitations in extreme climatic conditions present significant challenges for waterborne adhesive adoption across certain MEA regions. High temperatures and humidity levels can affect adhesive curing processes and long-term performance characteristics, requiring specialized formulations and application techniques that may increase costs and complexity.

Technical expertise requirements for proper waterborne adhesive application and optimization create barriers for some end-users. Unlike traditional solvent-based systems, waterborne formulations often require specific equipment modifications, process adjustments, and operator training to achieve optimal performance results. These requirements can slow adoption rates, particularly among smaller manufacturers with limited technical resources.

Raw material availability and price volatility affect market stability and growth predictability. Key polymer components and additives used in waterborne adhesive formulations may experience supply chain disruptions or price fluctuations, impacting manufacturer profitability and end-user cost structures. Regional supply chain limitations can exacerbate these challenges.

Competition from established alternatives remains a significant market restraint, as many end-users maintain familiarity and confidence with traditional solvent-based adhesive systems. Switching costs, including equipment modifications and process revalidation, can delay adoption decisions even when environmental and economic benefits are clearly demonstrated.

Emerging application sectors present substantial growth opportunities for waterborne adhesive manufacturers within the MEA region. The renewable energy sector’s expansion, particularly solar panel manufacturing and wind turbine assembly, creates demand for specialized adhesive solutions that combine environmental sustainability with high-performance characteristics.

Regional manufacturing expansion offers opportunities for localized production capabilities, reducing import dependencies and improving cost competitiveness. Countries like Saudi Arabia and UAE actively promote industrial diversification initiatives that support adhesive manufacturing investments, creating favorable conditions for market development.

Technology partnerships between international adhesive manufacturers and regional end-users enable development of customized solutions addressing specific climatic and application challenges. These collaborations can accelerate market penetration while ensuring optimal performance in demanding MEA operating conditions.

Sustainability initiatives across various industries create expanding demand for environmentally compliant adhesive solutions. Corporate environmental responsibility programs and green building certifications drive specification of waterborne adhesives, particularly in construction and packaging applications where environmental impact considerations are increasingly important.

Supply chain evolution within the MEA waterborne adhesives market reflects increasing regional integration and local manufacturing capabilities. Major international adhesive manufacturers establish regional production facilities to serve growing demand while reducing logistics costs and improving customer responsiveness. This trend enhances market stability and creates opportunities for local supplier development.

Customer behavior patterns demonstrate growing sophistication in adhesive selection criteria, with end-users increasingly evaluating total cost of ownership rather than initial purchase price alone. Environmental compliance costs, workplace safety considerations, and operational efficiency benefits influence purchasing decisions, favoring waterborne solutions despite potentially higher upfront costs.

Competitive intensity increases as market opportunities attract both established international players and emerging regional manufacturers. This competition drives innovation, improves product quality, and enhances customer service levels while potentially pressuring profit margins. Market leaders focus on differentiation through technical expertise and customized solution development.

Regulatory landscape evolution continues shaping market dynamics, with governments implementing increasingly comprehensive environmental protection frameworks. These regulations create market opportunities while establishing minimum performance standards that drive continuous product improvement and innovation initiatives across the industry.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into MEA waterborne adhesives market dynamics. Primary research activities include structured interviews with industry executives, technical specialists, and end-users across key market segments to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of industry publications, regulatory documents, company financial reports, and trade association data to establish market context and validate primary research findings. Government statistics, import/export data, and economic indicators provide additional market sizing and trend analysis support.

Data validation processes ensure research accuracy through triangulation of multiple information sources and expert review procedures. Industry specialists and market participants review preliminary findings to confirm accuracy and provide additional insights that enhance overall research quality and reliability.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop comprehensive market forecasts and growth projections. These methodologies account for regional variations, sector-specific dynamics, and external factors that influence market development patterns.

Gulf Cooperation Council (GCC) countries represent the most mature segment of the MEA waterborne adhesives market, with UAE and Saudi Arabia leading adoption rates across multiple application sectors. These markets benefit from advanced industrial infrastructure, supportive regulatory frameworks, and significant construction and manufacturing activities that drive adhesive demand. The region accounts for approximately 45% of total MEA market consumption.

North African markets demonstrate significant growth potential, with Egypt and Morocco emerging as key consumption centers. The region’s expanding packaging and textile industries create substantial demand for waterborne adhesive solutions, while government initiatives promoting industrial development support market expansion. MWR analysis indicates North Africa represents the fastest-growing regional segment with annual growth rates exceeding 8%.

Sub-Saharan Africa presents long-term growth opportunities despite current market development challenges. South Africa leads regional adoption, supported by established manufacturing sectors and environmental awareness initiatives. Other countries show emerging demand patterns as industrial infrastructure develops and environmental regulations evolve.

Turkey’s strategic position as a bridge between European and Middle Eastern markets creates unique opportunities for waterborne adhesive applications. The country’s diverse manufacturing base, including automotive, textiles, and construction materials, generates substantial demand while serving as a regional hub for technology transfer and market development initiatives.

Market leadership within the MEA waterborne adhesives sector encompasses both international corporations and specialized regional players, each contributing distinct capabilities and market approaches. The competitive environment reflects diverse strategies ranging from broad product portfolios to specialized niche applications.

Competitive strategies emphasize technical innovation, customer service excellence, and regional market development. Leading companies invest in local manufacturing capabilities, technical support infrastructure, and customer education programs to build sustainable competitive advantages in growing MEA markets.

By Technology:

By Application:

By End-User Industry:

Packaging applications dominate the MEA waterborne adhesives market, driven by expanding food and beverage industries and growing e-commerce activities. Flexible packaging represents the largest sub-segment, requiring adhesives that provide excellent barrier properties while maintaining food safety compliance. Label applications show particular growth potential as brand owners seek sustainable packaging solutions.

Construction sector applications demonstrate strong growth momentum, supported by major infrastructure projects across Gulf countries and urban development initiatives throughout the region. Flooring adhesives represent a significant opportunity as construction standards evolve to emphasize environmental sustainability and indoor air quality considerations.

Automotive applications reflect the industry’s transition toward sustainable manufacturing practices and lightweight vehicle designs. Interior assembly applications show increasing adoption of waterborne solutions as automotive manufacturers implement comprehensive environmental management systems and seek to reduce workplace exposure to volatile organic compounds.

Textile and apparel applications benefit from the region’s growing textile manufacturing capabilities, particularly in countries like Turkey and Egypt. Fabric lamination and carpet backing applications require specialized waterborne formulations that provide durability while meeting environmental compliance requirements.

Manufacturers benefit from waterborne adhesive adoption through reduced environmental compliance costs, improved workplace safety conditions, and enhanced product differentiation opportunities. These advantages enable competitive positioning while meeting increasingly stringent regulatory requirements across MEA markets.

End-users gain significant operational advantages including simplified handling procedures, reduced storage requirements, and elimination of expensive solvent recovery systems. Workplace safety improvements reduce insurance costs and regulatory compliance burdens while enhancing employee satisfaction and retention rates.

Environmental stakeholders benefit from reduced volatile organic compound emissions, improved air quality, and decreased environmental impact associated with adhesive manufacturing and application processes. These benefits support regional sustainability initiatives and climate change mitigation efforts.

Economic development benefits include job creation in manufacturing and technical support sectors, technology transfer opportunities, and reduced import dependencies through local production capabilities. These advantages contribute to regional economic diversification and industrial development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the MEA waterborne adhesives market, with manufacturers and end-users increasingly prioritizing environmental impact considerations in product selection and application decisions. This trend drives innovation in bio-based raw materials and circular economy approaches to adhesive manufacturing and disposal.

Digital transformation initiatives enhance adhesive application processes through smart manufacturing technologies, real-time monitoring systems, and predictive maintenance capabilities. These innovations improve efficiency, reduce waste, and optimize performance while supporting data-driven decision making across industrial applications.

Customization demand increases as end-users seek adhesive solutions tailored to specific application requirements and operating conditions. This trend drives collaboration between adhesive manufacturers and customers to develop specialized formulations that address unique challenges while maintaining environmental compliance.

Regional localization accelerates as manufacturers establish local production capabilities to serve growing MEA demand while reducing logistics costs and improving customer responsiveness. This trend supports economic development objectives while enhancing supply chain resilience and market competitiveness.

Manufacturing investments across the MEA region demonstrate industry confidence in long-term market growth potential. Major adhesive manufacturers announce facility expansions and new production capabilities to serve regional demand while reducing import dependencies and improving cost competitiveness.

Technology partnerships between international adhesive companies and regional end-users accelerate product development and market penetration. These collaborations focus on addressing specific climatic challenges and application requirements unique to MEA operating conditions.

Regulatory developments continue shaping market dynamics as governments implement comprehensive environmental protection frameworks. Recent policy initiatives in Gulf countries establish VOC emission limits that favor waterborne adhesive adoption across multiple industrial sectors.

Research and development initiatives focus on enhancing waterborne adhesive performance in extreme climatic conditions while maintaining environmental benefits. These efforts address traditional limitations and expand application opportunities across demanding industrial sectors.

Market entry strategies should prioritize regional partnerships and local technical support capabilities to address unique MEA market requirements effectively. Successful companies invest in customer education programs and application development services that demonstrate waterborne adhesive benefits while addressing performance concerns.

Product development focus should emphasize formulations optimized for extreme climatic conditions prevalent across MEA regions. Enhanced heat resistance, humidity tolerance, and curing reliability represent critical performance characteristics that can accelerate market adoption and competitive differentiation.

Investment priorities should include regional manufacturing capabilities, technical support infrastructure, and customer service networks that provide comprehensive solutions rather than simple product supply. MarkWide Research analysis suggests that companies with strong local presence achieve 25% higher market penetration rates compared to import-dependent competitors.

Strategic partnerships with regional distributors, system integrators, and end-users enable market development while reducing investment requirements and market entry risks. These relationships provide market intelligence, customer access, and technical expertise that support sustainable growth initiatives.

Long-term growth prospects for the MEA waterborne adhesives market remain highly positive, supported by expanding industrial sectors, strengthening environmental regulations, and increasing sustainability awareness across the region. Market development patterns suggest sustained growth momentum with projected annual growth rates of 7.2% through the next decade.

Technology evolution will continue addressing traditional performance limitations while expanding application opportunities across demanding industrial sectors. Advanced polymer chemistry, nanotechnology integration, and bio-based raw materials represent key innovation areas that will shape future market development.

Regional market maturation will create opportunities for specialized applications and premium product segments as industrial sophistication increases and environmental awareness grows. Countries currently in early adoption phases show potential for accelerated growth as infrastructure development and regulatory frameworks evolve.

Industry consolidation trends may accelerate as market opportunities attract investment while competitive pressures favor companies with comprehensive capabilities and regional presence. Strategic partnerships and acquisitions will likely shape competitive dynamics and market structure evolution.

The MEA waterborne adhesives market represents a compelling growth opportunity characterized by strong fundamentals, supportive regulatory trends, and expanding application possibilities across diverse industrial sectors. Market dynamics favor sustainable adhesive solutions that combine environmental benefits with enhanced performance characteristics, positioning waterborne technologies for sustained growth throughout the region.

Strategic success factors include regional market presence, technical expertise, and customer-focused solution development that addresses unique MEA operating conditions and application requirements. Companies that invest in local capabilities while maintaining innovation leadership will be best positioned to capitalize on emerging opportunities and navigate market challenges effectively.

Future market development will be driven by continued industrial expansion, environmental regulation implementation, and technology advancement that enhances waterborne adhesive performance and application versatility. The market’s evolution toward sustainability and performance optimization creates substantial opportunities for stakeholders committed to long-term regional development and customer success.

What is Waterborne Adhesives?

Waterborne adhesives are adhesive formulations that use water as a solvent. They are commonly used in various applications such as woodworking, packaging, and automotive industries due to their low environmental impact and ease of use.

What are the key players in the MEA Waterborne Adhesives Market?

Key players in the MEA Waterborne Adhesives Market include Henkel AG, BASF SE, and Dow Inc. These companies are known for their innovative adhesive solutions and strong market presence, among others.

What are the growth factors driving the MEA Waterborne Adhesives Market?

The growth of the MEA Waterborne Adhesives Market is driven by increasing demand for eco-friendly adhesives, rising construction activities, and the expansion of the automotive sector. Additionally, the shift towards sustainable materials is influencing market growth.

What challenges does the MEA Waterborne Adhesives Market face?

The MEA Waterborne Adhesives Market faces challenges such as stringent regulations regarding VOC emissions and competition from solvent-based adhesives. These factors can hinder market growth and innovation.

What opportunities exist in the MEA Waterborne Adhesives Market?

Opportunities in the MEA Waterborne Adhesives Market include the development of advanced adhesive technologies and the increasing adoption of waterborne adhesives in emerging markets. The growing trend towards sustainable packaging also presents significant potential.

What trends are shaping the MEA Waterborne Adhesives Market?

Trends shaping the MEA Waterborne Adhesives Market include the rise of bio-based adhesives and innovations in adhesive formulations that enhance performance. Additionally, the focus on sustainability is driving the development of greener adhesive solutions.

MEA Waterborne Adhesives Market

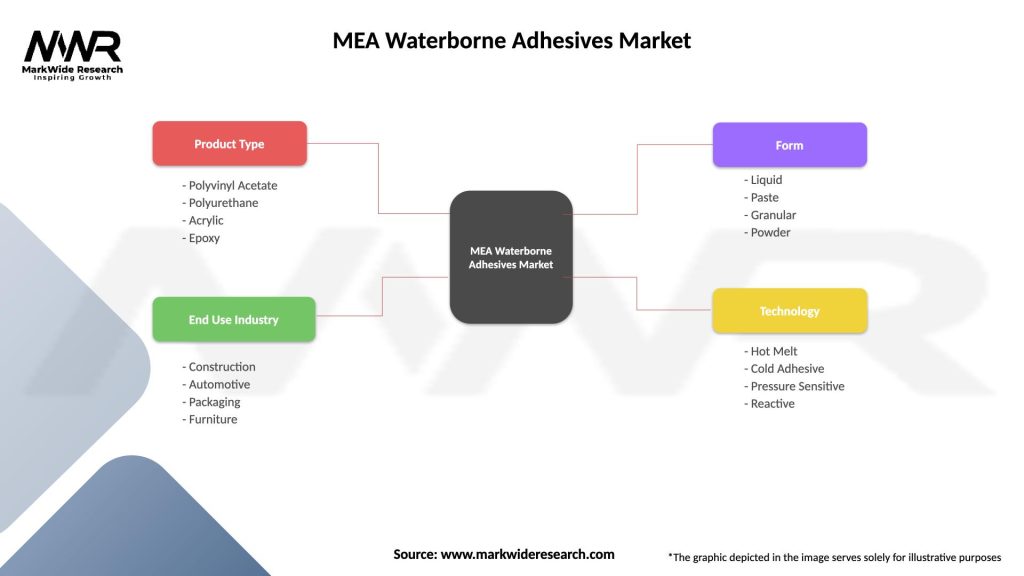

| Segmentation Details | Description |

|---|---|

| Product Type | Polyvinyl Acetate, Polyurethane, Acrylic, Epoxy |

| End Use Industry | Construction, Automotive, Packaging, Furniture |

| Form | Liquid, Paste, Granular, Powder |

| Technology | Hot Melt, Cold Adhesive, Pressure Sensitive, Reactive |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Waterborne Adhesives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at