444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA vegetable oil market represents a dynamic and rapidly evolving sector within the Middle East and Africa region, characterized by increasing consumer demand, technological advancements, and shifting dietary preferences. This comprehensive market encompasses various oil types including palm oil, sunflower oil, soybean oil, and olive oil, serving diverse applications across food processing, cooking, and industrial sectors. Market dynamics indicate robust growth driven by population expansion, urbanization trends, and rising health consciousness among consumers.

Regional consumption patterns demonstrate significant variations across different countries, with the Gulf Cooperation Council (GCC) nations showing higher per capita consumption compared to African markets. The market experiences substantial growth momentum, with analysts projecting a compound annual growth rate of 6.2% over the forecast period. Supply chain infrastructure continues to develop rapidly, supporting enhanced distribution networks and improved market accessibility across urban and rural areas.

Import dependency remains a critical characteristic of the MEA vegetable oil market, with approximately 78% of total consumption sourced through international trade channels. This dependency creates both opportunities and challenges, influencing pricing dynamics and market stability throughout the region.

The MEA vegetable oil market refers to the comprehensive ecosystem of production, distribution, and consumption of plant-based oils across Middle Eastern and African countries, encompassing both edible and industrial applications for various oil types derived from seeds, fruits, and nuts.

Market scope includes refined and unrefined vegetable oils utilized in household cooking, food processing, cosmetics manufacturing, and biodiesel production. The definition encompasses traditional oils such as olive oil, which holds cultural significance in Mediterranean regions, alongside modern processing oils like palm and soybean oil that serve industrial applications. Geographic coverage spans from Morocco in the west to the Arabian Peninsula in the east, and from Turkey in the north to South Africa in the south.

Value chain participants include international suppliers, local distributors, retail chains, food service providers, and end consumers. The market definition also incorporates organic and conventional oil categories, reflecting growing consumer preferences for sustainable and health-conscious products throughout the region.

Strategic market positioning reveals the MEA vegetable oil market as a high-growth sector driven by demographic trends, economic development, and evolving consumer preferences. The market demonstrates resilience despite global supply chain challenges, with local production initiatives gaining momentum across several countries. Key growth drivers include population growth rates exceeding 2.1% annually in many African nations, urbanization trends, and increasing disposable incomes in Gulf states.

Competitive landscape features a mix of international giants and regional players, with market consolidation trends emerging as companies seek to optimize distribution networks and enhance operational efficiency. The sector benefits from government initiatives promoting food security and local production capabilities, particularly in countries like Egypt, Morocco, and Saudi Arabia.

Market challenges include price volatility linked to global commodity markets, currency fluctuations, and infrastructure limitations in certain regions. However, technological advancements in processing and packaging, coupled with growing e-commerce adoption, create new opportunities for market expansion and consumer reach enhancement.

Consumer behavior analysis reveals significant shifts toward premium and health-oriented vegetable oil products, with organic variants experiencing accelerated growth of 12.4% annually. The following insights characterize current market dynamics:

Demographic expansion serves as the primary catalyst for vegetable oil market growth across the MEA region, with population increases directly correlating with consumption demand. Young demographics in many African countries create sustained demand growth, while urbanization trends shift consumption patterns toward processed and convenience foods requiring vegetable oils.

Economic development in Gulf states and emerging African economies drives increased purchasing power and dietary diversification. Rising middle-class populations demonstrate willingness to invest in premium oil products, supporting market value growth beyond volume expansion. Food processing industry growth creates substantial demand for industrial-grade vegetable oils, with the sector expanding at 8.7% annually across key markets.

Health awareness campaigns promote understanding of different oil types and their nutritional benefits, encouraging consumers to make informed choices. Government initiatives supporting local agriculture and food security create favorable conditions for domestic production development. Infrastructure improvements in transportation and storage facilities enhance market accessibility and reduce distribution costs, particularly benefiting remote and rural areas.

Culinary globalization introduces new cooking styles and oil applications, expanding market opportunities beyond traditional uses. Tourism growth in many MEA countries exposes local populations to international cuisines, driving demand for diverse oil varieties.

Price volatility represents a significant challenge for the MEA vegetable oil market, with global commodity price fluctuations directly impacting local market stability. Currency devaluation in several African countries exacerbates import costs, creating affordability challenges for price-sensitive consumers. Supply chain disruptions caused by geopolitical tensions, weather events, and transportation bottlenecks create periodic shortages and price spikes.

Import dependency exposes the market to external shocks and trade policy changes, limiting local market control and pricing flexibility. Approximately 82% of palm oil consumption relies on imports, creating vulnerability to international market conditions. Infrastructure limitations in storage and distribution networks result in product quality deterioration and increased wastage, particularly affecting rural markets.

Regulatory complexities across different countries create compliance challenges for international suppliers and distributors. Varying quality standards, labeling requirements, and import procedures increase operational costs and market entry barriers. Competition from alternative products including animal fats and synthetic oils limits market expansion in certain applications.

Economic instability in several regional markets affects consumer purchasing power and demand predictability. Limited access to financing for local producers and distributors constrains market development and infrastructure investment capabilities.

Local production development presents substantial opportunities for reducing import dependency and creating value-added processing capabilities. Countries with suitable agricultural conditions can develop oilseed cultivation and processing industries, supported by government incentives and international investment. Organic and premium segments offer higher margin opportunities as consumer awareness and purchasing power increase across the region.

E-commerce expansion creates new distribution channels and direct-to-consumer opportunities, particularly valuable in markets with limited traditional retail infrastructure. Digital platforms enable better consumer education about product benefits and usage applications. Industrial applications growth in biodiesel production, cosmetics manufacturing, and pharmaceutical industries diversifies demand sources beyond traditional food applications.

Technology adoption in processing, packaging, and distribution enhances operational efficiency and product quality. Smart packaging solutions with extended shelf life and improved convenience features create competitive advantages. Regional trade agreements and economic partnerships facilitate market access and reduce trade barriers between neighboring countries.

Sustainability initiatives align with global environmental trends, creating opportunities for certified sustainable palm oil and other environmentally responsible products. Health-focused product development targeting specific nutritional benefits and dietary requirements opens niche market segments with premium pricing potential.

Supply-demand equilibrium in the MEA vegetable oil market reflects complex interactions between local production capabilities, import volumes, and consumption patterns. Seasonal variations in agricultural output create predictable supply fluctuations, while consumption remains relatively stable throughout the year. Price transmission mechanisms from global markets to local retail prices vary significantly across different countries, influenced by currency stability, import policies, and market competition levels.

Competitive intensity varies by market segment, with commodity oils experiencing intense price competition while premium and specialty oils maintain higher margins through differentiation strategies. Market concentration levels differ across countries, with some markets dominated by few large players while others feature fragmented competitive landscapes.

Innovation cycles in product development, packaging, and marketing create opportunities for market share gains and premium positioning. Companies investing in research and development, particularly in health-beneficial oil formulations, demonstrate superior market performance. Distribution channel evolution reflects changing consumer shopping patterns, with traditional markets maintaining importance while modern retail formats gain market share at 15% annually.

Regulatory environment changes impact market dynamics through quality standards, import policies, and food safety requirements. According to MarkWide Research analysis, markets with stable regulatory frameworks demonstrate more predictable growth patterns and attract higher levels of investment.

Comprehensive market analysis employs multiple research methodologies to ensure data accuracy and insight reliability. Primary research includes extensive interviews with industry stakeholders, including producers, distributors, retailers, and consumers across key markets. Survey methodologies capture quantitative data on consumption patterns, purchasing behaviors, and market preferences through structured questionnaires administered to representative consumer samples.

Secondary research incorporates analysis of government statistics, trade data, industry reports, and company financial statements to establish market sizing and trend analysis. Data triangulation methods validate findings across multiple sources, ensuring research reliability and accuracy. Expert consultation with industry professionals, agricultural specialists, and market analysts provides qualitative insights into market dynamics and future trends.

Market modeling techniques utilize statistical analysis and forecasting methods to project future market scenarios and growth trajectories. Regional analysis employs comparative methodologies to identify market similarities and differences across different countries and sub-regions. Quality assurance protocols ensure data integrity through systematic verification processes and peer review procedures.

Continuous monitoring of market developments, policy changes, and industry innovations maintains research currency and relevance. Field research in key markets provides ground-level insights into consumer behaviors and market conditions not captured through traditional research methods.

Gulf Cooperation Council countries represent the most mature and high-value segment of the MEA vegetable oil market, characterized by sophisticated consumer preferences and strong purchasing power. The UAE and Saudi Arabia lead regional consumption, with per capita usage rates significantly exceeding global averages. Market share distribution shows GCC countries accounting for approximately 35% of regional consumption despite representing a smaller population base.

North African markets demonstrate diverse characteristics, with Egypt serving as the largest single country market and Morocco showing rapid growth in premium segment adoption. Libya and Algeria present opportunities constrained by economic and political factors, while Tunisia maintains steady market development. Import patterns vary significantly, with some countries maintaining strategic reserves while others operate on just-in-time procurement models.

Sub-Saharan African markets exhibit the highest growth potential, driven by population expansion and economic development. Nigeria, South Africa, and Kenya lead market development, while emerging markets like Ghana and Ethiopia show promising growth trajectories. Infrastructure development remains critical for market expansion, with improvements in transportation and storage facilities directly correlating with market accessibility.

Levantine region markets face unique challenges related to geopolitical situations but maintain cultural preferences for olive oil and traditional cooking methods. Jordan and Lebanon demonstrate resilience and adaptation in market development despite regional challenges.

Market leadership in the MEA vegetable oil sector features a combination of international corporations and regional specialists, each leveraging distinct competitive advantages. The competitive environment varies significantly across different oil types and market segments, with commodity oils experiencing intense price competition while premium segments allow for differentiation strategies.

Competitive strategies focus on supply chain optimization, brand building, and market-specific product development. Companies with local production capabilities demonstrate competitive advantages in cost structure and supply reliability. Strategic partnerships between international suppliers and local distributors create market access opportunities while leveraging regional expertise and relationships.

Product type segmentation reveals distinct market characteristics and growth patterns across different vegetable oil categories. Each segment demonstrates unique consumer preferences, pricing dynamics, and competitive landscapes:

By Oil Type:

By Application:

By Distribution Channel:

Premium oil categories demonstrate accelerated growth as consumer sophistication increases across the MEA region. Olive oil maintains cultural significance and premium positioning, particularly in North African and Levantine markets where traditional usage patterns support higher price points. Organic vegetable oils represent the fastest-growing category, with annual growth rates reaching 18.3% in select markets as health consciousness drives purchasing decisions.

Cooking oil categories reflect regional preferences and culinary traditions, with sunflower oil gaining popularity due to its neutral taste and health benefits. Palm oil dominates volume consumption but faces increasing scrutiny regarding sustainability practices. Specialty oils including avocado, coconut, and sesame oils create niche opportunities with premium pricing potential.

Industrial grade oils serve growing biodiesel and manufacturing sectors, with demand closely linked to economic development and environmental regulations. Food processing applications require consistent quality and competitive pricing, creating opportunities for suppliers with reliable supply chains. Packaging innovations across all categories focus on convenience, shelf life extension, and portion control to meet evolving consumer needs.

Private label products gain market share as retailers develop competitive offerings with attractive pricing. Brand loyalty varies significantly across categories, with premium oils maintaining stronger brand preferences while commodity oils compete primarily on price and availability.

Market participants across the MEA vegetable oil value chain realize diverse benefits from market development and expansion. Producers benefit from growing demand and opportunities for capacity expansion, while distributors leverage improved infrastructure and market access to enhance operational efficiency.

For Producers:

For Distributors and Retailers:

For Consumers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Health-conscious consumption emerges as the dominant trend shaping the MEA vegetable oil market, with consumers increasingly seeking oils with superior nutritional profiles and health benefits. This trend drives demand for oils rich in omega-3 fatty acids, antioxidants, and vitamins, creating opportunities for premium product positioning. Organic certification becomes increasingly important, with certified organic oils experiencing growth rates of 22.1% annually in select markets.

Sustainability focus influences purchasing decisions as consumers become more environmentally conscious. Sustainable palm oil certification and traceability requirements reshape supply chain practices and product positioning strategies. Packaging innovation emphasizes convenience, portion control, and extended shelf life through advanced materials and design solutions.

Digital transformation impacts distribution channels and consumer engagement, with e-commerce platforms gaining significant traction. Online sales channels enable direct consumer education about product benefits and usage applications. MWR data indicates that digital platform sales grow at rates exceeding traditional retail channels in urban markets.

Culinary diversification introduces new oil varieties and applications as international cuisine influences expand across the region. Specialty oils for specific cooking methods and ethnic cuisines create niche market opportunities. Private label development by major retailers creates competitive pressure on branded products while offering consumers value alternatives.

Supply chain localization efforts aim to reduce import dependency and enhance supply security through domestic production initiatives and regional sourcing strategies.

Production capacity expansion initiatives across the MEA region focus on reducing import dependency and creating local value addition. Several countries announce significant investments in oilseed processing facilities and refinery capacity to serve growing domestic and regional demand. Technology adoption in processing facilities enhances product quality and operational efficiency while reducing environmental impact.

Strategic partnerships between international suppliers and local distributors create enhanced market access and supply chain optimization. These collaborations leverage global expertise with local market knowledge to improve customer service and market penetration. Sustainability certifications become standard requirements as companies respond to environmental concerns and consumer preferences.

Government policy initiatives support food security objectives through strategic reserves, import diversification, and local production incentives. Several countries implement quality standards and labeling requirements to protect consumer interests and ensure product safety. Infrastructure investments in storage facilities, transportation networks, and port capabilities enhance supply chain efficiency and reduce distribution costs.

Digital platform launches by major retailers and specialized food companies create new distribution channels and customer engagement opportunities. These platforms enable better inventory management, customer data collection, and targeted marketing strategies. Research and development investments focus on health-beneficial oil formulations and sustainable production methods.

Market entry strategies should prioritize understanding local consumer preferences and regulatory requirements across different MEA markets. Companies seeking regional expansion benefit from partnerships with established local distributors who possess market knowledge and customer relationships. Product portfolio optimization requires balancing commodity oils for volume with premium products for margin enhancement.

Supply chain resilience becomes critical given the region’s import dependency and potential disruption risks. Diversifying supplier bases and maintaining strategic inventory levels help mitigate supply chain vulnerabilities. Investment priorities should focus on infrastructure development, particularly in storage and distribution capabilities, to support market expansion and operational efficiency.

Brand building initiatives prove essential in markets where consumer loyalty and quality perception drive purchasing decisions. Educational marketing about health benefits and usage applications creates competitive advantages in premium segments. Sustainability positioning aligns with global trends and regulatory developments while appealing to environmentally conscious consumers.

Technology adoption in processing, packaging, and distribution enhances competitiveness and operational efficiency. Companies investing in digital capabilities for customer engagement and supply chain management demonstrate superior market performance. Regulatory compliance requires proactive monitoring of policy changes and quality standards across different markets to ensure continued market access.

Long-term growth prospects for the MEA vegetable oil market remain highly positive, driven by fundamental demographic and economic trends that support sustained demand expansion. Population growth, urbanization, and rising disposable incomes create a favorable environment for market development over the next decade. MarkWide Research projects continued market expansion with growth rates maintaining momentum above 6% annually through the forecast period.

Market evolution will likely feature increased sophistication in consumer preferences, driving demand for premium and specialty oil products. Health consciousness trends are expected to accelerate, creating opportunities for functional oils with specific nutritional benefits. Local production development initiatives will gradually reduce import dependency in countries with suitable agricultural conditions and government support.

Technology integration will transform supply chain operations, customer engagement, and product development processes. Digital platforms will become increasingly important for market access and consumer education. Sustainability requirements will become standard expectations rather than competitive differentiators, reshaping supply chain practices and product positioning strategies.

Regional integration through trade agreements and economic partnerships will facilitate market access and reduce barriers to cross-border commerce. Infrastructure development will continue improving market accessibility and operational efficiency. Innovation focus will emphasize health benefits, convenience features, and environmental sustainability to meet evolving consumer expectations and regulatory requirements.

The MEA vegetable oil market represents a dynamic and rapidly growing sector with substantial opportunities for industry participants across the value chain. Fundamental drivers including population growth, economic development, and changing consumer preferences create a favorable environment for sustained market expansion. While challenges related to import dependency, price volatility, and infrastructure limitations exist, the overall market outlook remains highly positive.

Strategic success in this market requires understanding diverse consumer preferences, building resilient supply chains, and adapting to evolving regulatory environments across different countries. Companies that invest in local market knowledge, sustainable practices, and technology adoption will be best positioned to capitalize on growth opportunities. Health and sustainability trends will continue shaping market dynamics, creating opportunities for premium positioning and product differentiation.

Future market development will be characterized by increased sophistication, local production growth, and enhanced supply chain efficiency. The MEA vegetable oil market offers compelling opportunities for growth-oriented companies willing to invest in understanding and serving diverse regional markets with appropriate products and strategies.

What is Vegetable Oil?

Vegetable oil is a type of oil derived from the seeds, fruits, or other parts of plants. It is commonly used in cooking, food processing, and various industrial applications.

What are the key players in the MEA Vegetable Oil Market?

Key players in the MEA Vegetable Oil Market include companies like Cargill, Archer Daniels Midland Company, and Bunge Limited, among others. These companies are involved in the production, processing, and distribution of various vegetable oils.

What are the growth factors driving the MEA Vegetable Oil Market?

The MEA Vegetable Oil Market is driven by increasing consumer demand for healthy cooking oils, the rise in food processing industries, and the growing trend of plant-based diets. Additionally, the expansion of the food service sector contributes to market growth.

What challenges does the MEA Vegetable Oil Market face?

The MEA Vegetable Oil Market faces challenges such as fluctuating raw material prices, competition from alternative oils, and regulatory issues related to food safety and labeling. These factors can impact profitability and market stability.

What opportunities exist in the MEA Vegetable Oil Market?

Opportunities in the MEA Vegetable Oil Market include the development of innovative oil blends, increasing exports to emerging markets, and the growing demand for organic and non-GMO oils. These trends can enhance market potential.

What trends are shaping the MEA Vegetable Oil Market?

Trends in the MEA Vegetable Oil Market include a shift towards healthier oil options, increased use of sustainable sourcing practices, and the rise of e-commerce for oil distribution. These trends reflect changing consumer preferences and environmental considerations.

MEA Vegetable Oil Market

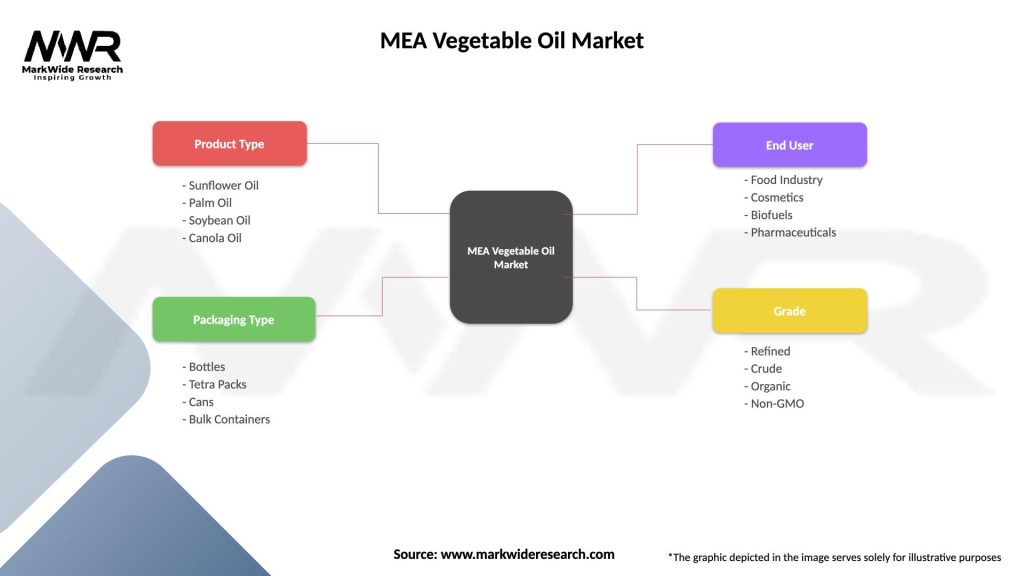

| Segmentation Details | Description |

|---|---|

| Product Type | Sunflower Oil, Palm Oil, Soybean Oil, Canola Oil |

| Packaging Type | Bottles, Tetra Packs, Cans, Bulk Containers |

| End User | Food Industry, Cosmetics, Biofuels, Pharmaceuticals |

| Grade | Refined, Crude, Organic, Non-GMO |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Vegetable Oil Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at