444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA UHT milk market represents a dynamic and rapidly evolving sector within the broader dairy industry across the Middle East and Africa region. Ultra-high temperature processing technology has revolutionized milk preservation and distribution, enabling extended shelf life without refrigeration requirements. This technological advancement has proven particularly valuable in the MEA region, where climate challenges and infrastructure limitations make traditional dairy distribution complex.

Market dynamics in the MEA UHT milk sector are driven by increasing urbanization, changing consumer lifestyles, and growing awareness of nutritional benefits. The region experiences significant growth in demand for convenient, long-lasting dairy products that maintain nutritional value. Consumer preferences are shifting toward packaged dairy solutions that offer safety, convenience, and extended storage capabilities.

Regional variations across the MEA market show distinct consumption patterns, with Gulf Cooperation Council countries demonstrating higher per capita consumption rates compared to sub-Saharan African markets. The market exhibits robust growth potential with expanding retail infrastructure and increasing disposable income levels across key demographic segments. Distribution networks continue to evolve, incorporating modern retail formats and e-commerce platforms to reach diverse consumer bases.

The MEA UHT milk market refers to the commercial ecosystem encompassing the production, processing, distribution, and consumption of ultra-high temperature treated milk products across Middle Eastern and African countries. UHT technology involves heating milk to temperatures exceeding 135°C for brief periods, effectively eliminating harmful microorganisms while preserving essential nutrients and extending shelf life to several months without refrigeration.

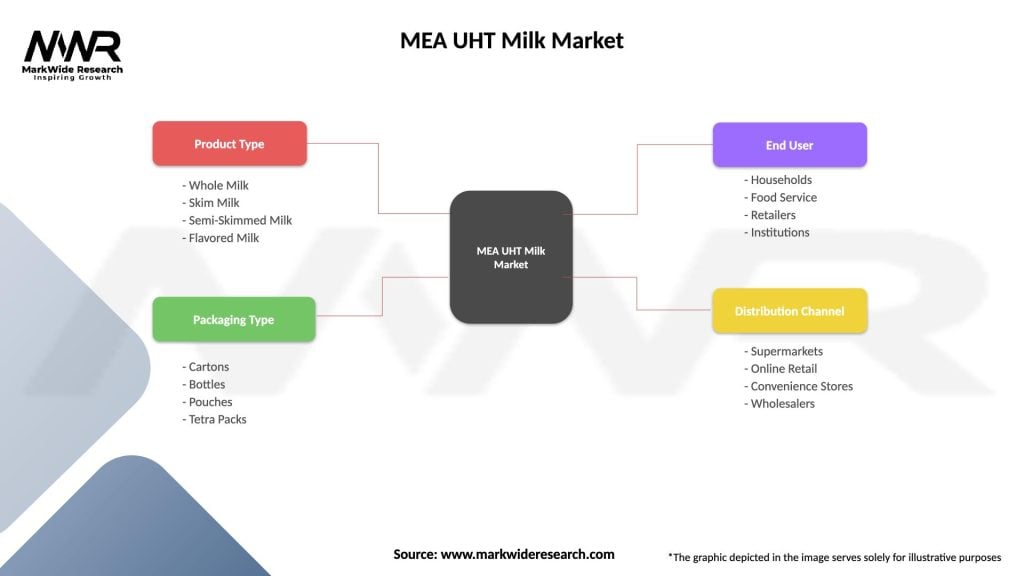

Market scope includes various UHT milk products such as whole milk, skimmed milk, semi-skimmed milk, and flavored variants distributed through multiple channels including supermarkets, convenience stores, and traditional retail outlets. The market encompasses both domestic production facilities and imported products, creating a complex supply chain network serving diverse consumer segments across the region.

Geographic coverage spans major economies including Saudi Arabia, United Arab Emirates, Egypt, South Africa, Nigeria, and Kenya, each contributing unique market characteristics and consumption patterns. The market definition includes both branded and private label products, organic and conventional variants, and different packaging formats ranging from individual portions to family-size containers.

Strategic analysis of the MEA UHT milk market reveals significant expansion opportunities driven by demographic trends, economic development, and evolving consumer preferences. The market demonstrates strong fundamentals with increasing penetration rates across urban and rural segments, supported by improving distribution infrastructure and rising health consciousness among consumers.

Key growth drivers include population growth, urbanization trends, and increasing awareness of dairy nutrition benefits. The market benefits from technological advancements in processing and packaging, enabling manufacturers to offer innovative products with enhanced convenience and nutritional profiles. Investment flows into the sector continue to strengthen production capabilities and expand market reach.

Competitive dynamics show a mix of international dairy giants and regional players competing across price points and product categories. Market leaders focus on brand building, distribution expansion, and product innovation to maintain competitive advantages. The sector demonstrates resilience against economic fluctuations due to the essential nature of dairy products in regional diets.

Future prospects indicate sustained growth potential with expanding middle-class populations and increasing adoption of modern retail formats. The market shows promising indicators for continued expansion, supported by government initiatives promoting food security and nutrition programs across the region.

Consumer behavior analysis reveals shifting preferences toward convenient, nutritious dairy options that align with busy lifestyles and changing dietary habits. The MEA UHT milk market demonstrates several critical insights that shape strategic decision-making for industry participants.

Population dynamics serve as fundamental drivers for the MEA UHT milk market, with rapidly growing populations across key countries creating expanding consumer bases. Urbanization trends contribute significantly to market growth, as urban consumers demonstrate higher propensity for packaged dairy products and modern retail shopping patterns.

Economic development across the region translates into increased disposable income levels, enabling consumers to prioritize quality and convenience in dairy product selection. Infrastructure improvements in retail and distribution networks facilitate better market penetration and product availability across diverse geographic areas.

Health and nutrition awareness continues to drive market expansion, with consumers increasingly recognizing the nutritional value of dairy products in balanced diets. Government initiatives promoting food security and nutrition programs create supportive environments for dairy market development.

Price sensitivity remains a significant constraint in many MEA markets, where consumers prioritize affordability over convenience features. Economic volatility in certain regional markets creates uncertainty in consumer spending patterns, affecting premium product adoption rates.

Cultural preferences for fresh dairy products in some markets limit UHT milk acceptance, particularly among traditional consumer segments who associate freshness with superior quality. Taste perceptions regarding UHT processing occasionally create barriers to market penetration among quality-conscious consumers.

Infrastructure challenges in rural and remote areas limit distribution reach and market accessibility, constraining overall market expansion potential. Regulatory complexities across different countries create compliance challenges for manufacturers seeking regional market expansion.

Emerging market segments present substantial growth opportunities, particularly in expanding urban centers and developing economies across the MEA region. Product innovation in flavored, fortified, and functional UHT milk variants offers differentiation opportunities and premium pricing potential.

E-commerce expansion creates new distribution channels and consumer touchpoints, enabling direct-to-consumer sales and subscription-based delivery models. Partnership opportunities with local distributors and retailers facilitate market entry and expansion strategies for international players.

Health and wellness trends drive demand for fortified and functional dairy products, creating opportunities for premium product development and targeted marketing campaigns. Sustainability initiatives offer differentiation opportunities through environmentally conscious packaging and production practices.

Supply chain dynamics in the MEA UHT milk market reflect complex interactions between raw material availability, processing capabilities, and distribution networks. Seasonal variations in milk production create supply fluctuations that manufacturers must manage through strategic sourcing and inventory planning.

Competitive intensity varies across market segments, with premium categories showing less price competition compared to value segments. Brand positioning strategies focus on quality, nutrition, and convenience attributes to differentiate products in crowded market spaces.

Consumer loyalty patterns demonstrate strong brand preferences once established, creating opportunities for sustained market share growth through consistent quality delivery. Price elasticity varies significantly across consumer segments, with urban affluent consumers showing lower price sensitivity compared to rural and lower-income segments.

Regulatory environments continue evolving across MEA countries, with increasing focus on food safety standards and nutritional labeling requirements. Trade dynamics affect raw material costs and finished product pricing, influencing competitive positioning and profitability metrics.

Technology adoption in processing and packaging continues advancing, enabling efficiency improvements and product innovation opportunities. Market consolidation trends show increasing activity as larger players seek scale advantages and market expansion capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the MEA UHT milk sector. Primary research involves extensive interviews with industry stakeholders including manufacturers, distributors, retailers, and consumers across key markets.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements to validate primary findings and identify market trends. Quantitative analysis utilizes statistical modeling to project market growth patterns and segment performance metrics.

Market segmentation analysis examines consumption patterns across demographic, geographic, and psychographic variables to identify growth opportunities and competitive dynamics. Supply chain analysis evaluates production capabilities, distribution networks, and cost structures affecting market competitiveness.

Gulf Cooperation Council countries represent the most mature UHT milk markets within the MEA region, characterized by high per capita consumption rates and strong preference for premium products. Saudi Arabia leads regional consumption with 35% market share, driven by large population and high disposable income levels.

United Arab Emirates demonstrates sophisticated consumer preferences with strong demand for imported premium brands and innovative product variants. Egypt represents the largest population-based market opportunity, though price sensitivity remains a key consideration for market penetration strategies.

South Africa shows mature market characteristics with established distribution networks and strong local production capabilities. Nigeria presents significant growth potential with expanding urban populations and increasing awareness of packaged dairy benefits.

Kenya demonstrates growing market sophistication with increasing modern retail penetration and rising consumer purchasing power. Morocco and Algeria show emerging market characteristics with expanding distribution infrastructure and growing consumer acceptance of UHT products.

Market leadership in the MEA UHT milk sector involves a combination of international dairy giants and strong regional players competing across multiple product categories and price segments. Competitive strategies focus on brand building, distribution expansion, and product innovation to maintain market positions.

Competitive dynamics show increasing focus on product differentiation through nutritional enhancement, packaging innovation, and targeted marketing campaigns. Market consolidation continues as larger players acquire regional brands to expand geographic reach and production capabilities.

Product segmentation in the MEA UHT milk market encompasses multiple categories based on fat content, packaging formats, and functional attributes. Market segmentation analysis reveals distinct consumer preferences and growth patterns across different product categories.

By Fat Content:

By Packaging Format:

By Distribution Channel:

Flavored UHT milk represents the fastest-growing category within the MEA market, driven by younger consumer preferences and innovation in taste profiles. Chocolate and strawberry variants lead flavor preferences, while vanilla and banana show emerging popularity across different age groups.

Fortified UHT milk products demonstrate strong growth potential, particularly variants enhanced with vitamins, minerals, and protein supplements. Calcium-enriched products appeal to health-conscious consumers, while vitamin D fortification addresses regional nutritional deficiencies.

Organic UHT milk shows premium positioning opportunities in affluent urban markets, though price sensitivity limits broader market penetration. Lactose-free variants address specific dietary requirements and expand addressable market segments.

Manufacturers benefit from extended shelf life capabilities that reduce inventory turnover pressures and enable broader geographic distribution without cold chain requirements. Production efficiency gains from UHT processing technology enable cost optimization and improved profit margins.

Retailers appreciate reduced refrigeration costs and lower product loss rates compared to fresh dairy alternatives. Inventory management becomes more efficient with longer shelf life products, enabling better stock planning and reduced waste.

Distributors gain operational advantages through simplified logistics and reduced cold chain infrastructure requirements. Market reach expansion becomes feasible to remote areas where refrigeration infrastructure remains limited.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness trends continue driving consumer preferences toward fortified and functional UHT milk products with enhanced nutritional profiles. Convenience packaging innovations focus on portability and resealability to meet changing lifestyle demands.

Sustainability initiatives gain importance as consumers and regulators emphasize environmental responsibility in packaging and production processes. Plant-based alternatives create competitive pressure while also expanding overall dairy alternative market awareness.

Digital marketing strategies become increasingly important for brand building and consumer engagement, particularly among younger demographic segments. Premium positioning trends show consumers willing to pay higher prices for perceived quality and nutritional benefits.

Production capacity expansion continues across the MEA region as manufacturers invest in modern UHT processing facilities to meet growing demand. Technology upgrades focus on energy efficiency and product quality improvements while reducing operational costs.

Strategic partnerships between international brands and local distributors facilitate market entry and expansion strategies. Acquisition activity increases as larger players seek to consolidate market positions and expand geographic reach.

Regulatory developments across MEA countries focus on food safety standards and nutritional labeling requirements, driving industry compliance investments. Sustainability initiatives gain momentum with packaging innovations and environmental responsibility programs.

Market entry strategies should prioritize understanding local consumer preferences and establishing strong distribution partnerships with regional retailers. MarkWide Research analysis indicates that successful market penetration requires balanced approaches combining competitive pricing with quality positioning.

Product development focus should emphasize flavored variants and functional enhancements that appeal to younger consumer segments while maintaining nutritional integrity. Investment priorities should include modern processing facilities and efficient distribution networks to support market expansion.

Brand building strategies must incorporate digital marketing channels and consumer education programs to build awareness of UHT milk benefits. Partnership development with local dairy farmers and suppliers ensures sustainable raw material sourcing and community support.

Growth projections for the MEA UHT milk market indicate sustained expansion driven by demographic trends, economic development, and changing consumer lifestyles. Market maturation in developed segments will be balanced by emerging opportunities in developing markets across the region.

Technology advancement will continue improving processing efficiency and product quality while reducing environmental impact. Consumer sophistication will drive demand for premium and functional products, creating opportunities for value-added offerings.

Distribution evolution will see increased importance of e-commerce channels and direct-to-consumer models, particularly in urban markets. MWR projections suggest the market will experience steady growth rates with regional variations based on economic conditions and consumer adoption patterns.

Competitive landscape will likely see continued consolidation as larger players seek scale advantages and market expansion capabilities. Innovation cycles will accelerate with focus on health benefits, convenience features, and sustainability attributes.

The MEA UHT milk market presents compelling growth opportunities driven by favorable demographic trends, economic development, and evolving consumer preferences toward convenient, nutritious dairy products. Market fundamentals remain strong with expanding urban populations, increasing disposable incomes, and growing awareness of dairy nutrition benefits supporting sustained demand growth.

Strategic success in this market requires understanding regional variations, consumer preferences, and distribution dynamics while maintaining focus on product quality and competitive positioning. Innovation opportunities in flavored variants, functional enhancements, and packaging solutions offer differentiation potential and premium pricing capabilities.

Industry participants must navigate challenges including price sensitivity, infrastructure limitations, and competitive intensity while capitalizing on expansion opportunities in emerging markets and premium segments. Long-term prospects indicate sustained market growth with evolving consumer sophistication driving demand for enhanced product offerings and improved accessibility across the MEA region.

What is UHT Milk?

UHT Milk, or Ultra-High Temperature Milk, is a type of milk that has been heated to a high temperature to kill bacteria and extend its shelf life without refrigeration. It is commonly used in various applications, including food service, retail, and for consumers who prefer long-lasting dairy products.

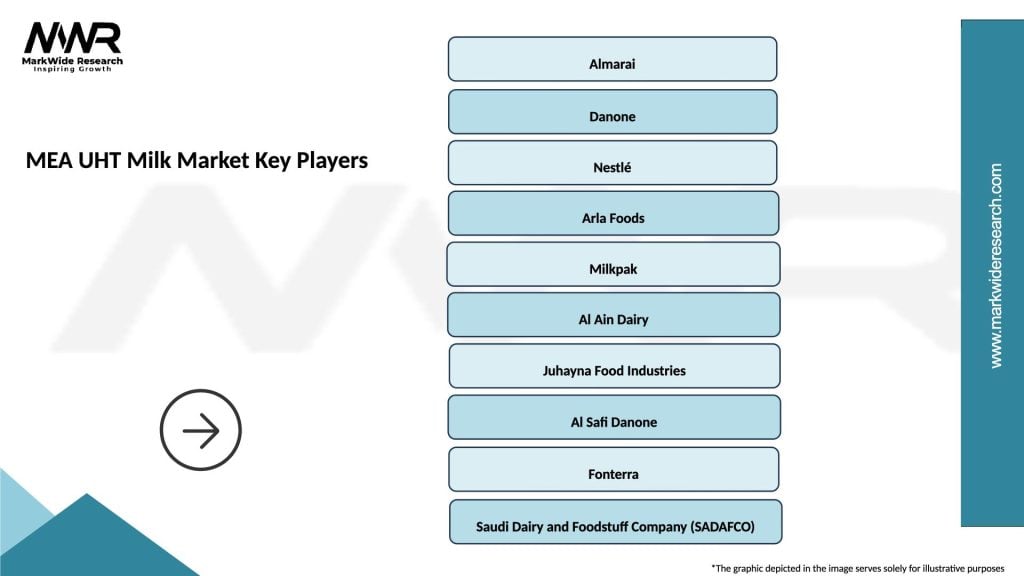

What are the key players in the MEA UHT Milk Market?

Key players in the MEA UHT Milk Market include Almarai, Nestlé, and Lactalis, which are known for their extensive product ranges and strong distribution networks. These companies focus on innovation and quality to meet the growing demand for UHT milk among consumers, among others.

What are the main drivers of the MEA UHT Milk Market?

The main drivers of the MEA UHT Milk Market include the increasing demand for long shelf-life dairy products, changing consumer lifestyles, and the growth of the food service industry. Additionally, the rising awareness of food safety and convenience is propelling market growth.

What challenges does the MEA UHT Milk Market face?

The MEA UHT Milk Market faces challenges such as competition from fresh milk products, fluctuating raw material prices, and consumer perception regarding the nutritional value of UHT milk. These factors can impact market dynamics and growth potential.

What opportunities exist in the MEA UHT Milk Market?

Opportunities in the MEA UHT Milk Market include expanding product offerings to cater to health-conscious consumers, increasing penetration in emerging markets, and leveraging e-commerce for distribution. Innovations in packaging and flavors can also attract new customer segments.

What trends are shaping the MEA UHT Milk Market?

Trends shaping the MEA UHT Milk Market include the rise of organic and fortified UHT milk products, increased focus on sustainability in packaging, and the growing popularity of plant-based alternatives. These trends reflect changing consumer preferences and environmental concerns.

MEA UHT Milk Market

| Segmentation Details | Description |

|---|---|

| Product Type | Whole Milk, Skim Milk, Semi-Skimmed Milk, Flavored Milk |

| Packaging Type | Cartons, Bottles, Pouches, Tetra Packs |

| End User | Households, Food Service, Retailers, Institutions |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA UHT Milk Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at