444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The MEA (Middle East and Africa) thermal imaging systems market is experiencing significant growth due to the increasing adoption of thermal imaging technology across various industries. Thermal imaging systems play a crucial role in enhancing safety, security, and surveillance measures by detecting and visualizing heat signatures emitted by objects and living organisms. These systems have found applications in sectors such as defense, automotive, healthcare, industrial, and construction, among others.

Meaning

Thermal imaging systems utilize infrared radiation to capture and produce images based on the temperature differences of objects. Unlike traditional cameras that rely on visible light, thermal cameras detect heat signatures and convert them into visible images. This enables users to identify potential threats or anomalies that may not be visible to the naked eye.

Executive Summary

The MEA thermal imaging systems market is poised for significant growth in the coming years. Factors such as increasing security concerns, growing demand for industrial automation, and the need for advanced healthcare solutions are driving the market’s expansion. Additionally, the integration of thermal imaging systems with other technologies such as artificial intelligence (AI) and Internet of Things (IoT) is further fueling market growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

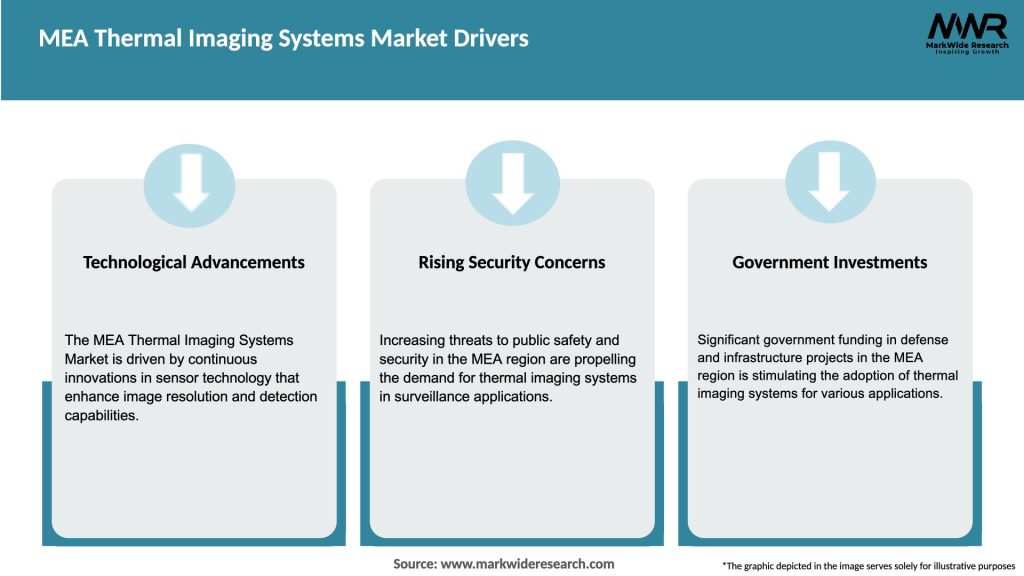

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MEA thermal imaging systems market is characterized by intense competition among key players. Companies are focusing on product innovation, strategic partnerships, and mergers and acquisitions to gain a competitive edge. Additionally, the market is witnessing a shift towards the development of lightweight and portable thermal imaging systems to cater to the growing demand for mobile applications.

Regional Analysis

The MEA thermal imaging systems market is segmented into countries such as the United Arab Emirates, Saudi Arabia, South Africa, and others. Among these, the United Arab Emirates is expected to dominate the market due to its significant investments in defense modernization and infrastructure development. Saudi Arabia is also witnessing substantial growth, driven by its defense sector. South Africa’s market is expanding due to the increasing adoption of thermal imaging systems in the mining and industrial sectors.

Competitive Landscape

Leading Companies in the MEA Thermal Imaging Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The MEA thermal imaging systems market can be segmented based on technology, application, end-use industry, and region. By technology, the market can be divided into cooled and uncooled thermal imaging systems. Applications of thermal imaging systems include surveillance, threat detection, industrial process monitoring, healthcare diagnostics, and research and development. End-use industries encompass defense, automotive, healthcare, industrial, and construction sectors, among others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the MEA thermal imaging systems market. While the market experienced a temporary slowdown during the initial phases of the pandemic due to supply chain disruptions and reduced economic activities, the demand for thermal imaging systems subsequently increased. Thermal cameras were widely used for temperature screening and monitoring in public places, workplaces, and healthcare facilities to prevent the spread of the virus. This led to a surge in demand for thermal imaging systems, particularly in the healthcare and public safety sectors.

Key Industry Developments

Analyst Suggestions

Future Outlook

The MEA thermal imaging systems market is expected to witness substantial growth in the coming years. Factors such as increasing security concerns, technological advancements, and the integration of thermal imaging with AI and IoT will drive market expansion. Additionally, emerging applications in sectors such as smart homes, agriculture, and firefighting will create new growth opportunities. However, market players need to address challenges such as high initial costs, limited awareness, and regulatory complexities to fully capitalize on the market’s potential.

Conclusion

The MEA thermal imaging systems market is experiencing significant growth driven by the increasing adoption of thermal imaging technology across various industries. The market offers immense opportunities for industry participants and stakeholders, with applications in defense, automotive, healthcare, and industrial sectors. The integration of thermal imaging systems with AI and IoT technologies is a key trend shaping the market’s future. However, challenges such as high costs and regulatory complexities need to be addressed to unlock the market’s full potential. Overall, the MEA thermal imaging systems market is poised for substantial growth, driven by advancements in technology and increasing demand for enhanced safety and security measures.

What is MEA Thermal Imaging Systems?

MEA Thermal Imaging Systems refer to advanced imaging technologies that detect infrared radiation to create thermal images. These systems are widely used in various applications, including surveillance, building inspections, and medical diagnostics.

What are the key players in the MEA Thermal Imaging Systems Market?

Key players in the MEA Thermal Imaging Systems Market include FLIR Systems, Inc., Teledyne Technologies, and Raytheon Technologies, among others. These companies are known for their innovative thermal imaging solutions and extensive product portfolios.

What are the growth factors driving the MEA Thermal Imaging Systems Market?

The growth of the MEA Thermal Imaging Systems Market is driven by increasing demand for surveillance and security applications, advancements in sensor technology, and the rising need for predictive maintenance in industrial sectors.

What challenges does the MEA Thermal Imaging Systems Market face?

The MEA Thermal Imaging Systems Market faces challenges such as high costs associated with advanced thermal imaging technologies and the need for skilled personnel to operate these systems effectively. Additionally, competition from alternative imaging technologies poses a challenge.

What opportunities exist in the MEA Thermal Imaging Systems Market?

Opportunities in the MEA Thermal Imaging Systems Market include the growing adoption of thermal imaging in healthcare for diagnostics, expanding applications in automotive industries for safety features, and increasing investments in smart city projects.

What trends are shaping the MEA Thermal Imaging Systems Market?

Trends shaping the MEA Thermal Imaging Systems Market include the integration of artificial intelligence for enhanced image analysis, the miniaturization of thermal cameras for portable applications, and the increasing use of thermal imaging in renewable energy sectors for efficiency monitoring.

MEA Thermal Imaging Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Handheld, Fixed, Mounted, Thermal Cameras |

| End User | Healthcare, Manufacturing, Automotive, Defense |

| Technology | Uncooled, Cooled, Infrared, Dual-Use |

| Application | Building Inspection, Firefighting, Surveillance, Research |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the MEA Thermal Imaging Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at