444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA rigid plastic packaging market represents a dynamic and rapidly evolving sector within the broader packaging industry across the Middle East and Africa region. This market encompasses a comprehensive range of rigid plastic containers, bottles, jars, trays, and specialized packaging solutions designed to meet the diverse needs of various industries including food and beverage, pharmaceuticals, personal care, and industrial applications.

Market dynamics in the MEA region are characterized by increasing urbanization, growing consumer awareness regarding product safety, and rising demand for convenient packaging solutions. The market is experiencing robust growth driven by expanding retail sectors, particularly in countries like the United Arab Emirates, Saudi Arabia, South Africa, and Nigeria. Rigid plastic packaging offers superior protection, extended shelf life, and enhanced product visibility compared to traditional packaging alternatives.

Regional variations within the MEA market reflect different economic development stages, regulatory frameworks, and consumer preferences. The Gulf Cooperation Council (GCC) countries demonstrate strong demand for premium packaging solutions, while African markets show increasing adoption of cost-effective rigid plastic alternatives. The market is projected to grow at a compound annual growth rate (CAGR) of 6.2% over the forecast period, indicating substantial expansion opportunities.

Sustainability initiatives are increasingly influencing market dynamics, with manufacturers focusing on recyclable materials, lightweight designs, and circular economy principles. The integration of advanced technologies such as barrier coatings, smart packaging features, and innovative closure systems is driving product differentiation and market competitiveness across the region.

The MEA rigid plastic packaging market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of inflexible plastic containers and packaging solutions across Middle Eastern and African countries. This market encompasses various polymer-based packaging products that maintain their structural integrity under normal handling conditions, providing superior protection and preservation capabilities for packaged goods.

Rigid plastic packaging distinguishes itself from flexible packaging through its ability to maintain shape and structural stability without external support. These packaging solutions are manufactured using various plastic resins including polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), and polystyrene (PS), each offering specific performance characteristics suited to different applications.

Market scope includes bottles for beverages and pharmaceuticals, containers for food products, cosmetic jars and tubes, industrial packaging solutions, and specialized medical packaging. The definition extends to both primary packaging that directly contacts products and secondary packaging used for distribution and retail presentation.

Geographic coverage encompasses the diverse economies and markets across the Middle East and Africa, including oil-rich Gulf states, emerging African economies, and established markets in South Africa and Egypt. This regional focus reflects unique market characteristics, regulatory environments, and consumer preferences that distinguish the MEA region from global packaging markets.

Strategic market positioning of rigid plastic packaging in the MEA region demonstrates exceptional growth potential driven by demographic shifts, economic diversification, and evolving consumer preferences. The market benefits from increasing disposable incomes, urbanization trends, and expanding retail infrastructure across key regional markets.

Key growth drivers include the booming food and beverage sector, pharmaceutical industry expansion, and rising demand for personal care products. The market is experiencing approximately 65% of demand originating from food and beverage applications, with pharmaceutical packaging representing the fastest-growing segment at 8.1% annual growth rate.

Technological advancement plays a crucial role in market evolution, with manufacturers investing in advanced molding technologies, barrier enhancement solutions, and sustainable material innovations. The integration of smart packaging features and tamper-evident closures is gaining traction, particularly in pharmaceutical and premium consumer goods segments.

Competitive landscape features a mix of international packaging giants and regional specialists, with market consolidation trends evident as companies seek to expand geographic coverage and technological capabilities. Strategic partnerships between global manufacturers and local distributors are becoming increasingly common to navigate complex regulatory environments and cultural preferences.

Future outlook remains optimistic, supported by continued economic growth, infrastructure development, and increasing alignment with global sustainability standards. The market is expected to benefit from growing e-commerce penetration and demand for protective packaging solutions suitable for long-distance transportation and storage.

Market segmentation analysis reveals distinct patterns across different application areas and geographic regions within the MEA market. The following insights provide comprehensive understanding of market dynamics:

Consumer behavior trends indicate increasing preference for convenient, portable packaging solutions that offer product visibility and ease of use. The growing middle-class population across the region is driving demand for premium packaging aesthetics and functionality.

Regulatory environment is evolving toward stricter food safety standards and environmental compliance requirements, creating opportunities for advanced packaging solutions that meet international quality standards while addressing local market needs.

Demographic transformation across the MEA region serves as a fundamental driver for rigid plastic packaging market expansion. Rapid urbanization, growing population, and increasing disposable incomes create sustained demand for packaged goods requiring protective and attractive packaging solutions.

Economic diversification initiatives in oil-dependent economies are fostering growth in manufacturing, food processing, and consumer goods sectors. These industries require reliable packaging solutions to support product quality, brand differentiation, and market expansion strategies.

Retail sector evolution including the expansion of modern trade formats, supermarkets, and convenience stores drives demand for standardized, attractive packaging that enhances product presentation and consumer appeal. The growth of organized retail creates opportunities for premium packaging solutions.

Food safety awareness among consumers and regulatory bodies is increasing demand for packaging solutions that provide superior barrier properties, contamination prevention, and extended shelf life. Rigid plastic packaging offers excellent protection against moisture, oxygen, and external contaminants.

Pharmaceutical industry growth driven by aging populations, increasing healthcare access, and rising chronic disease prevalence creates substantial demand for specialized pharmaceutical packaging. Rigid plastic containers offer precise dosing, child-resistant features, and regulatory compliance capabilities.

E-commerce expansion requires packaging solutions that can withstand transportation stresses, provide product protection during shipping, and offer convenient opening experiences for consumers. Rigid plastic packaging meets these requirements while maintaining cost-effectiveness.

Brand differentiation needs encourage manufacturers to invest in distinctive packaging designs, premium materials, and innovative closure systems that enhance product appeal and consumer loyalty in competitive markets.

Environmental concerns regarding plastic waste and ocean pollution create regulatory pressures and consumer resistance that may limit market growth. Increasing awareness of environmental impact drives demand for alternative packaging materials and recycling initiatives.

Raw material price volatility affects manufacturing costs and profit margins, particularly for petroleum-based plastic resins. Fluctuating oil prices and supply chain disruptions can significantly impact production economics and pricing strategies.

Regulatory complexity across different MEA countries creates compliance challenges for manufacturers seeking regional market expansion. Varying food safety standards, labeling requirements, and environmental regulations increase operational complexity and costs.

Infrastructure limitations in certain African markets, including inadequate transportation networks, unreliable power supply, and limited recycling facilities, constrain market development and increase distribution costs.

Competition from alternative packaging materials including glass, metal, and flexible packaging solutions challenges market share in specific applications. Each alternative offers distinct advantages that may be preferred in certain market segments.

Economic instability in some regional markets affects consumer spending patterns and industrial investment decisions. Currency fluctuations and political uncertainties can impact market growth and investment attractiveness.

Skilled labor shortage in advanced manufacturing processes limits production capacity expansion and technology adoption. The need for specialized technical expertise in packaging design and production creates workforce development challenges.

Sustainability innovation presents significant opportunities for companies developing eco-friendly rigid plastic packaging solutions. The growing emphasis on circular economy principles creates demand for recyclable, biodegradable, and reduced-material packaging alternatives.

Smart packaging integration offers opportunities to incorporate sensors, QR codes, and interactive features that enhance consumer engagement, provide product information, and enable supply chain tracking. These technologies add value and differentiation potential.

Pharmaceutical expansion driven by healthcare infrastructure development and increasing medical tourism creates substantial opportunities for specialized pharmaceutical packaging. The segment requires high-quality, compliant packaging solutions with growth potential.

Premium market segments including luxury cosmetics, specialty foods, and craft beverages offer opportunities for high-value packaging solutions that command premium pricing and higher profit margins.

Regional manufacturing expansion allows companies to establish local production facilities, reduce transportation costs, and better serve regional markets while creating employment opportunities and building customer relationships.

Technology partnerships with equipment manufacturers, material suppliers, and research institutions can accelerate innovation, reduce development costs, and create competitive advantages in emerging market segments.

Export market development enables MEA-based manufacturers to leverage cost advantages and regional expertise to serve global markets, particularly in similar climate conditions and cultural contexts.

Supply chain evolution in the MEA rigid plastic packaging market reflects increasing sophistication and integration across the value chain. Manufacturers are developing closer relationships with raw material suppliers, investing in local production capabilities, and establishing regional distribution networks to improve responsiveness and reduce costs.

Technology adoption patterns vary significantly across the region, with GCC countries leading in advanced manufacturing technologies while African markets focus on cost-effective production solutions. This creates opportunities for technology transfer and gradual market development strategies.

Consumer preference shifts toward convenience, sustainability, and premium aesthetics are reshaping product development priorities. According to MarkWide Research analysis, consumer willingness to pay premium prices for sustainable packaging has increased by 23% over the past three years.

Competitive intensity is increasing as international players expand regional presence while local manufacturers enhance capabilities and market reach. This dynamic creates pressure for continuous innovation, cost optimization, and customer service excellence.

Regulatory harmonization efforts across regional trade blocs are gradually reducing compliance complexity and enabling more efficient market expansion strategies. Standardized regulations facilitate cross-border trade and investment decisions.

Investment flows into the packaging sector are increasing, driven by private equity interest, government industrial development initiatives, and multinational corporation expansion strategies. These investments support capacity expansion and technology upgrades.

Market maturation in established segments is driving companies to explore new applications, develop innovative products, and expand into emerging market segments to maintain growth momentum and competitive positioning.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines quantitative data analysis with qualitative market intelligence to provide holistic market understanding.

Primary research activities include extensive interviews with industry executives, manufacturers, distributors, and end-users across key MEA markets. These interactions provide firsthand insights into market trends, challenges, and opportunities from multiple stakeholder perspectives.

Secondary research sources encompass industry publications, government statistics, trade association reports, and company financial statements. This information provides historical context, market sizing data, and competitive landscape analysis.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify growth opportunities. Multiple validation methods ensure forecast accuracy and reliability.

Geographic coverage methodology ensures representative sampling across diverse MEA markets, accounting for economic development levels, regulatory environments, and cultural factors that influence packaging preferences and adoption patterns.

Industry expert validation involves consultation with packaging industry specialists, technology experts, and regional market analysts to verify findings and enhance analysis quality.

Data triangulation processes cross-reference multiple information sources to ensure consistency and accuracy of market insights, growth projections, and competitive analysis.

Gulf Cooperation Council (GCC) countries represent the most mature and sophisticated segment of the MEA rigid plastic packaging market. The region benefits from high disposable incomes, advanced retail infrastructure, and strong demand for premium packaging solutions across food, beverage, and personal care segments.

United Arab Emirates serves as a regional hub for packaging distribution and innovation, with Dubai and Abu Dhabi hosting major trade exhibitions and serving as entry points for international manufacturers. The market shows strong growth in luxury packaging and sustainable solutions.

Saudi Arabia represents the largest single market within the GCC, driven by Vision 2030 economic diversification initiatives and growing manufacturing sector. The pharmaceutical packaging segment shows particular strength due to healthcare infrastructure investments.

South Africa leads the African continent in packaging sophistication and manufacturing capabilities. The market benefits from established industrial infrastructure, skilled workforce, and strong regulatory framework that supports quality packaging production.

Nigeria offers substantial growth potential driven by large population, increasing urbanization, and expanding consumer goods market. The market shows 78% growth concentration in Lagos and Abuja metropolitan areas.

Egypt serves as a strategic manufacturing and distribution hub for North Africa and Middle East markets. The country’s geographic position and industrial capabilities make it attractive for regional packaging operations.

Kenya demonstrates strong growth in pharmaceutical and food packaging segments, supported by East African Community trade integration and growing middle-class consumption patterns.

Morocco benefits from proximity to European markets and growing automotive and aerospace industries that require specialized packaging solutions for component protection and logistics.

Market leadership in the MEA rigid plastic packaging sector is characterized by a mix of global multinational corporations and strong regional players who understand local market dynamics and customer preferences.

Strategic positioning varies among competitors, with some focusing on high-volume, cost-effective solutions while others emphasize premium packaging, sustainability, or specialized applications. Market consolidation trends are evident as companies seek scale advantages and geographic expansion.

Innovation competition centers on sustainable materials, smart packaging features, and manufacturing efficiency improvements. Companies investing in R&D and technology partnerships are gaining competitive advantages in emerging market segments.

Customer relationship strategies emphasize long-term partnerships, technical support, and customized solutions that address specific regional requirements and regulatory compliance needs.

By Material Type:

By Application:

By Product Type:

Food and Beverage Category demonstrates the strongest market presence with consistent growth driven by changing consumer lifestyles, urbanization, and increasing demand for processed and packaged foods. This category benefits from 71% market penetration in urban areas across major MEA markets.

Beverage packaging within this category shows particular strength in carbonated soft drinks, bottled water, and juice applications. PET bottles dominate this segment due to lightweight properties, clarity, and cost-effectiveness. The growing health consciousness trend is driving demand for smaller portion sizes and premium water packaging.

Food container applications are expanding rapidly in dairy products, ready-to-eat meals, and snack packaging. HDPE and PP containers offer excellent barrier properties and microwave compatibility, meeting consumer convenience requirements.

Pharmaceutical Category represents the fastest-growing segment with specialized requirements for child-resistant packaging, tamper-evident features, and regulatory compliance. This category shows 85% growth concentration in prescription medication packaging.

Solid dosage packaging including bottles for tablets and capsules requires precise manufacturing tolerances and quality control systems. The segment benefits from increasing healthcare access and aging population demographics across the region.

Liquid pharmaceutical packaging demands superior barrier properties and compatibility with active ingredients. This application requires specialized materials and manufacturing processes to ensure product stability and safety.

Personal Care Category emphasizes aesthetic appeal, premium materials, and innovative closure systems. This segment shows strong growth in skincare, haircare, and cosmetic applications with increasing consumer spending on personal care products.

Manufacturers benefit from growing market demand, opportunities for capacity expansion, and potential for premium pricing in specialized segments. The market offers stable long-term growth prospects supported by demographic trends and economic development.

Raw material suppliers gain from increasing resin consumption and opportunities to develop specialized materials for emerging applications. The focus on sustainability creates demand for recycled content and bio-based materials.

Equipment suppliers benefit from manufacturing capacity expansion, technology upgrades, and automation investments by packaging manufacturers seeking efficiency improvements and quality enhancements.

Brand owners gain access to innovative packaging solutions that enhance product protection, extend shelf life, and provide marketing differentiation. Rigid plastic packaging offers design flexibility and cost-effectiveness.

Retailers benefit from packaging solutions that improve product presentation, reduce handling costs, and meet consumer convenience expectations. Standardized packaging facilitates inventory management and logistics efficiency.

Consumers enjoy enhanced product quality, convenience features, and safety benefits provided by advanced rigid plastic packaging solutions. The packaging offers product visibility, easy opening, and reclosability features.

Environmental stakeholders benefit from increasing industry focus on sustainability, recyclability, and circular economy principles. The development of eco-friendly packaging solutions addresses environmental concerns while maintaining functionality.

Government entities gain from industrial development, employment creation, and export potential associated with packaging manufacturing investments. The industry supports economic diversification and technology transfer objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration represents the most significant trend shaping the MEA rigid plastic packaging market. Manufacturers are investing heavily in recycled content incorporation, lightweight design optimization, and end-of-life recyclability improvements. This trend is driven by regulatory requirements and consumer environmental awareness.

Smart Packaging Adoption is gaining momentum with integration of QR codes, NFC tags, and sensor technologies that provide product information, authentication, and supply chain tracking capabilities. These features enhance consumer engagement and brand protection.

Premiumization Trend reflects growing consumer willingness to pay higher prices for superior packaging aesthetics, functionality, and sustainability credentials. This trend is particularly strong in cosmetics, pharmaceuticals, and specialty food segments.

Local Manufacturing Expansion is accelerating as companies establish regional production facilities to reduce transportation costs, improve supply chain resilience, and better serve local market requirements. MWR data indicates 34% increase in regional manufacturing investments over the past two years.

Barrier Technology Enhancement focuses on developing advanced coating systems and multi-layer structures that extend product shelf life and reduce food waste. These technologies are particularly important in hot climate conditions prevalent across the MEA region.

Customization Capabilities are expanding as manufacturers invest in flexible production systems that can accommodate smaller batch sizes and specialized customer requirements. This trend supports brand differentiation and market segmentation strategies.

Digital Integration throughout the supply chain includes automated quality control systems, predictive maintenance technologies, and digital customer interfaces that improve efficiency and customer service capabilities.

Strategic acquisitions and partnerships are reshaping the competitive landscape as companies seek to expand geographic coverage, enhance technology capabilities, and achieve economies of scale. Recent consolidation activities demonstrate industry maturation and growth strategies.

Manufacturing facility expansions across key MEA markets reflect growing demand and companies’ commitment to regional market development. New production facilities incorporate advanced technologies and sustainability features to meet evolving market requirements.

Technology licensing agreements between international technology providers and regional manufacturers are accelerating innovation adoption and capability development. These partnerships facilitate knowledge transfer and market entry strategies.

Sustainability initiatives including closed-loop recycling programs, renewable energy adoption, and waste reduction projects demonstrate industry commitment to environmental responsibility and circular economy principles.

Regulatory compliance investments in quality management systems, testing laboratories, and certification processes ensure market access and customer confidence in product quality and safety standards.

Research and development collaborations with universities, research institutions, and technology partners are driving innovation in materials science, manufacturing processes, and packaging design capabilities.

Market entry strategies by international players include joint ventures, distribution partnerships, and direct investment approaches tailored to specific regional market characteristics and regulatory requirements.

Investment prioritization should focus on sustainability technologies, automation capabilities, and regional manufacturing expansion to capture growing market opportunities while addressing environmental concerns and operational efficiency requirements.

Market entry strategies for new participants should emphasize partnerships with established local distributors, compliance with regional regulatory standards, and understanding of cultural preferences that influence packaging design and functionality requirements.

Product development focus should prioritize lightweight designs, enhanced barrier properties, and smart packaging features that provide value-added benefits to customers while reducing environmental impact and manufacturing costs.

Geographic expansion should target high-growth markets in Africa while maintaining strong positions in established GCC markets. Phased expansion approaches can minimize risks while capturing growth opportunities.

Technology investment priorities should include advanced molding technologies, quality control systems, and digital integration capabilities that improve manufacturing efficiency and product quality consistency.

Sustainability strategy development should encompass recycled content integration, circular economy participation, and life cycle assessment capabilities that demonstrate environmental responsibility and regulatory compliance.

Customer relationship management should emphasize technical support, customization capabilities, and long-term partnership approaches that create competitive advantages and customer loyalty in increasingly competitive markets.

Long-term growth prospects for the MEA rigid plastic packaging market remain highly positive, supported by continued economic development, population growth, and increasing consumer goods consumption across the region. The market is expected to maintain robust growth momentum over the next decade.

Technology evolution will continue driving market advancement through materials innovation, manufacturing process improvements, and smart packaging integration. These developments will create new market segments and applications while improving existing product performance.

Sustainability transformation will accelerate as regulatory requirements strengthen and consumer awareness increases. Companies investing early in sustainable technologies and circular economy solutions will gain competitive advantages and market leadership positions.

Regional integration through trade agreements and economic partnerships will facilitate market expansion and reduce trade barriers. This integration will create larger addressable markets and economies of scale opportunities for manufacturers.

Digital transformation will reshape industry operations through automation, data analytics, and customer interface technologies. Companies embracing digital technologies will achieve operational excellence and enhanced customer service capabilities.

Market maturation in established segments will drive companies toward innovation, specialization, and value-added services to maintain growth and profitability. This evolution will create opportunities for premium positioning and market differentiation.

Investment attraction will continue as the packaging sector demonstrates stable returns, growth potential, and strategic importance to regional economic development objectives. According to MarkWide Research projections, the market will experience compound annual growth exceeding 6% through the forecast period.

The MEA rigid plastic packaging market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, economic development, and changing consumer preferences across the Middle East and Africa region. The market benefits from strong fundamentals including urbanization, rising disposable incomes, and expanding retail infrastructure that support sustained demand growth.

Strategic opportunities abound for companies willing to invest in sustainability technologies, regional manufacturing capabilities, and customer-focused innovation. The market’s evolution toward premium segments, smart packaging features, and environmentally responsible solutions creates multiple avenues for growth and differentiation.

Competitive success will increasingly depend on companies’ ability to balance cost-effectiveness with sustainability requirements, technological advancement with market accessibility, and global expertise with local market understanding. The most successful participants will be those who can navigate regulatory complexity while delivering superior customer value.

Future market leadership will belong to companies that embrace sustainability as a core business strategy, invest in advanced manufacturing technologies, and develop deep customer relationships based on technical expertise and service excellence. The MEA rigid plastic packaging market offers compelling opportunities for growth, innovation, and long-term value creation in an increasingly important global region.

What is Rigid Plastic Packaging?

Rigid plastic packaging refers to containers made from plastic that maintain their shape and do not deform under normal handling. This type of packaging is commonly used for products such as food, beverages, and consumer goods due to its durability and versatility.

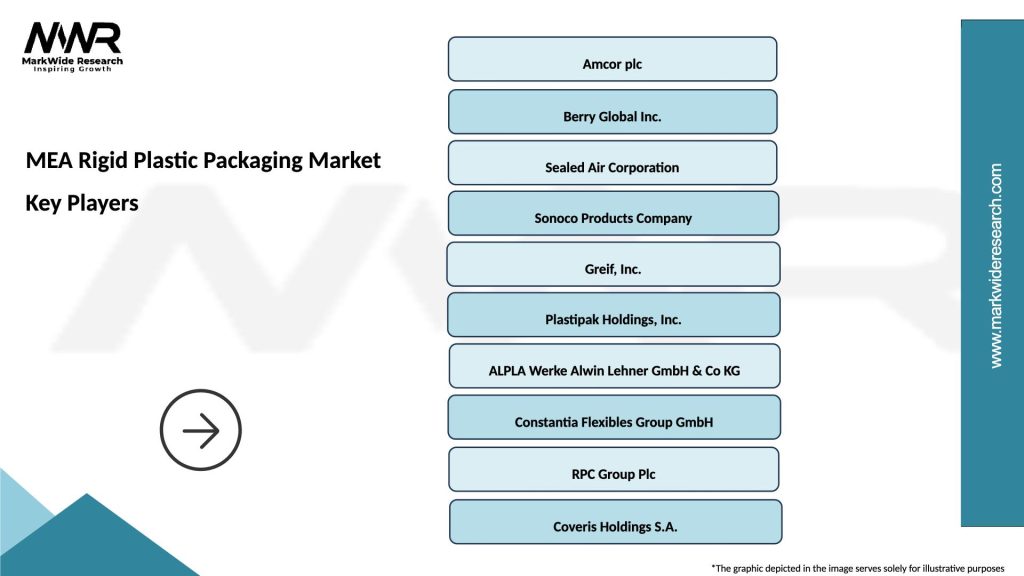

What are the key companies in the MEA Rigid Plastic Packaging Market?

Key companies in the MEA Rigid Plastic Packaging Market include Amcor, Berry Global, and Sealed Air, among others. These companies are known for their innovative packaging solutions and extensive product offerings across various industries.

What are the growth factors driving the MEA Rigid Plastic Packaging Market?

The growth of the MEA Rigid Plastic Packaging Market is driven by increasing demand for convenience packaging, rising consumer awareness about product safety, and the expansion of the food and beverage industry. Additionally, the shift towards sustainable packaging solutions is also contributing to market growth.

What challenges does the MEA Rigid Plastic Packaging Market face?

The MEA Rigid Plastic Packaging Market faces challenges such as regulatory pressures regarding plastic waste and recycling, fluctuating raw material prices, and competition from alternative packaging materials. These factors can impact production costs and market dynamics.

What opportunities exist in the MEA Rigid Plastic Packaging Market?

Opportunities in the MEA Rigid Plastic Packaging Market include the development of biodegradable and recyclable packaging solutions, as well as innovations in design and functionality. The growing e-commerce sector also presents new avenues for rigid plastic packaging applications.

What trends are shaping the MEA Rigid Plastic Packaging Market?

Trends in the MEA Rigid Plastic Packaging Market include the increasing adoption of smart packaging technologies, the rise of sustainable materials, and the focus on lightweight packaging solutions. These trends are driven by consumer preferences for eco-friendly products and enhanced user experiences.

MEA Rigid Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Containers, Trays, Tubs |

| Packaging Type | Flexible, Rigid, Semi-Rigid, Blister |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household |

| Material | Polyethylene, Polypropylene, Polystyrene, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Rigid Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at