444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The MEA pipeline security market refers to the market for security solutions and services specifically designed to protect pipelines in the Middle East and Africa (MEA) region. Pipelines play a crucial role in the transportation of oil, gas, and other valuable resources across vast distances. However, they are also vulnerable to various threats such as sabotage, theft, vandalism, and terrorist attacks. The MEA pipeline security market offers a range of innovative solutions and technologies to safeguard these critical infrastructure assets.

Meaning

MEA pipeline security encompasses the measures, systems, and technologies deployed to protect pipelines from unauthorized access, physical damage, and other security risks. It involves a comprehensive approach that includes the implementation of surveillance systems, intrusion detection systems, access control measures, and security personnel. The primary goal of pipeline security is to ensure the uninterrupted flow of resources while minimizing the risks associated with potential security breaches.

Executive Summary

The MEA pipeline security market is witnessing significant growth due to the increasing emphasis on safeguarding critical energy infrastructure. With the rising incidents of pipeline attacks and thefts in the region, governments and pipeline operators are investing heavily in advanced security solutions. These solutions provide real-time monitoring, threat detection, and rapid response capabilities, thus enhancing the overall security posture of pipelines in the MEA region.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MEA pipeline security market is driven by a combination of factors, including the increasing threat landscape, technological advancements, regulatory compliance, and investment in infrastructure development. These factors are creating a conducive environment for the growth of pipeline security solutions and services in the region. However, challenges such as high implementation costs, lack of skilled workforce, geographical constraints, and the evolving nature of security risks pose obstacles to market growth. To capitalize on the market opportunities, pipeline security providers need to continuously innovate and offer comprehensive solutions that address the unique security requirements of the MEA region.

Regional Analysis

The MEA pipeline security market can be segmented into various regions, including the Middle East and North Africa. The Middle East region, comprising countries such as Saudi Arabia, UAE, Qatar, and Iran, holds significant market potential due to its extensive oil and gas infrastructure. The North Africa region, including countries like Algeria, Egypt, and Libya, also presents opportunities for pipeline security providers. These regions are witnessing increasing investments in pipeline infrastructure, which drives the demand for robust security solutions.

Competitive Landscape

Leading Companies in the MEA Pipeline Security Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

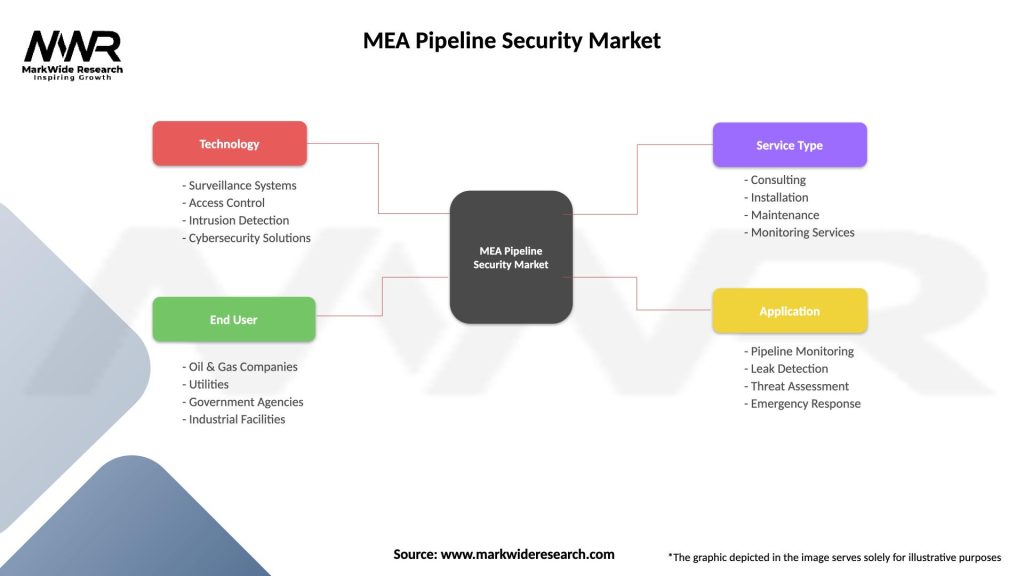

The MEA pipeline security market can be segmented based on the following:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the MEA pipeline security market. On one hand, the pandemic has disrupted supply chains, slowed down construction projects, and reduced demand for energy resources, affecting new pipeline investments. This temporary slowdown has impacted the market growth to some extent.

However, the pandemic has also highlighted the importance of secure and reliable energy infrastructure. Governments and pipeline operators have recognized the need for resilient pipeline systems to ensure the uninterrupted supply of essential resources. This realization has led to increased investments in pipeline security to protect against potential threats, including those arising from the pandemic, such as increased cyberattacks targeting critical infrastructure.

The pandemic has also accelerated the adoption of digital technologies and remote monitoring solutions. With travel restrictions and limited on-site presence, pipeline operators are increasingly relying on advanced surveillance systems and remote monitoring capabilities to ensure pipeline security during these challenging times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The MEA pipeline security market is expected to grow steadily in the coming years. The increasing investments in pipeline infrastructure, stringent regulatory requirements, and growing security threats are key factors driving the market. The adoption of advanced surveillance systems, cybersecurity solutions, and integration of AI and big data analytics will shape the future of pipeline security in the region. Collaboration between industry stakeholders and continuous innovation in security technologies will be crucial for addressing emerging challenges and ensuring the resilience of pipeline infrastructure.

Conclusion

The MEA pipeline security market is witnessing significant growth due to the increasing emphasis on safeguarding critical energy infrastructure. The market offers a range of solutions and services to protect pipelines from physical attacks, thefts, and cyber threats. The adoption of advanced surveillance systems, cybersecurity solutions, and integration of AI and big data analytics are key trends in the market. Although challenges such as high implementation costs and the shortage of skilled workforce exist, collaboration, innovation, and strategic partnerships present opportunities for pipeline security providers. As governments and pipeline operators recognize the importance of resilient pipeline systems, the market is poised for steady growth in the coming years.

What is Pipeline Security?

Pipeline Security refers to the measures and technologies implemented to protect pipeline infrastructure from threats such as sabotage, theft, and natural disasters. This includes physical security, surveillance systems, and cybersecurity protocols to ensure the safe transport of oil, gas, and other materials.

What are the key players in the MEA Pipeline Security Market?

Key players in the MEA Pipeline Security Market include companies like Honeywell, Siemens, and Schneider Electric, which provide advanced security solutions and technologies for pipeline protection. These companies focus on integrating physical security with digital monitoring systems, among others.

What are the main drivers of the MEA Pipeline Security Market?

The main drivers of the MEA Pipeline Security Market include the increasing incidents of pipeline vandalism and terrorism, the growing demand for energy security, and the need for regulatory compliance in the oil and gas sector. Additionally, advancements in technology are enabling more effective security solutions.

What challenges does the MEA Pipeline Security Market face?

The MEA Pipeline Security Market faces challenges such as the high costs associated with implementing advanced security systems and the complexity of integrating new technologies with existing infrastructure. Additionally, the evolving nature of threats requires continuous updates and adaptations to security measures.

What opportunities exist in the MEA Pipeline Security Market?

Opportunities in the MEA Pipeline Security Market include the development of innovative security technologies such as drones and AI-based monitoring systems. There is also potential for growth in cybersecurity solutions as the industry increasingly digitizes its operations.

What trends are shaping the MEA Pipeline Security Market?

Trends shaping the MEA Pipeline Security Market include the integration of IoT devices for real-time monitoring, the use of big data analytics for threat assessment, and a shift towards more comprehensive security frameworks that combine physical and cyber defenses. These trends are enhancing the overall security posture of pipeline operations.

MEA Pipeline Security Market

| Segmentation Details | Description |

|---|---|

| Technology | Surveillance Systems, Access Control, Intrusion Detection, Cybersecurity Solutions |

| End User | Oil & Gas Companies, Utilities, Government Agencies, Industrial Facilities |

| Service Type | Consulting, Installation, Maintenance, Monitoring Services |

| Application | Pipeline Monitoring, Leak Detection, Threat Assessment, Emergency Response |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the MEA Pipeline Security Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at