444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA military aviation market represents a critical component of the region’s defense infrastructure, encompassing advanced aircraft systems, maintenance services, and technological innovations across the Middle East and Africa. Regional governments are increasingly investing in modernizing their air force capabilities to address evolving security challenges and maintain strategic defense positions. The market demonstrates robust growth potential driven by geopolitical tensions, counter-terrorism operations, and the need for advanced surveillance capabilities.

Military aviation procurement in the MEA region has experienced significant expansion, with countries prioritizing fighter jets, transport aircraft, helicopters, and unmanned aerial vehicles. The market benefits from substantial defense budgets allocated by oil-rich nations and strategic partnerships with international defense contractors. Growth rates in the sector indicate a 6.2% CAGR projected over the forecast period, reflecting sustained investment in aerial defense capabilities.

Technological advancement remains a key driver, with regional air forces seeking next-generation aircraft equipped with advanced avionics, stealth capabilities, and precision strike systems. The integration of artificial intelligence and autonomous systems is reshaping military aviation operations, enhancing mission effectiveness and operational efficiency across diverse combat scenarios.

The MEA military aviation market refers to the comprehensive ecosystem of military aircraft procurement, maintenance, modernization, and support services across Middle Eastern and African nations. This market encompasses fixed-wing aircraft, rotary-wing platforms, unmanned systems, and associated defense technologies designed for military operations, surveillance, and strategic defense applications.

Military aviation systems in this context include fighter aircraft, transport planes, attack helicopters, reconnaissance platforms, and emerging drone technologies. The market covers both new aircraft acquisitions and upgrade programs for existing fleets, along with comprehensive maintenance, repair, and overhaul services that ensure operational readiness and mission capability.

Regional defense priorities shape market dynamics, with countries investing in air superiority platforms, close air support capabilities, and strategic airlift capacity. The market also includes training systems, simulation technologies, and pilot development programs essential for maintaining professional military aviation forces capable of addressing contemporary security challenges.

Strategic defense investments across the MEA region are driving unprecedented growth in military aviation capabilities, with nations prioritizing air force modernization to address regional security challenges. The market demonstrates strong momentum supported by government defense spending, international partnerships, and technological advancement initiatives that enhance operational effectiveness.

Key market segments include combat aircraft, transport platforms, helicopter systems, and unmanned aerial vehicles, each experiencing distinct growth patterns based on operational requirements and strategic priorities. Fighter aircraft procurement represents the largest segment, driven by air superiority needs and multi-role capability requirements across diverse mission profiles.

Regional market dynamics reflect varying investment patterns, with Gulf Cooperation Council countries leading procurement activities while African nations focus on cost-effective solutions and capability building. Technology transfer agreements and local manufacturing initiatives are becoming increasingly important, with 35% of new contracts including industrial participation requirements that support domestic defense industry development.

Future market prospects remain positive, supported by ongoing geopolitical tensions, counter-terrorism operations, and the need for advanced surveillance capabilities. The integration of next-generation technologies, including artificial intelligence and autonomous systems, is expected to create new opportunities for market expansion and capability enhancement.

Market analysis reveals several critical insights that define the MEA military aviation landscape and influence procurement decisions across the region:

Geopolitical tensions across the MEA region serve as the primary catalyst for military aviation investment, with nations seeking to maintain strategic defense capabilities and deter potential threats. Regional conflicts and security challenges necessitate advanced air power projection capabilities, driving demand for modern fighter aircraft, surveillance platforms, and precision strike systems.

Counter-terrorism operations require specialized aviation assets capable of conducting intelligence, surveillance, and reconnaissance missions in challenging environments. Military forces increasingly rely on helicopter platforms and unmanned systems to support ground operations, border security, and anti-insurgency campaigns that demand persistent aerial presence and rapid response capabilities.

Modernization programs for aging aircraft fleets create substantial procurement opportunities as countries replace legacy systems with advanced platforms featuring improved performance, reliability, and mission effectiveness. Technology obsolescence in existing fleets drives upgrade programs and new aircraft acquisitions that incorporate cutting-edge avionics, weapons systems, and defensive countermeasures.

Economic diversification initiatives in oil-rich nations include defense industry development as a strategic priority, creating demand for technology transfer agreements and local manufacturing capabilities. Industrial participation requirements in major procurement programs support domestic defense sector growth while reducing long-term dependency on foreign suppliers and enhancing supply chain resilience.

Budget constraints in several MEA countries limit military aviation procurement, particularly for nations facing economic challenges or reduced oil revenues that impact defense spending allocations. Fiscal pressures require governments to prioritize essential defense capabilities while deferring non-critical acquisitions, affecting market growth potential in certain segments.

Technology transfer restrictions imposed by supplier nations can limit access to advanced military aviation systems, particularly for countries subject to arms embargoes or export control regulations. International sanctions and diplomatic tensions may restrict procurement options and complicate maintenance support for existing aircraft fleets, creating operational challenges.

Infrastructure limitations in some regions constrain the deployment and operation of advanced military aircraft, requiring substantial investments in airfield facilities, maintenance capabilities, and support infrastructure. Technical expertise shortages limit the ability to operate and maintain sophisticated aviation systems, necessitating extensive training programs and foreign technical assistance.

Long procurement cycles and complex acquisition processes can delay critical capability development, particularly for large-scale programs requiring extensive evaluation, negotiation, and approval procedures. Political instability in certain regions may disrupt defense planning and procurement activities, creating uncertainty for both suppliers and military organizations seeking to modernize their aviation capabilities.

Unmanned systems integration presents significant growth opportunities as military forces recognize the strategic value of drone technologies for surveillance, reconnaissance, and precision strike operations. UAV platforms offer cost-effective solutions for persistent monitoring, border security, and counter-terrorism missions while reducing risk to human operators in dangerous environments.

Maintenance and sustainment services represent expanding market segments as countries seek comprehensive support solutions for their growing aircraft fleets. Long-term service contracts provide predictable revenue streams for suppliers while ensuring operational readiness and mission availability for military operators throughout aircraft service lives.

Technology upgrade programs create opportunities for avionics modernization, weapons system integration, and capability enhancement of existing aircraft platforms. Retrofit solutions allow countries to extend aircraft service lives while incorporating advanced technologies at lower costs than complete fleet replacement programs.

Regional manufacturing partnerships offer opportunities for international suppliers to establish local production capabilities while meeting industrial participation requirements. Joint ventures and technology transfer agreements can create sustainable business models that support long-term market presence and customer relationship development across the MEA region.

Supply chain complexity characterizes the MEA military aviation market, with procurement programs involving multiple international suppliers, technology partners, and local industrial participants. Global defense contractors must navigate varying regulatory requirements, export control restrictions, and industrial participation mandates while delivering advanced aviation capabilities to regional customers.

Competition intensity has increased as established aerospace companies compete with emerging suppliers offering cost-effective alternatives and flexible financing arrangements. Market dynamics favor suppliers capable of providing comprehensive solutions including aircraft platforms, support services, training programs, and technology transfer agreements that address customer requirements holistically.

Customer sophistication continues to evolve as regional air forces develop greater technical expertise and operational experience with advanced aviation systems. Procurement decisions increasingly emphasize total cost of ownership, operational effectiveness, and long-term sustainment considerations rather than initial acquisition costs alone.

Technology convergence is reshaping market dynamics as traditional aviation systems integrate with emerging technologies including artificial intelligence, autonomous systems, and advanced sensors. Innovation cycles are accelerating, requiring suppliers to continuously invest in research and development while maintaining competitive pricing and delivery schedules for current generation systems.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into MEA military aviation market dynamics, trends, and growth prospects. Primary research activities include structured interviews with defense officials, military aviation experts, industry executives, and procurement specialists across the region to gather firsthand market intelligence.

Secondary research encompasses analysis of government defense budgets, procurement announcements, industry reports, and regulatory documentation to establish market baselines and identify emerging trends. Data validation processes cross-reference multiple sources to ensure accuracy and reliability of market information and statistical projections.

Market segmentation analysis examines procurement patterns across different aircraft categories, regional markets, and customer segments to identify growth opportunities and competitive dynamics. Quantitative modeling incorporates historical data, current market conditions, and future projections to develop realistic growth scenarios and market forecasts.

Expert consultation with industry specialists, military aviation professionals, and regional defense analysts provides qualitative insights that complement quantitative data analysis. Continuous monitoring of market developments, policy changes, and technological advancement ensures research findings remain current and relevant for strategic decision-making purposes.

Gulf Cooperation Council countries dominate MEA military aviation procurement, accounting for approximately 68% of regional defense spending on aviation systems. Saudi Arabia and UAE lead investment activities with comprehensive air force modernization programs that include advanced fighter aircraft, transport platforms, and helicopter systems designed to enhance regional security capabilities.

North African markets demonstrate growing interest in cost-effective military aviation solutions, with countries like Egypt and Morocco pursuing balanced procurement strategies that combine new aircraft acquisitions with upgrade programs for existing fleets. Regional cooperation initiatives are fostering joint procurement programs and shared training facilities that optimize resource utilization.

Sub-Saharan Africa represents an emerging market segment with increasing defense aviation investments driven by counter-terrorism operations and border security requirements. Nigeria and South Africa lead regional procurement activities, focusing on multi-role aircraft and helicopter platforms suitable for diverse operational environments and mission profiles.

Market distribution patterns reflect varying economic capabilities and security priorities across the region, with oil-rich nations investing in advanced combat aircraft while other countries prioritize transport and surveillance platforms. Regional partnerships and technology sharing agreements are becoming increasingly important for smaller markets seeking to develop indigenous aviation capabilities through collaborative programs.

International aerospace companies dominate the MEA military aviation market, with established suppliers leveraging decades of experience and proven track records to secure major procurement contracts. Market leadership positions are maintained through continuous innovation, comprehensive support services, and strategic partnerships with regional governments and defense organizations.

Key market participants include:

Competitive strategies increasingly emphasize technology transfer, local manufacturing, and comprehensive lifecycle support to differentiate offerings and meet customer requirements for industrial participation and capability development.

By Aircraft Type:

By Application:

By End User:

Fighter Aircraft Segment represents the largest market category, driven by regional air forces seeking advanced combat capabilities and air superiority platforms. Multi-role fighters are particularly popular due to their versatility and cost-effectiveness, allowing countries to address multiple mission requirements with single aircraft types. Technology advancement in avionics, weapons systems, and stealth capabilities continues to drive procurement decisions and upgrade programs.

Transport Aircraft Category experiences steady growth as military forces recognize the importance of strategic mobility and logistics support capabilities. Tactical transports and cargo aircraft enable rapid deployment of personnel and equipment across vast regional distances, supporting both peacetime operations and emergency response missions. Aerial refueling capabilities are increasingly important for extending fighter aircraft range and operational flexibility.

Helicopter Segment demonstrates robust growth driven by counter-terrorism operations, border security missions, and close air support requirements. Attack helicopters provide precision firepower and battlefield mobility, while transport helicopters enable rapid troop deployment and casualty evacuation in challenging terrain. Utility helicopters serve diverse roles including search and rescue, VIP transport, and disaster response operations.

Unmanned Systems Category represents the fastest-growing segment, with 12.4% annual growth reflecting increasing adoption of drone technologies across military applications. Surveillance UAVs provide persistent monitoring capabilities while reducing risk to human operators, making them ideal for border patrol and intelligence gathering missions in hostile environments.

Defense contractors benefit from substantial procurement opportunities across diverse aircraft categories and support services, enabling long-term revenue growth and market expansion in the strategically important MEA region. Technology transfer requirements create opportunities for establishing local partnerships and manufacturing facilities that provide sustainable competitive advantages and customer relationship development.

Regional governments gain access to advanced military aviation capabilities that enhance national security, regional stability, and strategic defense postures. Industrial participation programs support economic diversification objectives while building indigenous defense industry capabilities and reducing long-term dependency on foreign suppliers for critical military systems.

Military organizations receive state-of-the-art aviation platforms and support services that improve operational effectiveness, mission success rates, and force protection capabilities. Comprehensive training programs and maintenance support ensure optimal utilization of advanced systems while developing professional expertise within regional air forces.

Local suppliers and service providers benefit from participation in major procurement programs through subcontracting opportunities, technology transfer agreements, and capability development initiatives. Supply chain integration creates sustainable business opportunities while supporting broader economic development and industrial base strengthening across the region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Autonomous systems integration is transforming military aviation operations, with air forces increasingly adopting unmanned platforms for surveillance, reconnaissance, and combat missions. Artificial intelligence capabilities are being incorporated into aircraft systems to enhance decision-making, target identification, and mission effectiveness while reducing pilot workload and operational risks.

Multi-domain operations are driving demand for aircraft platforms capable of seamless integration with ground, naval, and cyber warfare systems. Network-centric warfare concepts require advanced communication systems and data sharing capabilities that enable real-time coordination across military branches and coalition partners.

Sustainability initiatives are influencing procurement decisions as military organizations seek to reduce environmental impact and operational costs through fuel-efficient aircraft and alternative propulsion technologies. Lifecycle cost optimization has become a critical factor in aircraft selection, with customers prioritizing platforms offering low maintenance requirements and high operational availability.

Modular design approaches are gaining popularity as they enable rapid capability upgrades and mission-specific configurations without requiring complete aircraft replacement. Open architecture systems allow integration of third-party components and future technology insertions, providing flexibility and cost-effectiveness throughout aircraft service lives.

Strategic partnerships between international aerospace companies and regional governments are reshaping market dynamics through technology transfer agreements and local manufacturing initiatives. Joint ventures and industrial cooperation programs are establishing sustainable supply chains while building indigenous defense capabilities across the MEA region.

Advanced manufacturing technologies including 3D printing and digital production methods are being implemented to reduce costs and improve supply chain efficiency. Local assembly facilities are being established in key markets to meet industrial participation requirements while providing responsive customer support and maintenance services.

Next-generation avionics and sensor systems are being integrated into both new aircraft and retrofit programs, enhancing situational awareness and mission effectiveness. Cybersecurity measures are becoming standard features as military aviation systems face increasing threats from digital attacks and electronic warfare capabilities.

Training modernization programs are incorporating virtual reality, simulation technologies, and advanced training systems to improve pilot proficiency while reducing training costs and aircraft utilization. MarkWide Research analysis indicates that 78% of regional air forces are investing in upgraded training capabilities to maximize return on aviation system investments.

Market participants should prioritize technology transfer capabilities and local partnership development to meet growing customer demands for industrial participation and indigenous capability building. Successful suppliers will demonstrate commitment to long-term regional presence through manufacturing investments, training programs, and comprehensive support services that extend beyond initial aircraft delivery.

Investment strategies should focus on emerging technologies including autonomous systems, artificial intelligence, and advanced sensors that represent future growth opportunities. Research and development initiatives should address regional operational requirements including extreme climate conditions, extended range capabilities, and multi-mission flexibility that characterize MEA military aviation needs.

Customer relationship management requires deep understanding of regional security challenges, operational requirements, and procurement processes that vary significantly across different countries and military organizations. Tailored solutions that address specific customer needs while maintaining cost-effectiveness will be essential for competitive success in diverse market segments.

Supply chain resilience should be prioritized to ensure reliable delivery and support services despite potential geopolitical disruptions and export control restrictions. Local sourcing and regional supplier development can provide competitive advantages while meeting customer requirements for supply chain security and industrial participation.

Market growth prospects remain positive through the forecast period, supported by continued defense modernization programs and emerging security challenges that require advanced aviation capabilities. MarkWide Research projections indicate sustained investment in military aviation systems with particular emphasis on multi-role platforms and unmanned systems that provide operational flexibility and cost-effectiveness.

Technology evolution will continue driving market transformation as artificial intelligence, autonomous systems, and advanced materials create new capability opportunities. Next-generation aircraft will feature enhanced stealth characteristics, extended range, and improved survivability that address evolving threat environments and operational requirements across the MEA region.

Regional manufacturing capabilities are expected to expand significantly as countries pursue industrial diversification and defense independence objectives. Technology transfer programs will create opportunities for establishing sustainable aerospace industries while reducing long-term dependency on foreign suppliers for critical military systems and support services.

Market consolidation may occur as smaller suppliers struggle to meet increasing technology and support requirements, while established aerospace companies strengthen their positions through strategic partnerships and local manufacturing investments. Innovation cycles are expected to accelerate, requiring continuous investment in research and development to maintain competitive advantages in rapidly evolving market segments.

The MEA military aviation market represents a dynamic and rapidly evolving sector driven by regional security challenges, defense modernization priorities, and technological advancement opportunities. Strong growth fundamentals supported by substantial defense budgets, geopolitical tensions, and the need for advanced air power capabilities create favorable conditions for sustained market expansion across diverse aircraft categories and support services.

Market success will increasingly depend on suppliers’ ability to provide comprehensive solutions that include technology transfer, local manufacturing, and long-term support services that address customer requirements for industrial participation and capability development. Innovation leadership in emerging technologies such as autonomous systems, artificial intelligence, and advanced sensors will be critical for maintaining competitive positions in this strategically important market.

Future opportunities are substantial for companies that can navigate complex procurement processes, establish sustainable regional partnerships, and deliver advanced aviation capabilities that enhance military effectiveness while supporting broader economic development objectives. The MEA military aviation market will continue to evolve as regional air forces adapt to changing security environments and embrace next-generation technologies that define the future of military aviation operations.

What is Military Aviation?

Military Aviation refers to the use of aircraft and other flying machines for the purposes of conducting military operations, including combat, reconnaissance, and transport. It encompasses various types of aircraft such as fighter jets, transport planes, and unmanned aerial vehicles (UAVs).

What are the key players in the MEA Military Aviation Market?

Key players in the MEA Military Aviation Market include Lockheed Martin, Boeing, and Northrop Grumman, which are known for their advanced military aircraft and technologies. Other notable companies include Airbus and Thales, among others.

What are the main drivers of the MEA Military Aviation Market?

The main drivers of the MEA Military Aviation Market include increasing defense budgets, geopolitical tensions, and the need for modernization of military fleets. Additionally, advancements in technology and the rising demand for unmanned systems are contributing to market growth.

What challenges does the MEA Military Aviation Market face?

The MEA Military Aviation Market faces challenges such as budget constraints, regulatory hurdles, and the complexity of integrating new technologies. Additionally, political instability in certain regions can impact procurement and operational capabilities.

What opportunities exist in the MEA Military Aviation Market?

Opportunities in the MEA Military Aviation Market include the development of advanced drone technologies, increased collaboration between nations for joint military exercises, and the potential for growth in defense exports. The focus on cybersecurity in aviation systems also presents new avenues for innovation.

What trends are shaping the MEA Military Aviation Market?

Trends shaping the MEA Military Aviation Market include the increasing use of artificial intelligence in flight operations, the shift towards more sustainable aviation technologies, and the growing importance of cyber defense in military aviation. Additionally, there is a rising interest in multi-role aircraft that can perform various missions.

MEA Military Aviation Market

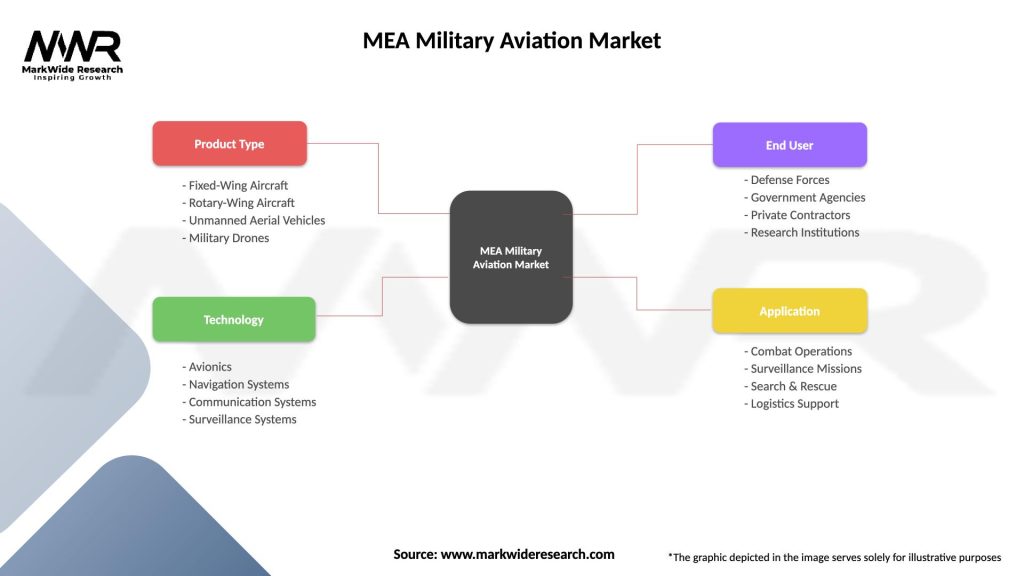

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles, Military Drones |

| Technology | Avionics, Navigation Systems, Communication Systems, Surveillance Systems |

| End User | Defense Forces, Government Agencies, Private Contractors, Research Institutions |

| Application | Combat Operations, Surveillance Missions, Search & Rescue, Logistics Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Military Aviation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at