444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA meal replacement products market represents a rapidly evolving segment within the broader nutrition and wellness industry across the Middle East and Africa region. This dynamic market encompasses a diverse range of products including protein shakes, meal bars, powdered supplements, and ready-to-drink formulations designed to provide complete nutritional profiles as alternatives to traditional meals. Market growth has been particularly robust, with the sector experiencing a 12.4% CAGR over recent years, driven by increasing health consciousness and busy lifestyle demands.

Regional dynamics within the MEA market show significant variation, with the Gulf Cooperation Council (GCC) countries leading adoption rates at approximately 38% market share, followed by South Africa and Egypt as emerging growth markets. The market’s expansion is characterized by rising disposable incomes, urbanization trends, and growing awareness of nutritional supplementation benefits among health-conscious consumers.

Product innovation continues to drive market evolution, with manufacturers focusing on culturally appropriate flavors, halal certification, and locally sourced ingredients to meet regional preferences. The integration of traditional Middle Eastern and African nutritional elements into modern meal replacement formulations has created unique market opportunities, particularly in premium product segments targeting fitness enthusiasts and busy professionals.

The MEA meal replacement products market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and consumption of nutritionally complete food products designed to substitute traditional meals across Middle Eastern and African countries. These products are formulated to provide essential macronutrients, vitamins, minerals, and other nutritional components necessary for maintaining healthy dietary patterns while offering convenience and portion control benefits.

Meal replacement products in this regional context include various formats such as protein powders, ready-to-drink shakes, nutrition bars, meal replacement cookies, and specialized formulations targeting specific dietary requirements including weight management, sports nutrition, and medical nutrition therapy. The market encompasses both international brands adapted for regional preferences and locally developed products incorporating traditional ingredients and flavors.

Market participants range from multinational nutrition companies to regional manufacturers, distributors, and retailers, creating a complex value chain that serves diverse consumer segments across urban and rural markets throughout the MEA region.

Strategic market positioning within the MEA meal replacement products sector reveals a landscape characterized by significant growth potential and evolving consumer preferences. The market demonstrates strong momentum driven by demographic shifts, lifestyle changes, and increasing health awareness among regional populations. Consumer adoption rates have shown consistent improvement, with urban markets leading the trend at approximately 45% higher penetration compared to rural areas.

Key market drivers include rising obesity rates, growing fitness culture, increasing female workforce participation, and expanding retail infrastructure across major metropolitan areas. The market benefits from supportive regulatory environments in several countries, particularly regarding nutritional labeling and health claims, which enhance consumer confidence and product accessibility.

Competitive dynamics reflect a mix of established international players and emerging regional brands, with market leaders focusing on product localization, distribution network expansion, and strategic partnerships with local retailers and fitness centers. Innovation trends emphasize natural ingredients, sustainable packaging, and culturally relevant flavor profiles that resonate with diverse regional tastes and dietary preferences.

Consumer behavior analysis reveals several critical insights shaping market development across the MEA region:

Lifestyle transformation across the MEA region serves as the primary catalyst for meal replacement product adoption. Rapid urbanization, increasing work pressures, and changing family structures have created substantial demand for convenient nutrition solutions that align with modern lifestyle requirements. Time constraints experienced by working professionals, particularly in major cities like Dubai, Riyadh, and Johannesburg, drive consistent market growth as consumers seek efficient alternatives to traditional meal preparation.

Health consciousness trends represent another significant driver, with rising awareness of nutrition’s role in preventing lifestyle diseases and maintaining optimal wellness. The growing prevalence of obesity and diabetes across the region has heightened consumer focus on portion control and balanced nutrition, areas where meal replacement products offer clear advantages. Fitness culture expansion particularly among younger demographics has created strong demand for sports nutrition and performance-oriented meal replacement solutions.

Economic factors including rising disposable incomes in oil-rich nations and expanding middle-class populations across Africa contribute to market accessibility and premium product adoption. Additionally, increasing female workforce participation has created demand for convenient nutrition solutions that support busy professional lifestyles while maintaining health and wellness goals.

Cultural barriers present significant challenges to market expansion, particularly in traditional communities where communal dining and home-cooked meals hold deep cultural significance. Consumer skepticism regarding processed nutrition products versus traditional food sources remains prevalent in certain market segments, limiting adoption rates among older demographics and rural populations.

Regulatory complexities across different MEA countries create operational challenges for manufacturers and distributors. Varying standards for nutritional labeling, health claims, and import regulations require substantial compliance investments and can delay product launches. Price sensitivity in emerging markets limits premium product penetration, while economic volatility in certain regions affects consumer spending on non-essential nutrition products.

Supply chain constraints including limited cold storage infrastructure, distribution network gaps in remote areas, and import dependency for key ingredients create operational challenges. Additionally, taste preferences and flavor expectations vary significantly across the diverse MEA region, requiring substantial product adaptation investments that may not always guarantee market success.

Product innovation opportunities abound in developing culturally appropriate formulations that incorporate traditional ingredients and flavors while meeting modern nutritional standards. Halal certification presents a significant opportunity for market expansion, as products meeting Islamic dietary requirements can access broader consumer bases across Muslim-majority countries in the region.

Digital transformation offers substantial growth potential through e-commerce platforms, mobile applications, and direct-to-consumer marketing strategies. The increasing smartphone penetration and internet connectivity across the region create opportunities for personalized nutrition programs and subscription-based delivery services that enhance customer engagement and loyalty.

Partnership opportunities with healthcare providers, fitness centers, and corporate wellness programs can drive market expansion through professional endorsements and institutional sales channels. Medical nutrition therapy represents an underexplored segment with significant potential, particularly for products designed to support specific health conditions prevalent in the region.

Competitive intensity within the MEA meal replacement products market continues to escalate as both international and regional players vie for market share across diverse consumer segments. Market consolidation trends are emerging as larger companies acquire regional brands to expand their geographic footprint and gain access to local market knowledge and distribution networks.

Innovation cycles are accelerating, with companies investing heavily in research and development to create products that address specific regional health concerns and taste preferences. Sustainability initiatives are becoming increasingly important, with consumers showing growing preference for environmentally responsible packaging and ethically sourced ingredients.

Pricing dynamics reflect the diverse economic conditions across the region, with premium positioning successful in affluent markets while value-oriented strategies prove more effective in price-sensitive segments. Distribution evolution shows a clear shift toward omnichannel approaches, combining traditional retail with digital platforms to maximize market reach and customer convenience.

Comprehensive market analysis for the MEA meal replacement products market employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability. Primary research includes extensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions across key markets including UAE, Saudi Arabia, South Africa, Nigeria, and Egypt.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, and trade association data to provide comprehensive market context. Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure research findings meet the highest standards of accuracy and reliability.

Market segmentation analysis utilizes advanced statistical modeling techniques to identify key consumer segments, product categories, and regional variations. Trend analysis incorporates historical data patterns, current market indicators, and forward-looking projections to provide actionable insights for market participants and stakeholders.

Gulf Cooperation Council countries maintain market leadership within the MEA region, with the UAE and Saudi Arabia demonstrating the highest consumption rates and premium product adoption. Market maturity in these markets is reflected in sophisticated distribution networks, strong brand awareness, and consumer willingness to invest in high-quality nutrition products. The region benefits from high disposable incomes, health-conscious populations, and supportive regulatory environments that facilitate market growth.

North African markets including Egypt and Morocco show strong growth potential driven by large populations, increasing urbanization, and rising health awareness. Market development in these regions focuses on affordable product options and local flavor preferences, with significant opportunities for brands that can successfully adapt to regional tastes and price points.

Sub-Saharan Africa represents the fastest-growing segment, with countries like South Africa, Nigeria, and Kenya leading adoption trends. Market expansion is supported by growing middle-class populations, increasing fitness awareness, and improving retail infrastructure. However, price sensitivity remains a key consideration, with successful brands focusing on value propositions and accessible product formats.

Market leadership within the MEA meal replacement products sector is characterized by a diverse mix of international nutrition giants and emerging regional players, each leveraging unique strengths to capture market share across different consumer segments and geographic markets.

Competitive strategies emphasize product localization, strategic partnerships with regional distributors, and investment in marketing campaigns that resonate with local cultural values and health priorities.

Product type segmentation reveals distinct market dynamics across different meal replacement categories:

By Product Format:

By Application:

By Distribution Channel:

Weight management products dominate the MEA meal replacement market, reflecting widespread concerns about obesity and lifestyle-related health issues across the region. Consumer preferences in this category emphasize products with proven efficacy, natural ingredients, and sustainable weight loss support. The segment benefits from strong marketing support and healthcare professional endorsements, particularly in GCC markets where premium positioning is successful.

Sports nutrition meal replacements represent the fastest-growing category, driven by expanding fitness culture and increasing participation in recreational and competitive sports. Product innovation focuses on performance enhancement, recovery support, and convenience for active lifestyles. This segment shows particular strength among younger demographics and urban populations with access to fitness facilities and sports programs.

Medical nutrition products serve specialized market needs, particularly for patients with diabetes, cardiovascular conditions, and digestive disorders. Regulatory compliance and clinical validation are critical success factors in this segment, with products requiring healthcare professional recommendations and often reimbursement support from insurance providers.

Manufacturers benefit from expanding market opportunities across diverse consumer segments and geographic regions within the MEA market. Revenue diversification through multiple product categories and distribution channels provides stability and growth potential, while increasing consumer health awareness creates sustainable demand for innovative nutrition solutions.

Retailers and distributors gain access to high-margin product categories with strong consumer loyalty and repeat purchase patterns. Market expansion opportunities include both traditional retail channels and emerging e-commerce platforms, allowing for comprehensive market coverage and customer reach optimization.

Healthcare professionals benefit from evidence-based nutrition tools that support patient care and wellness programs. Professional endorsement opportunities create additional revenue streams while contributing to improved patient outcomes and health education initiatives.

Consumers receive convenient access to nutritionally complete meal alternatives that support health goals, lifestyle requirements, and dietary preferences. Product variety ensures options for different needs, budgets, and taste preferences across the diverse MEA region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trends are reshaping the MEA meal replacement products market, with consumers increasingly seeking customized nutrition solutions tailored to individual health goals, dietary restrictions, and lifestyle requirements. Technology integration enables brands to offer personalized recommendations through mobile applications and online platforms, creating enhanced customer engagement and loyalty.

Clean label movement continues gaining momentum, with consumers demanding transparency in ingredient sourcing, processing methods, and nutritional content. Natural ingredients and minimal processing approaches are becoming key differentiators, particularly among health-conscious consumers willing to pay premium prices for perceived quality and safety benefits.

Sustainability initiatives are becoming increasingly important, with brands investing in eco-friendly packaging, sustainable ingredient sourcing, and carbon footprint reduction programs. Consumer awareness of environmental issues is driving demand for products that align with sustainability values, creating competitive advantages for environmentally responsible brands.

Functional nutrition trends emphasize products that provide specific health benefits beyond basic nutrition, including immune support, cognitive enhancement, and digestive health. Ingredient innovation incorporates probiotics, adaptogens, and other functional components that address specific health concerns prevalent in the MEA region.

Strategic partnerships between international nutrition companies and regional distributors have accelerated market expansion across the MEA region. MarkWide Research analysis indicates that these collaborations have improved product accessibility and local market knowledge, resulting in more effective marketing strategies and distribution network optimization.

Product innovation initiatives focus on developing culturally appropriate formulations that incorporate traditional Middle Eastern and African ingredients while meeting international nutritional standards. Halal certification programs have expanded significantly, with major brands investing in certification processes to access broader Muslim consumer markets across the region.

Digital transformation projects have revolutionized customer engagement and sales channels, with companies launching mobile applications, subscription services, and personalized nutrition programs. E-commerce platform development has been particularly significant in markets with limited traditional retail infrastructure, enabling direct-to-consumer sales and improved market penetration.

Regulatory harmonization efforts across several MEA countries have simplified compliance requirements and facilitated cross-border trade in nutrition products. Standardization initiatives for labeling requirements and health claims have reduced regulatory complexity and enabled more efficient market entry strategies for international brands.

Market entry strategies should prioritize cultural sensitivity and local market adaptation to achieve sustainable success in the diverse MEA region. Investment priorities should focus on understanding regional taste preferences, dietary habits, and health concerns to develop products that resonate with target consumers and differentiate from competitive offerings.

Distribution network development requires a multi-channel approach combining traditional retail partnerships with emerging digital platforms to maximize market reach and customer convenience. Partnership strategies with local distributors, healthcare providers, and fitness centers can accelerate market penetration and build brand credibility through professional endorsements.

Product portfolio optimization should include both premium offerings for affluent markets and value-oriented products for price-sensitive segments. Innovation investments should emphasize functional benefits, natural ingredients, and sustainable packaging to align with evolving consumer preferences and regulatory requirements.

Marketing strategies must address cultural nuances and health priorities specific to each market while building brand trust through transparency, quality assurance, and professional endorsements. Digital marketing initiatives should leverage social media platforms and influencer partnerships to reach younger demographics and build brand awareness across the region.

Market trajectory for MEA meal replacement products indicates continued robust growth driven by demographic trends, lifestyle changes, and increasing health consciousness across the region. Growth projections suggest the market will maintain strong momentum with an estimated 11.8% CAGR over the next five years, supported by expanding urban populations and rising disposable incomes in key markets.

Technology integration will play an increasingly important role in market development, with artificial intelligence, personalized nutrition algorithms, and mobile health applications creating new opportunities for customer engagement and product customization. MWR forecasts indicate that digital channels will account for an increasing share of total sales, particularly among younger consumer segments.

Product innovation trends will continue emphasizing functional nutrition, sustainability, and cultural adaptation to meet evolving consumer expectations and regulatory requirements. Market consolidation is expected to accelerate as larger companies acquire regional brands and smaller players to expand their geographic footprint and product portfolios.

Regulatory evolution will likely bring increased standardization across the region, facilitating cross-border trade and reducing compliance complexity for international brands. Healthcare integration opportunities will expand as medical nutrition therapy gains recognition and reimbursement support in developed markets within the region.

The MEA meal replacement products market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse consumer segments and geographic regions. Market fundamentals remain strong, supported by demographic trends, lifestyle changes, and increasing health awareness that create sustainable demand for convenient nutrition solutions.

Success factors for market participants include cultural sensitivity, product localization, multi-channel distribution strategies, and continuous innovation to meet evolving consumer preferences. Strategic investments in digital transformation, sustainability initiatives, and partnership development will be critical for achieving competitive advantages and long-term market success.

Future opportunities abound in personalized nutrition, functional ingredients, medical applications, and emerging markets across the region. Companies that can effectively navigate cultural complexities, regulatory requirements, and competitive dynamics while delivering high-quality, culturally appropriate products will be best positioned to capitalize on the significant growth potential within the MEA meal replacement products market.

What is MEA Meal Replacement Products?

MEA Meal Replacement Products refer to food items designed to replace one or more meals in a day, often used for weight management or nutritional supplementation. These products typically include shakes, bars, and powders that provide essential nutrients.

What are the key players in the MEA Meal Replacement Products Market?

Key players in the MEA Meal Replacement Products Market include Herbalife, SlimFast, and Optimum Nutrition, among others. These companies offer a variety of meal replacement options catering to different dietary needs and preferences.

What are the growth factors driving the MEA Meal Replacement Products Market?

The MEA Meal Replacement Products Market is driven by increasing health consciousness among consumers, the rise in obesity rates, and the growing demand for convenient meal solutions. Additionally, the trend towards fitness and wellness is boosting product adoption.

What challenges does the MEA Meal Replacement Products Market face?

The MEA Meal Replacement Products Market faces challenges such as regulatory scrutiny regarding health claims and potential consumer skepticism about the efficacy of meal replacements. Additionally, competition from traditional food options can hinder market growth.

What opportunities exist in the MEA Meal Replacement Products Market?

Opportunities in the MEA Meal Replacement Products Market include the development of plant-based and organic meal replacements, as well as products tailored for specific dietary needs like keto or gluten-free. The increasing trend of online shopping also presents a significant growth avenue.

What trends are shaping the MEA Meal Replacement Products Market?

Trends shaping the MEA Meal Replacement Products Market include the rise of personalized nutrition, where products are tailored to individual health goals, and the incorporation of functional ingredients like probiotics and superfoods. Additionally, sustainability in packaging and sourcing is becoming increasingly important.

MEA Meal Replacement Products Market

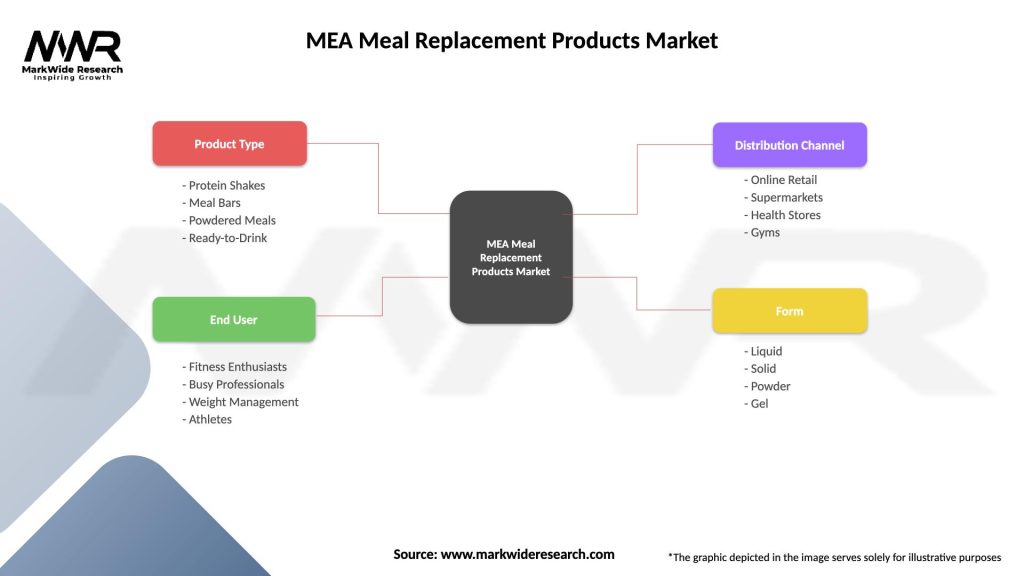

| Segmentation Details | Description |

|---|---|

| Product Type | Protein Shakes, Meal Bars, Powdered Meals, Ready-to-Drink |

| End User | Fitness Enthusiasts, Busy Professionals, Weight Management, Athletes |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Gyms |

| Form | Liquid, Solid, Powder, Gel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Meal Replacement Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at