444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA jet charter services market represents a dynamic and rapidly evolving sector within the Middle East and Africa aviation industry. This specialized market encompasses private aircraft charter services, on-demand flight solutions, and luxury air transportation across the region’s diverse economic landscape. Market dynamics indicate substantial growth potential driven by increasing business travel demands, rising high-net-worth individual populations, and expanding commercial activities across key regional hubs.

Regional characteristics of the MEA jet charter services market reflect unique geographical and economic factors that distinguish it from other global markets. The market benefits from strategic positioning between major international business centers, with countries like the UAE, Saudi Arabia, and South Africa serving as primary aviation hubs. Growth trajectories show the market expanding at a compound annual growth rate of 8.2%, supported by infrastructure development and regulatory improvements across multiple jurisdictions.

Service diversification within the MEA jet charter market includes business aviation, leisure travel, medical evacuation services, and cargo transportation. The market demonstrates resilience through economic fluctuations while adapting to changing customer preferences and technological advancements. Regional adoption rates vary significantly, with Gulf Cooperation Council countries showing 65% higher utilization compared to other MEA regions, reflecting economic prosperity and business travel requirements.

The MEA jet charter services market refers to the comprehensive ecosystem of private aircraft rental and charter services operating across Middle East and Africa regions, providing on-demand aviation solutions for business, leisure, and specialized transportation needs. This market encompasses various aircraft types, service models, and operational frameworks designed to meet diverse customer requirements while maintaining high safety and service standards.

Charter services within this context include aircraft management, flight operations, ground handling, and comprehensive travel solutions that extend beyond basic transportation. The market definition encompasses both traditional charter operators and emerging digital platforms that facilitate aircraft booking and management services. Service categories range from light jets for short-distance travel to heavy jets for intercontinental flights, with specialized aircraft for unique mission requirements.

Strategic positioning of the MEA jet charter services market reflects strong fundamentals supported by economic diversification efforts across the region. The market demonstrates robust growth potential through increasing business aviation demand, tourism development, and infrastructure investments. Key performance indicators show consistent expansion with charter flight hours increasing by 12% annually across major regional markets.

Market segmentation reveals diverse customer bases ranging from corporate clients to high-net-worth individuals, government entities, and specialized service requirements. The competitive landscape includes established international operators alongside emerging regional players who leverage local market knowledge and regulatory expertise. Technology integration plays an increasingly important role in service delivery, with digital booking platforms showing 35% adoption growth among charter service providers.

Regional variations in market development reflect different economic conditions, regulatory environments, and infrastructure capabilities. Gulf states lead market development with advanced aviation infrastructure, while African markets show significant growth potential despite infrastructure challenges. Service innovation continues driving market evolution through enhanced customer experiences, operational efficiency improvements, and sustainable aviation initiatives.

Market intelligence reveals several critical insights that shape the MEA jet charter services landscape. Understanding these insights provides valuable perspective on market dynamics, customer behavior, and growth opportunities across the region.

Economic diversification across MEA countries serves as a primary driver for jet charter services market growth. Government initiatives to reduce oil dependency and develop alternative economic sectors create increased business travel demands and corporate aviation requirements. Infrastructure development projects, including new airports and aviation facilities, enhance market accessibility and service capabilities across the region.

High-net-worth individual growth in the region contributes significantly to market expansion. Increasing wealth concentration, particularly in Gulf states, drives demand for luxury travel services and personalized aviation solutions. Business expansion activities by multinational corporations establishing regional operations create consistent demand for flexible transportation solutions that charter services provide effectively.

Tourism development initiatives across MEA countries boost leisure charter demand. Government programs promoting tourism, combined with major events and attractions, create seasonal demand spikes that benefit charter operators. Time sensitivity in business operations drives preference for charter services over commercial aviation, particularly for executive travel and urgent business requirements.

Regulatory improvements in aviation policies and international agreements facilitate market growth. Streamlined customs procedures, improved air traffic management, and bilateral aviation agreements enhance operational efficiency and market accessibility for charter operators.

High operational costs represent a significant restraint for MEA jet charter services market expansion. Fuel expenses, aircraft maintenance, insurance, and regulatory compliance costs create substantial operational overhead that impacts service pricing and market accessibility. Economic volatility in certain regional markets affects customer spending patterns and charter service demand, particularly during economic downturns or oil price fluctuations.

Regulatory complexity across different MEA jurisdictions creates operational challenges for charter operators. Varying aviation regulations, customs procedures, and permit requirements increase administrative burden and operational complexity. Infrastructure limitations in certain markets restrict service expansion and operational efficiency, particularly in smaller airports and remote locations.

Skilled personnel shortage in aviation sector affects service quality and operational capacity. Limited availability of qualified pilots, maintenance technicians, and aviation professionals constrains market growth and service expansion capabilities. Security concerns in certain regional areas impact charter operations and customer confidence, requiring additional security measures and operational precautions.

Competition from commercial aviation improvements, including enhanced business class services and increased flight frequencies, provides alternative options for potential charter customers. Environmental regulations and sustainability requirements create additional compliance costs and operational constraints for charter operators.

Digital transformation presents significant opportunities for MEA jet charter services market expansion. Implementation of advanced booking platforms, artificial intelligence for flight optimization, and mobile applications can enhance customer experience and operational efficiency. Sustainable aviation initiatives, including alternative fuel adoption and carbon offset programs, create competitive advantages and align with environmental consciousness trends.

Market consolidation opportunities exist through strategic partnerships, acquisitions, and joint ventures that can enhance service capabilities and geographic coverage. Emerging markets within Africa present untapped potential for charter services as economic development and infrastructure improvements create new demand sources.

Specialized services development, including medical evacuation, cargo charter, and government services, offer diversification opportunities beyond traditional passenger charter. Technology integration in aircraft systems, ground operations, and customer service can differentiate operators and improve service quality.

Regional connectivity improvements through new routes and destinations can expand market reach and customer base. Corporate partnerships with businesses, hotels, and event organizers create stable revenue streams and customer acquisition channels. Fractional ownership and jet card programs provide alternative business models that can attract price-sensitive customers while maintaining service quality.

Supply and demand dynamics in the MEA jet charter services market reflect complex interactions between economic conditions, customer preferences, and operational capabilities. Demand fluctuations correlate strongly with business cycles, seasonal patterns, and major events across the region. Charter operators must maintain flexible capacity management to address varying demand levels while optimizing operational efficiency.

Competitive dynamics involve established international operators competing with regional specialists who offer local market expertise and customized services. Price competition remains intense, particularly in mature markets, while service differentiation becomes increasingly important for market positioning. Technology adoption rates vary among operators, creating competitive advantages for early adopters of digital solutions and advanced aircraft systems.

Regulatory dynamics continue evolving as governments balance aviation safety requirements with market development objectives. Customer behavior shifts toward digital engagement, personalized services, and sustainable travel options influence service delivery models and operational strategies. Economic interdependencies between regional markets create spillover effects that impact charter demand across multiple countries.

Operational dynamics include fleet utilization optimization, crew scheduling efficiency, and maintenance planning that directly impact service quality and profitability. Market maturity levels vary significantly across the MEA region, with established markets showing different growth patterns compared to emerging markets with higher growth potential but infrastructure challenges.

Comprehensive research methodology employed for MEA jet charter services market analysis incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes structured interviews with industry executives, charter operators, and key stakeholders across the region to gather firsthand insights on market conditions, trends, and challenges.

Secondary research encompasses analysis of industry reports, government publications, aviation authorities data, and company financial statements to establish market baselines and validate primary research findings. Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators.

Regional segmentation analysis examines market characteristics across different MEA countries and sub-regions to identify variations in demand patterns, regulatory environments, and growth opportunities. Competitive intelligence gathering includes operator performance analysis, service offering comparisons, and market positioning assessment.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Market modeling incorporates economic indicators, industry trends, and regulatory developments to create comprehensive market projections and scenario analysis.

Gulf Cooperation Council countries dominate the MEA jet charter services market with 52% regional market share, driven by strong economies, advanced infrastructure, and high business activity levels. The UAE leads regional charter operations with Dubai and Abu Dhabi serving as major aviation hubs. Saudi Arabia shows rapid growth in charter services, supported by Vision 2030 economic diversification initiatives and increased business travel requirements.

North African markets demonstrate steady growth with Egypt and Morocco leading charter service development. These markets benefit from tourism growth and improving aviation infrastructure, though regulatory complexity remains a challenge. South Africa maintains the largest charter market in sub-Saharan Africa, with Johannesburg and Cape Town serving as primary operational bases for regional and international charter services.

East African markets show emerging potential with Kenya and Ethiopia developing charter service capabilities. Infrastructure improvements and economic growth create opportunities, though market development remains in early stages. West African markets present mixed conditions with Nigeria leading charter activity despite infrastructure and regulatory challenges.

Regional connectivity patterns show strong intra-GCC charter traffic, growing North-South Africa routes, and emerging cross-regional business travel. Market maturity varies significantly, with Gulf markets showing sophisticated service offerings while African markets focus on basic charter services and infrastructure development. Growth projections indicate continued GCC market leadership with accelerating growth in select African markets.

Market leadership in the MEA jet charter services sector includes both international operators and regional specialists who compete across different service segments and geographic markets. The competitive environment reflects diverse strategies ranging from premium service positioning to cost-effective solutions targeting price-sensitive customers.

Competitive strategies focus on service differentiation, geographic expansion, and technology integration to capture market share and enhance customer loyalty. Market positioning varies from ultra-luxury operators targeting high-net-worth individuals to business-focused operators serving corporate customers with efficient, reliable services.

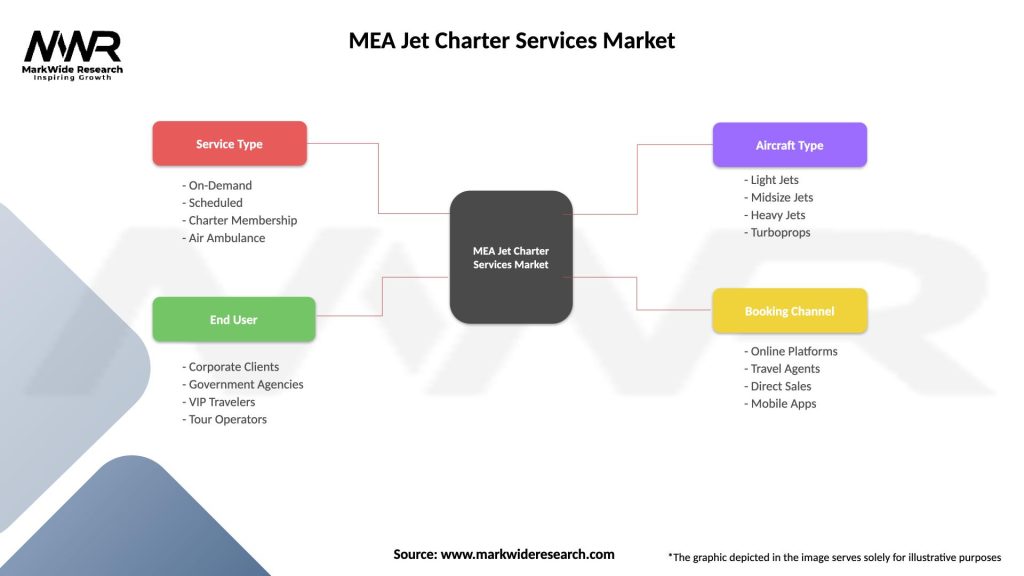

Service type segmentation divides the MEA jet charter services market into distinct categories based on operational models and customer requirements. Each segment demonstrates unique characteristics, growth patterns, and competitive dynamics that influence overall market development.

By Aircraft Type:

By Service Model:

By End User:

Corporate aviation represents the most significant category within MEA jet charter services, driven by multinational business operations and executive travel requirements. This category shows consistent demand patterns with business travel accounting for 58% of total charter hours. Service expectations in corporate aviation emphasize reliability, efficiency, and professional service delivery that supports business objectives.

Leisure charter services demonstrate seasonal demand patterns with peak activity during holiday periods and major events. This category benefits from tourism development initiatives and increasing disposable income among affluent customers. Service customization in leisure charter focuses on luxury amenities, destination flexibility, and personalized travel experiences.

Government and diplomatic charter services provide stable revenue streams for operators while requiring specialized security and protocol capabilities. This category involves official transportation, diplomatic missions, and emergency response services. Compliance requirements in government charter services necessitate enhanced security measures and regulatory adherence.

Medical evacuation services represent a specialized category with unique operational requirements and regulatory considerations. This category requires specialized aircraft configurations, medical equipment, and trained personnel. Emergency response capabilities in medical charter services provide critical healthcare transportation across the region’s diverse geographic landscape.

Cargo charter services address specialized transportation needs for high-value, time-sensitive, or unusual cargo requirements. This category complements passenger charter operations and provides operational diversification opportunities for charter operators.

Charter operators benefit from diverse revenue streams, operational flexibility, and market expansion opportunities across the MEA region. Revenue diversification through multiple service offerings reduces dependency on single market segments and provides stability during economic fluctuations. Operational efficiency improvements through technology integration and fleet optimization enhance profitability and service quality.

Aircraft manufacturers gain from increased aircraft demand, aftermarket services opportunities, and technology development partnerships with charter operators. Market expansion in MEA region creates new sales opportunities and long-term customer relationships. Service innovation collaboration with operators drives product development and competitive positioning.

Customers benefit from flexible travel solutions, time savings, and personalized service experiences that commercial aviation cannot provide. Business efficiency improvements through charter services enable productive travel time and schedule flexibility. Access enhancement to remote destinations and specialized transportation requirements supports business and personal objectives.

Airport operators benefit from increased traffic, premium service fees, and infrastructure utilization optimization. Revenue enhancement through charter operations provides additional income streams beyond commercial aviation. Service differentiation through charter facilities attracts high-value customers and enhances airport positioning.

Regional economies benefit from aviation industry development, employment creation, and tourism enhancement through improved connectivity. Economic multiplier effects from charter operations support various service sectors and infrastructure development. Investment attraction through enhanced transportation capabilities supports business development and economic diversification.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital integration emerges as a dominant trend transforming MEA jet charter services market operations and customer interactions. Online booking platforms streamline charter reservations and provide real-time aircraft availability information. Mobile applications enable customers to manage charter services, track flights, and access personalized travel information. Artificial intelligence applications optimize flight planning, crew scheduling, and maintenance planning to improve operational efficiency.

Sustainability initiatives gain prominence as environmental consciousness influences customer preferences and regulatory requirements. Carbon offset programs allow customers to neutralize flight emissions through verified environmental projects. Sustainable aviation fuel adoption reduces environmental impact while maintaining operational performance. Fuel efficiency improvements through advanced aircraft technologies and operational optimization reduce environmental footprint and operating costs.

Service personalization becomes increasingly important for customer retention and market differentiation. Customized travel experiences include personalized catering, ground transportation, and accommodation arrangements. Loyalty programs reward frequent customers with priority booking, service upgrades, and exclusive benefits. Concierge services extend beyond aviation to provide comprehensive travel and lifestyle support.

Fleet modernization trends focus on newer, more efficient aircraft with advanced technology and improved passenger amenities. Technology integration in aircraft systems enhances safety, efficiency, and passenger experience. Connectivity solutions provide high-speed internet and communication capabilities during flight. Cabin innovations improve comfort and productivity for business travelers.

Infrastructure expansion across the MEA region continues enhancing charter service capabilities and market accessibility. New airport facilities and terminal expansions improve ground handling capabilities and customer experience. Air traffic management system upgrades reduce delays and improve operational efficiency for charter operators.

Regulatory harmonization efforts among MEA countries streamline operational requirements and reduce administrative burden for charter operators. Bilateral aviation agreements expand route options and operational flexibility. Safety standard improvements align regional practices with international best practices.

Technology partnerships between charter operators and technology companies accelerate digital transformation initiatives. Blockchain applications improve transaction security and operational transparency. Data analytics platforms enhance decision-making and operational optimization. Maintenance technology advances improve aircraft reliability and reduce operational disruptions.

Market consolidation activities include strategic acquisitions, partnerships, and joint ventures that reshape competitive landscape. Service integration creates comprehensive aviation solutions combining charter, management, and support services. Geographic expansion strategies extend operator reach across multiple MEA markets.

Sustainable aviation initiatives gain momentum through industry collaboration and regulatory support. Alternative fuel development projects advance sustainable aviation fuel availability. Electric aircraft development for short-range applications presents future opportunities for sustainable charter services.

Strategic positioning recommendations for MEA jet charter services market participants emphasize differentiation through service excellence and operational efficiency. MarkWide Research analysis suggests operators focus on technology integration to enhance customer experience and operational performance. Market segmentation strategies should target specific customer groups with tailored service offerings that address unique requirements and preferences.

Geographic expansion strategies should prioritize markets with strong economic fundamentals and improving aviation infrastructure. Partnership development with local operators, airports, and service providers can accelerate market entry and reduce operational risks. Regulatory compliance capabilities must be strengthened to navigate complex multi-jurisdictional requirements effectively.

Technology investment priorities should focus on digital platforms, operational systems, and customer-facing applications that improve efficiency and service quality. Sustainability initiatives should be integrated into operational strategies to meet evolving customer expectations and regulatory requirements. Fleet optimization strategies should balance operational flexibility with cost efficiency through appropriate aircraft selection and utilization planning.

Customer relationship management systems should leverage data analytics to personalize services and improve customer retention. Operational excellence programs should focus on safety, reliability, and service consistency to build customer confidence and market reputation. Financial management strategies should address cost optimization while maintaining service quality and safety standards.

Growth projections for the MEA jet charter services market indicate continued expansion driven by economic development, infrastructure improvements, and increasing aviation demand. Market evolution will be influenced by technology adoption, regulatory developments, and changing customer preferences toward personalized and sustainable travel solutions. MWR forecasts suggest the market will maintain strong growth momentum with annual expansion rates of 8.2% over the next five years.

Technology transformation will reshape service delivery models through digital platforms, artificial intelligence, and advanced aircraft systems. Sustainability requirements will drive adoption of alternative fuels, carbon offset programs, and more efficient operational practices. Market maturation in established regions will coincide with rapid development in emerging markets, creating diverse growth opportunities.

Competitive landscape evolution will feature increased consolidation, strategic partnerships, and service integration as operators seek scale advantages and operational efficiency. Customer expectations will continue rising for personalized services, digital engagement, and environmental responsibility. Regulatory environment improvements will facilitate market access and operational efficiency while maintaining safety standards.

Infrastructure development will enhance market capabilities through new airports, improved facilities, and advanced air traffic management systems. Economic diversification across MEA countries will create sustained demand for business aviation services. Regional connectivity improvements will expand market reach and create new route opportunities for charter operators.

The MEA jet charter services market represents a dynamic and growing sector with significant opportunities for expansion and development. Market fundamentals remain strong, supported by economic diversification, infrastructure development, and increasing demand for flexible aviation solutions. The market demonstrates resilience through economic cycles while adapting to technological advances and changing customer preferences.

Strategic success in this market requires focus on operational excellence, customer service differentiation, and technology integration. Regional variations in market development create diverse opportunities for operators with appropriate strategies and capabilities. Sustainability initiatives and digital transformation will increasingly influence competitive positioning and customer preferences.

Future growth prospects remain positive, driven by continued economic development, infrastructure improvements, and evolving customer needs. Market participants who successfully navigate regulatory complexity, invest in technology, and maintain service excellence will be well-positioned for long-term success in the expanding MEA jet charter services market.

What is Jet Charter Services?

Jet Charter Services refer to the on-demand rental of private jets for various purposes, including business travel, leisure trips, and cargo transport. This service offers flexibility, privacy, and convenience to travelers who require tailored flight solutions.

What are the key players in the MEA Jet Charter Services Market?

Key players in the MEA Jet Charter Services Market include companies like VistaJet, NetJets, and Air Charter Service, which provide a range of private jet options and services. These companies cater to diverse client needs, from corporate travel to luxury vacations, among others.

What are the growth factors driving the MEA Jet Charter Services Market?

The MEA Jet Charter Services Market is driven by factors such as increasing demand for business travel, a rise in high-net-worth individuals, and the growing preference for personalized travel experiences. Additionally, the expansion of air travel infrastructure in the region supports market growth.

What challenges does the MEA Jet Charter Services Market face?

The MEA Jet Charter Services Market faces challenges such as regulatory hurdles, high operational costs, and competition from commercial airlines. These factors can impact pricing strategies and service availability for charter service providers.

What opportunities exist in the MEA Jet Charter Services Market?

Opportunities in the MEA Jet Charter Services Market include the potential for growth in emerging markets, advancements in technology for booking and managing flights, and increasing partnerships with luxury travel agencies. These factors can enhance service offerings and customer reach.

What trends are shaping the MEA Jet Charter Services Market?

Trends shaping the MEA Jet Charter Services Market include a growing emphasis on sustainability in aviation, the rise of digital platforms for booking, and an increase in demand for on-demand charter services. These trends reflect changing consumer preferences and technological advancements.

MEA Jet Charter Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | On-Demand, Scheduled, Charter Membership, Air Ambulance |

| End User | Corporate Clients, Government Agencies, VIP Travelers, Tour Operators |

| Aircraft Type | Light Jets, Midsize Jets, Heavy Jets, Turboprops |

| Booking Channel | Online Platforms, Travel Agents, Direct Sales, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Jet Charter Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at