444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA inflight entertainment and connectivity market represents a rapidly evolving sector within the Middle East and Africa aviation industry, driven by increasing passenger expectations for seamless digital experiences during air travel. This dynamic market encompasses comprehensive entertainment systems, high-speed internet connectivity, and advanced passenger communication technologies that transform the traditional flying experience into an engaging digital journey.

Regional airlines across the MEA region are investing heavily in next-generation inflight entertainment and connectivity (IFEC) solutions to differentiate their services and enhance passenger satisfaction. The market demonstrates robust growth potential with airlines recognizing that superior inflight entertainment capabilities directly correlate with customer loyalty and competitive positioning in the global aviation marketplace.

Technology advancement continues to reshape the MEA inflight entertainment landscape, with satellite-based connectivity solutions enabling passengers to stream content, conduct business communications, and maintain social media connectivity at cruising altitude. The integration of wireless streaming technologies and bring-your-own-device (BYOD) platforms has revolutionized how passengers consume entertainment content during flights.

Market dynamics indicate that the MEA region is experiencing accelerated adoption of advanced IFEC systems, with growth rates reaching 8.2% CAGR as airlines modernize their fleets and upgrade existing entertainment infrastructure. This expansion reflects the region’s strategic position as a major aviation hub connecting Europe, Asia, and Africa.

The MEA inflight entertainment and connectivity market refers to the comprehensive ecosystem of digital entertainment systems, internet connectivity solutions, and passenger communication technologies specifically deployed within aircraft operating in the Middle East and Africa regions. This market encompasses hardware installations, software platforms, content licensing, and connectivity services that enable passengers to access entertainment, communication, and productivity tools during flight.

Inflight entertainment systems traditionally include seatback screens, overhead displays, and audio systems that provide movies, television shows, music, games, and flight information to passengers. Modern connectivity components integrate satellite communication systems, wireless access points, and streaming platforms that enable internet access and real-time communication capabilities.

Contemporary IFEC solutions extend beyond traditional entertainment to encompass comprehensive digital ecosystems that support passenger productivity, social connectivity, and personalized content experiences. These systems integrate with airline operational systems to provide flight tracking, destination information, and seamless service integration throughout the passenger journey.

Strategic analysis of the MEA inflight entertainment and connectivity market reveals a sector experiencing unprecedented transformation driven by evolving passenger expectations and technological advancement. Airlines throughout the region are prioritizing IFEC investments as essential components of their competitive differentiation strategies.

Market expansion is characterized by increasing adoption of satellite-based connectivity solutions, with 72% of regional airlines planning significant IFEC upgrades within the next three years. This investment trend reflects recognition that superior inflight entertainment capabilities directly impact customer satisfaction scores and brand loyalty metrics.

Technology integration patterns show accelerating deployment of wireless streaming platforms and BYOD solutions that reduce hardware costs while expanding content accessibility. Regional carriers are leveraging these technologies to offer personalized entertainment experiences that rival ground-based streaming services.

Competitive positioning within the MEA aviation market increasingly depends on IFEC capabilities, with premium airlines using advanced entertainment systems as key differentiators in marketing campaigns and customer acquisition strategies. This trend drives continuous innovation and investment across the sector.

Comprehensive market analysis reveals several critical insights shaping the MEA inflight entertainment and connectivity landscape:

Primary growth drivers propelling the MEA inflight entertainment and connectivity market include evolving passenger expectations shaped by ubiquitous ground-based connectivity and streaming entertainment services. Modern travelers expect seamless digital experiences that match or exceed their home entertainment capabilities.

Competitive differentiation requirements drive airlines to invest in superior IFEC systems as essential components of their brand positioning strategies. Premium carriers use advanced entertainment capabilities to justify higher ticket prices and attract business travelers who prioritize productivity during flight time.

Regional aviation growth creates expanding opportunities for IFEC deployment as MEA airlines add new routes and modernize existing fleets. The region’s position as a global aviation hub generates high passenger volumes that justify significant technology investments.

Technology advancement reduces implementation costs while expanding capability options, making advanced IFEC systems accessible to a broader range of airlines. Satellite communication improvements enable reliable high-speed connectivity across previously challenging routes.

Revenue generation potential through premium connectivity services and targeted advertising creates additional business justification for IFEC investments. Airlines can monetize entertainment systems through subscription services and partnership arrangements with content providers.

Implementation costs represent significant barriers for smaller regional airlines seeking to upgrade their IFEC capabilities. Initial hardware investments, installation expenses, and ongoing connectivity fees can strain operational budgets, particularly for carriers operating on thin profit margins.

Technical complexity associated with integrating advanced IFEC systems into existing aircraft configurations creates operational challenges. Airlines must coordinate with multiple technology providers while ensuring compliance with aviation safety regulations and certification requirements.

Bandwidth limitations over certain MEA routes constrain the quality of connectivity services that airlines can reliably deliver. Satellite coverage gaps and capacity constraints can result in inconsistent passenger experiences that damage brand reputation.

Regulatory compliance requirements vary across MEA jurisdictions, creating complexity for airlines operating international routes. Different countries maintain distinct regulations regarding passenger data privacy, content restrictions, and communication system approvals.

Maintenance requirements for sophisticated IFEC systems demand specialized technical expertise that may not be readily available at all MEA airports. This creates operational risks and potentially higher maintenance costs for airlines serving diverse regional destinations.

Emerging technologies create substantial opportunities for innovative IFEC solutions tailored to MEA market requirements. Artificial intelligence integration enables personalized content recommendations and predictive maintenance capabilities that enhance both passenger satisfaction and operational efficiency.

Partnership development with regional content providers offers airlines opportunities to differentiate their entertainment offerings through exclusive programming and culturally relevant content. These collaborations can reduce licensing costs while improving passenger engagement metrics.

Fleet modernization programs across the MEA region create natural upgrade opportunities for advanced IFEC systems. Airlines replacing aging aircraft can integrate state-of-the-art entertainment technologies from the initial installation phase.

Business model innovation through subscription-based connectivity services and premium entertainment tiers enables airlines to generate additional revenue streams while offering passengers flexible service options. This approach can improve overall profitability of IFEC investments.

Cross-industry collaboration with telecommunications providers and technology companies creates opportunities for integrated service offerings that extend beyond traditional inflight entertainment to encompass comprehensive digital travel experiences.

Competitive dynamics within the MEA inflight entertainment and connectivity market reflect intense rivalry among technology providers seeking to establish dominant positions in this growing sector. Leading suppliers compete on system reliability, content variety, and total cost of ownership to secure long-term airline partnerships.

Technology evolution continues reshaping market dynamics as satellite communication capabilities improve and new connectivity solutions emerge. The transition from traditional seatback systems to wireless streaming platforms represents a fundamental shift that affects both suppliers and airlines.

Customer expectations drive continuous innovation as passengers demand entertainment experiences comparable to premium home streaming services. Airlines must balance these expectations with operational constraints and cost considerations to maintain competitive positioning.

Regional variations in market development create diverse opportunities and challenges across MEA countries. Developed aviation markets demonstrate different adoption patterns compared to emerging regions, requiring flexible technology and business model approaches.

Integration complexity affects market dynamics as airlines seek comprehensive solutions that minimize operational disruption while maximizing passenger satisfaction. Successful suppliers must demonstrate expertise in both technology implementation and ongoing support services.

Comprehensive research methodology employed for analyzing the MEA inflight entertainment and connectivity market incorporates multiple data collection and analysis techniques to ensure accurate market insights and reliable projections. Primary research activities include structured interviews with airline executives, technology suppliers, and industry experts across the MEA region.

Secondary research encompasses analysis of airline financial reports, technology supplier announcements, regulatory filings, and industry publications to identify market trends and competitive positioning. This approach provides comprehensive coverage of market developments and strategic initiatives.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to confirm key findings. Statistical analysis techniques ensure that market projections reflect realistic growth scenarios based on historical trends and current market conditions.

Regional analysis methodology incorporates country-specific research to account for varying regulatory environments, economic conditions, and aviation market maturity levels across the MEA region. This granular approach enables accurate assessment of market opportunities and challenges.

Technology assessment includes evaluation of emerging IFEC solutions and their potential impact on market dynamics. Expert interviews with technology developers provide insights into innovation timelines and commercial viability of next-generation systems.

Middle East markets demonstrate the highest adoption rates for advanced IFEC systems, with major carriers in the UAE, Qatar, and Saudi Arabia leading regional investment initiatives. These airlines leverage superior entertainment capabilities as key differentiators in their global expansion strategies, capturing 45% of regional market share.

Gulf Cooperation Council countries show particularly strong growth in premium IFEC deployments, driven by high passenger expectations and airline profitability levels that support significant technology investments. Regional carriers use advanced entertainment systems to maintain competitive advantages in international markets.

African markets present diverse adoption patterns, with South African and Kenyan airlines leading continental IFEC investments while other regions show more gradual implementation timelines. Economic constraints and infrastructure limitations influence technology selection and deployment strategies across different African markets.

North African carriers demonstrate increasing interest in modern IFEC solutions as they expand route networks and modernize fleet operations. Egyptian and Moroccan airlines are investing in connectivity upgrades to support growing tourism and business travel segments.

Emerging markets across sub-Saharan Africa show growing adoption rates of cost-effective IFEC solutions, with wireless streaming platforms gaining traction as alternatives to traditional hardware-intensive systems. These markets prioritize solutions that offer strong return on investment with minimal operational complexity.

Market leadership in the MEA inflight entertainment and connectivity sector is characterized by intense competition among established technology providers and emerging solution specialists. Leading companies compete on system reliability, content variety, and comprehensive service support.

Competitive strategies focus on developing comprehensive solution portfolios that address diverse airline requirements while minimizing total cost of ownership. Successful providers demonstrate expertise in both technology implementation and ongoing operational support.

Technology segmentation within the MEA inflight entertainment and connectivity market reflects diverse approaches to delivering passenger entertainment and communication services:

By Technology:

By Aircraft Type:

By Service Type:

Premium entertainment systems demonstrate the strongest growth potential within the MEA market, with business and first-class installations driving 62% of revenue generation. These systems feature large high-definition displays, extensive content libraries, and personalized service integration that justifies premium pricing strategies.

Wireless streaming solutions show accelerating adoption rates as airlines seek cost-effective alternatives to traditional seatback systems. These platforms reduce installation costs while offering flexibility for content updates and passenger device integration, making them attractive for budget-conscious carriers.

Satellite connectivity services represent the fastest-growing category as passenger demand for internet access during flights continues expanding. Airlines recognize that reliable connectivity capabilities directly impact customer satisfaction and competitive positioning in premium market segments.

Content licensing arrangements create ongoing revenue opportunities for entertainment providers while enabling airlines to offer diverse programming options. Regional content partnerships allow carriers to differentiate their entertainment offerings through culturally relevant programming.

Maintenance and support services generate substantial recurring revenue for IFEC suppliers while ensuring system reliability for airline operations. Comprehensive service agreements reduce operational risks and provide predictable cost structures for airline technology investments.

Airlines benefit from advanced IFEC systems through enhanced passenger satisfaction scores, competitive differentiation capabilities, and potential revenue generation through premium service offerings. Superior entertainment systems directly correlate with improved customer loyalty and higher ticket price premiums.

Passengers experience significant value through access to extensive entertainment content, reliable internet connectivity, and productivity tools that transform flight time into productive or enjoyable experiences. Modern IFEC systems rival ground-based entertainment quality while enabling continuous connectivity.

Technology suppliers gain access to growing market opportunities with recurring revenue potential through service contracts and content licensing arrangements. The MEA region’s aviation growth creates expanding demand for innovative IFEC solutions.

Content providers access new distribution channels and revenue streams through airline partnerships while reaching captive audiences during extended flight periods. These arrangements create mutually beneficial relationships that expand content reach and generate licensing revenue.

Airport operators benefit from improved passenger satisfaction levels that enhance overall travel experiences and support airport retail and service revenue generation. Satisfied passengers are more likely to spend additional time and money in airport facilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trends are reshaping the MEA inflight entertainment landscape as airlines implement artificial intelligence and machine learning technologies to deliver customized content recommendations based on passenger preferences and travel patterns. These systems analyze viewing history and demographic data to create tailored entertainment experiences.

Sustainability initiatives drive adoption of energy-efficient IFEC systems that reduce aircraft fuel consumption while maintaining superior passenger experiences. Airlines prioritize solutions that support environmental goals while delivering competitive entertainment capabilities.

Integration advancement enables seamless connectivity between inflight entertainment systems and passenger personal devices, creating unified digital experiences that extend beyond traditional aircraft boundaries. This trend supports omnichannel service delivery throughout the travel journey.

Content diversification reflects growing demand for regionally relevant programming, with airlines investing in Arabic language content, local news services, and culturally appropriate entertainment options. This localization strategy enhances passenger engagement and satisfaction levels.

Real-time connectivity capabilities enable live streaming services, social media access, and business communication tools that transform aircraft into productive work environments. These features particularly appeal to business travelers who represent high-value customer segments.

Recent industry developments demonstrate accelerating innovation and investment within the MEA inflight entertainment and connectivity market. Major airlines are announcing significant IFEC upgrade programs that will reshape passenger experiences across the region.

Technology partnerships between airlines and leading IFEC suppliers are creating comprehensive solution deployments that integrate entertainment, connectivity, and operational systems. These collaborations enable more efficient implementations while reducing total cost of ownership.

Satellite constellation expansions by major communication providers are improving connectivity coverage and capacity across MEA routes, enabling airlines to offer more reliable internet services and enhanced streaming capabilities to passengers.

Regulatory approvals for next-generation IFEC systems are accelerating deployment timelines as aviation authorities streamline certification processes for proven technologies. This regulatory support enables faster market adoption of innovative solutions.

Investment announcements from regional airlines indicate strong commitment to IFEC modernization, with several carriers allocating substantial budgets for comprehensive entertainment system upgrades across their entire fleets.

Strategic recommendations for MEA inflight entertainment and connectivity market participants emphasize the importance of developing flexible, scalable solutions that can adapt to diverse airline requirements and evolving passenger expectations. MarkWide Research analysis indicates that successful market positioning requires comprehensive service portfolios rather than standalone technology offerings.

Investment priorities should focus on satellite connectivity capabilities and wireless streaming platforms that offer superior cost-effectiveness compared to traditional embedded systems. Airlines seeking competitive advantages should prioritize solutions that enable rapid content updates and personalized passenger experiences.

Partnership strategies with regional content providers and telecommunications companies can create differentiated service offerings while reducing operational costs. These collaborations enable airlines to offer unique entertainment experiences that reflect local cultural preferences and language requirements.

Technology selection criteria should emphasize system reliability, maintenance simplicity, and integration capabilities with existing airline operational systems. Solutions that minimize operational disruption while maximizing passenger satisfaction will achieve the strongest market adoption rates.

Market entry strategies for new suppliers should focus on demonstrating clear value propositions through pilot programs and partnership arrangements with regional airlines. Success requires understanding diverse market requirements across different MEA countries and airline business models.

Long-term projections for the MEA inflight entertainment and connectivity market indicate sustained growth driven by continued aviation sector expansion and evolving passenger expectations for digital connectivity during air travel. The market is expected to maintain strong growth momentum with increasing adoption of advanced satellite-based connectivity solutions.

Technology evolution will continue reshaping market dynamics as artificial intelligence, virtual reality, and augmented reality capabilities integrate into inflight entertainment systems. These innovations will create new opportunities for passenger engagement while enabling airlines to differentiate their service offerings.

Regional development patterns suggest that emerging MEA markets will experience accelerated IFEC adoption as economic growth supports aviation sector expansion and airline fleet modernization programs. According to MWR projections, these markets will contribute increasing market share over the forecast period.

Competitive landscape evolution will likely favor suppliers that can demonstrate comprehensive solution capabilities, strong regional support networks, and innovative technology development. Market consolidation may occur as airlines seek simplified vendor relationships and integrated service offerings.

Investment trends indicate that airlines will continue prioritizing IFEC capabilities as essential competitive differentiators, with premium carriers leading adoption of next-generation systems that enable superior passenger experiences and operational efficiency improvements.

The MEA inflight entertainment and connectivity market represents a dynamic and rapidly evolving sector that reflects the broader transformation of the aviation industry toward enhanced passenger experiences and digital service integration. Strong growth fundamentals driven by regional aviation expansion, evolving passenger expectations, and technological advancement create substantial opportunities for airlines, technology suppliers, and service providers.

Market success will increasingly depend on the ability to deliver comprehensive, reliable, and cost-effective IFEC solutions that meet diverse airline requirements while providing passengers with entertainment and connectivity experiences that rival ground-based alternatives. The integration of advanced technologies including artificial intelligence, satellite connectivity, and wireless streaming platforms will continue reshaping competitive dynamics.

Strategic positioning within this market requires understanding regional variations, regulatory requirements, and airline business model differences across the MEA region. Successful participants will demonstrate flexibility in solution design, comprehensive service support capabilities, and commitment to ongoing innovation that addresses evolving market needs.

Future growth prospects remain strong as the MEA aviation sector continues expanding and airlines recognize IFEC capabilities as essential competitive differentiators. The market will reward suppliers and airlines that prioritize passenger satisfaction, operational efficiency, and technological innovation in their strategic planning and investment decisions.

What is MEA Inflight Entertainment and Connectivity?

MEA Inflight Entertainment and Connectivity refers to the systems and services that provide entertainment options and internet connectivity to passengers during flights in the Middle East and Africa region. This includes video on demand, live television, and Wi-Fi services that enhance the passenger experience.

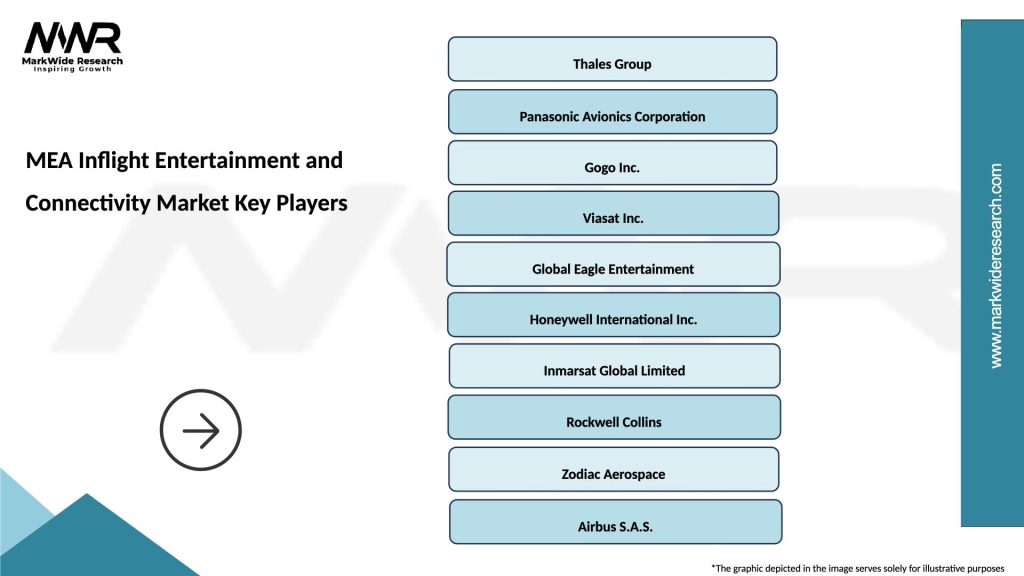

What are the key players in the MEA Inflight Entertainment and Connectivity Market?

Key players in the MEA Inflight Entertainment and Connectivity Market include Panasonic Avionics, Thales Group, and Gogo Inc. These companies are known for their innovative solutions and technologies that enhance inflight entertainment and connectivity options, among others.

What are the growth factors driving the MEA Inflight Entertainment and Connectivity Market?

The growth of the MEA Inflight Entertainment and Connectivity Market is driven by increasing passenger demand for high-quality entertainment options, the expansion of airline fleets, and advancements in satellite technology. Additionally, the rise in air travel in the region contributes to this growth.

What challenges does the MEA Inflight Entertainment and Connectivity Market face?

The MEA Inflight Entertainment and Connectivity Market faces challenges such as high installation and maintenance costs, regulatory hurdles, and the need for continuous technological upgrades. These factors can hinder the adoption of new systems and services by airlines.

What opportunities exist in the MEA Inflight Entertainment and Connectivity Market?

Opportunities in the MEA Inflight Entertainment and Connectivity Market include the potential for partnerships between airlines and technology providers, the growing demand for personalized passenger experiences, and the expansion of low-cost carriers offering inflight services. These factors can lead to innovative solutions and increased market penetration.

What trends are shaping the MEA Inflight Entertainment and Connectivity Market?

Trends shaping the MEA Inflight Entertainment and Connectivity Market include the integration of mobile devices with inflight systems, the rise of streaming services, and the implementation of high-speed internet connectivity. These trends reflect changing consumer preferences and technological advancements.

MEA Inflight Entertainment and Connectivity Market

| Segmentation Details | Description |

|---|---|

| Product Type | Streaming Services, Inflight Wi-Fi, Seatback Entertainment, Mobile Connectivity |

| End User | Airlines, Passengers, Airports, Service Providers |

| Technology | Satellite Communication, Air-to-Ground, Wi-Fi 6, 5G |

| Service Type | Content Delivery, Network Management, Customer Support, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Inflight Entertainment and Connectivity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at