444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA hazardous waste handling automation market represents a rapidly evolving sector driven by stringent environmental regulations and increasing industrial safety requirements across the Middle East and Africa region. Automated systems for hazardous waste management are transforming how industries handle, process, and dispose of dangerous materials, significantly reducing human exposure risks while improving operational efficiency. The market encompasses sophisticated robotics, automated sorting systems, remote monitoring technologies, and intelligent waste processing equipment designed specifically for hazardous material handling.

Regional dynamics indicate substantial growth potential, with the market experiencing a 12.4% CAGR as industries prioritize worker safety and environmental compliance. Key sectors driving adoption include petrochemicals, pharmaceuticals, mining, and manufacturing industries that generate significant volumes of hazardous waste requiring specialized handling protocols. The integration of artificial intelligence and IoT technologies is enabling more sophisticated waste categorization and processing capabilities.

Government initiatives across MEA countries are accelerating market expansion through enhanced regulatory frameworks and environmental protection mandates. Countries like Saudi Arabia, UAE, and South Africa are leading adoption rates, with 65% of regional market activity concentrated in these nations. The growing emphasis on sustainable industrial practices and circular economy principles is further propelling demand for automated hazardous waste handling solutions.

The MEA hazardous waste handling automation market refers to the comprehensive ecosystem of automated technologies, systems, and equipment designed to safely manage, process, and dispose of hazardous waste materials across Middle East and Africa regions. This market encompasses robotic handling systems, automated sorting and classification technologies, remote monitoring solutions, and intelligent processing equipment that minimize human contact with dangerous substances while ensuring regulatory compliance and environmental protection.

Hazardous waste handling automation involves the deployment of sophisticated mechanical, electronic, and software systems that can identify, segregate, transport, and process various categories of dangerous waste materials including chemical residues, radioactive substances, biological waste, and toxic industrial byproducts. These systems integrate advanced sensors, artificial intelligence algorithms, and precision robotics to execute complex waste management protocols with minimal human intervention.

Market scope includes both hardware components such as robotic arms, automated conveyor systems, and containment equipment, as well as software solutions for waste tracking, regulatory reporting, and process optimization. The automation extends across the entire waste management lifecycle from initial collection and categorization through final disposal or treatment processes.

Market transformation in the MEA hazardous waste handling automation sector is being driven by converging factors including regulatory pressure, technological advancement, and growing environmental consciousness. The region’s industrial expansion, particularly in oil and gas, chemicals, and mining sectors, is generating increasing volumes of hazardous waste that require sophisticated handling solutions to ensure worker safety and environmental protection.

Technology adoption is accelerating across key markets, with 78% of large industrial facilities in the region planning automation investments within the next three years. Advanced robotics, AI-powered classification systems, and IoT-enabled monitoring solutions are becoming standard components of modern hazardous waste management operations. The integration of these technologies is delivering significant improvements in safety metrics, operational efficiency, and regulatory compliance.

Regional leadership is emerging from Gulf Cooperation Council countries, where substantial investments in industrial infrastructure and environmental protection are driving market growth. The pharmaceutical and petrochemical industries represent the largest application segments, accounting for significant portions of total market demand. MarkWide Research analysis indicates that automation adoption rates are highest among multinational corporations operating in the region, with local companies increasingly following suit.

Future prospects remain highly favorable, supported by continued industrial development, strengthening regulatory frameworks, and increasing availability of advanced automation technologies. The market is expected to benefit from growing awareness of occupational health risks associated with manual hazardous waste handling and the long-term cost benefits of automated systems.

Strategic insights reveal several critical factors shaping the MEA hazardous waste handling automation market landscape:

Market maturity varies significantly across the region, with advanced economies showing higher adoption rates while emerging markets present substantial growth opportunities. The increasing availability of financing options and technology partnerships is facilitating broader market penetration across diverse industrial sectors.

Primary growth drivers propelling the MEA hazardous waste handling automation market include strengthening regulatory frameworks that mandate safer waste handling practices. Governments across the region are implementing comprehensive environmental protection laws that require industries to adopt automated systems for hazardous waste management, creating substantial market demand.

Industrial expansion in key sectors such as petrochemicals, pharmaceuticals, and mining is generating increasing volumes of hazardous waste that require sophisticated handling solutions. The region’s position as a global energy hub means continuous growth in industrial activities that produce dangerous byproducts requiring automated management systems.

Safety consciousness is driving adoption as companies recognize the liability risks associated with manual hazardous waste handling. Workplace safety incidents related to hazardous waste exposure have decreased by 72% in facilities implementing automated handling systems, demonstrating clear safety benefits that justify investment costs.

Technological advancement is making automation solutions more accessible and cost-effective. Improvements in robotics, sensor technology, and artificial intelligence are enabling more sophisticated waste handling capabilities while reducing system costs and complexity. The availability of modular automation solutions allows companies to implement systems gradually based on their specific needs and budget constraints.

Economic incentives including government subsidies, tax benefits, and financing programs are supporting automation adoption. Many MEA countries offer financial incentives for companies investing in environmental protection technologies, making automated hazardous waste handling systems more economically attractive.

High initial investment requirements represent the primary barrier to market adoption, particularly for small and medium-sized enterprises. Comprehensive automated hazardous waste handling systems require substantial capital expenditure for equipment procurement, installation, and staff training, which can be prohibitive for companies with limited financial resources.

Technical complexity of advanced automation systems creates implementation challenges for organizations lacking specialized technical expertise. The integration of robotics, AI algorithms, and monitoring systems requires skilled personnel for operation and maintenance, creating ongoing operational challenges in regions with limited technical talent pools.

Infrastructure limitations in certain MEA markets constrain automation deployment. Reliable power supply, internet connectivity, and technical support services are essential for automated systems operation, but may be inconsistent in some regional markets, limiting adoption potential.

Regulatory uncertainty in emerging markets creates hesitation among potential adopters. While environmental regulations are strengthening across the region, inconsistent enforcement and evolving compliance requirements make it difficult for companies to justify automation investments without clear regulatory certainty.

Cultural resistance to automation in some traditional industries slows adoption rates. Companies with established manual processes may resist technological change due to concerns about job displacement or skepticism about automation benefits, requiring extensive change management efforts to overcome.

Emerging market penetration presents significant growth opportunities as developing economies in the MEA region strengthen their environmental regulations and industrial safety standards. Countries experiencing rapid industrialization require comprehensive hazardous waste management solutions, creating substantial market potential for automation providers.

Technology partnerships between international automation companies and local system integrators offer opportunities to expand market reach while providing localized support services. These collaborations can overcome technical expertise limitations and provide cost-effective solutions tailored to regional market needs.

Retrofit market expansion represents a substantial opportunity as existing industrial facilities upgrade their hazardous waste handling capabilities. Many established facilities require automation solutions that can integrate with existing infrastructure, creating demand for flexible and adaptable automation systems.

Circular economy initiatives are creating new opportunities for advanced waste processing automation that can recover valuable materials from hazardous waste streams. Technologies that can safely extract and recycle components from dangerous waste materials align with sustainability goals while providing economic benefits.

Service-based business models including automation-as-a-service offerings can overcome capital investment barriers by providing access to advanced technologies through operational expense arrangements. These models make automation more accessible to smaller companies while providing recurring revenue opportunities for providers.

Competitive dynamics in the MEA hazardous waste handling automation market are characterized by a mix of international technology providers and regional system integrators competing to capture growing demand. Market consolidation is occurring as larger companies acquire specialized automation providers to expand their capabilities and regional presence.

Innovation cycles are accelerating as companies invest in research and development to create more sophisticated and cost-effective automation solutions. The integration of artificial intelligence, machine learning, and advanced robotics is enabling new capabilities that were previously unavailable, driving continuous market evolution.

Customer expectations are evolving toward comprehensive solutions that provide end-to-end hazardous waste management capabilities rather than individual components. This trend is driving providers to develop integrated platforms that combine hardware, software, and services into complete automation ecosystems.

Regulatory influence continues to shape market dynamics as governments implement new environmental protection requirements and safety standards. Companies must continuously adapt their automation solutions to meet evolving compliance requirements, creating ongoing development and upgrade opportunities.

Economic factors including oil price fluctuations and regional economic conditions influence investment decisions in automation technologies. However, the long-term trend toward stricter environmental regulations and improved safety standards provides underlying market stability despite short-term economic variations.

Comprehensive market analysis was conducted using multiple research methodologies to ensure accurate and reliable market insights. Primary research involved extensive interviews with industry executives, technology providers, end-users, and regulatory officials across key MEA markets to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, government publications, regulatory documents, and company financial statements to validate primary research findings and provide comprehensive market context. Data triangulation techniques were employed to cross-verify information from multiple sources and ensure accuracy.

Market sizing methodologies utilized bottom-up and top-down approaches to develop comprehensive market assessments. Bottom-up analysis involved detailed examination of individual market segments, application areas, and regional markets, while top-down analysis provided overall market context and validation.

Quantitative analysis included statistical modeling to project market growth trends and identify key growth drivers and restraints. Qualitative assessment provided deeper insights into market dynamics, competitive positioning, and strategic implications for market participants.

Expert validation processes involved review of research findings by industry experts and academic researchers specializing in waste management automation and environmental technology to ensure accuracy and completeness of market analysis.

Gulf Cooperation Council countries dominate the MEA hazardous waste handling automation market, accounting for 58% of regional market share due to substantial industrial infrastructure and strong regulatory frameworks. Saudi Arabia leads adoption with extensive petrochemical and manufacturing sectors requiring sophisticated waste management solutions.

United Arab Emirates demonstrates high automation penetration rates, particularly in Dubai and Abu Dhabi industrial zones where multinational corporations have implemented advanced hazardous waste handling systems. The country’s focus on becoming a regional technology hub is driving continued investment in automation technologies.

South Africa represents the largest market in the African continent, with significant mining and chemical industries driving demand for automated hazardous waste handling solutions. The country’s established industrial base and relatively advanced regulatory framework support market growth.

Egypt shows emerging market potential with growing industrial sectors and strengthening environmental regulations. Government initiatives to attract foreign investment in manufacturing are creating opportunities for automation technology adoption.

Nigeria presents substantial long-term opportunities despite current infrastructure challenges. The country’s large industrial base, particularly in oil and gas sectors, creates significant demand for hazardous waste management solutions as regulatory frameworks continue to develop.

Regional variations in adoption rates reflect differences in industrial development, regulatory maturity, and economic conditions. Advanced economies show higher penetration rates while emerging markets present substantial growth potential as infrastructure and regulations continue to develop.

Market leadership is distributed among several key players offering comprehensive hazardous waste handling automation solutions:

Competitive strategies focus on developing specialized solutions for specific industry applications while expanding regional service capabilities. Companies are investing in local partnerships and technical support infrastructure to better serve MEA market requirements.

Innovation focus areas include AI-powered waste classification systems, improved safety features, and integration capabilities with existing industrial infrastructure. Companies are also developing modular solutions that allow phased implementation to reduce initial investment barriers.

By Technology:

By Application:

By End-User Industry:

Robotic handling systems represent the largest technology segment, driven by their versatility and ability to handle diverse hazardous waste types safely. These systems offer precise manipulation capabilities while maintaining safe distances between operators and dangerous materials, making them essential for comprehensive waste management operations.

Chemical waste management dominates application segments due to the region’s substantial petrochemical industry presence. Automated chemical handling systems deliver 92% reduction in exposure incidents compared to manual handling methods, demonstrating clear safety benefits that justify investment costs.

Petrochemical end-users account for the largest market share, reflecting the MEA region’s position as a global energy hub. These facilities generate substantial volumes of hazardous waste requiring sophisticated automated handling systems to ensure worker safety and environmental compliance.

Healthcare applications show rapid growth rates as hospitals and medical facilities upgrade their waste management capabilities. The COVID-19 pandemic highlighted the importance of safe medical waste handling, accelerating adoption of automated systems in healthcare settings.

Technology integration trends show increasing demand for comprehensive solutions that combine multiple automation technologies into integrated platforms. Customers prefer systems that provide end-to-end waste management capabilities rather than individual components requiring separate integration efforts.

Safety enhancement represents the primary benefit for industrial operators, with automated systems eliminating direct human contact with hazardous materials. This significantly reduces occupational health risks and potential liability exposure while ensuring consistent safety protocol compliance.

Operational efficiency improvements include faster processing speeds, reduced handling errors, and optimized waste segregation capabilities. Automated systems can operate continuously without fatigue, delivering consistent performance that exceeds manual handling capabilities while reducing overall operational costs.

Regulatory compliance benefits include comprehensive documentation, consistent handling protocols, and reduced risk of compliance violations. Automated systems provide detailed tracking and reporting capabilities that simplify regulatory reporting requirements and demonstrate compliance commitment to authorities.

Cost optimization occurs through reduced labor requirements, minimized waste disposal penalties, and improved processing efficiency. While initial investment costs are substantial, long-term operational savings typically justify automation investments within reasonable payback periods.

Environmental protection advantages include reduced risk of accidental releases, improved containment capabilities, and optimized waste processing that minimizes environmental impact. These benefits align with corporate sustainability goals and environmental responsibility commitments.

Scalability benefits allow facilities to adapt automation systems to changing waste volumes and types without significant infrastructure modifications. This flexibility supports business growth while maintaining consistent safety and efficiency standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming hazardous waste handling automation through advanced classification algorithms and predictive maintenance capabilities. AI-powered systems can identify waste types with 96% accuracy, enabling optimized processing protocols and improved safety outcomes.

IoT connectivity is enabling comprehensive monitoring and tracking capabilities that provide real-time visibility into waste handling operations. Connected sensors monitor container conditions, track waste movement, and alert operators to potential safety issues before they become critical problems.

Collaborative robotics trends show increasing adoption of systems designed to work safely alongside human operators. These solutions provide automation benefits while maintaining human oversight capabilities, making them suitable for facilities requiring flexible operational approaches.

Modular system design is gaining popularity as companies seek automation solutions that can be implemented gradually based on budget constraints and operational requirements. Modular approaches allow phased deployment while maintaining system integration capabilities.

Sustainability focus is driving development of automation systems that support circular economy principles through improved waste recovery and recycling capabilities. Advanced processing systems can safely extract valuable materials from hazardous waste streams, providing economic and environmental benefits.

Remote operation capabilities are becoming standard features as companies seek to minimize human presence in hazardous environments. Advanced control systems enable operators to manage waste handling processes from safe distances while maintaining full operational control.

Technology partnerships between automation providers and regional system integrators are expanding market reach while providing localized support capabilities. These collaborations combine international technology expertise with regional market knowledge to deliver more effective solutions.

Regulatory developments across MEA countries are strengthening environmental protection requirements and mandating automated handling systems for certain hazardous waste categories. These regulatory changes are creating substantial market demand while establishing clear compliance frameworks.

Investment initiatives including government funding programs and private sector investments are supporting automation adoption across various industries. MWR analysis indicates that public-private partnerships are particularly effective in accelerating market development in emerging economies.

Innovation breakthroughs in robotics, sensor technology, and artificial intelligence are enabling more sophisticated waste handling capabilities while reducing system costs and complexity. These technological advances are making automation accessible to a broader range of companies and applications.

Market consolidation activities include acquisitions and strategic partnerships that are creating larger, more comprehensive automation providers capable of delivering end-to-end solutions. This consolidation is improving service capabilities while expanding geographic coverage.

Training programs and educational initiatives are addressing technical expertise gaps by developing skilled workforce capabilities for automation system operation and maintenance. These programs are essential for supporting market growth in regions with limited technical talent pools.

Strategic recommendations for market participants include focusing on comprehensive solution development rather than individual component offerings. Companies should invest in integrated platforms that combine hardware, software, and services to meet customer demands for complete automation ecosystems.

Regional expansion strategies should prioritize markets with strong regulatory frameworks and established industrial bases while building local partnerships to overcome technical support and cultural barriers. Successful market entry requires understanding of local regulations, business practices, and customer preferences.

Technology investment priorities should focus on artificial intelligence, IoT connectivity, and advanced safety features that differentiate offerings in competitive markets. Companies must balance innovation investment with cost management to maintain competitive pricing while delivering advanced capabilities.

Service model development including automation-as-a-service offerings can overcome capital investment barriers while providing recurring revenue opportunities. These models require strong technical support capabilities and financial partnerships to deliver effective solutions.

Partnership strategies should emphasize collaborations with local system integrators, technology providers, and financing organizations to create comprehensive market coverage. Successful partnerships combine complementary capabilities while sharing market development risks and costs.

Customer education initiatives are essential for accelerating adoption rates, particularly in markets with limited automation experience. Companies should invest in demonstration facilities, training programs, and case study development to showcase automation benefits and build customer confidence.

Market trajectory indicates continued strong growth driven by expanding industrial activities, strengthening regulatory requirements, and advancing automation technologies. The MEA hazardous waste handling automation market is positioned for sustained expansion as environmental consciousness and safety awareness continue to increase across the region.

Technology evolution will continue advancing toward more intelligent, autonomous systems capable of handling complex waste management scenarios with minimal human intervention. Next-generation systems are expected to achieve 98% autonomous operation rates while maintaining comprehensive safety and compliance capabilities.

Regional development patterns suggest that advanced economies will continue leading adoption while emerging markets present substantial growth opportunities as infrastructure and regulations mature. The expansion of industrial activities across Africa particularly offers significant long-term market potential.

Industry transformation toward comprehensive waste management ecosystems will drive demand for integrated automation solutions that provide end-to-end capabilities. Companies offering complete platforms rather than individual components will be best positioned to capture market opportunities.

Regulatory trends indicate continued strengthening of environmental protection requirements that will mandate automation adoption in many applications. These regulatory drivers provide underlying market stability and growth momentum that supports long-term investment planning.

Innovation acceleration in artificial intelligence, robotics, and sensor technologies will enable more sophisticated and cost-effective automation solutions. These technological advances will expand market accessibility while improving system capabilities and performance outcomes.

The MEA hazardous waste handling automation market represents a dynamic and rapidly expanding sector driven by compelling safety, regulatory, and economic factors. The convergence of strengthening environmental regulations, advancing automation technologies, and growing industrial activities across the region creates substantial opportunities for market participants and stakeholders.

Market fundamentals remain highly favorable, with strong growth drivers including mandatory safety requirements, operational efficiency benefits, and long-term cost advantages supporting continued adoption across diverse industrial sectors. The region’s position as a global energy and industrial hub ensures sustained demand for sophisticated hazardous waste management solutions.

Technology advancement continues enabling more capable and accessible automation solutions that address traditional barriers including high costs and technical complexity. The integration of artificial intelligence, IoT connectivity, and advanced robotics is creating new possibilities for safe and efficient hazardous waste handling that were previously unavailable.

Regional opportunities span from advanced Gulf economies with established industrial infrastructure to emerging African markets with substantial growth potential. Success in this diverse market requires understanding of local conditions, regulatory requirements, and customer needs while delivering proven automation capabilities.

Future prospects indicate sustained market expansion supported by continued industrial development, evolving regulatory frameworks, and advancing automation technologies. Companies that invest in comprehensive solutions, regional partnerships, and customer education initiatives will be best positioned to capture the significant opportunities presented by this growing market.

What is Hazardous Waste Handling Automation?

Hazardous Waste Handling Automation refers to the use of technology and automated systems to manage and process hazardous waste materials safely and efficiently. This includes the automation of collection, transportation, treatment, and disposal processes to minimize human exposure and environmental impact.

What are the key players in the MEA Hazardous Waste Handling Automation Market?

Key players in the MEA Hazardous Waste Handling Automation Market include Veolia Environnement, SUEZ, and Clean Harbors, among others. These companies are involved in providing innovative solutions for hazardous waste management and automation.

What are the main drivers of the MEA Hazardous Waste Handling Automation Market?

The main drivers of the MEA Hazardous Waste Handling Automation Market include increasing regulatory pressures for safe waste management, the growing volume of hazardous waste generated, and advancements in automation technologies that enhance operational efficiency.

What challenges does the MEA Hazardous Waste Handling Automation Market face?

The MEA Hazardous Waste Handling Automation Market faces challenges such as high initial investment costs for automation technologies, the complexity of hazardous waste regulations, and the need for skilled personnel to operate advanced systems.

What opportunities exist in the MEA Hazardous Waste Handling Automation Market?

Opportunities in the MEA Hazardous Waste Handling Automation Market include the development of smart waste management solutions, integration of IoT technologies for real-time monitoring, and increasing demand for sustainable waste disposal methods.

What trends are shaping the MEA Hazardous Waste Handling Automation Market?

Trends shaping the MEA Hazardous Waste Handling Automation Market include the rise of digitalization in waste management, the adoption of AI and machine learning for predictive maintenance, and a growing focus on sustainability and circular economy practices.

MEA Hazardous Waste Handling Automation Market

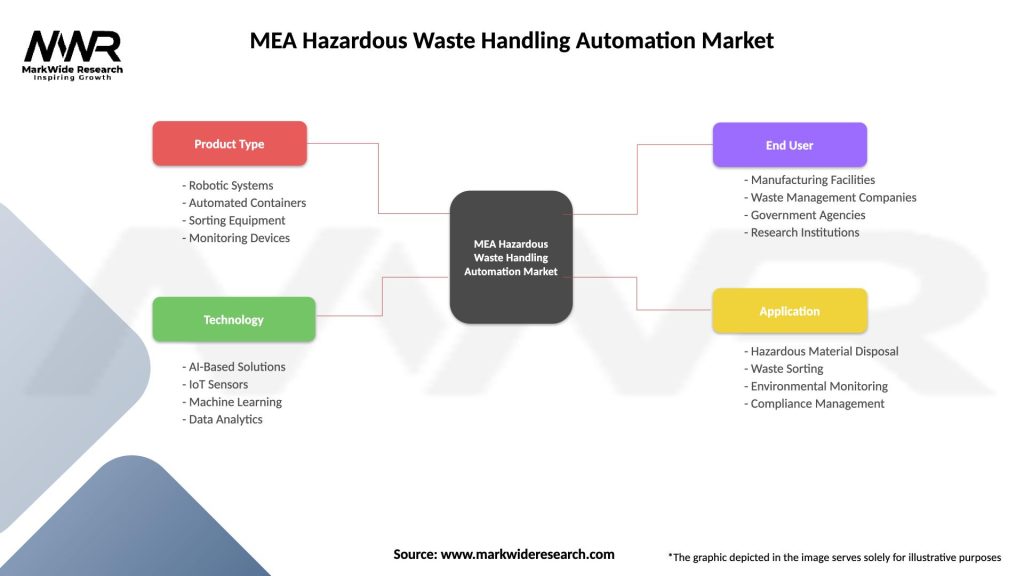

| Segmentation Details | Description |

|---|---|

| Product Type | Robotic Systems, Automated Containers, Sorting Equipment, Monitoring Devices |

| Technology | AI-Based Solutions, IoT Sensors, Machine Learning, Data Analytics |

| End User | Manufacturing Facilities, Waste Management Companies, Government Agencies, Research Institutions |

| Application | Hazardous Material Disposal, Waste Sorting, Environmental Monitoring, Compliance Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Hazardous Waste Handling Automation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at